There are many ways that investors in the UK can elect to invest £75k – be it stocks, index funds, precious metals, real estate, or even cryptocurrencies.

In this guide, we explore the 10 best ways to invest £75k in the UK, across multiple strategies and asset classes. We also explain how investors in the UK can choose their own investments that align with their personal goals and tolerance for risk.

Investors searching for the best way to invest £75k in the UK may consider one or more of the 10 assets listed below: Seasoned investors will often build a portfolio that contains some or even all of the above asset classes. As a result, when selecting the best way to invest £25k in the UK, be sure to read through all 10 methods.Best Ways to Invest £75k in the UK in 2023

A Closer Look at the Top Ways How to Invest £75,000

While £75k represents a vast sum of capital to invest in the financial markets, investors will need to tread carefully.

The key takeaway is that when searching for the best way to invest £75k in the UK, investors should consider their long-term financial goals and tolerance for risk.

Additionally, it is important to diversify, which means spreading the £75k across multiple asset classes.

Read on to obtain inspiration on how to invest £75,000 in the UK right now.

1. Dash 2 Trade – World-Class Crypto Analytics Terminal Offering its Digital Token via a Presale Launch

The first asset class to consider when building a portfolio of investments with £75k is cryptocurrency. On the one hand, cryptocurrencies are high-risk assets, so investors should limit the amount that they allocate to this industry. With that said, cryptocurrency is the best-performing asset class in recent years.

In fact, even though cryptocurrencies have been in a bearish cycle since the turn of 2022, plenty of projects continue to generate sizable returns. To offer some context, Bitcoin, Ethereum, XRP, BNB, and many other low-cap cryptocurrencies are now trading 60-80% below their prior all-time high.

However, there are also plenty of success stories. For instance, in early 2022, Lucky Block witnessed growth of 6,000% after completing its presale launch. Tamadoge, which raised $19 million during its presale in October 2022, witnessed growth of 2,000%. As such, crypto presales arguably offer one of the best ways to invest £75,000 in the UK.

One of the best crypto presales available to invest in right now is Dash 2 Trade. This project is in the midst of building an analytics platform that offers professional, high-grade data and research tools. Backed by the D2T token, the platform will enable crypto investors and traders to consistently outperform the market through a variety of features.

For instance, Dash 2 Trade will offer premium members daily trading signals. Each signal is sent in real-time and explains which cryptocurrency to buy or sell, and the respective limit order price to enter. Signals also come with the suggested stop-loss and take-profit order prices. Additionally, Dash 2 Trade will also offer social media metrics.

This informs premium Dash 2 Trade members when a particular cryptocurrency or presale is trending across platforms like Reddit. This offers great insight into a digital asset that could be about to witness sizable gains. One feature includes on-chain statistics, which can flag large blockchain transactions and ‘whale’ investments.

Another feature that will appeal to traders is the strategy builder. This enables Dash 2 Trade members to build automated trading strategies and test them out in live but risk-free crypto market conditions. There will also be regular trading competitions with real-world prizes, in addition to a cryptocurrency project scoring system.

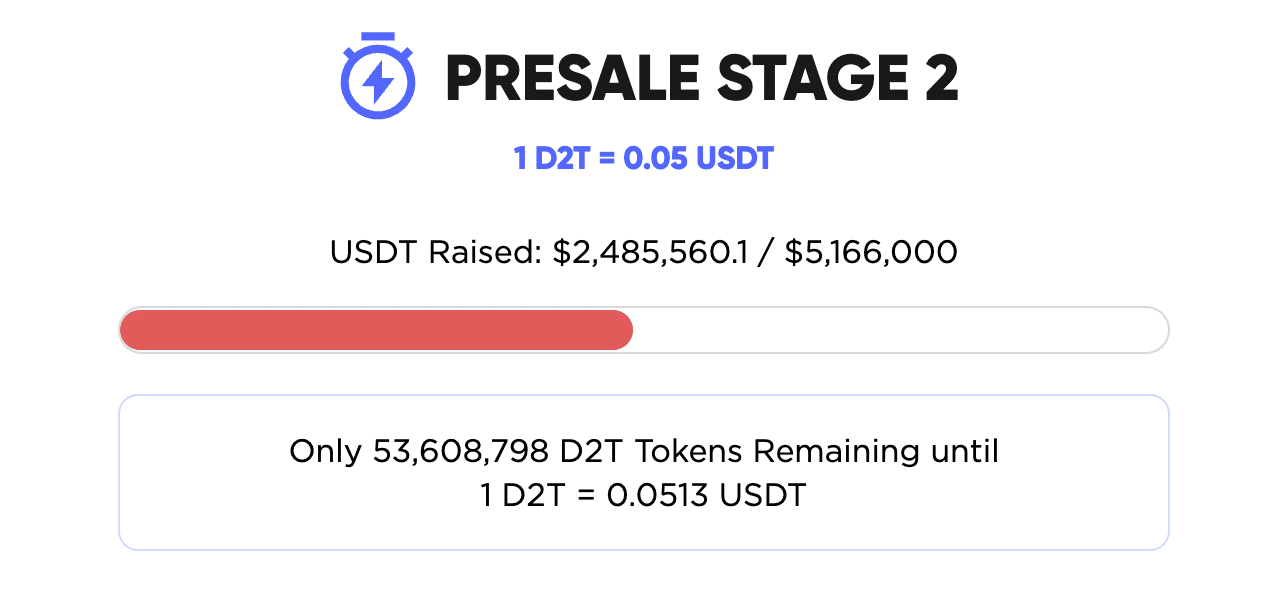

Crucially, in order to access all of the features and tools available on Dash 2 Trade, users will need to pay a monthly subscription fee in D2T tokens. This means that the value of the D2T token will correlate to the growth and success of the Dash 2 Trade ecosystem. Right now, Dash 2 Trade is offering its D2T tokens to early investors via a presale launch.

There are nine stages of the presale and each one increases the price of the D2T token. For instance, stages one and two are priced at $0.0476 and $0.05, respectively. This means that the earlier the presale investment is made, the lower the entry price for the investor. As of writing, more than $2.4 million has been sold to presale investors.

To obtain more information about this high-growth project, check out the Dash 2 Trade whitepaper and join its Telegram group. Moreover, Dash 2 Trade is running a $150k giveaway competition, where one winner will be selected randomly. Multiple ticket entries can be secured by following Dash 2 Trade on social media.

2. IMPT – Invest in an Up-and-Coming Carbon Credit Trading Ecosystem

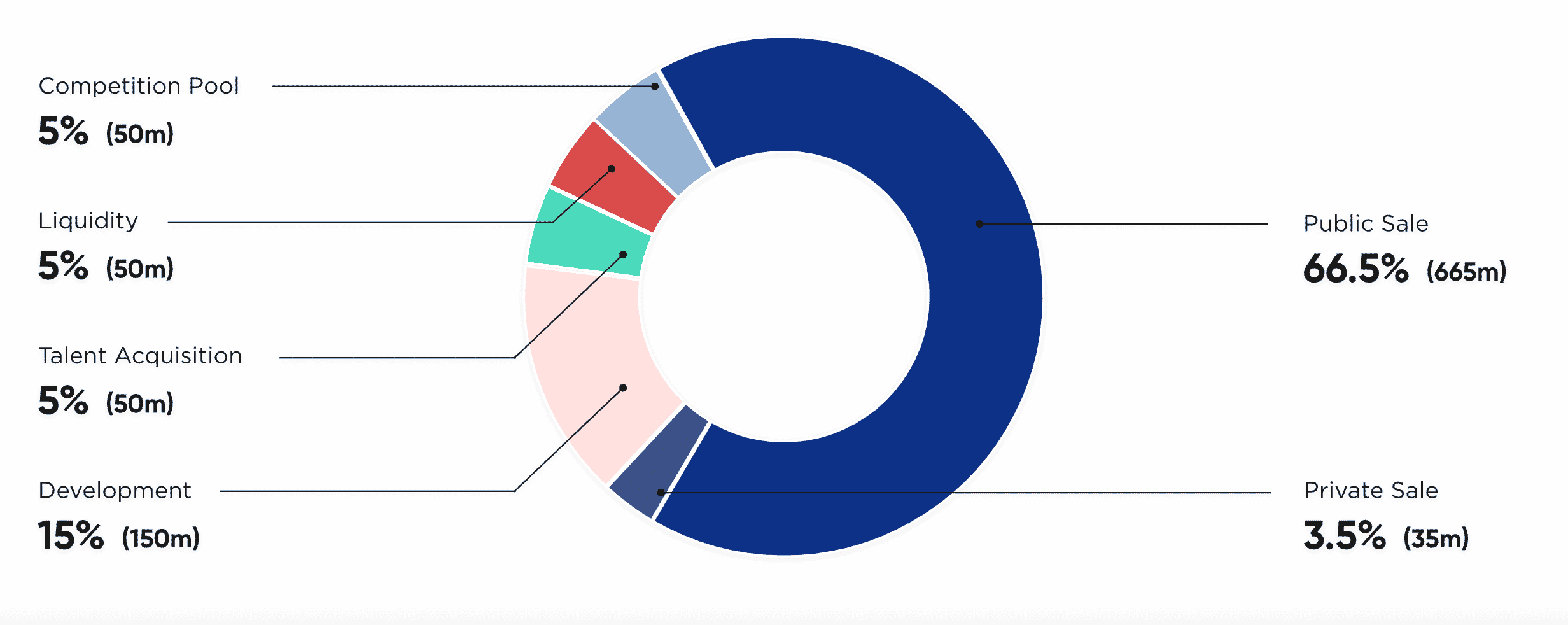

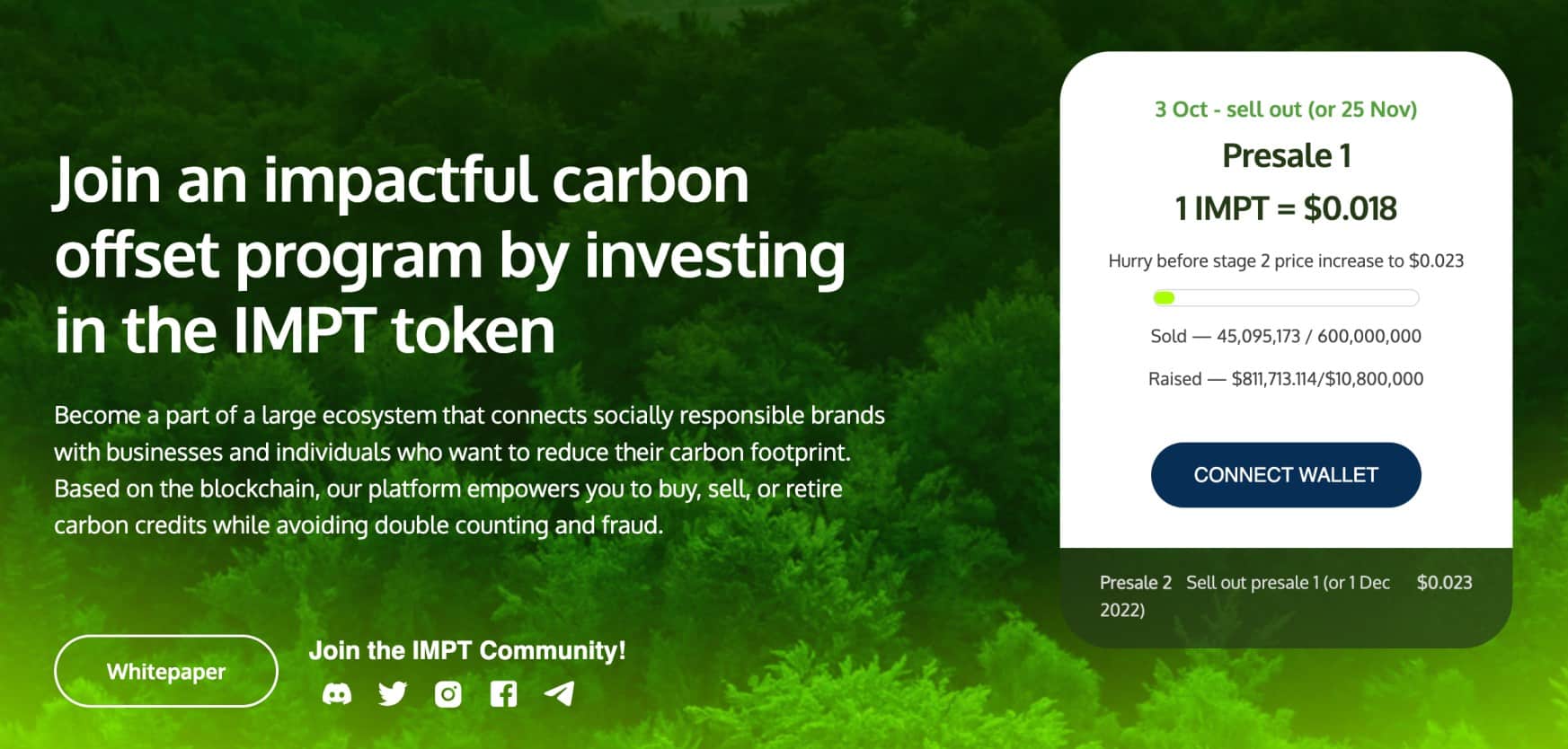

The next opportunity to consider when assessing the best way to invest £75k in the UK is IMPT. Much like Dash 2 Trade, IMPT is currently offering its native digital currency through a presale launch that has already raised $10 million. Before explaining the details of the presale, let’s explore why IMPT could be one of the hottest cryptocurrency projects of 2023.

In a nutshell, IMPT is utilizing blockchain technology to create a global ecosystem that facilitates carbon credit trading. For those unaware, in the UK – and dozens of other developed nations, companies are limited in how much carbon and other harmful gasses they can emit into the atmosphere.

Naturally, due to the respective industry, some companies require additional emissions throughout the year. To facilitate this, the company must purchase carbon credits from the open market. The price of UK carbon credits fluctuates based on demand and supply much like any other tradable instrument. Therefore, the carbon credit trading space is now a multi-billion dollar industry.

However, this marketplace is not as accessible as it should be – especially for small companies and retail investors in the UK. As a result, IMPT is expected to make huge waves in the coming months and years. Companies needing additional emissions can subsequently purchase carbon credits from the IMPT ecosystem.

This is a seamless process that simply requires companies to buy carbon credits from the IMPT secondary market. At the other end of the trade, those in possession of carbon credits can sell their holdings to companies. Once again, the value of the trade will be dependent on demand and supply, which determines global carbon credit prices.

Even UK retail investors can get in on the action should they wish to speculate on the future growth of the carbon credit market. It’s just a case of buying IMPT tokens and holding the digital assets in a private wallet until an opportunity to sell arises. Additionally, IMPT is also partnering with thousands of global brands to spread awareness of its green credentials.

This includes a cashback feature that enables consumers to earn IMPT tokens when they make eligible purchases online. To gain exposure to the future growth of IMPT, investors in the UK now have access to the project’s presale launch. As of writing, the presale is in stage one – which means a token price of $0.018.

However, the presale is approaching stage two – which will increase the price to $0.023. Once again, as we noted when we discussed the Dash 2 Trade presale, early investors have access to the best price possible.

3. Stock Index Funds – Gain Exposure to Hundreds of Stocks Through a Single ETF

Although choosing to buy cryptocurrency in the UK offers an opportunity to target above-average returns, it is also wise to diversify into other asset classes. Therefore, another option to consider when evaluating the best way to invest £75k in the UK is to allocate funds to an index fund.

In a nutshell, index funds are tasked with tracking a predefined section of the stock market. For example, in the UK, the FTSE 100 is an index fund that tracks the 100 largest companies that are listed on the London Stock Exchange. It is not possible to invest directly in an index fund. On the contrary, the investment is facilitated by an ETF provider.

For instance, iShares is a popular ETF provider that offers access to the FTSE 100 in addition to dozens of other index funds. Let’s suppose that the investor allocates £20,000 to an iShares FTSE 100 ETF. Although the ETF contains 100 companies, each stock will contribute a different percentage to the portfolio.

For example, Shell and AstraZeneca have a weighting of 9.3% and 7.8% respectively. This means that of the £20,000 FTSE 100 investment, £1,860 will be allocated to shares in Shell, and £1,560 to AstraZeneca. With that said, the FTSE 100 hasn’t offered suitable returns in recent years. In fact, by investing in the FTSE 100 in five years ago, the portfolio would be down 7%.

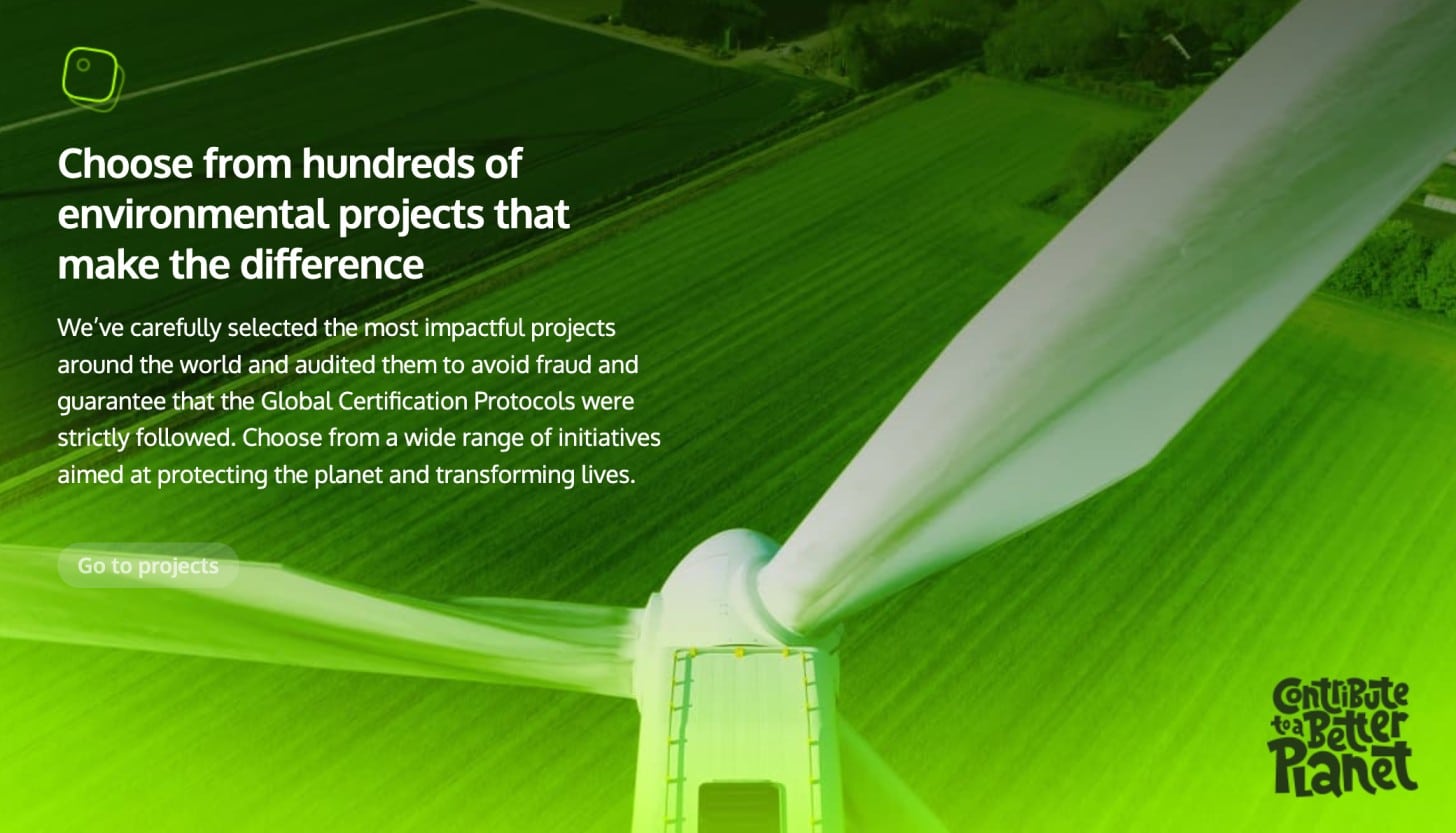

Instead, investors in the UK might consider the US stock markets. There are FCA-regulated brokers in the UK – such as eToro, that offer access to the US stock markets on a 0% commission basis. One of the most sought-after index funds in this regard is the S&P 500. Through a single investment, this index fund offers diversified access to 500 large US companies.

4. Real Estate – Invest in the UK and International Property Market via REITs

Seasoned investors in the UK will often have exposure to real estate. Over the course of time, real estate has generated staple growth, albeit, in both bullish and bearish cycles. Nonetheless, real estate remains one of the best ways to hedge against inflation and a stagnant economy. The key issue is that diversification in real estate can be challenging with capital of just £75k.

Moreover, buying a suitable investment property can require expertise in the real estate space in addition to being time-consuming, especially when it comes to renting and managing the property. Instead, investors might consider a real estate investment trust (REIT). A REIT is a large financial institution that actively manages investor funds.

The REIT will have a sizable portfolio of properties within its real estate portfolio – each of which will generate passive income through rental payments. The REIT will have its own team of analysts that select the most suitable properties for either rental income or appreciation. This means that REITs offer a passive way to invest in real estate.

REITs trade on public exchanges, so entering and exiting the market is a seamless process. Moreover, investors in the UK can also access REITs that track international property markets. As REITs are backed by ETFs, the minimum investment is often very low. REITs track a variety of real estate assets, including residential units, commercial warehouses, hospitals, and more.

5. Bonds – Receive Passive Income via Bi-Annual Coupon Payments

The next option to consider when assessing the best way to invest £75k in the UK is bonds. By purchasing bonds, the investor will lend money to a corporation or government. The institution will repay the money at the end of the bond term – which can be anything from six months to many decades.

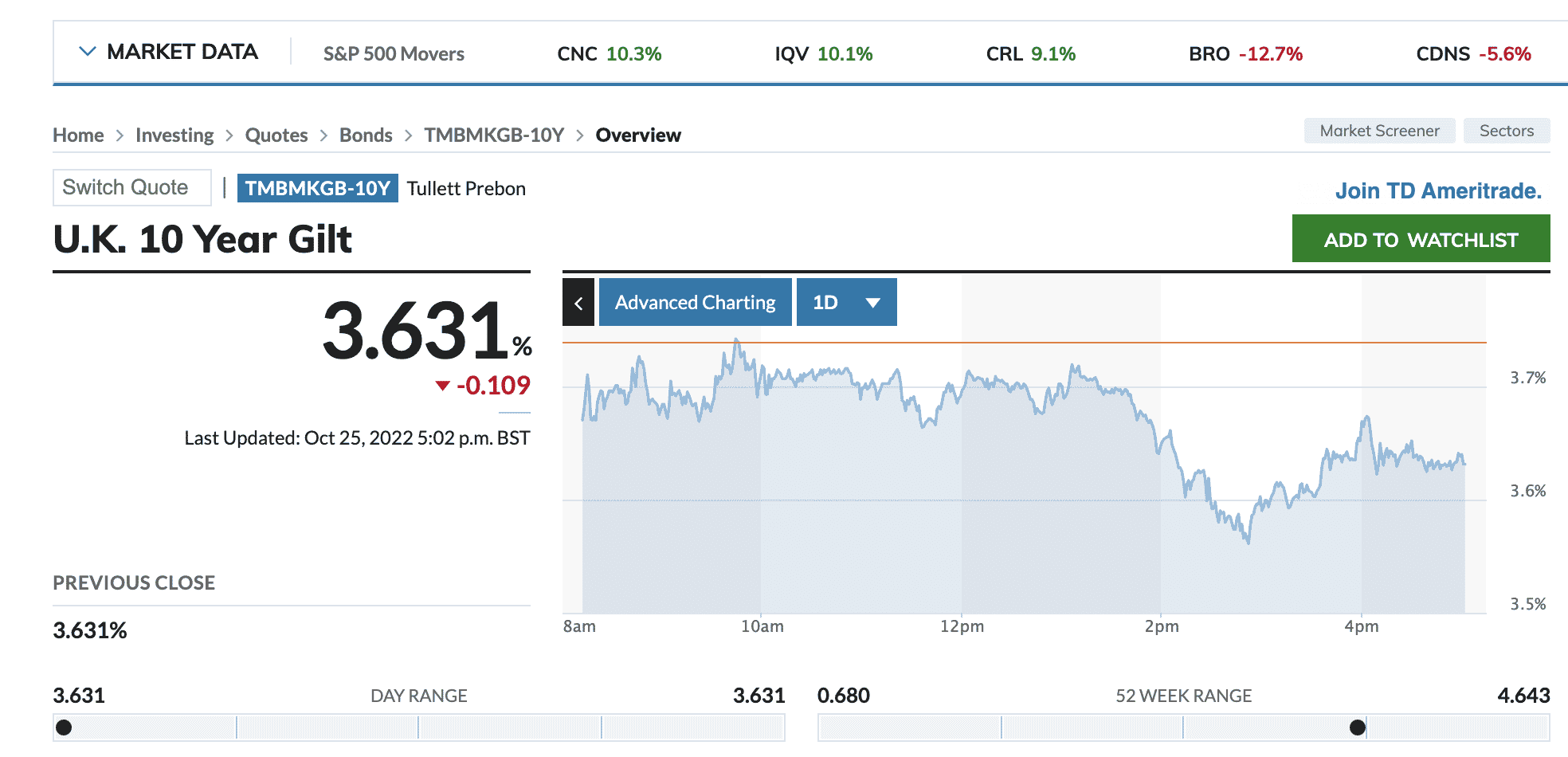

In the meantime, the bondholder will receive interest payments on a bi-annual basis. The interest rate on a bond – known as the coupon payment, will vary considerably depending on the issuer. For instance, bonds issued by the UK government (gilts) are typically viewed as risk-free and as such, this will be reflected in the yield.

With that said, due to rising Bank of England interest rates, UK government bonds can be purchased with yields of 3-5%. Corporate bonds, on the other hand, typically offer a higher rate of interest when compared to gilts. This is because the risk of default is higher.

After all, while the government can print money to meet its bond obligations, this option isn’t available to private companies. Nonetheless, bonds may be suitable for long-term investors that seek predictable passive income. On the flip side, the original investment won’t be returned until the end of the bond maturity, so this needs to be taken into account.

6. ISAs – Invest Up to £20k Annually Without Any Tax Obligations

Many investors will consider utilizing an individual savings account (ISA) when assessing the best way to invest £75k in the UK. In the current tax year, UK investors can allocate up to £20k into an ISA. Any investment gains made from the assets within the ISA will not attract any tax. This covers both dividends and capital gains.

Stocks and Shares ISAs permit pretty much any investment class. This includes stocks, ETFs, index funds, bonds, and more. Although the tax advantages are obvious, Stocks and Shares ISAs also come with their drawbacks. For example, Stocks and Shares ISAs are offered by online brokers which charge annual fees.

This fee will be charged irrespective of whether the investments are generating gains. Furthermore, the broker will charge a fee to buy and sell assets on its platform. Another thing to bear in mind is that UK investors can generate capital gains of up to £12,300 without paying any tax. Dividend income of £2,000 or under will also be tax-free without an ISA.

As a result, investors in the UK are likely better off utilizing a low-cost broker rather than a Stocks and Shares ISA – especially if investments will be made regularly. For example, although UK broker eToro does not offer ISAs, it facilitates 0% commission trading on both UK and international stocks. Stamp duty tax is waivered and there is no annual fee.

7. Dividend Stocks – Invest in Established Dividend-Paying Companies

There are a significant number of stocks both in the UK and abroad that have a long-standing dividend policy in place. This means that simply by holding shares in the company, the investor will receive cash every three months. The cash is funded through the company’s retained earnings, so it is essentially sharing profits with stockholders.

It is, however, important to remember that companies can stop paying dividends at any given time. This might be because the company is running into financial issues and its broader business model is declining. For instance, during COVID, many companies suspended their dividend program to preserve cash.

On the other hand, there are also companies that have consistently paid dividends for more than 50 consecutive years. In fact, ‘Dividend Kings’ have increased their annual dividend payments for five decades or more, so these are the stocks that should be considered when building a portfolio.

Some of the most recognized Dividend Kings include Emerson Electric, American States Water, Procter & Gamble, Cincinnati Financial Sysco, Hormel Foods, and Coca-Cola. Ultimately, dividend companies offer a great way to diversify against broader stock market conditions, as investors will continue to receive quarterly income regardless of the share price.

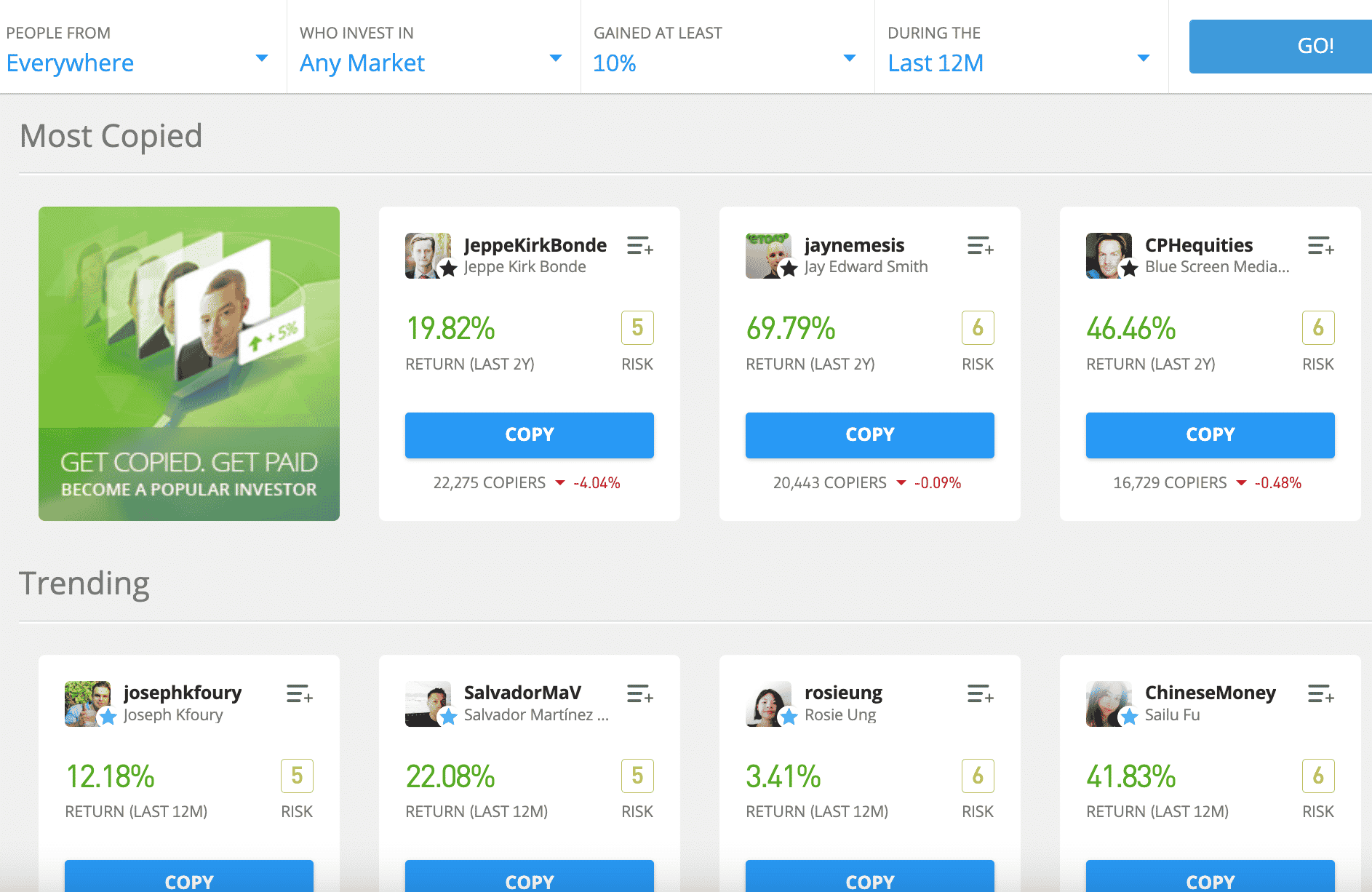

8. Copy Trading – Automatically Mirror the Investments of a Successful Trader

The next option to consider when searching for the best way to invest £75k in the UK is Copy Trading. In its most basic form, this feature enables UK investors to passively ‘copy’ the investments of a successful trader. Although several other platforms exist in this space, eToro dominates the Copy Trading arena.

eToro offers direct access to thousands of traders that can be mirrored at the click of a button. The minimum investment is $200 (about £180) per trader that the investor wishes to copy. eToro displays an abundance of useful data that helps clear the mist when it comes to choosing a trader.

For example, how much money the investor has made each month since joining eToro, the level of risk they typically take, and how actively they enter and exit positions. Copy Trading is perhaps the best way to invest £75k in the UK to actively trade assets but in a passive way.

An example of Copy Trading is as follows; Let’s say that an investment of £10,000 is made into an eToro trader. The trader decides to allocate 15% of their portfolio to Coca-Cola stock, and 20% to Bitcoin. The investor will, therefore, copy the positions at a proportionate amount. This means £1,500 (15% of £10,000) in Coca-Cola stock and £2,000 (20% of £10,000) in Bitcoin.

9. Crypto Staking – Receive Passive Income in Crypto Assets

Crypto staking is an interesting concept that enables investors to earn passive income on idle digital assets. There are two ways to access the crypto staking scene. First, the traditional option is to stake cryptocurrencies directly into the blockchain network. For example, staking ADA tokens on the Cardano blockchain.

The second option is to stake cryptocurrencies on a third-party platform like Crypto.com. This offers a higher rate of interest than blockchain networks can pay, as the funds are utilized for crypto loans. Investors will often get to choose their required lock-up term and this will determine the interest rate on offer.

For example, Crypto.com offers three options in this regard – flexible, 1-month, and 3-month terms. During a fixed term, investors cannot withdraw the funds until it concludes. This is somewhat similar to bonds. Flexible terms, however, offer the freedom to make a withdrawal at any time.

Interest is usually paid in the cryptocurrency that is being staked. For example, let’s suppose the investor stakes 10,000 ADA tokens on a flexible term. The staking tool pays 4% annually. This means that by staking ADA for one year, the investor will earn 400 tokens. A period of six months, however, would yield 200 ADA tokens – and so on.

10. NFTs – Buy NFTs While Prices are Low

NFTs are a popular branch of the wider cryptocurrency space. Unlike cryptocurrency tokens, each NFT is unique from the next. This offers a way to represent value and ownership on the blockchain network. During the previous bull market, NFT sales went through the roof – with billions of dollars worth of transactions taking place throughout 2021.

The best NFTs – such as those representing virtual real estate in the Sandbox and Decentraland metaverse worlds, sold for many millions of pounds. This was also the case with virtual art NFT collections like CryptoPunks and Bored Ape Yacht Club. However, as the broader cryptocurrency space remains in a bearish market, NFT prices have collapsed.

This means that those with an interest in the future of NFTs can now enter the market at a hugely attractive entry price. Of course, there are no guarantees that NFT valuations will ever go back to pre-2022 levels. However, if they do, the upside based on current prices may appeal to those with a higher appetite for risk.

To offer some insight into popular NFT collections, Lucky Block is well worth checking out. Its unique series of NFTs offers a ticket entry into one of its lucrative competitions – one of which offers the chance to win a $1 million (about £870k) UK property. After buying the Lucky Block NFT, the holder will also receive regular crypto rewards in LBLOCK tokens.

How to Choose the Best £75k Investments For You

Ascertaining the best way to invest £75k in the UK can be challenging – especially considering the current state of the economy. Nonetheless, the financial markets offer plenty of long and short-term investment opportunities throughout the year.

But, rather than attempting to time the market to perfection, it’s best to create a diversified portfolio that offers exposure to many different asset classes.

In this section, we discuss some of the key ways that investors can evaluate the best place to invest £75,000 in the UK.

Liquidity

One of the first metrics to consider when assessing how to invest £75k in the UK is the liquidity of the chosen asset. Liquidity is a term used to describe how easy or difficult it will be to sell the investment for cash at any given time.

For example, crypto assets and stocks are highly liquid, meaning that investors can cash out whenever they see fit. Bonds and conventional property investments, however, are far from liquid.

Ultimately, it is best to stick with liquid asset classes when evaluating the best way to invest £75,000 in the UK in 2022. After all, nobody quite knows what the state of the economy will be like in 2023, so it’s best to have access to capital when needed.

Risk and Returns

It goes without saying that some asset classes offer the opportunity to target much higher returns when compared to other markets. However, higher returns ultimately mean taking on additional levels of risk.

- For example, investing in crypto presales – such as Dash 2 Trade and IMPT potentially enables investors to target gains in excess of 500% or more in a short period of time.

- As noted earlier, Tamadoge generated gains of 1,000% after completing its presale and this was achieved in just a week of trading.

- However, crypto presales are high-risk investment opportunities, so investors should never risk more than they can realistically afford to lose.

On the other hand, investors that have virtually no tolerance for risk will need to accept that the investment gains on offer will be extremely limited. For example, although UK gilts are offering yields of 3-5% as of writing, this doesn’t cover the rate of inflation.

Volatility

Another angle to consider when choosing the best way to invest £75k in the UK is the volatility index of the asset. The most volatile markets typically offer the most attractive upside potential. But once again, also has the highest level of risk.

For example, cryptocurrencies, growth stocks, and NFTs are super-volatile. Prices can rise and fall by considerable amounts in a short period of time. This means that investors entering these markets need to be able to handle to emotions of volatility.

Those that prefer to avoid volatility entirely might need to consider a predictable asset class like UK government bonds. After buying newly issued gilts, the interest payment received every six months will always remain the same.

How to Invest £75k in the UK

At this stage of our guide, investors should now have a firm grasp of the best way to invest £75k in the UK.

To conclude, we will now provide a beginner-friendly guide on how to invest in the Dash 2 Trade presale campaign.

Step 1: Get MetaMask Wallet

When investing in digital token presales, investors will need to have access to a crypto wallet.

For this tutorial, we will explain the steps required when using MetaMask. This wallet is used by over 30 million people for its user-friendly, intuitive, and safe interface.

The MetaMask wallet can be downloaded free of charge via the following methods:

- Mobile app for iOS and Android

- Browser extension for Google Chrome, Firefox, Brave, and Microsoft Edge

Beginners typically opt for the browser extension as this permits access to crypto presales via a laptop or PC.

Open the MetaMask wallet after installing it and do the following:

- Choose a very strong password

- Write down the 12-word recovery password and keep this somewhere private and safe

Step 2: Buy Ethereum

So far, the MetaMask wallet has been downloaded, installed, and set up. The next step is to buy some crypto tokens – which will be used to invest in the Dash 2 Trade presale.

The Dash 2 Trade presale accepts both Ethereum and USDT. For the purpose of this tutorial, we will be using Ethereum.

Investors can buy Ethereum in the UK with a debit card from dozens of crypto exchanges.

Step 3: Transfer Ethereum to MetaMask

After buying Ethereum, transfer the tokens to MetaMask. Copy the MetaMask wallet address from the main interface (below ‘Account 1’).

Next, request a withdrawal from the crypto exchange and paste the MetaMask wallet address. Expect to see the Ethereum tokens arrive in MetaMask within 10 minutes (a notification will pop up).

Step 4: Connect Wallet to Dash 2 Trade

Now that the investor has Ethereum stored in the MetaMask wallet, the next step is to visit the Dash 2 Trade homepage.

Click on the ‘Connect Wallet’ button and chose MetaMask from the two options that are displayed.

Click on the notification that appears from MetaMask – which is asking to confirm the connection to Dash 2 Trade. Confirm the connection to proceed.

Step 5: Invest in Dash 2 Trade Presale

And finally – the MetaMask wallet is now connected to Dash 2 Trade – so the investor can now specify how many D2T tokens they wish to buy. As of writing, 1 D2T token amounts to $0.05.

Confirm the investment and come back to the Dash 2 Trade website after the presale has finished to claim the D2T tokens.

Conclusion

Those with £75,000 to invest in the financial markets should look to diversify the funds across multiple assets that align with the investor’s appetite for risk and target returns.

In this guide, we have discussed crypto, stocks, index funds, ISAs, real estate, and more.

One of the top investments to consider exploring further is the Dash 2 Trade presale. Investors in the UK can buy D2T tokens at the best price available before the project launches on crypto exchanges.