Looking to buy AT&T stock? The world’s biggest telecom provider is one of the most popular dividend stocks. The firm has increased its dividend payment every single year since its IPO in 1984. But, in acquiring DirecTV and Time Warner in the mid-2010s, AT&T has saddled itself with debt now totalling $180bn.

Does the firm’s commitment to dividends outweigh the risk of its share price continuing to fall? Below we delve into AT&T financials to find out. We spell out the pros and cons of AT&T stock as an investment. Furthermore, we’ll also explore one of the most popular brokers to buy AT&T stock at zero commission by examining two popular and fully regulated trading platforms: eToro and Webull.

How to Buy AT&T Stock in 2023

- ✅Step 1: Open an account with a regulated broker – Investors can head to their preferred broker and get started by filling out a few personal details and setting a password.

- 🔑Step 2: Verification – Proof of ID and proof of address are all investors need to get verified with a FCA-regulated broker of their choice. Anti-fraud measures keep everybody safe.

- 💳 Step 3: Deposit – With verification confirmed, investors can deposit funds. Choose from credit/debit card, wire transfer and a range of e-wallets. No deposit charge.

- 🔎 Step 4: Search for AT&T Stock – Users need only enter the AT&T stock symbol into the search toolbar.

- 🛒 Step 5: Buy AT&T Stock – It’s common practice for experienced traders to conduct thorough market research before investing any capital in the stock market.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

Below we examin a few regulated brokers that allow traders to buy AT&T stock. Each trading platform offers:

- Zero commission for investors wanting to buy stock in AT&T.

- A wide range of stocks (including some popular new stocks) and other financial assets.

- Comprehensive regulation.

- Established market presence.

- User compensation coverage to protect against fraud.

- Fully regulated

- Reliable customer service.

1: eToro

eToro offers 3000+ stocks, with 900+ trading on 15 international exchanges. 250+ ETFs, commodities, indices, forex and crypto are on offer too.

Three features make eToro stand head and shoulders above the competition:

eToro: Zero Commission on Stock Trades

Rivals (like Webull featured below) offer zero commission too. But eToro matches this offer with low spread fees, particularly for tech stocks like AT&T. Investors can buy AT&T stock with eToro with a 0.25% spread fee. 186k users follow the AT&T stock price story on its dedicated eToro homepage. Here there is an up-to-the-minute newsfeed, stats, research and powerful charting tools.

eToro: Regulation

Using a regulated broker cannot prevent losses due to market conditions; but it does give peace of mind when it comes to the risk of fraud. eToro is regulated in the US by the mighty SEC, as well as registered with FinCEN and FINRA. Insurance coverage up to $500k per investor is provided by the SIPC. The broker is further regulated by ASIC in Australia, CySEC in Europe and by the FCA in the UK.

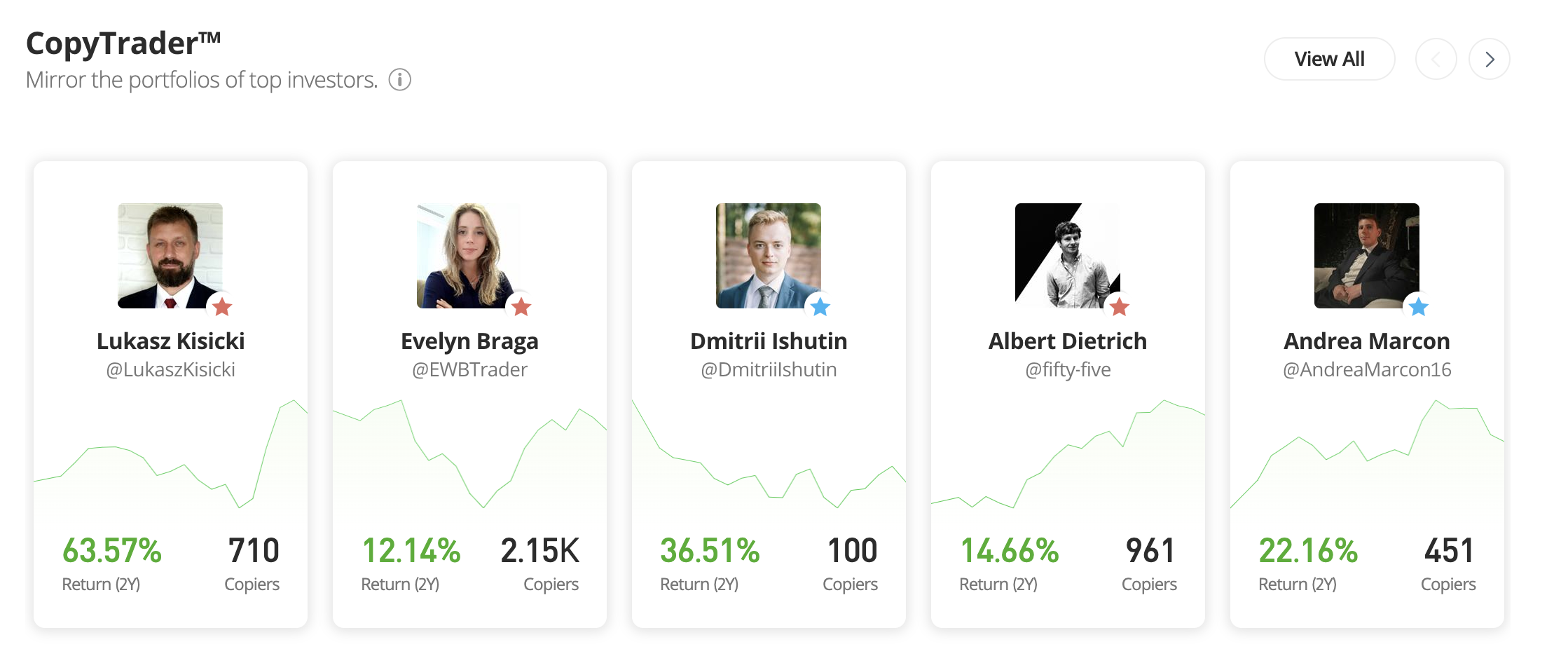

eToro: Social Trading

eToro is a pioneer in the field of social trading. With it, investors who want to buy stocks on eToro can directly benefit from the trading experience of others. eToro provides 65+ Smart Portfolios, which allow investors to buy into strategic positions set up by eToro experts. CopyTrader allows users to directly copy the trades of more experienced investors. There are 4,000 trading gurus to choose from. CopyTrader works in real-time, and is free.

| Number of Stocks: | 3000+ (international) |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying AT&T: | Spread fee of just 0.14% (at time of writing) |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2: Webull

Like eToro, Webull is a well-established broker with full regulation and zero commission on share transactions. Headquartered in New York, Webull is regulated by the SEC, FINRA, FinCEN and features the same SIPC compensation cover as eToro. What’s more, Webull offers extra compensation up to $150m via its clearing firm Apex Clearing Corp.

With Webull, investors looking to buy AT&T stock have 5,000+ shares in all to pick from (including new stocks). Webull also offers a line in ETFs, IRA accounts and, unlike eToro, offers options trading and a specialised margin account for more advanced traders.

Three perks that make Webull stand out are its support for:

- Extended hours trading (pre-market and after-hours).

- 24/7 customer service support.

- Level 2 Advance (Nasdaq TotalView) charting tools

The Webull stock app has attracted a review score average of 4.4/5 on Google Play as well as a stellar 4.7/5 score on the App Store.

In summary, Webull offers a similarly slick trading experience to eToro. The levels of regulation with both brokers is reassuringly high. Zero commission on stock trades makes them both competitive.

| Number of Stocks: | 5000+ |

|---|---|

| Pricing System: | Spread fee, no commission |

| Cost of Buying AT&T: | Spread fee: not available |

Your capital is at risk.

Step 2: Research AT&T Stock

Investors wanting to buy AT&T stock need to know what this company is as well as the strength of its financial position. Investors should always do their research before they invest in stocks.

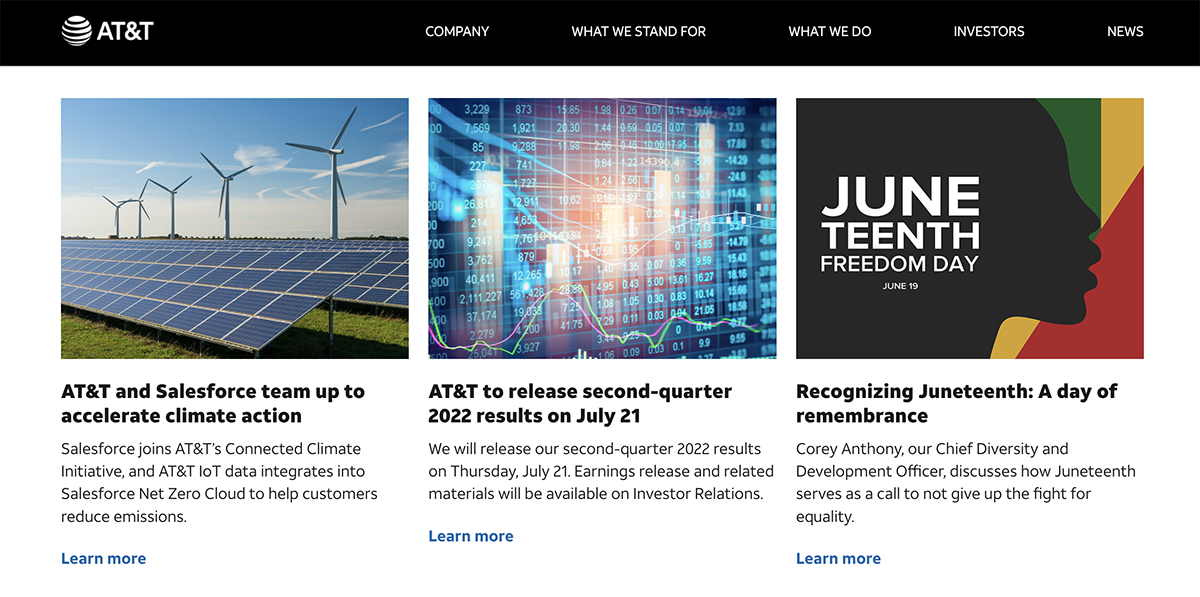

What is AT&T?

AT&T is a giant telecoms conglomerate. Headquartered in Dallas, Texas, this is the world’s biggest telecoms provider and America’s largest mobile phone provider.

AT&T’s history goes back to 1878 when it began as the American District Telegraph Company. Its history is intimately connected with the original Bell Telephone Company founded by telephone pioneer Alexander Graham Bell. AT&T had the lion’s share of the US telecoms sector for the whole of the twentieth century.

- AT&T currently reaches 255m US consumers with its 5G network.

- Named one of the leading fiber internet provider by CNET in March, 2022.

- Over 20m wireless subscribers in Mexico.

- Investors can buy AT&T stock on the NASDAQ exchange.

- The AT&T stock ticker is simply ‘T’.

AT&T Stock Price — How Much is AT&T Stock Worth?

The AT&T stock price today is $20.32.

From the AT&T stock chart below, some market analysts have suggested that:

- The price barely stopped rising over the course of 2019.

- AT&T took a big hit — like all other stocks — with the onset of the Pandemic in 2020.

- However, unlike many other stocks, its value did not recover dramatically.

- After a peak above $33 on May 17th 2021, fears over AT&T’s debt burden have caused the share value to fall.

- The AT&T share price peaked again for a 2022 high of $27.32 on January 19th.

- In the second week of April, 2022, 21% of the share price was wiped off over the course of a weekend. This happened with AT&T merging their WarnerMedia business with Discovery to create a new standalone company Warner Bros. Discovery Inc.

- Since then, the price appears to have found a resistance level with a double-bottom over May and June around $18.

AT&T Stock: Three Key Financial Metrics

Along with so many tech stocks, the AT&T price has been under pressure in 2022 over global inflation fears and the Ukraine crisis. Are its financials robust enough to weather the macro storm?

The AT&T homepage on eToro is a popular place for investors figuring out whether to buy AT&T stock. Alongside powerful charting tools and analyst research, eToro provides useful financial information.

From this overview, as well as other information provided by eToro, we can pick out three key metrics. These will give us a basic idea of the health of AT&T as a stock.

| Metric | Definition | Shows? |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

| Debt-to-Equity Ratio | Long-term debt divided by shareholder equity | How much debt the company is in as a proportion of shareholder equity |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

AT&T EPS (Earnings Per Share): 2.36

This means that, for each share, AT&T has been making a profit of $2.36.

AT&T P/E Ratio: 8.59

The P/E ratio shows how highly the market values a company’s shares. Thanks to its high levels of debt, AT&T attracts a fairly low P/E ratio.

AT&T Debt-to-Equity Ratio: 118.99%

AT&T is in debt to the tune of $180bn+.

It has a Quick Ratio of only 0.83. This means that, if it had to service all its debts at once using its assets and cash, it could only service 83% of the total debt.

This high debt burden is a red flag to investors. It explains why the stock has been in freefall since late May 2021.

AT&T Financials Summary:

In delivering its Q1 2022 financial results, the firm divides its business into four main groups:

- Mobility (consumer mobile phones)

Q1 revenues up 5.5% year-on-year (YOY). - Business Wireline (business internet provision)

Q1 revenues down 6.7% YOY. - Consumer Wireline (consumer internet provision)

Broadband revenues up 6.8% YOY. - WarnerMedia

Total HBO Max and HBO subscribers up 12.8m YOY globally.

AT&T has expanded into Mexico, where revenues were down in Q1 almost 50% thanks to the divestment of Vrio, which provides video services via Sky Brasil, DirecTV Go and DirecTV Latin America.

Excluding the impact of divestments, consolidated reviews for Q1 2022 were up 2.5% YOY.

- $118bn consolidated revenues over course of 2021.

- $135bn+ capital investment over the last 5 years.

AT&T Stock Dividends

AT&T is one of the more popular dividend stocks.

- The firm currently boasts a dividend yield of 5.9%.

- AT&T’s annual dividend payment has increased every year since its IPO in 1984. Maintaining this momentum appears to be an article of faith in the company culture.

- AT&T is currently ranked in the 20 companies for dividend yield (see table below).

- ‘Dividend yield’ shows what percentage of a company’s share price is paid out in dividends every year.

- The higher the dividend yield, the more generous the payouts.

Table: 20 Popular Dividend Stocks 2023

| COMPANY | SECTOR | DIVIDEND YIELD |

|---|---|---|

| Pioneer Natural Resources Co | Energy | 12.2% |

| Lumen Technologies Inc | Telecoms | 9.8% |

| Diamondback Energy Inc | Energy | 9.1% |

| Devon Energy Corp | Energy | 8.0% |

| Al Tria Group Inc | Food, Beverages and Tobacco | 7.9% |

| Vornado Realty Trust | Real Estate | 7.6% |

| Simon Property Group Inc | Real Estate | 7.2% |

| Gap Inc | Retail | 6.7% |

| Oneok Inc | Energy | 6.7% |

| Kinder Morgan Inc | Energy | 6.6% |

| Hanesbrands Inc | Consumer Durables | 6.2% |

| Western Union Co | Software and Services | 6.1% |

| AT&T Inc | Telecoms | 5.9% |

| Willians Cos Inc | Real Estate | 5.4% |

| Iron Mountain Inc | Real Estate | 5.4% |

| Leggett & Platt Inc | Consumer Durables | 5.3% |

| Prudential Financial Inc | Insurance | 5.3% |

| Verizon Communications Inc | Telecoms | 5.2% |

| Huntingdon Banc Shares Inc | Banking | 5.2% |

| Lyondellbasell Indu-Cl A | Materials | 5.2% |

Data compiled by Alphapicks.co.uk from Bloomberg, S&P 500, NASDAQ

Note that:

- Both the share price and the dividend which influence the dividend yield ratio of a company can change unexpectedly. But dividend yield remains a useful indicator of a company’s strength as a dividend stock.

- Investors commonly research how to buy AT&T dividend stock. ‘Dividend stock’ is the same as normal stock. One does not need to buy a special type of stock to access dividends.

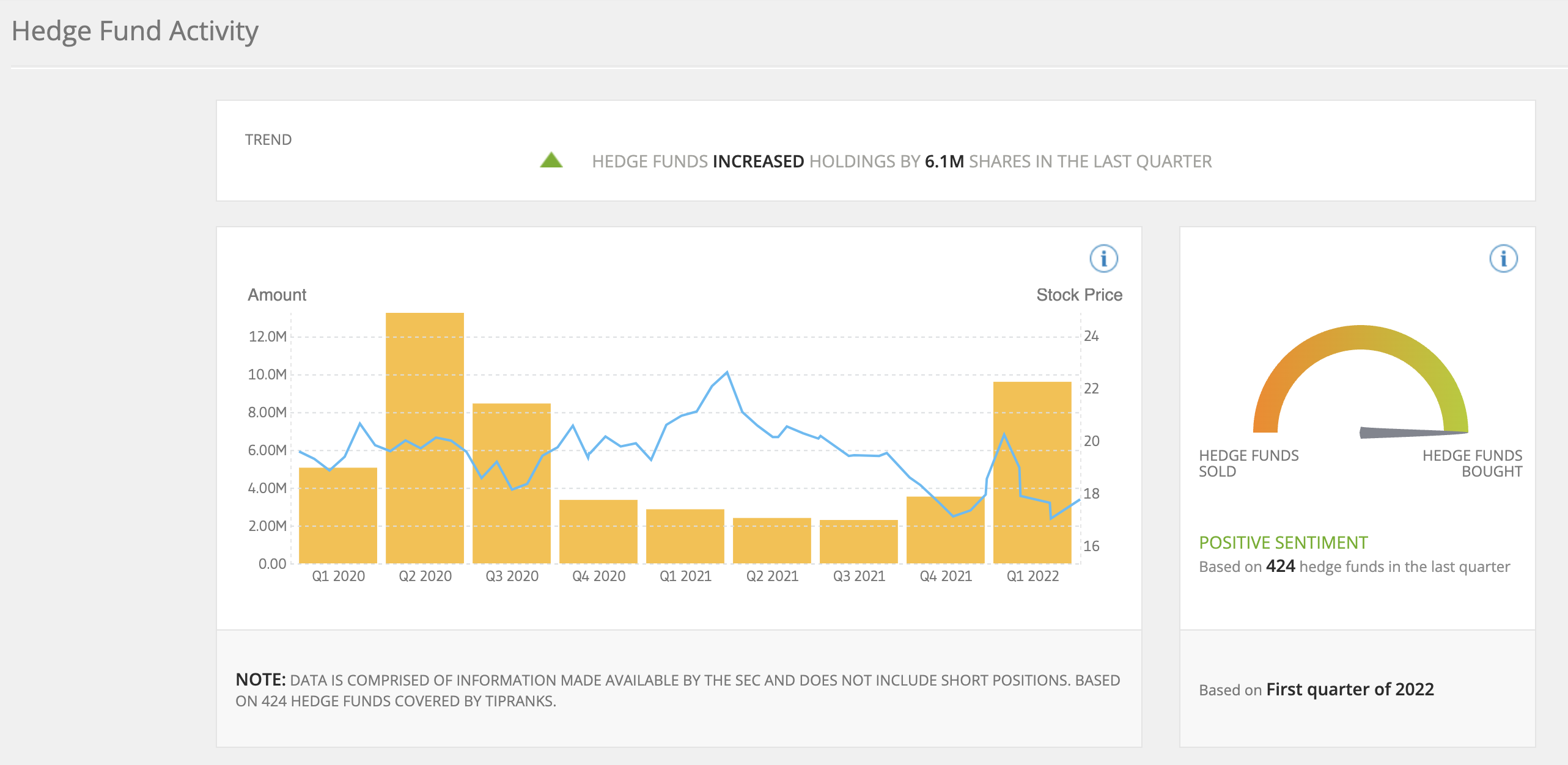

In the chart above:

- The blue line shows the AT&T stock price. This relates to the right-hand axis.

- The yellow blocks show net hedge fund transactions per quarter. This relates to the left-hand axis.

Q1 2022 has seen hedge funds increase their holdings in AT&T by 6.1m shares.

- Hedge fund manager T. E. Claugus of GMT Capital Corp has opened a new position worth $52.5m.

- Ray Dalio of Bridgewater Associates has topped up his holding to $48.4m.

- C. Davidson of Wexford Capital LP has topped up his holding to $23.57m.

AT&T stock is traded on the US NASDAQ exchange.

The NASDAQ Composite Index is officially in a bear market. It has fallen from 16,057 on November 19th 2021 to 11,232 today. That is a fall of 30%.

The NASDAQ is a tech-heavy exchange. And tech stocks have been hit particularly badly by fears over rising interest rates. Many tech companies are valued with high P/E ratios on the understanding that their revenues will increase over time. But interest rate hikes make this Discounted Cashflow calculation less rosy, because these companies’ debts will become more expensive to pay off.

Step 3: Open a Trading Account with a Regulated Broker

Investors wanting to buy AT&T stock will need to sign up with an online broker. Onboarding with a broker to invest in stocks tends to follow the same format:

- Sign up

- Verify ID

- Deposit Funds

- Search for AT&T Stock

- Buy AT&T Stock

AT&T Stock – Investor Sentiment

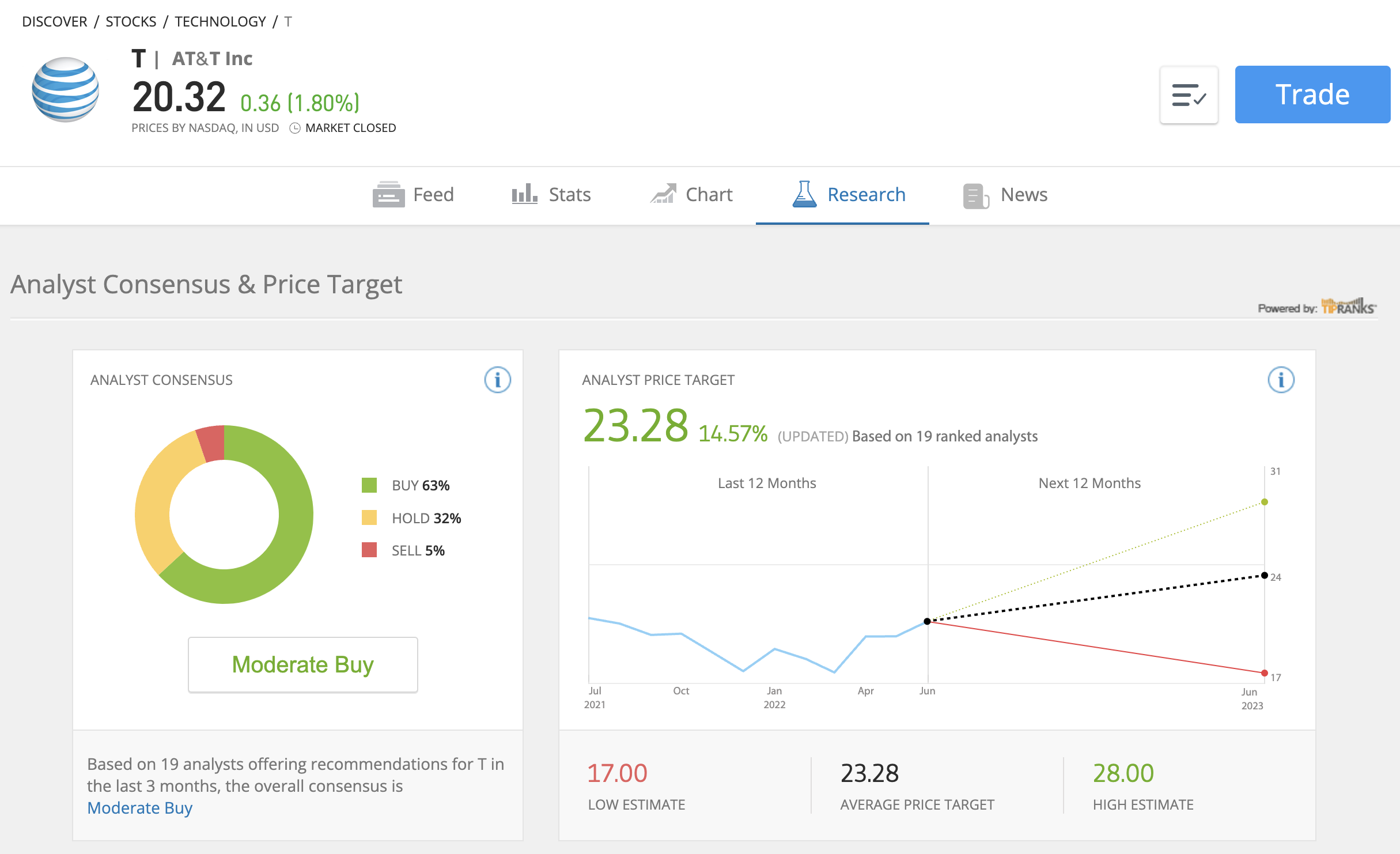

BUY: Analysts say ‘Moderate Buy’

Although we must take the views of professional analysts with a pinch of salt, the responsible investor should always get a feel for the experts’ AT&T stock forecast.

The AT&T stock price today is $20.32.

$23.28 is the average target price for AT&T in 12 months predicted by 19 analysts polled by eToro. That is almost 15% higher than its current level.

- 63% of analysts say ‘Buy’.

- 32% of analysts say ‘Hold.

- Just 5% of analysts say ‘Sell’.

SELL: AT&T in $180bn Debt

AT&T’s current debt burden of $180bn+ is legendary in the business.

Back in the mid-2010s, the firm borrowed from the bond markets to finance its acquisitions in DirecTV and Time Warner. In the biggest borrowing splurge of the company’s history, AT&T increased its debt to $160bn. This made it the most indebted company on the planet, with more liabilities than some sovereign states.

In 2018, C. Moffett, a partner at research firm MoffettNathanson said, ‘We have never seen anything of this scale before. If AT&T were a rapidly growing company, the debt would raise some eyebrows; but it isn’t growing – profit and revenues are shrinking. I don’t know why the market isn’t more concerned.’

What made AT&T’s leveraging expedition worse was that neither the DirecTV ($49bn) nor Time Warner ($85bn) acquisition turned out to be a money-spinner:

- AT&T spun off DirecTV in 2021.

- Time Warner was spun off in 2022.

Conclusion

We note that the AT&T stock price has been falling since Q1 2020 as a result of investor fears over its debt. We further observe, however, that the current bear market caused by inflation and interest rate hikes may be concealing the essential strength of this company; AT&T is a market leader, after all.

For investors figuring where to buy AT&T stock, we have focussed on two brokers: eToro vs. Webull.