Investors who have a nest egg of half a million dollars need to know how to invest that money for the long term. $500k can enable investors to live on investment income, provide for a well-cushioned retirement, or even pass on money to their descendants.

In this guide, we’ll explain the best way to invest $500k in 2023 and teach investors how to build a diversified portfolio. Read on to learn how to invest $500k today!

12 Best Ways to Invest $500k in 2023

With $500k to invest, investors have a lot of different options for putting their money to work. For investors asking the question, “What can I invest in with $500k?” these are the 12 best ways to invest $500k today and start building a diversified portfolio:

- FightOut – Invest in this Crypto to Earn M2E rewards & Purchase Bonuses

- Dash 2 Trade – Diversify in an Exciting New Crypto Analytics Platform During Presale

- Top Crypto Projects – Crypto Projects like Tamadoge or Bitcoin offer Investment Opportunities

- Stocks – Invest in Individual Growth, Value, and Dividend Companies

- Real Estate – Invest in a House or Start a Rental Business

- Index Funds – Match the Performance of the S&P 500

- NFTs – Collect One-of-a-kind Digital Artworks

- ETFs – Focus on Themes like 5G, Space & More

- REITs – Take a Stake in Commercial Real Estate

- Bond Funds – Safe Investment in Government & Corporate Debt

- Copy Trading – Actively Trade by Mimicking Experienced Traders

- Crypto Interest Accounts – Put Crypto to Work by Earning Interest

A Closer Look at the Best Ways to Invest $500,000

Choosing what to invest $500k with comes down to understanding the benefits and drawbacks of each potential investment. So, we’ll take a closer look at the 12 best $500k investments and explain why investors might want to include them in their portfolios.

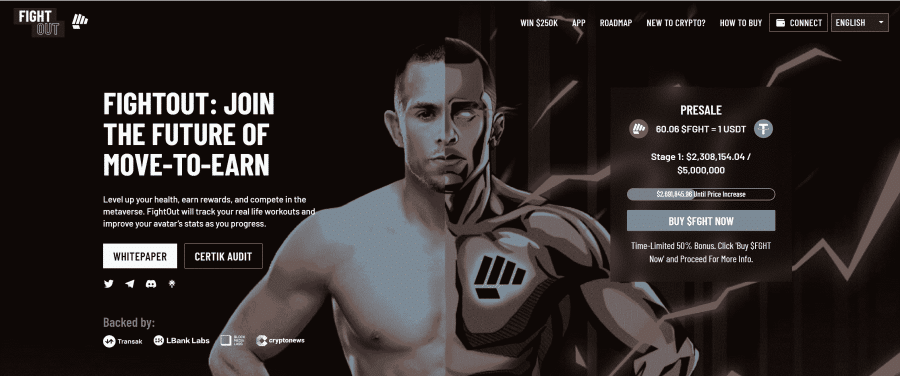

1. FightOut – Invest in this Crypto to Earn M2E rewards & Purchase Bonuses

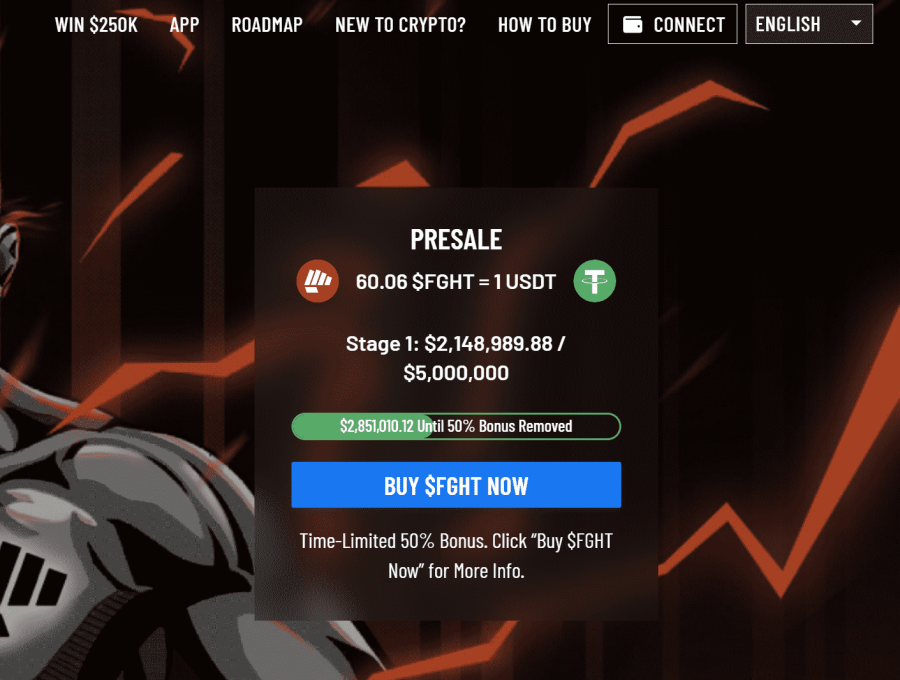

Within a few days of the launch of its first presale stage, FightOut has already raised over $2.3 million USDT. Investors should consider buying its native token $FGHT while the prices are expected to rise in the coming times. Currently, buyers can get the token at a discounted price of $0.0167 per token.

The project has created an effective system to reward its users for fitness movements. Users can make an additional income by simply completing their workout routines. Also, FightOut has created a new-age metaverse to gamify fitness & lifestyle.

The platform enables users to create soulbound NFT avatars in its metaverse. Interestingly, these avatars will enhance in direct relation to the users’ actual fitness performance. Consequently, users will also be able to compete with other community members in FightOut’s metaverse.

The project has created an in-app currency called REPS to effectively reward its users. This creates an additional incentive for users to meet their fitness goals and lead a healthy lifestyle. Furthermore, users can use REPS to buy useful products from FightOut’s marketplace. Users can get access to membership discounts, cosmetic NFTs, and similar products.

Investors should refer to FightOut’s whitepaper to get a better understanding of the project’s numerous features.

$FGHT Tokenomics & Purchase Bonuses

FightOut deploys an ERC-20 standard for its native token $FGHT. It is a limited supply token built on top of Ethereum. From its total supply, 90% of the tokens would be available for purchase in the project’s presale stages.

The $FGHT token can be used to participate in FightOut’s tournaments and leagues. Moreover, users can also buy REPS using $FGHT. In doing so, they can get an additional 25% REPS.

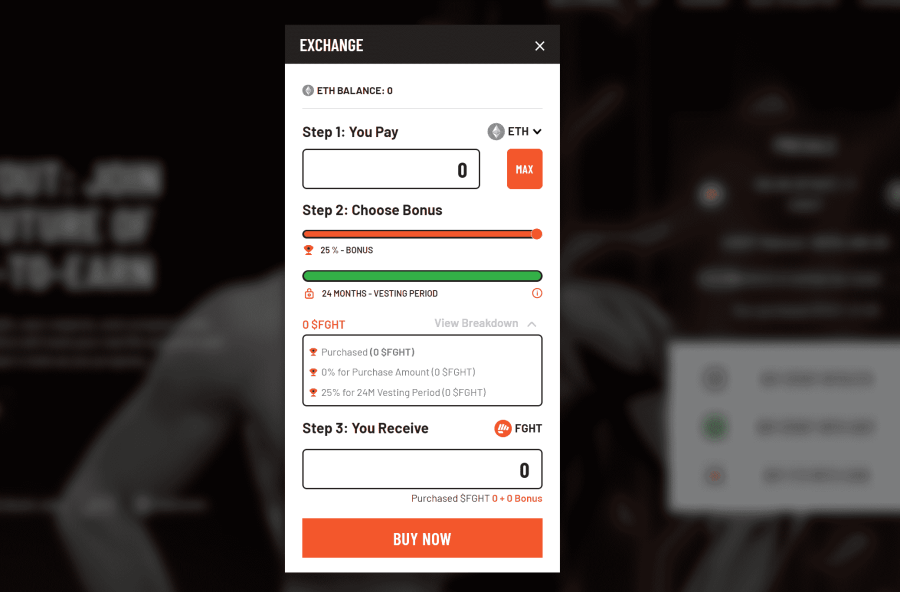

Investors opting to take part in the ongoing presale stages would be entitled to receive purchase bonuses that start from 10%. To receive this, they need to start with an investment of merely $500 with 6 months of vesting. Moreover, buyers can also get exciting membership rewards by staking their $FGHT.

$FGHT Presale Performance

FightOut’s first presale stage has already caught momentum while the project raised over $2.7 million USDT in a relatively short period of time.

Buyers can also get up to 50% additional tokens as rewards during the ongoing presale stages. To always stay updated, buyers can consider joining FightOut’s Telegram channel.

| Presale Started | 14 December |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

2. Dash 2 Trade – Diversify in an Exciting New Crypto Analytics Platform During Presale

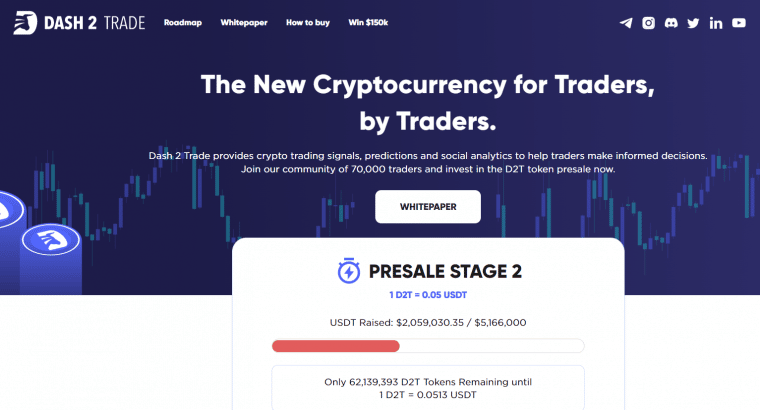

Our top pick for the best way to invest $500k is to enter a position in new crypto presale project Dash 2 Trade, a unique crypto analytics and intelligence platform that raised almost $2 million of investment in its first three days after launch.

The project is racing through the early stages of its presale to huge excitement in the crypto space, with presale projects one of the most consistent ways crypto investors have been able to secure profits in 2023.

Presales have outperformed the biggest coins in the market, with projects like Tamadoge, STEPN, Sweat Economy, and Aptos all seeing big gains from their presale price.

That is because crypto projects typically offer low entry points when they first launch to secure investment and ensure they can continue through their developmental stage.

The native D2T token, which will power the Dash 2 Trade platform, was priced at $0.0467 in phase 1 of the presale, but in the ninth and final phase the token will cost $0.0662 each.

That is an increase of 39% and means that a $1,000 investment returned 21,000 D2T in phase 1 compared to just 15,100 in phase 9.

A total of 700 million of the 1 billion max supply of D2T tokens will be sold in the presale, with a hard cap of $40 million.

Read our full how-to-buy guide on Dash 2 Trade.

While many crypto projects – and especially crypto presales – can be risky, Dash 2 Trade is a low risk investment compared to others.

The developers are fully public, doxxed and have been KYC-verified by leading third party organization CoinSniper.

The token’s smart contract has also been audited by another firm, SolidProof, meaning it is scam-proof.

Furthermore, the developers are the same team behind beginners’ trading platform Learn2Trade, which has more than 70,000 global users.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

| $0.0556 | $4,865,000 | 87,500,000 |

| $0.0580 | $5,075,000 | 87,500,000 |

| $0.0606 | $5,302,500 | 87,500,000 |

| $0.0635 | $5,556,250 | 87,500,000 |

| $0.0662 | $5,792,500 | 87,500,000 |

Dash 2 Trade is a new analytics and trading signals platform that users a range of metrics and data to help crypto traders and investors make better-informed decisions on their holdings to help maximize potential profits.

The dashboard, which has a three-tiered monthly subscription model, will feature trading signals that highlight buying and selling opportunities, as well as track social sentiment and on-chain data to spot trends early.

Traders will be able to utilize a range of tools and a back-tester to optimize strategies and test them in real-time without risking capital, while also utilizing social tools to discuss insights.

Dash 2 Trade is also developing a bespoke scoring system to track the best new crypto presales on the market – giving them a score out of 100 from a range of insights to ensure investor confidence.

There will also be alerts on new coin listings to limit missed opportunities.

More information on the project can be found in the Dash 2 Trade whitepaper or on the Telegram group.

| Presale Started | October 19 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | 1,000 D2T |

| Max Investment | N/A |

3. Top Crypto Projects – Crypto Projects like Tamadoge or Bitcoin offer Investment Opportunities

Cryptocurrency is a relatively new asset class, but a growing number of investors are choosing to include digital currencies in their portfolios. This is especially true of large investors, who see crypto as a suitable way to diversify away from more traditional assets like stocks.

There are thousands of popular crypto projects to choose from, from established market leaders like Bitcoin and Ethereum to emerging cryptocurrencies that are just getting off the ground. One benefit to investing in crypto projects is that all of these different cryptocurrencies have different pros and cons, so investors can build a diversified portfolio within this broad asset class.

BTC is currently trading at around $20,000, 70% down from its all-time high.

Crypto has been in a bear market for all of 2022 and may yet go further down before the end of the year. However, no bear market lasts forever and as the next Bitcoin halving approaches, the crypto markets will pick up.

Diversity in any portfolio is key and with tens of thousands of crypto projects to choose from – all offering different protocols and solutions – investing in the crypto market could reap big rewards, albeit as a much riskier investment than traditional stocks and other asset classes.

One strategy could be to invest in long-established coins, such as Bitcoin or Ethereum, that offer lower risk but lower potential for high returns.

Another could be to invest in new crypto projects that have smaller market caps and more room to grow.

Among new crypto projects, investors may want to take a look at Tamadoge, a play-to-earn ecosystem that also includes non-fungible token (NFT) ownership.

Tamadoge launched at the end of September to huge excitement and hype, rising almost 2,000% from its early presale price.

The TAMA token price has since pulled back but may now be an attractive entry point for some, plus its ecosystem is building long-term value for holders.

As users spend TAMA, the native cryptocurrency of Tamadoge, on in-game upgrades and NFTs, 5% of the tokens used for each transaction are removed from circulation and burned. This means that the more people that use TAMA, the faster coins are removed from circulation. Eventually, demand could outstrip supply, which would be expected to send the price of TAMA higher.

For investors who think that crypto represents an avenue for future growth, Tamadoge is one of the most promising cryptocurrencies available right now.

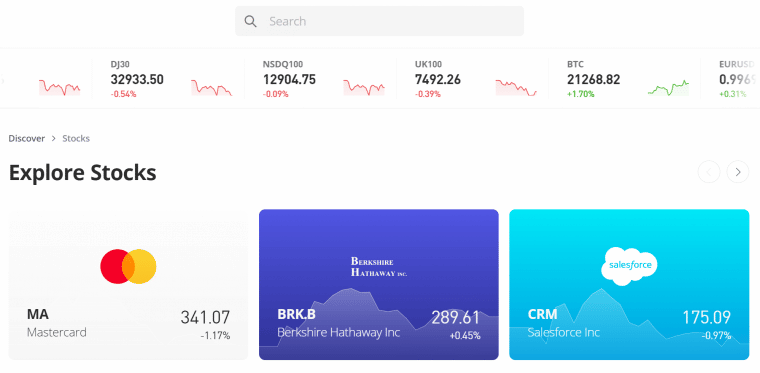

4. Stocks – Invest in Individual Growth, Value, and Dividend Companies

Stocks are among the most popular investments in the world and are a part of almost every major investor’s portfolios. Investing in stocks enables investors to pick companies that they believe in and benefit as their businesses grow.

When investing in stocks, there are 3 different types of stocks investors can look for. Growth stocks belong to companies that are experiencing rapid earnings growth and that are expected to continue to keep growing quickly for years to come. Many of the best tech stocks are growth stocks.

Value stocks belong to more established companies that have strong, reliable business models. They may not be growing as quickly as growth stocks, but value stocks can deliver steady returns to investors over time.

Dividend stocks make payments, usually in cash, to investors. Dividend stocks are worth considering as the best way to invest $500k for income, since the cash from dividends can be used to cover everyday expenses without liquidating other investments.

Investors will need a stock broker in order to buy and sell stock shares. Check out eToro, which offers 0% commission on stock trades and offers shares from the US and markets around the world.

5. Real Estate – Invest in a House or Start a Rental Business

Real estate can be a suitable option for investing $500k because the real estate market is largely uncorrelated to the stock market. That means that if investors hold both stocks and real estate, they may find that real estate values remain high even when the stock market drops. This is especially valuable for investors who need to sell assets on a regular basis for income.

Investing in real estate can also be used to generate steady income. Many investors purchase investment homes, which they can then rent out throughout the year or as vacation rentals. While this requires some work – renting a home is like running a business – it offers a way to diversify income sources and make money from property beyond just price appreciation.

Keep in mind when investing in real estate that it’s less liquid than stocks or cryptocurrencies. If an investor wants to sell a house, for example, the process could take months instead of minutes. So, real estate is typically not the best way to invest $500k short-term.

6. Index Funds – Match the Performance of the S&P 500

Index funds are widely considered to be a relatively safe, low cost, and low-effort investment. Index funds are designed to mimic the holdings of major stock indices like the S&P 500 or the NASDAQ 100. So, when an investor holds an S&P 500 fund, their investment performance matches the performance of the 500 largest stocks on the US market.

Index funds typically have management fees of 0.25% or less, making them potentially attractive for investors who are wary of high fees. Historically, index funds have outperformed most individual investors who try to beat the market by investing in individual stocks. Many financial advisors say that index funds are the best place to invest $500k.

Investors will need a stock broker like eToro in order to buy and sell index funds. eToro offers index funds for the major US and European stock markets with 0% commission.

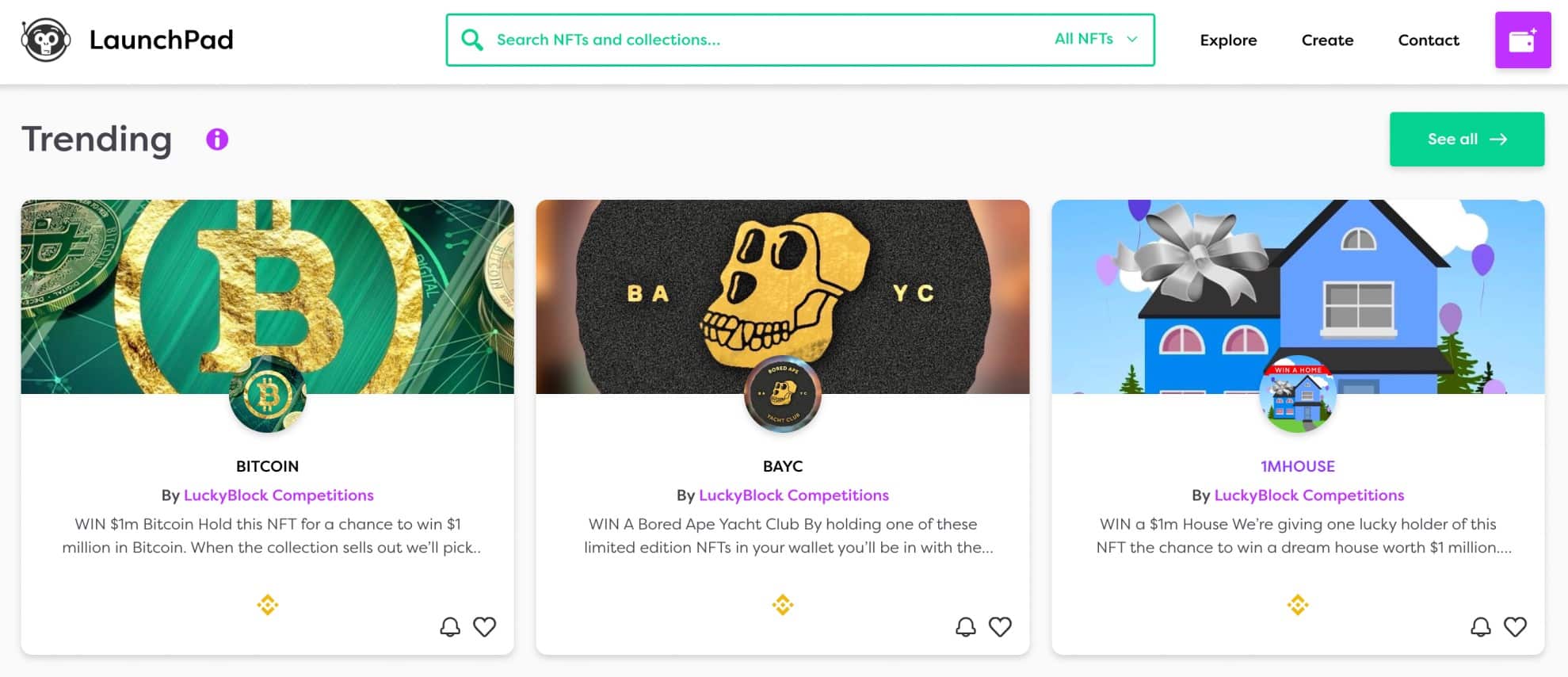

7. NFTs – Collect One-of-a-kind Digital Artworks

NFTs, or non-fungible tokens, are unique digital creations that have proven to be very popular among art collectors and investors. NFTs can be one-of-a-kind digital artworks that appreciate in value just like traditional art. In addition, they can also serve as digital passes to exclusive clubs and benefits, giving them some attributes that traditional art investments don’t offer.

The NFT market can be volatile compared to the traditional art market, so it’s most suitable for investors who have a stomach for ups and downs. However, the market as a whole has grown tremendously in value over the past several years and many experts are optimistic about the future of NFTs.

One of the best NFTs to consider as a $500k investment is the Lucky Block Platinum Rollers Club NFT. This NFT offers investors a 1-in-10,000 chance to win $10,000 every single day. Investors can also lease out their Lucky Block NFTs to generate steady income. Lucky Block Platinum Rollers Club NFTs are currently available for sale on the LaunchPad NFT marketplace.

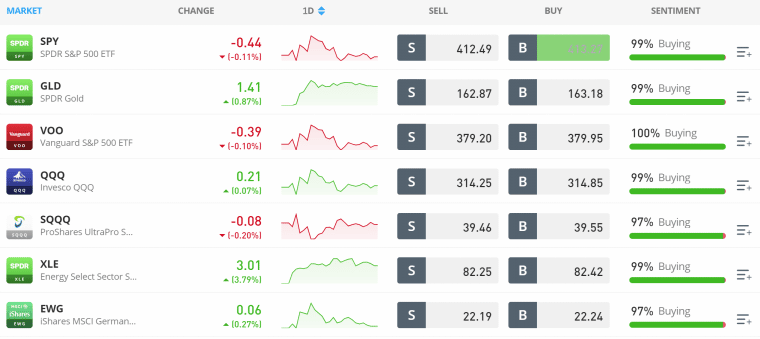

8. ETFs – Focus on Themes like 5G, Space & More

ETFs, or exchange-traded funds, are baskets of stocks that investors can purchase just like individual stocks.

The benefit of investing in ETFs is that they enable investors to build a diversified stock portfolio in a single trade or invest in specific market sectors or themes. Some of the most exciting ETFs today focus on themes like 5G stocks, blockchain stocks, and even space stocks.

ETFs are managed investments, so they do come with some fees. These can range from less than 0.25% of the amount invested per year to 1-2% per year depending on whether stocks in the ETF are actively traded. Investors may want to stay away from ETFs with fees over 1%, as these fees can take a lot of money out of a $500k investment.

Investors can buy and sell top ETFs through most major brokerages. eToro offers 0% commission trading on hundreds of US ETFs.

9. REITs – Take a Stake in Commercial Real Estate

REITs, or real estate investment trusts, are companies that buy and manage real estate. Investing in REITs is one of the best ways to get exposure to the real estate market without buying property directly.

There are many different types of REITs for investors to choose from. Residential REITs invest in single-family homes and apartment buildings and make money by renting them out. Commercial REITs may develop or buy commercial properties, which they can rent out to retailers, professional offices, and other businesses. There are even REITs that invest in farmland or industrial properties.

Most REITs pay dividends to investors, making them a suitable investment for income generation. Keep in mind that the price of REITs can go up and down as the price of real estate changes. So, while REITs trade on the stock market, they don’t always move in tandem with the broader stock market.

Investors can buy and sell a variety of popular REITs through stock brokers like eToro.

10. Bond Funds – Safe Investment in Government & Corporate Debt

Bonds are I.O.U. notes that governments and companies issue when they want to raise money. Individuals and financial firms can buy bonds, giving the issuer money. In return, they receive regular interest payments on the loaned money and their entire bond payment back at the end of the bond’s term.

Bonds are widely considered to be one of the safest $500k investments. Investors who want to know how to invest $500k to make $1 million probably shouldn’t look to bonds, as they typically have returns of only a few percent per year. However, for investors who want to protect their nest egg or want a low-risk alternative to stocks, bonds can be a worthwhile investment.

One of the most popular ways to invest in bonds is through bond funds, including mutual funds and ETFs. Bond funds purchase bonds from a wide variety of governments and companies, creating a portfolio of interest payments and risk profiles. Bond funds usually have low management fees as well.

Investors can purchase bond funds through most brokers that offer ETFs, including eToro.

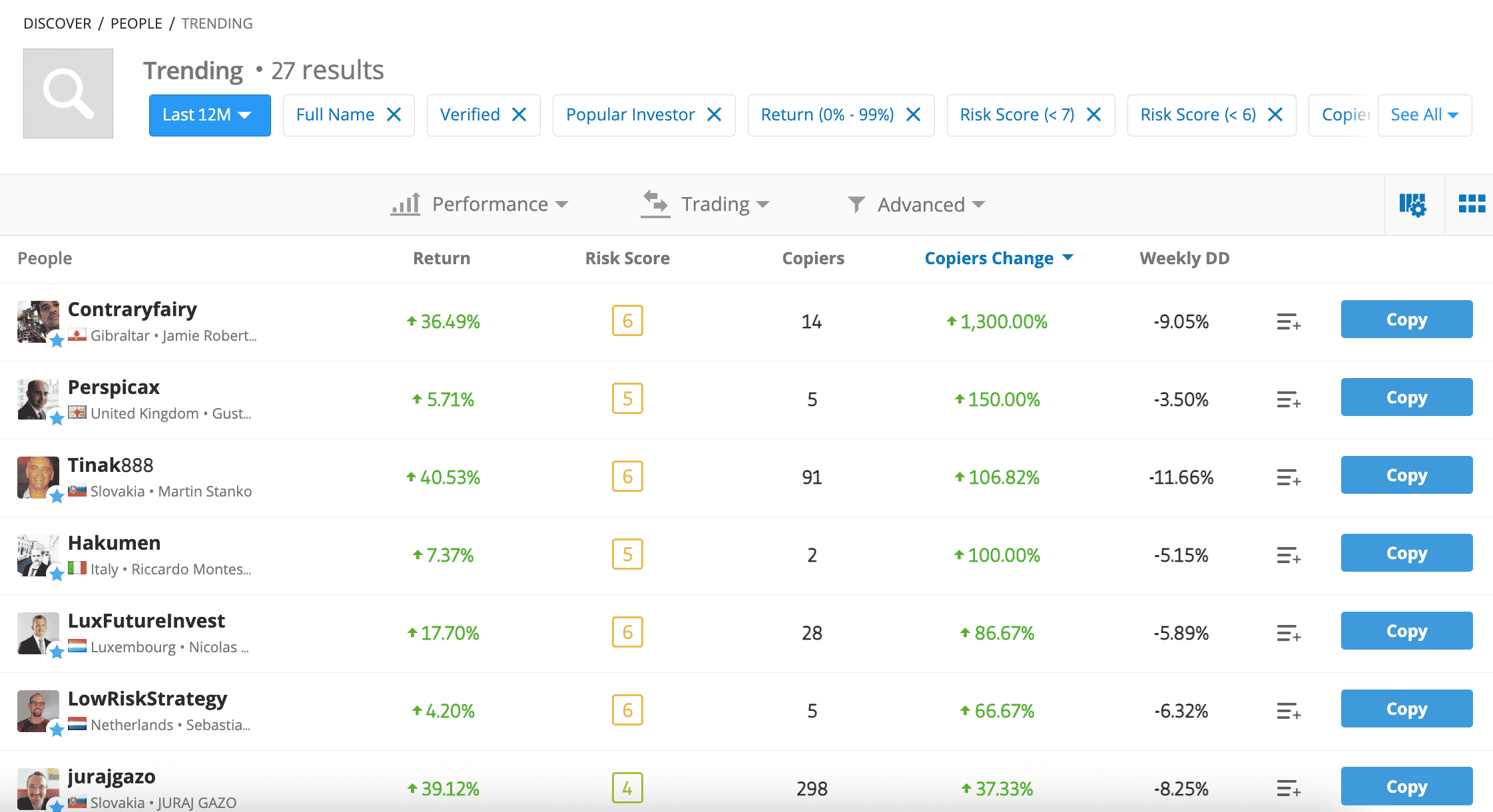

11. Copy Trading – Actively Trade by Mimicking Experienced Traders

Copy trading platforms enable investors to actively trade stocks, cryptocurrencies, and other assets by mimicking the moves of more experienced traders. This can be a suitable way for new investors or investors who don’t have a lot of time to study the market to try to beat the returns offered by passive investing.

Copy trading platforms like eToro allow investors to see what positions a trade has taken in the past and how they’ve performed. Investors can start copy trading with as little as $200, so someone with $500k to invest can follow multiple copy traders.

Importantly, copy trading can be used to diversify into asset classes that investors may not be comfortable navigating themselves. For example, investors can use copy trading to dive into forex trading or commodities trading. They can also copy long-term investors who have diversified portfolios that have outperformed the market in recent years.

12. Crypto Interest Accounts – Put Crypto to Work by Earning Interest

Crypto interest accounts are somewhat like savings accounts for cryptocurrencies. Investors who hold cryptocurrencies can lock up their tokens for a period of time and earn interest on them in return. Some crypto interest accounts enable investors to claim their tokens back at any time, making this a relatively flexible investment option.

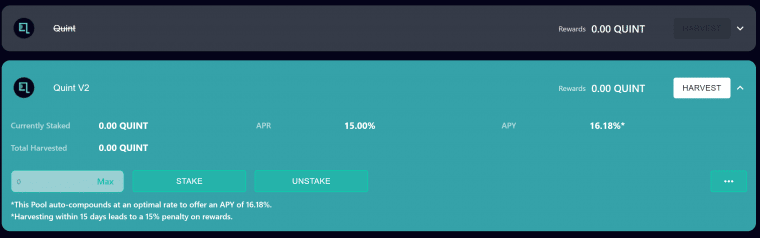

The benefit of a crypto interest account over a traditional savings account is that the interest rates can be much higher. For example, Quint, one of the top crypto interest platforms, offers interest rates up to 39.08% APY when investors stake QUINT and BNB. Investors can also earn interest on multiple different cryptocurrencies, enabling them to create a portfolio of interest rates.

Investors should keep in mind that crypto interest accounts are not regulated like traditional savings accounts and are not subject to the same government protections. So, it’s important to choose a trustworthy and secure crypto interest platform.

How to Choose the Best $500k Investments for You

The best way to invest $500k will likely involve building a diversified portfolio that uses a combination of the investments we reviewed above. In this part of our guide, we’ll help investors decide how to invest $500,000 in the way that’s best suited to their needs.

Diversification

Diversification is important for investing any amount of money, but it’s especially important when deciding what to invest in with $500k. Diversification means spreading investments across different asset classes (like stocks, cryptocurrencies, real estate, and more), market sectors, countries, risk levels, and return potentials.

In general, the more diversified a portfolio is, the better it will stand up to market downturns. As an example, if the stock market crashes, a portfolio that includes 100% stocks will suffer dramatically. But a portfolio that is 25% stocks, 25% crypto, 25% real estate, and 25% bonds is likely to fare much better.

Put simply, a big part of learning how to invest $500k is learning how to diversify.

Risk Tolerance

All investing involves risk, but not all investments are equally risky. When choosing how to invest $500k, it’s important for investors to think carefully about how much risk they’re willing to take on and how much of their portfolio can be invested in high-risk assets.

There’s no right answer for every investor when it comes to thinking about risk. Young, aggressive investors may be willing to put half or more of a $500k portfolio in relatively risky investments like individual stocks and cryptocurrencies. Older investors who rely on their $500k portfolio for retirement income may be much less willing to take on risk. These investors may invest 10% or less of their portfolio in asset classes like stocks and crypto.

Keep in mind that risk and returns often go hand-in-hand. Higher risk investments usually offer higher potential returns. Lower risk investments usually deliver lower returns. Investors should also keep in mind that just because an asset class is widely considered low-risk – for example, bonds – individual investments within that asset class can still be quite risky.

Income Investing

Investors in search of the best way to invest $500k for income may want to consider investments that deliver steady cash returns. Some examples of assets that offer cash payments include dividend stocks, dividend-paying REITs, and bonds.

Generating steady income from investments is important because it enables investors to have cash flow. Investors can use cash from dividends to cover everyday expenses without having to sell off their investments.

When investing for income, keep in mind that dividends aren’t everything. If a dividend stock loses value, for example, that depreciation may offset any dividends the stock paid out. It’s important to balance income, growth, and value when choosing investments.

How to Invest $500k – FightOut Tutorial

Ready to get started with the best way to invest $500,000 in 2023? We’ll walk investors through how to purchase FightOut right now.

Step 1: Download a Cryptocurrency Wallet

To get started, investors need to have a crypto wallet like MetaMask installed. (Mobile users are recommended to download the TrustWallet)

Step 2: Connect the Wallet

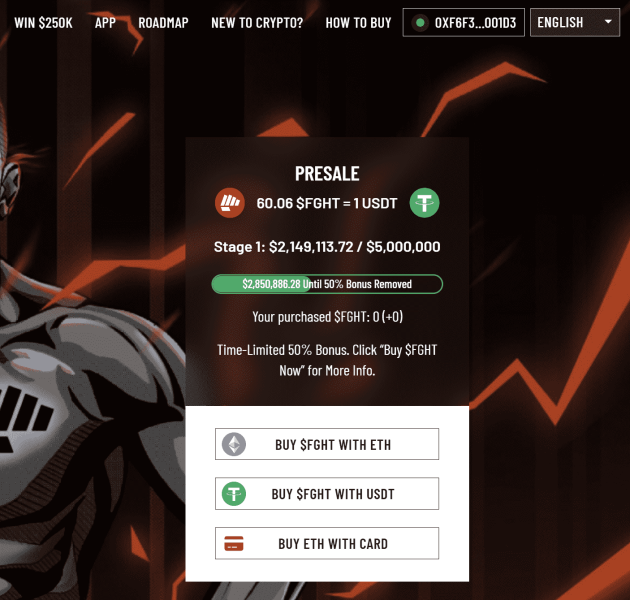

After installing the wallet, investors should go to FightOut’s official presale page. Then, they should search for and click on the “BUY $FGHT NOW” button. Now, buyers can choose the wallet they have downloaded (e.g. MetaMask or TrustWallet).

Step 3: Buy ETH/USDT

Now, investors should check if they have enough ETH or USDT balance in their wallets. Also, they can choose to purchase ETH via a credit card.

Buyers can now click either on the “Buy $FGHT with ETH” or “Buy FGHT with USDT” button.

Step 4: Buy $FGHT

Now investors should mention the amount of ETH/USDT they wish to exchange in return for the $FGHT tokens.

Step 5: Claim $FGHT

In this last step, buyers just need to confirm the transaction after checking the number of $FGHT tokens to be received. They can claim $FGHT based on the vesting period they opted for in the previous step.

Where to Invest $500k – the Best Option?

For investors deciding what to invest $500k in, there are a lot of promising options. Based on our research FightOut is amongst the best option. The project offers a next-gen fitness app that allows users to earn Move-to-Earn rewards. After already having a successful presale launch, investors should consider buying the token before the token price increases.

Conclusion

For investors with $500k to invest in the market, it’s important to build a diversified portfolio with many different assets.

These can include cryptocurrency projects, stocks, ETFs, real estate, bonds, and more. Investors in search of where to invest $500,000 right now can also check out FightOut – a project that has effectively filled in the gaps in the M2E space by creating an innovative fitness app and rewarding its users for fitness movements. Buyers can still buy the tokens at a relatively low price of $0.0167

FightOut - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $1M+ Raised

- Real-World Community, Gym Chain