Leading online retailer and tech giant Amazon is one of the most popular companies and has a market cap in excess of $1.2 trillion at the time of writing.

In this guide, we explain how to buy Amazon stock in 2023.

We also reveal where to buy Amazon stock by reviewing the popular brokerage sites to execute your trading order and talk about the potential benefits and pitfalls of investing in Amazon.

How to Buy Amazon Stock

To buy Amazon stock with a heavily-regulated broker and with 0% commission, follow the simple guide below.

Top online broker eToro allows you to invest in Amazon stock in fractional amounts of $10 or more.

- ✅Step 1 – Open a Trading Account: Users can head over to the website of their preferred broker and begin the registration process. Enter your personal details and create a username and password.

- 🛂Step 2 – Upload ID: Get your newly created account verified instantly by uploading a copy of your ID. Choose from a passport, state ID, or driver’s license.

- 💳Step 3 – Deposit Funds: Users can deposit funds by choosing a payment method which may include e-wallets, credit/debit cards, and ACH.

- 🔎Step 4 – Buy Amazon Stock: Users can search for the Amazon stock on the search bar of the platform and begin the open order process. Enter the amount you wish to invest and confirm the transaction.

Step 1: Decide Where to Buy Amazon Stock

Publicly-traded stocks vary in price by some distance, and Amazon’s shares are valued around $121 at the time of writing. As such, when you’re deciding on where to buy Amazon stocks, you might elect to do so at a brokerage that supports fractional trading.

This allows you to allocate smaller amounts to gain exposure to the company. To help you decide where to buy stocks, we’ve reviewed some popular brokers for US-based traders:

1. eToro

Furthermore, you can allocate just $10 when buying Amazon stock as eToro supports fractional stock investing. Signing up for an account to buy Amazon stock takes a matter of minutes, as you can have your account confirmed pretty much right away. You can also access several top exchanges, manage your portfolio and invest in stocks via the eToro stock app.

Moreover, US clients do not need to pay a deposit fee and have plenty of supported payment types to choose from. This includes credit and debit cards, bank wire transfers, and also e-wallets such as PayPal, Skrill, and Neteller. The minimum deposit is just $10. If you decide to trade more than just stocks, you can also buy and sell over 250 ETFs with 0% commission via this brokerage.

At eToro, you can mirror the positions of top-performing stock investors by allocating some funds to the ‘Copy Trader’ feature. This is a simple case of investing $200 or more to a pro-investor. Any buy or sell order fulfilled by the seasoned investor will also appear in your portfolio. This is a passive way to build a diverse portfolio of top-performing stocks.

Similarly, you can check out the ‘Smart Portfolio’ section on the main eToro dashboard. Put simply, eToro has put together a selection of fully allocated and weighted portfolios, allowing you to invest in a balanced and carefully chosen basket of stocks via one order. There are various smart portfolios that are composed of tech assets. The minimum investment in these portfolios is $500.

| Number of Stocks | 3,000+ |

| Deposit Fee | FREE |

| Fee to Buy Amazon | Commission-Free |

| Minimum Deposit | $10 |

Your capital is at risk.

2. Webull

You can allocate just $5 when partaking in fractional trading at Webull. Like at eToro, there are thousands of stocks listed here. With that said, you won’t find many internationally-listed stocks at this brokerage, apart from a selection of ADRs. For a more detailed comparison of eToro vs Webull read our complete review here.

Do be aware that ADRs sometimes invite depositary service or custody, fees, and at Webull this usually ranges from $0.01 to $0.03 per share. Accepted payment types include ACH and bank wire transfers. and Webull does not stipulate a minimum deposit. Bank wire transfers attract a fee of $8 on each transaction when making a deposit and $25 per withdrawal.

There aren’t any copy trading features at this brokerage. However, we found a few tools, such as a variety of order types, screeners, news and data, and adaptable charts with various timeframes. Additionally, US clients can buy cryptocurrency by allocating just $1. There is also the option to invest in Amazon stock via an IRA.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Amazon Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research Amazon Stock

Part of the process of investing in this company is deciding where to buy Amazon stock. However, it’s crucial you research Amazon in full before allocating any funds.

As such, this step will cover everything from what the company does and how its stock has performed in the past.

What is Amazon?

Amazon is now one of the world’s most recognized and valuable brands of its kind. This vast enterprise sells everything from housewares, electronics, and furniture, to toys, books, and stationary.

The company also offers cloud services – which include renting out computer resources, and data storage on a large scale.

- Amazon Web Services (AWS) was created in 2002 and first provided data on website popularity, internet traffic patterns, and other information for marketers and developers.

- The Elastic Compute Cloud (EC2), which leases out computer processing capacity in tiny or large amounts, was added to AWS’s offering in 2006.

- Amazon’s Simple Storage Service (S3), which leases out data storage online, was launched the same year.

As of October 2022, around 200 million individuals have signed up for Amazon Prime throughout the world. By 2026, Amazon Prime Video is predicted to have over 240 million members globally.

Younger demographics appear to be the most regular users of Amazon’s video offerings as more people than ever look to streaming services for entertainment.

Amazon Stock Price – How Much is Amazon Stock Worth?

Amazon now has since surpassed a market capitalization of over $1.2 trillion. Amazon became a publically listed company on the NASDAQ in 1997, with an initial IPO price of $18. This would be the equivalent of $1.50 per share, taking the company’s three stock splits into account.

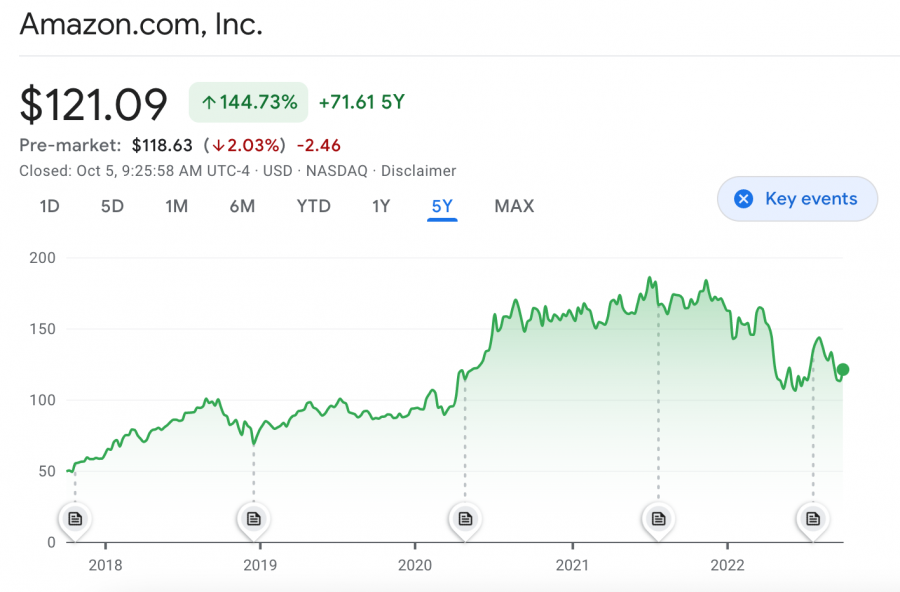

If you had allocated $1,000 to Amazon when stocks first hit the NASDAQ, your investment would be worth over $2.2 million at the time of writing. Over the last five years of trading, Amazon stocks have increased in value by over 144%, whereas the NASDAQ Composite has only risen by 69% in the same period.

Amazon’s share price has taken a tumble in 2022, as negative macroeconomic factors have hampered growth. The Fed’s decision to raise interest rates has made equities much ‘riskier’ in general, leading to a broad sell-off of Amazon shares. However, Amazon still dominates the e-commerce space – even if it isn’t as dominant as it was in 2021.

Amazon Market Capitalization

At the time of writing, Amazon is the fifth-largest company in the world as measured by market cap, behind the likes of Microsoft, Saudi Aramco, Google and Apple. At this time, Amazon carries a market capitalization of over $1.2 trillion.

Amazon Index Funds

Amazon is a member of multiple indices. This includes the NASDAQ Composite and NASDAQ 100, the S&P 100 and 500/Consumer Discretionary, and the Russel 1000 and 3000.

EPS and P/E Ratio

Amazon’s latest earnings report in Q2 2022 saw the company’s EPS come in negative at -$0.20. The reason given for this poor performance was supply chain constraints and rising interest rates, creating a challenging business environment.

In terms of its P/E ratio – which indicates what the market will pay as of writing, based on earnings in the past and present – this stands at 57.78 at the time of writing in September 2022.

The stock’s highest P/E ratio without NRI was around 3,732 times for the last 13 years, while 44 times was the lowest.

Amazon Stock Dividends

Since its founding, Amazon has never paid dividends to its investors.

Instead, gains are used by the company to develop and expand into other areas, in an attempt to boost revenues (and profits).

Amazon Stock Features

You can look at a range of different metrics and features when analyzing the Amazon stock. We have discussed a few below:

Network Effect

The network effect is a phenomenon that occurs when the estimated value of a service (or product) improves as more people use it.

As such, when researching how to invest in Amazon stock, you will probably see this term used to describe the company. The firm’s brand has grown tremendously powerful as a result of the network effect, amongst other things.

For instance:

- When customers flock to Amazon’s website, the platform becomes more appealing to businesses looking for new customers

- As more vendors join the Amazon marketplace and eventually provide a bigger quantity and diversity of products, a higher quantity of online shoppers will use the website

- In 2021, Amazon’s third-party merchants topped 6 million, with the business adding 2,000 new vendors every day

- Meanwhile, the number of Prime members is increasing at a rate of 30 million people each year, according to estimates

The network effect has allowed Amazon’s e-commerce operation to continue to grow at speed and is showing no sign of slowing down.

Amazon is consistently ranked among the world’s most valuable brands. For instance, Amazon came fourth place in Forbes’ most recent ranking of global companies.

Amazon Dominates Online Retailing

Amazon is one of the most popular shopping sites in the world.

Amazon is able to provide a variety of benefits to its customers, such as:

- Customers all over the world are attracted to Amazon’s lower-cost and widely varied choices. This should ensure Amazon’s dominance in the e-commerce market

- The company holds a market share in the US e-commerce business of over 45%.

- As of late 2021, Amazon Prime is offered in 22 countries. In the US alone, nearly 1 in every 3 people pay for an Amazon Prime membership

- Amazon ships an estimated 1.6 million packages each day. This equates to daily revenue of almost $610 million

- Retail subscription fees alone brought in $25.21 billion for Amazon last year

This positions the company well for future success, which should benefit stockholders looking to invest in Amazon stock for years to come.

Amazon is a Cloud Computing Pioneer

As you may have discovered when researching how to buy Amazon stock, the company is a pioneer in cloud computing.

This is a sector that is expected to develop at a compound annual growth rate of over 16% through 2026, according to some market commentators.

- Amazon Web Services (AWS) has risen to the top of the cloud market

- Specifically, as of the first quarter of 2022, AWS had a share of over 33% of the $180 billion market

- Microsoft Azure, Amazon’s closest competition, came in second with a market share of just over 20%

- Interestingly, Amazon’s cloud computing division now has far higher profit margins than its traditional e-commerce division

- The company’s net sales in 2021 were $469.8 billion, with AWS contributing over 13% of the total, or $62.2 billion

- AWS’ operational income of $18.5 billion, on the other hand, accounted for over 74% of the company’s overall operating income of $24.9 billion in the same year

Cloud computing solutions, such as analytics and data storage, provide significant benefits to organizations.

This includes greater flexibility, lower costs, and increased productivity. As such, the company’s bottom line should benefit as AWS grows to account for a bigger share of Amazon’s sales.

Step 3: Open an Account and Buy Amazon Stock

After analyzing the available brokers that allow you to buy Amazon, users can choose a suitable platform to begin trading with. The sections below discuss the steps involved in purchasing Amazon stocks.

Step 1: Open a Stock Broker Account

Users can head over to the chosen broker they wish to begin trading with and download the stock app. Traders are required to enter their personal details and create their account by confirming their username and password.

Step 2: Upload ID

The next step is to verify your identity by uploading a valid photo ID. Users can do so by sending a copy of your passport/driver’s license and proof of address.

Step 3: Deposit Funds

The next step for users is to deposit funds into the account. Choose one of the available payment methods and then deposit money into the trading account.

Some of the available payment methods may include credit/debit card options, bank transfers or e-wallets like PayPal.

Step 4: Buy Amazon Stock

The final step is to begin purchasing the stock. Search for Amazon by typing the company name or ticker symbol on the search bar and click “enter”. Users can now create a new buy order position. Enter the amount you wish to enter into the position and confirm the transaction.

Amazon Stock – Summary

Over the past five years of trading, Amazon stock beat the NASDAQ Composite by just over 75%. In the past year, however, Amazon’s stock has lagged the broader market.

- As well as beating the NASDAQ Composite, Amazon stock has climbed by over 142% over the last five years, compared to only around 47% for the S&P 500

- When you are researching the ins and outs of how to buy Amazon stock, you can look at the company’s recent difficulties, as well as focus on the firm’s long term strategy

Conclusion

Amazon is one of the biggest companies in the world, with a market cap in excess of $1.2 trillion. Users who are interested in purchasing this stock can do so by picking a suitable stock brokerage platform and creating an account.