The Alibaba Holdings Group is a Chinese-based technology company that focuses on e-commerce and retail globally. Alibaba is also the third-largest publicly traded company in China, with a market cap of $247 billion.

In this guide, we discuss buying Alibaba stock in the simplest way possible. Our research includes an analysis of the stock’s historical performance and suggestions for the where to buy Alibaba stock in 2022.

Buying Alibaba Stock – An Overview

If you are looking to buy stocks, it’s wise to use a cost-effective and intuitive-to-use online brokerage.

- Open an account with a regulated broker – Head over to the broker’s website or mobile app and create an account. Provide your email address and create a username and password to complete this step.

- Verify Your Account – You will need to verify your account by providing a valid photo ID -i.e. a passport or driver’s license. Users also need to submit a proof of address document. For example – a bank statement or utility bill.

- Deposit – Once your account is verified, you will need to deposit fiat currency into your account. To continue, select any of the multiple payment methods that the broker provides

- Buy Ford Stock – Search for “Alibaba” using the navigation tools and enter your desired position size. Click “Open Trade” to confirm your purchase.

The steps above present a brief overview of buying Alibaba stock using a regulated broker. Continue reading our guide for a more detailed description of buying Alibaba stock.

Step 1: Choose a Stock Broker

Your first step is to pick a stock brokerage that can simplify the investment process. Most trading platforms offer low fees on trades and provide tools & features.

Considering these key factors, below are stockbrokers from where to buy Alibaba stock.

1. eToro

An online brokerage that provides commission-free trades and a

If you are looking for the cheapest ways to buy Alibaba stock – eToro’s brokerage provides commission-free trading to all users. The global broker charges a fixed spread fee, which works out to be cheaper for you.

The minimum deposit to start trading on eToro is only $10. While Alibaba’s stock is currently trading at $90, eToro offers fractional sharing options. Thus, you can hold a percentage of a share instead of purchasing 1 whole stock of Alibaba Group.

A social trading platform, eToro brings the community together with their “Copy Trading” tool. As the name suggests, investors can copy the trades of senior traders for no additional fees. Therefore, you can buy cheap stocks, diversify your limited funds and hold Alibaba stock with a minimum deposit.

Should you wish to diversify your investments, eToro allows users to invest in multiple asset classes – including buying cryptocurrencies, stocks, ETFs and indexes. Possessing a stock app, eToro is available on iOS, Android and via the web.

To maintain safety, eToro is regulated by bodies including the FIC, ASIC, CySEC, FINRA and FinCEN around the globe.

| Number of Stocks | 2,500 + |

| Deposit Fee | Free |

| Cost of buying Ford Stock | 0% commission (Small spread fee) |

| Minimum Trade Size | $10 |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull – Trading App to Purchase Alibaba Stock

The Webull online platform is another way for users to buy Alibaba stock. Launched

Through Webull, you can start purchasing stocks with as little as $5 per position without paying any commissions. After spending an annual margin rate of 6.99%, users can invest in any of the 3,000 + stocks available on the platform.

While there is no fee for deposits or withdrawals, Webull only supports bank transfers as a payment option. Despite this, the platform is rated well due to its simple-to-use user interface, which can be accessed via the Webull app or web account.

Notably, the mobile app also has extensive price alerts, and 2-Factor Authentication features to accommodate new users. You can also buy cryptocurrencies commission-free, which is ideal for users looking to trade in multiple asset classes.

Webull is regulated by the Securities & Exchange Commission (SEC) in the United States, FINRA and SFC.

| Number of Stocks | 3,000 + |

| Deposit Fee | No deposit fee |

| Cost of buying Ford Stock | 0% commission (Small spread fee) |

| Minimum Trade Size | $5 |

Your capital is at risk.

For further comparisons on the platforms mentioned above, read our eToro vs Webull analysis to find out more info on the two brokers.

Step 2: Research Alibaba Stock

Now that you know where to buy Alibaba stock, it is vital to research the Alibaba Group. Much like when you buy Amazon stock, it is important to analyse the company’s financials and business model to reach a conclusion on your investment decision.

We have completed a detailed study of Alibaba Group below to save you time and research. Read on to learn about some key financial data relating to Alibaba stock.

What is Alibaba

The Alibaba Group is a multinational technology company that runs an e-commerce

Owned by Jack Ma, Alibaba’s first & foremost business is Alibaba.com – an online marketplace that connects importers in over 190 countries with Chines exporters. The company began its expansion by purchasing taobao.com – China’s largest shopping website.

Alibaba also runs China’s most popular online payment system – alipay.com, which works similarly to PayPal. A Goliath in the internet technology sector, Alibaba also offers online marketing, cloud computing and logistics operations.

With a market capitalisation of $247 billion, Alibaba is currently the third most valuable company in China and the 35th most valuable globally.

Alibaba Stock Price – How Much is Alibaba Stock Worth

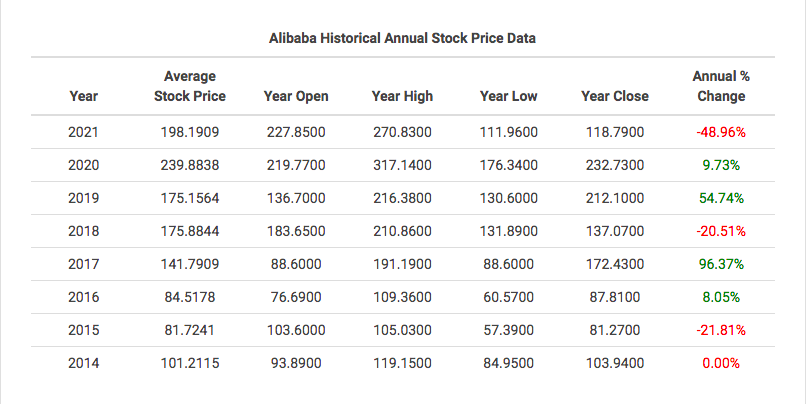

Launched in 1999, Alibaba decided to go public a full 15 years after its initial release. On the 14th of September, 2014, Alibaba’s IPO was listed at $68 a share.

On the first trading day, the company rewarded its investors with a 38% price increase, closing at $93. At this time, Alibaba was valued at $231 billion.

Despite the small sample size, Alibaba’s stock has been met with high levels of volatility in the last 8 years. In 2015, Alibaba closed with a 21% annual loss and a stock price of just $81. After that, the stock experienced a sensational rise from 2017 to 2020. Reaching an all-time high of $309 in October of 2020, Alibaba’s market cap rallied to $873 billion.

If you had invested $100 on the stock’s opening trading session in 2014, your assets would total $620 by October 2020. A profit of more than 620% in 6 years. However, the stock’s downward spiral proved to be just as fast as its sensational rally.

Alibaba shares plunged from $309 to just $128 by January 2021. After a price correction in Q2 following the pandemic, Q3 was just as impaired due to a slow profit margin of just 3% for Alibaba’s core business – Alibaba.com.

2022 has proved to be another challenging year for Alibaba Group. Falling to double-digits for the first time since 2016, the Alibaba stock price is currently trading below $90.

Currently, Alibaba stock’s P/E ratio has corrected to 23.98 compared to 42 in 2020. The EPS (earnings per share) has also reduced from $8.47 in Q4 of 2020 to $3.7.

Alibaba Stock Dividends

Alibaba Group does not offer any quarterly or annual dividends to users.

Is Alibaba Stock a Buy

Let’s analyse this by taking a detailed look into some of the main factors and talking points.

Recent Earnings

Alibaba’s recent earnings have been slightly sluggish for the e-commerce platform, being one of the key factors for declining the Alibaba stock price.

For the current fiscal year of 2022, Alibaba is expected to earn $7.42 per share. This is 25% below on a YoY basis. However, the company expects growth to pick up by 7% in 2023.

While company sales increased by 36% to $31.1 billion, this was short of the Zack Consensus estimate of $31.9 billion. Notably, Alibaba’s cloud computing business is up 33% in 2022, one of the key industries that the company is looking to focus on.

Trading Low

Currently, Alibaba is trading below $90 with a total market cap of $247 billion. The Alibaba stock price is down from a price of $209 on a YoY basis, which equates to a decrease of 58%. However, the price correction is due to external factors – including the rise of the Covid-19 pandemic, false delisting rumours, and uncertainty in the Chinese economy in early 2021.

Alibaba Group has rewarded users with massive returns in the previous 8 years. Historically, the Alibaba stock price has always rallied after significant price corrections. After losing 20% in 2018, Alibaba soared by 54% the following year. Similarly, a 21% price correction in 2015 was followed by a 97% price rally over 2 years.

While historical performance is not an indicator of future profits, Alibaba Group’s strong cloud computing numbers and market monopoly in the e-commerce sector can make it a strong long-term investment.

Fundamentals and Long-Term Earnings

Despite the turbulent start to 2022, the Alibaba Group has a five-year annualised earnings growth of 25%. Despite a decrease in the company’s active consumer growth segment, the current consumer numbers are at 882 million. Alibaba has al

Alibaba made further headlines by making $84.5 billion in the company’s annual singles day shopping event. The revenue was up from $74.5 billion in the previous year. This shows that Alibaba is still in growth mode despite the slowdown in its e-commerce business.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 3: Open an Account & Buy Stock

We have analysed the Alibaba stock based on historical performance, let’s take a look at investing in the stock. In the example below, we show you the process of investing in Alibaba Group with a reputable broker.

Step 1: Open an account with a regulated broker

Visit the broker’s website to create an investing account. To complete the sign-up process, users will be required to provide their email addresses and create a unique username and password.

Complete this process by entering your full name and phone number and clicking on “Start Investing”.

Step 2: Verify Your Identity

Regulated brokers require all users to complete a mandatory verification process before you can begin investing. You will need to provide two documents to complete this procedure.

- First, provide a valid photo ID. This can be either a passport or a valid driver’s license.

- Next, provide your address proof. For example – a Bank statement that shows your name, address and date. Any other utility bills will also be accepted.

- The broker will verify your identity in under 5 minutes and send you a verification confirmation via email.

Step 3: Deposit Funds

Before buying Alibaba stock, you need to deposit funds in your account.

Most platforms will provide multiple payment methods including credit/debit card options, bank transfers and e-wallets. PayPal, Neteller and Skrill.

Choose your preferred payment method and insert the deposit amount. Confirm this by clicking on “Deposit”.

Step 4: Search for Alibaba Stock

Once your funds have been deposited, you can proceed to search for “Alibaba” on the navigation bar.

After selecting the stock, click the “Trade” option to continue.

Step 5: Buy Alibaba Stock

Once you click on trade, select the amount of money you wish to put in Alibaba stock.

There are two options mentioned – “Buy” and “Sell”. The former is for trading on the value of the shares to go up, while the latter is to trade on the price of a stock to fall. You can also choose to leverage your trades on Alibaba by up to 1:5. This can result in a potential profit (or loss) of 5x.

After entering the amount, you want to deposit, click on “Set Order” to confirm the purchase.

Alibaba Stock Strengths and Weaknesses

Now that we have navigated the company’s historical performance, earnings reports and current price levels, we can make a decision on whether or not to buy Alibaba’s stock.

The Alibaba stock could be a good option for the long-term. Firstly, the Alibaba stock price has massively corrected since 2020. After reaching an ATH of $309, the stock sits below the $90 mark. The decrease of more than 70% could be alarming for investors, but the company’s earnings highlight some key positives for the future of Alibaba.

The e-commerce retailer’s cloud computing business segment is 33% higher on a YoY basis. Notably, while Alibaba’s active consumer numbers have only increased by 2%, the number equates to 882 million users in total. Due to the company’s monopolistic control over China’s e-commerce market, Alibaba’s slow growth is not a major concern.

Finally, Alibaba expects a revival in its earnings in 2023. Their earnings per share are expected to increase by 7% to $7.88 by next year. The current numbers have led many pricing analysts to predict a turnaround in Alibaba’s stock price as well. A group of 48 analysts from the CNN Business team estimate a price of $155, which is more than a 60% price increase from current levels.

Conclusion

This guide has discussed buying Alibaba stock in 2022. We have covered key factors affecting the stock’s growth including historical performance, earnings reports, Alibaba 12-month price forecasts and the current stock price.

If you are looking to hold Alibaba stock for the long term, you will receive a substantial price discount at current levels. You should purchase Alibaba stock from a quality brokerage that offers low trading fees, simple set-up procedures and multiple trading features.