UK investors with a cash balance of £25,000 have plenty of asset classes to consider when building a portfolio. A diversified investment strategy might consider stocks, ETFs, commodities, real estate, and even crypto assets.

In this guide, we discuss the best way to invest £25k in the UK across 10 different methods.

The 10 methods that we will discuss in this guide on the best way to invest £25k in the UK are listed below: Seasoned investors will often build a portfolio that contains some or even all of the above asset classes. As a result, when selecting the best way to invest £25k in the UK, be sure to read through all 10 methods.Best Ways to Invest £25k in the UK in 2023

A Closer Look at the Top Ways How to Invest £25,000

Creating a portfolio of investments will require the investor to assess their long-term goals and tolerance for risk. In many cases, investors that have time on their side will often elect to gain exposure to higher growth markets, such as stocks and crypto.

On the other hand, those that are in the midst of a long-term retirement plan might also consider lower-risk assets, such as bonds and dividend stocks.

To help clear the mist, we will now explore the 10 best ways to invest £25,000 in the UK. This will also include the best short-term investments.

1. Crypto Assets – Invest in High Potential Crypto Projects like Dash 2 Trade

More and more investors in the UK are turning to crypto assets like Bitcoin as a means to outperform the broader stock market. After all, over the prior one and five years, the UK’s FTSE 100 index has actually declined in value by 4% and 8%, respectively. In comparison, crypto assets have generated unprecedented returns.

The first crypto asset to launch in 2009 was Bitcoin. Although Bitcoin is still the largest and most sought-after crypto asset in this space, there are thousands of other tokens to consider. Nonetheless, early investors in Bitcoin are now looking at gains of several million percentage points. This is because Bitcoin was worth just a few cents in its early years of trading.

Since then, Bitcoin has hit highs of nearly $69,000. The good news is that the process of buying Bitcoin in the UK is now super-easy. In fact, it takes just a few minutes when using an FCA-regulated broker like eToro, which supports UK debit/credit cards and even e-wallets such as Skrill and PayPal.

Another so-called benefit of investing in Bitcoin at this moment in time is that the broader market has been on the decline since hitting highs in late 2021. This means that instead of paying $69,000 per BTC token, investors in the UK can get a 70% discount at the $20,000 level. As such, first-time investors can enter the crypto asset market at a huge discount.

As will be the theme throughout the guide on the best way to invest £25k in the UK, diversification in the crypto asset arena is key. This means that instead of just electing to buy Ethereum and Bitcoin, investors should consider dipping their toes into other high-quality projects. For example, those with an interest in the metaverse have plenty of ways to diversify.

Some of the best metaverse crypto coins in the market are inclusive of the Sandbox, Decentraland, and Enjin. Additionally, investors might also consider some high-growth meme coins, such as Shiba Inu and Dogecoin. With that said, perhaps the highest-growth market in this space as of writing is crypto presales.

In a nutshell, new crypto projects that are launching their digital token for the first time will look to raise funds from early investors. This means that early investors will be able to buy the token at the best price possible. Consider that in 2014, the Ethereum presale priced its token at just $0.31, which has since hit highs of over $4,900.

One of the best crypto presales to consider right now is being run by Dash 2 Trade. This innovative project is building a crypto analytics terminal that will provide investors with state-of-the-art pricing data, including social media metrics, on-chain analysis, and insight into where the ‘smart money’ is going.

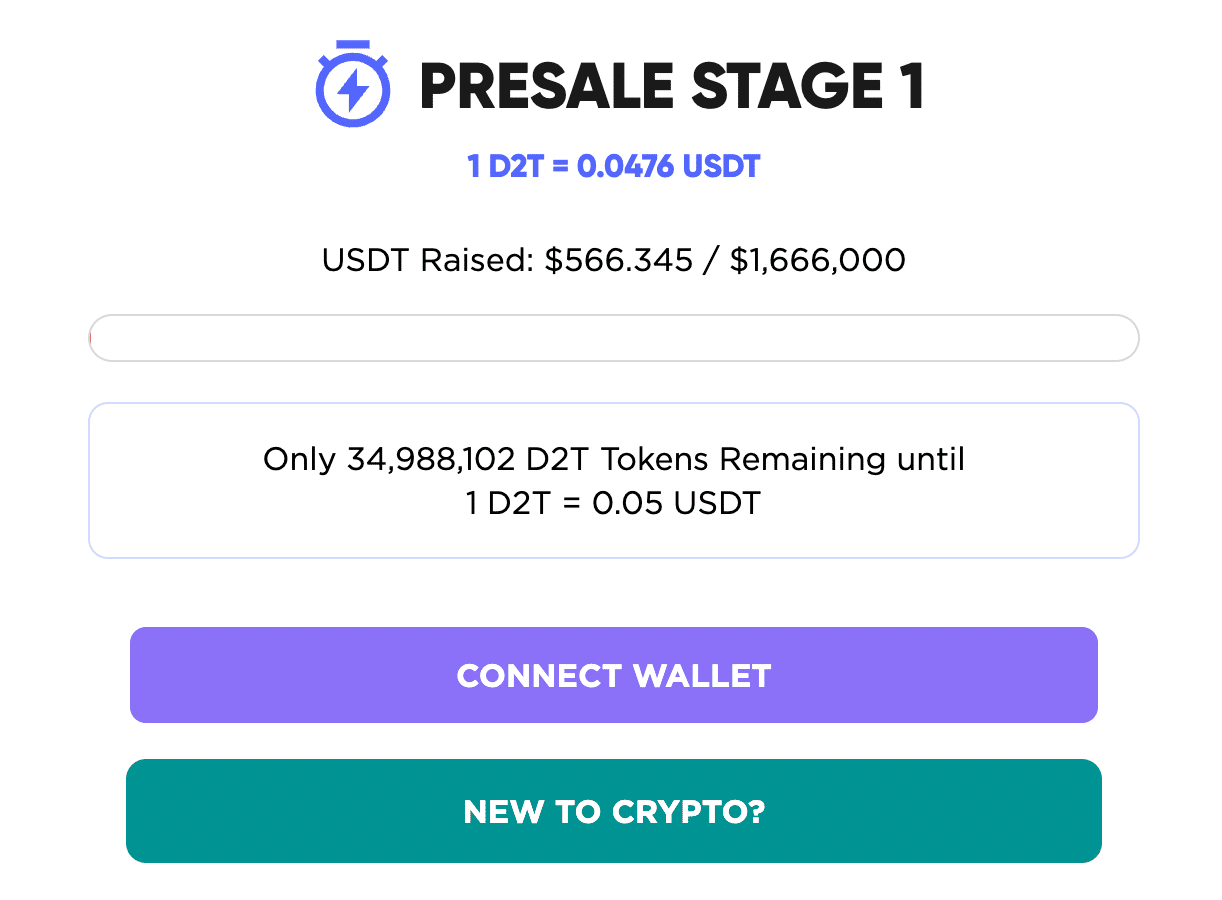

Moreover, the Dash 2 Trade terminal will also offer real-time trading signals that inform token holders of which crypto assets to buy and when. Other features of the terminal include backtesting, strategy building, crypto rating scores, and social trading. The Dash 2 Trade presale is offering its D2T at an early-bird price of $0.0476. For those with a lower risk tolerance looking for the best way to invest £5k in the UK, Dash 2 Trade could be a popular asset to consider.

This is the lowest price that the D2T will be available at. In fact, after the initial batch of D2T tokens is sold, the presale price will increase to $0.05. For more information on how to access the Dash 2 Trade presale in the UK, a step-by-step guide is provided further down.

- Check out the Dash 2 Trade whitepaper for more information on this high-growth project

- To get real-time updates on the project, check out the Dash 2 Trade Telegram group

In the meantime, another crypto presale that is ongoing at this moment in time is IMPT. IMPT is considered a green crypto project that aims to combine the benefits of blockchain and smart contracts with making the world a more sustainable place. Its decentralized ecosystem enables companies to offset their carbon emissions through credits, which are backed by IMPT tokens.

At the other end of the scale, investors with an interest in growth markets might consider that carbon credit prices continue to witness incredible growth in the global space. As such, by purchasing IMPT tokens, this offers exposure to the UK carbon credit trading industry. As of writing, the presale has raised over $6 million and IMPT can be purchased at $0.018.

2. Dividend Stock ETFs – Passively Invest in a Variety of Markets Through a Single Investment

The next asset class to consider when assessing the best way to invest £25k in the UK is dividend stocks. This means that the investor will be allocating funds to stocks that pay dividends, with distributions typically made every three months. The first option in this regard is to spend some time researching individual dividend stocks for the portfolio.

With that said, perhaps the most efficient and risk-averse option is to consider a dividend stock exchange-traded fund (ETF). The ETF will purchase a basket of dividend stocks on behalf of investors in addition to rebalancing and maintaining the portfolio on a regular basis. This means that investing in a dividend stock ETF is completely passive.

Every three months, the ETF provider will transfer the investor’s share dividends to the brokerage account where the investment was made. Moreover, the value of the ETF will increase if collectively, the share price of the dividend shares held in the portfolio rises. This means that dividend stock ETFs are ideal for both regular income and capital growth.

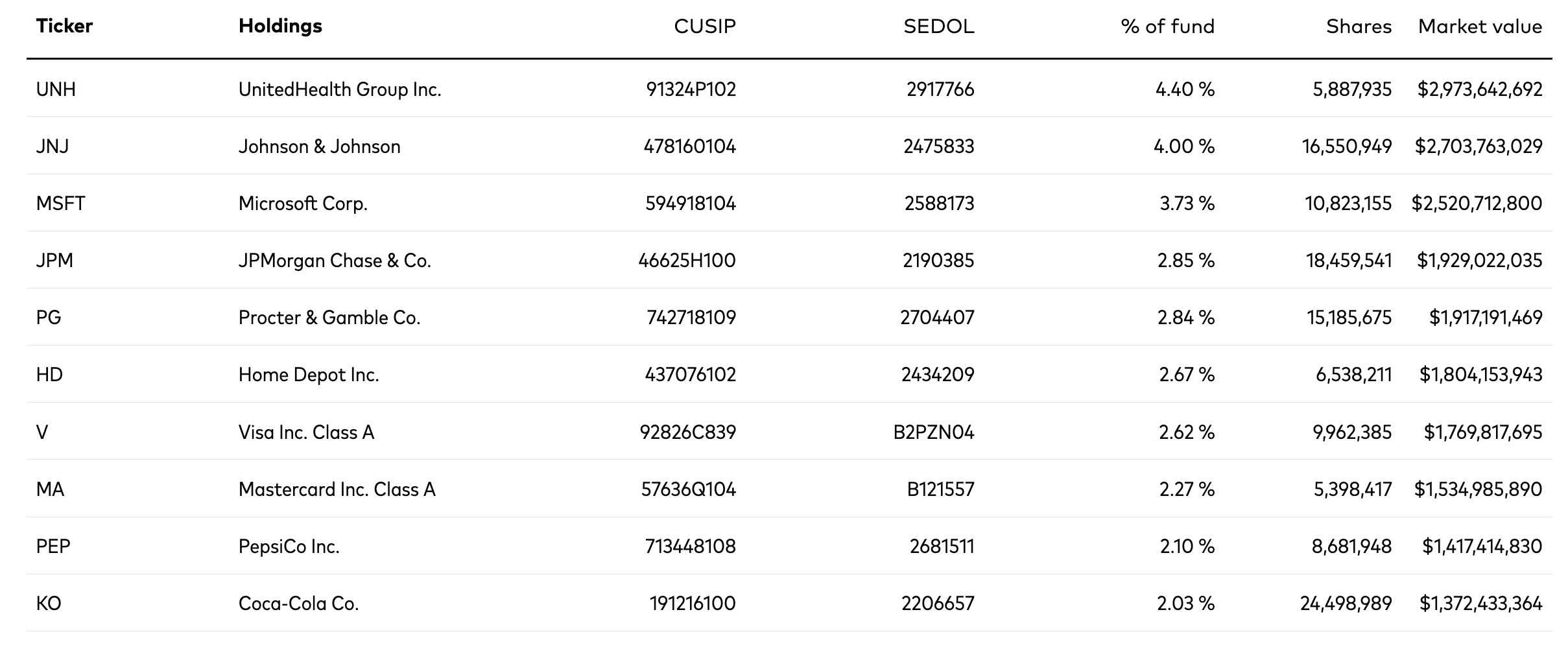

One of the most popular options in this market is the Vanguard Dividend Appreciation ETF. This ETF contains 289 dividend-paying stocks, which covers everything from UnitedHealth Group, Microsoft, and Home Depot to MasterCard, Johnson & Johnson, and Pepsi. The annual expense ratio of this ETF is just 0.06% – or 60p for every £1,000 invested.

3. Dow Jones Index Fund – Managed Portfolio of 30 Leading US Stocks

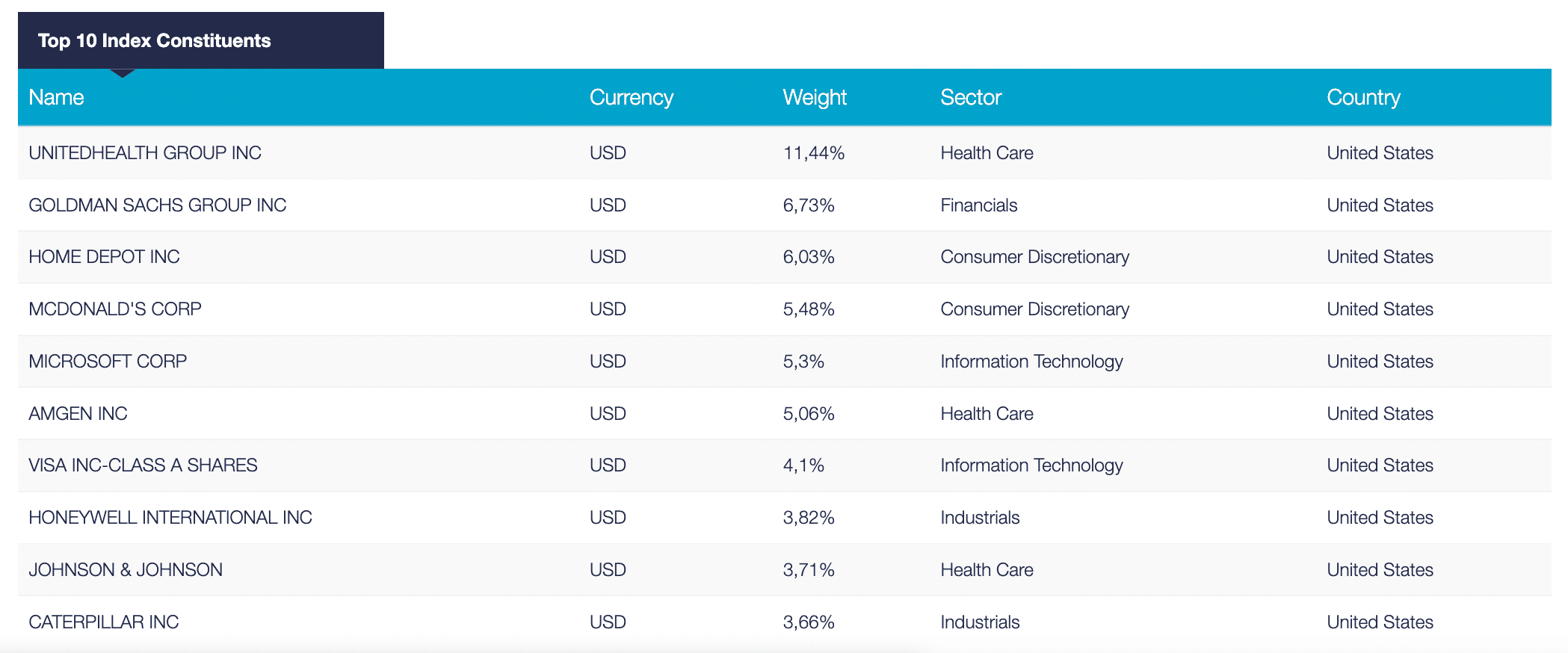

The Dow Jones is one of the best-known index funds in the stock market – and for good reason. This index fund has generated average annualized gains of approximately 10% since its inception. Unlike other popular index funds – such as the FTSE 100 and S&P 500, the Dow Jones represents a small number of companies at just 30.

However, each company is a market leader in its respective industry with a blue-chip status and a solid dividend policy. As such, by investing in the Dow Jones, this offers exposure to the broader US economy. Another important factor to take into account is that the Dow Jones is weighted by the share price rather than market capitalization.

This means that companies with a higher share price represent a larger percentage of the portfolio. For example, UnitedHealth Group and Goldman Sachs carry a weighting of 11.44% and 6.75% respectively. This means that those with £25,000 to invest in the Dow Jones will indirectly own £2,860 and £1,687 worth of UnitedHealth Group and Goldman Sachs shares, respectively.

Moreover, the Dow Jones will rebalance its portfolio every three months, which means increasing or decreasing the weighting of each portfolio constituent. In terms of fees, investors should not pay an expense ratio of over 0.10% when investing in the Dow Jones via an ETF provider like iShares and Vanguard.

4. Commodities – Consider Allocating Funds to Precious Metals, Energies, and Agriculture

Thus far, we have discussed the benefits of allocating funds to crypto assets, presales, dividend stock ETFs, and the Dow Jones index fund. To ensure that maximum diversification is achieved, another option to consider when assessing the best way to invest £25k is commodities.

There are many commodities that can be traded online and this industry is generally split into three categories. First, there are precious metal commodities, which typically include gold and silver. However, more experienced investors will also consider speculating on palladium and platinum.

The easiest and most cost-effective way to invest in precious metals is through an ETF. The best ETFs in this space are physically backed by precious metals, which offers direct exposure to global spot prices. Alternatively, investors in the UK can trade the future value of gold, silver, and more via a UK CFD broker.

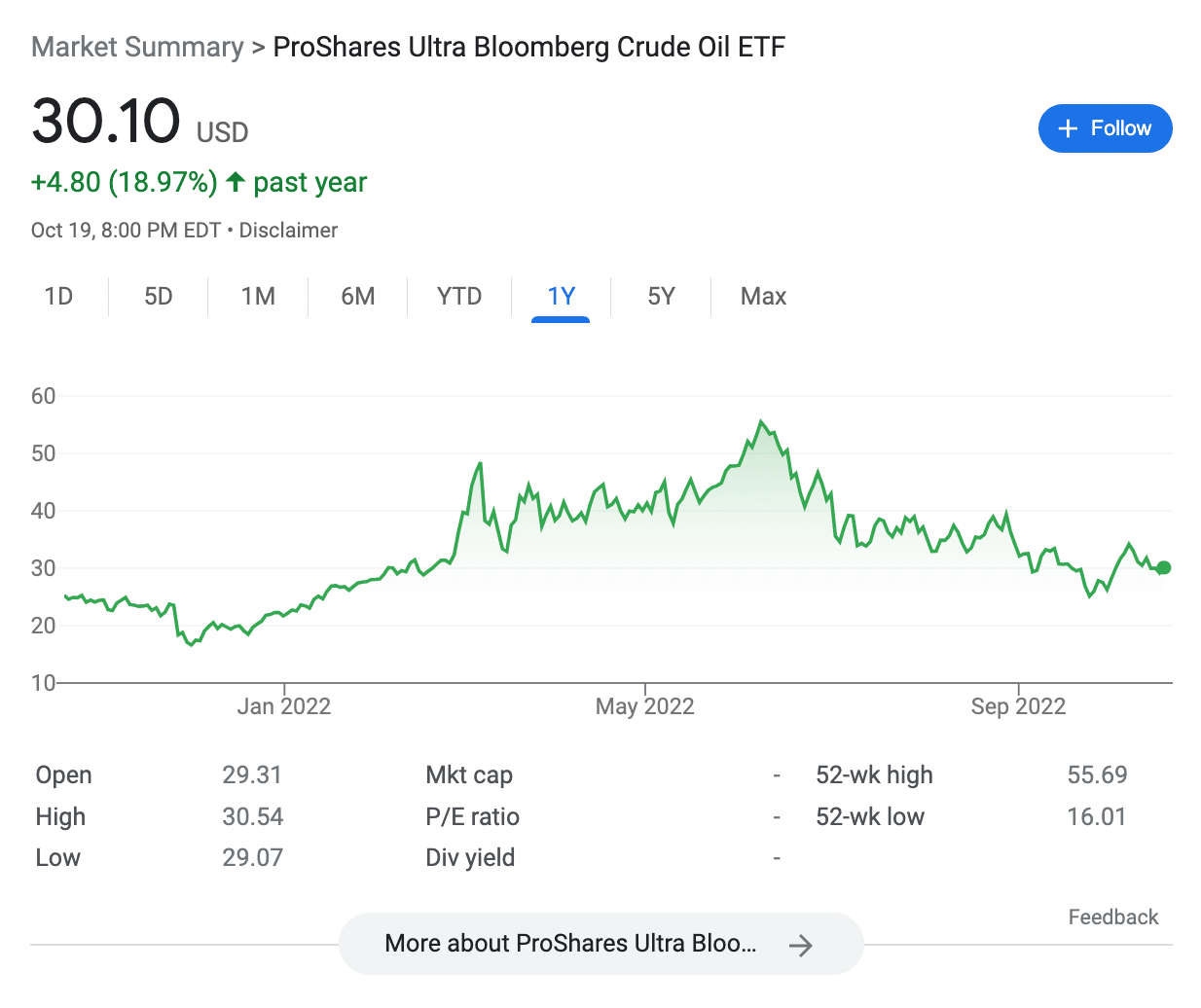

The second commodity category to consider is energy. This largely covers the WTI and Brent crude oil markets in addition to natural gas. CFDs offer the easiest way to trade energies, not least because they track spot prices like-for-like. Alternatively, it is also possible to invest in oil and natural gas via relevant stocks or ETFs.

Finally, agricultural products are increasingly becoming popular with UK investors. Through CFDs, it is possible to trade everything from wheat and corn to sugar and orange juice. To invest in commodities successfully, investors will need to conduct research into geopolitical events, global economic news, and supply and demand.

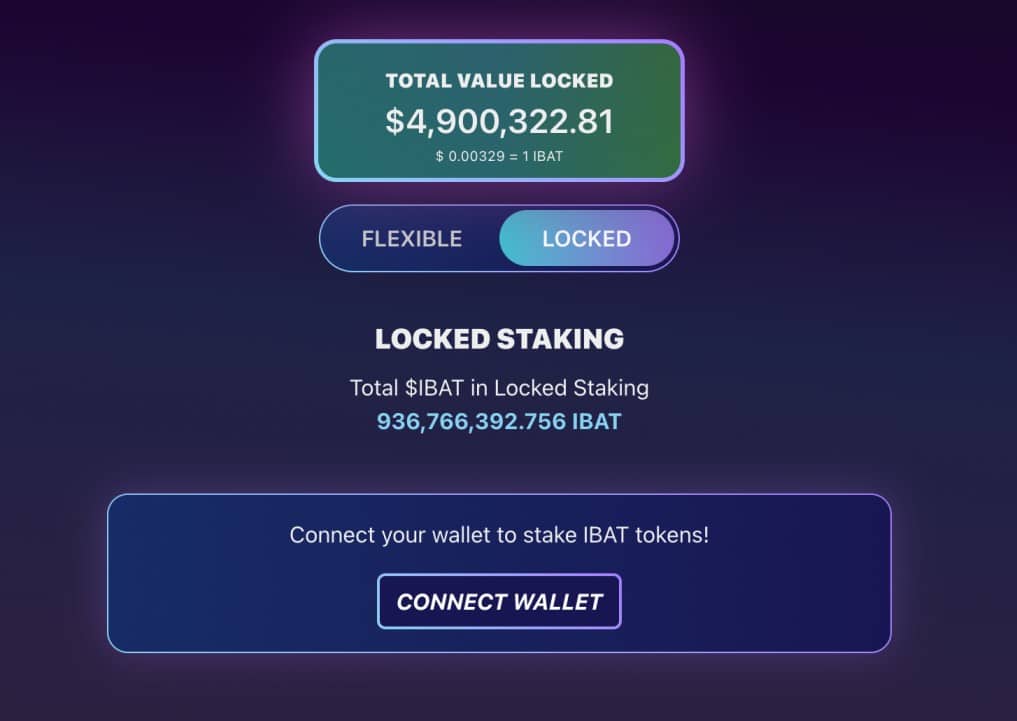

5. Crypto Staking – High Risk-Reward Investment Option for Passive Investors

Investors with a higher appetite for risk might consider crypto staking as one of the best ways to invest £25,000. The reason for this is that staking offers a passive way to earn income and capital gains. In its most basic form, staking platforms enable investors to deposit their crypto assets and in return, generate interest.

The interest is often funded through mining transactions or an inflationary policy of the respective blockchain. Either way, from the perspective of the investor, once the crypto assets are deposited there is nothing else to do. In many ways, staking operates in a similar way to a traditional savings account in the UK.

This is because the crypto assets will generate interest for as long as they remain in the staking pool. Some platforms in this space offer both flexible and fixed accounts. Flexible accounts enable instant, penalty-free withdrawals in return for a more conservative interest rate. Fixed accounts offer higher rates but the crypto assets will be locked for an agreed period.

One option to consider in terms of suitable staking ecosystems is Battle Infinity. This newly launched project offers an in-house staking tool for its native digital currency – IBAT. The platform offers the option of fixed and flexible terms, both of which offer competitive rates.

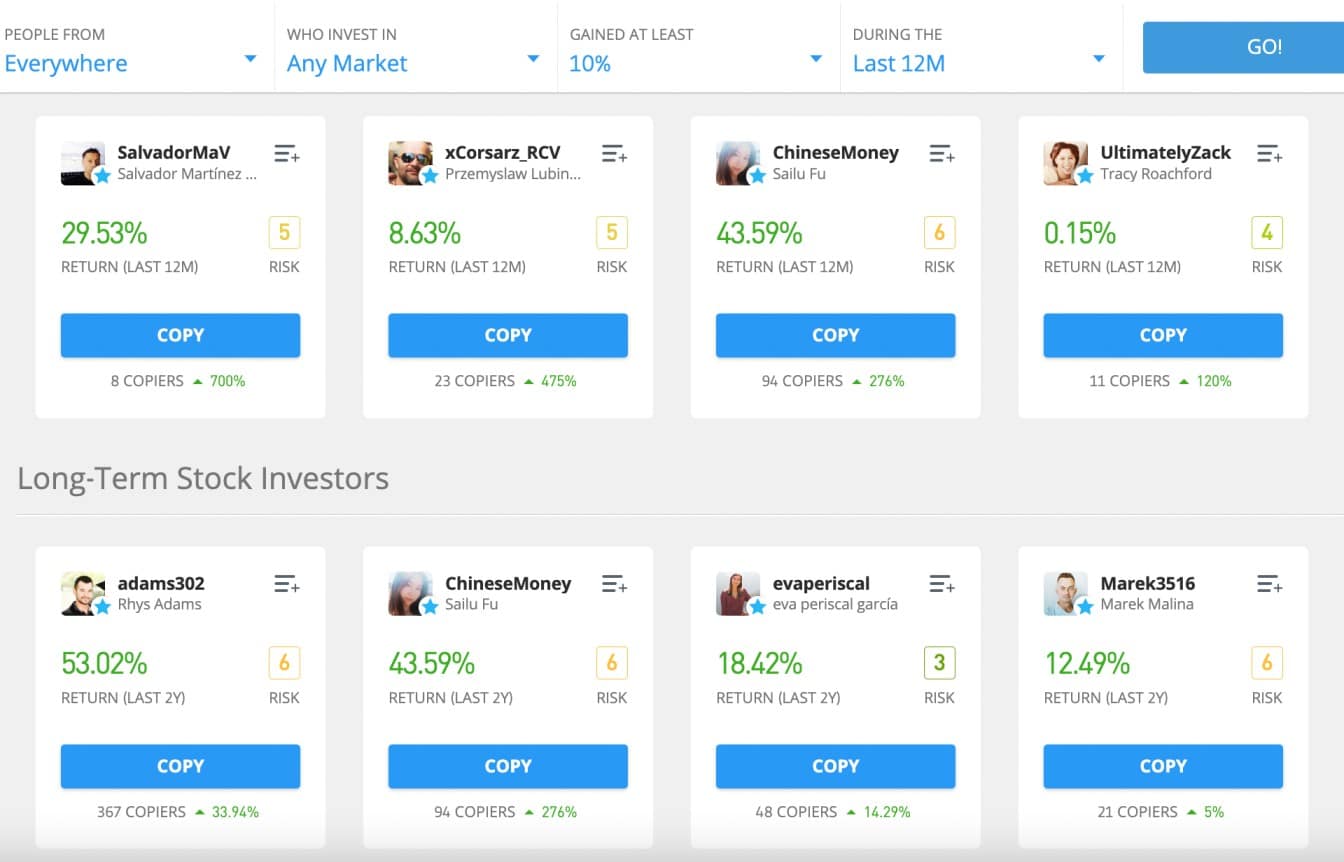

6. Copy Trading – Mirror the Investments of an Experienced Trader

Copy Trading is a growing concept and perhaps the best way to invest £25,000 in the UK in 2023 passively. The concept of Copy Trading is simple – the investor will choose a trader to copy and then thereon, all future investments will be carried over the portfolio automatically. One of the most popular Copy Trading platforms in this market is eToro, which is FCA-regulated.

eToro offers access to thousands of seasoned traders that can be copied at the click of a button. Investors will appreciate that each mirrored trade will be proportionate to the original investment. For example, let’s suppose that £5,000 is invested into a stock trader that has a long-standing track record on the eToro platform.

The trader elects to allocate 5% and 8% of their portfolio into HSBC and Royal Mail stocks, respectively. Considering that a £5,000 investment into the trader was initiated, the investor will automatically have a £250 and £400 stake in HSC and Royal Mail. This means that Copy Trading is somewhat similar to an ETF.

However, the Copy Trading tool offers an active way to access the financial markets. After all, the trader that is being copied can elect to buy and sell any assets of their choosing. The minimum investment per copied trader is $200 (about £180). This means that diversification across multiple traders can be achieved. No additional fees are charged to use the Copy Trading feature.

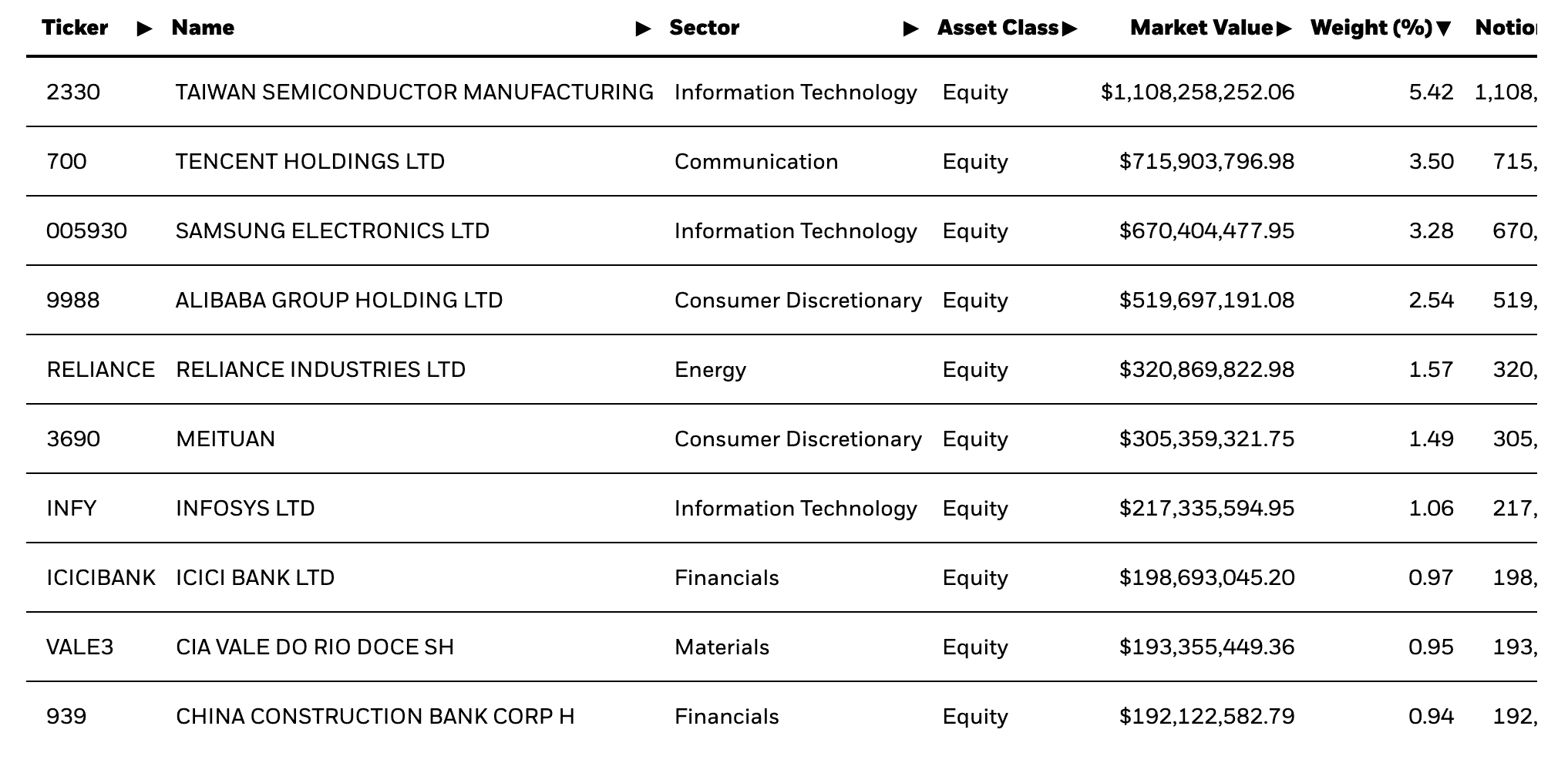

7. Emerging Market Funds – Gain Exposure to the High-Growth Economies

As noted earlier, the FTSE 100 is one of the worst-performing index funds in the global markets – at least over the prior 20 years. Therefore, when searching for the best place to invest £25,000 in the UK, it might be worth allocating capital further afield. One such option in this regard is to gain exposure to high-growth emerging economies.

This refers to countries that are yet to fully develop their local economies and thus – there is plenty of upside from an investment perspective. Some of the most prominent emerging economies to focus on include Thailand, Indonesia, the Philippines, Brazil, Mexico, and South Africa.

In terms of how to invest in foreign markets, the easiest and most cost-effective way is to opt for an ETF. The chosen ETF will likely buy leading stocks from a variety of emerging countries, in addition to rebalancing the portfolio every three months. The ETF provider will also distribute any dividends that it receives from the stocks held in the portfolio.

One of the most popular products in this space is the iShares MSCI Emerging Markets ETF. This ETF offers access to over 800 stocks from the emerging markets, including Taiwan, China, India, Brazil, South Korea, Indonesia, Mexico, and South Africa. Since its inception in 2003, this ETF has generated average annualized returns of 7.93%.

8. Staple Stocks – Invest in Companies That Have Stable Revenues in All Economic Conditions

Another area of the financial market that is worth considering when searching for the best way to invest £25k in the UK is staple stocks. In a nutshell, staple stocks refer to companies that sell products or services that are always in demand. This means that even during a recession, the company will continue to generate stable revenues.

An example of a popular staple stock is Walmart. The US supermarket giant sells budget-friendly food and beverage, so it generally does well in all economic conditions. In fact, during the 2008 financial crisis, Walmart stock generated gains of over 60%. Similarly, Procter & Gamble is another example of a solid staple stock.

This global powerhouse sells household goods that are utilized by virtually everyone. Think along the lines of dishwashing liquid, cleaning products, odor eliminators, soap, and toothpaste. Ultimately, while staple stocks might not offer the most attractive upside in comparison to other markets, they can be great to hold in a portfolio during uncertain economic times.

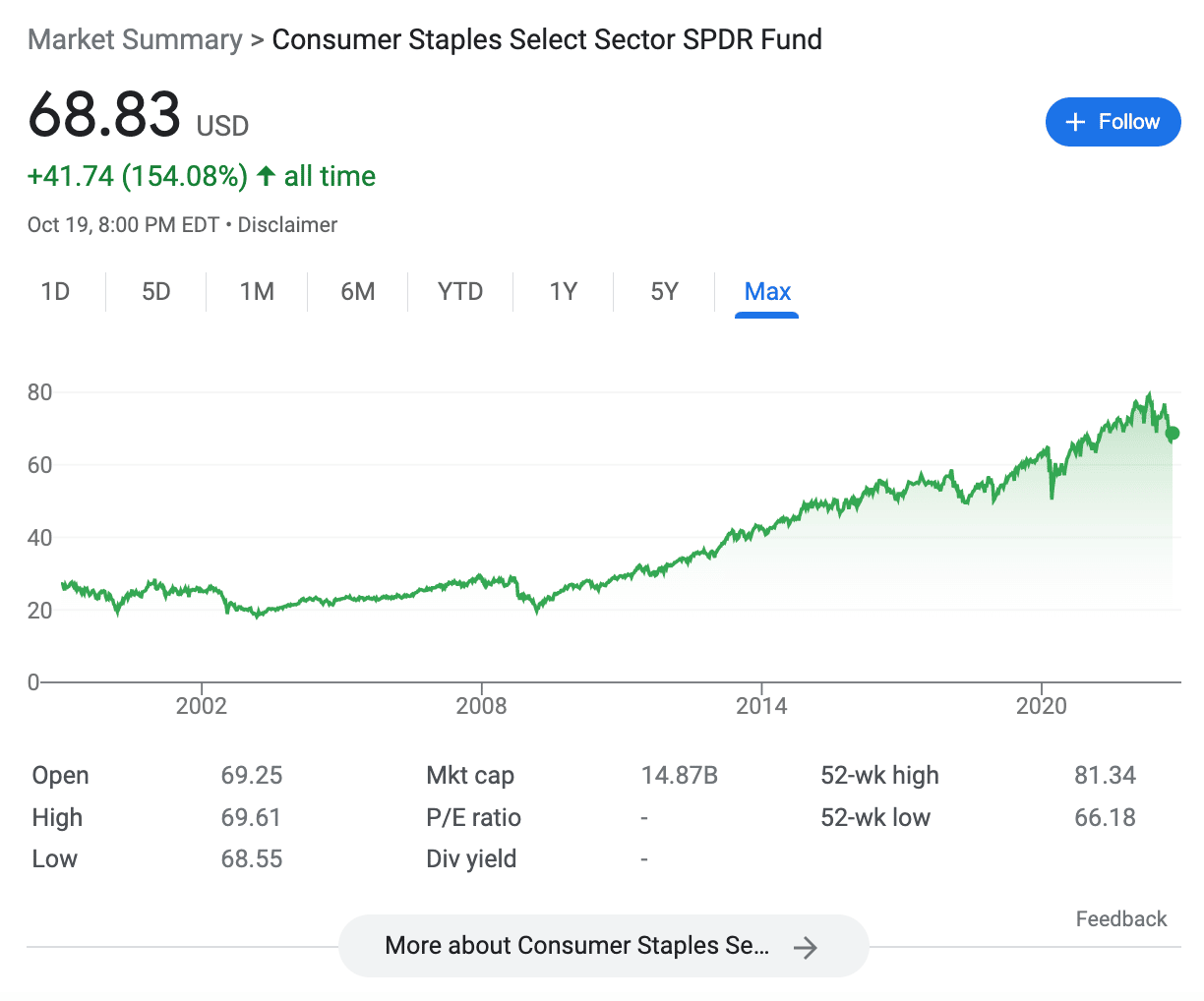

Those without any experience in selecting individual investments might also consider an ETF that exclusively focuses on staple stocks. For example, the Consumer Staples Select Sector SPDR Fund offers access to 33 companies from within this industry, including the likes of Procter & Gamble, Coca-Cola, Phillip Morris, Colgate-Palmolive, Walmart, and Costco.

9. NFTs – Buy, Sell, and Flip NFTs on the Open Market

Another high-growth market that could be worth considering more in the coming years is non-fungible tokens – or NFTs. NFTs are digital tokens that operate on the blockchain network. Each NFT is unique from the next, which means that they can provide proof of ownership of an item, such as virtual art, property, or securities.

In 2021 alone, estimates suggest that NFT sales amounted to between $17-23 billion. Although sales are down in 2022 to date, this is largely because of the wider crypto bear market. Nonetheless, NFTs offer an opportunity to generate gains through a process known as ‘flipping’. This refers to the process of buying an NFT and selling for a higher price at a later date.

Although some of the best-known NFTs in this space – such as CryptoPunks and BAYC have sold for several million dollars, there are many alternatives available for just a few pounds. Launchpad.XYZ, for example, is a popular marketplace that offers a variety of low-cost NFTs for beginners to consider.

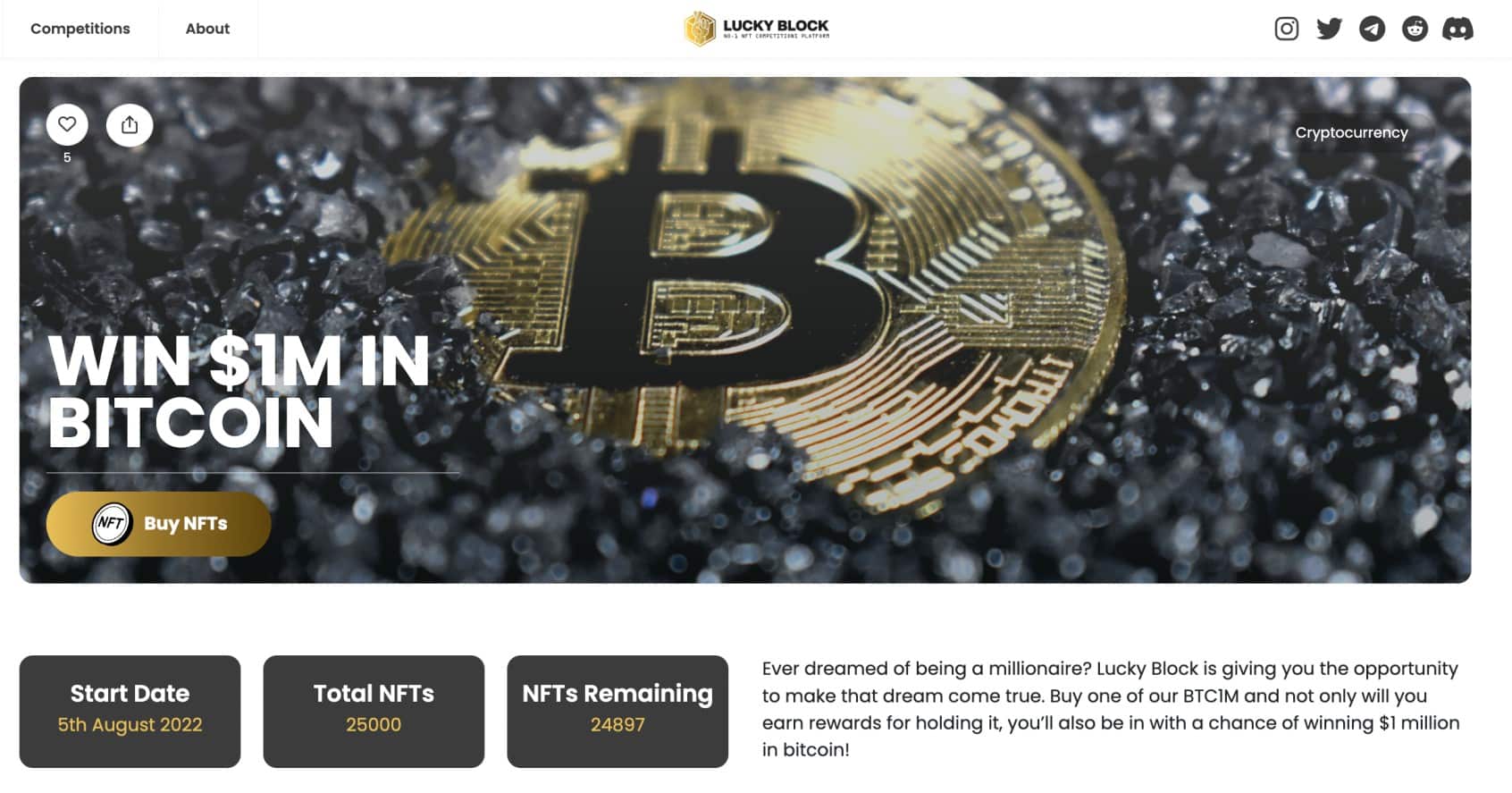

One of the most notable collections on the platform is the Lucky Block NFT range. There are several categories of Lucky Block NFTs and each one offers entry into a specific competition – such as a $1 million property or $1 million worth of Bitcoin. We also came across the Tamadoge NFT range, which offers a variety of perks within its P2E gaming network.

10. REITs – Invest in Real Estate via an ETF Provider

No longer is it a requirement to purchase a property outright to gain exposure to the real estate space. On the contrary, real estate investment trusts – or REITs, enable investors in the UK to allocate funds to a specific property market with a small amount of capital. Each REIT will be backed by an ETF provider, which will purchase properties on behalf of investors.

Not only that, but the ETF provider also takes care of the research and due diligence process, in addition to finding tenants, collecting rent, and distributing dividends. Therefore, investors can access the real estate market in a completely passive way. Another interesting aspect of REITs is that they offer access to various segments of the property market.

For example, while some REITs focus on residential properties, other options include warehouses, shopping centers, healthcare facilities, and commercial buildings. Most importantly, REITs trade as ETFs on a public stock exchange. As a result, investors can cash in their REIT position at any given time.

How to Choose the Best £25k Investments For You

Choosing the right investments is the most challenging part of the process – especially for beginners. Therefore, in this section, we’ll discuss some notable considerations to make when creating a £25k investment portfolio.

Risk Appetite

Perhaps the most important factor to consider is the amount of risk that the investor is comfortable taking. Make no mistake about, all investments come with an inherent level of risk. However, some assets are a lot risker than others.

At one end of the scale, savings accounts, government bonds, and dividend stocks are considered low-risk, and thus – the returns on offer will follow suit.

Higher-risk assets – which offer the best chance possible of generating sizable growth, include stocks, emerging market ETFs, and cryptocurrencies.

One of the best ways to reduce risk exposure is to diversify across multiple asset classes and markets.

Investment Returns

Investors will also need to evaluate how much growth they wish to see in the investment funds. To offer some insight, US-listed index funds such as the S&P 500 and Dow Jones have historically generated annualized returns of 10% since their inception dates.

Cryptocurrencies, although much risker, have generated significantly higher returns in recent years. For example, in the weeks prior to writing this guide, a newly launched crypto asset called Tamadoge witnessed gains of over 1,000% after completing its presale. This is why the previously discussed Dash 2 Trade presale might be of interest to investors seeking higher gains.

The lowest investment returns are, of course, typically available on low-risk assets, such as gilts and savings accounts.

Time Horizon

Another aspect to consider when searching for the best way to invest £25k is the time horizon of the investment strategy.

For example, short-term investors might consider crypto presales or even CFD trading markets on precious metals and energies.

On the other hand, long-term investors might be more suited to stocks and index funds. If your personal wealth grows over the long run, your next decision may become how to invest £50k.

Active or Passive

Complete beginners will likely prefer passive investment vehicles. This means that once the investment is made, there is nothing else to do until it comes to cashing out. ETFs and index funds are great examples of passive investments.

Those with more time might consider the added upside available when taking an active approach to investing. This means frequently trading the likes of stocks and crypto with the view of outperforming the broader market.

How to Invest £25,000 in the UK

As we have stressed throughout this guide, when assessing how to invest £25k in the UK it is super-important to diversify. The more diversified a portfolio, the less risk exposure that is being undertaken.

Nonetheless, in this section, we will explain how to invest in the Dash 2 Trade presale launch – which we found to offer an attractive upside potential for early investors.

Step 1: Get a Cryptocurrency Wallet

The first requirement when investing in the Dash 2 Trade presale is to get a cryptocurrency wallet.

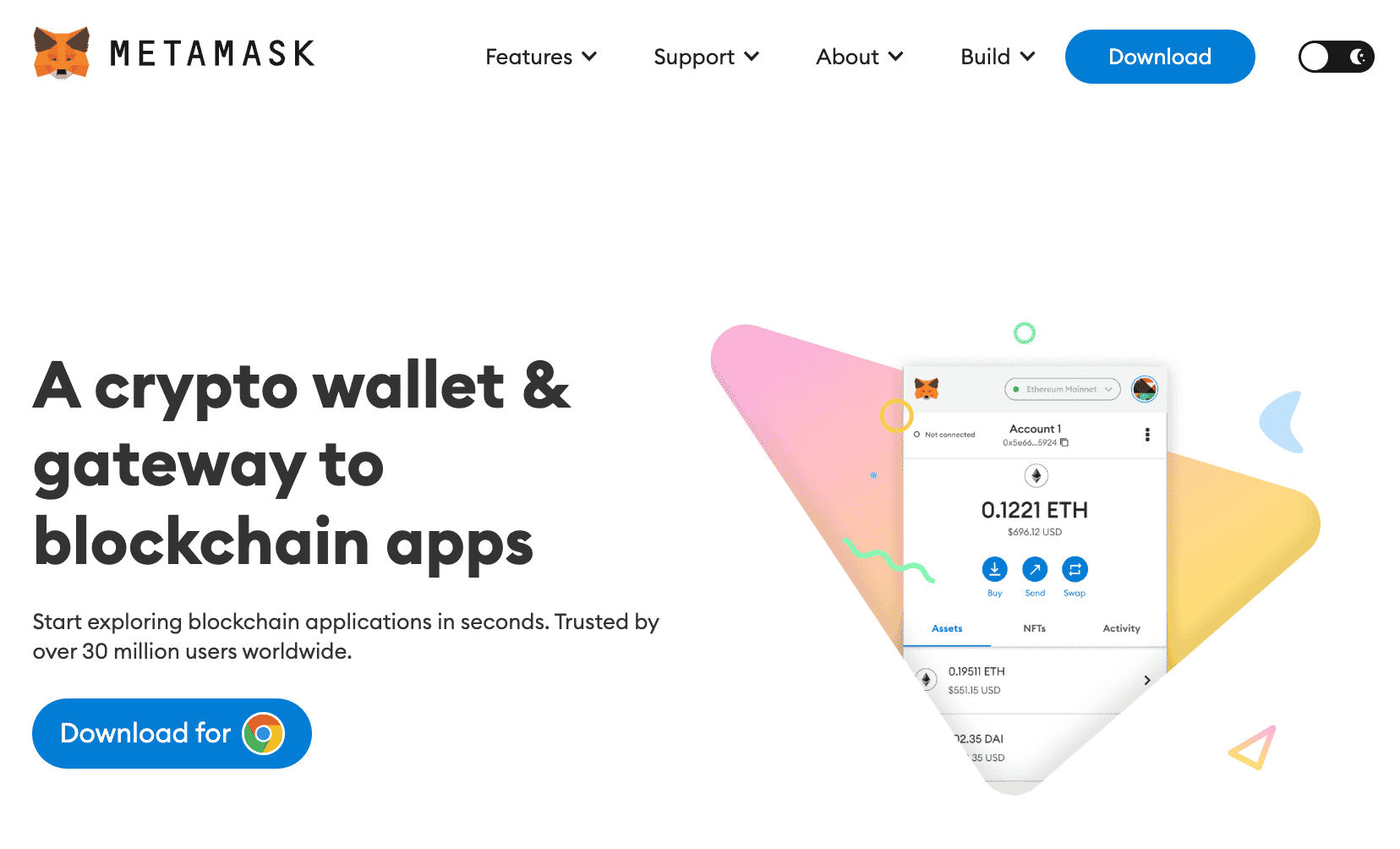

For both beginners and experienced traders, one of the best crypto wallets in the UK is MetaMask. This is because MetaMask is safe, user-friendly, and downloadable as a browser extension for Google Chrome, Microsoft Edge, and Firefox.

Here’s how to set the MetaMask wallet up:

- Visit the MetaMask website and download the extension wallet for the preferred browser (e.g. Google Chrome)

- Open the browser extension and elect to create a new wallet

- Enter a strong password

- Write down the 12-word backup password that MetaMask displays on the screen

It is important to keep the 12-word password somewhere secure and never share this with anyone – as it offers access to the wallet remotely.

Step 2: Buy Ethereum or USDT

When investing in a traditional stock IPO, the purchase is made with pounds and pence. However, crypto presales instead require digital assets when completing the payment. In the case of Dash 2 Trade, the presale accepts Ethereum and USDT.

Both of these cryptocurrencies can easily be purchased online, with the best crypto exchanges in the UK accepting debit/credit cards for a seamless user experience.

After buying Ethereum or USDT from an exchange, the next step is to transfer the tokens to MetaMask.

Step 3: Transfer Ethereum or USDT to MetaMask

Open up the MetaMask wallet extension and look for the ‘Account 1’ tab towards the top of the interface. Just beneath the tab, the Ethereum wallet address will be partially displayed. Next to the address, click on the copy icon.

This will copy the MetaMask wallet address to the user’s clipboard.

Now head over to the crypto exchange that is currently holding the Ethereum or USDT tokens.

- In the crypto exchange account dashboard, look for the ‘Withdraw’ button

- Select ETH or USDT and elect to withdraw the entire amount

- Paste in the MetaMask wallet address

- Confirm the withdrawal

Within the next few minutes, the ETH or USDT tokens will then appear in the MetaMask wallet.

Step 4: Connect Wallet to Dash 2 Trade

Next, visit the Dash 2 Trade website. Click on ‘Connect Wallet’ and select ‘MetaMask’.

A notification will now appear on-screen, sent from the MetaMask wallet extension. This will require confirmation of the connection between MetaMask and Dash 2 Trade.

Provide the required confirmation and head back to the Dash 2 Trade presale dashboard.

Step 5: Invest in Dash 2 Trade Presale

If the connection between the MetaMask wallet and the Dash 2 Trade website was completed successfully, an order box will appear on the screen.

This will ask the investor to type in the number of D2T tokens to buy during the presale. The equivalent number of ETH or USDT tokens will update in the order box.

Confirm the swap and the Dash 2 Trade presale will collect the tokens from the MetaMask wallet. After the presale is finished, go back to the Dash 2 Trade website to claim the tokens.

Note: If the Dash 2 Trade order box states that there are not enough ETH/USDT tokens in the MetaMask wallet, the investor will need to slightly reduce the quantity. This is likely because there aren’t enough tokens to cover the Ethereum blockchain fee.

Conclusion

Overall, investors in the UK have access to a sizable spectrum of options, from dividend stock ETFs and Copy Trading to the Dow Jones index fund and commodities.

It will be beneficial to consider a range of different markets when building a portfolio to ensure that the investments are well diversified.

One of the most notable investment classes we came across during the research process was the Dash 2 Trade presale. This offers an opportunity to invest in a high-quality crypto project at presale prices.