Had you invested in Bitcoin when the crypto asset was first launched in 2009, today – you would likely be a multi-millionaire. If like many others in the United Kingdom you are looking at how to invest in this popular cryptocurrency – this beginner’s guide is for you.

Within it, not only do we explain how to buy Bitcoin in the UK with an FCA broker – but we explore the ins and outs of how this marketplace works.

How to Buy Bitcoin UK – Quick Guide

Step 1: Create a Crypto Exchange Account

First up you need to register with a regulated and trusted crypto exchange, such as eToro.com.

Step 2: Deposit Funds

You will need to deposit at least $10 – or about £7, to get started with a Bitcoin investment at eToro. You can do this with a UK bank transfer, debit/credit card, or an e-wallet.

Step 3: Search for Bitcoin

Enter ‘BTC’ into the search bar and click on ‘Trade’ when you see Bitcoin appear.

Step 4: Buy Bitcoin UK

In the ‘Amount’ box, enter the size of your Bitcoin investment from $10 upwards. Hit the ‘Open Trade’ button to confirm your Bitcoin purchase.

Bonus Step: Take Part in a Crypto Presale

Of course, you can hold your Bitcoin, but if you’re looking for the best way to make quick returns off your crypto, you can use it to participate in top crypto presales like the Dash 2 Trade presale.

If you’re after a more detailed and comprehensive walkthrough of how to buy Bitcoin in the UK – we provide this further down.

Where to Buy Bitcoin in the UK

Wondering if you can buy Bitcoin online? You will need to buy Bitcoin in the UK from an online broker or exchange – just like you would invest in equities via a share dealing site.

The best Bitcoin brokers UK in this space offer low fees, plenty of markets, and a strong regulatory framework.

If you’re yet to choose a suitable provider – below you will find reviews of the best places to buy Bitcoin in the UK.

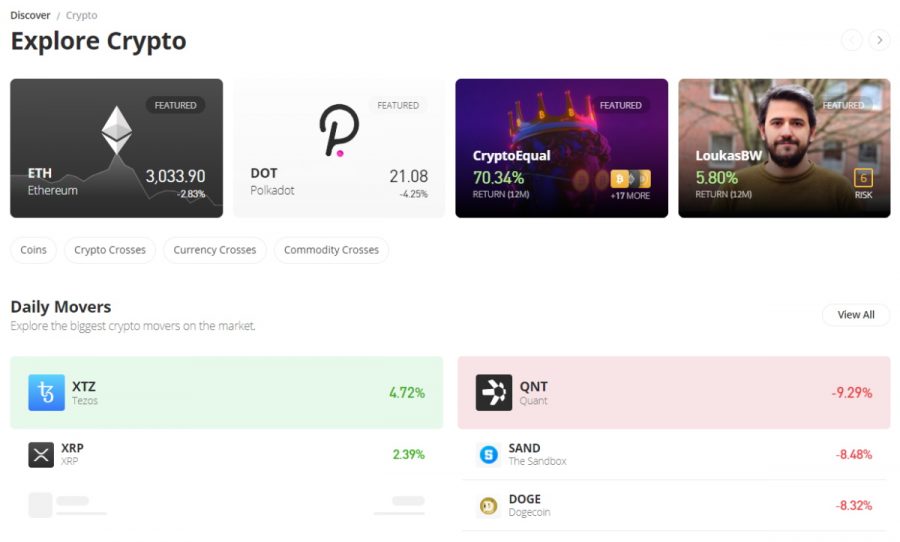

1. eToro – Best Place to Purchase Bitcoin UK (FCA Regulated)

Most importantly, the broker is authorized and regulated by the FCA. This means that you can buy Bitcoin in the UK in a secure way. In terms of fees, eToro is a great place to learn how to buy and sell Bitcoin for just 1% per trade (plus the bid/ask spread). In addition to Bitcoin, eToro offers more than 75+ alternative cryptocurrencies. As such, you can also buy Ethereum, XRP and Dogecoin with low fees. Furthermore, eToro also provides access to one of the best crypto wallets across the board.

This is particularly useful if you want to diversify your portfolio across several digital assets. You can also diversify into traditional asset classes at eToro – with the broker supporting thousands of shares and ETFs, and even currencies and hard/soft commodities. Back to Bitcoin, another option to consider at eToro is a CryptoPortfolio.

Put simply, through a single investment, you will be gaining exposure to a diversified basket of digital currencies. Best of all, your CryptoPortfolio will be managed, maintained, and rebalanced by the eToro team. To get started right now – eToro requires a minimum first-time deposit of $10 and you can fund your account instantly with a UK debit/credit card or Paypal.

For a more detailed eToro review UK, be sure to read our dedicated article.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 78 | Tight spreads | 1% + the market price | $10 |

What we like

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

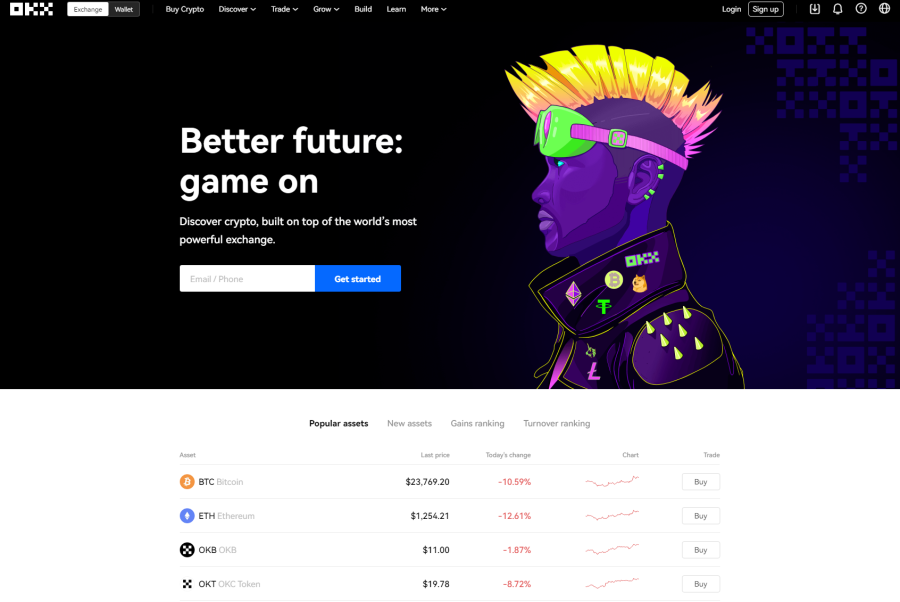

2. OKX – Buy Bitcoin with Low Fees

Founded in 2017, OKX (formally OKEx) is a market-leading crypto exchange that’s been making waves in the industry thanks to its huge range of assets, great security, and high-profile partnerships.

OKX is very transparent about its security. It keeps 95% of its assets offline in cold storage but even OKX’s hot wallets are semi-offline making them near-impervious to digital attack. Furthermore, to ensure there’s no single point of failure, the authorization of at least 2 users is required to access cold storage.

With some of the lowest fees in the industry, using OKx to buy Bitcoin in the UK is a great choice. It boasts taker fees of 0.1% and maker fees of just 0.08%. However, OKX doesn’t share its deposit fees which likely vary greatly based on the payment provider.

With over 140 crypto-assets and 300 trading pairs available on OKX, users are spoilt for choice. On top of its diverse range of assets, OKX offers investors the ability to earn interest on their crypto balances and even take out loans using their assets as collateral.

OKX is a well-rounded, easy-to-use exchange that comes equipped with tons of advanced features. It’s a great choice for any investor looking to buy Bitcoin in the UK.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 140 | 0.1% Taker 0.08% Maker | 0.1% | $10 |

What we like

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection

3. AQRU – Best Platform to Buy Bitcoin for Yield Generation

AQRU’s yields are higher than what you could expect to obtain with a traditional bank account. AQRU allows users to withdraw their holdings at any time, providing flexibility. In addition, AQRU charges no fees to begin earning interest, with FIAT withdrawals also being free of charge.

Another feature is that AQRU allows users to fund their accounts in FIAT and then use these funds to buy BTC, ETH or stablecoins. The purchasing process is facilitated through MoonPay, a crypto-payments gateway.

Finally, AQRU also employs a multi-layer insurance policy to protect your holdings, including Multi-Sig technology from leading wallet provider Fireblocks.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 5 | Set by MoonPay | No fee (third-party fees may apply) | N/A |

What we like

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Bitstamp – Leading Exchange with Low Fees

Notably, this fee drops to only 0.25% if you exceed $10,000 (£7975) in trading volume per month. UK-based clients can fund their Bitstamp account using the Faster Payments (FP) network for free, with no minimum deposit threshold. Withdrawals back to your account are only £2 per transaction. If you wish to purchase Bitcoin without depositing, you can use your credit/debit card to buy BTC instantly – although this will cost 5% per position.

In terms of the trading experience, Bitstamp users can trade on one of three platforms – Bitstamp.net, Tradeview, or the mobile app. The middle option is tailored more towards experienced investors, featuring advanced order types and order book information, whilst the other two are great for casual investors. Finally, since Bitstamp offers 24/7 support worldwide, you’ll always be able to get a solution to any problems you may have.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 50+ | 0.5% per trade | 0.5% | No minimum |

What we like

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

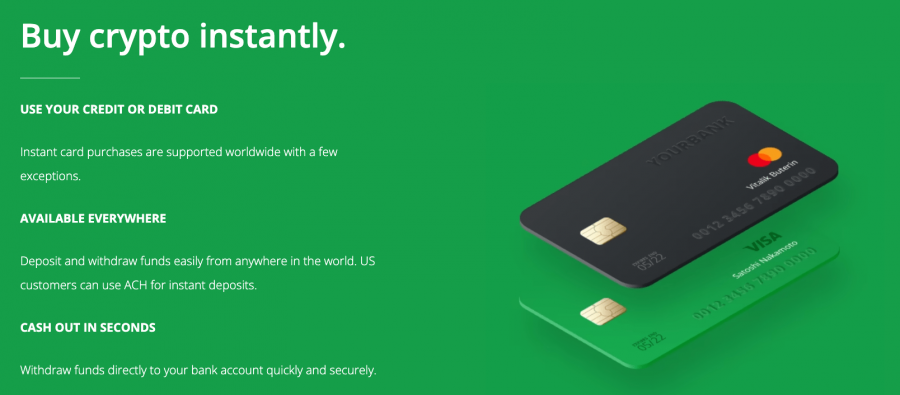

5. Crypto.com – User-Friendly App to Get Bitcoin

Alternatively, users can instantly buy Bitcoin through the Crypto.com app using their credit or debit card. This usually accrues a fee of 2.99%, although the cost is waived for the first 30 days of trading. In terms of deposits, Crypto.com allows users to fund their account balance with crypto free of charge. However, FIAT deposits are not yet accepted on the exchange, and withdrawals are subject to a network fee.

The Crypto.com app is the central hub of the trading experience, with users able to buy and sell coins in just a few taps. App users can complete ‘Missions’ which reward them in Diamonds – these can then be exchanged for Mystery Boxes containing CRO. Finally, Crypto.com even offers a crypto VISA card, with the top tier providing an impressive 8% cashback in certain places.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 250 | Maker-taker fees | From 0.4% | £20 |

What we like

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

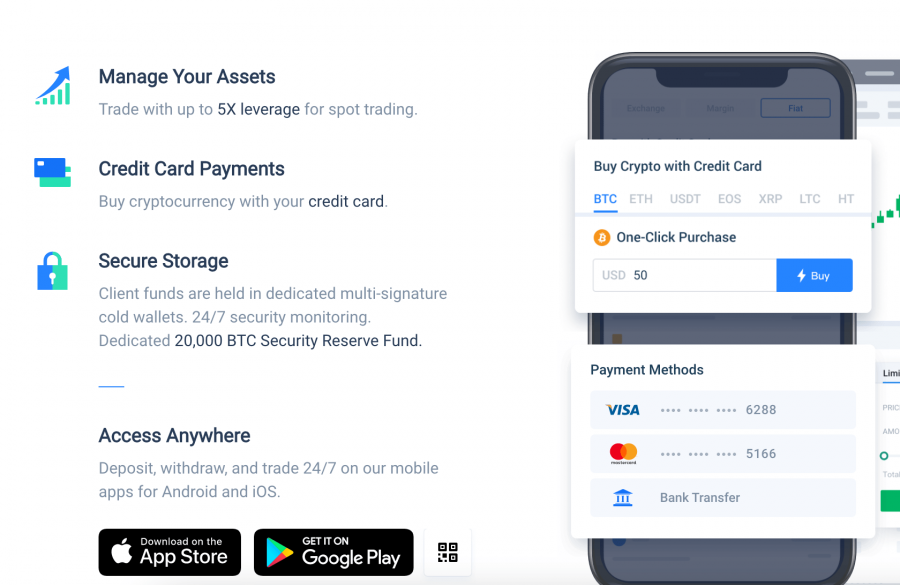

6. Huobi – Popular Platform to Buy Bitcoin in the UK with Credit Card

The great thing about Huobi is that users can also buy BTC using a credit or debit card through the platform’s ‘Quick Buy’ feature. Although this will come with a higher fee, it removes the need to deposit and supports over 50 local currencies. In terms of trade opportunities, aside from the spot market, Huobi also offers futures, swaps, and USDT-margined contracts.

The trading experience with Huobi is streamlined, as users can trade on their browsers or the dedicated mobile app. The latter option is more suited to beginners, as the app offers multiple order types, fast withdrawals, and even 24/7 support. Finally, Huobi also has a dedicated self-custody wallet app with full support for various blockchains.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 400 | Commission | 0.2% Base Fee | $100 |

What we like

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

7. Coinbase – Popular Place for Beginners

For example, the standard commission charged on this platform is a whopping 1.49%. And, if you decide to buy Bitcoin instantly with your debit or credit card – you will be charged a fee of 3.99%. Furthermore, Coinbase also adds a mark-up on the spread – so this is an additional fee that needs to be considered. The minimum Bitcoin investment here is just £2.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 100+ | Spreads, fixed fees, commissions | From 0.40% maker fee and 0.60% taker fee. 1.49% per slide. | £50 with UK bank account |

What we like

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

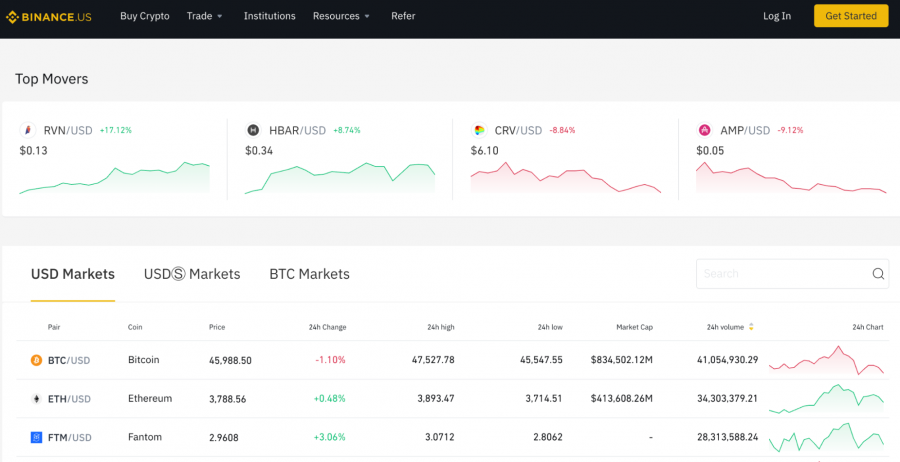

8. Binance – Top Exchange to Trade Bitcoin UK

For example, the highest commission that you will pay when buying and selling Bitcoin is just 0.10% per slide. This will be reduced if you hold BNB tokens in your Binance crypto wallet or you trade larger amounts. You can also access more than 1,000 digital assets markets here – and even earn interest on your idle cryptocurrency investments.

| Number of Cryptos | Pricing Structure | Bitcoin Trading Fee | Minimum Deposit |

| 500+ | Maker-taker fees for P2P transactions fees | 0.35% maker fee & 0% taker fee | £3 via Faster Payments |

What we like

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

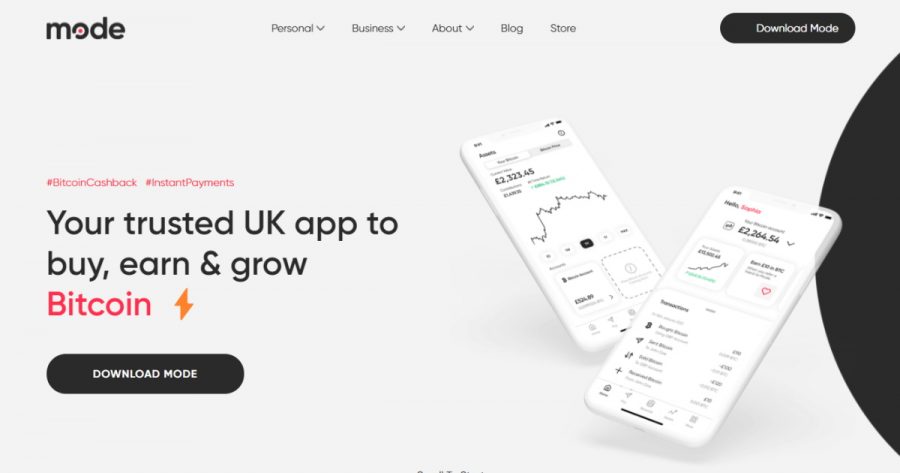

9. Mode – Purchase Bitcoin via bank transfer

When it comes to fees, Mode will charge you a buy and sell commission of 0.99% – which is in addition to the spread. No deposit fees apply and you can fund your account via a UK bank transfer. This is typically processed in less than five minutes. The minimum amount of Bitcoin that you can buy on the Mode app is £50.

10. Coinjar – Simple Exchange to Buy From £5

When it comes to Coinjar fees, this depends on how you plan to fund your Bitcoin purchase. For example, if you want to buy Bitcoin instantly with a debit or credit card – you will be charged a fee of 2%. If you deposit funds via UK Faster Payments – you won’t need to pay any fees. However, once the funds arrive and you buy Bitcoin, you will need to pay a trading commission of 1%.

11. Uphold – 115+ Altcoins to Buy

Uphold lets you buy Bitcoin with a credit card, debit card, or bank transfer, and you can deposit as little as £10 when making your first deposit. The exchange doesn’t charge deposit fees when making a bank transfer, but credit and debit card deposits incur a 3.99% fee.

Trading fees on Uphold are low, but variable. Instead of charging a fixed commission, this exchange charges a spread that can be higher or lower than average depending on market conditions. Typically, the fee for trading Bitcoin ranges between 0.8% and 1.2% of your total transaction.

Should I Buy Bitcoin?

It goes without saying that Bitcoin is one of the fastest-growing assets of the past decade.

However, the value of this digital currency is not only volatile – but is largely based on speculation and hype. The same can be said of SHIB, with many crypto-hungry investors looking to buy Shiba Inu as one of the most popular meme coins across the board. Also, did you know that the best Bitcoin casinos in the UK all support BTC? Read our article to find out more.

With this in mind, you must perform your own research before risking any money.

Benefits of Buying Bitcoin

Bitcoin is Still Young

First and foremost, by investing in Bitcoin – you can enter this marketplace at an early stage. Sure, Bitcoin has been traded since 2009 – but this is nothing in the grand scheme of things. After all, some of the most successful public companies have been tradable stocks for several decades.

Crucially, Bitcoin has already been adopted by millions of people – as well as many notable institutions and companies. For example, in early 2021, Tesla – which is the largest automaker globally, invested $1.5 billion of its own cash into Bitcoin.

Huge Market Returns

Cryptocurrencies like Bitcoin are attractive to investors that seek above-average market returns. For example, the FTSE 100 grew by just under 3% between 2017 and 2022. The Dow Jones, during the same period, grew by 82%.

However, in comparison, Bitcoin has increased in value by more than 4,000% over that period – which far exceeds any traditional stock market index. This means that had you invested just £500 into Bitcoin back in 2017, your investment would have been worth £20,000+ by 2022.

As of early 2023, the price of Bitcoin has corrected somewhat to the £17,000 range, but is still in a long term uptrend.

Fractional Investing

Bitcoin trades for tens of thousands of pounds – which is a significant amount of money to be risking on a single cryptocurrency token that carries a high level of risk. The good news for casual investors is that Bitcoin can be fractionalised.

In other words, you can buy just a small fraction of one Bitcoin token – which allows you to gain exposure to this market with a modest amount of money. In fact, if you were to buy Bitcoin in the UK via eToro – you only need to invest $10 – which is about £7.

Bitcoin Savings Accounts

There is often a misconception that you can only make money from a Bitcoin investment if the value of the token increases in the open market.

However, although this is one way to grow the size of your investment – you can also deposit your Bitcoin into a cryptocurrency savings account. In doing so, you will be paid a rate of interest on the Bitcoin tokens that you deposit.

The specific rate of interest varies depending on the platform you use – but it is not uncommon to earn up to 8% per year. This is, of course, significantly more than you will earn with a traditional savings account in the UK.

Finite Supply and Decentralized

In terms of the technology itself – which is useful to understand when learning how to buy Bitcoin in the UK, the underlying network is decentralized.

In simple terms, this means that no central bank, entity, or nation-state controls Bitcoin. Instead, transactions are verified by independent miners. Anyone can become a Bitcoin miner by purchasing specialist hardware.

More importantly, with no centralized authority in place, the supply of Bitcoin cannot be controlled or manipulated. Furthermore, Bitcoin is a finite asset class like gold, insofar that only 21 million tokens will ever be minted.

Ways of Buying Bitcoin

There are several different ways to buy Bitcoin in the UK. Consider the options discussed below to ensure you select the best process for your personal preferences.

Buying Bitcoin With PayPal

The first option to consider is to buy Bitcoin with PayPal. This e-wallet allows you to add an extra layer of security to your Bitcoin purchase – as you won’t be required to enter your debit or credit card numbers directly into the website of a broker or exchange.

Moreover, when you buy Bitcoin with PayPal in the UK via eToro – you will only need to cover a deposit fee of 0.5%. Another benefit of using Paypal at eToro is that your transaction will be processed instantly.

Buy Bitcoin With Credit Card or Debit Card

The easiest way to buy Bitcoin in the UK is with a credit or debit card. Your transaction will be processed instantly and depending on the broker – you will only need to cover a small minimum deposit.

However, fees on credit or debit card purchases can be costly when buying Bitcoin. For instance, the process at Coinbase costs almost 10%. And at Binance, through its third-party partners, this fee can go as high as 10% of the purchase amount.

If you’re wondering how to buy Bitcoin with a debit card without paying high fees – eToro will charge you just 0.5%.

Buy a Bitcoin With Neteller or Skrill

We also found that FCA-regulated broker eToro allows you to deposit funds instantly with Neteller and Skrill. You can then use the money to buy Bitcoin from just $10.

What is the Best Way to Buy Bitcoin?

It makes sense that you have plenty of options when it comes to buying Bitcoin in the UK – not least because the digital currency has since surpassed a market valuation of £1 trillion.

When thinking about where to buy Bitcoin – most investors in the UK will use a centralized exchange or broker.

With that said, decentralized Bitcoin exchanges in the UK are also becoming popular – so it’s worth considering your options before proceeding.

Centralized Exchanges and Brokers

When using a centralized exchange or broker, you are buying Bitcoin through a third-party entity. Examples of this include the likes of eToro and Mode.

This is because when you use these providers – you can buy Bitcoin in the UK directly – and the respective centralized platform will facilitate the transaction on your behalf.

Another huge benefit of using a centralized platform like Bitcoin or Mode is that both providers are regulated in the UK. Not only does this mean that you can buy BTC in the UK safely, but you can also pay for your purchase with real money.

On the other hand, unregulated exchanges – of which there are many, will often only be able to accept deposits in the form of cryptocurrency.

Decentralized Exchanges

Decentralized exchanges – or DEX’s, are a relatively new phenomenon in the cryptocurrency industry. Put simply, by using a DEX, you can buy and sell Bitcoin without going through a centralized entity. In other words, you will be trading on a peer-to-peer basis.

As revolutionary as this might sound, there are several drawbacks of using a DEX to buy Bitcoin in the UK.

- First, all decentralized exchanges are unregulated – as there is no central operator running the site.

- Second, you will likely find that your chosen DEX carries little in the way of liquidity. This means that you will pay a higher spread to access the market and you might find it difficult to find a buyer once you eventually cash out.

- Third, you won’t be able to deposit funds with a debit/credit card or bank transfer when you use a DEX.

Taking the above points into account, when learning how to buy Bitcoin in the UK – it’s best to stick with regulated centralized brokers like eToro or Mode.

Bitcoin Price

The price of Bitcoin will fluctuate through the day – just like stocks and shares. In terms of whether the value of Bitcoin moves up or down, this will depend on the wider market sentiment.

For example:

- If the markets are positive on Bitcoin and more people are buying – this will result in its price increasing

- On the other hand, if there is negative sentiment in the market, this will result in the price of Bitcoin going down

It is also important to note that Bitcoin is typically traded against the US dollar. This is no different from other commonly traded commodities like natural gas, oil, or gold.

If you deposit GBP into your crypto brokerage account, your funds will simply be converted into USD at the time of the purchase.

Or, in the case of eToro, your deposit will be converted to USD in real-time – so you can proceed to buy and sell Bitcoin without worrying about constantly fluctuating exchange rates.

When it comes to the performance of Bitcoin, we have just over 14 years’ worth of trading history. As we briefly mentioned earlier, the price of Bitcoin stood at less than 1 cent when the token was launched in 2009.

By the end of 2017, Bitcoin hit new all-time highs of $20,000 – before going on a prolonged downward trend that lasted for nearly two years. During this period Bitcoin hit lows of about $4,000.

In more recent times, Bitcoin was priced at just $5,000 after the World Health Organization declared COVID-19 a pandemic. However, the digital currency then went on a prolonged upward swing – hitting all-time highs of almost $69,000 in late 2021.

Since then, it’s been a tough period for Bitcoiners, as the coin’s price now trades at just $20,780. This is a

Bitcoin Price Prediction

Many inexperienced investors will search the internet for Bitcoin price predictions – with the hope of gaming insight into where the digital currency could be headed in the near future.

For example, many commentators argue that Bitcoin will surpass $100,000 by the end of 2023. However, many of the same analysts believed that this figure would be breached in 2022 – so in our view, it’s best to avoid Bitcoin price predictions entirely.

Instead, when attempting to assess how Bitcoin will perform in both the short and long term, consider performing your own research. This will allow you to make your own informed decisions – rather than relying on baseless Bitcoin price predictions.

How to Buy Bitcoin Safely

If you’re worried about how to buy Bitcoin in the UK securely, or if you want to buy Dogecoin and other cryptocurrencies, there are several strategies that you can adopt to ensure you invest in a safe environment.

We explore these strategies in more detail below.

Safety Tip 1: Only Buy Bitcoin in the UK From an FCA Broker

The financial services industry in the UK is regulated by the FCA. This financial body is tasked with ensuring that retail clients are treated fairly by online brokers – and that risk warnings are clear and visible.

Ultimately, when thinking about how to buy Bitcoin in the UK – it’s crucial that you stick with FCA-regulated brokers. In doing so, you can ensure that your Bitcoin investments are being conducted in a fair, safe, and legitimate manner.

This is why eToro is one of the best places to buy Bitcoin in the UK – as the broker is not only authorized and regulated by the FCA – but the SEC (US), ASIC (Australia), and CySEC (Cyprus) too.

Safety Tip 2: Keep Your Investments Modest

The old-age saying of never investing more than you can afford to lose could not be more fitting in the cryptocurrency arena.

- As noted many times throughout this guide, Bitcoin is highly speculative and volatile – so you stand the chance of losing some, or all, of your investment funds.

- The best safeguard against this risk is to only invest modest amounts.

- For example, at eToro, you only need to risk a minimum of $10 when you buy Bitcoin – which is an inconsequential amount for most of us.

A number of other platforms, however, have a much higher minimum investment requirement. As such, this is something worth checking before you open an account with your chosen broker.

Safety Tip 3: Use the Best Bitcoin Wallet

Another huge risk that is closely associated with the Bitcoin industry is wallet storage. For those unaware, digital currencies are stored in wallets – which can come in the form of a mobile app, desktop software, or hard device.

The most challenging part of the process is keeping your wallet away from the wrong hands. For example, if your Bitcoin wallet is stored on your laptop and you unwittingly download a virus – there is every chance that your funds will be stolen.

If the thought of having the keep a cryptocurrency wallet secured makes you nervous, you could consider keeping your Bitcoin tokens at a regulated broker like eToro. In doing so, eToro will be responsible for keeping your tokens safe.

How to Spend & Reinvest Bitcoin in Crypto Presales

Once you’ve bought Bitcoin, there are several things you can do with it, including hold it for investment purposes, spend it, or trade it for other crypto. One of the most popular and profitable things to do with Bitcoin these days, though, is to reinvest it into high-potential crypto presales.

Dash 2 Trade, IMPT, and Calvaria are three of the best crypto presales right now, all of which offer innovative blockchain models and tokens that appreciate in value throughout the presale – as well as low entry points – meaning if you get in early you’re virtually guaranteed profits.

This presents a quicker way to make profits with your Bitcoin than if you’re to just hold it and hope for the value to increase.

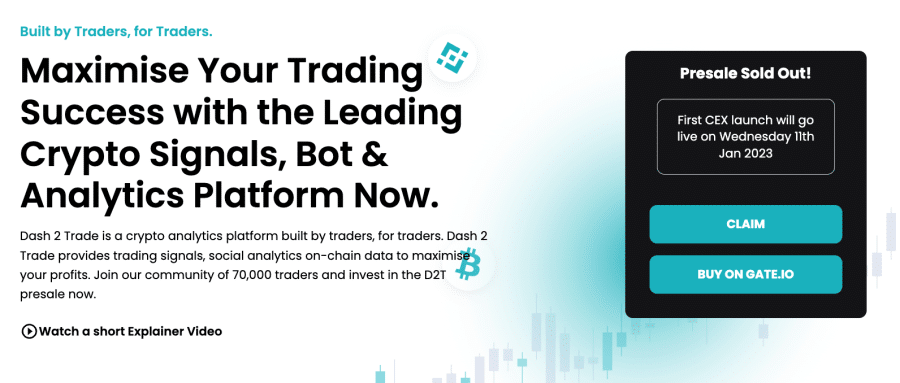

Dash 2 Trade – Crypto Intelligence Platform

Dash 2 Trade is our top pick for the best presale on the market now and is one of the fastest-growing cryptos after it sold out its presale and secured $14m in funding.

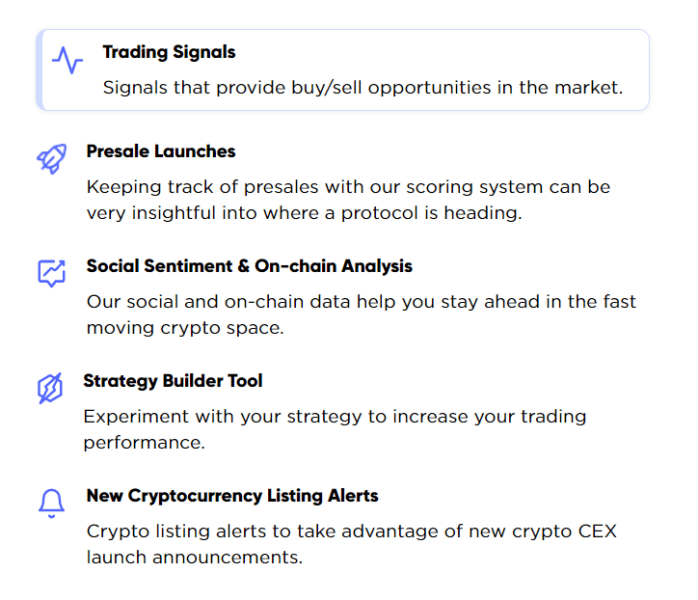

The crypto intelligence and analytics platform aims to help its users become better investors and traders by utilizing a range of data points and insights to help them make better-informed decisions.

It will do that by offering trading signals to highlight buying/selling opportunities and tracking social sentiment and on-chain data to spot trends early.

Dash 2 Trade will also develop a scoreboard for other crypto presale projects, giving them a score out of 100 based on a range of insights to ensure investor confidence, while alerts will be sent out on new coin listings.

Traders can take advantage of a range of tools, automated trading APIs and even a back-tester to optimize and test strategies in real time without risking capital.

There will also be social trading tools, members-only Discord groups and a risk profiler to help traders reach more consistent results.

Dash 2 Trade is built by the doxxed and KYC-verified team behind Learn2Trade, a beginners’ trading platform with more than 70,000 global users.

The native D2T token is now available on leading CEXs, including BitMart and Gate.io. Following these listings, the D2T price soared by triple-digits from the presale price.

Read our full guide on how to buy Dash 2 Trade token during the presale, or read through the whitepaper and join the Telegram group for more information.

How to Buy Bitcoin UK – Tutorial

If you’re ready to invest in Bitcoin right now – but need a little help, this section of our guide will walk you through the process with eToro.

In choosing this broker, it will take less than five minutes from start to finish to buy Bitcoin.

Plus, the minimum investment requirement is just $10 – so you get started with a small amount of money.

Step 1: Open an Account

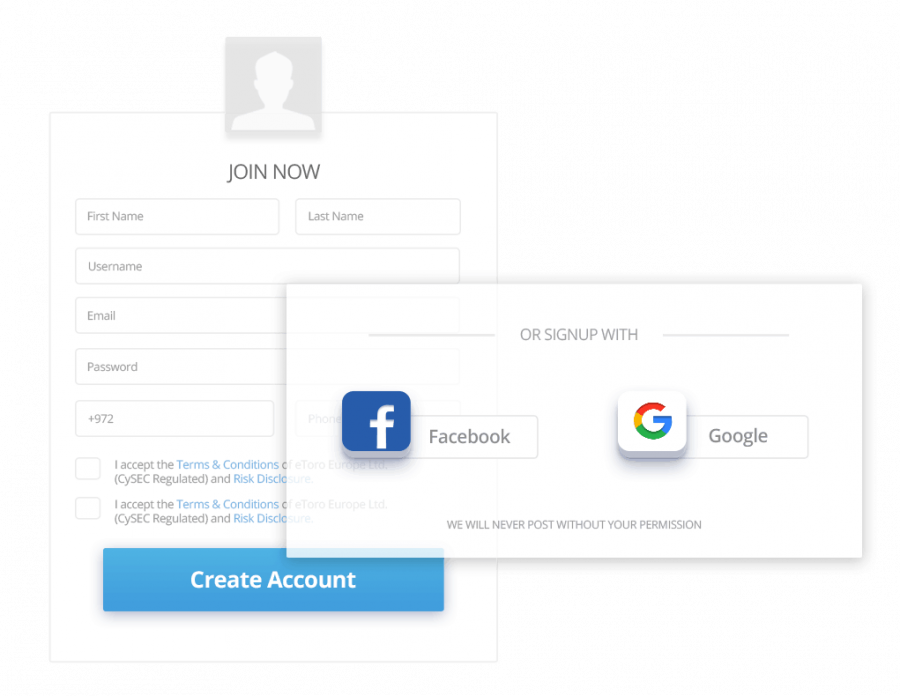

eToro is a regulated brokerage site – so it requires all new investors to open an account. This is a simple process that requires you to enter some information about who you are. This will include your name, date of birth, home address, and mobile phone number.

Additionally, you also need to choose a username/password and verify your email address. Finally, eToro will ask you a couple of questions about your prior investment experience – which is to ensure that it offers you the right financial products.

Step 2: Upload ID

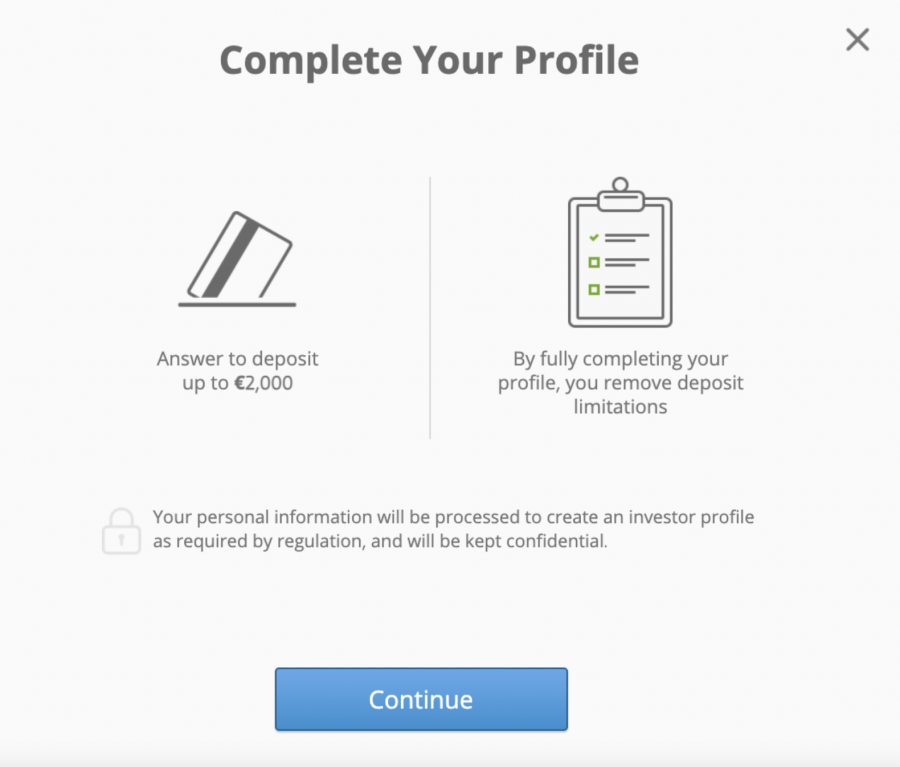

You will now be asked to verify your newly created account. This can be completed near-instantly by uploading two documents.

First, for proof of address, upload a recently issued utility bill or bank statement. Second, upload a passport or driver’s license for proof of identity.

If you don’t have the aforementioned documents to upload right now – you can still make a deposit and subsequently buy Bitcoin. However, your deposit limit will be capped to €2,000 (about £1,600) and you won’t be able to make a withdrawal until this is done.

Step 3: Deposit Money

Next up is the deposit process. If you want to deposit funds instantly so that you can proceed to buy Bitcoin without delay – consider using a debit or credit card issued by Visa or MasterCard.

You can also fund your account instantly when using Paypal or Skrill. Bank transfers, on the other hand, can take anywhere from 0-3 working days.

Regardless of the payment method you choose, eToro requires a minimum deposit of only $10 – which is around £7. Furthermore, you will pay a small fee of 0.5% on the deposit amount.

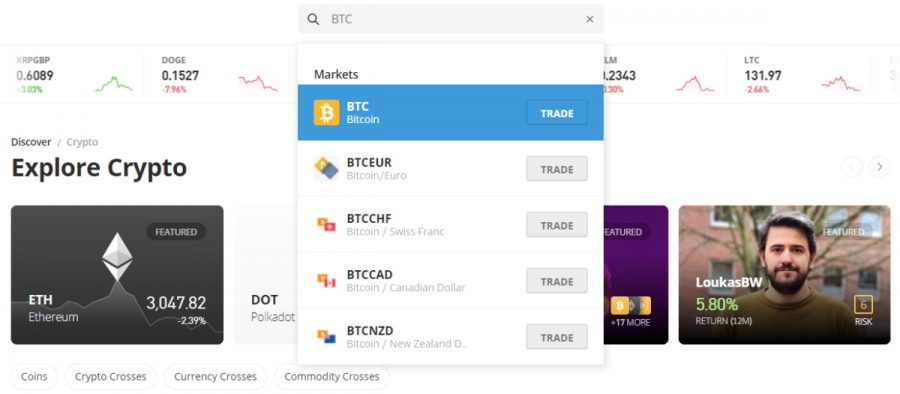

Step 4: Search for Bitcoin

With thousands of markets supported on the eToro website, it’s best to search for Bitcoin so that you can go straight to the relevant investment page.

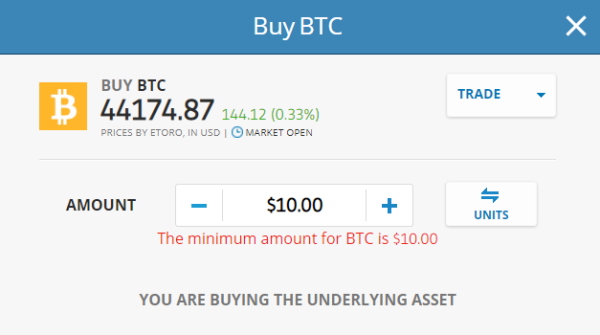

As you can see from the image above, when ‘BTC’ appears, click on the ‘Trade’ button to load an order box.

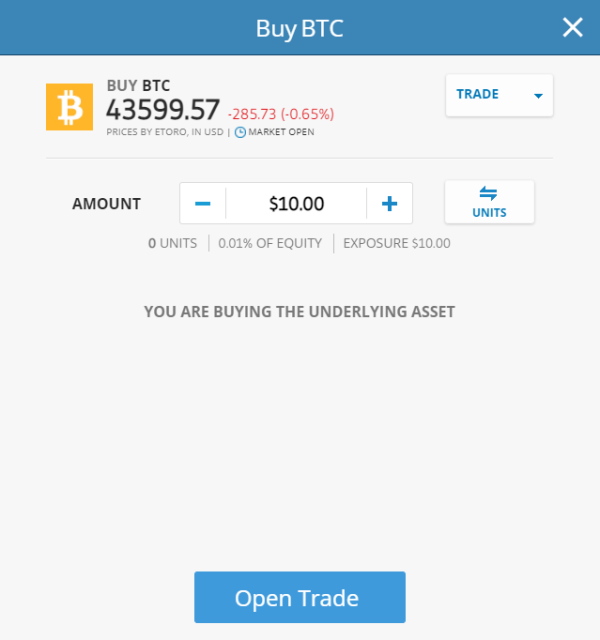

Step 5: Buy Bitcoin UK

If this is your first time trading online – you should know that the Bitcoin investment process at eToro has been designed for beginners.

As such, the only piece of information that you need to provide is the amount of money that you wish to invest. As noted earlier, this can be any amount of your choosing – as long as you meet the minimum of $10.

Once you are happy with the amount entered, you can complete the Bitcoin investment process by clicking on the ‘Open Trade’ button.

Latest Bitcoin News

Finally, let’s take a quick look at the latest Bitcoin news for the week beginning January 30th 2023 – ensuring you’re up-to-date with important market news and price movements:

- It was another bullish week for Bitcoin, as its price surged by 4.37%. This marked the third week in a row where Bitcoin has closed bullishly, with the price now hovering around the $23,200 region.

- BTC’s price increases are good news for miners after new data revealed that mining revenue is up by 50%. Miner revenue is now nearing the $23m level, thanks to the ongoing Bitcoin ‘bull run’.

- Finally, Nigeria-based Bitcoiners now have to pay a 60% premium to buy Bitcoin due to the country’s push towards a ‘cashless’ society. One Bitcoin is currently valued at around $38,000 in Nigeria following the government’s decision to impose daily limits on ATM withdrawals.

Conclusion

In reading this comprehensive guide on how to buy Bitcoin in the UK – you are now armed with the required tools to complete your investment in safety.

Not only that – but you also know the benefits and risks of buying Bitcoin and which brokers to consider for the job. If you want to buy Bitcoin in the UK today – eToro offers low fees and an FCA-regulated status.

It takes just two minutes to open an account at eToro and the broker allows you to instantly deposit from just $10 (about £7) via a debit/credit card or e-wallet. If you would like to invest in an asset with a high risk, high reward profile, check out our best crypto presales page instead.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.