In these turbulent economic times, UK investors are searching for the best place to allocate their funds. How an investor wishes to allocate their investment capital will depend on their personal goals.

Today, we talk about the best way to invest £10,000 in the UK in 2023. We discuss a select number of asset classes for consideration, including stocks, managed portfolios, commodities, cryptocurrency, and more.

10 Best Ways to Invest £10k in the UK in 2023

After analyzing the best way to invest £10k in the UK in 2023, we’ve categorized and ranked the top options in the market right now.

- New Cryptocurrency Projects – Invest in Top New Crypto Presales like Dash 2 Trade

- ETFs – Pooled Investment Security for Diversification

- Preset Managed Portfolios – Collection of Assets That Tracks Specific Market Segments

- NFTs – Buy Unique Digital Assets and Rare Collectables

- Earn Crypto – Stake or Accumulate Interest on Digital Currencies

- Dividend-Paying Stocks – Invest in Companies With a Solid Dividend Program

- Commodities – Diversify Equity Risk With Hard and Soft Commodities

- Index Funds – Invest in a Basket of Stocks With One Transaction

- Copy Trading – Mirror the Trades of a Vetted Investor

- Invest in Property – Build Wealth by Investing in Real Estate

As is clear from the above list, there is an asset class to suit most UK investors.

Throughout this guide, we are going to explain each £10k option in terms of risk and upside potential.

A Closer Look at How to Invest £10,000 in the UK

Investors looking for the best ways to invest £10k in the UK in 2023 will not be short of options when deciding where to allocate their funds.

There are lots of investable markets, albeit, the tricky part for investors is finding the most suitable assets for their goals. This includes picking a time frame in terms of long or short-term investing.

A common approach is to invest in multiple markets to create a diverse portfolio and hopefully reduce risk.

Read on to choose the best £10k investments today.

1. New Cryptocurrency Projects – Invest in Crypto Presales and Newly Launched Projects

Those looking for the best way to invest £10k in the UK could consider allocating a small portion of their portfolio to up-and-coming cryptocurrencies. Blockchain technology has been touted as having the potential to revolutionize a wide range of sectors. As such, cryptos could be one of the best investments in the UK.

This includes everything from healthcare and banking, to supply chains and transportation. Distributed ledgers enable new sorts of economic activity that were previously impractical. The blockchain sector is sometimes referred to as a transformational one, with the potential to transform the world in the way the internet did in the 1990s.

As such, for those who think digital currencies will have a bright future, the potential of this technology and its real-world uses could make for an alluring investment. The need for a dependable, long-term store of wealth is also a common justification for investing in cryptocurrencies.

Many newbie investors explore how to buy Bitcoin, largely because it is a well-established token. It’s also the largest by market capitalization and is therefore highly liquid. Investors who bought BTC tokens early on have seen incredible returns.

For instance, those who purchased Bitcoin from a crypto exchange 10 years ago will have witnessed gains of many millions of percent when it surpassed a value of $68,000 during its all-time high in 2021. In the last five years of trading, Bitcoin investors have seen gains of almost 290%. In comparison, the FTSE 100 has declined in value over the same period.

This is impressive when taking into consideration that we are in the midst of a crypto winter. BTC tokens are trading around 65% lower than the aforementioned high.

With that said, many investors are looking for the next big crypto project to could explode. As such, one of the best ways to invest £10,000, or at least some of it, is by finding pre-ICO projects.

Numerous benefits can result from investing in presales, including buying assets at a discounted price, and potentially bigger profits as a result. Our team has researched this subject extensively. We found that one of the most exciting presales to invest in is Dash 2 Trade.

The Dash 2 Trade project seeks to become a leading social trading and crypto analytics platform. The dashboard will provide all the trading tools required to profit from market opportunities, such as trading signals, and accessible on-chain research.

Dash 2 Trade focuses on trading signals with the potential to provide the biggest impact. This includes listing technical indicators, alerts, social analytics, presales, and more. The group behind Learn 2 Trade co-founded this project. For anyone unaware, this is a well-known trading signal platform with over 70,000 subscribers worldwide.

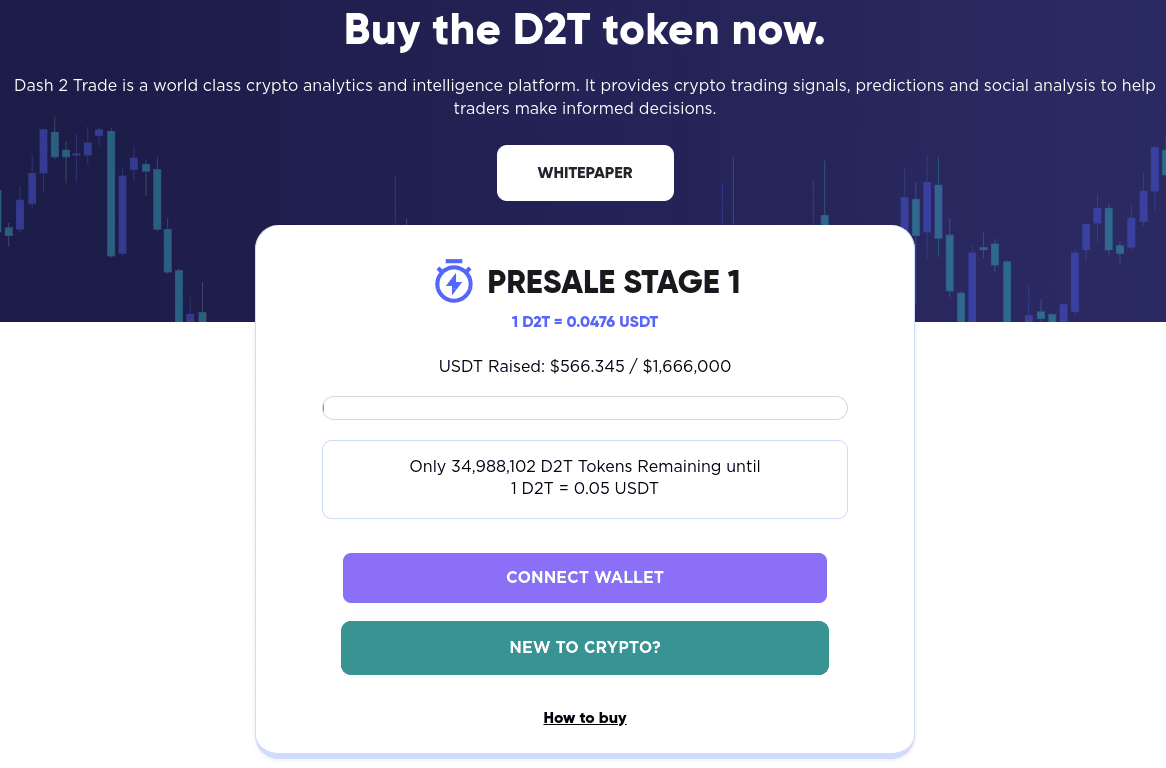

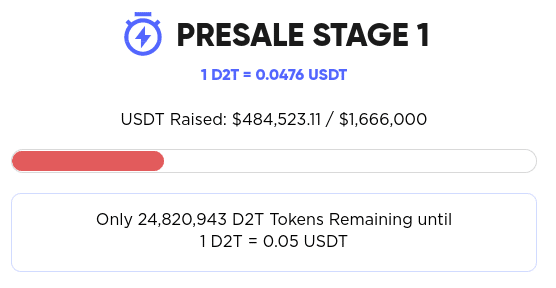

The D2T token is built on the Ethereum Network and serves as the native token of the ecosystem. The D2T supply will be capped at one billion tokens. At the time of writing, Dash 2 Trade is in the first stage of its presale. During this stage, early investors can buy D2T tokens at the discounted price of $0.0476 per token.

When the project moves onto stage two of its presale campaign, D2T will rise to $0.05 per token.

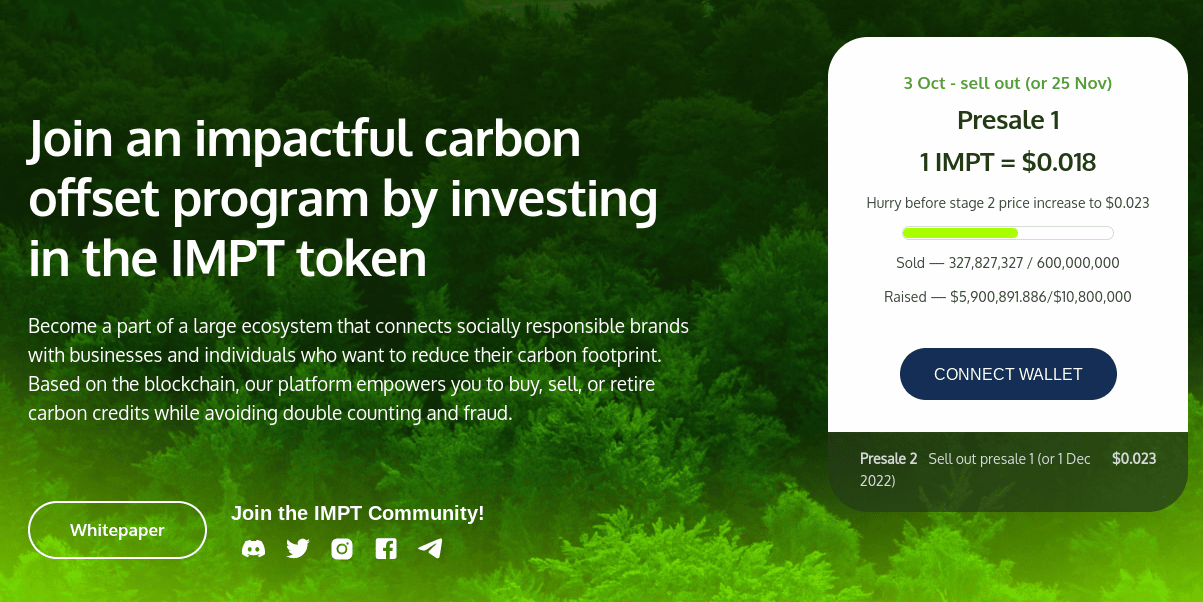

Investors looking for ways to invest £10,000 in the UK may also want to have a look at IMPT. This blockchain project is in the first stage of a green crypto presale.

Corporations, small businesses, and individual users can head over to the IMPT platform to participate in this carbon offset scheme. Shopping with any of the thousands of green companies that have partnered with IMPT is one option for platform users to earn carbon credits.

After each purchase, the site rewards customers with IMPT tokens, which can be swapped for carbon credits. The overarching goal is to help them to reduce their impact on the environment. Read this guide to find out more about how to buy carbon credits in the UK.

2. ETFs – Pooled Investment Security for Diversification

For stock investors, properly diversifying a portfolio takes a lot of effort, knowledge, and free cash flow. Additionally, diverse portfolios must be rebalanced when trends shift. This is one of the reasons that some analysts think ETFs (exchange-traded funds) are the best way to invest £10k in the UK.

ETFs offer a hands-off way to invest as they track an underlying basket of equities or funds. Furthermore, an ETF, unlike a managed fund, seeks to replicate the performance of the index rather than outperform it. This offers immediate exposure to a diverse variety of equities.

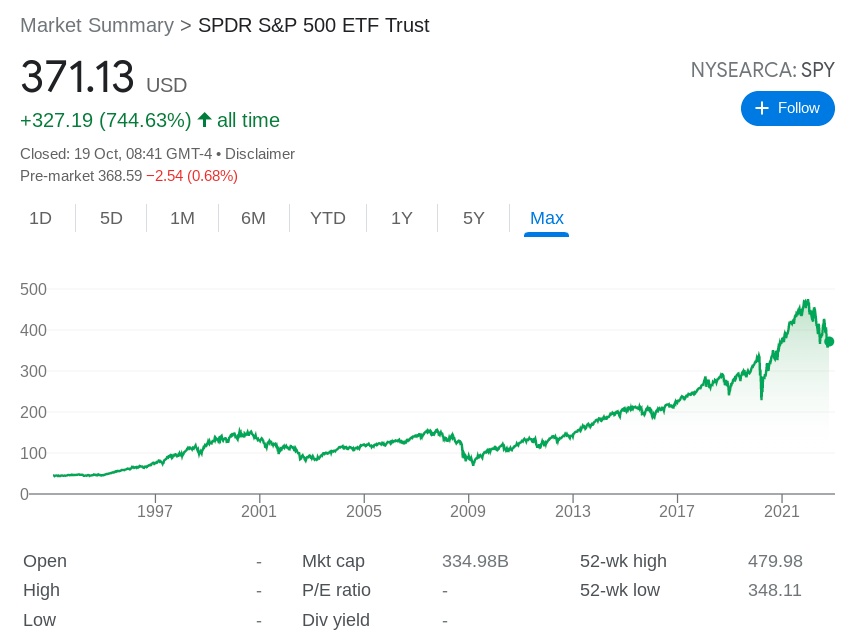

An ETF is managed and weighted according to the market performance of the underlying index it tracks. The SPDR S&P 500 is among the most actively traded ETFs. It tracks the performance of the S&P 500 stock market index, one of the largest and longest-standing of its kind. It’s also one of the best benchmarks for large-cap equities in the US.

By allocating some of the £10,000 to this ETF, investors gain indirect exposure to stocks like Apple, Microsoft, Amazon, Alphabet, Berkshire Hathaway, Johnson & Johnson, and many more. At this time, Apple, Microsoft, and Amazon stocks make up 6.95%, 5.73%, and 3.26% of the fund respectively.

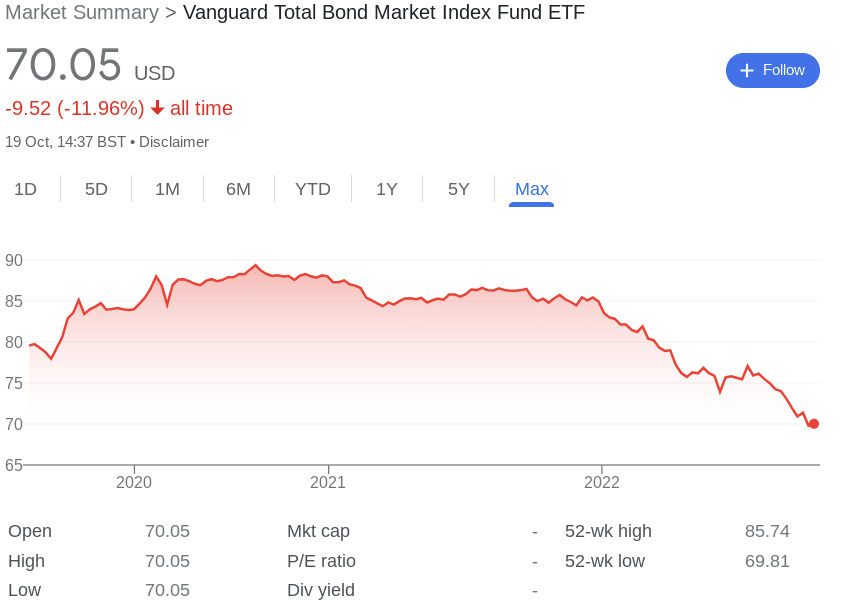

As such, if an investor allocated £10k to this particular ETF, they would passively buy £695 of Apple stock, and so on. Over the last five years of trading, the SPDR S&P 500 ETF has increased by around 45%. There are also ETFs that track bonds – for example, Vanguard Total Bond Market ETF.

The investing goal of the fund is to replicate the performance of a big, market-weighted bond index. It offers extensive exposure to the taxable investment-grade bond market in US dollars. This excludes inflation-protected and tax-exempt bonds.

The portfolio offers exposure to 10,174 bonds. At the time of writing, this fund has net assets worth more than $271 billion. Those with £10,000 to invest in building a portfolio could consider adding more than one ETF and something completely different like presale cryptocurrencies.

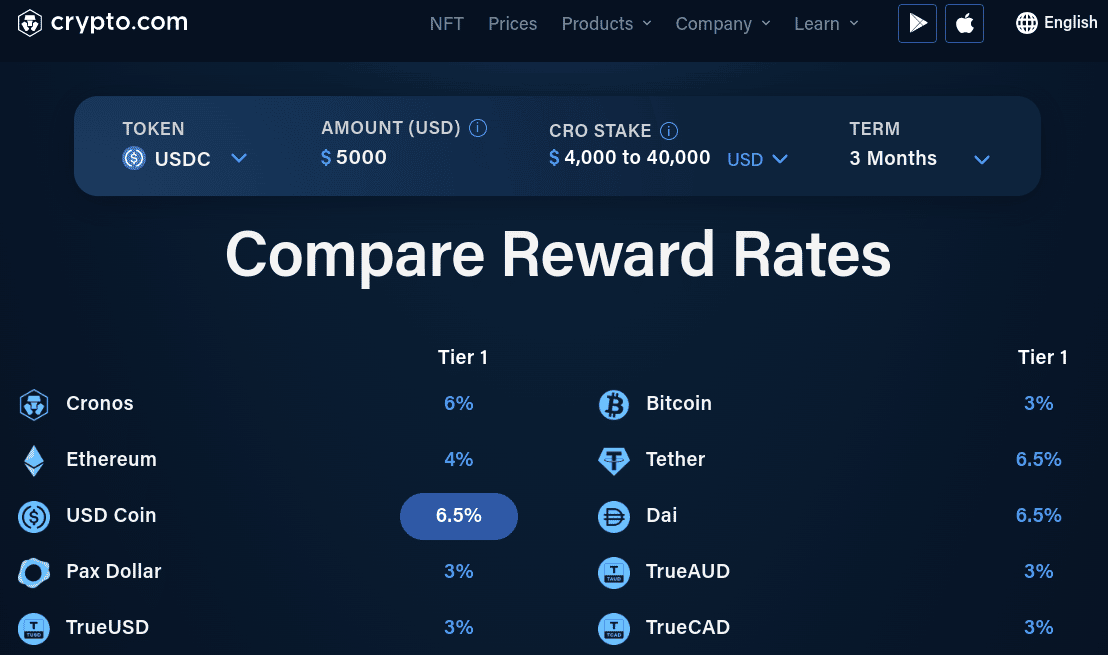

3. Preset Managed Portfolios – Collection of Assets That Tracks Specific Market Segments

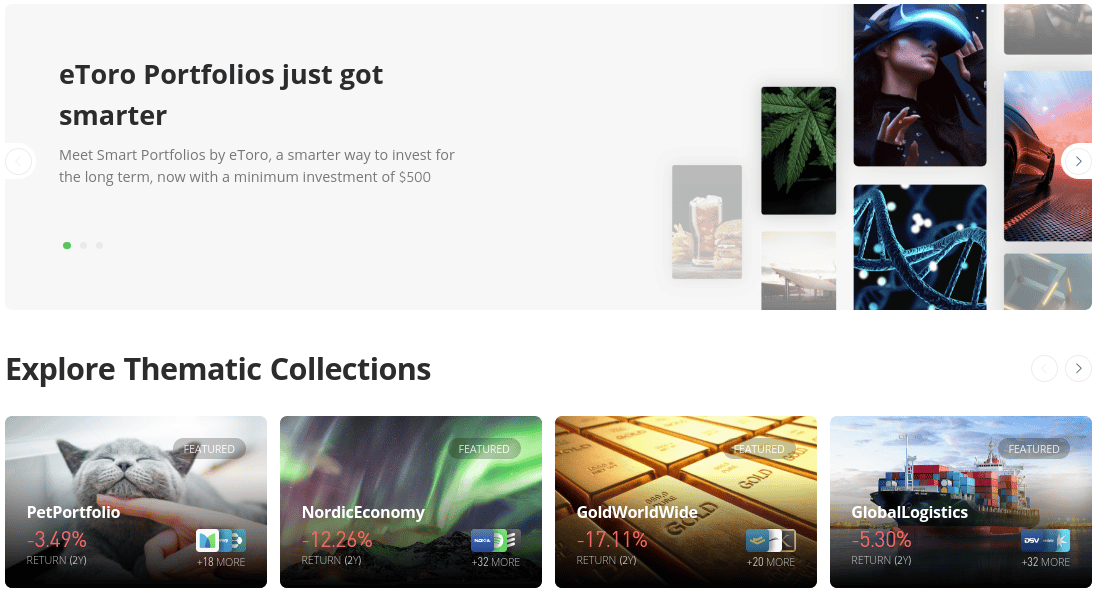

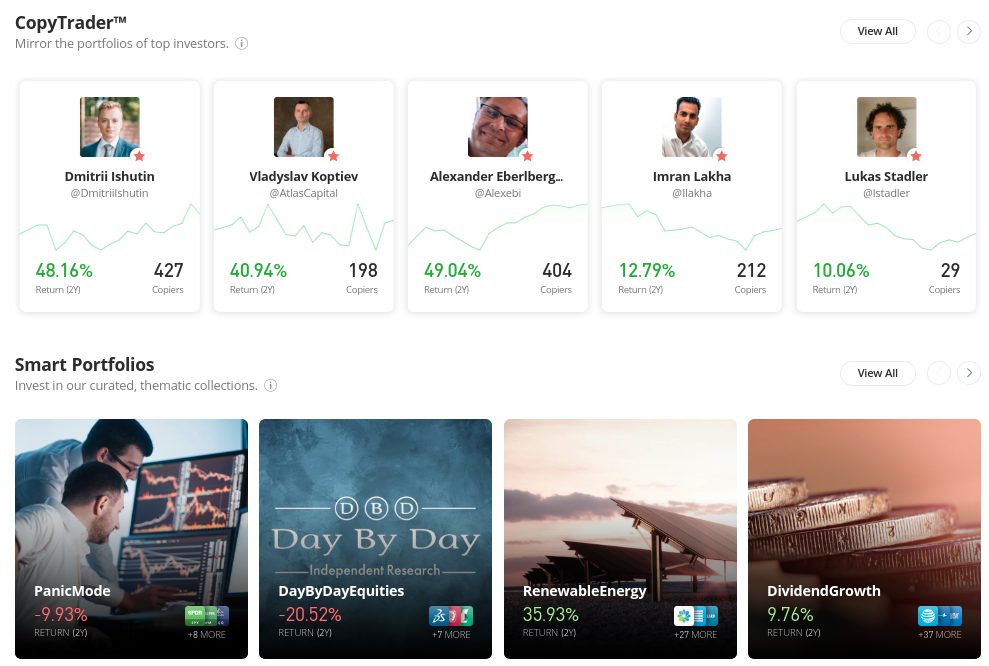

According to some analysts, one of the best ways to invest £10,000 passively is via a preset managed portfolio. If this sounds appealing, FCA-regulated brokerage eToro offers a range of Smart Portfolios to suit most investors.

Put simply, each Smart Portfolio is a curated collection of stocks or cryptocurrencies. They track assets based on a theme, such as pets or energy for instance. Some track a range of equities from a specific sector.

An example of this is the RenewableEnergy Smart Portfolio, which contains 30 climate change stocks. This includes a diverse selection of companies that are focused on clean energy and the technology used in the sector.

When assessing how to invest £10,000 in the UK, it’s a simple case of filtering the Smart Portfolios down by specific interests and choosing the most suitable. This includes options such as retail, transportation, manufacturing, technology, cryptocurrencies, and more.

eToro also offers a range of Partner Portfolios. One example is the Smart Portfolio by Carl Icahn, a US investor, activist shareholder, and philanthropist. This portfolio is made up of the equities Carl himself invests in. This includes sectors such as cloud computing and gaming.

According to data supplied by eToro, the Carl Icahn Smart Portfolio has produced returns of over 26% in the last two years. This is just one example and is no guarantee of future returns. Prior to allocating £10,000 to invest in a Smart Portfolio, it’s important to look at the statistics provided. The minimum investment for most Smart Portfolios is $500 and no additional fees apply.

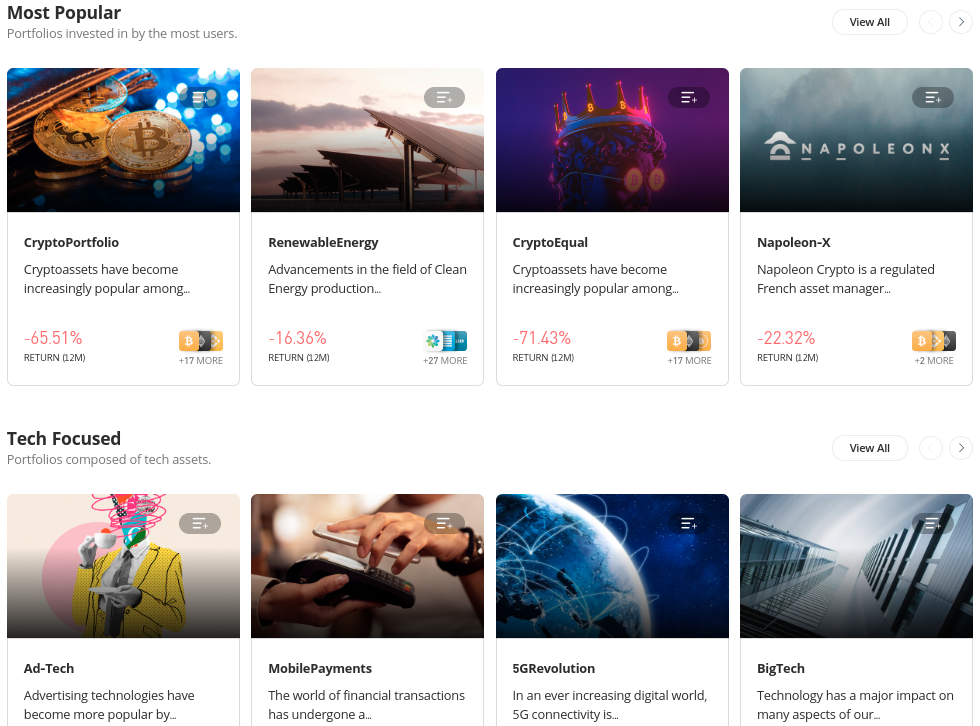

4. NFTs – Buy Unique Digital Assets and Rare Collectables

An NFT (non-fungible token), in its most basic form, is a type of digital asset. NFTs come in various forms, such as artwork, game avatars, land, music, and more. As the NFT is owned by the individual who buys it, they can provide a record of ownership that is verifiable through a digital ledger.

The uniqueness of the digitalized asset is ensured by the safe recording of NFTs on a blockchain, which is the same technology used to power cryptocurrencies. NFTs are regarded as contemporary collectibles. As such, some market commentators think they offer the best way to invest £10k in the UK.

A CryptoPunk NFT from Sotheby’s first curated NFT sale in 2021 sold for over $1 million. However, one of the most well-known collections of NFTs is from the Bored Ape Yacht Club (BAYC). The series features cartoon apes. As is the nature of NFTs, each has a different value. The value of NFTs like Bored Apes is determined by how rare their traits are.

NFTs and crypto are the cornerstones of Web3. As the popularity of this technology becomes more widespread, more exciting and useful NFT projects are popping up. Tamadoge, for instance, is an NFT P2E (play to earn) platform.

The native token is TAMA and players will breed, feed, and train NFT pets and take them to battle in the Tamaverse. This is the project’s metaverse, which is under construction. Moreover, Tamadoge is set to release a unique collection of 21,100 NFTs, 1,000 of which are rare.

At this time, 100 Tamadoge ultra-rare NFTs are available to buy on the OpenSea platform. The creator notes that NFTs boost awareness, speed, and agility to aid players in reaching the top of the leaderboard in the Tamadoge game. If the presale and launch of its native crypto token TAMA is anything to go by, Tamadoge NFTs have huge potential.

Those looking for the best way to invest £10,000 in the UK in 2023 might also like Lucky Block. This is a popular NFT competition platform with lots of contests and rewards. ‘Win $1 million in Bitcoin’ is one noteworthy competition. All participants must do to enter is purchase and hold one of Lucky Block’s BTC1M NFTs.

The smart chain contract will select a winner at random from NFT holders after the collection has sold out. In another example, to participate in the 5* holiday competition, participants must purchase and hold a 5HOLIDAY NFT. More contests are available just for NFT holders and there are also rewards in the form of LBLOCK crypto tokens.

LBLOCK was released in early 2022 and made history by becoming the fastest digital currency to reach a market capitalization of $1 billion.

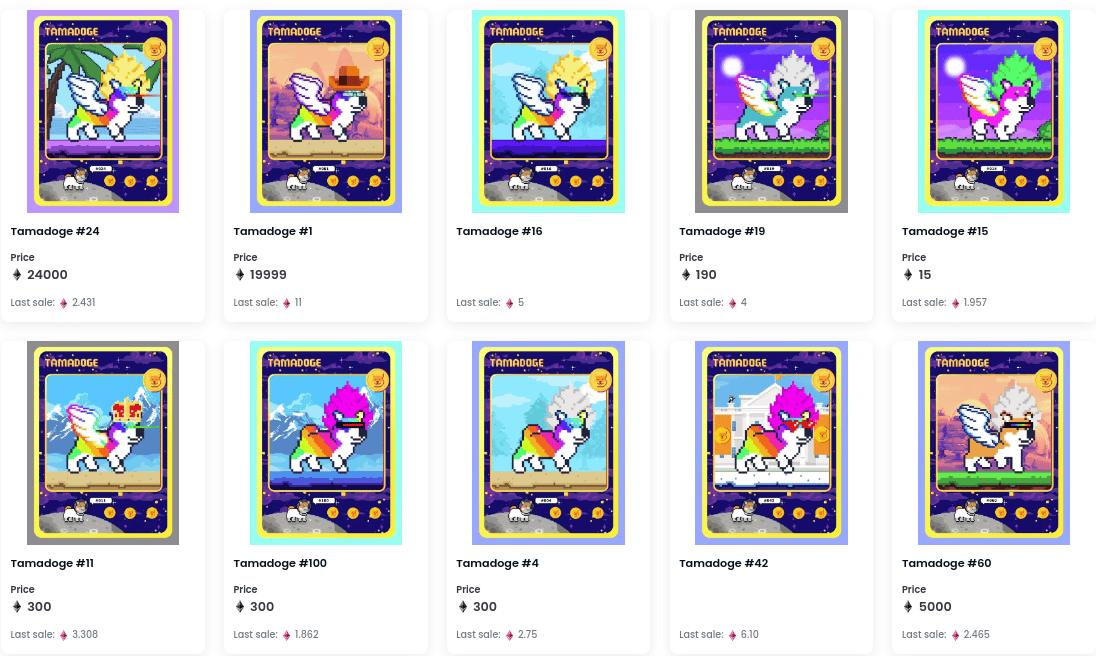

5. Earn Crypto – Stake or Accumulate Interest on Digital Currencies

We touched on crypto rewards in the previous section on NFTs. Put simply, some consider crypto interest accounts as one of the best ways to invest £10,000 in the UK. It’s also possible to earn staking rewards on certain cryptocurrencies.

Let’s start with earning interest. Some platforms offer investors the chance to earn interest on idle digital currencies. Interest rates for high-yield savings accounts are often substantially lower than those for cryptocurrency lending.

Lending might be an appealing source of passive income for investors who have already decided they will keep cryptocurrencies long-term. Additionally, if investors reallocate their funds, interest accumulates over time, enhancing the potential earning power of cryptocurrency. Crypto investors have a variety of options for how to earn interest.

Furthermore, depending on the cryptocurrency staked and the platform used, investors might expect a different payout from their staked coin. With the well-known exchange Crypto.com, investors may earn up to 14.5% annually on their cryptocurrency and up to 8.5% for stablecoins.

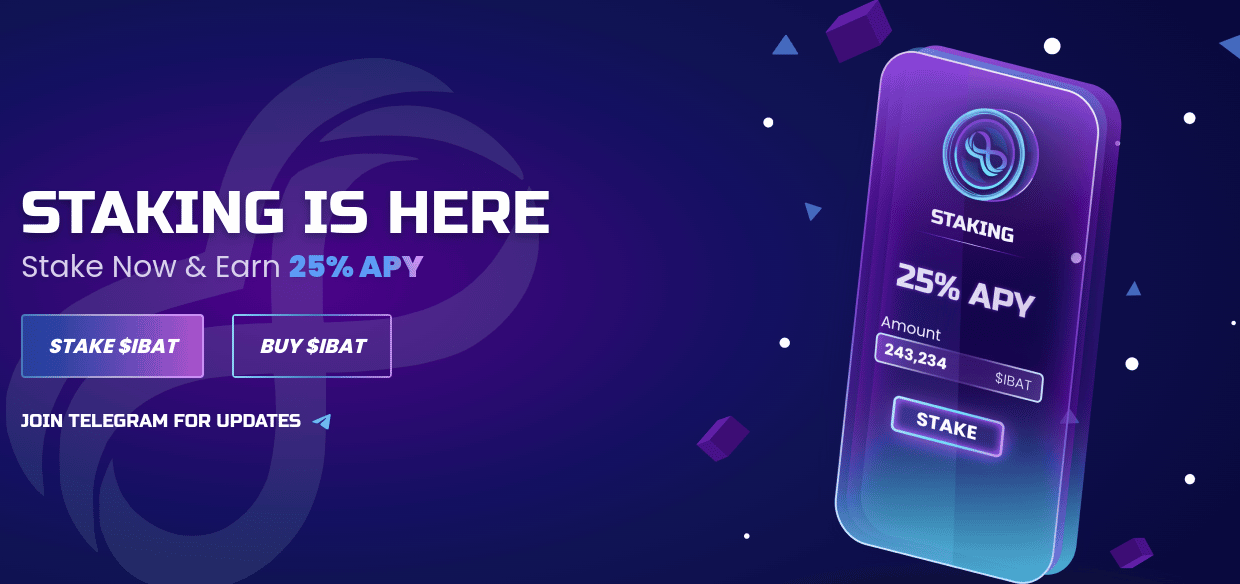

Staking provides a different option to earn cryptocurrency. One of the best options is the Battle Infinity ecosystem, which hosts numerous P2E games. Gamers can explore the immersive environment of the project’s metaverse, and buy, sell and swap in-game assets as NFTs.

IBAT is a crypto token that powers the platform. At Battle Infinity, there is more than one option for staking its native token IBAT – locked and flexible. Investors can stake a particular number of IBAT tokens via the flexible option and will earn 12% APY (annual percentage yield). Investors may also withdraw their funds at any time and re-stake the interest they have accrued on those tokens.

Battle Infinity also supports locked staking. In order to earn higher APYs, investors must lock a predetermined quantity of tokens for a specific period of time. For instance, when locking IBAT for 360, 180, and 90 days, Battle Infinity pays an APY of 25%, 20%, and 17% respectively.

Investors who opt to lock their IBAT tokens up for 30 days can earn 14% APY on their investment. However, note that a fee of 10% will be taken if the investor decides to ‘unstake’ before the previously agreed locked time.

6. Dividend-Paying Stocks – Invest in Companies With a Solid Dividend Policy

Wondering what the best shares to buy in the UK are? In the eyes of some market commentators, the best way to invest £10k in the UK is by allocating funds to dividend stocks. This is because there is a level of dependability that comes with investing in dividend-paying stocks, not to mention quarterly payments.

For example, one of the top UK banks with a dividend yield is Natwest Group. Natwest offers an annual dividend of 5.12%, as of writing. The most recent quarterly payment was 3.5p per share.

That said, it is risky for investors to put all of their eggs in one basket. As such, some investors may decide to invest 5k in a variety of dividend stocks and keep the rest for some of the other assets featured in this guide.

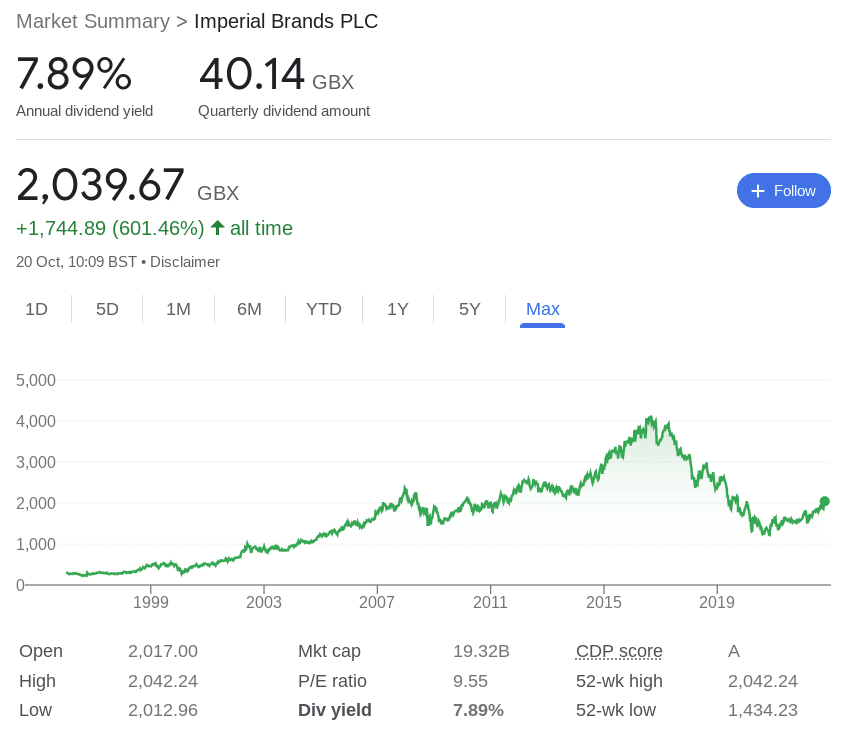

Big tobacco stocks are also known for paying dividends. As such, when opting to buy shares in the UK for dividends, Imperial Brands, a British multinational tobacco firm, is a common choice. At the time of writing, this stock pays an annual dividend yield of 7.9%. Over the past year of trading, the stock has increased by over 29%.

All is not lost for investors that would rather not add tobacco or bank stocks to their portfolio. Plenty of stocks pay dividends. Some are dividend aristocrats. Dividend Aristocrats are a unique class of companies with a lengthy history of generating – and increasing payments to investors for at least 25 consecutive years.

Dividend Aristocrat stocks include Exxon, Coca-Cola, Johnson & Johnson, Procter & Gamble, and Walmart – however, there are more. This type of company is usually well-established and therefore could be a more solid option for those deciding how to invest £10,000 in the UK.

7. Commodities – Diversify Equity Risk With Hard and Soft Commodities

Another consideration when weighing up the best ways to invest £10,000 is allocating funds to commodities. A commodity is a product or raw resource that is traded in the global marketplace. Commodities are typically harvested, farmed, manufactured, and exchanged in sufficient quantities.

This type of investment can be divided into several categories: agricultural, energy, metals, and environmental. Agricultural commodities refer to goods like coffee, corn, soy, sugar, and wheat. Energy commodities can include crude oil, gasoline, and natural gas. Metals are inclusive of things like gold, copper, silver, and more.

Oil and gold are among the most traded commodities. Since gold is a dollar-denominated commodity, its price is often negatively correlated with the value of USD. As such, during uncertain times, gold is regarded by some as a safe haven and an inflation hedge.

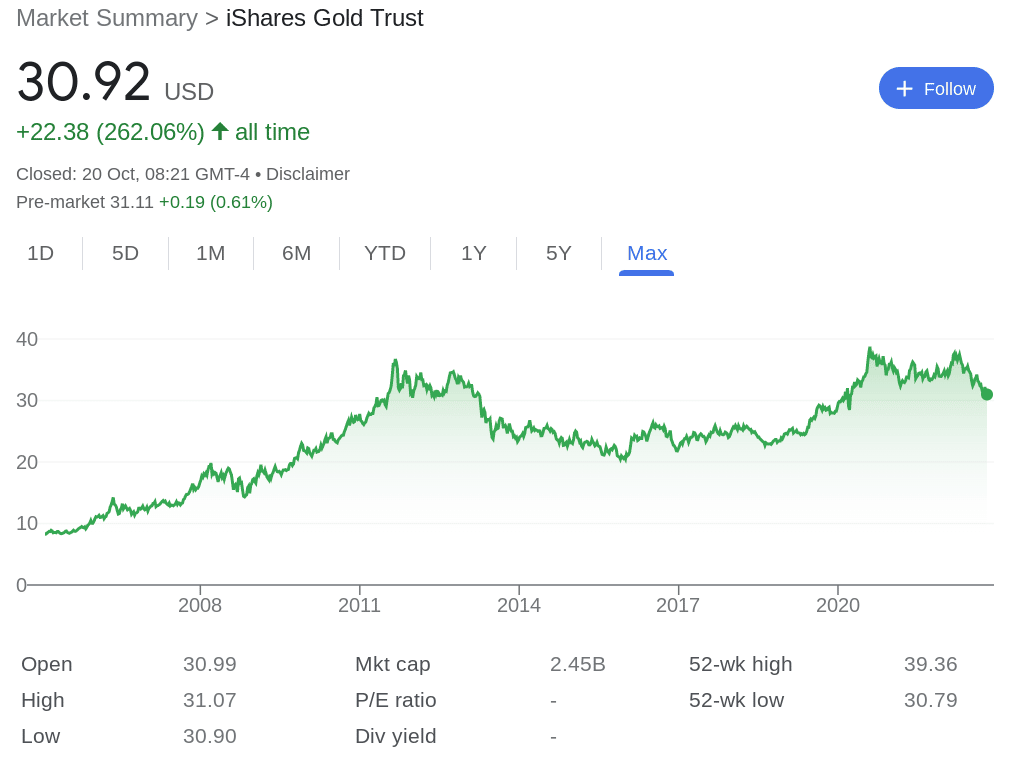

Buying, storing, and securing bars of gold, or even wheat bushels, isn’t as simple as it sounds. It’s much less complicated to invest in an ETF that simply tracks the price of the market in question. A prime example is iShares Gold Trust, which tracks the price of the precious metal on global stock markets.

Based on the price of this ETF at the time of writing, the fund has produced returns of almost 26% for investors over the last five years. Another common choice for investors is the VanEck Vectors Gold Miners ETF. The benchmark for this ETF is the NYSE Arca Gold Miners Index. This tracks the performance of large-cap stocks engaged primarily in gold and silver mining.

8. Index Funds – Invest in a Basket of Stocks With One Transaction

We have mentioned index funds a few times throughout this guide as it’s a common way to invest in multiple assets at once. It is also for this reason that many analysts consider the best index funds UK the best way to invest £10k in the UK. There are distinctions between an ETF and an index fund.

An ETF may be purchased and sold directly at any time throughout the day – as they trade on public exchanges. In contrast, an index fund is merely tasked with tracking a market and exposure is only possible through an ETF. Nonetheless, these funds are passively managed and matching the performance of the underlying benchmark is the objective.

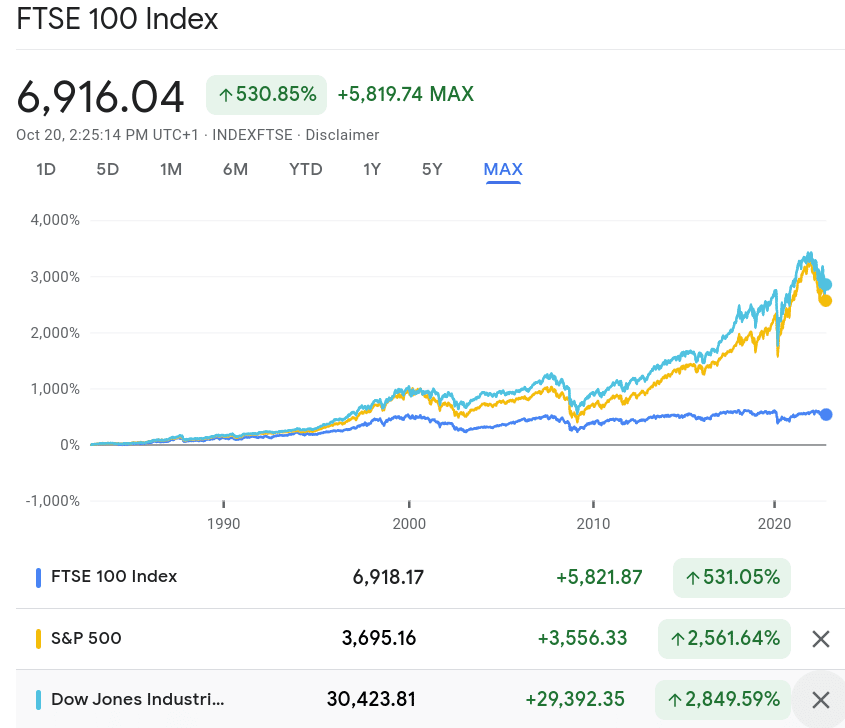

The FTSE 100 is a well-known index fund. This index fund tracks the top 100 companies listed on the LSE. Holdings include NatWest, Lloyds Banking Group, Shell, Harbour Energy, BP, Rightmove, and a diverse variety of other companies.

There is also a long list of index funds for those who believe one of the best ways to invest £10,000 might be in US equities. The two most well-known are the Dow Jones Industrial Average and the S&P 500.

The Dow Jones Industrial Average is sometimes referred to as the Dow 30. This index keeps track of 30 significant, publicly traded blue-chip stocks that trade on the NYSE and NASDAQ. Holdings include Coca-Cola, Goldman Sachs, Intel, McDonald’s, Microsoft, Nike, American Express, Apple, and more. Over the last five years of trading, based on its current price, the Dow Jones has increased by over 31%.

The S&P 500 monitors the market values of US companies that are leaders in their respective industries. These companies include Tesla, Apple, Microsoft, Meta, Disney, Amazon, Walmart, and hundreds more. As of the time of writing, S&P 500 has increased by almost 44% in five years of trading.

9. Copy Trading – Mirror the Trades of a Vetted Investor

Those who are still undecided on the best place to invest £10,000 in the UK could consider Copy Trading. This is another passive investment tool offered by eToro. Instead of allocating funds to a ready-made basket of stocks or cryptocurrencies, investors can choose one or more individual traders to mirror.

There are 30 million traders to choose from and results can be filtered down by preferred asset class, risk tolerance, gains, and more. The minimum investment is $200 (around £178) and there are no extra charges involved.

Investors can copy up to 100 traders simultaneously if they wish. As such, those with £10,000 to invest could copy the trades of over 50 pros. After allocating funds to Copy Trading, any position the individual opens or closes is reflected (in proportion) in the investor’s account.

For instance, let’s say the investor allocates £1,000 to Copy Trading. If the pro they are copying uses 20% of their funds to buy BP stock, £200 worth will appear in the investor’s portfolio. If they then sell and make a 15% profit, the investor will make passive gains of £30.

Copy Traders at eToro invest in a range of markets, although some concentrate on just one or two. This can include commodities such as gold, foreign currencies, ETFs, cryptocurrencies, and index funds.

10. Invest in Property – Build Wealth by Investing in Real Estate

Some market analysts consider the best place to invest £10,000 in the UK to be the real estate sector. A direct real estate investment often comprises purchasing a specific piece of property or a share in one. This can include a house, a block of flats, or on the commercial side of things a shopping center or office, for example.

When someone wants to invest in real estate, they often borrow money. While some of these investors adopt a long-term buy-and-hold strategy, others opt for a fix-and-flip approach. That said, it’s now feasible to invest in a sizable portfolio of real estate assets that offer many of the same advantages.

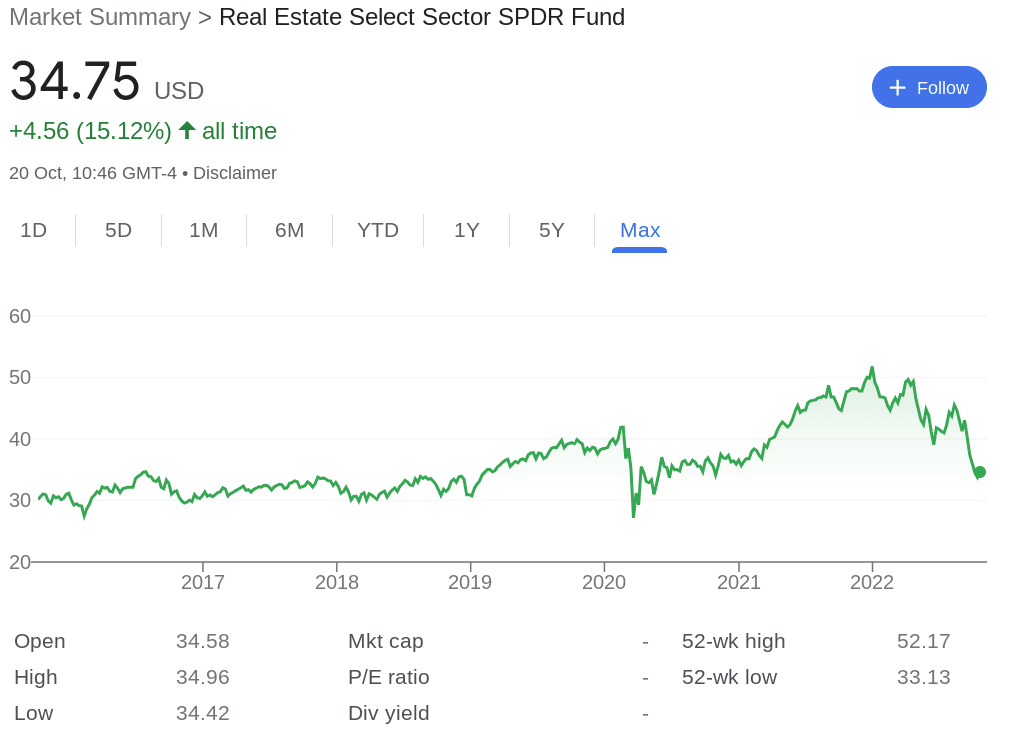

This is thanks to the increasing popularity of real estate investment trusts (REITs). For instance, by investing in the Real Estate Select Sector SPDR Fund, it’s possible to diversify a portfolio by purchasing a number of equities and REITs all at once.

This particular REIT follows the S&P Real Estate Select Sector Index. There are 33 top-performing real estate stocks in it in this weighted basket of securities. Some of the top holdings include Prologis, American Tower, Crown Castle, and Equinix.

There are many other property groups, developers, and realty companies included in the fund. The Real Estate Select Sector SPDR Fund has a weighted average market cap of more than $52 billion, with assets under management totaling more than $4.4 billion.

How to Choose the Best £10k Investments For You

Below we explain some important points to consider before making a final decision on the best way to invest £10,000 in the UK.

Weigh Up Potential Risks and Returns

Prior to deciding on the best way to invest £10k in the UK, it’s crucial to fully understand the potential loss involved.

As such, when weighing up the potential returns, the investor should consider learning the ins and outs of the market, as well as their own experience and appetite for risk.

- That is to say, some markets carry more risk than others

- This is why when deciding how to invest £10,000 in the UK, many choose to create a diverse portfolio

- This lessens the impact if one asset is underperforming

- For instance, one could spread their £10k investment out and buy crypto tokens presale, an asset class that is volatile

- The investor could also opt to pick some blue-chip dividend-paying stocks for more stability

By creating a portfolio of high-risk assets like crypto and NFTs, along with blue-chip dividend stocks and ETFs, an investor can balance out the risk.

It’s also worth remembering that these days, cryptocurrency projects such as IMPT, Tamadoge, Lucky Block, and Battle Infinity all reward investors in different ways. Battle Infinity also allows investors to stake its native token (IBAT) for extra income.

Hands-on or Passive Investing

Another consideration when deciding how to invest £10,000 in the UK is whether to take a passive or hands-on approach. That is to say, some investors may prefer to invest in individual stocks, NFTs, and cryptocurrencies.

Other investors will find the idea of building a portfolio passively more appealing. In this case, the most suitable options are Smart Portfolios or Copy Trading at eToro.

As we said, this brokerage allows investors to either allocate funds to a ready-made portfolio or copy the trades of a pro.

Not only does this present an opportunity to shorten the learning curve, but it also saves a lot of research. ETFs are also considered to be passive, as it is a weighted basket of assets that the investor doesn’t need to balance or manage themselves.

The investor must, of course, start by choosing the right ETF for their goals. eToro accepts super-low investments of $10 (about £8) on all stocks, ETFs, and cryptocurrencies. The latter attracts a commission fee of 1% on buy and sell orders, whereas stocks and ETFs are commission-free.

How to Invest £10k in the UK

We will now go over the step-by-step procedure needed when choosing a crypto presale as the best way to invest £10k in the UK.

As noted above, Dash 2 Trade is currently offering its D2T token to early investors at a low price of $0.0476.

Step 1: Obtain a Crypto Wallet

To invest in the Dash 2 Trade presale, it’s necessary to download or install a crypto wallet. One of the most installed and trusted cryptocurrency wallets is MetaMask.

This is one of the best crypto wallets in the UK for beginners as it’s super easy to navigate and is available as an app or a browser extension.

Not only that but the wallet supports thousands of tokens on the Ethereum ERC-20 protocol and is compatible with numerous blockchains. Investors can also store NFTs in the wallet, which is compatible with popular marketplaces such as OpenSea.

MetaMask can be installed as an extension on Chrome, Brave, Edge, and others. Alternatively, as we said, it can be downloaded onto a mobile phone via the appropriate app store.

Step 2: Buy ETH

Next, investors need to buy Ethereum in order to swap ETH for D2T tokens during the presale.

The first step to achieve this is to head over to a cryptocurrency exchange and make a deposit.

Then, the investor needs to search for Ethereum, enter an amount to buy, and place an order.

Step 3: Transfer Ethereum to MetaMask

Investors now need to transfer the ETH tokens over to MetaMask.

To do this, copy the Ethereum wallet address, which can be found at the top of the MetaMask dashboard. Next, go back to the crypto exchange where the purchase was completed and request a withdrawal.

To complete the transaction, when prompted by the exchange, the investor will need to paste the aforementioned address in. The transfer will be completed straight away in most cases.

Step 4: Visit Dash 2 Trade and Connect MetaMask Wallet

Head over to the Dash 2 Trade platform and select ‘Connect Wallet’ on the main dashboard.

This step should be carried out on the same device as the MetaMask wallet was downloaded/installed.

Click ‘MetaMask’ and then authorize the connection to continue.

Step 5: Complete Dash 2 Trade Presale Investment

After selecting and connecting the appropriate wallet, investors can buy D2T tokens on presale.

Investors can click ‘Exchange ETH’ after entering the quantity of D2T they want to purchase. The minimum is 1,000 D2T.

The presale price in the initial stage is $0.0476 per D2T and after that, it will rise to $0.05. Investors will be prompted to confirm the transaction by their wallet provider, who will also display the gas price.

Step 6: Claim Tokens

As D2T is currently in its presale phase, investors will have to wait until this has concluded before adding tokens to their wallets.

This is simple enough. Head over to Dash 2 Trade and click ‘Claim’. To complete the transaction, connect the MetaMask wallet again and the D2T tokens will be added.

Conclusion

This guide has talked about the best ways to invest £10,000 in the UK. We’ve covered a range of markets and instruments, including those that are passive. One route many investors take is to find crypto presale tokens trading at a discount.

Some of the best presale cryptocurrencies to invest in are D2T and IMPT. Dash 2 Trade is building a social trading and crypto analytics platform offering professional-grade tools such as signals and on-chain data.

The Dash 2 Trade presale is currently live and selling out fast.