Uranium is a radioactive heavy metal and non-renewable energy source that is often utilized as an alternative to oil and natural gas.

Although uranium can not be traded directly, retail clients can gain exposure to this asset via relevant stocks that are involved in its production and supply.

In this guide, we explore the 10 best uranium stocks according to market analysts with expertise in this field.

Best Uranium Stocks According to Performance 2023 – List of Uranium Stocks

Some of the best uranium stocks right now according to market analysts are listed below:

- Rio Tinto – Global Mining Company Involved in Uranium and Raw Materials

- BHP Billiton – Multinational Mining Firm Specializing in Metals, Minerals, and Energies

- Cameco – Canada-Based Uranium Stock Providing Emission-Free Nuclear Energy

- Sibanye-Stillwater – 100 Million Pounds of Uranium in South Africa-Based Mine

- Uranium Energy – Small-Cap Pure Play Uranium Stock

- Fission Uranium – Growth Stock Committed to the Exploration of Uranium

- Uranium Royalty – Holding Company That Makes Uranium-Centric Investments

- Denison Mines – Exploration and Production of North American Uranium

- NexGen Energy – Committed to Delivering Clean Energy Fuel via Uranium Mining

- Global X Uranium ETF – Gain Exposure to 46 Stocks Involved in the Uranium Industry

When searching for the best uranium stocks in the market, investors will need to perform their own due diligence before risking any funds. As such, never invest in any of the companies found on the above uranium stocks list without independent research.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

A Closer Look at the Best Performing Uranium Stocks

There are many ways to gain exposure to uranium across stocks and even ETFs.

While some firms operating in this space specialize exclusively in uranium, others are behind a wide variety of energy sources and raw materials. This offers plenty of ways to build a risk-adjusted, diversified portfolio of energy uranium stocks.

In this section, we explore the 10 best uranium stocks according to market commentators that are heavily active in this space.

1. Rio Tinto – Global Mining Company Involved in Uranium and Raw Materials

Founded in 1873, Rio Tinto is one of the largest mining companies globally. The firm is behind a strong portfolio of metals and raw materials, including but not limited to iron ore, copper, aluminum, coal, diamonds, and gold. Additionally, Rio Tinto also has a dedicated division for uranium operations. This is split across two primary mining sites in Namibia and Australia.

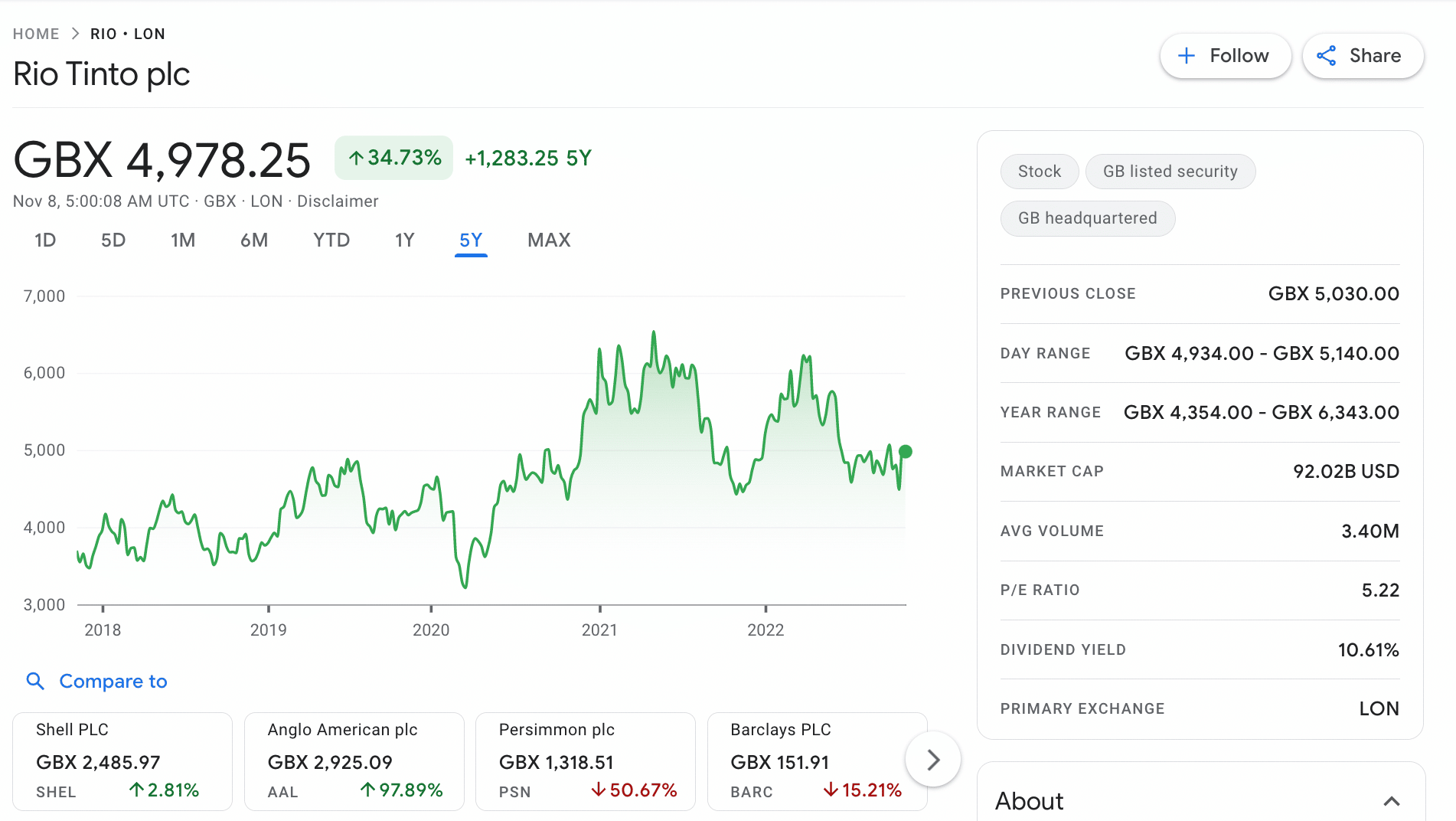

According to recent estimates, Rio Tinto is the third largest producer of uranium. This is especially interesting considering that the vast majority of revenues generated by the firm are associated with the production of iron ore and aluminum. Nonetheless, Rio Tinto has a dual stock exchange listing in London and Australia.

Most of the stock’s trading activity is, however, found on the London Stock Exchange. As of writing, Rio Tinto carries a market capitalization of nearly $80 billion. Over the prior 12 months of trading, Rio Tinto stock has generated growth of 11%. Over a five-year period, the stock is up nearly 35%. In comparison, the FTSE 100 has declined by 1.79% over the same five-year timeframe.

According to some analysts, Rio Tinto is also one of the best dividend stocks to watch. As of writing, this uranium energy stock is offering a running dividend yield of over 10.6%. Current pricing levels afford Rio Tinto stock a P/E ratio of just over 5 times.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

2. BHP Billiton – Multinational Mining Firm Specializing in Metals, Minerals, and Energies

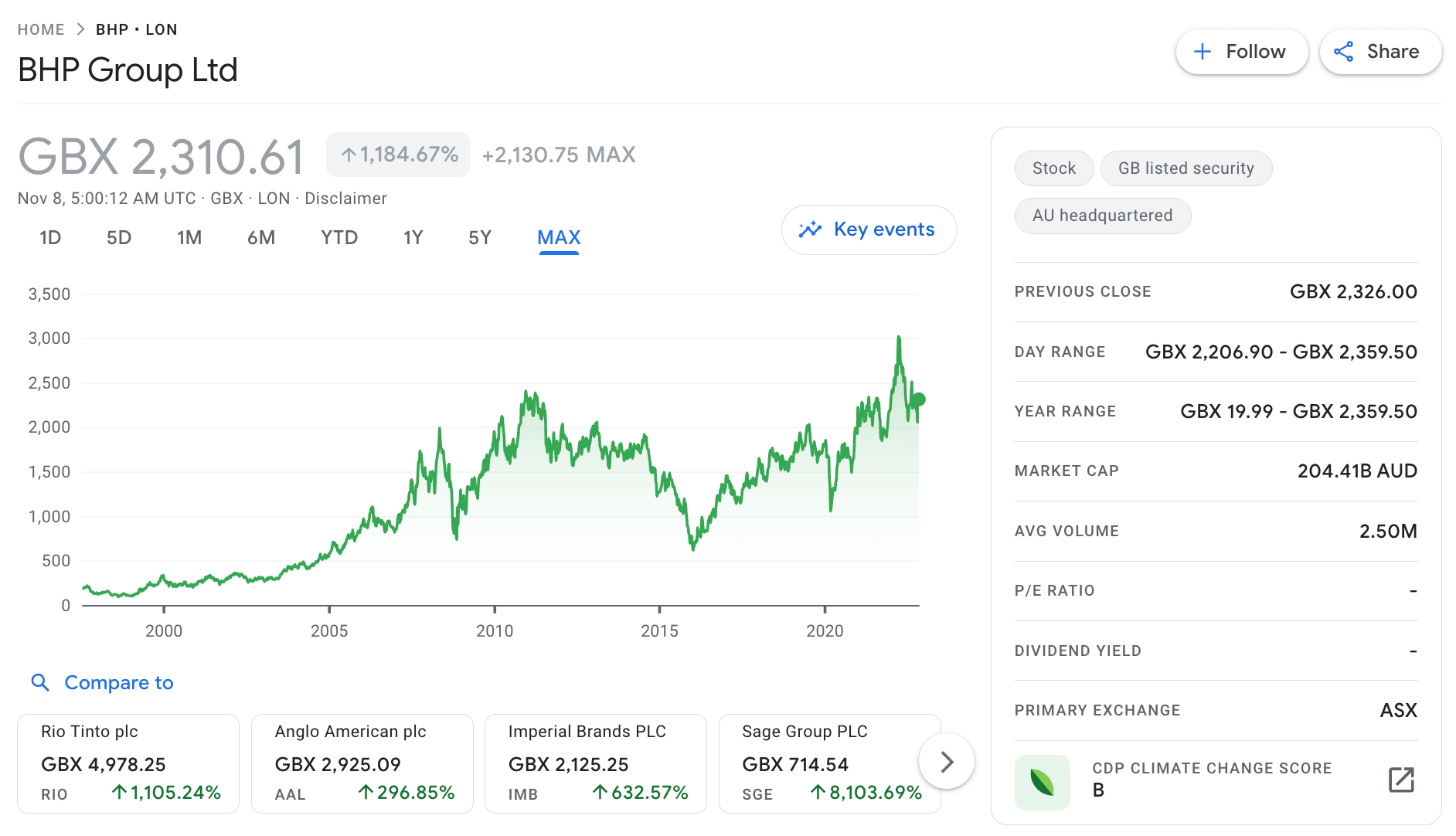

BHP Billiton is a direct competitor to the previously discussed Rio Tinto. Therefore, when searching for the best uranium stocks, investors will often come across this multinational company. Founded in 1885, BHP Billion is headquartered in Australia, albeit, much like Rio Tinto – it also has a dual listing on the London Stock Exchange.

BHP Billion has global operations that focus on a wide range of minerals, metals, and energies. This includes everything from oil and natural gas to nickel, coal, iron ore, copper, and uranium. One of its largest uranium mines is based in South Australia and this forms part of its 2005 acquisition of WMC Resources, a deal that was worth $7.3 billion at the time.

In a similar nature to Rio Tinto, BHP Billiton offers a diversified way to gain exposure to global uranium prices, not least because it is not a pure play. In terms of its London Stock Exchange listing – which is where the majority of trading volume is found, BHP Billiton stock carries a market capitalization of over £116 billion.

This makes it one of the largest companies on the FTSE 100. In terms of performance, BHP Billiton stock has generated gains of over 20% over the prior 12 months. On a five-year basis, this uranium stock price is up over 62%. Therefore, this far exceeds the market average when using the FTSE 100 as a benchmark. As of writing, BHP Billiton stock is offering a running dividend yield of 11%.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

3. Cameco – Canada-Based Uranium Stock Providing Emission-Free Nuclear Energy

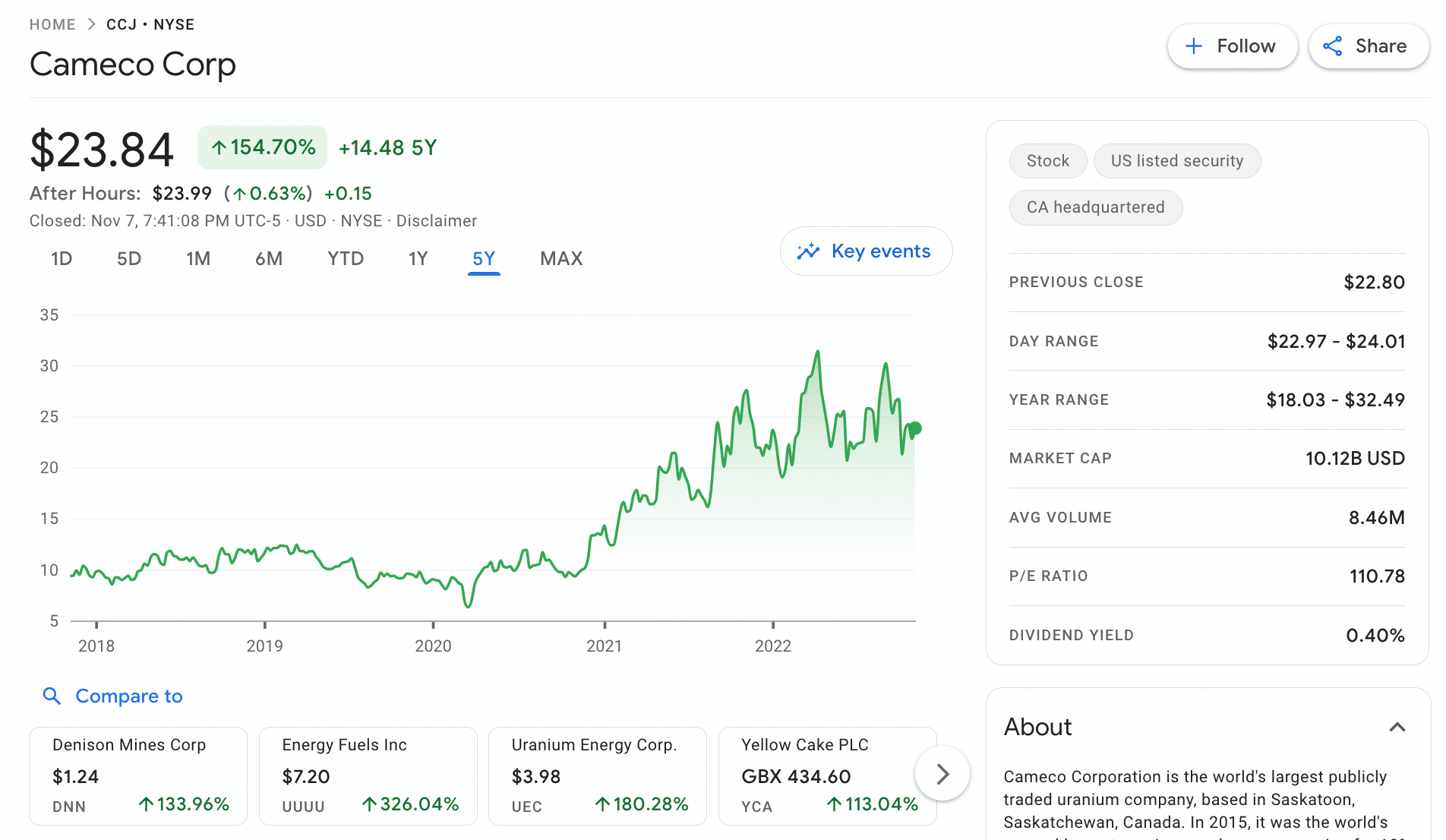

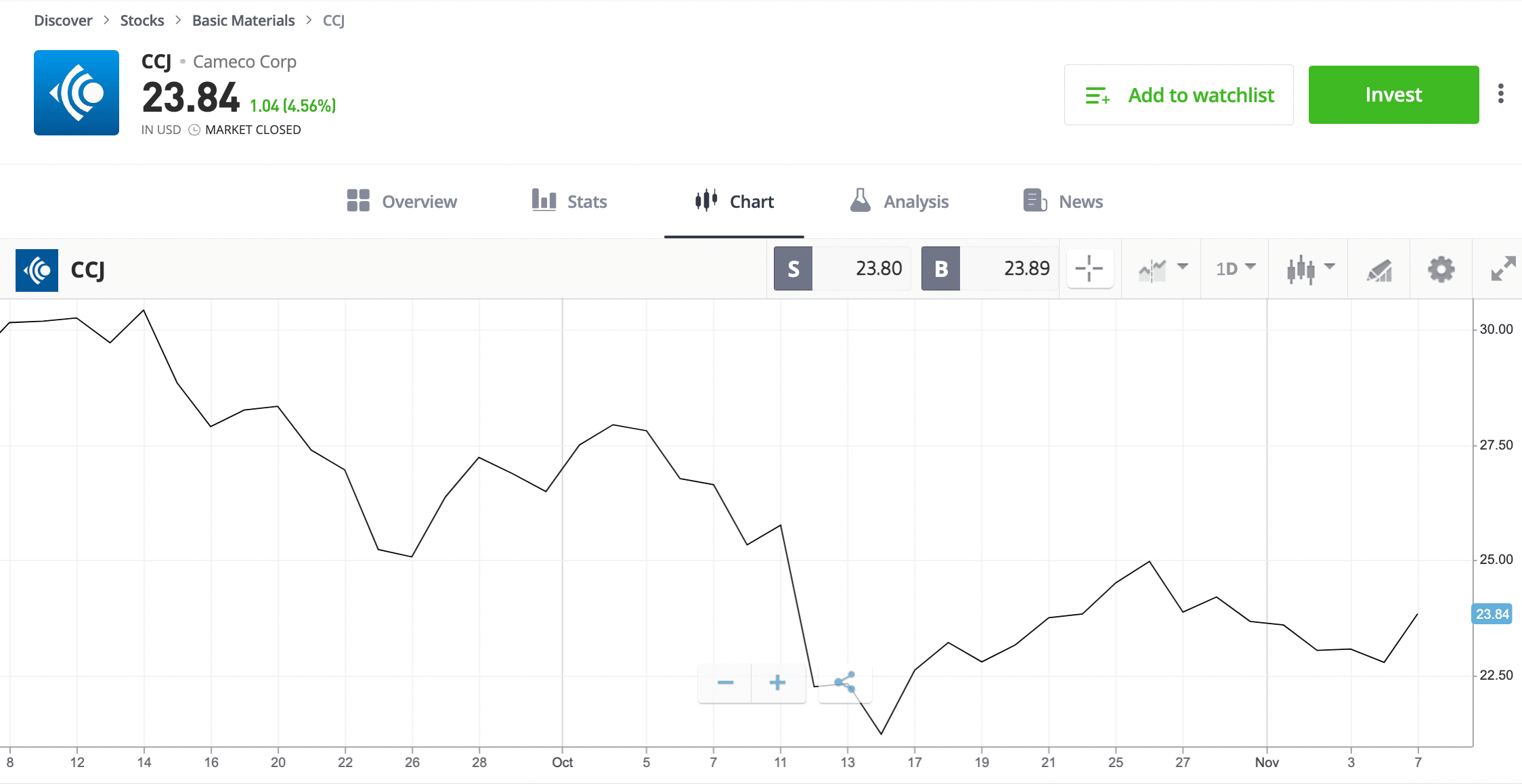

According to some market analysts, Cameco is one of the best uranium stocks in this space – not least because of the returns it has generated in recent years. In fact, on a five-year basis, Cameco uranium stock has witnessed growth of over 154%. Cameco can be considered a small-to-medium cap stock, with a market capitalization of $10 billion on the NASDAQ as of writing.

This Canada-based firm specializes in the production and supply of uranium fuel, which it claims facilitates clear-air utilities. Moreover, Cameco notes that its uranium supply generates emissions-free nuclear power. The firm has a licensed capacity to produce over 30 million pounds of uranium each year.

According to Cameco, the firm has more than 464 million pounds of proven reserves. In terms of its performance over the prior year of trading, Cameco stock is down 15%. Moreover, its most recent quarterly earnings call came with mixed emotions from investors.

On the one hand, revenues were up 7.60% to $388 million while net income rose by 72%. However, the firm still made a $19.5 million loss for the quarter. On the flip side, earnings per share and EBITDA rose by 121% and 272% respectively. Finally, Cameco is offering a running dividend yield of 0.4% as of writing.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

4. Sibanye-Stillwater – 100 Million Pounds of Uranium in South Africa-Based Mine

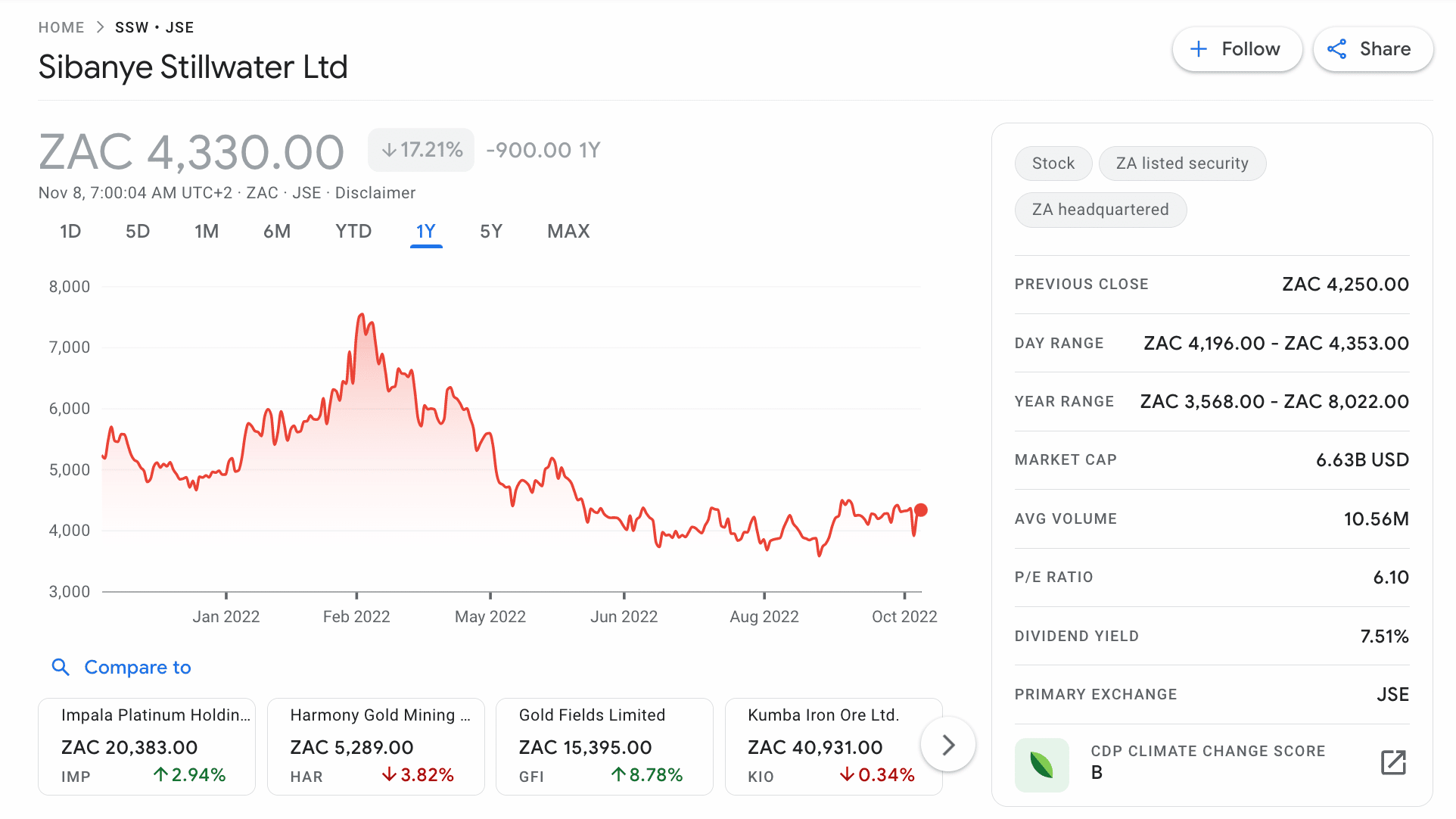

Founded in 2012, Sibanye-Stillwater is a South Africa-based precious metals company that is often involved in energies – inclusive of uranium. in fact, Sibanye-Stillwater recently entered this marketplace and now claims to have over 100 million pounds worth of uranium reserves at its Free State mining operation.

In addition to uranium, Sibanye-Stillwater is heavily involved in the exploitation of gold. Listed on the Johannesburg Stock Exchange, Sibanye-Stillwater carries a market capitalization of 122 billion ZAR (approximately $6.8 billion) as of writing. Over the prior 12 months of trading, this uranium stock is down 17%.

The stock is down over 8% on a five-year basis. With that said, Sibanye-Stillwater is offering a running dividend yield of over 7.5% as of writing. The firm is also carrying a modest P/E ratio of 6.10 times.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

5. Uranium Energy – Small-Cap Pure Play Uranium Stock

Investors searching for the best uranium stocks might prefer companies that are defined as a pure play. This includes the likes of Uranium Energy – which is exclusively involved in the development of clean, low-cost uranium. Founded in 2003, Uranium Energy is listed on the NYSE American.

It carries a market capitalization of just $1.4 billion as of writing, which could appeal to those in the market for small-cap stocks with suitable long-term upside potential. This is, however, an ultra-volatile uranium stock and investors should bear this in mind before proceeding.

For example, over the prior five years of trading, Uranium Energy stocks have increased by over 180%. On a 12-month basis, however, the stock is down 21%. Moreover, Uranium Energy stock has witnessed a 52-week high and low of $6.60 and $2.34 respectively, which further highlights its volatile nature.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

6. Fission Uranium – Growth Stock Committed to the Exploration of Uranium

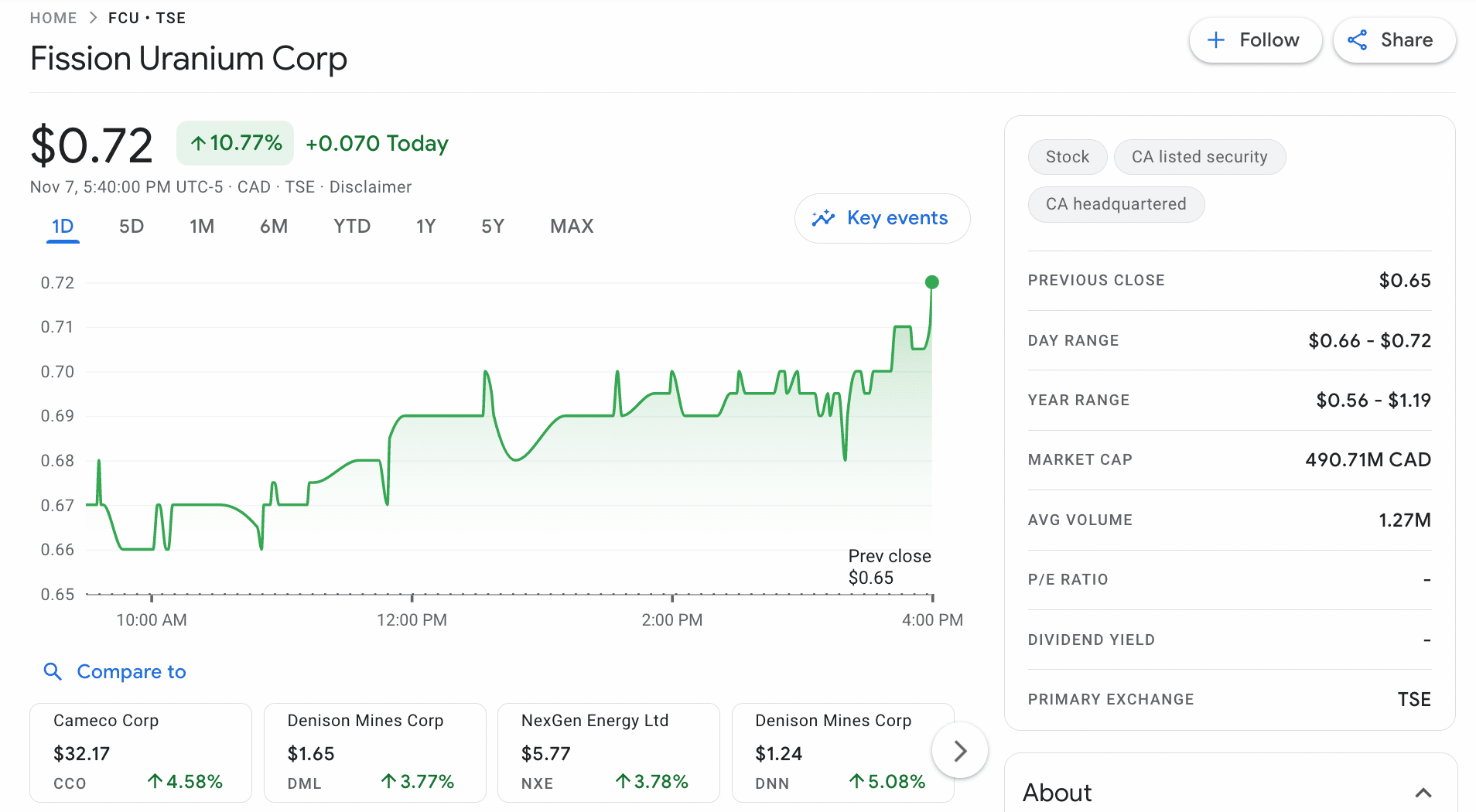

Fission Uranium is yet another pure play uranium stock on this list. Based on its market capitalization of just $490 million as of writing, the company firmly sits in the growth stock category. In fact, although Fission Uranium trades on the Toronto Stock Exchange, its share price of $0.72 CAD means that the firm may also appeal to those in the market for uranium penny stocks.

This does, however, also mean that Fission Uranium is a high-risk stock that witnesses extreme volatility. For example, in the 24 hours prior to writing, Fission Uranium stock has increased by 10%. Year-to-date, on the other hand, the stock is down 18%. Volatility is also confirmed in its 52-week high and low of $1.19 CAD and $0.56 CAD.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

7. Uranium Royalty – Holding Company That Makes Uranium-Centric Investments

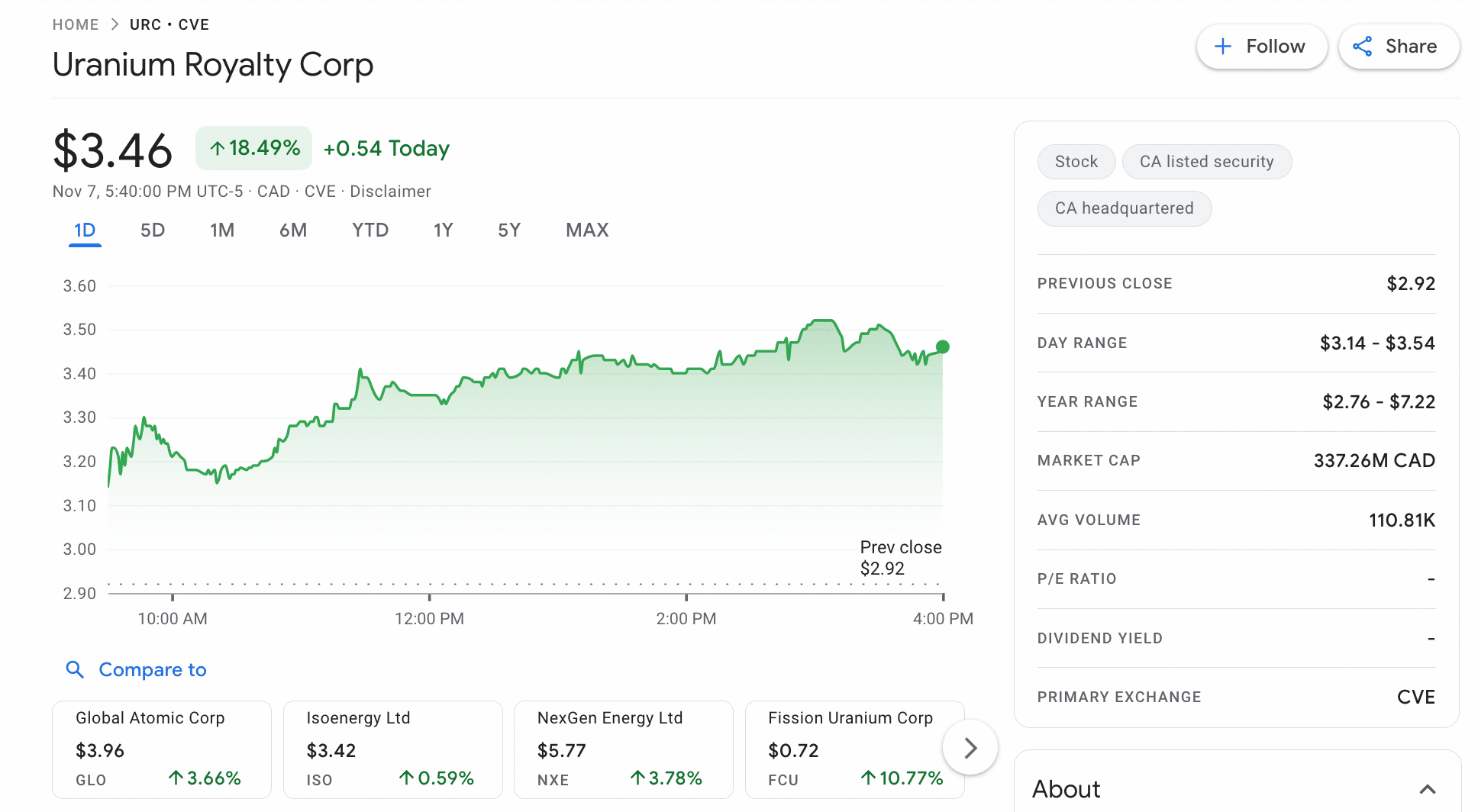

Uranium Royalty is a Canada-based holding company that makes Uranium-centric investments on behalf of shareholders. Listed on the TSX exchange, Uranium Royalty offers exposure to uranium interests via streams, royalties, and equity.

As of writing, the firm has a modest market capitalization of just $337 million CAD. Investors should, however, tread with caution when considering this uranium stock.

First and foremost, liquidity seems to be an issue, with just $110,000 worth of Uranium Royalty Corp stock traded in the prior 24 hours. Second, this micro-cap stock represents a volatile investment. Over the prior year of trading, the stock is down nearly 50%. Over the past five years, however, Uranium Royalty is up 193%.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

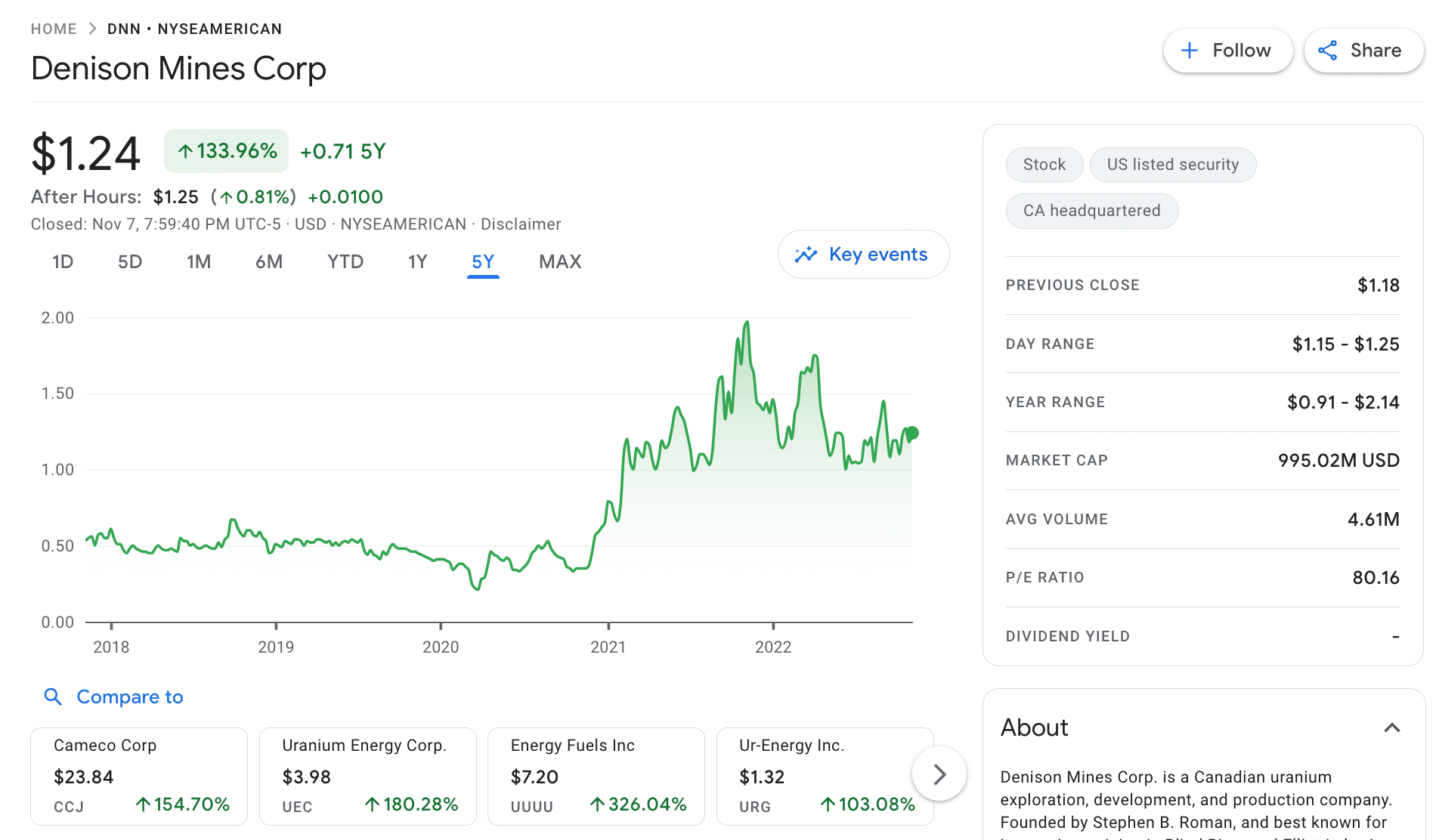

8. Denison Mines – Exploration and Production of North American Uranium

Founded in 1985, Denison Mines is a Canada-based mining company that specializes in the production and exploration of North American uranium. The firm is listed on the NYSE American with a market capitalization of just under $1 billion. This is one of the most volatile uranium miners stocks, with the firm losing 40% of its valuation in the prior 12 months.

Longer-term investors have, however, witnessed returns of 133% in the prior five years of trading. In its most recent quarterly earnings call, Denison Mines reported a 47% increase in revenue. EBITDA was up 29%. However, Denison Mines still reported a $16.15 million loss for the quarter.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

9. NexGen Energy – Committed to Delivering Clean Energy Fuel via Uranium Mining

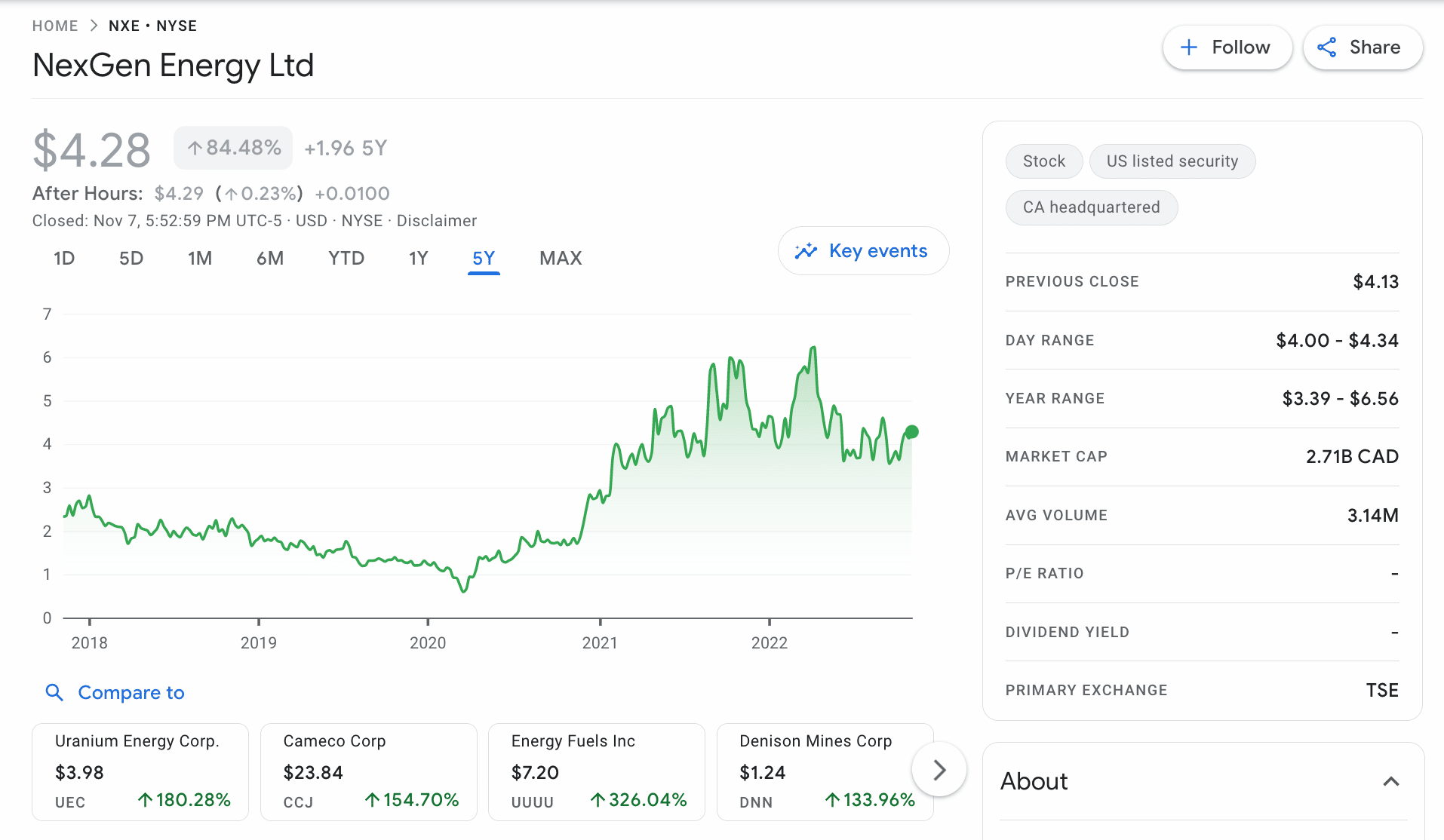

NexGen Energy is a Canada-based mining company that is dedicated exclusively to clean energy sources via the extraction of uranium. The firm was founded as recently as 2011 and now trades on the NYSE. This volatile uranium stock has produced a 52-week high and low of $6.56 and $3.39 respectively.

Although NexGen Energy stock is up 9% over the prior six months of trading, it has a decline of 33% on a 12-month basis. Five-year returns are notable at just over 84%. There is no dividend policy in place with this uranium stock.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

10. Global X Uranium ETF – Gain Exposure to 46 Stocks Involved in the Uranium Industry

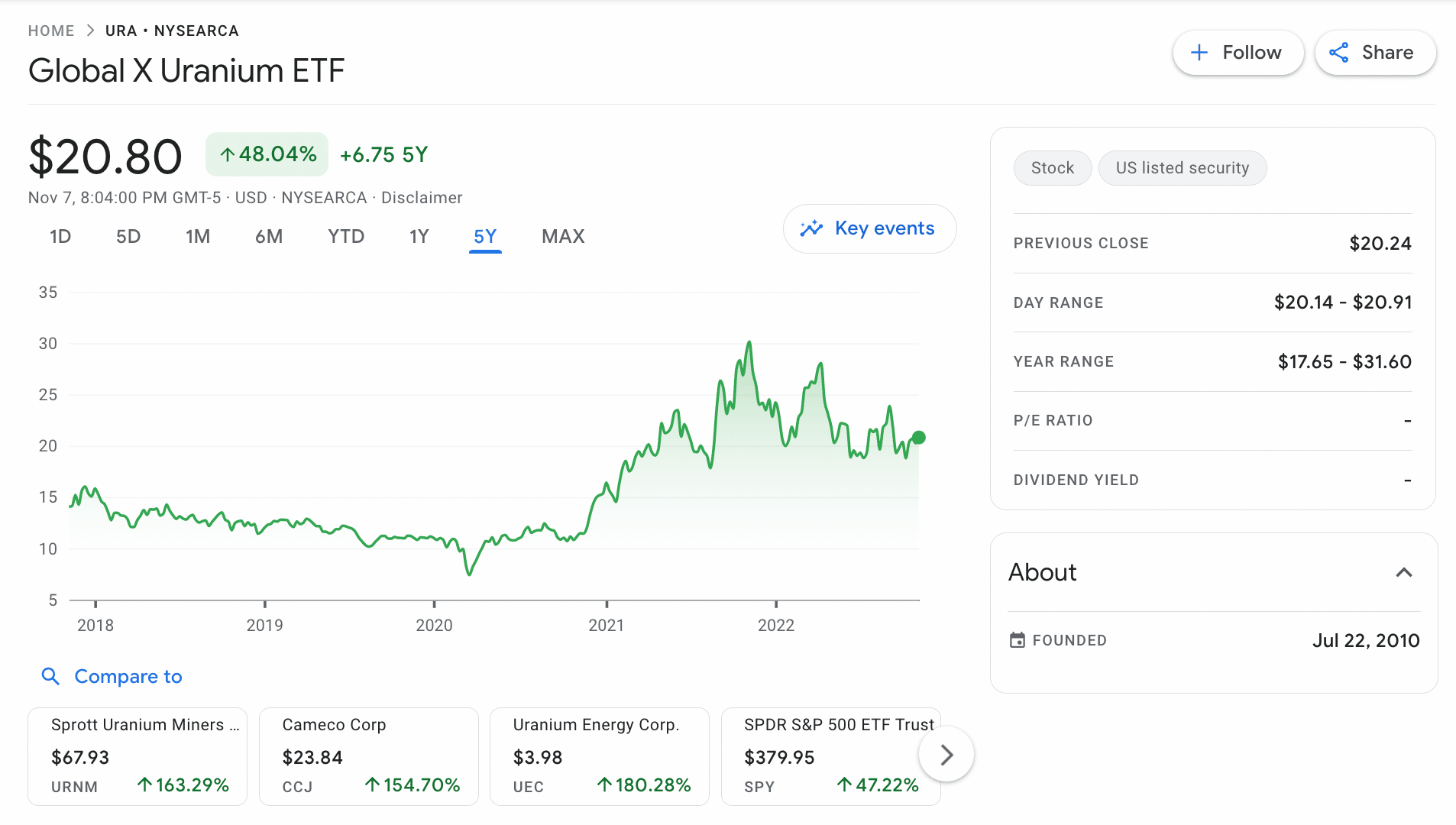

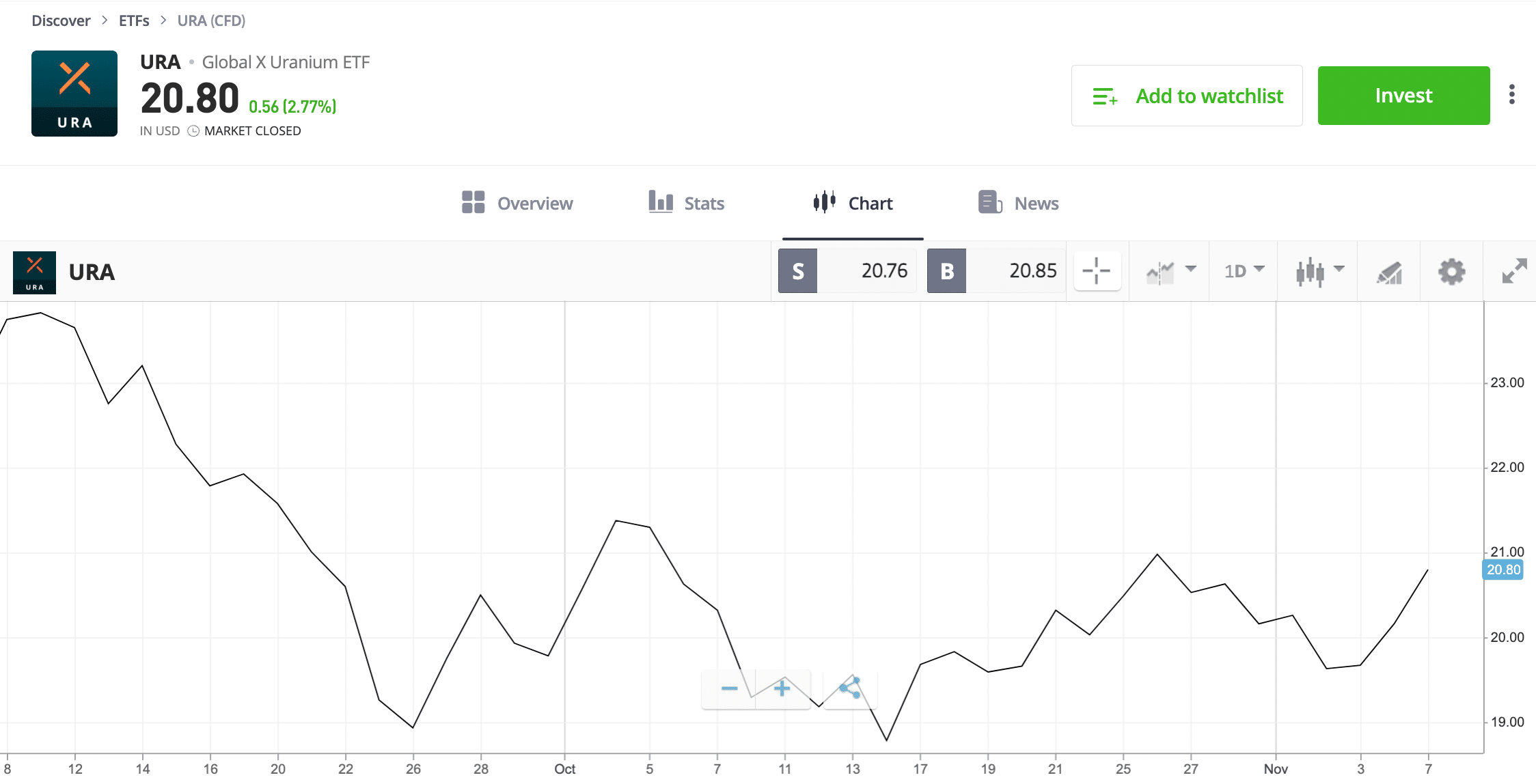

An alternative option to consider when searching for the best uranium stocks is a specialist ETF. This takes away the need to pick and choose individual uranium stocks – as this is taken care of by the ETF provider. The Global X Uranium ETF, for example, enables investors to gain exposure to 46 stocks that are involved in the uranium industry.

This comes from a wide scope of perspectives, such as exploration, extraction, refining, and manufacturing equipment. Some of the largest holdings in this ETF include Cameco, Sprott Physical, Nac Kazatog, Nexgen Energy, and Uranium Energy. This ETF trades on the NYSE Arca with over $1.5 billion in net assets under management.

As a result, investors can buy and sell this uranium stock ETF at any given time during standard market hours. In terms of performance, this ETF has generated gains of 48% in the prior five years. On a 12-month basis, however, this uranium ETF is down 32%.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

Why do People Invest in Uranium Stocks?

The overarching reason that people invest in uranium stocks is to gain exposure to this non-renewable energy source. Many market commentators believe that uranium – despite its radioactive traits, could be a solution to the world’s over-reliance on conventional oil and natural gas.

However, and much like any other energy source, it is not possible to invest directly in or trade uranium prices. On the contrary, investors wishing to gain exposure to uranium will need to consider other financial vehicles. In addition to stocks, it is also possible to speculate on the future value of uranium through ETFs, as well as derivatives like futures and options.

- In terms of its potential, uranium is directly correlated to the production of nuclear energy.

- According to some estimates, one pellet of uranium produces the same amount of energy output as three barrels of crude oil and one ton of coal.

- Moreover, the US government has stated its intentions to invest in uranium mining.

With that being said, many uranium stocks – at least in terms of pure plays, have witnessed sizable losses in recent months. This is notable, considering that uranium spot prices continue to rise.

Things to Consider Before Investing in Uranium Stocks

Even the best uranium stocks operate in a niche market. As a result, investors should ensure that they have a firm grasp of both the potential upside and risks before buying any uranium-centric equities.

In this section, we discuss the main considerations that investors need to make.

Pure Plays are Largely Small Caps

First and foremost, it should be noted that the majority of uranium stocks are small-cap companies. This is a risk in itself, considering that small-cap stocks are prone to huge volatility swings and most concerning – a lack of liquidity in the market.

Some pure play uranium stocks are listed on OTC markets, which makes it even more challenging for retail investors to gain exposure.

Most Uranium Stocks Operate Outside of the US

The majority of uranium stocks operate outside of the US markets. Oftentimes, firms operating in this space elect to list on Canadian exchanges, which again, can make access more challenging for the average trader.

This also presents a currency risk. After all, non-US uranium stocks will need to be bought and sold in the domestic currency where the equities are listed.

High Operating Costs

Mining companies require significant sums of capital to fund the exploration of uranium. In turn, this means that many uranium stocks carry high levels of debt. Some of the uranium stocks discussed on this page are struggling to make a profit, so this further increases the risk threshold.

Trends Prefer Renewables

On the one hand, uranium does present suitable characteristics to offer a solid alternative to crude oil and natural gas. Some companies operating in this space possess proprietary technology that can generate green and low-cost nuclear fuel.

However, many commentators argue that uranium is not fit for purpose in a world that is aiming to become more sustainable. After all, uranium carries radioactive properties, which in turn, is a conduit for lung cancer and other health issues.

Instead, from an investment perspective, the general trend seems to be moving closer to renewable energy stocks and ETFs.

Correlation Between Spot Prices and Uranium Stocks

It is also important to remember that there is no guarantee that uranium stocks will mirror the actual spot price of the metal. This is no different from investing in oil stocks.

Crucially, the markets will consider a wide range of metrics when attempting to value the position of a uranium stock. Not only in terms of spot prices, but the firm’s balance sheet, market share, debt levels, proven reserves, and more.

This is why rather than searching for the best uranium stocks, risk-averse investors will often turn to ETFs. This at the very least reduces the exposure to a small number of companies.

Where Can You Buy Uranium Stocks?

After compiling a list of top uranium stocks by performance, the next step is to find a suitable broker. This is where things can get tricky, as some uranium stocks are either listed outside of the US or traded on OTC exchanges.

Nonetheless, eToro is a popular stock trading platform that offers access to a variety of uranium companies and ETFs.

eToro – Regulated Uranium Stock Broker

eToro was launched in 2007 and this popular stock broker is now utilized by more than 27 million traders. Many of the uranium stocks discussed on this page are supported by eToro. This is inclusive of Rio Tinto, BHP Billiton, Cameco, and Sibanye-Stillwater.

Although the aforementioned uranium stocks are listed in the UK, Canada, and South Africa eToro offers access on a 100% commission-free basis. This is the case regardless of where the trader is from and extends to thousands of other stocks.

Furthermore, investors only need to risk $10 per uranium stock, so this minimum will perhaps appeal to those on a budget. Another thing to note about eToro is that it also offers access to uranium ETFs. This includes the previously discussed Global X Uranium ETF, which offers access to 46 individual stocks operating in this space.

ETFs, just like stocks, can be bought and sold at 0% commission on the eToro platform. When it comes to safety, eToro is regulated by multiple financial bodies – including the SEC, FCA, ASIC, and CySEC. Opening an account at eToro typically takes 5-10 minutes and the broker supports e-wallets like PayPal and Neteller, Visa, MasterCard, and traditional bank transfers.

The minimum deposit is $10 for US clients and typically $50 for other nationalities. eToro does not charge any deposit or withdrawal fees when the payment is made in US dollars. In addition to uranium stocks and ETFs, eToro also allows clients to buy Bitcoin and other digital currencies from a minimum of $10. Commodities and forex trading is supported too.

eToro is also popular as a Copy Trading platform, as it promotes a passive investment experience. This enables clients to select a seasoned trader based on core metrics like past performance and risk, and then invest a minimum of $200 into the individual. Any subsequent positions that the trader makes will be replicated in the client’s eToro portfolio.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

This beginner’s guide has discussed a range of uranium mining stocks that are proving popular with speculative investors. This includes broader mining companies like Rio Tinto and BHP Billiton – which in addition to uranium, also produce other metals and raw materials.

We have also discussed a selection of pure play uranium stocks – many of which carry small market capitalization. To access the uranium stocks highlighted today, eToro is an SEC-regulated broker that does not charge trading commissions when buying and selling equities. The minimum deposit and trade value at eToro is $10.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.