Bitcoin’s appeal to investors has continued to grow globally. The foremost digital asset has proven to be a reliable investment vehicle for traders looking to hedge against inflation. With rising adoption in Southeast Asia, there’s a growing interest from investors keen on learning more about cryptocurrency.

Singapore is one of the biggest financial markets in the Asia-Pacific region. This thriving economy is filled with a budding crypto community.

This guide explores how to buy Bitcoin in Singapore with ease. We also consider the best platforms that allow you to buy Bitcoin instantly.

How to Buy Bitcoin Singapore – Quick Guide

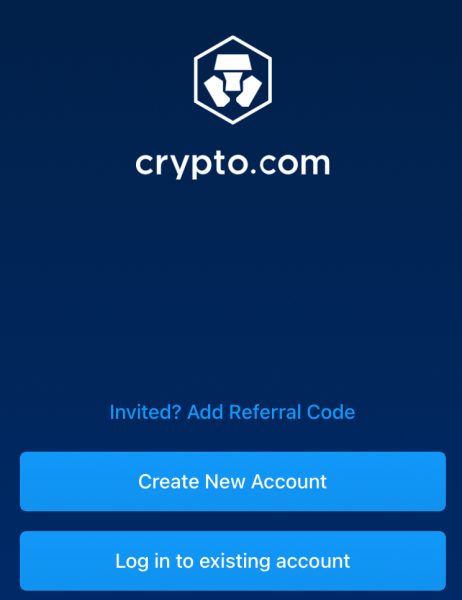

This section considers how to buy Bitcoin in Singapore on Crypto.com – one of the most reputable platforms that allow you to buy Bitcoin in Singapore. Crypto.com is the ideal service for traders looking to make Bitcoin purchases in the country. Here are the simple steps to follow if you’re pressed for time:

- Step 1✅ Open an account with Crypto.com: Visit the Crypto.com Exchange home page and click “Sign Up”. Enter your name, nationality, Email address, and username.

- Step 2💳 Deposit: Go to the “Transfer” section and click on “Deposit”. Crypto.com allows you to fund your account using crypto and Instant Deposits via ACH.

- Step 3🔎 Search for Bitcoin: In the exchange’s “Markets” page, search for “Bitcoin”.

- Step 4🛒 Buy: Click on the search results and enter your desired purchase amount.

Cryptoassets are a highly volatile unregulated investment product.

Where to Buy Bitcoin in Singapore

Now, let’s consider where to buy Bitcoin in Singapore. While there are many exchanges in the market, the following best crypto exchanges in Singapore reviewed below offer the best services for crypto investors:

1. Crypto.com: User-Friendly Platform to Buy Bitcoin in Singapore

Crypto.com is a popular cryptocurrency exchange with millions of customers globally. If you’re looking to invest in Bitcoin in Singapore, Crypto.com is your best option.

Launched in 2016, Crypto.com is a registered and reputable Singapore-based exchange. The crypto broker is operated by Foris DAX Asia – a holding company which operates in Singapore with an exemption from the Monetary Authority of Singapore (MAS)

Crypto.com is renowned for its user-friendliness and ease of use. The broker has a well laid-out user interface that supports over 250 cryptocurrencies and trading pairs on its platform. The exchange also offers a quick signup process and relatively low fees, allowing investors to start their Bitcoin journey with low risk.

Deposits and withdrawals are available via crypto, cards, ACH transfers, and the broker’s Crypto.com Pay service. The exchange has a minimum deposit of 100 USDC for new users making deposits with the SWIFT service. However, the minimum deposit is reduced to 27.70 SGD using the ACH deposit channel.

We love Crypto.com because the exchange caters to all types of investors. There’s a high-quality trading platform available for active traders who would like to speculate. If you’re a passive investor, there’s a staking service available on the exchange that allows you to earn up to 14.5% per annum on select coins.

Trades on Crypto.com are charged based on a tier system. The exchange charges 0.4% maker and taker fees for Level one users and 0.35% for Level Two users. However, users can enjoy a 10% discount on fees if they pay using the exchange’s native Cronos (CRO) token. Users should also note that the exchange charges fees for withdrawals, although these charges vary between coins.

In terms of security, the exchange keeps most user funds in cold storage. Users’ fiat currency is also kept in controlled custodian bank accounts, while the exchange uses multi-factor authentication (MFA) to prevent unauthorised access to your funds.

Cryptoassets are a highly volatile unregulated investment product.

2. Capital.com: A Versatile, Trustworthy Broker

Capital.com is a multi-asset broker that offers significant value for crypto investors looking to buy Bitcoin in Singapore.

Founded in 2016, it operates with licenses from regulators like the Financial Conduct Authority (FCA) and the Australian Securities & Investment Commission (ASIC). While it operates in Singapore as well, the broker doesn’t seem to have any licenses from the Monetary Authority of Singapore (MAS) or any of the country’s financial regulators.

Capital.com offers access to over 400 cryptocurrencies via contracts for difference (CFDs). These contracts allow investors to buy cryptocurrencies at a given price and at a particular time. The difference between the BTC price at the start of the contract and its maturation will determine the investor’s profit or loss.

With Capital.com, Users don’t buy Bitcoin – but trade CFDs denominated in Bitcoin.

Capital.com is more suited for professional traders with its focus on CFDs. The broker offers a minimum deposit of 27.70 SGD, and it is available on multiple trading interfaces – especially the user-friendly MetaTrader 4 (MT4).

The exchange also offers commission-free trades for crypto CFDs. Similarly, Capital.com provides access to various stock exchanges which means investors can buy stock CFDs in Singapore right now.

Deposits on Capital.com are available via cards and e-wallets and they’re free. However, users might still have to pay a fee to their bank or payment channel when processing deposits or withdrawals.

Additional features available from this broker include advanced charting, market news and analyses, top-notch educational and research tools, and access to an online community of fellow traders.

In terms of security, Capital.com offers several top-notch safety procedures. The broker partners with some of Europe’s largest banks to protect and store customer funds in segregated bank accounts entirely separate from the company’s accounts. All customer deposits are also protected by the broker’s Investor Compensation Fund, although this feature is only available to retail investors.

Capital.com is also fully compliant with PCI Data Security Standards. This means that the broker routes customer funds through the most secure data environments, with encryption available through Transport Layer Security and data being securely backed up.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and can afford the risks.

3. Binance: Low-Fee Cryptocurrency Exchange

Launched in 2017, Binance is the largest crypto platform globally, with billions of dollars in daily trading volumes.

While it operates as a floating entity, Binance operates in over 100 countries. However, Binance is not licensed to operate in Singapore. It has so far failed to secure a regulatory license from the Monetary Authority of Singapore (MAS), and it recently withdrew its bid for a regulatory license from the watchdog.

Binance is a suitable option for anyone looking to buy Bitcoin in Singapore due to its liquidity. The broker offers support for over 600 coins and trading pairs on its platform. This means that it can process your Bitcoin order without a hitch. With its quick signup process and a minimum balance of 13.85 SGD, beginners should have no trouble getting started with Bitcoin trading on Binance.

In terms of fees, Binance charges a 0.1% commission on trades if you want to buy Bitcoin in Singapore. However, you can get a 25% deduction for using the exchange’s Binance Coin (BNB) token as your fee payment channel.

Investors looking for how to buy Bitcoin in Singapore would be able to choose from a variety of payment channels, including cards, wire transfers, payment processors, and e-wallets. The exchange also supports advanced trading tools for speculators, as well as loans and staking opportunities for passive investors.

Finally, users rest assured of fund security on Binance because the broker offers top-notch safety features. These include two-factor authentication (2FA), behavioural analysis, and 98% cold storage.

Cryptoassets are a highly volatile unregulated investment product.

Should I Buy Bitcoin?

Now that we know the exchanges that offer Bitcoin to Singaporeans, let’s examine a critical question – should you purchase the asset?

Over the years, Bitcoin has become one of the most popular financial assets globally. Many have flocked to purchase it, and for different reasons:

Benefits of Buying Bitcoin

Still unsure on why you should buy Bitcoin? Here are the expected benefits for investors who buy Bitcoin in Singapore:

Decentralisation

Due to their decentralised nature, Bitcoin transactions are by nature, not monitored by central governments or financial institutions. This makes it a great option for all who require extra privacy. Users’ information can be stolen using typical payment systems like PayPal or credit cards, giving hackers access to their complete financial records and allowing them to perform fraudulent transactions. However, due to BTC’s unique blockchain technology, these issues are non-existent.

Low Transaction Fees

Imagine spending more than $35 to withdraw money from your bank account. Anytime you withdraw more than $1000, you may be required to pay that fee. On the other hand, Bitcoin transactions usually carry only network fees, which are largely negligible.

Security

With the rise in data breaches globally, it’s more important than ever to keep your funds secure. Fortunately, Bitcoin helps with this.

All Bitcoin transactions are recorded on an open distributed ledger. Once the transaction is recorded, it can’t be changed or tampered with. Additionally, the Bitcoin network uses a proof-of-work (PoW) consensus algorithm. This is one of the most secure blockchain consensus mechanisms as validators compete to verify transactions on the network. Hackers interested in hijacking the network would find it incredibly hard to do so as they need to control over 50% of the computing resources. This is impossible given the way the Bitcoin network is decentralised.

Nascent Asset

A major reason you should buy Bitcoin in Singapore is that it is still in its early days. Despite being in existence for just a little over 13 years, Bitcoin’s market cap is close to $1 trillion.

With new technological concepts emerging and the world shifting to Web3, crypto is predicted to become the means of exchange for the future. Right now, Bitcoin holds incumbency power in its industry, making it the top dog.

Bitcoin is also getting a boost from institutional investors who see it as a great store of value. Companies like MicroStrategy and Terra blockchain hold billions in Bitcoin and are committed to buying more.

Institutional investment is always a boost for any asset due to the liquidity surrounding the asset. With Bitcoin now available at a discount, we expect more institutions to flood the market and purchase more of the asset

Cross-border Payments

Besides being a suitable investment, Bitcoin offers more in use cases. For investors who intend to send money across borders, the leading cryptocurrency is one of the best options.

Bitcoin works as a medium of cross-border payments for several reasons. It is fast, with transactions being processed in less than a minute. Bitcoin transactions are also secure and very cheap. You only have to worry about very negligible network fees.

Compare this to banks or even traditional payment processors, which are slow and expensive. Bitcoin’s decentralised nature means no single entity will sanction your transactions. You can be confident that your transaction recipient will get their value within minutes.

Ways of Buying Bitcoin

Thinking of how to buy Bitcoin in Singapore? We have listed several ways for you to get the digital asset.

Buying Bitcoin with PayPal

PayPal is a well-known online payment system that lets users send money to anyone, anywhere in the world. Furthermore, the payment method is utilised to purchase various goods and services online.

If you have funds in your PayPal account, you can easily select it as a payment method on platforms like Crypto.com and choose the Singapore Dollars (SGD) as your fiat currency. This comes at no extra cost to you. You can easily fund your trading account with PayPal to buy Bitcoin in Singapore.

Buy Bitcoin with Credit Card or Debit Card

People looking for a way to buy Bitcoin increasingly use credit and debit cards. Credit and debit cards offer convenience as well as security of user funds. The brokers reviewed above allow investors to buy Bitcoin in Singapore using your card.

To buy Bitcoin with your credit/debit card, select it as a payment method and fill in the required card details. Meanwhile, we recommend only exploring this option when on a reputable platform like Crypto.com.

Bitcoin Price

At press time, Bitcoin’s price is trading at $39,711.46, up 1.92% in the last 24 hours. The premier digital asset has however underperformed in the one-week trading metrics and is down 6.54%. This presents a unique opportunity to buy Bitcoin at a bargain using a low-fee platform like Crypto.com.

Bitcoin Price Prediction

Wondering when to buy Bitcoin? This Bitcoin price prediction is a forecast of the future that should guide investors on how Bitcoin’s price should move.

The price history of Bitcoin is a tale of extremes. Bitcoin, which began at $0.0008 in 2009 and soared to nearly $70,000 in just over a decade, has made incredible gains.

Because of its low barrier to entry, Bitcoin has attracted many retail investors. As a result, many prospective investors tend to ask the same question – will the price of Bitcoin grow again in the future?

Morgan Stanley, one of the world’s major banks, has claimed that Bitcoin has reached an important milestone in becoming more widely accepted as a currency. According to the article, the integration of Strike – a FinTech payment processor for the Bitcoin Lightning Network – with BlackHawk Network, the world’s largest payment processor, prepares the path for Bitcoin to solidify its position as a means of exchange.

BTC: Shield Against Growing Fiat Devaluation

Because Bitcoin is a deflationary asset, residents of nations with unstable fiat currencies now use it as a store of value to shield themselves from hyperinflation. In addition, Bitcoin has the benefit of being resistant to manipulation – unlike fiat. No single entity controls the Bitcoin network, so it is impossible to mine more of it at will. Bitcoin has a hard cap of 21 million tokens after which there will be no more of it to be created. This hard cap makes Bitcoin the ultimate inflation-resistant asset.

BTC Fast Tracking Affordable Renewable Energy

Questions surrounding how Bitcoin works have naturally arisen among investors and the general public as Bitcoin has become more mainstream. One of these concerns is the possible environmental impact of mining, the mechanism through which the blockchain generates new coins and verifies transactions.

Bitcoin mining consumes a lot of electricity. However, as with many things, determining the actual environmental consequences of that energy use is difficult. While Bitcoin consumes a substantial amount of energy, this does not automatically imply that it is a significant contributor to climate change.

As both cryptocurrency and green-energy technology evolve, the opposite outcome appears to be more likely. As a result, Bitcoin miners seek out the lowest power sources. While certain fossil fuels may be used, the best method for miners to optimise profits is to select areas with excess cheap energy and enabling climatic conditions.

Bitcoin is positioned perfectly to assist in making renewable energy more affordable and accessible to the general public. Above all, the Cambridge Bitcoin Electricity Consumption Index’s experts found that Bitcoin’s environmental footprint now remains negligible at best.

Uptrend In BTC Price

Therefore, our Bitcoin price prediction states that the minimal cost of Bitcoin in 2022 will be $53,406.93. The price of Bitcoin can reach a high of $64,031.26 this year, while the asset’s average trading price is predicted to be around $55,451.30.

Based on its pricing in recent years, we estimate that the minimum price of Bitcoin in 2023 will be roughly $79,934.45. The highest possible BTC price will be approximately $95,652.26, while Bitcoin’s average price in 2023 is expected to be $82,152.51.

Moving on, Bitcoin’s minimum and maximum prices in 2024 are anticipated to be about $118,785.07 and $138,246.97, respectively. Therefore, the projected trading cost for the year is $122,892.69 on average.

In our long-term price prediction for 2025, the minimum BTC price is expected to drop to $168,972.20. The asset’s maximum price is expected to reach $210,048.98, meaning an average trading price of $175,116.84 for the year.

The average BTC price is expected to be about $366,101.77 when 2026 rolls by. After that, it may fall to a low of $353,502.75, although it could also rise to $432,374.66 by 2027.

How to Buy Bitcoin Safely

The steps of buying bitcoin are outlined here. However, you should still conduct research and choose your best option, depending on your specific circumstances.

Choose a Cryptocurrency Exchange

Choosing a crypto trading platform is the first step in purchasing Bitcoin. Cryptocurrency exchanges and online brokerages are popular trading outlets for buying digital assets. Cryptocurrency exchanges are the most convenient method because they provide a large range of functions and a more significant number of cryptocurrencies to trade. However, we recommend checking out their fees, security and regulation, payment methods, and minimum deposits before settling for an option.

Choose a Method of Payment

The payment methods accepted by exchanges vary. For example, most large platforms let you link your debit/credit cards or bank account for wire transfers. PayPal is also another widely accepted mode of payment for most exchanges. Select your preferred payment gateway and fund your account.

Buy Bitcoin

After verifying and depositing funds into your account, you can begin buying Bitcoin.

This technique varies by exchange, with some allowing you to buy BTC by simply pressing a “Sell” button and entering how much you want to buy.

Store your Bitcoin

Wallets for Bitcoin and other cryptos offer a protected way to safeguard crypto assets. Keeping your digital assets in your wallet rather than being on an exchange ensures that only you have access to the private keys to your funds. It also reduces the chance of your assets being stolen if the exchange is hacked.

How to Buy Bitcoin in Singapore

If you plan to buy Bitcoin (BTC) in Singapore, you’ll probably have many questions. This includes, among other things, how and where to buy Bitcoin, which payment method to use, and the Bitcoin price.

We recommend Crypto.com as the best place to buy Bitcoin in Singapore, follow these steps to kickstart your crypto journey:

Step 1: Sign up on Crypto.com

You can sign up on Crypto.com through the website or mobile app. The Crypto.com app is available on all app marketplaces. You can easily register your email address and phone number to access the exchange.

Step 2: Verify Your Account

Crypto.com requires know-your-customer (KYC) identity verification before you can access any of its services.

To do this, you’ll have to scan your National Registration Identity Card (NRIC) or international passport. You’ll also have to send in a recent passport photograph for ID verification. The verification process usually takes a few days to be completed.

Step 3: Fund Your Account

Once your ID verification is approved, fund your Crypto.com account. Remember that acceptable deposit channels include crypto, cards, ACH transfers, and the broker’s Crypto.com Pay service.

Step 4: Buy Bitcoin

After you’ve made your deposit, look for the BTC symbol, then click on it to buy Bitcoin.

Enter the amount you require and click ‘Buy BTC’ to finish your transaction. Your wallet will be updated immediately with your balance.

How to Sell Bitcoin

If you’re interested in investing in cryptocurrencies, you’ll need to understand how to buy Bitcoin and also be able to sell it.

- Go to the bottom navigation bar and select “Accounts”. Select “Fiat Wallet” to access your fiat money.

- Connect your Fiat Wallet with StraitsX and follow the on-screen instructions.

- Go to Crypto.com’s homepage by tapping “Home” on the bottom navigation bar to begin trading. Then select “Trade” to start buying or selling cryptocurrencies.

- You’ll be redirected to the “Sell BTC” page after selecting your cryptocurrency of preference. Insert your amount, Then, select the fiat currency you’d like to receive.

- Press the ‘NEXT’ button. This will bring you to the Sell Preview page. Click SELL to continue. By clicking the ‘CONFIRM’ button, you can confirm your sell order.

Conclusion

Bitcoin has become one of the most popular financial assets, and interest among Singaporeans is undoubtedly rising. The asset offers a great way for investors to speculate in a global market and make money, and it is also an ideal channel for Singaporeans looking to hedge their wealth against rising inflationary trends.

If you’re looking to buy Bitcoin in Singapore, we would recommend a broker like Crypto.com. Under a license exemption, the broker operates in Singapore, making it a safe place to trade digital assets. Crypto.com is also reputed for having a user-friendly interface, as well as features that cater to both passive investors and active traders.

With Crypto.com, you can rest assured that your funds are safe. The broker keeps most of l users’ cryptocurrencies offline, and it has a $750 million insurance policy in case of a hack. In addition, users’ fiat balances are held in custodian bank accounts, and its security software has been peer-reviewed.

Cryptoassets are a highly volatile unregulated investment product.