AMC is a movie theatre company that narrowly avoided bankruptcy in 2021 after finding itself front and center of the meme stock craze. The company is now the biggest exhibitor globally, partly thanks to multiple acquisitions such as UCI and Odeon.

This guide will show you provide guidance on buying AMC stock.

We also explore where to buy AMC stock without paying any commission and whether or not the firm represents a viable investment for your portfolio.

Buy AMC Stock – An Overview

AMC was a well performing meme stocks in 2021 for growth. As such, if you want to know learn to invest in AMC stock – we’ve outlined a guide below.

The following guide details the process of buying AMC stock. it takes just five minutes to complete.

- ✅ Step 1: Open an Account with a Regulated Broker

Select a trusted broker from our guide and complete the sign-up form by entering information about who you are as well as a chosen username and password. You will also need to complete the KYC process by uploading a passport and bank statement. Many other forms of ID are supported so check the site if you are unsure of what qualifies. - 💳 Step 2: Deposit Funds

Most high-quality brokers will accept a range of payment methods. Typically, there is no deposit fee for US stock traders. Deposit types include credit/debit cards, ACH, e-wallets, and wire transfers. - 🔎 Step 3: Search for AMC Stock

To find AMC stock, type the company into the search bar that you see on the main dashboard. Next, select the asset and click ‘Trade’. - 🛒 Step 4: Buy AMC Stock

At this point, you can place an order to buy AMC stock. You can allocate $10 or more if the broker supports fractional share investing. Click on the ‘Open Trade’ button and you will find the stocks in your portfolio.

For any beginner reading, you will find a full and detailed step-by-step guide later on.

This includes useful screenshots to guide you through the process of buying AMC stock on a commission-free basis today.

Step 1: Choose a Stock Broker

You will also need to make a choice on where to buy AMC stock. This is a US-listed mid-cap company so there will be no shortage of platforms offering access to this stock.

The tricky part of choosing a platform can be finding a cost-economical and multifaceted broker you can trust with your investments.

To save you some time, we’ve researched and reviewed some excellent stock trading platforms to buy AMC stock.

In the following reviews, we cover everything from fees and supported deposit methods to core trading features and tools.

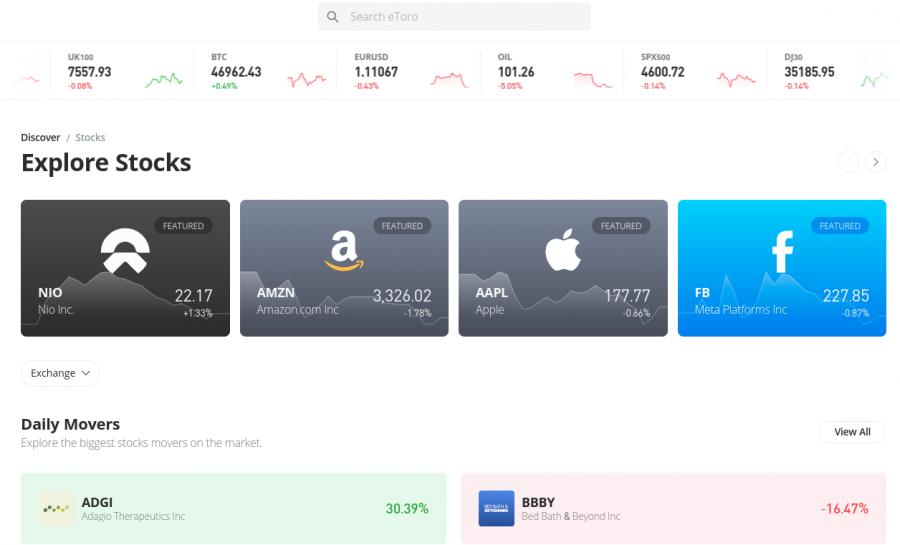

1. eToro

eToro looks after over 25 million investors and traders from around the world. The broker is approved to offer stocks to US traders and is also licensed by multiple regulatory bodies such as the FCA, ASIC, and CySEC. As such, eToro offers a transparent, fair, and above-board service.

As well as being able to buy AMC stock with 0% commission, there are over 2,500 other stocks available to trade and sell. This includes stocks from the US, UK, Australia, Canada, Asia, Europe, and numerous other markets.

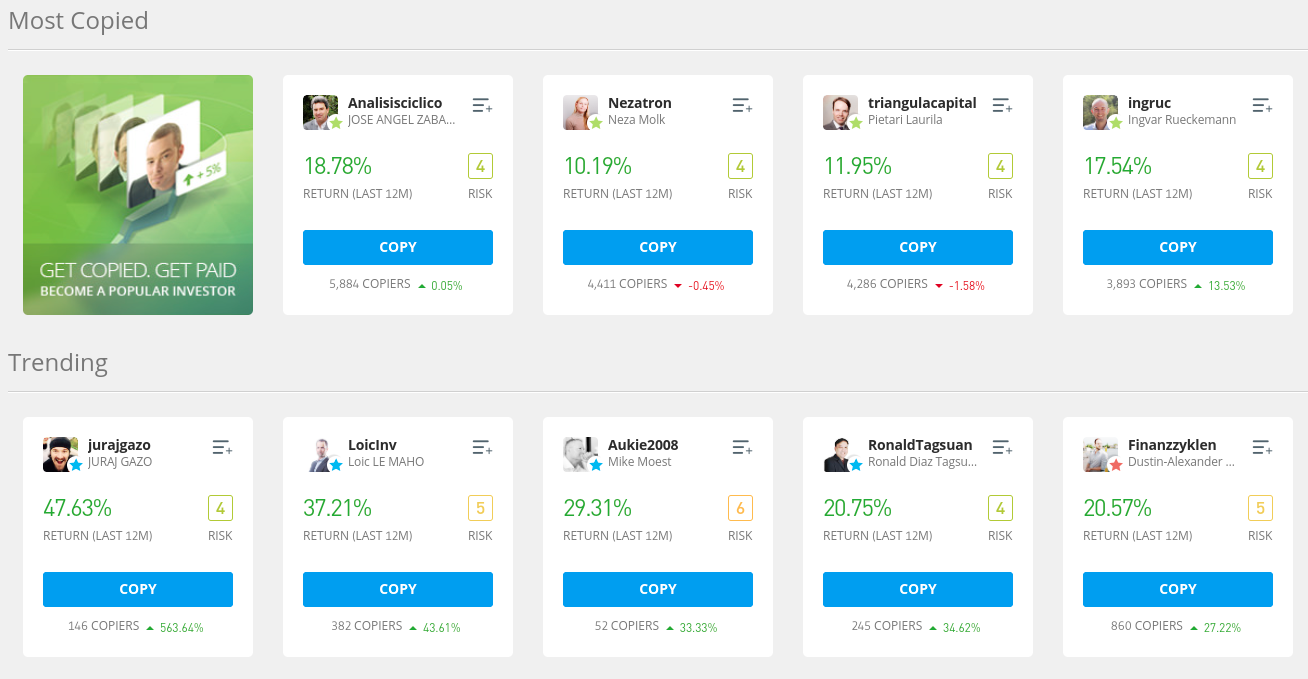

If you wish to invest in a stock that costs more per share than you would like to risk, this broker will let you buy a fraction from just $10 or more. Investors wanting to try a hands-off approach, can also opt to invest in the copy trading tool at eToro.

This entails allocating $200 or more to a real pro-investor who concentrates on stock trading. That is to say, you can filter the results by things like the market they choose to invest in, historical gains made, and location, and then click ‘Copy’ and allocate some funds to the investor of your choosing.

As an example, if they buy stocks in AMC and also Amazon, you’ll see the same stocks in your portfolio, in proportion to the amount you allocated to the individual. It’s as simple as that. You can stop copying the positions of the trader whenever you like. Another option is to invest in a smart portfolio. There are many available surrounding various different sectors and categories.

Instead of allocating funds to a person’s trades, you will instead invest in a full basket of stocks that have been chosen by eToro. Either way, there is no fee to pay on USD deposits and you can get started by funding your account with $10 or more. Payment types are inclusive of various credit/debit cards, a bank wire, ACH, and also Skrill and Neteller.

In terms of e-wallets, you can also choose to buy stocks with PayPal. When it comes to trading tools, you will find ProCharts at eToro. This is a tool that can be used to perform technical analysis on AMC stocks, and it allows you to compare charts from various timeframes.

You will also be able to partake in a social trading environment because you can access a live news feed, take part in discussions with other stock traders, and follow specific topics.

eToro also offers a free demo account loaded with paper funds. In addition to this, you can download the free cell phone app so you can buy AMC stock on the move and track the performance of your investment.

| Number of Stocks | 2,500+ |

| Deposit Fee | FREE |

| Fee to Buy AMC | Commission-Free |

| Minimum Deposit | $10 |

Your capital is at risk.

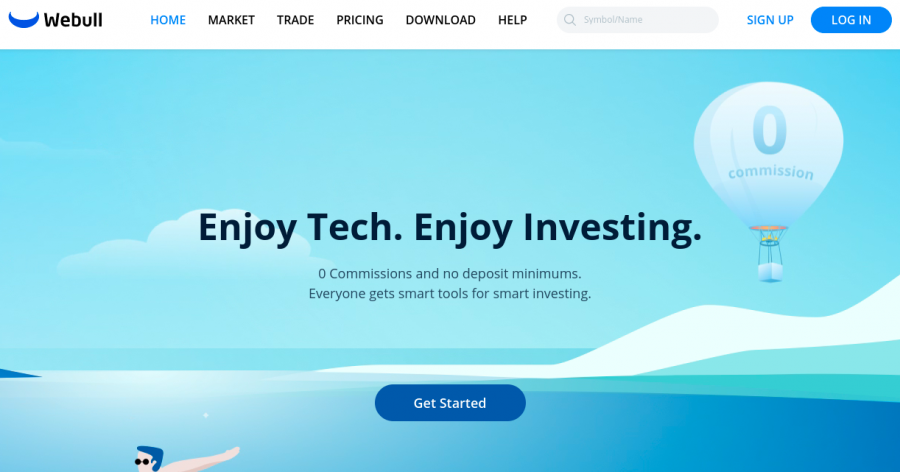

2. Webull

There are 5,000 other stocks listed here too – so Webull is solid for diversifying. Check what fees you will be liable for if you think you may wish to access internationally listed stocks though. This is because, unlike at the aforementioned eToro, Webull charges fees on non-US stocks via ADRs.

This US broker offers a safe trading space as it is registered with the SEC among other regulatory bodies. Whilst there isn’t an overly extensive set of tools, you will find a dozen or more charts, 50 technical indicators, and some educational content aimed at newbie investors.

The minimum stake is just $5 at Webull, which allows you to add a fraction of a share in AMC stock to your portfolio without risking too much. To begin trading stocks, you will need to fund your account with either ACH or a bank wire.

If you fund your Webull trading account with ACH, you will not be required to pay a fee. If however, you pick a bank wire, you will be charged a flat fee of $8 per transaction on deposits, and $25 on withdrawals. Webull offers an excellent stock app, allowing you to buy AMC stock on the go.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy AMC Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research AMC Stock

Prior to allocating any funds to an investment, much like when you might buy Amazon stock, it’s crucial you perform some research of your own.

This will invariably include things like, how AMC stock has performed since its IPO, price predictions, and potential advantages of opting to invest in the company.

What is AMC?

As you are already in the process of researching the process of investing in AMC stock, you will likely already know what this company does. Nonetheless, AMC is a US entertainment company that owns movie theatres all over the world.

- AMC was founded in 1920

- At the time of writing, the company operates over 10,000 screens

- AMC theatres are located in more than 950 establishments globally

- The company offers AMC ‘dine-in cinemas’ where moviegoers can order from a menu and the site has a fully operational kitchen

- AMC is an industry leader in premium theatre formats and services, such as IMAX screens, power recliners, and reserved luxury seating

- Along with its subsidiaries, such as Odeon, and Movietickets.com, it also offers food distribution, theatre exhibitions, online ticket booking, and other services

This US movie chain is one of the biggest of its kind. The company makes most of its revenue via ticket sales, food and beverage, and memberships.

AMC Stock Price – How Much is AMC Stock Worth?

As we touched on, AMC is over a hundred years old. The company was acquired by Wanda Group in 2012. In 2013, AMC stock became publically listed when it began trading on the NYSE at $18 per share. At which time it raised over $330 million.

- Moving forward, by April 2020, stocks had fallen to a little over $2 per share.

- At this time the company was in hot water financially.

- This was largely down to the global disruption caused by the COVID-19 pandemic.

- As a result, many entertainment stocks suffered because of global lockdowns and restrictions forcing the closure of theatres and other such venues.

At the start of the global pandemic, the company already had an estimated $5 billion in debt which was due to mass refurbishments following its Odeon take over.

In fact, things were so bad that AMC announced later in 2020 that it planned to try to raise just $47 million to swerve bankruptcy.

At this point, hedge funds took advantage of the chance to increase the leverage on their short bets in the company. By early 2021, AMC was trading at its all-time lowest value of $2. This is when everything changed for AMC and it became a popular meme stock.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

For anyone who missed it, retail investors from online groups like Reddit’s WallStreetBets took a strong interest in AMC stock. This was of a very similar nature to what happened to one of the more well-known meme stocks GameStop. As such, large numbers of independent retail investors bought AMC stock on mass.

In doing so, stocks went from around $2 at the start of January 2021, to over $13 by the end of the month, showing an increase of around 550%. AMC stock fell again and was trading at $10 per share at the start of May 2021.

- However, following another meme rally and the announcement of shareholder perks such as free popcorn, AMC stock experienced an all-time high of around $70 per share.

- This happened in mid-June 2021.

- Crucially, success in 2021 saved AMC from having to declare bankruptcy.

Over the last year of trading, AMC stock has increased by almost 58%. However, at the time of writing, AMC stock is 74% beneath its all-time high.

Many market commentators foresee AMC stock producing gains for investors, due to acquisitions, improving financials, and the company’s long-term expansion plan.

EPS and P/E Ratio

When you’re looking at the ins and outs of buying AMC stock, it’s crucial to explore the EPS and P/E ratios. Financial reports of listed companies are released on a quarterly basis, although not all at the same time.

Let’s take a look at the quarterly financials of AMC as of December 2021 – which is the most recent report released by the firm of writing:

- As of December 2021, AMC’s 12-month P/E ratio was at -6.12

- The average P/E ratio for fiscal years December 2017 to 2021 was 0.1

- AMC’s P/E ratio had a low of -10.7 in 2017 and a high of 21.5 in 2019

- Its EPS for the trailing 12 months ending December 2021 was -2.83

- In Q4 2021, EPS was expected to be -0.25 but was instead -0.11, which is a surprise of over 56%

- In 2020, the EPS was -39.15

Anyone can calculate the P/E ratio themselves by dividing the stock price by the EPS, however, this can be found by conducting a search online.

Some market analysts think AMC will report a positive EPS surprise and a year-over-year increase in earnings in its next quarterly results. You can check this out yourself once released.

Market Capitalization

As of writing, the market capitalization of AMC is at just under $8 billion. A year earlier, AMC had a market cap of around $4.5 billion. Of course, this valuation will fluctuate along with its share price, but as it stands, this is considered a mid-cap stock.

Index Funds

AMC is included in the Russell 2000 and 3000. As such, it is held by multiple ETFs, such as the iShares Russell 2000, Vanguard Mid Cap Index, and around 70 others. If you like the sound of diversifying, you can trade ETFs.

AMC Stock Dividends

AMC does not pay dividends.

However, if you decide to invest, you could also invest in other dividend stocks. This will allow you to diversify your exposure to AMC.

Increase in Liquidity Following Come Back

As we touched on, the so-called meme rally in 2021 helped AMC to get back on track financially. This undoubtedly makes it a better investment than it was in 2020.

In addition to this, theatres were allowed to open their doors once more in late 2021, which resulted in an increase in revenue for AMC.

- Revenue climbed by over 620% year-over-year as of the fourth quarter of 2021

- Drink and food sales increased by almost 90% of AMC’s pre-pandemic levels

- AMC’s achievement of positive profits before EBITDA and operating cash flow also went down well with investors

- In fact, in February 2021, the stock increased by almost 15% based on its preliminary results

AMC no longer has to worry about playing defense now that it has nearly $2 billion in liquidity and cash streaming. Instead, it can consider how to expand.

AMC’s Plan to Grow Value for Shareholders

Management was able to generate a little more than half a billion dollars in cash because of the firm’s stock acquisitions, which with the sale of stocks in the company allowed AMC to avoid bankruptcy.

AMC has pledged that the money raised from the aforementioned meme rally has been and will continue to be used for some major projects.

As we briefly talked about earlier, this entails investing in its main business, movie theaters, and infrastructure as well as debt reduction for the company.

AMC’s long-term growth plan includes the following targets:

- AMC has kick-started plans to upgrade all of its Dolby Cinema and IMAX premium screens

- To grow the company, AMC has begun diversifying by taking over leases from struggling cinema chains

- In addition to acquiring smaller exhibitor chains, the company is also launching AMC-branded popcorn which will be available outside of theatres – which will yield new revenue streams.

- In April 2022, the company announced that it has purchased multiple theaters in Connecticut, Maryland, Annapolis, and upstate New York

- This will give AMC 66 extra cinema screens, with the possibility of more from the same owners

- Furthermore, the company bought a large stake in Hycroft in 2022, a gold and silver mining company

- Following news of the investment, Hycroft stock rallied, and it briefly enjoyed being the most actively traded company in the US

AMC’s decision to expand its screen count and make acquisitions to grow the business means its well-positioned to generate free cash flow and maintain its place as the world’s biggest theatre chain.

Moreover, the aforementioned investment creates a transformational opportunity for AMC, as it is now an entertainment company with diverse holdings and a better chance at stability and growth.

AMC Could Still Benefit from the Meme-Stock Effect

Some market commentators thought interest in meme stocks would have died down by now.

However, this speculative tendency has continued, wreaking havoc on hedge funds that bet against AMC stock.

Furthermore:

- The CEO of the company has done well with its social media activities and has maintained an optimistic attitude toward AMC

- As a result of this, the CEO is now well-liked by retail investors who own stocks and will look to support AMC

- Moreover, AMC has stayed popular on Reddit’s trading threads as one of the main meme stocks

- At the time of writing, short interest in AMC is at approximately 20%

- As such, short interest levels are still deemed high, thus indicating the possibility of another squeeze

Even if there is another rally, which many analysts believe possible, there is no guarantee that AMC will breach the all-time high of $70 it reached in June 2021.

However, if you believe in the future of the company, you could buy AMC stock and hold on to it with the hope your investment appreciates.

Alternatively, see it as a short-term opportunity, where you might buy AMC stock at a low price and sell if it skyrockets again, following strong financials or a meme rally.

For instance, if you bought AMC stock in January 2021 at $2 each and sold them in June of the same year, you would have been looking at gains of around 3,400%.

AMC is Offering Perks to Shareholders

AMC shareholders can engage with the company via the Investors Connect platform. This is where you’ll find the latest updates, offers, and promotions.

Some of the perks offered to shareholders have included:

- Free large popcorn refills and discount Tuesdays

- AMC Stubs Insiders are awarded 20 points for each $1 spent and a $5 reward every time you hit 5,000 points

- ‘I Own AMC’ NFTs are dished out to shareholders

- The company has also teamed up with Orange Comet to mint thousands of themed NFTs

- This includes a collection of Walking Dead NFTs priced at $50 each, along with a further 750 unique animations which cost $250 per token

Around 580k shareholders signed up to the Investors Connect portal and were each given the aforementioned AMC NFTs for free. The adoption of NFTs is likely to make this company more popular with a wider variety of investors young and old.

Step 3: Open an Account & Buy Stock

Once you’ve researched AMC stock with respect to its price history and financials, you can think about which platform can fulfill your trading order.

Step 1: Open a Broker Account

To open a stock broker account head over to the main page and complete the sign up form.

Only basic details are required. For instance:

- Enter your desired username and password

- Add your email address so the broker can confirm your trading account registration

- Enter a cell phone number when prompted and wait for the code to land in your inbox

The broker will also ask you to enter the SMS code you receive to validate your cell phone number.

You will also be asked for some basic information such as your date of birth, residential address, and social security number.

Step 2: Upload ID

Regulated brokers must adhere to strict KYC requirements.

All this means for you as a stock investor is that you need to attach a copy of your passport, or another photo ID such as a valid driver’s license. This can also be a state ID as long as it has a valid date.

Next, the platform will need to confirm your address. To complete this final step, attach a copy of a bank statement, tax letter, utility bill, or one of many other documents accepted for the KYC process.

Step 3: Deposit Funds

Now you have a fully functioning account, you can fund it to buy AMC stock.

Most brokers support a wide range of payment methods, some of the most common are online banking, wire transfers, and e-wallets like Skrill, Neteller, and PayPal. You can also buy stocks with a credit card using some platforms.

Upon confirming your deposit amount and details, you will find that your account has been credited accordingly.

Step 4: Search for AMC Stock

Now that you have funds in your account, you need to search for AMC stock. When you see AMC in the list of markets, click ‘Trade’.

When you’ve selected your chosen market, you will be redirected to an order form to complete your purchase and add the stocks to your portfolio.

Step 5: Buy AMC Stock

Here, we are investing $30, which is more than AMC’s stock price at the time of writing, so we are buying almost two stocks.

With that said, to buy AMC stock, you only need fulfil the minimum order requirement, regardless of the cost per share.

As such, if you only risk $10 to buy AMC stock, you are adding a fraction of a share to your portfolio.

Click on ‘Open Trade’ to confirm your AMC investment.

Factors Affecting AMC

Despite AMC stock losing value since its meme rally, many market commentators have this company down as a strong buy. To recap some of the things we’ve talked about today, AMC put the money it gained from its meme rally of 2021 to use.

First of all, AMC chose to wipe out half a billion dollars worth of debt. Secondly, the company is investing in refurbishing its theatres to entice more moviegoers.

AMC has also made investments in alternative corporations, such as the gold and silver mining company Hycroft. This all bodes well for future growth.

- Revenue increased by 620% year-over-year in the fourth quarter of 2021 so things are looking up financially for AMC

- The smash-hit movie Spider-Man No Way Home grossed $1.9 billion at the box office in 2021 which helped ticket sales

- Another blockbuster success, The Batman, will be included in AMC’s first-quarter numbers. At the time of writing, The Batman has so far earned over $350 million in the US

- Furthermore, AMC has been making various acquisitions to grow its business Most notably, struggling companies the Odean Group, Starblex Cinemas, Carmike, and Nordic

- More recently, AMC has announced cinema-goers can now use cryptocurrencies to buy tickets at its US theatres

- This includes options such as Bitcoin, Ethereum, and Litecoin, but also Shiba Inu and Dogecoin

The latter was accepted following a social media poll held by AMC’s CEO. Two-thirds of people voted in favor of Dogecoin tokens being added to the list of accepted cryptocurrencies on the AMC app.

If there was any uncertainty surrounding the hundred-year-old cinema chain’s ability to stay relevant – this should offer further insight into its progressive plans to grow.

Moreover, as the world bounces back from the worst of the COVID-19 pandemic, there is no doubt that theatres will see an increase in revenue. This was already apparent in the company’s financial report released in December 2021 when revenue increased to $1.17 billion.

The company made over $46 million from operations in its fourth quarter alone. This is also when theatres in the US began to reopen following the third wave of closures and lockdowns.

Conclusion

In this guide on buying AMC stock, we’ve explained various aspects you might consider prior to investing, such as the firm’s price action and lack of dividends.

We’ve also talked about AMC’s comeback from the brink of bankruptcy and how it cleverly used its popularity as a meme stock to strengthen its finances.