Alphabet is the parent company of Google. This is a world-renowned multinational technology conglomerate that focuses on cloud computing, online advertising, AI, and, of course, search engines.

In this guide, we show you the process of buying Alphabet stock . You’ll also learn whether Alphabet represents a worthy investment based on its current and future stock price outlook.

Buying Alphabet Stock – An Overview

Learning about investing in stocks is one thing, but you need to be careful about which trading platform you choose. To have a pleasant experience when you buy Alphabet stock, choose a reputable broker with a simple platform and low fees.

Follow this overview to buy Google stock:

- ✅ Step 1: Open an Account

To get started, visit a regulated broker and fill out the registration form. This entails entering some information about who you are and completing the KYC process. The latter is the process of allowing the broker to validate your identity by uploading your photo ID and proof of residency. - 💳 Step 2: Deposit Funds

Most popular brokerages will support a plethora of credit/debit cards, e-wallets, and banking methods. - 🔎 Step 3: Search for Alphabet Stock

When you’re looking to buy Google stock, this will be listed as Alphabet. As such, type ’Alphabet’ into the search bar to locate it. By clicking ‘Trade’ you will see an order box appear. - 🛒 Step 4: Buy Alphabet Stock

Some broker’s allow you to buy Alphabet stock in fractional amounts. This is ideal for investors who don’t have spare funds to risk thousands of dollars on a single Alphabet stock.

Although the above guide is easy-to-follow, you may feel you need a more detailed guide of buying stocks.

If this is the case, you’ll find a complete tutorial on buying Alphabet stock later on.

Step 1: Choose a Stock Broker

Choosing a broker is a daunting task when you’re looking to buy Alphabet stock for the first time.

There is such a vast and varied selection of brokers in this space.

With this in mind, we’ve reviewed the popular trading platforms to invest in Google in the sections below.

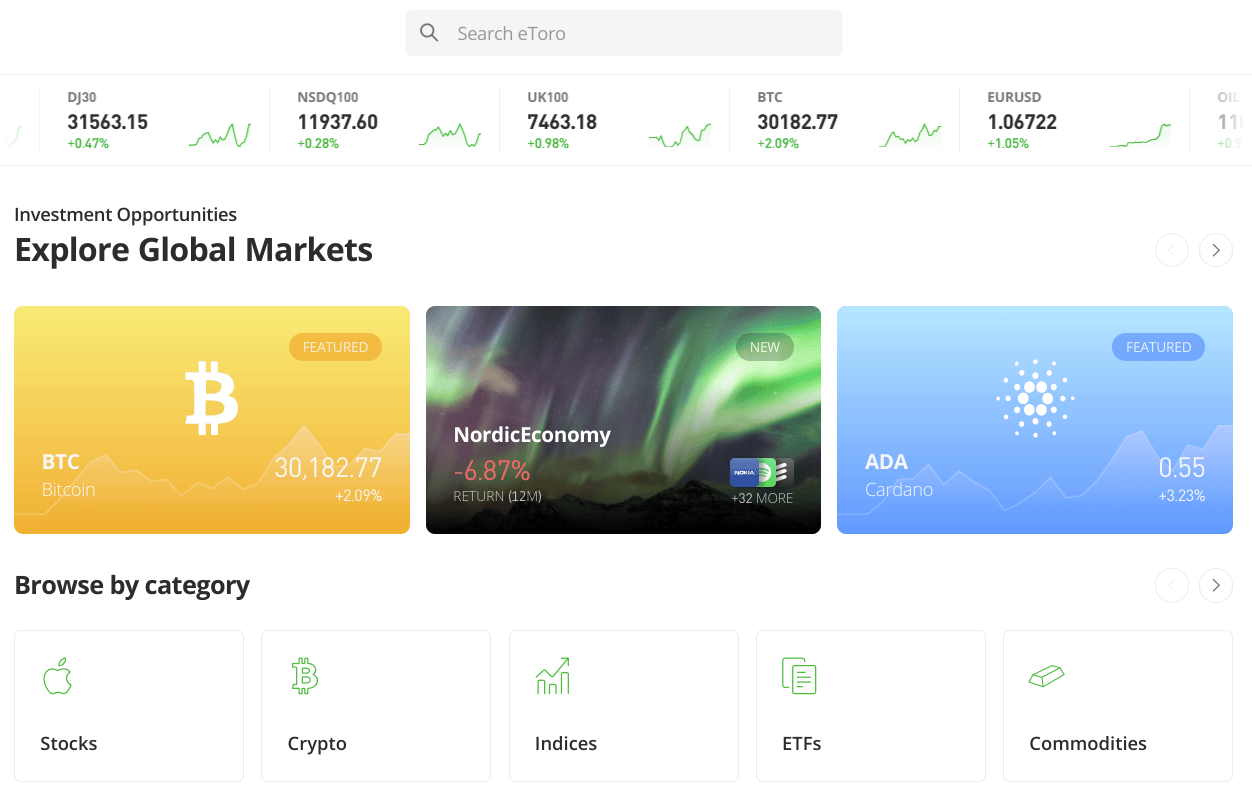

1. eToro

eToro offers an simple-to-navigate social trading platform for US-based investors looking to buy Alphabet stock. A social trading platform offers a way of networking with other investors. You can follow, like, and even copy other people. On this subject, eToro pioneered Copy Trading, and it’s really simple to use.

Find an investor, allocate $200 or more, and you’ll automatically copy their trades in real-time. This also means any gains or losses they experience from their stock positions will also be reflected in your portfolio, in proportion to your investment in Copy Trading.

eToro offers all of its 2,500+ stocks with 0% commission – including that of Alphabet. This allows you to invest in companies from all over the world whilst only paying a small spread. There are also hundreds of commission-free ETFs accessible in the US, as well as cryptocurrencies, which come with a small 1% trading fee.

You can find out about investing in cryptocurrencies here if you decide to diversify later. The eToro platform supports stakes as low as $10 on any asset, which allows you to partake in fractional investing. This means that although Alphabet stock trades for over $2,000 – you can gain exposure to this company with just a few dollars.

eToro is regulated by the SEC, and also adheres to guidelines imposed by various other financial bodies. As such, you can rely on a professional and fair experience. There are lots of payment types accepted at this online brokerage. You can finance your Alphabet stock purchase by selecting a banking method like wire transfer or ACH.

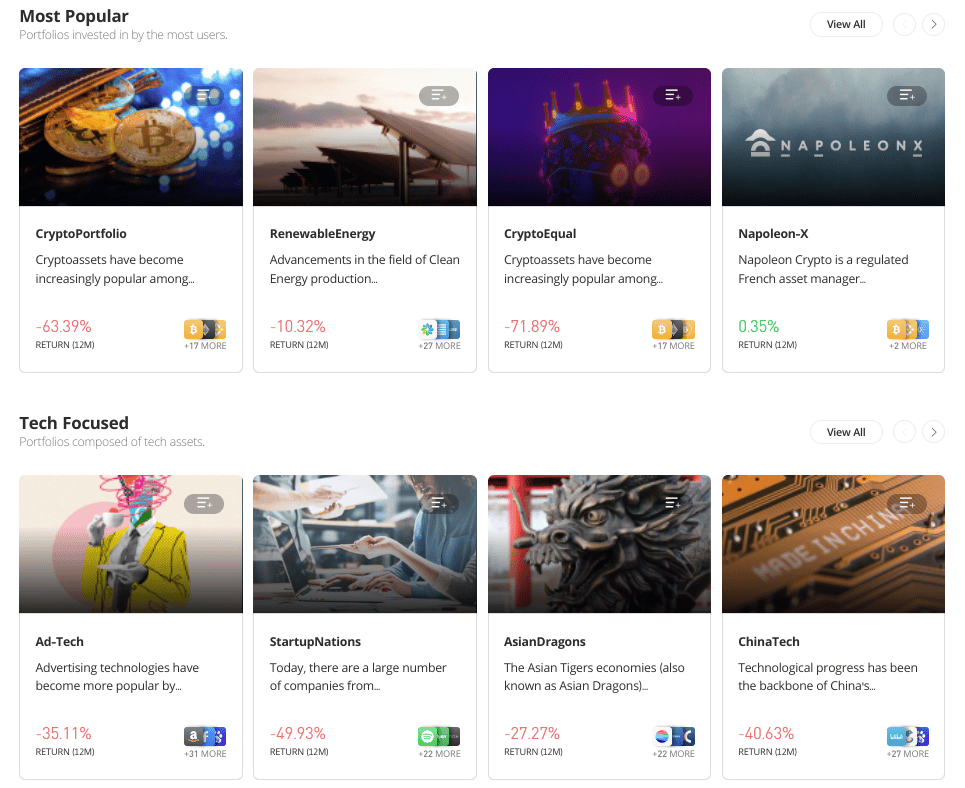

You could also pick a credit/debit card, or an e-wallet such as PayPal, Neteller, or Skrill. In any case, there is no deposit fee when you finance your account with US dollars and you can get started with just $10 in your account. You can also shorten the trading learning curve by investing in a Smart Portfolio.

Each Smart Portfolio comprises a range of stocks and you can pick one based on the sector or theme. As you are here to familiarise yourself with buying Alphabet stock, you might filter the results down to view only tech-focused portfolios. For instance, the ‘BigTech’ Smart Portfolio features large-cap tech stocks such as Alphabet, Amazon, Microsoft, and Apple.

Furthermore, at eToro, you can add any assets you are interested in to your watchlist. This allows you to track them all in one place, within your account, and with very little effort. You will also be able to view price charts, which can be customized. This enables you to change the theme, view different timeframes, and even choose the color you feel more comfortable looking at.

You can study the charts in different styles and formations such as candlestick, line, mountain, or bar. Every trader will be given a standard ‘Real’ account, as well as a handy ‘Virtual’ account. The latter is comparable to a demo and comes with $100k in free paper funds to practice with. You can also buy Alphabet stock on the go by downloading the free cell phone app offered by eToro.

| Number of Stocks | 2,500+ |

| Deposit Fee | FREE |

| Fee to Buy Alphabet | Commission-Free |

| Minimum Deposit | $10 |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull

Moreover, you won’t be charged any commission when you buy Alphabet stock at Webull because it is US-listed. Although, if you decide to trade foreign stocks later they will be offered as ADRs, and you will need to check out what trading fees you will incur.

The platform is simple to use and comes with some trading tools. You cannot copy the trades of others here but can customize your workstation. You will also have access to fundamental company information and a stock screener. Webull also offers aggregate ratings, watchlists, price charts, and technical indicators.

If you decide this is the place to buy Alphabet stock, you can download the Webull app to trade on the go. This platform also offers a free paper trading account that enables you to try out various strategies and hone in on your skills. Payment methods are limited at Webull and some come with a charge.

Unlike eToro, Webull charges $8 on every bank wire deposit and $25 per withdrawal. You can, however, make a deposit via ACH for free.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Alphabet Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research Alphabet Stock

Prior to investing your hard-earned capital, it’s vital to conduct thorough research. As such, part of learning about buying Alphabet stock is researching the ins and outs of the company and also its performance on the exchange it’s trading on, same as investors would do if they buy Snap stock.

Below, we talk about everything from the Alphabet stock price performance, P/E ratio, market capitalization, and more.

What is Alphabet

Alphabet is the parent company of Google, which was created in 1998. Google is the world’s largest search engine.

Google stock was renamed Alphabet in 2015 to reflect its expanding areas of interest. As a result, Alphabet is the parent company of several Google subsidiaries.

- Alphabet owns Google Chrome, Maps, Drive, Play, Pixel, and Fiber

- The company has acquired hundreds of companies over the years

- Alphabet also owns Android, YouTube, DoubleClick, Nest, Adsense, and many more

- Google Workspace and Google Cloud Platform are two of Alphabet’s cloud products that have been gaining traction in this burgeoning market

- Google’s increasing expenditures on infrastructure, analytics, data management, security, artificial intelligence (AI), and are all key pluses

- Alphabet also offers fleet management services to businesses. This segment of the company offers services like fuel, accident, and tire management

- Fleet services also include maintenance and repair, roadside assistance, tax management, safety/eco-driving training, and much more

As you can see, Alphabet’s business model is far-reaching and includes everything from cloud computing, search, and web browsing to fleet management services.

The company makes billions of dollars in revenue from advertising, such as that brought in from Google Search and YouTube.

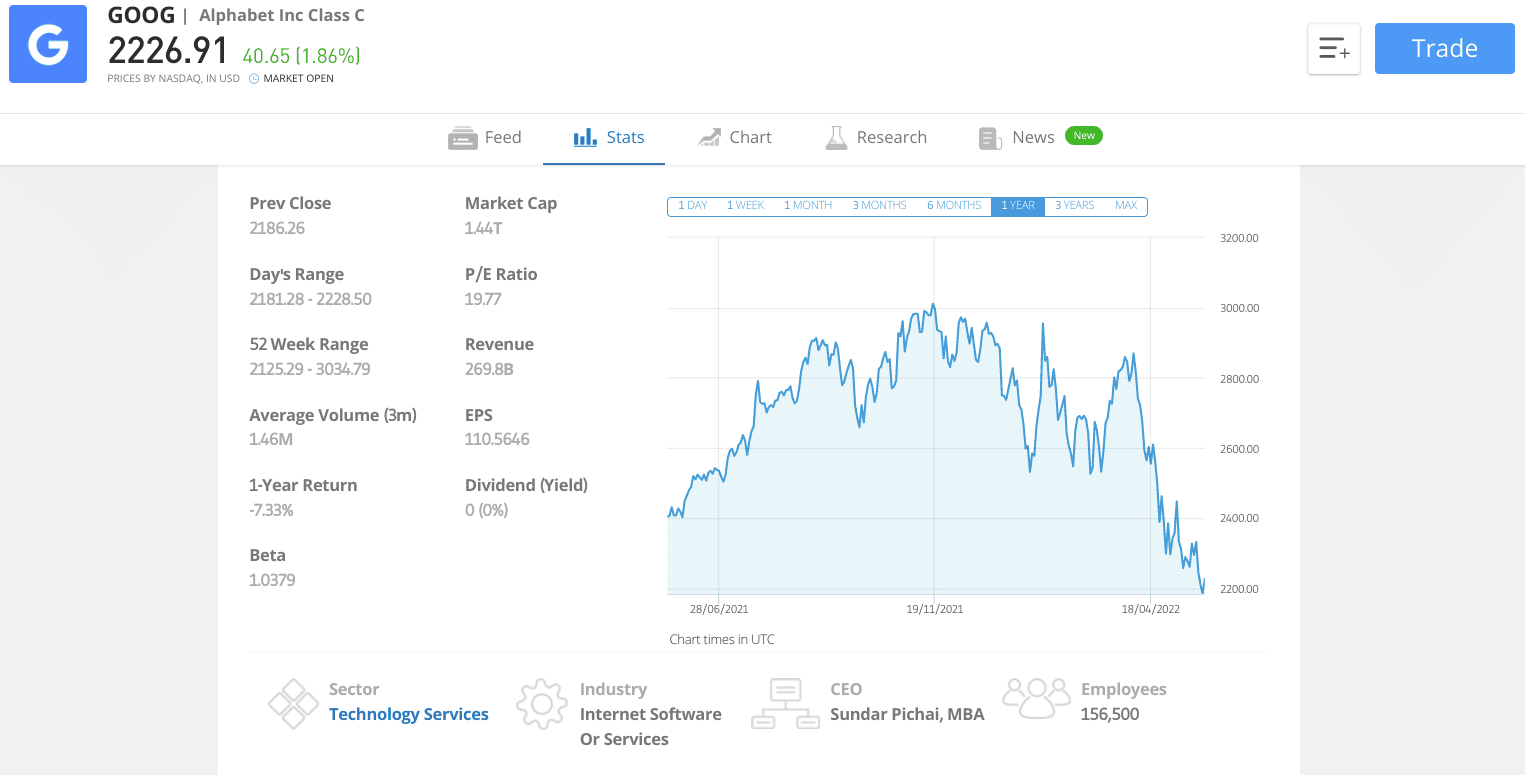

Alphabet Stock Price – How Much is Alphabet Stock Worth

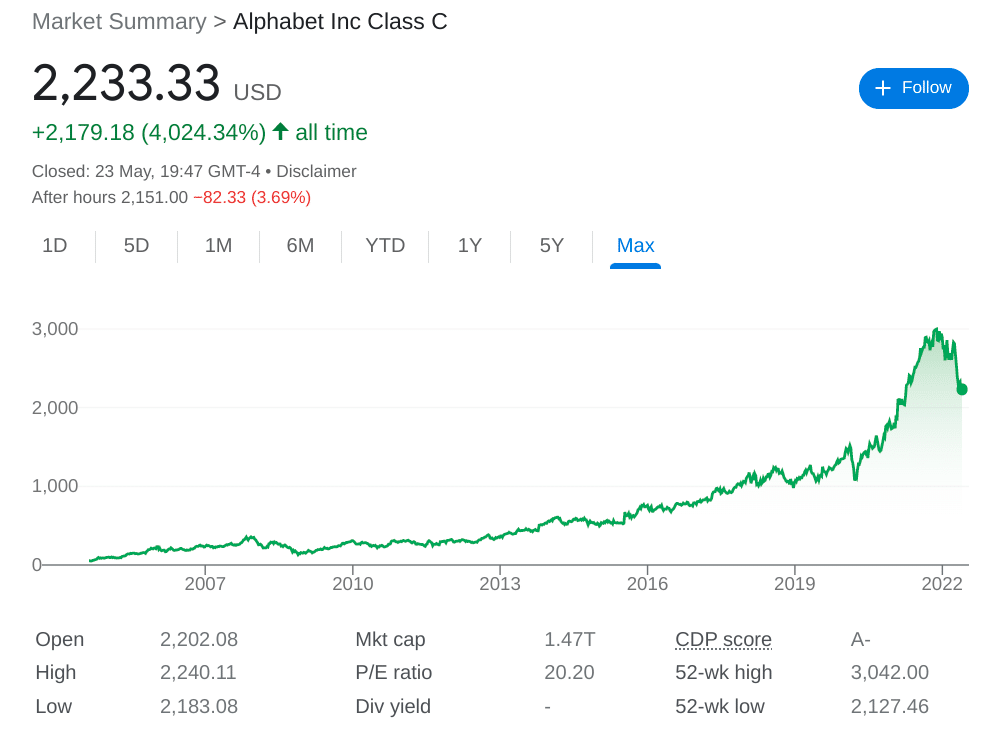

Google, then Alphabet, became publically listed in August 2004 at $85 per share. The company wasn’t well-known at that time, and the internet was still in its infancy. Since then, Alphabet has become one of the most prominent technology companies in the world. Over five years of trading, Alphabet’s stock price has increased by almost 115%.

In the same time frame, the S&P 500 index managed just over 64%. 2021 was an interesting year for big tech companies like Alphabet. At the start of the year, there were antitrust suits being actioned by the US justice department surrounding advertising and search monopolies. Additionally, there was a reported change in Apple’s operating system privacy policies.

Apple’s new update, which was still in the early stages, meant apps would need to gain the permission of users to store and collect data. As most of Google’s revenue comes from advertising, new internet regulations were initially a concern for investors. That said, in November 2021, Alphabet reached an all-time high of around $3,000.

In early 2022, and despite reasonable returns in 2021, Alphabet’s stock fell alongside the broader tech sector. Multiple software firms saw analyst downgrades, which had a knock-on effect on the Alphabet stock price. As such, by the end of January 2022, it had fallen to nearly $2,535. Alphabet stock steadily increased again, rising to around $2,960 at the start of February 2022.

However, later in the month, Alphabet stock was again around $2,551, which indicates a decline of about 14% in a matter of weeks. This also came as investors shielded away from high-growth equities due to increasing interest rates, inflation, and other headwinds, such as the Russia-Ukraine conflict.

At the time of writing, Alphabet has lost over 25% of its value since its all-time high in 2021. The company still has plenty of room to grow, and the company’s quarterly financials in March 2022 illustrated an increase in revenue of nearly 23%.

EPS and P/E Ratio

When you buy Alphabet stock, you will be able to look at the financial health of the company each quarter when a new earnings report is released.

Here’s what we found out from Alphabet’s last four quarterly earnings calls:

- Q2 2021 EPS expected was $19.10, and $27.32 was reported. This was a surprise of 42.70%

- Q3 2021 EPS expected was $23.24, and $27.99 was reported. This was a surprise of 20.44%

- Q4 2021 EPS expected was $27.28, and $30.69 was reported. This was a surprise of 12.52%

- Q1 2022 EPS expected was $25.54, and $24.62 was reported. This was a surprise of -3.61%

In terms of revenue and P/E

- As reported in March 2022, revenue was up 22.95% year-on-year

- Operating income was up 22.25%

- The P/E ratio at the time of writing is 20.20

You can use this information as a means to compare Alphabets performance in previous quarters, or years, or indeed against another company in the same sector.

Market Capitalization

Alphabet is a large-cap stock. At the time of writing, Alphabet has a market capitalization of nearly $1.5 trillion. This makes it one of the largest companies in the world by market cap, alongside the likes of Apple, Microsoft, and Saudi Aramco.

Index Funds

This company is a ‘FAANG’, which refers to the most well-performing tech stocks in the US. In a nutshell, this is an acronym for Facebook (Meta), Amazon, Apple, Netflix, and Google (Alphabet).

These stocks make up a large portion of the S&P 500 index.

Some of the funds that hold Alphabet stock include:

- SPDR S&P 500 ETF Trust

- Communication Services Select Sector SPDR Fund

- Vanguard Communication Services ETF

- Invesco QQQ Trust

- iShares Core S&P 500 ETF

- Vanguard Total Stock Market ETF

At the time of writing, there are over 250 ETFs that hold Alphabet stock. As such, you could opt to learn to invest in Alphabet stock via a fund, which in turn will simultaneously add a diverse selection of other companies to your portfolio.

Read More: You can learning to trade ETFs here.

Alphabet Stock Dividends

Alphabet is not a dividend-paying company and has stated on more than one occasion that it has no intention of doing so for the foreseeable future. This might be disheartening for those looking to buy Alphabet stock for a steady cash flow.

However, the reason the company states for choosing not to offer cash or stock payment to investors is that future earnings are retained to grow the business. The idea is that in turn, this should increase the value of the company, which is beneficial for investors.

If you are keen on receiving dividends, we’ve covered some of the popular dividend stocks to add to your portfolio.

Factors Affecting Alphabet Stock

Prior to deciding whether to buy Google stock, make sure you check out the many variables that will influence the value of your investment.

Alphabet is one of the most successful tech stocks in the world. Moreover, it is constantly growing, continues to innovate, and makes smart tech-based acquisitions to expand its business.

See some of the reasons you might decide to buy Alphabet stock below:

Alphabet has Made Hundreds of Smart Acquisitions Over the Years

As we mentioned earlier, Google was founded in 1998, although it did not go public until 2004. At the time of writing, the company has made over 230 acquisitions in a little more than two decades.

As such, the corporation is much more than an online search engine. Alphabet has entered industries such as advertising, hardware, and many more as a result of its purchases.

As such, when you buy Alphabet stock, you’re not investing in a one-trick pony.

Some of the company’s most important acquisitions are listed below:

- Online video platform YouTube

- Mobile advertising firm AdMob

- Online advertising corporation DoubleClick

- Consumer electronics company and wearable activity tracker Fitbit

- GPS navigation software firm Waze

- Software and travel company, ITA Software

- Telecommunications specialist Motorola Mobility

- Home automation firm Nest

- Telecommunications specialist HTC

- Data analytics company Looker

As you can see, these are all strategic acquisitions by Alphabet, and this is only a select handful. The company tends to focus on technology firms that can grow its business in all directions.

Moreover, in March 2022, Alphabet announced its pending acquisition of cybersecurity firm Mandiant. The acquisition is estimated to be worth around $5.4 billion.

The purchase will enhance the security of Google Cloud and also allow it to offer more services.

Alphabet Is a Technological Innovator

In 2022, Alphabet launched a multi-search feature on Google. It’s a new approach for individuals to locate what they’re looking for by combining visuals and text. For example, people can take a snapshot of a shirt design and then search for one with the same pattern.

The business also announced new search capabilities to assist users to identify and make appointments with healthcare providers that accept their insurance. Moreover, with ad automation, AI-powered search advertisements let Google’s clients respond rapidly to the market circumstances that matter most to them.

YouTube has witnessed considerable growth over recent years. With over two billion monthly signed-in users, and has become a primary destination for learning, instructional videos, and entertainment.

Many people have returned to face-to-face activities following the easing of Covid-19 lockdowns. However, the time spent on YouTube increased. Alphabet is forward-thinking.

For instance, YouTube’s transition from desktop to mobile presented an enormous opportunity and was well-received. One of the company’s other opportunities which it hoped will grow the company is YouTube Shorts.

YouTube Shorts has more than 30 billion daily views at the time of writing, which is four times more than a year earlier. Alphabet also launched additional video editing tools in the first quarter of 2022, and it is continuing to invest in making Shorts an even better experience for artists and viewers alike.

Has Plenty of Room to Grow in the Long-Term

Another potential way Alphabet is looking to grow revenue and increase its users is to hit people’s living rooms. Every day, nearly 700 million hours of YouTube material are watched on television.

As such:

- Alphabet plans to provide new smartphone control navigation and engagement tools for YouTube’s linked TV users. This will allow them to comment on and share content they’re viewing on TV straight from their smartphones

- Alphabet will continue to invest in innovative form factors, seamless multi-device experiences, and user privacy

- The company will also continue to provide developers with the tools they need to flourish on mobile applications in the coming years

- Google Play pricing has changed to assist all developers to flourish in the marketplace. 99% of developers qualify for a service charge of 15% or less at the time of writing. This had an immediate impact on the firm’s earnings

- However, Alphabet believes it is a long-term strategy for supporting the ecosystem and becoming the most developer-focused app store and gaming platform accessible

- To attract more business, Alphabet is also looking into other billing solutions

- Moreover, Alphabet released the Data Safety area on Google Play in early 2022

- Here, users can learn more about how apps gather, distribute, and safeguard their data

Furthermore, in terms of hardware, the Pixel 6 cell phone is a major step forward for the line. It’s the fastest-selling Pixel ever, and the firm is making significant headway in raising customer knowledge of the brand.

Google Cloud Revenue is Growing

Google Cloud revenue increased around 44% year over year in the first quarter of 2022, with sustained strong success across its platform and workspace.

In cybersecurity, the company has introduced new offerings such as assured workloads to address digital sovereignty in the European Union.

Additional products include virtual machine threat detection, a first-to-market, and agentless malware detection capabilities. Not to mention an advanced intrusion detection system for crypto-mining.

Alphabet Invests Heavily in the US

Google has spent billions of dollars on offices and data centers in 26 states over the last five years. This has resulted in the creation of over 40,000 full-time employment positions.

- In addition, in its Q1 2022 earning transcript, the company claims to have invested more than $40 billion on research and development in the US, between 2020 and 2021 alone

- In 2022, Alphabet plans to invest $9.5 billion in its US offices and data centers to support its flexible work plans, generating roughly 12,000 Google jobs

- The investments and employment will take place across the country in offices and data centers. This covers both the establishment of new offices and data centers as well as the upgrading of existing ones

- With a pledge to create 20,000 units in the Bay Area, the business is also supporting affordable housing programs

Outside of the US, Alphabet has announced additional office locations in Warsaw and London, as well as a new product development center in Nairobi.

When you buy Alphabet stock, you’re investing in a company that is not afraid to invest heavily in research and development.

Google’s Stock Split and Potential Dow Jones Listing

When it comes to growing its business model, Alphabet has another advantage. As well as being one of the popular tech stocks, the majority of the world’s population uses Google’s services on a daily basis.

However, because of Alphabet’s stock price, this well-known company has been out of reach for many investors during the previous decade. That said, Google’s proposal for a 20-for-1 stock split in July 2022 may be able to solve this problem.

Furthermore, the split may increase the chances of Alphabet stock being added to the Dow Jones Industrial Average, potentially bringing in a lot more interest and capital.

Step 3: Open an Account & Buy Stock

When you’ve decided where to buy Alphabet stock, you can place an order to add the firm to your portfolio. As made clear in our earlier broker reviews, we concluded a regulated broker was the right place to buy Alphabet stock.

Step 1: Open a Broker Account

Visit the broker’s website and create a free account. You can get the ball rolling by clicking ‘Join’ and completing the registration form you are presented with.

This will require you to enter your email address, as well as a username and password.

Next, tell the broker your full name, address, nationality, date of birth, and social security number.

After entering any other basic information required to create an account from which to buy Alphabet stock, you will need to finish the KYC process.

Step 2: Upload ID

Completing the KYC process takes no time at all at. You can upload a copy of your state ID, a driver’s license, or a passport to prove your name and date of birth.

Next, the broker will be able to validate your residency from a recent utility bill, bank statement, or one of the many other supporting documents.

Step 3: Deposit Funds

As we mentioned earlier, in the US, you can get started and buy Alphabet stock with as little as a few dollars if your broker supports fractional investing.

Click ‘Deposit’ and enter an amount. Next, choose your preferred payment method from the list. This will include ACH, wire transfer, debit/credit card, and also e-wallets such as Skrill, Neteller, and PayPal.

Step 4: Search for Alphabet Stock

To locate Alphabet stock you can utilize the simple search function. Type either Alphabet or Google into the bar.

GOOG represents Class C stock, and GOOGL is Class A. The latter gives investors voting rights and is therefore usually chosen by long-term traders.

Click ‘Trade’ and the broker will present you with an order form to fill in, so you can buy Alphabet stock.

Step 5: Buy Alphabet Stock

You can buy Alphabet stock by entering a number in the box labeled ‘Amount’ and executing your order. The stock will be sent to your portfolio.

Alphabet Stock Strengths

Opinions differ but Alphabet is generally considered a long-term buy. Alphabet is one of the biggest tech conglomerates in the world and continues to grow.

See a brief recap below to help you decide whether or not you should buy Alphabet stock:

- Over five years Alphabet stock has increased by around 115%

- A 20-for-1 stock split is taking place in July 2022

- Based on the price at the time of writing, this implies a value of around $112

- Market commentators think this makes Alphabet the ideal candidate for the Dow Jones Industrial Average

- Alphabet owns companies like YouTube, Android, AdClick, Fitbit, Motorola Mobility, Mandiant, Nest, and more

- The company’s Google Cloud business is growing and revenue was up 44% year on year in Q1 2022

- Pixel 6 was the fastest-selling cell phone of the line so far with over 1.2 million units shipped out in Q1 2022

- Alphabet is investing billions of dollars in the US, building and upgrading offices and data centers

It’s important to research any potential investment yourself prior to allocating funds to it.

Conclusion

Today we’ve explained the process of buying Alphabet stock in detail – which included a thorough guide of signing up with a brokerage and completing your purchase.

We also looked at some of the reasons people choose to invest in this huge tech company. For a fair and transparent experience when you buy Alphabet stock, you should only place an order at a regulated and reputable trading platform.