With inflation growing at unprecedented levels and the pound sterling at record lows against the US dollar, UK investors are increasingly looking at ways to both protect and grow their wealth.

The purpose of this guide is to explore the best way to invest £5,000 in the UK. We cover a range of investment classes, including but not limited to digital assets, stocks, index funds, and more.

The list below offers an overview of the 10 best ways to invest £5,000 in the UK. Each of the above investments carries its own risk and reward. With an investment of £5,000, it is therefore wise to take a diversified approach to help reduce the risk exposure. More on this later.10 Best Ways to Invest £5,000 in the UK in 2023

A Closer Look at the Top Ways How to Invest £5,000

Looking for the best investments in the UK? With £5,000 in investment capital, there are plenty of asset classes and markets available to UK investors.

It is, however, important to remember that the higher the target returns, the more risk that needs to be made. Similarly, when investing in low-risk markets, expect to make a more modest return on the capital. For those with a higher risk tolerance, our articles on the best way to invest £20k in the UK and how to invest £75k UK according to traders cover all the popular assets in 2023.

With this in mind, in the sections below we discuss the best way to invest £5,000 in the UK across 10 different asset classes – each of which comes with its own risk profile.

1. Digital Assets – Invest in Top New Crypto Projects and Presales

Did you know that cryptocurrencies are one of the top assets to invest in within the UK according to Reddit users. Digital assets, otherwise referred to as cryptocurrencies or blockchain tokens, operate in a high-risk, high-reward market. Over the prior 10 years, digital assets have outperformed the vast majority of markets – whether that’s stocks, index funds, commodities, or real estate.

One of the main reasons for this is that digital assets like Bitcoin, Ethereum, XRP, and Litecoin are, in the grand scheme of things, emerging technologies that are still in their infancy. After all, Bitcoin and Ethereum – the two largest cryptocurrencies in this space, were only launched in 2009 and 2015, respectively. Some crypto market analysts consider cryptos to be the best way to invest £10k UK.

To offer some insight into the returns witnessed thus far by early investors, Bitcoin – the world’s first and still de-facto digital asset, has generated gains of many millions of percent since its launch. In what started as a developer’s pipedream has since resulted in Bitcoin going from a few pennies to more than $68,000 per token.

Ethereum has also witnessed incredible growth since its 2015 launch. Early investors paid just $0.31 per token during its 2014 presale campaign. Fast forward to late 2021 and Ethereum reached an all-time high of $5,000. This translates into gains of 1.6 million percent. However, it is crucial to remember that digital assets are risky investments.

Not only is the digital asset space new and unproven over the course of time, but investments are typically made on a speculative basis. That is to say, investments are made with the sole hope of making money in the event the price of the crypto asset increases. Furthermore, the broader crypto market is highly volatile.

For instance, we mentioned above that in late 2021, both Bitcoin and Ethereum hit all-time highs of $68,000 and $5,000 respectively. However, both digital assets have since hit 52-week lows of 70%, from the previous peak. As such, the wider cryptocurrency arena is currently embroiled in a bearish market.

The good news for those with a firm understanding of the risks is that this means digital assets can now be purchased at a huge discount. In the previous bear market, for instance, Bitcoin and Ethereum hit lows of $3,500 and $150, respectively. Those that entered the market at these price points have since registered significant returns.

Furthermore, and perhaps most importantly, Bitcoin and Ethereum are just two digital assets in a space that now consists of over 21,000 projects. Even during the current bear market, newly launched crypto projects have gone on to generate gains of 1,000% and more in the space of just a few weeks.

Lucky Block, for example, which was launched in early 2022, generated growth of 6,000% in under a month after its presale launch. Tamadoge, which had its presale in Q3 2022, went on to generate gains of 1,000% after being listed on its first centralized exchange. Ultimately, presales offer the opportunity to buy digital assets from a newly launched project at the best price possible.

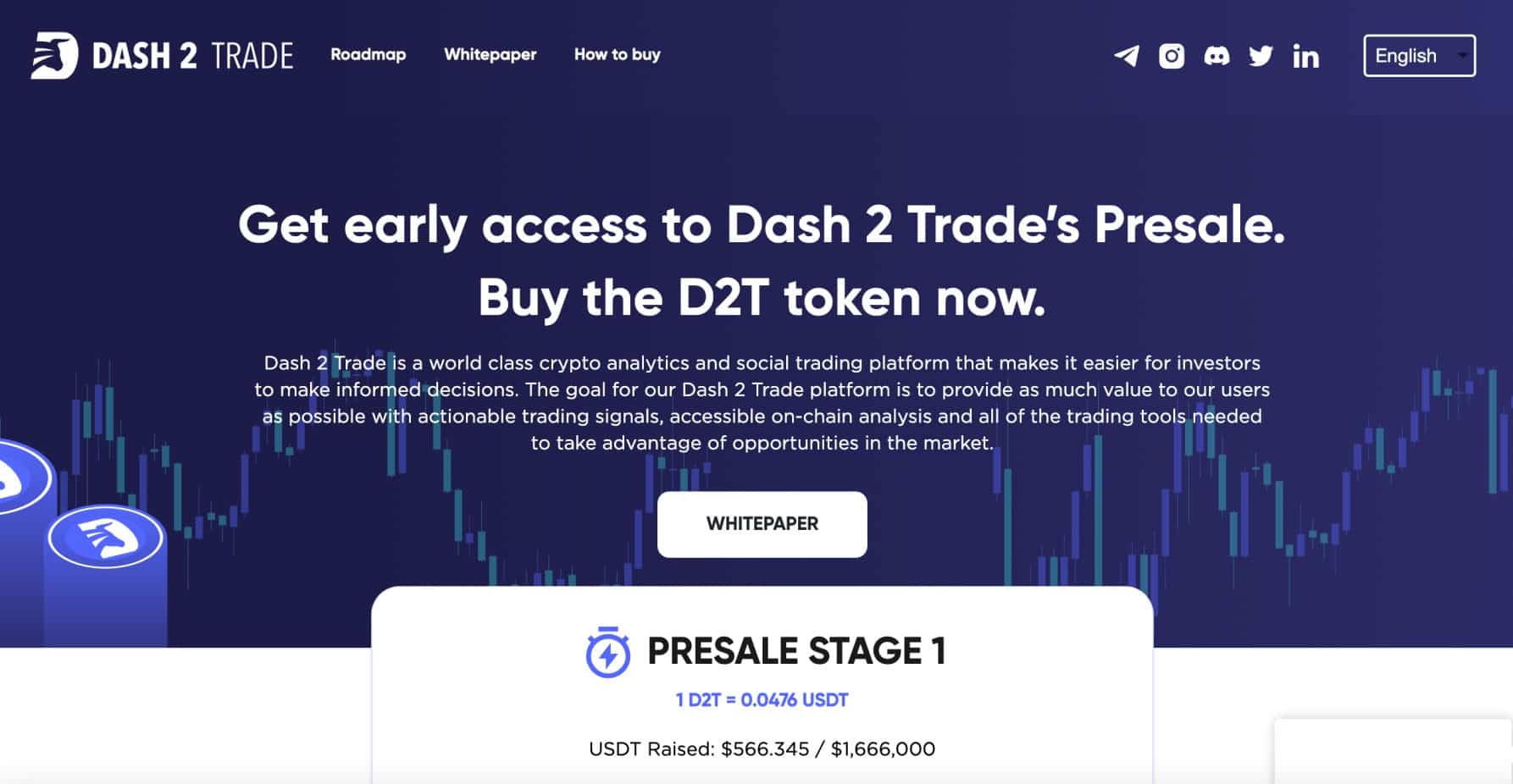

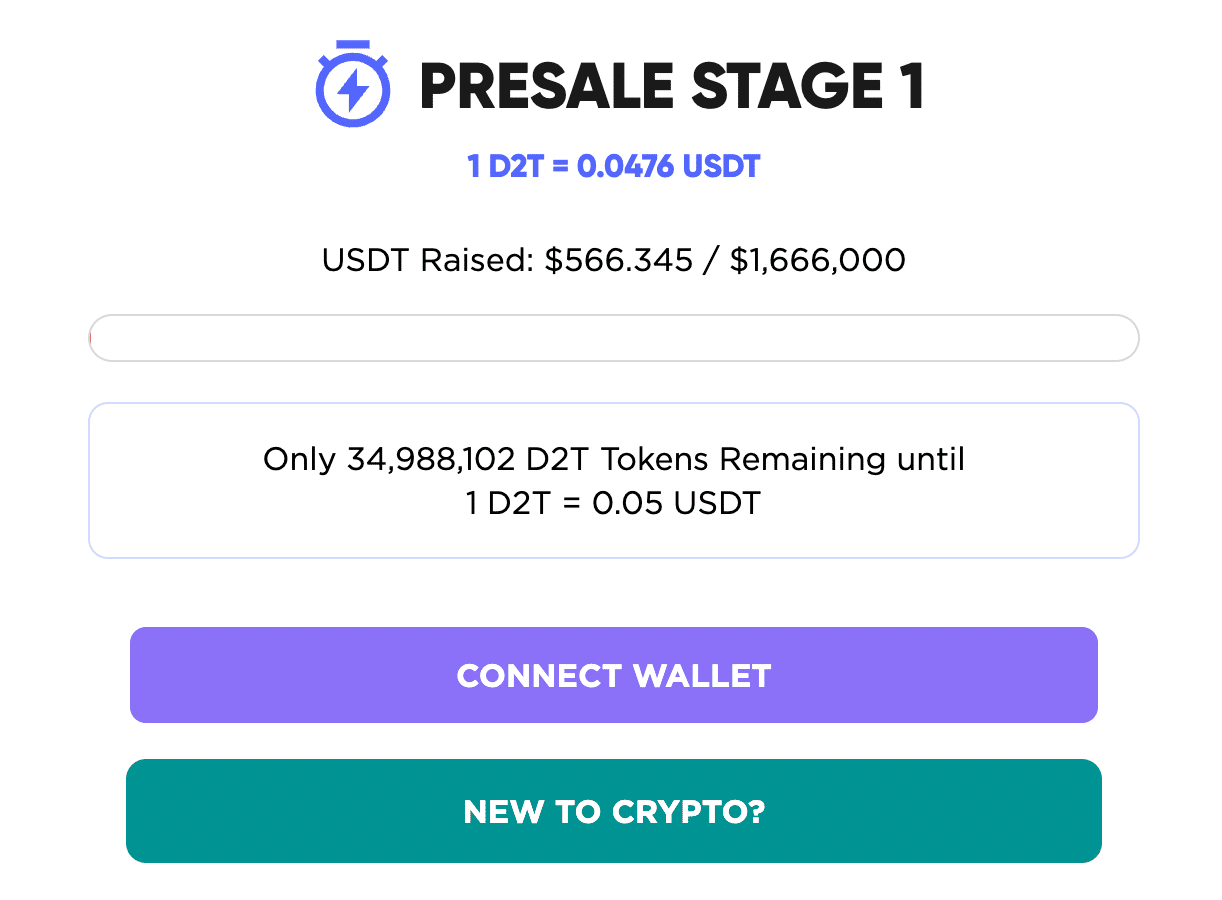

At the time of writing this guide on the best way to invest £5,000 in the UK, there are two presales in particular that could produce notable results. First, there is the Dash 2 Trade presale. This project is building a global analytics dashboard that will provide intimate access to professional-grade digital asset data.

This includes signals that inform members of what crypto trades to place, access to social media and on-chain statistics, high-grade pricing trends, backtesting facilities, and insight into the best upcoming projects that are about to launch. The Dash 2 Trade analytics dashboard will be backed by the D2T token – which has just started its presale campaign. Learn more about this innovative crypto project by reading the Dash 2 Trade whitepaper and by subscribing to the official Telegram group.

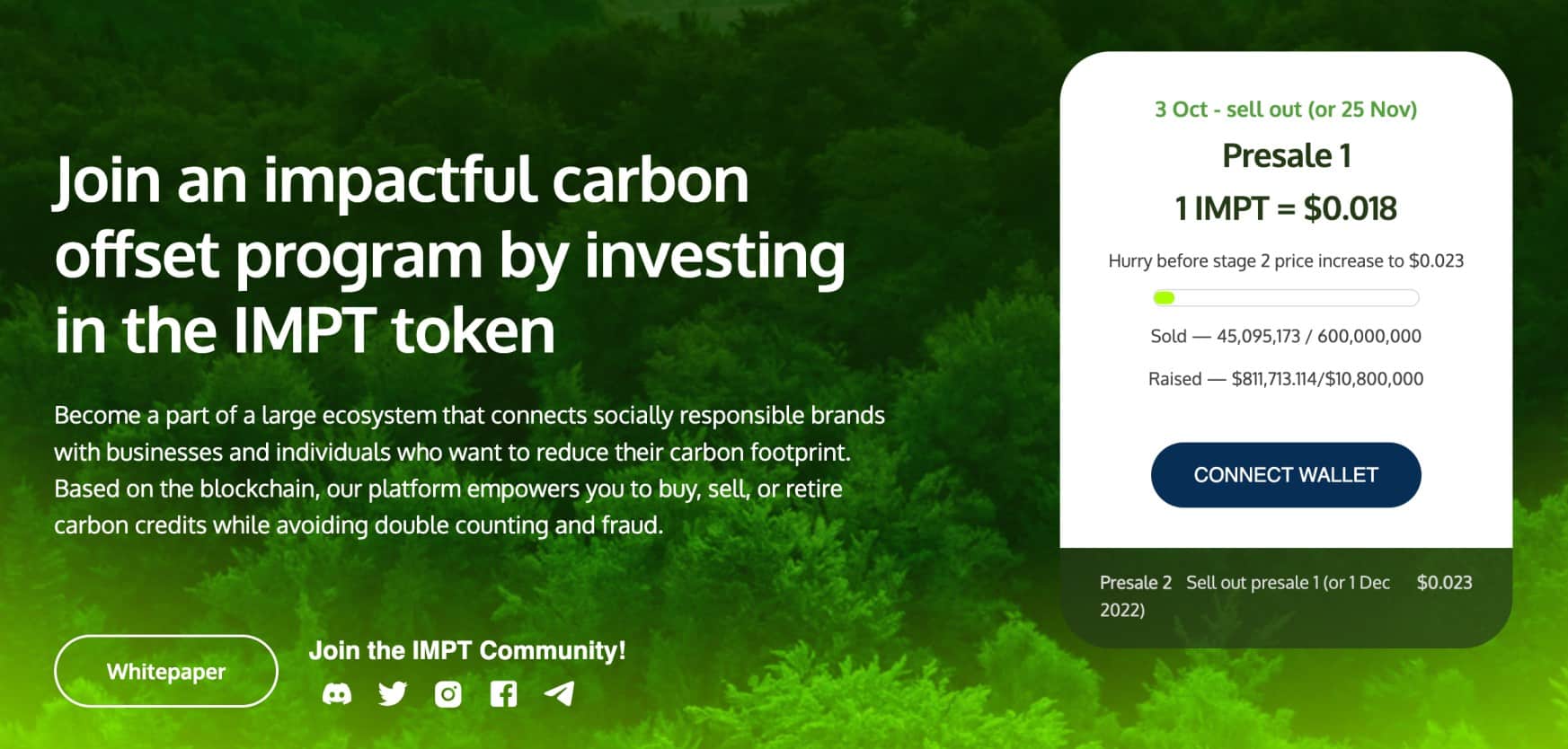

The second presale to keep an eye on is IMPT. This project is looking to utilize blockchain technology to help make the world a greener place. Its ecosystem enables investors to buy IMPT tokens and then convert the digital assets to carbon credits. Businesses can then elect to burn their carbon credits to offset their emissions.

Alternatively, investors can keep hold of their carbon credits in the hope that global prices continue to rise. This offers IMPT token holders the opportunity to generate a financial return from the growth of the carbon credit market. IMPT is currently offering its native digital asset at presale prices.

Read our guide on how to buy carbon credits in the UK for more information on this growing marketplace.

2. Stocks – Build a Diversified Portfolio of Individual Stocks and Shares

Looking to buy the best shares in the UK according to equity traders? Stocks and shares are perhaps a lot more familiar to investors in the UK when compared to digital assets. By purchasing stocks, this represents a stake in the respective company. As a stockholder, certain rights are afforded – such as being entitled to a share of dividend payments and being able to vote in annual general meetings.

The overarching objective when investing in stocks is to make money, which will come to fruition if the price of the shares increases. For example, buying 10 shares at £10 each and cashing out at £15 would yield a profit of £50 (£5 profit per stock x 10 shares). If the company pays dividends, this offers extra income.

In most cases, dividends are paid to shareholders every three months. However, not all companies pay dividends, so do bear this in mind. In the UK, the primary share market is the London Stock Exchange – which is home to thousands of companies. Then there is the AIM (Alternative Investment Market). This is the secondary UK stock exchange and it lists small-cap firms.

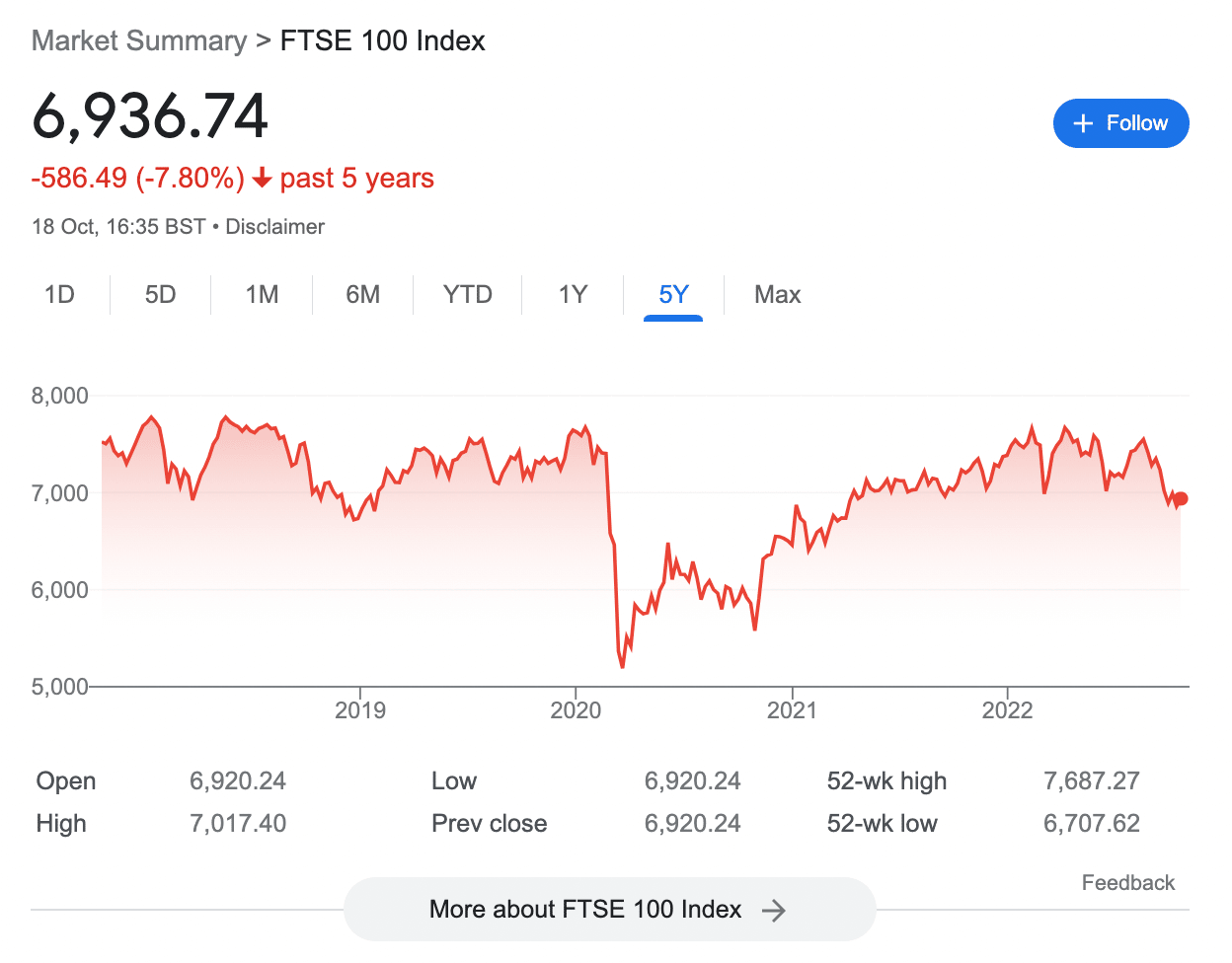

We should, however, note that the UK stock market has performed awfully badly in recent years. For example, those investing in the FTSE 100 five years ago – which represents the 100 largest UK stocks, would now be looking at a loss of 7.5%. This is why it might be worth exploring the US markets, which consistently outperform UK stocks year-on-year.

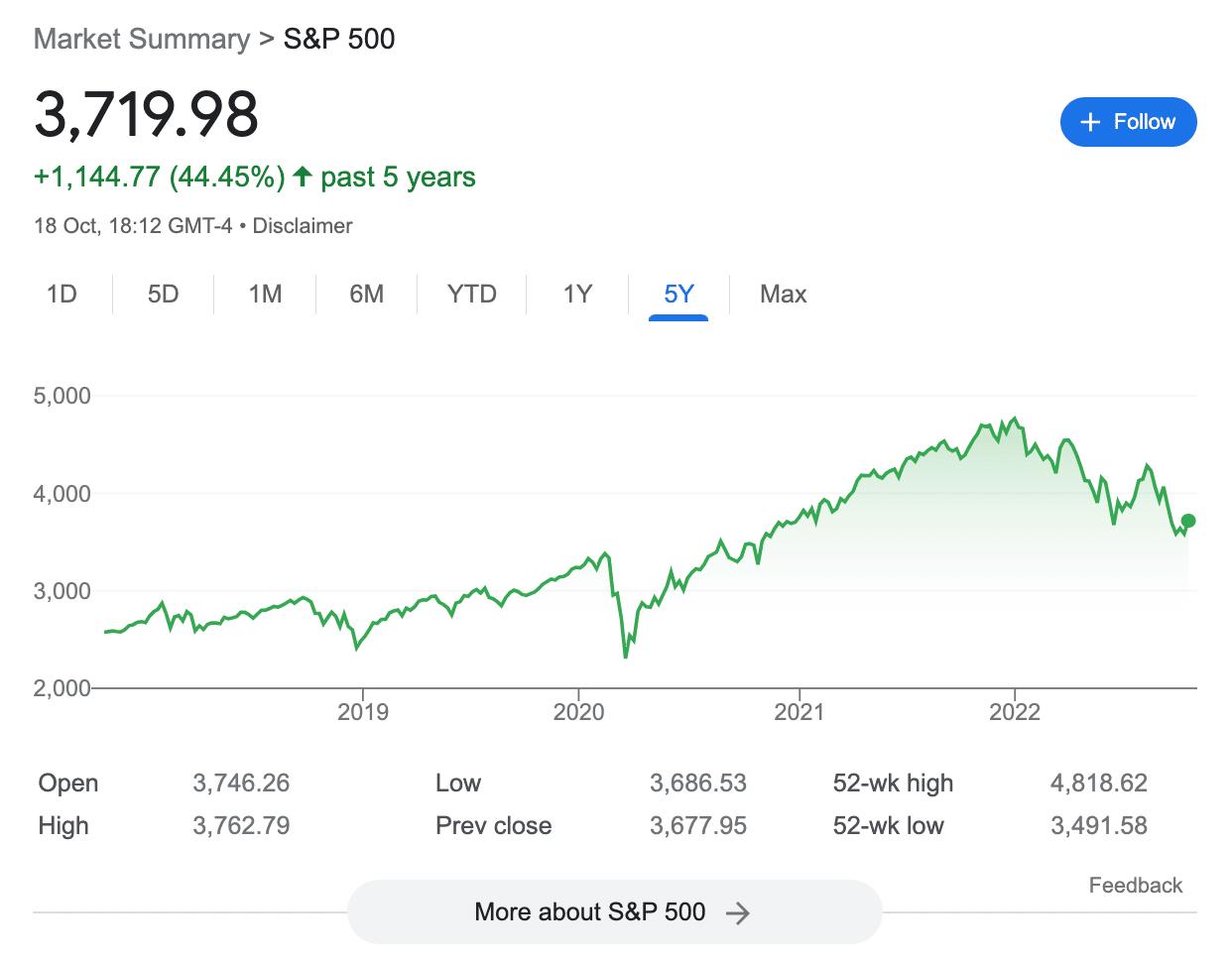

The S&P 500, which represents the 500 largest US stocks, has grown by 42% in the prior five years. And this takes into account the bear market of 2022, where US stock prices have fallen sharply. In terms of how to pick stocks to buy, the best option is to create a highly diversified portfolio. This means buying stocks from many different industries.

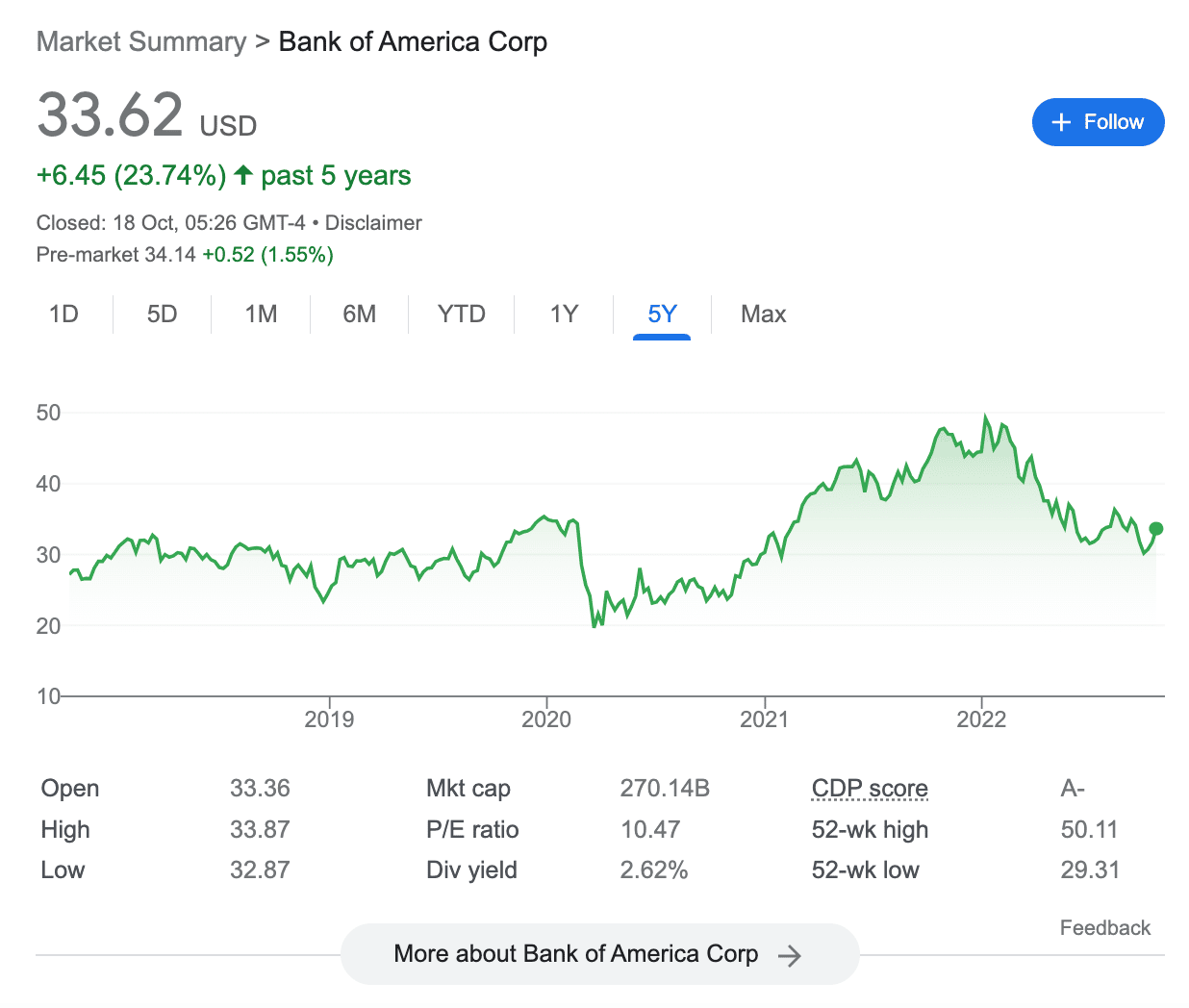

For example, instead of exclusively investing in Tesla, seasoned traders might consider diversifying into other electric vehicle stocks like Lucid Motors and Rivian. Similarly, to gain exposure to the banking industry, investors might consider a basket of relevant stocks, such as Bank of America, JPMorgan Chase, and Wells Fargo.

This means that by investing $10 into a stock that is priced at $1,000 – the investor will own 1% of a single share. Therefore creating a diversified portfolio can even be done on a budget. Furthermore, when buying foreign stocks on eToro – which includes companies in the US, Europe, Asia, and more – there are no trading commissions to pay.

3. Index Funds – Diversify Stock Investments via an Index Fund

Picking individual stocks and shares to invest in not only requires a time commitment and dedication to research processes but there are much better ways to diversify. In this regard, the best index funds UK perhaps offer the best way to invest £5,000 in the UK. In a nutshell, index funds track a specific segment of the stock market.

For example, an index fund that tracks the FTSE 100 will mirror the performance of the 100 largest companies in the UK. Index funds are weighted, usually by market capitalization. This means that larger UK companies like HSBC, AstraZeneca, BP, and Rio Tinto will represent a higher portion of the FTSE 100 index.

For instance, let’s say that BP and HSBC represent 3% and 5% of the FTSE 100. By investing £5,000 into a FTSE 100 index, the investor will indirectly own £150 (3%) and £250 (5%) in BP and HSBS stocks. Index funds not only offer a way to invest £5,000 into the stock market, but the process is entirely passive.

This is because the index fund will be managed by an ETF provider such as iShares. The provider will add, remove, or rebalance stocks within the index fund to ensure it continues to track the respective market – in this case, the FTSE 100. Moreover, index fund investments typically come with low fees, usually under 0.3% annually.

However, as we established earlier, the FTSE 100 and the broader UK stock market have performed poorly over the prior couple of decades. Instead, it could be worth exploring index funds that track other economies, such as the US stock markets. One of the most popular index funds in this regard is the S&P 500.

This index fund tracks the 500 largest companies that are listed on the two primary US exchanges – the NYSE and the NASDAQ. This means that the investor will have exposure to some of the biggest American brands, including but not limited to Apple, Microsoft, Johnson & Johnson, PayPal, Netflix, Tesla, Walmart, Costco, and JP Morgan Chase.

Other popular US-based index funds include the Dow Jones, which tracks 30 selected large-cap companies from a variety of industries. Crucially, index funds not only offer a way to hedge against rising inflation levels, but they generally pay dividends too. As such, investing in an index fund will entitle investors to their share of any dividend payments that are distributed quarterly.

4. Commodities – Hedge Against the Stock Market With Gold and Other Commodity Products

To reiterate, diversifying is of the utmost importance when assessing how to invest £5k in the UK. Therefore, in addition to new crypto projects, individual stocks, and index funds – investors might also consider commodities. Over the prior 12 months, energy prices have witnessed unprecedented highs, which means that commodities like oil and natural gas have performed very well.

One of the easiest ways to gain exposure to oil and natural gas in the UK is via contracts-for-differences (CFDs). CFDs are a financial derivative that tracks the global spot price of commodities in real-time. This means that investors in the UK can speculate on the future value of oil and natural gas without taking ownership of the asset.

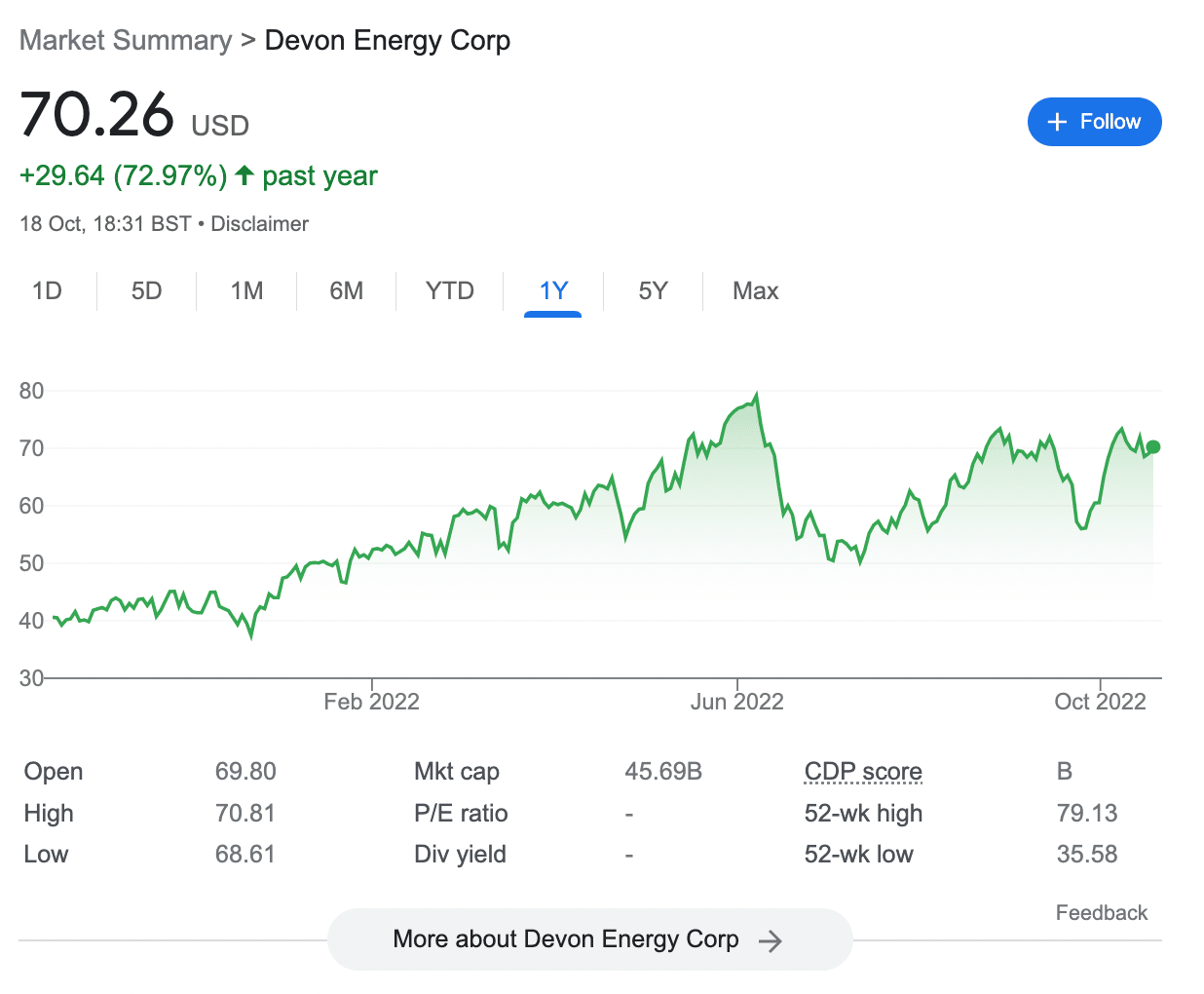

Moreover, CFD brokers in the UK enable retail clients to trade non-gold commodities with leverage of up to 1:10. Another way to gain exposure to rising energy prices is by investing in a basket of oil stocks. Some of the best-performing companies in this market include Devon Energy and ConocoPhillips, which have generated 12-month gains of 72% and 56%, respectively.

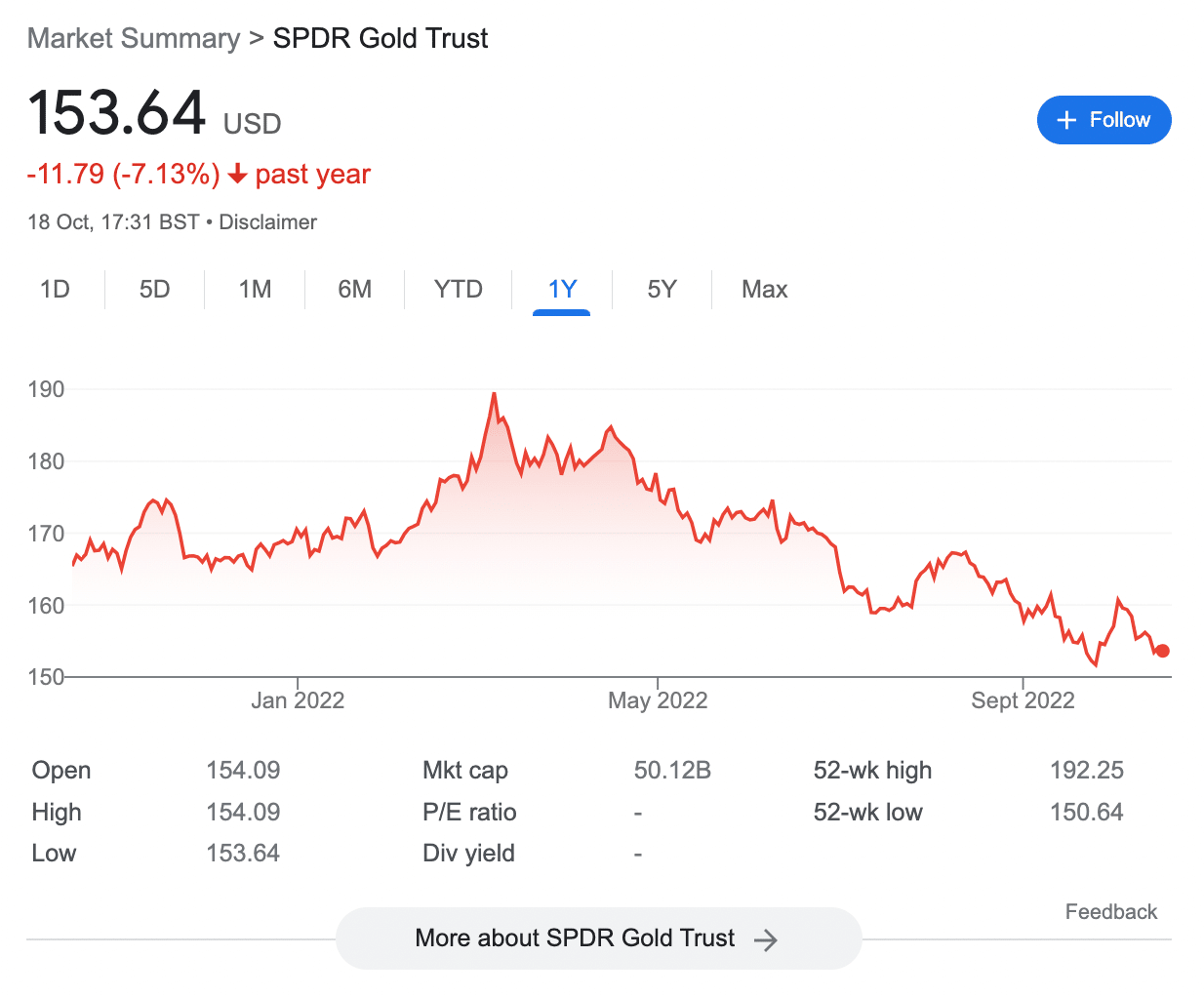

In addition to energy, other commodities that are popular with investors are precious metals. This is inclusive of gold and silver, in addition to platinum and palladium. Gold, in particular, often performs well during times of economic turmoil, not least because it is viewed as a store of value.

This was the case during the most recent stock market recession that occurred in the midst of the 2008 financial crisis. Once again, investors in the UK can gain exposure to gold via CFDs, with retail clients having access to leverage of 1:20. Longer-term investors might consider a gold ETF instead.

The ETF provider – whether that’s iShares or SPDR, will be backed by physical gold bullion. This means that by purchasing shares in the ETF – which will trade on a public stock exchange, investors can indirectly secure exposure to global gold prices. On top of gold and energy, it is also possible to invest in soft commodities.

These are agricultural commodities that are traded on a global basis. Examples include sugar, wheat, corn, coffee, and even cattle. Soft commodities can be traded in the UK via leveraged CFDs. In some cases, it might even be possible to invest in the underlying commodity via an ETF. Alternatively, it is possible to buy stocks in companies that produce the respective agricultural product.

5. Stocks and Shares ISA – Set up a Tax-Efficient Investment Account

In the UK, residents can open a Stocks and Shares ISA to benefit from long-term tax advantages. In a nutshell, up to £20,000 can be invested into an ISA in the current tax year. Any investments made through the ISA within the annual allocation will remain tax-free. This means that the investments will not attract capital gains or dividend tax.

This can be highly beneficial over the course of time. For instance, let’s suppose that £5,000 is invested into an index fund in 2022. The investor holds on to the index fund for 20 years, during which, it generates average annualized returns of 10%. This means that at the end of the 20-year period, the £5,000 investment will be worth over £33,000.

Without an ISA, upon withdrawing the funds from the index fund the investment would attract capital gains tax. But, if the initial £5,000 investment was put through an ISA, then no tax will be due upon making a withdrawal. There are a number of factors to consider before opting for a Stocks and Shares ISA.

First and foremost, ISA investment accounts are provided by online brokers. This means that an account will need to be opened with a suitable broker and a deposit subsequently made. The broker will charge an annual fee for operating the ISA which, in the case of Hargreaves Lansdown, stands at 0.45%.

Furthermore, the broker will also charge a fee on each investment that is made – including both buy and sell orders. At Hargreaves Lansdown, this starts at £11.95. Don’t forget that shares listed on the London Stock Exchange also attract a stamp duty fee of 0.5%, on the purchase.

With this in mind, once the fees of an ISA are added up, it remains to be seen whether the process is worth it. This is especially the case considering that UK investors get annual capital gains and dividend tax allowances of £12,300 and £2,000, respectively. In comparison, a discount broker like eToro offers 0% stamp duty, 0% commission, and 0% annual maintenance fees.

6. NFTs – Gain Exposure to the Ever-Growing NFT Trend

Non-fungible tokens – or simply NFTs, are a relatively new addition to the digital asset and blockchain technology industry. The main concept with NFTs is that they prove ownership of an item – which can be tangible or non-tangible. To offer some insight, one of the most successful NFT projects to date is the Bored Ape Yacht Club collection.

This collection consists of 10,000 NFTs – each of which represents a virtual drawing of an ape. Each NFT is unique from the next and ownership is verified by the Ethereum blockchain. When the Bored Ape Yacht Club collection was launched in 2021, investors paid the equivalent of £167-ish – payable in Ethereum tokens.

What was to follow was unprecedented. By the end of 2021, the same collection was changing hands at over £1 million per NFT. Some of the most recognized celebrities globally opted to invest in a Bored Ape Yacht Club NFT, including but not limited to Justin Bieber, Snoop Dogg, Neymar, Madonna, Eminem, and Tom Brady.

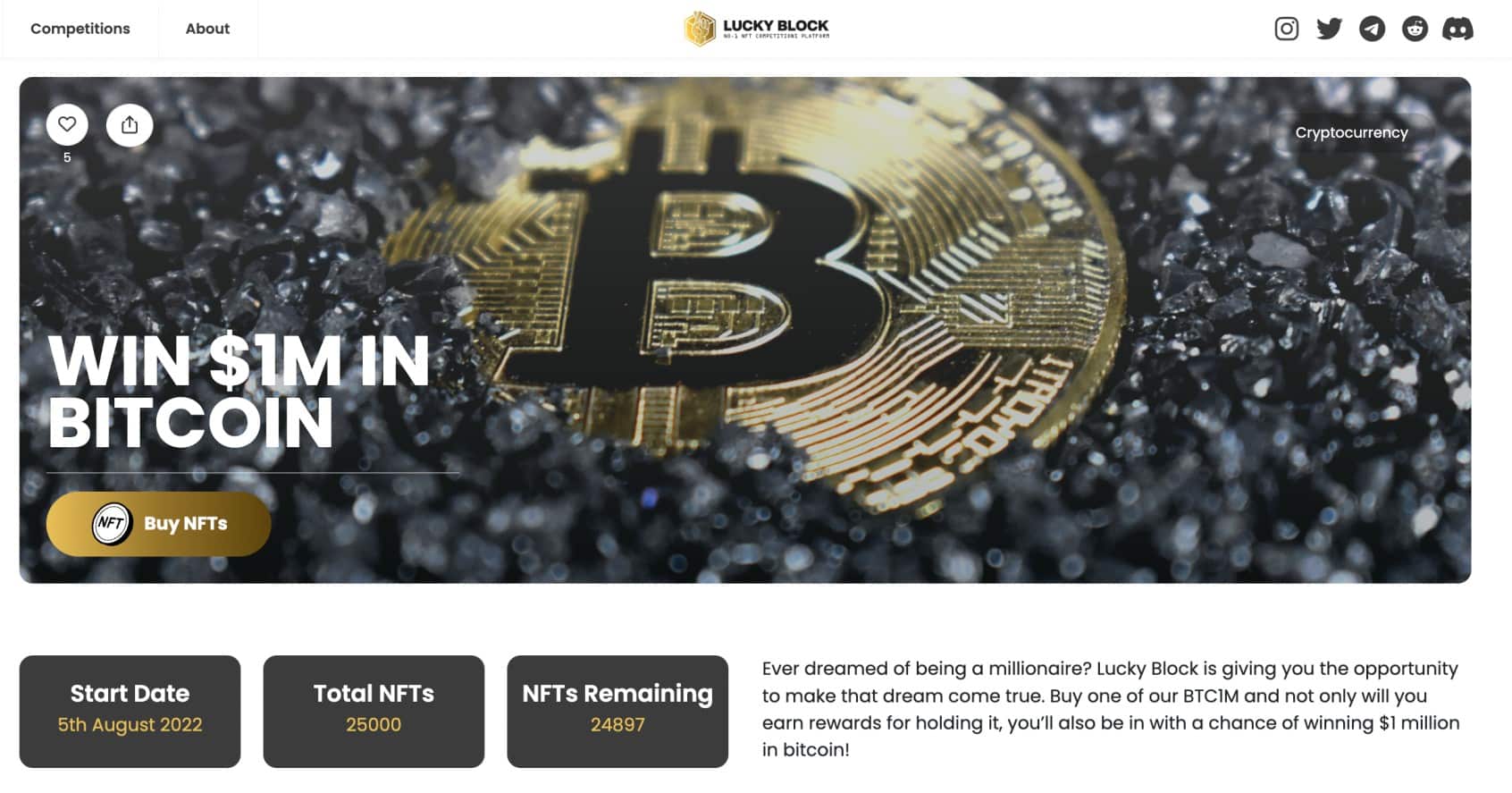

As a result of this hype, many new NFT projects have since entered the market. One such example is the Lucky Block NFT collection. This blockchain project operates a competition platform that offers a range of life-changing prizes. This includes a £1 million UK property, $1 million worth of Bitcoin, and notably – a Bored Ape Yacht Club NFT.

In order to enter a competition, users must purchase a Lucky Block NFT. Even if the purchase does not result in a win, the NFT holder will continue to earn rewards – paid in LBLOCk tokens. Another notable project in the NFT space is Tamadoge. We mentioned earlier that the TAMA token generated gains of 1,000% after completing its presale launch.

However, Tamadoge is also about to launch its own NFT collection, which will connect to its metaverse and play-to-earn gaming empire. Of the 21,100 collection, 1,000 Tamadoge NFTs are deemed rare. As is the case with digital assets and all investments for that matter, do treat with caution when buying NFTs. After all, this space is highly speculative.

7. Crypto Interest Accounts – Buy and Hold Digital Assets in a Crypto Interest Account

Another method to consider when assessing the best way to invest £5,000 in the UK in 2023 is a crypto interest account. In its most basic form, this investment arena operates much like a conventional savings account that pays interest. However, instead of depositing pounds and pence, investors will earn interest on digital assets like Bitcoin and Ethereum.

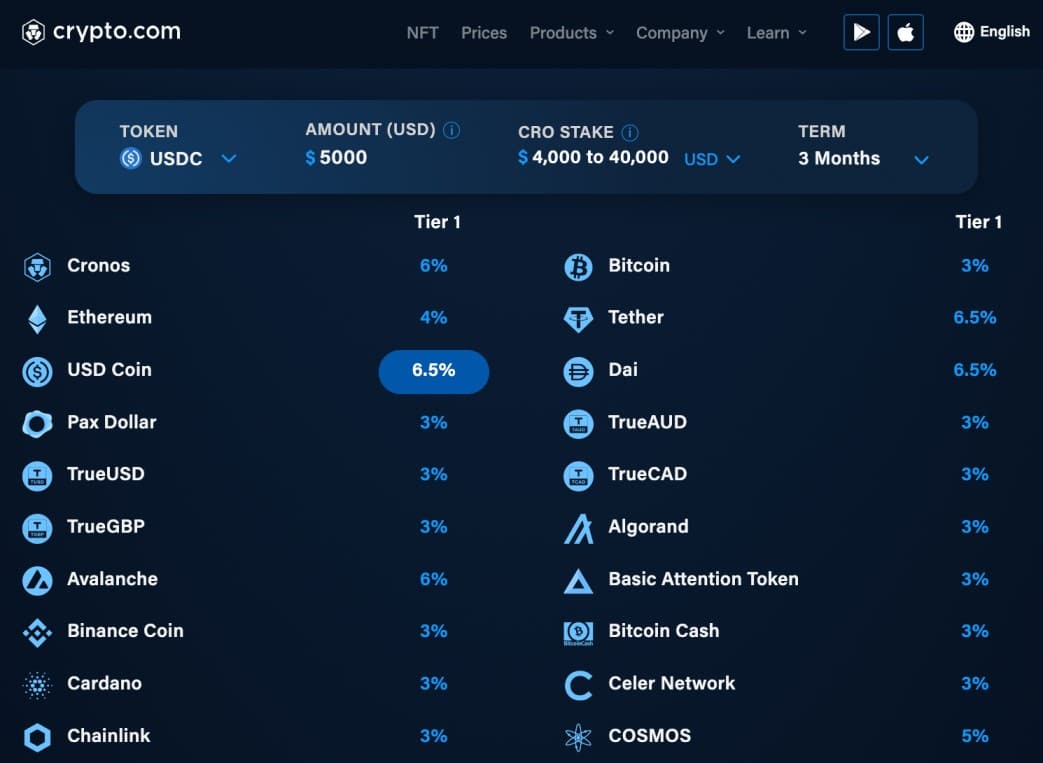

After electing to buy Bitcoin from a UK crypto exchange, investors can then transfer their digital assets over to a reputable interest account provider. One of the most popular providers in this space is Crypto.com. This provider offers interest accounts on dozens of digital assets with the maximum APY at 14.5%.

This is a huge rate of interest when compared to what’s on offer at UK high street banks. Moreover, Crypto.com even offers an interest rate of up to 8.5% on stablecoins, which are pegged to fiat currencies like the US dollar. In terms of specifics, Crypto.com offers flexible accounts that permit instant withdrawals at any given time.

However, in order to get the best APY possible, investors will need to consider a one or three-month lock-up period. During this timeframe, withdrawals will not be permitted – so do bear this in mind. Also consider that just because a high rate of interest is being earned, this doesn’t guarantee a return. After all, the digital asset could decline in value by more than the APY.

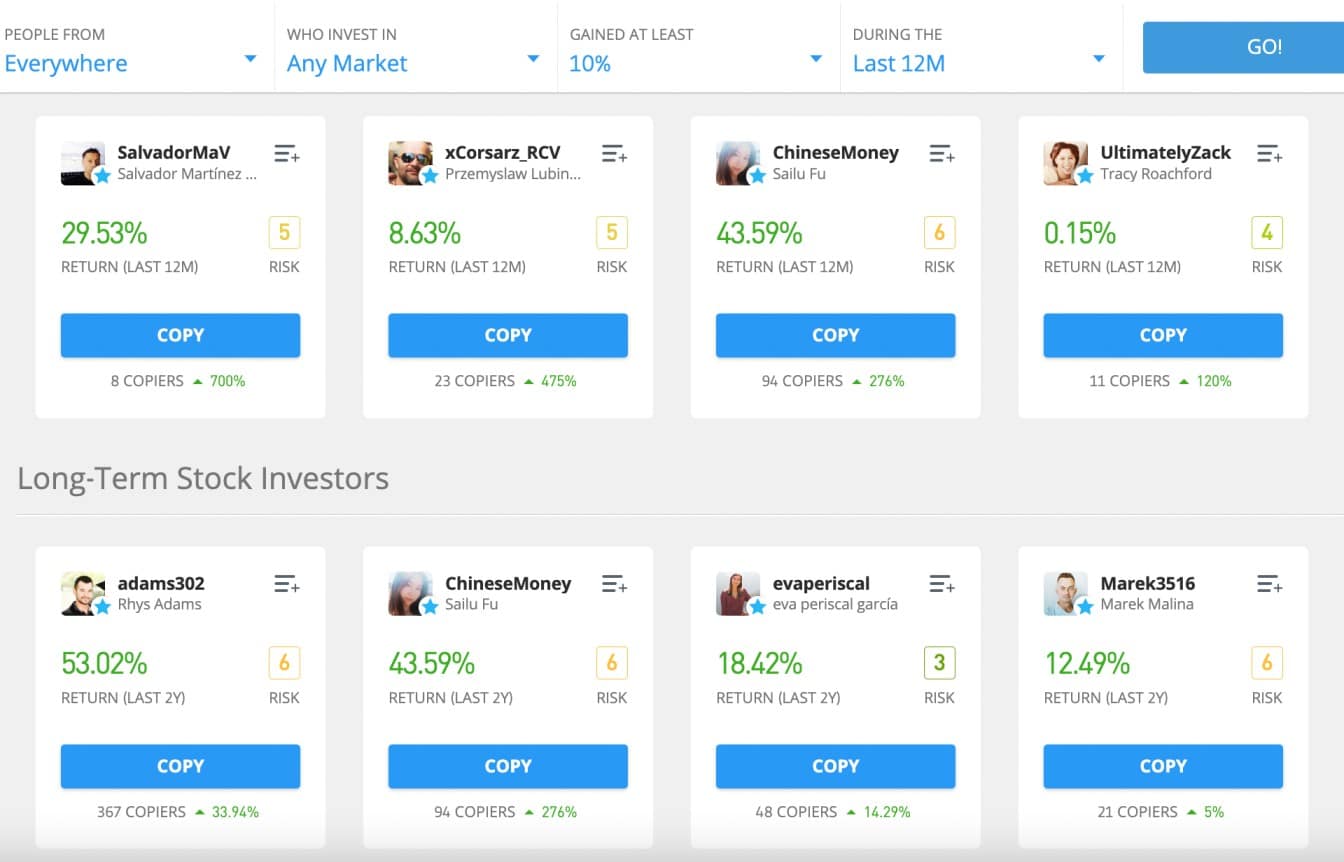

8. Copy Trading – Invest Money Into a Successful Trader to Replicate Their Moves

Another angle to consider when evaluating the best way to invest £5,000 in the UK is to utilize the Copy Trading tool at eToro. Put simply, this enables UK investors to ‘copy’ the investments of a successful trader. For instance, if the trader invests in Devon Energy and Bitcoin, the same position will be mirrored in the eToro portfolio.

There are thousands of verified traders to choose from in this regard and the minimum capital outlay is $200 – or about £175. After choosing a trader to copy, future investments will be mirrored at a proportionate level. For example, let’s suppose that £5,000 is invested in a stock trader on the eToro platform.

The stock trader allocates 10% of their portfolio to Tesla and 10% to Microsoft. In turn, the eToro user will automatically invest £500 (10% of £5,000) into Tesla and the same again into Microsoft. When the trader sells their position, the eToro user will automatically do the same.

Copy Trading is suitable for investors in the UK that want to actively buy and sell assets but do not have the required time to follow the markets throughout the day. This popular tool is also suitable for first-time investors with no prior trading experience. The most risk-averse approach to Copy Trading is to diversify across multiple investors.

9. Dividend Stocks – Focus on Earning Passive Income via Quarterly Dividend Payments

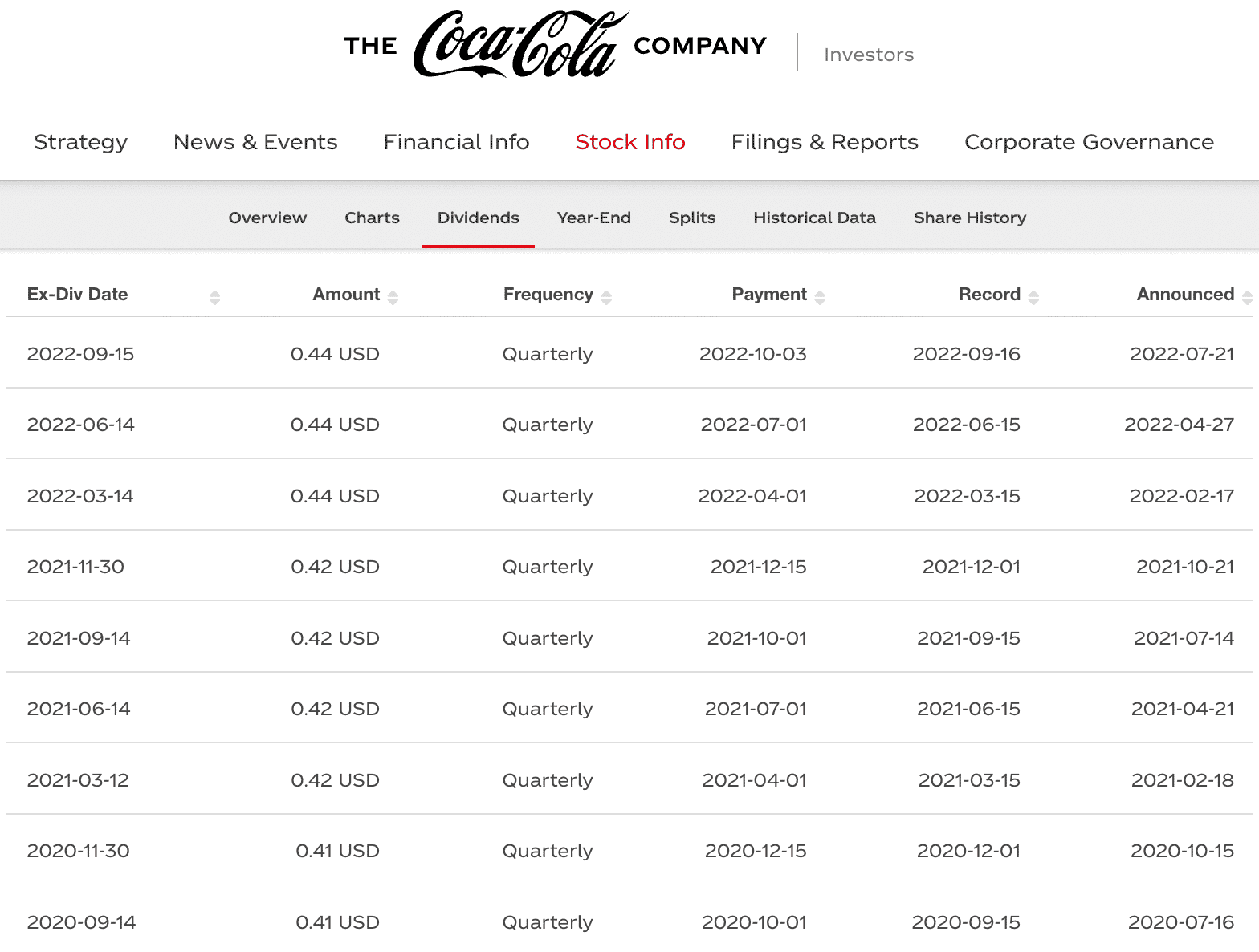

Dividend stocks could represent one of the best ways to invest £5k for those on the lookout for regular, passive income. Put simply, these are stocks that have a dividend program in place, which means that the company distributes a portion of its retained income to shareholders. The size of the dividend payment will depend on how many shares are held.

Moreover, in the vast majority of cases, companies pay dividends every three months. This will be paid into the brokerage account that holds the respective shares. The dividend yield refers to the size of the payment in relation to the current stock price of the company. Therefore, the higher the yield, the better.

On average, companies pay a dividend yield in the region of 2-4% – anything above this would be considered high. Nonetheless, from a risk management perspective, it could be worth focusing on dividend aristocrats or kings. These are companies that have paid and increased the size of their dividend payment for at least 25 or 50 years, respectively.

The likes of Coca-Cola and Johnson & Johnson, for example, have met this criterion for over 60 consecutive years. This means that even during the most turbulent economic periods, the aforementioned companies continued to pay and increase their dividend payments. This illustrates that dividend aristocrats and kings have a hugely robust balance sheet.

Another benefit of dividend stocks is that each quarterly payment can be used to reinvest in the markets. This has the potential to increase wealth faster through the concept of compound interest. Furthermore, there is also the possibility of generating capital gains when investing in dividend stocks. This will happen if the share price of the stock increases.

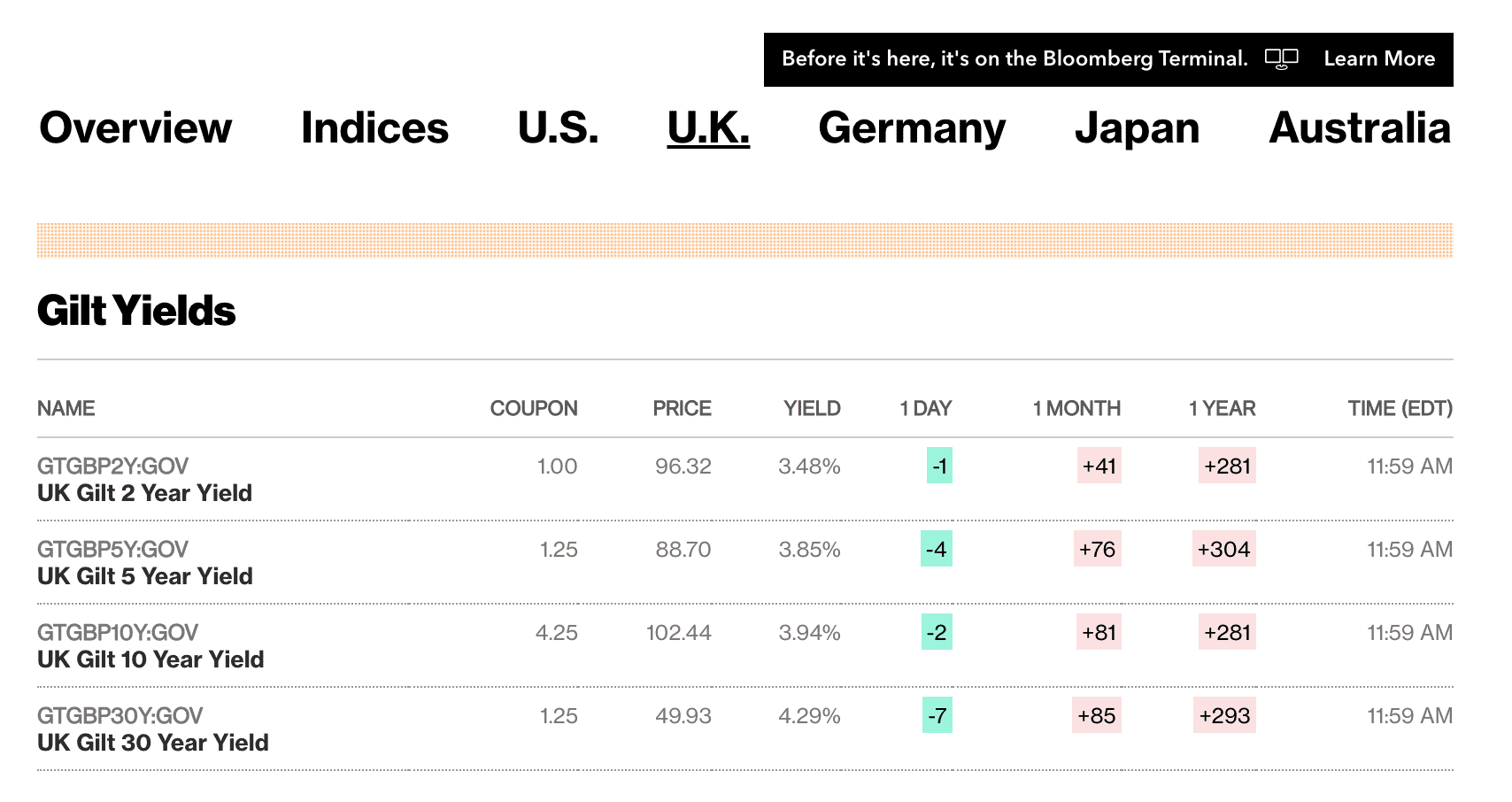

10. Gilts – Invest in UK Government Bonds

The final option to consider when assessing how to invest £5,000 in the UK is gilts. This refers to bonds issued by the UK government. In effect, investors lend money to the government, receive bonds, and subsequently earn interest. The government will make an interest payment to bondholders every six months.

This will continue to be the case until the bonds mature. At the end of the term, the investor will receive their original investment back. For example, as of writing, bond yields on 10-year gilts are paying just under 4% annually. An investment of £5,000 would therefore yield £200 annually, across two £100 payments.

After 10 years, the investor will receive their original £5,000 investment. Although gilts are viewed as one of the least risky investments to make in the UK, interest rates are not overly attractive. Even at a yield of 4%, this is below the current rate of inflation by some distance. Nonetheless, gilts can be useful during times of economic uncertainty.

How to Choose the Best £5k Investments of 2023

Many online brokers in the UK specifically offer their services to casual investors.

As a result, most of the investments discussed on this page require a small capital outlay that rarely exceeds £20-ish. For instance, buying stocks – irrespective of the share price, via the eToro platform requires just $10 – or about £8.

With this in mind, building a diversified portfolio that contains a vast range of asset classes and markets has never been easier.

Below, we discuss some of the considerations to make when assessing how to invest £5,000 in the UK.

Risk Profile

The most important assessment to make when building a portfolio of investments is the amount of risk associated with each asset.

- Seasoned investors will typically only allocate a small segment of their portfolio to higher-risk assets, such as emerging bonds or cryptocurrencies.

- In turn, the majority of the portfolio will be focused on lower-risk assets, such as index funds and dividend stocks.

- Nonetheless, the appetite for risk will vary from one investor to the next.

As such, when building a short list of suitable £5,000 investments, investors will need to evaluate how much risk they feel comfortable taking as well as whether they want a long or short-term investment.

Upside Potential

Another factor to consider by those with £5,000 to invest in the financial markets is the upside potential of the chosen asset(s). The possible returns on offer will typically depend on the amount of risk that the investor is willing to take.

- For example, we mentioned earlier that the newly launched crypto asset Tamadoge returned over 1,000% in the space of a week after completing its presale.

- This is why there is growing interest in presale campaigns, with both Dash 2 Trade and IMPT proving popular as of writing.

- However, high returns in the crypto space means taking on sizable levels of risk.

Assets with a lower risk profile, such as gilts or dividend stock, offer a much smaller upside potential. Nonetheless, a well-diversified portfolio should contain a mixture of assets with various risk-reward ratios.

Income or Growth

Investors looking for the best place to invest £5,000 in the UK should also consider whether they wish to focus on income or growth. The former refers to investments that generate regular, passive income – such as dividend stocks or bonds.

Growth investors, however, will look at assets that have the potential to generate above-average capital gains – with examples including digital assets, crypto presales, and small-cap stocks.

How to Invest £5,000 in the UK

To offer insight into the best way to invest £5k in the UK, we will now explain the process required when opting for a crypto presale. While digital assets have a higher risk spectrum, equally, they do offer an attractive upside for many.

Below, we offer a step-by-step guide on how to invest in the Dash 2 Trade presale.

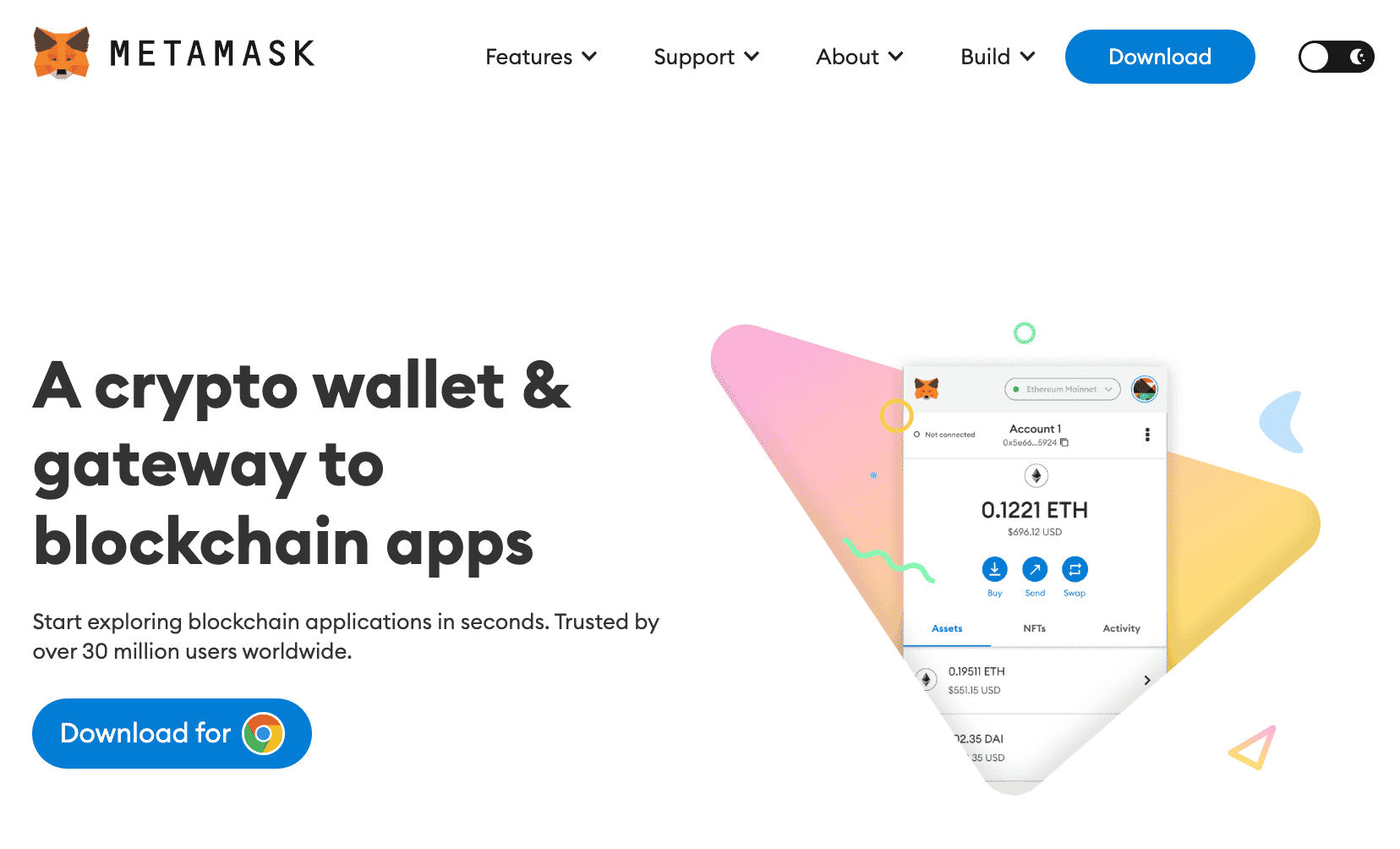

Step 1: Get a Crypto Wallet

In order to invest in the Dash 2 Trade presale, investors in the UK will need to have access to a crypto wallet.

For beginners, one of the best crypto wallets in the UK is Metamask. Investors like MetaMask for its simple use interface and the fact that it can be accessed via a web browser extension (e.g. Google Chrome) or mobile app.

Visit the MetaMask website and download the wallet onto a preferred device. For the most simplistic investment experience possible, consider a browser extension.

Open the MetaMask wallet and choose a password, before writing down the 12-word backup phrase. Never share this with anyone as the backup phrase offers access to the wallet in the event the password is forgotten.

Step 2: Buy Ethereum

Now that the wallet has been installed, the next step is to buy Ethereum. The reason for this is that Ethereum is the required payment currency when investing in the Dash 2 Trade presale. Essentially, investors will be exchanging Ethereum for D2T tokens.

Ethereum can be purchased from a variety of online crypto exchanges. – many of which accept debit/credit cards and UK bank transfers via Faster Payments.

Step 3: Transfer Ethereum to MetaMask

Next, the Ethereum tokens that have been purchased from a crypto exchange will need to be transferred to the MetaMask wallet.

- At the top of the main MetaMask interface, the wallet address for Ethereum is displayed.

- Copy it and head over to the exchange where the Ethereum tokens are currently located.

- Request a withdrawal from the crypto exchange and paste the MetaMask wallet address.

Most exchanges will process the withdrawal request near-instantly, meaning the Ethereum tokens should appear in the MetaMask wallet in under five minutes.

Step 4: Visit Dash 2 Trade and Connect MetaMask Wallet

The next step is to visit the Dash 2 Trade website. After clicking on the ‘Connect Wallet’ button, select MetaMask.

- Do note that when connecting the wallet to Dash 2 Trade, this needs to be done on the same device where MetaMask is located.

- For instance, those wishing to complete the process via a laptop will need to have the MetaMask wallet installed via a browser extension.

A pop-up notification will then appear via the MetaMask wallet. This is asking for confirmation that a connection to Dash 2 Trade should be made. Provide authorization to move on to the next step of the investment process.

Step 5: Complete Dash 2 Trade Presale Investment

The final step is to buy D2T tokens. As noted above, the purchase will be paid for with the Ethereum tokens that were purchased in the previous step.

Now that the MetaMask wallet is connected to the Dash 2 Trade dashboard, the investor can type in the number of Ethereum that they wish to swap.

As of writing, the first batch of D2T tokens will be sold at $0.0476, before increasing to $0.05. This means that for every $100 invested (about £88), a total of 2,100 D2T tokens will be purchased.

To complete the presale investment, authorization for the transaction will need to be confirmed via the pop-up notification that appears in the MetaMask wallet.

Step 6: Claim Tokens

At this stage of the walkthrough, the presale investment has been confirmed. However, the D2T tokens cannot be claimed until after the presale campaign has concluded.

When it has, head back to the Dash 2 Trade website and click on the ‘Claim’ button. The investor will once again need to link their MetaMask wallet. After confirming, the D2T tokens will be transferred to MetaMask.

Conclusion

To combat rising inflation and the cost-of-living crisis, there are many ways to invest £5,000 in the UK. This beginner’s guide has covered everything from dividend stocks and index funds to interest accounts and commodities.

One of the most popular avenues for investors to take in the current financial landscape is crypto presales. Dash 2 Trade – which is building a professional-grade analytics terminal, is currently offering its D2T token via presale prices.

Those wishing to invest in the Dash 2 Trade presale before it sells out can refer to the step-by-step guide above.