The process of buying Bitcoin from the comfort of your home should take you no more than 10 minutes from start to finish. All you need to do is open an account with a regulated Bitcoin broker, deposit some funds, and enter your stake.

If you’re completely new to the process, this guide will show you how to buy Bitcoin in a safe and cost-effective way.

How to Buy Bitcoin Easily & Safely

The quickfire guide below will show you how to buy Bitcoin in the US right now. For this tutorial, we’ll explain the required steps with eToro – an SEC-regulated broker that supports low-cost Bitcoin purchases from $10.

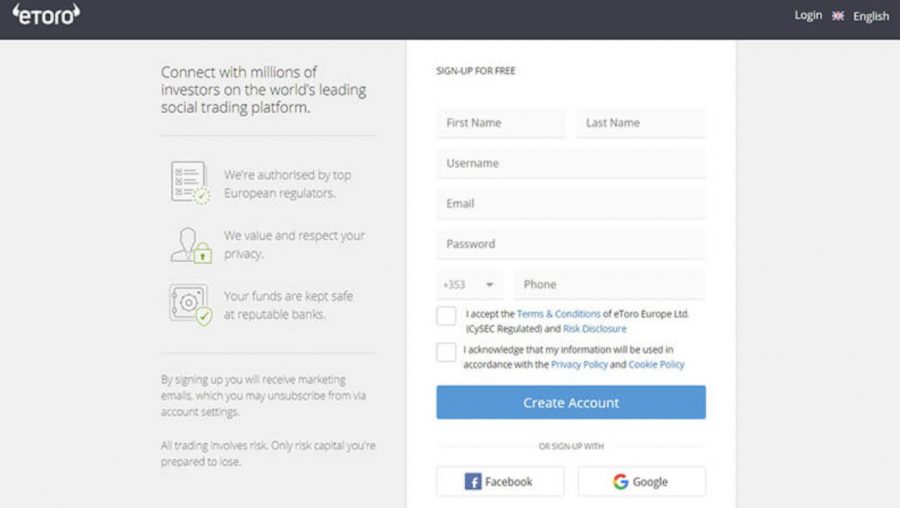

- ✅Step 1 – Register an eToro Account – First, open a free account on eToro.com by entering your personal information when prompted.

- 💳 Step 2 – Deposit Funds – You can deposit US dollars fee-free at eToro from a minimum of just $10. Choose from a debit/credit card or an e-wallet to ensure your deposit is processed instantly.

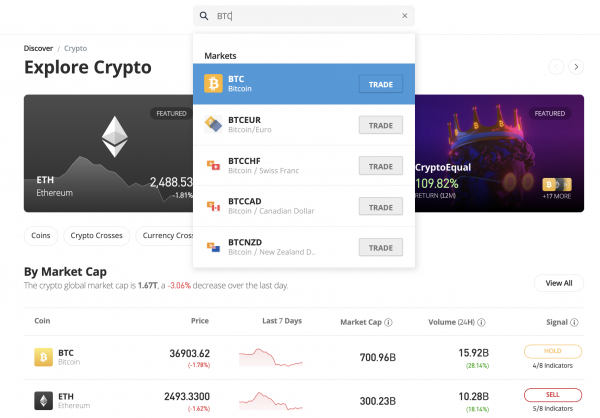

- 🔎Step 3 – Search for Bitcoin – In the search box, enter ‘Bitcoin’ and click on the ‘Trade’ button to process to the final step.

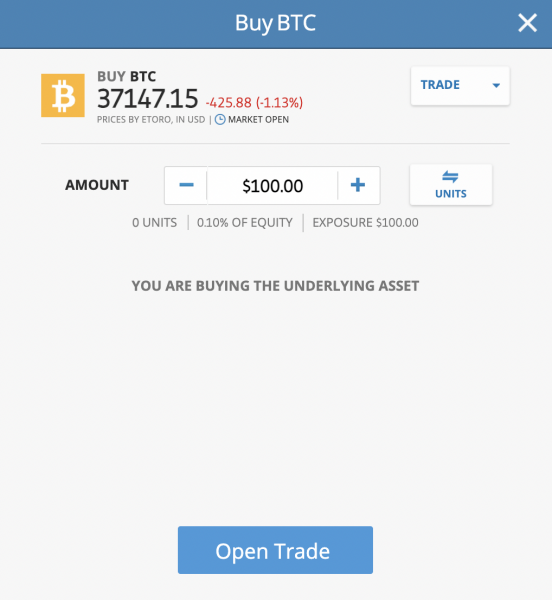

- 🛒Step 4 – Buy Bitcoin – Enter the total amount that you would like to invest in Bitcoin and click on ‘Open Trade’. Once you confirm your order, eToro will debit your cash balance and add your newly purchased Bitcoin tokens to your portfolio.

If you need a more detailed explanation of how to buy Bitcoin in the US with eToro – you’ll find a full walkthrough further down.

Where to Buy Bitcoin – Best Platforms

If you’re wondering where to buy Bitcoin online and how to get into crypto in general, there are dozens of cryptocurrency trading platforms that support instant payment methods. This means you can choose your preferred payment option when funding your long term crypto investments.

However, you need to be wary about what fees the platform in question charges – and whether or not it is regulated by a reputable financial body. For crypto traders looking for the best coins to mine in 2023, BTC is one of the leading digital assets when it comes to mining cryptocurrencies.

When deciding where to buy Bitcoin today, consider the five platforms reviewed below.

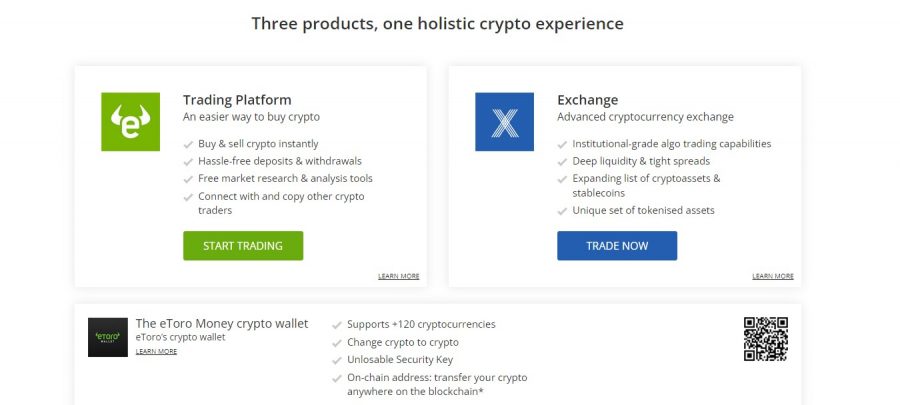

1. eToro – Overall Best Place to Buy Bitcoin in 2023

The platform is regulated by the SEC, FCA, ASIC, and CySEC – and registered with FINRA. You can easily open an account in less than five minutes and deposit US dollars with a debit/credit card, ACH, or a bank wire. This means you can buy Bitcoin with a bank account, e-wallet, or debit card.

E-wallets are supported too and all USD deposits are fee-free. eToro is also one of the best places to buy new altcoins such as Sandbox with tight spreads.

This makes eToro a super low-cost option when thinking about where to buy Bitcoin with fiat money. Once you have made a deposit, you can then buy cryptocurrency on a spread-only basis – which is the difference between the bid and ask price. But it’s not just limited to cryptocurrencies, eToro also allows users to invest in the best Bitcoin ETFs on the market.

If you want to invest in cryptocurrencies in addition to Bitcoin, eToro supports over 75 coins and tokens. This means you can buy Solana, Binance Coin, Ethereum, Dogecoin, Axie Infinity, AAVE, Decentraland, Quant, Litecoin, the Graph, Cardano, Polkadot and more.

You can also invest in a cryptocurrency-centric Smart Portfolio – which is managed by eToro and contains a wide basket of digital tokens. Moreover, you can also use the Copy Trading tool, which allows you to copy successful eToro Bitcoin traders automatically which is perfect for beginners. In terms of account minimums, you can deposit from just $10 as a US client. $10 is also the minimum amount of Bitcoin that you can buy. You’ll also be pleased to learn that eToro also offers one of the best crypto credit cards on the market.

When it comes to payment methods, eToro supports a wide range of options. As such, users can buy Bitcoin with a credit card, PayPal, bank transfer with ease.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Coinbase – Good Place to Buy Bitcoin as a Beginner

Then, when the money is credited to your Coinbase account, you can proceed to buy Bitcoin at a commission of 1.49%. Although this is deemed expensive, Coinbase charges even more when you buy Bitcoin with a debit/credit card – with the commission amounting to almost 4%. This option does, however, allow you to buy Bitcoin instantly. Other digital currency markets are available on Coinbase – should you wish to diversify. This means you can gain exposure to the most undervalued cryptos on the market in 2023 from the comfort of your own home.

Coinbase is also a good option when it comes to storing your Bitcoin tokens. The platform requires all users to pass a two-step verification process in order to log in. Moreover, 98% of all client funds are kept in cold wallets – and attempting to log in from a new device or IP address requires an extra verification step. For more details read our guide on the best crypto cold wallets.

Additionally, Coinbase supports a wide range of digital assets which means you can buy Ethereum, Dogecoin and other popular altcoins from your smartphone device.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

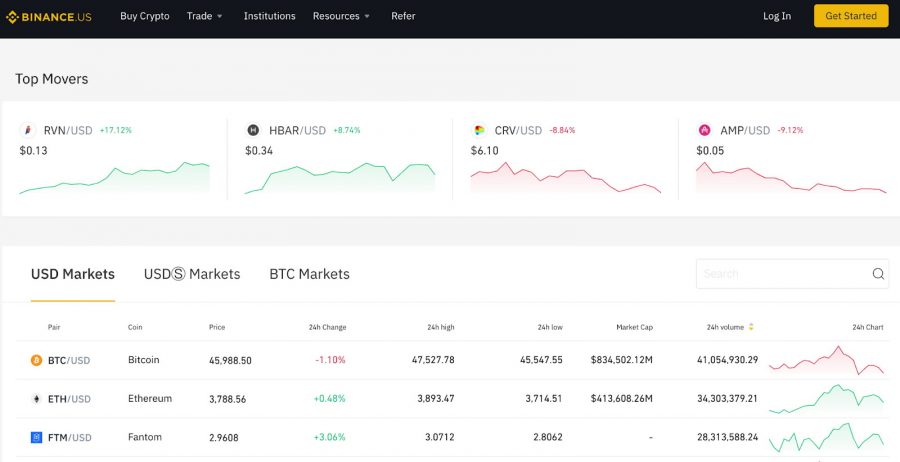

3. Binance – Popular Bitcoin Exchange Offering 60+ Markets

And, when you proceed to buy Bitcoin with your deposited funds, you will be charged an instant buy fee of 0.5%. On the other hand, spot trading commissions on the main Binance exchange amount to just 0.10%. This is very competitive, so Binance could be a good option if you find yourself trading crypto-to-crypto pairs.

When it comes to supported markets, the US version of Binance offers 60+ markets. This covers a relatively broad selection of digital tokens – covering both large and mid-cap projects. For seasoned investors, Binance offers over-the-counter services as well as an advanced trading platform with enhanced tools and analysis features.

As one of the largest crypto exchanges across the board, did you know that you can buy Celo and other popular new cryptocurrencies including Terra Luna with some of the industry’s lowest transaction fee rates when compared to the likes of Coinbase and Kraken? For more details read our Binance review today.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

4. Webull – Buy Bitcoin From Just $1

In terms of fees, Webull does not charge traditional trading commissions. But, spreads of 1% or more will need to be factored in. Nevertheless, perhaps the stand-out feature of Webull is that it allows you to invest from just $1 when buying Bitcoin. This is also the case with other cryptocurrencies available at Webull.

Furthermore, when you open an account here, you can get started without needing to meet a minimum deposit. Webull is also a good option if you’re looking to invest money for your retirement, as several IRAs are supported. Finally – and providing you meet the standard $2,000 minimum balance requirement, Webull allows you to trade on margin.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Kraken – Safe Cryptocurrency Exchange to Buy Bitcoin via a Bank Wire

For instance, payments sent from MVB Bank require just $1 while at Etana Custody, the minimum is $150. Nevertheless, once your bank wire arrives in your Kraken account – which usually takes 0-1 business days, you can buy Bitcoin at a commission of just 0.26%. If you trade large amounts, your commission will be reduced. In addition to Bitcoin, Kraken supports more than 50 other digital currencies.

Should I Buy Bitcoin Now?

Bitcoin is often widely considered to be the best cryptocurrency to invest in. However, If you’re wondering whether to buy Bitcoin right now – your investment decision should be based on independent research.

While you might try to time the market well, the best way to enter the market is through a dollar-cost averaging strategy – which we explain in more detail further down. But just how much Bitcoin should I buy?

Another thing to consider is that Bitcoin is extremely volatile, so you are likely to experience rapid pricing swings. On that note, if you have a high risk tolerance then you might be interested in Bitcoin robots. The best crypto bots such as Bitcoin Prime allow you to speculate on the price movements of cryptos via Bitcoin CFDs. If you’d like to learn more about Bitcoin robots then we recommend checking out or in-depth Bitcoin Prime review now.

The best way to counter this is to engage with a buy-and-hold strategy, which means that you will keep hold of your BTC tokens in the long run. In doing so, you can ride out the volatile waves that the cryptocurrency markets regularly encounter. But once you’ve bought BTC where do you store it? Read our Ledger Nano X review for more details on this market leading cold crypto wallet.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Benefits of Buying Bitcoin

In the sections below, we discuss five key reasons why so many investors in the US and further afield are looking to gain exposure to Bitcoin.

Huge Growth Since 2009

If you’re looking to buy Bitcoin today, then you are likely doing so because you hope to make significant returns on your investment. This is something that Bitcoin has achieved since it was launched in 2009.

During its first few years, for instance, Bitcoin could be purchased at less than a dollar per token. Even in early 2017, this digital currency was trading at just $1,000.

This means that had you invested in 2017 and held on until Bitcoin hit its all-time high of $69,000 in 2021, your money would have been worth almost 7,000% more.

Buy the Dip

Perhaps the best way to buy Bitcoin is when the broader cryptocurrency markets go through a dip. This happens when the price of Bitcoin goes through a downward trend.

Although this often scares inexperienced investors away, buying the dip will allow you to enter the market at a discount.

For example, we mentioned above that Bitcoin hit $69,000 in 2021. However, in January 2023, the digital token has hit lows of $20,000. This is a decrease of around 70% from all-time highs.

There are plenty of opportunities to buy the dip in this marketplace, as Bitcoin and other cryptocurrencies regularly go through volatile pricing swings.

Limited Supply

All global currencies – whether it’s the US dollar, euro, or British pound, experience inflation. This is largely because of central bank monetary and fiscal policies, which result in so-called money printing.

However, in the case of Bitcoin, its supply cannot be manipulated by any single person or authority. On the contrary, new Bitcoin is minted automatically every 10 minutes.

This will continue to be the case until approximately 2140 – when the total supply will be capped to 21 million tokens. From an investment perspective, this means that you are purchasing an asset that in many ways, is not too dissimilar to gold.

After all, both Bitcoin and gold have a fixed supply, and thus – they are both referred to as stores of value by many market commentators.

Fast and Decentralized Transactions

Although Bitcoin isn’t the most efficient blockchain network, cross-border transactions are still a lot faster than traditional payment methods. For instance, no matter where the sender and receiver are located, Bitcoin transactions take just 10 minutes to arrive.

Moreover, fees typically amount to less than $5 per transaction. This is the case regardless of how much is being sent.

Another major benefit of sending and receiving transactions via the Bitcoin network is that the system is entirely decentralized. Once again, this means that no person, authority, central bank, or government can control the network.

Small Unit Purchases

Another core benefit of buying Bitcoin is that the digital currency can be fractionalized. This means that you can buy just a small fraction of one Bitcoin unit.

For example, if Bitcoin was priced at $40,000 and you decided to invest $40 – you would be purchasing 0.1% of one token.

This is ideal for those looking to gain exposure to Bitcoin for the first time without risking large sums of money. This allows you to engage in a dollar-cost averaging strategy.

Earn Interest

More and more platforms now offer crypto accounts for a wide variety of coins, including Bitcoin, allowing you to earn passively from your cryptos. If you’re looking for the best Bitcoin interest account, the crypto interest platform Aqru offers a variable interest rate on BTC deposits.

Methods of Buying Bitcoin

Once you have researched Bitcoin from top to bottom and made the decision to proceed with an investment, you then need to think about which payment method to opt for.

The best ways to buy Bitcoin in the US are discussed below.

Buying Bitcoin With Paypal

A selection of online brokers allow you to buy Bitcoin with Paypal. However, as Paypal has since entered the cryptocurrency market itself, you won’t have many platforms to choose from.

With that said, eToro enables Paypal deposits at a minimum of just $10 and USD payments are credited fee-free.

Buy Bitcoin With Credit Card or Debit Card

Some of the cryptocurrency exchanges and brokers that we discussed today allow you to buy Bitcoin instantly with a credit/debit card.

Although this is perhaps the most convenient payment method to choose from, credit/debit card transactions are known to be expensive when buying Bitcoin.

For example, we mentioned earlier that Coinbase and Binance charge 3.99% and 4.5% on credit/debit card payments.

eToro, on the other hand, permits fee-free credit/debit card deposits that are funded in US dollars.

Buy Bitcoin With Neteller or Skrill

Another option to consider when thinking about how to buy Bitcoin instantly is to use an e-wallet like Neteller or Skrill.

As noted in the sections above, eToro allows e-wallet deposits from just $10 and your payment will be credited instantly.

What is the Best Way to Buy Bitcoin?

You should also consider the different platforms that are present in the Bitcoin investment landscape.

For instance, many inexperienced investors confuse Bitcoin exchanges and brokers as two of the same things.

Although both platform types give you access to the Bitcoin markets, the way in which your transaction is carried out is actually different.

What about crypto signals?

Ever wondered how to buy BTC using the best crypto signals? Crypto signals are trading ideas sent out by advanced crypto investors that tell you whether you should buy or sell a specific crypto at a specific price and time.

The best crypto signals are based on a variety of metrics, such as trending news, technical and fundamental analysis, bullish and bearish markets, and investor sentiment.

Bitcoin Exchange

The vast majority of Bitcoin platforms operate as a cryptocurrency exchange. In simple terms, this means that the exchange in question operates as a middleman between buyers and sellers.

For example, let’s suppose that you want to buy Bitcoin with US dollars. For this transaction to occur at a cryptocurrency exchange, a user would need to sell their BTC tokens to you in exchange for USD.

In turn, your chosen Bitcoin exchange would charge a commission once the trade has been executed. The key problem with Bitcoin exchanges is that many platforms are unregulated.

While this might appeal to those seeking to buy Bitcoin in an anonymous manner, you can never be quite sure that your money and digital tokens are safe.

Moreover, unregulated Bitcoin exchanges will often only allow you to deposit funds in cryptocurrency – meaning that you won’t be able to use a debit/credit card or perform a bank transfer.

Bitcoin Broker

If you’re learning how to buy Bitcoin in the US for the first time, then it might be best to use a broker. Unlike exchanges, brokers sit between you and the cryptocurrency markets. And as such, you can buy Bitcoin instantly, directly with the broker.

Using a broker is by far the easiest and more importantly safest way to buy Bitcoin online. For instance, brokers like eToro are regulated by several licensing bodies – which includes the SEC. This means that you can be sure that your funds and digital assets are in safe hands.

- Another core benefit of using a broker to buy Bitcoin is that you can deposit US dollars via a range of payment methods.

- Kraken, for example, supports bank wire deposits. eToro, Coinbase, and Binance also offer support for debit/credit card payments.

And finally, you need to consider storage options when you buy Bitcoin. When using an exchange, you are encouraged to withdraw your digital assets to a private wallet – which can be confusing for beginners.

On the other hand, when using an SEC-regulated broker like eToro to buy Bitcoin, you can safely leave your tokens in your portfolio. This simply means that eToro will be tasked with keeping your tokens safe.

Decentralized Exchange (DEX)

Although the vast majority of Bitcoin trading goes through centralized exchanges and brokers, it is also worth making reference to the rise of decentralized exchanges (DEXs). In a nutshell, these platforms allow you to buy Bitcoin directly from a seller without going through a third party.

The key issue with decentralized exchanges is that they are not regulated. Moreover, trading volumes at DEXs are still very low in comparison to traditional exchanges and brokers. As such, this means that liquidity levels are often insufficient to facilitate trades.

Bitcoin Price

When researching the price of Bitcoin, you will quickly notice that the digital asset is typically traded and quoted in US dollars. This is not too dissimilar to how commodities are priced, such as gold, silver, wheat, oil, and natural gas.

And, just like the aforementioned hard and soft commodities, the price of digital currencies like Bitcoin is dictated by demand and supply.

That is, when more and more people buy Bitcoin, its value will rise. But, when selling pressure outweighs new buy orders, its price will decline.

In terms of its historical price action, we mentioned earlier that Bitcoin initially traded at less than $1. As of writing, Bitcoin is trading around the $20,000 level – 70% below all-time highs.

Another thing to note about the price of Bitcoin is that it does not trade on centralized exchanges. This is in stark contrast to traditional stocks – which are listed on centralized-controlled exchanges like the NYSE or NASDAQ.

As a result of this, you will notice that Bitcoin prices may fluctuate slightly across different exchanges. This differentiation will be minute and any gap in pricing will quickly be taken advantage of by market arbitrators.

Bitcoin Price Prediction

If you’re looking to research Bitcoin price predictions, you won’t be short of options. That is, the internet is packed with analysis of which direction the price of Bitcoin is likely to take in the near future.

However, make no mistake about it, rarely do Bitcoin predictions come to fruition. Moreover, while you will easily find articles explaining that Bitcoin is set to increase in value, equally, you’ll also find price predictions arguing for the exact opposite.

With this in mind, rather than focusing on Bitcoin price predictions, it’s best to approach digital currencies through a long-term strategy.

In other words, if you believe that Bitcoin will continue to rise over the course of time, then holding long-term will allow you to ride out volatility pricing spikes.

When to Buy Bitcoin

Ever wondered if it’s too late to buy Bitcoin in 2023? We briefly mentioned earlier that rather than attempting to time the market, it’s best to consider dollar-cost averaging your investments.

In its most basic form, this means committing to an investment schedule of regular, smaller purchases. For example, you might consider buying $300 worth of Bitcoin at the end of each month. Or, $75 worth of Bitcoin every week.

Here’s a quick example to help clear the mist:

- In month 1, you buy $300 worth of Bitcoin at a token price of $40,000

- In month 2, you buy $300 worth of Bitcoin at a token price of $50,000

- In month 3, you buy $300 worth of Bitcoin at a token price of $30,000

- In month 4, you buy $300 worth of Bitcoin at a token price of $30,000

Across your four monthly investments of $300, you now have an average purchase price of $37,500. The good thing about dollar-cost averaging is that you are following the broader market sentiment over the course of time.

That is, when Bitcoin goes through a downward trend, you will be reducing the average cost of your investment portfolio through cheaper purchases. On the other hand, when Bitcoin is going through an upward trend, you will be investing when prices are on the rise.

Buying the BTC Dip

We discussed buying the dip earlier in this guide. To recap, this is the way that some investors look to time the market.

More specifically, you might consider buying Bitcoin during a downward trend with the view of paying a lower cost price.

However – and much like in the traditional stock markets, history suggests that dollar-cost averaging is a lot more effective from a profit perspective than that of constantly buying the dip.

This is because when Bitcoin goes through a prolonged upward trend, you are potentially missing out. After all, you likely will not make another purchase until the price drops again.

How to Buy Bitcoin Safely

There are several ways that you can ensure that you buy Bitcoin safely. Not only in terms of using regulated brokers to complete your purchase, but in terms of wallet security.

Here’s what you need to know to buy and hold Bitcoin in a secure manner.

Regulated Brokers

It goes without saying that the safest way to buy Bitcoin online is through a regulated online broker.

If you’re from the US, then your chosen Bitcoin broker should hold a license with the SEC and be a member of FINRA.

This is one of the reasons why we prefer eToro for the Bitcoin investment process – not least because the platform meets the aforementioned criteria. For even greater scrutiny, eToro is also licensed by regulators in Europe and Australia.

When using a regulated broker, you won’t be able to buy Bitcoin anonymously. This is because the broker in question will need to comply with anti-money laundering regulations by verifying your identity.

This can be achieved easily by uploading a copy of your government-issued ID.

Be Wary of Fees

In order to buy Bitcoin in the US safely, you need to have a firm understanding of what fees you are paying. This is because some methods of buying Bitcoin can be costly.

The most important fees to look for include:

- Commission: This is the fee charged by brokers and exchanges when you both buy and sell Bitcoin. This is usually a percentage

- Spread: This is the most difficult fee to assess, and it considers the mark-up between the buy and sell price offered by your chosen platform. At eToro, for example, the spread starts from just 0.75%.

- Debit/Credit Cards: If you decide to buy Bitcoin with a debit/credit card, then expect to pay between 3-5% with your chosen broker. With that said, you can avoid paying a transaction fee entirely when using eToro when depositing funds in US dollars.

Another thing to know about fees when buying Bitcoin is that you should avoid cryptocurrency ATMs – of which there are many thousands scattered across the US. This is because on average, you will be charged between 10-20%.

Moreover, this fee often isn’t advertised. Instead, the fee is quoted in terms of the total amount of BTC that you will get.

For example, if the actual market price is $40,000 and the Bitcoin ATM charges a 20% fee, you are effectively paying $48,000 per token. And as such, you would need Bitcoin to increase by 20% just to break even.

Storage

Once you have completed your Bitcoin purchase, you then need to decide how you intend on storing your tokens. In many cases, other than the odd exception – such as Coinmama, you will have the option of leaving your BTC tokens on the platform that you made the purchase from.

This can be a safe and convenient option if you are using a regulated and trusted broker like eToro or Coinbase. However, if you leave your tokens on an unlicensed platform, then you are putting your funds at risk.

For instance, in 2021 alone, it was estimated that over $4 billion worth of digital assets were stolen from both centralized and decentralized exchanges.

Bitcoin Wallet Security

Although keeping your Bitcoin tokens at a regulated broker like eToro is perhaps the best storage option, some of you might prefer to retain 100% control over your digital assets. If this is the case, then you might look to withdraw your tokens to a private wallet.

Regardless of which wallet type you opt for (mobile, desktop, etc.), you will need to ensure that you follow a set of safety protocols. This includes creating a strong password/PIN and ensuring that you keep your private keys written down on a piece of paper somewhere safe.

Moreover, it is important that you avoid clicking on unknown links on the device that your Bitcoin wallet is kept on.

Keep Stakes Sensible

Another tip to ensure you buy Bitcoin safely is to be sensible with your investment stakes. Put simply this means never investing more than you can afford to lose.

In order to do this, you will need to use a broker that supports small minimum deposits and low investments. At eToro, for example, you only need to deposit and invest $10 into Bitcoin.

Can You Buy Bitcoin Without ID?

We mentioned earlier that by using a regulated broker to buy Bitcoin online, you will need to go through an identity verification process by uploading a copy of your government-issued ID.

This is also the case with unregulated exchanges that accept deposits in the form of US dollars. With that said, many cryptocurrency exchanges allow you to trade anonymously. The only caveat here is that you will need to deposit funds with cryptocurrency.

This means that in order to buy Bitcoin with no verification documents, you would need to fund your account with another digital asset like Ethereum. Then, you would need to swap your ETH tokens for BTC.

How to Buy Bitcoin Online – Tutorial

If the earlier quickfire guide on how to buy Bitcoin in the US wasn’t quite elaborate enough for you, below we explain the step-by-step process in a more detailed way.

Step 1: Open an Account

First, you need to register an account with eToro. This requires entering some basic information about who you are – such as your name, date of birth, and nationality.

You also need to enter and verify your email address and cell phone number.

Step 2: Upload ID

Once again, in using a regulated online broker like eToro, you will have access to deposits and withdrawals in US dollars.

However, this also means that you need to upload a copy of your government-issued ID. Once you upload a clear copy of your document, eToro should be able to verify it straightaway.

Step 3: Deposit Funds

You can now make a deposit into your eToro account – with the broker supporting plenty of payment methods. This includes everything from debit/credit cards and ACH to Paypal and bank wires.

And, not only is the minimum deposit threshold set to a very reasonable $10 – but no fees are charged on USD deposits – regardless of the payment type being used.

Step 4: Search for BTC

In the search bar – which is located at the top of the screen, enter ‘BTC’.

When you see Bitcoin appear below the search bar, which in the image above, you can click on the ‘Trade’ button.

Step 5: Buy Bitcoin

And finally, you will now need to place a buy order so that eToro knows you wish to invest in Bitcoin. For this part of the process, you simply need to specify your total stake. This can be stated in US dollars from $10 upwards.

In our example above, we are looking to buy Bitcoin at a total stake of $100. Once you press the ‘Open Trade’ button, eToro will instantly carry out your trade, and the tokens will be added to your portfolio.

How to Sell Bitcoin

If you decide to leave your BTC tokens in your eToro account, then the process of cashing out is instant. All you need to do is create a sell order from within your portfolio – which you can do by clicking on the red cross button located next to your Bitcoin investment.

Then, you can click on the ‘Close Trade’ button. In doing so, eToro will instantly sell your tokens and add the cash proceeds to your account balance – which you can withdraw.

On the other hand, if you currently have Bitcoin stored in a private wallet, in order to cash out you will first need to transfer the tokens to a cryptocurrency exchange.

So, now that you know how to buy and sell BTC, you might also want to read our guide on how to spend Bitcoin in 2023.

Latest Bitcoin News

Finally, let’s take a quick look at the latest Bitcoin news for the week beginning January 30th 2023, to ensure you’re up-to-date with any significant developments or price movements:

- It was another excellent week for BTC investors, as the coin’s value rose by 4.37%. This is the third week in a row where BTC’s price has ended in the green, with the coin now trading around the $23,200 level.

- Bitcoin miners appear to be experiencing a comeback, as data revealed that mining revenue is up 50% this month. At the start of January, mining revenue was around $15.3m, yet it is now heading towards the $23m mark.

- Nigerian Bitcoiners are going through a tough time, as BTC is now selling at a 60% premium in the country. This premium stems from the government’s push towards a ‘cashless’ society, which currently limits the amount each person can withdraw from ATMs daily.

Conclusion

This beginner’s guide has left no stone unturned when it comes to learning about how to buy Bitcoin in the US. We’ve covered everything from reviews of top Bitcoin exchanges to a discussion on which payment methods are best to use.

And, of course, we have also walked you through the process of how to buy Bitcoin via SEC-regulated broker eToro in a super-safe and secure way. At eToro, you can use a debit/credit card, e-wallet bank transfer to pay for your BTC investment and the minimum deposit requirement is just $10.

Cryptoassets are a highly volatile unregulated investment product.