Coinbase is one of the world’s most popular cryptocurrency exchanges and it’s also publically listed, which means you can add the firm to your portfolio with ease.

In this beginner’s guide we review where to buy Coinbase stock with low fees. We also analyze the growth potential of Coinbase to assess whether or not this growth stock represents a viable investment.

Buying Coinbase Stock – An Overview

Learning to buy Coinbase stock is made much more simple when you opt to do so at a regulated and simple-to-use platform.

As such, you will find a guide on creating a broker account, funding it, and buying Coinbase stock below. You won’t have to pay any commission when buying Coinbase stock in the US and can even elect to do so in fractional quantities from $10.

- ✅ Step 1: Open an Account with a Regulated Broker

Visit a trusted broker and fill out the registration form. Enter your chosen username and password, as well as information regarding your identity. You can also upload your ID and proof of residency when prompted to complete the KYC process. - 💳 Step 2: Deposit Funds

When you’ve created an account, you can arrange a deposit. There are tons of payment methods supported, such as e-wallets, credit/debit cards, ACH, and wire transfers. US traders pay no fees when funding their accounts. - 🔎 Step 3: Search for Coinbase Stock

To place an order to buy Coinbase stock, you will need to find it by entering its name into the search bar on the eToro dashboard. When you see it appear, select the ‘Trade’ button. - 🛒 Step 4: Buy Coinbase Stock

At this point, you will be presented with a trading order box. To buy Coinbase stock, enter the US dollar amount you wish to allocate to the company. This can be $10 or more. To place your investment, click ‘Open Trade’.

There will be a more detailed guide of buying Coinbase stock at eToro later in this article.

Step 1: Choose a Stock Broker

First, you will need to decide where to buy Coinbase stock.

To help you make your mind up, you’ll see our complete analysis of the stock trading platforms below. We rank brokers based on fees, ease of use, asset diversity, and much more.

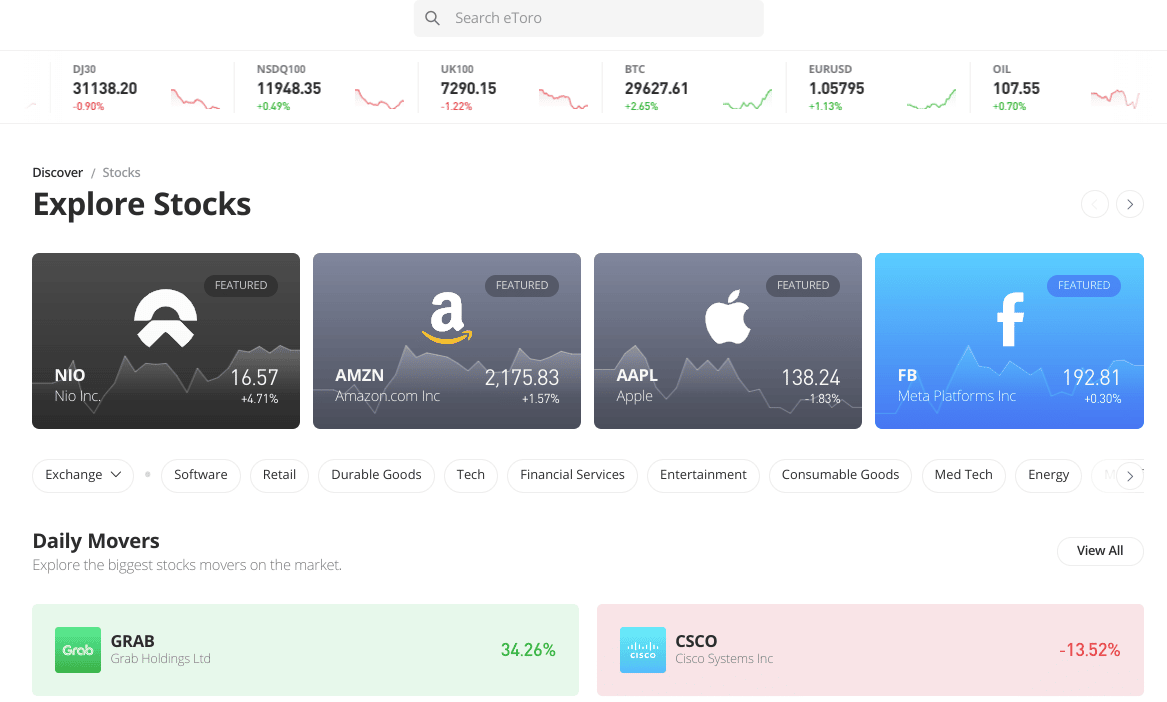

1. eToro

eToro is a well-known place to buy Coinbase stock for a multitude of reasons. The platform has been approved by major regulators such as the SEC in the US, the FCA in the UK, ASIC in Australia, and CySEC in Europe. As such, it’s considered very safe for US stock traders.

You can buy Coinbase stock with stakes as low as $10 at eToro. This is because, as we touched on, this platform supports fractional equity investing. Not only that, but you can buy and sell more than 2,500 stocks whilst paying 0% commission.

US investors can also diversify by buying digital currencies for a small commission fee of 1%. eToro offers plenty of options in this regard, ranging from crypto under $1 to large-cap offerings such as Bitcoin. You can also access a range of ETFs, which are offered to US traders with 0% commission.

Some of the ETFs available on eToro which hold Coinbase stock include the Next Generation Internet Investment Strategy by ARK and Invest Amplify Transformational Data Sharing ETF. You can fund your account to buy Coinbase stock using your debit or credit card. You can also buy stocks with PayPal at eToro, as well as Neteller or Skrill.

Alternatively, arrange an ACH payment or make a deposit using Rapid Transfer. The minimum deposit is $10 and there will not be a fee taken from this if you are a US trader. All traders are given a free paper trading account with $100k in demo funds at eToro. This is very helpful for strategizing, or for newbies who want to practice placing orders and navigating the site.

That said, the eToro platform takes no time at all to get used to. eToro also has a cell phone app. The online broker caters to stock investors with varying levels of expertise and also offers passive trading tools. The most noteworthy is Copy Trading, as it allows you to choose a pro stock investor to invest in.

You can allocate as little as $200 to Copy Trading. As soon as the person places an order to buy stocks, or indeed cash out, you’ll see the action reflected in your own portfolio. Alternatively, if you like the sound of ETFs, you could check out Smart Portfolios, as there are many that are made up of equities, and also those focused on crypto assets.

In this case, you can take your pick of the Smart Portfolios on offer and invest $500 or more to add it to your portfolio. Each portfolio is weighted, managed, and periodically rebalanced. In this case, you are able to invest in a curated portfolio of assets with no management fees and little research.

| Number of Stocks | 2,500+ |

| Deposit Fee | FREE |

| Fee to Buy Coinbase | Commission-Free |

| Minimum Deposit | $10 |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

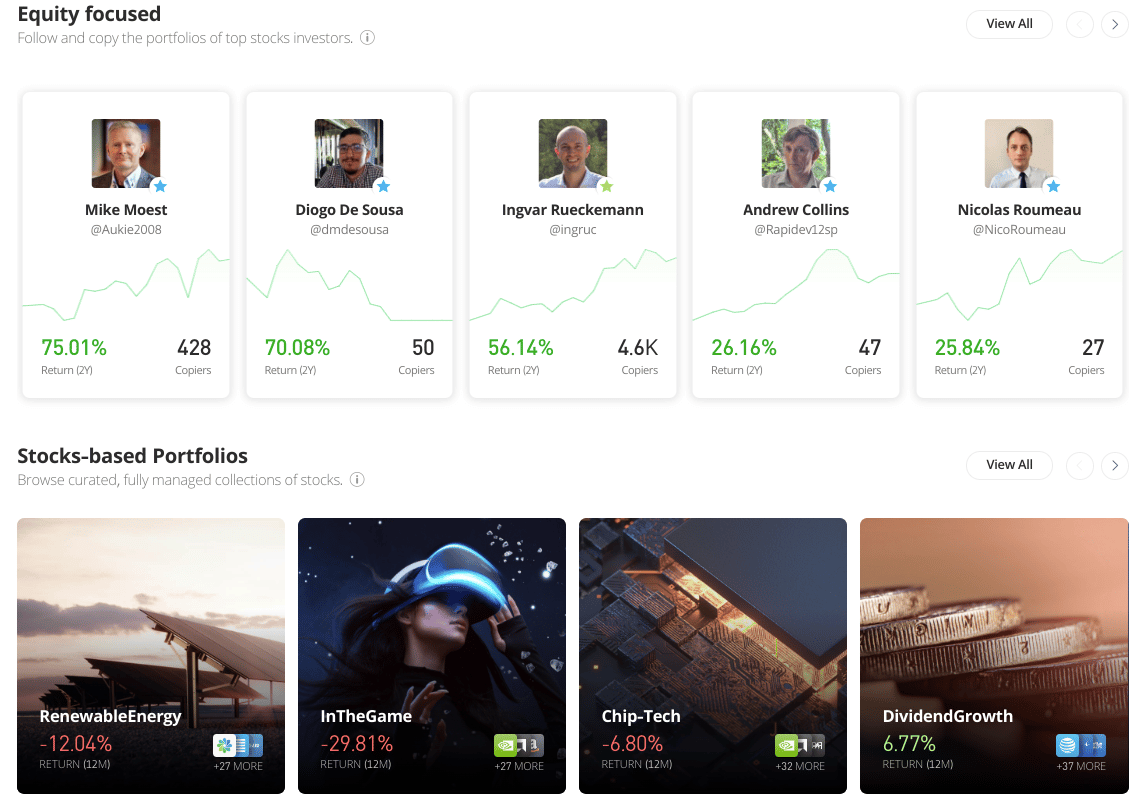

2. Webull

If you were hoping to diversify by adding foreign stocks to your portfolio at some point, note that this broker is somewhat limited in this department. Nonetheless, US stocks are commission-free. In contrast, internationally listed stocks are offered as ADRs, which on this platform attracts variable fees.

There is no option to copy seasoned investors on this platform. However, there is a customizable workstation, real-time market data, various technical indicators, price charts, and stock screeners, which is useful if you have some experience.

Webull also offers a free paper trading account, which, as we said, can be useful for all skill sets. Payment methods are limited compared to eToro. You can make a fee-free deposit via ACH, or you can fund your account with a bank wire transfer and accept the $8 charge on each transaction.

It’s also worth noting that a fee of $25 is applicable each time you make a withdrawal via bank wire transfer. This broker sometimes offers promotions to investors. For instance, at the time of writing, eligible traders can get six free stocks upon opening and funding a Webull account.

There are plenty of terms and conditions attached to this promotion, so familiarize yourself with those before you decide whether this is the right place to buy Coinbase stock. Finally, Webull offers a free cell phone app so you can buy Coinbase stock when you are away from your desktop device with ease.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Coinbase Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research Coinbase Stock

Prior to allocating any of the funds that you have aside when you've learned to invest in Coinbase - ensure you carry out thorough research.

To give you the a simple start possible, below you will see some crucial information and data about the company to help you determine whether or not Coinbase represents a viable investment.

What is Coinbase?

Coinbase is one of the DeFi stocks on the market in 2023. Former Airbnb engineer Brian Armstrong created the Coinbase exchange in 2012. At this point, the platform became the cryptocurrency exchange we know today.

This is a place where people can buy, sell, transfer, and store digital currencies

- Coinbase is a US-based company and cryptocurrency exchange platform that is available in over 100 countries

- This is one of the biggest publically traded cryptocurrency companies of its kind

- At the time of writing, the exchange serves more than 98 million clients, 230,000 ecosystem partners, and 13,000 institutions

- Coinbase offers multiple products which are built for the cryptocurrency economy

- This includes Prime API programming, query and transact services, and more

- Businesses can also access a range of products, including but not limited to the Prime platform, commerce, institutional-grade offline storage, and more

- Individuals have the Coinbase trading platform to buy and sell digital assets and can also access a hosted wallet, a crypto Visa card, and more

This crypto exchange is a force to be reckoned with. When it comes to trading volume, Coinbase is one of the biggest in the US.

As such, when you've familiarized yourself with investing in Coinbase, you're inadvertently capitalizing on the popularity of cryptocurrencies as well.

Coinbase Stock Price - How Much is Coinbase Stock

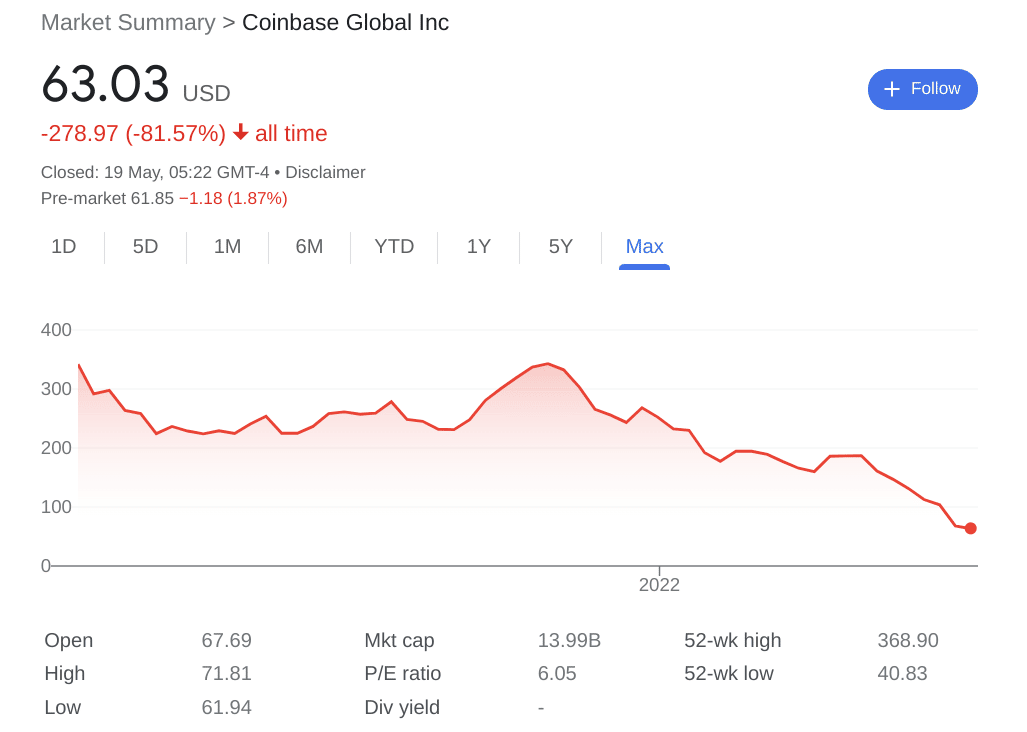

Coinbase officially became a cryptocurrency exchange in 2012. Prior to its public listing, the stock was only available to private investors. This was via the NASDAQ private market. This all changed in April 2021, when Coinbase went public via a direct listing. The move allowed retail investors to buy Coinbase stock too.

After a volatile session, Coinbase stock completed its first day of trading at a little over $328, down from a high of around $425. This was impressive after initially receiving a $250 reference price from the NASDAQ.

Coinbase's IPO was a landmark moment, as no cryptocurrency exchange had ever been publically listed on a US stock exchange before then. Not only that, but this valued the company at ten times more than it was when it was a private firm with no listing. Cryptocurrencies such as Bitcoin also increased amid the enthusiasm for the Coinbase listing.

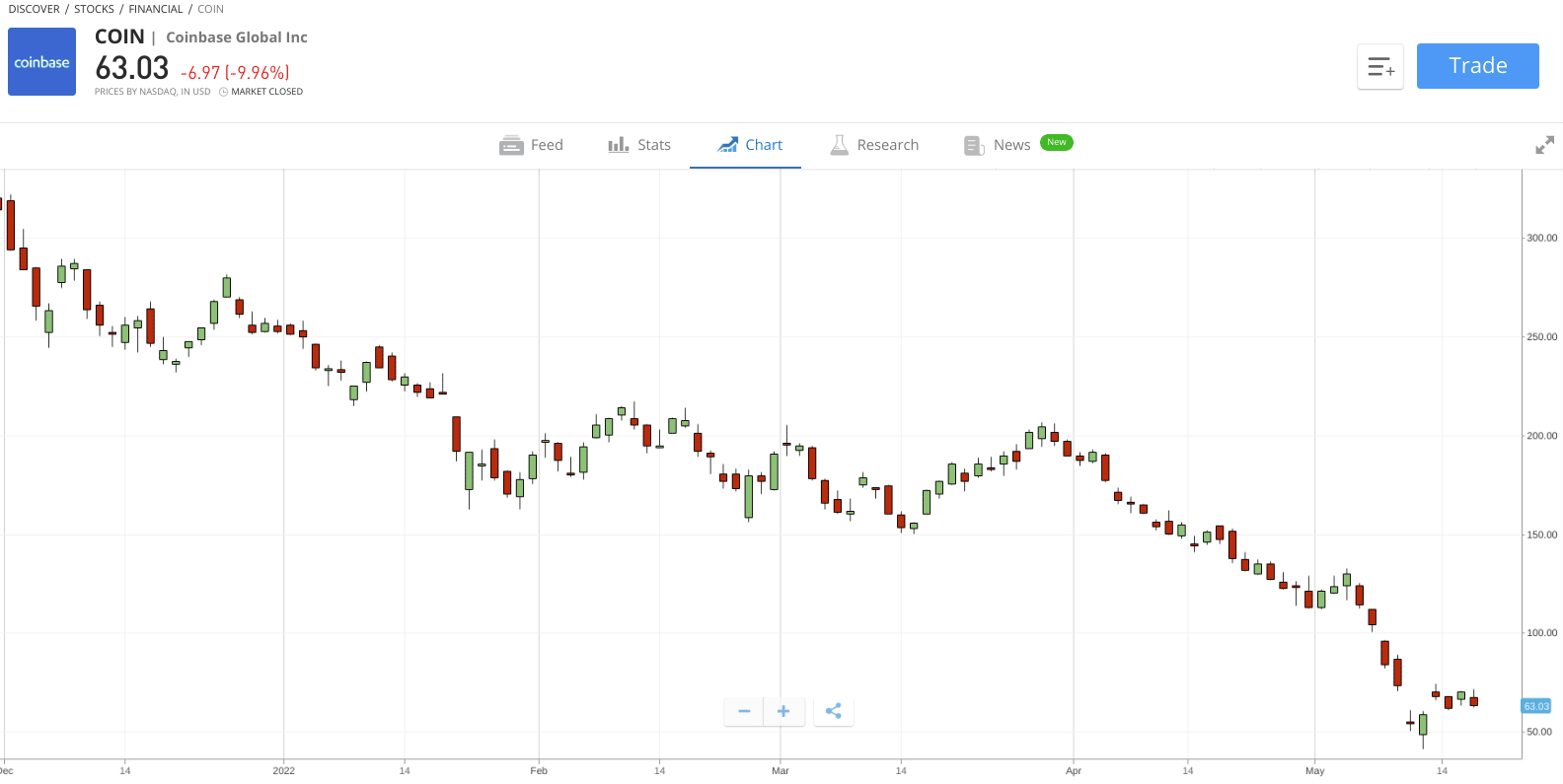

Throughout most of 2021, Coinbase stock was trading between a low of $220 and a high of $344. By early November 2021, Coinbase stock closed at its all-time highest value to date when it hit $357 However, by the 20th of December 2021, Coinbase stock had fallen to $238. This illustrates a drop of over 33% in less than two months.

The reason behind this was largely down to the company's Q3 2021 financial results, which many investors found to be disappointing. Coinbase stock entered 2022 at just over $252. By the end of January, traders could buy Coinbase stock for around $177. Since then, Coinbase stock has hit lows of $40.

Early 2022 has been fraught with inflation fears, economic uncertainty, and rising interest rates, and the cryptocurrency industry didn't escape the broader pullback. Coinbase is trading over 80% lower than its IPO. However, this company is still expanding and many believe this represents an opportunity to buy the stock at a cheap price.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

EPS and P/E Ratio

The P/E ratio and EPS of a company offer investors a closer look at its valuation and whether it might be trading at a reasonable price.

For any beginners learning to buy Coinbase stock, you will find this information in the company's quarterly financial reports.

- Coinbase's highest P/E Ratio in the last three years was 34.52 times

- The P/E ratio at the time of writing is 6.05 times

- Meanwhile, the diluted EPS, according to the Q1 2022 quarterly financials, was -1.98

Market Capitalization

Coinbase's strong financials have helped it to achieve some impressive valuations over the years.

- By June 2021, the company had a valuation of $86 billion

- At the time of writing, Coinbase carries a market capitalization of a much lower $14 billion

- That said, this still makes Coinbase a large-cap stock

When you buy Coinbase stock, you will see the market capitalization fluctuate constantly, along with supply and demand.

Index Funds

Coinbase stock is held by many leading funds.

This includes:

- ARK Innovation

- ARK Fintech Innovation

- ARK Next Generation Internet

- Amplify Transformational Data Sharing

- and many more

As such, you can invest in Coinbase stock by allocating some funds to one of these ETFs, whilst simultaneously exposing your investment portfolio to other companies. All the ETFs listed above can be found at eToro.

Moreover, the platform allows you to trade ETFs with 0% commission. You can also allocate small amounts of $10 or more to add a fraction of an ETF to your portfolio.

If you have no experience with funds and aren't sure where to start, you can learn by reading this guide here on trading ETFs.

Coinbase Stock Dividends

Coinbase does not pay dividends and has never hinted at doing so at any point in the future. That said, you could buy Coinbase stock and also invest in other dividend stocks at eToro.

This way you are able to diversify as well as receive regular dividend payments. If you are unsure of buying dividend stocks, you can learn by clicking this link, which will take you to a guide.

Coinbase Stock as an Investment

After getting clued up on the Coinbase stock price, company history, and funds it features in, you can consider whether or not it makes a solid investment.

Below you can take a look at some of the potential advantages of opting to buy Coinbase stock:

Coinbase Stock Offers an Alternative Way to Access Cryptocurrencies

Coinbase gives you access to some of the altcoins. An alternative is to invest in a large-scale crypto exchange instead.

You can achieve this by opting to buy Coinbase stock. This quite literally allows you to gain indirect access to the digital currency markets as it's one of the largest exchanges in the world.

Coinbase Has a Huge Customer Base and is Expanding

The majority of Coinbase's revenue comes from trading volume, and a large number of its customers are located in the US.

However, Coinbase is attempting to diversify its revenue streams by expanding internationally:

- Hiring experienced regional and country leaders around the world are among the first steps in Coinbase's plan for global expansion

- The goal is to allow Coinbase to better service consumers on a local level

- In 2022, the company aims to add 6,000 new employees, primarily to support its foreign expansion

- The company's CEO Brian Armstrong revealed that Coinbase is hiring 1,000 individuals to support its expansion into India alone

Other areas of expansion as part of Coinbases roadmap include:

- Americas - Canada and Latin America

- APAC - Asia, as well as Oceana

- EMEA - Sub-Saharan and North Africa, in addition to Europe and the Middle East

Coinbase is on track to achieve its long-term expansion goals. It entered Mexico in February 2022.

This enabled Mexican consumers to send and receive money as well as convert their digital currencies into the platform's 100+ crypto assets, including the USDC stablecoin.

As such, by using the Coinbase wallet, Mexican clients can avoid exorbitant sender fees whilst also having the opportunity to increase their funds and earn interest.

This follows its August 2021 entry into Japan, which was made possible by becoming partners with Mitsubishi UFJ Financial Group, a bank with 40 million customers in the country.

The Crypto Exchange is Diversifying its Revenue Stream With New Products and Services

When researching buying Coinbase stock, you may have seen that in October 2021, the exchange announced that it would build an NFT marketplace on the Ethereum network, akin to Rarible or OpenSea.

The Coinbase NFT marketplace is powered by Web3. The P2P marketplace will allow people to discover, buy, and mint NFTs. It also includes elements of social media, which the company hopes will set it apart from other providers of a similar ilk.

This NFT marketplace enables users to follow other people's activities on the platform as well as showcase their own profiles. On the 'For You' news feed, people will also be able to comment and like the posts of others. As such, the Coinbase NFT marketplace is likely to be more like a community.

In 2021, the NFT market was said to be worth around $25 billion. By the end of 2022, some market analysts think it could reach volumes of up to $35 billion in net sales.

According to Coinbase, over 2.5 million people signed up for the email subscription service for updates and joined the waiting list after the announcement. Management believes that the NFT marketplace has the potential to be a bigger business for Coinbase than crypto itself.

This could be accurate, given that over $10 billion was transacted on OpenSea in 2021 alone and this number is expected to be much higher in 2022. Market analysts believe this is one of many reasons Coinbase stock is a bargain, as it is potentially on the cusp of a huge growth spurt.

Coinbase Has Teamed up With Mastercard

Mastercard announced a partnership with Coinbase in January 2022.

This is exciting news for anyone looking to buy Coinbase stock.

- Coinbase's goal was to eliminate friction in the NFT buying process by partnering with Mastercard

- Coinbase and the payment giant struck a deal that will allow clients to purchase NFTs on the platform using a credit or debit card

- While this arrangement means you won't need crypto to buy an NFT, you'll still need a digital wallet to hold them

- If you need some help finding such storage options, you'll find a guide on crypto wallets here

- At the moment, customers must open a crypto wallet, purchase digital currencies, and then spend those on NFTs in an online marketplace

As such, this is a smart move by Coinbase. The fact that direct fiat payments will be accepted on Coinbase's NFT marketplace could attract even more traders looking for the next big digital asset to add to their portfolio.

Wants to Establish an Open Financial System for Everyone

Coinbase's objective is to expand global economic freedom. Approximately 1.7 billion adults in the world are unbanked and it is a problem that affects many countries.

Despite this, two-thirds of unbanked people own a phone that should enable them to access financial services.

- These are the types of problems that crypto is ideally suited to address. As such, Coinbase is well-positioned to provide a financial solution

- Coinbase wants to get crypto into the hands of everybody who wants it, regardless of their financial situation

- With decentralized and non-custodial products like Coinbase Wallet, the company is positioned to access overseas markets at scale

- This will allow Coinbase to provide user-controlled, secure, and straightforward interactions with local communities

- Additionally, this will enable more people to have experiences like NFT drops from local creators

As we said, this expansion is already underway. Coinbase will provide a full suite in those countries that have clearly defined crypto regulations.

This includes the custodial, full-fiat trading solutions, such as the flagship Coinbase app, and products that host user-created content such as the NFT marketplace.

Coinbase will also provide a comprehensive suite of sophisticated prime brokerage services to institutional clients around the world, including custody and private client support.

Step 3: Open an Account & Buy Stock

In this section of our guide, we offer a full guide of buying Coinbase stock from start to finish.

We will show you the steps to creating an account with a broker and buying Coinbase in five steps next.

Step 1: Open an Account with a Regulated Broker

Select a regulated broker, visit its homepage and complete the registration process. This takes a few minutes then you'll be able to buy Coinbase stock and other assets.

You will start by entering your chosen username and a strong password. The broker will also need you to enter an email address that will be connected to your account.

When prompted, add your date of birth, nationality, full name, address, and social security number. There is also a simple questionnaire to fill out.

This will require some very basic information about your prior trading experience, that is if you have any.

Step 2: Upload ID

As per AML laws, you will be required to complete the KYC process. This is simple and simply entails attaching some ID so the broker can validate your identity.

This process is standard practice at any regulated brokerage and takes a matter of minutes at this particular trading platform.

- You can upload a copy of your passport, a driver's license, or your state ID for the first part.

- Then, you can upload a copy of a recently dated utility bill, bank statement, or other official letter addressed to you.

Step 3: Deposit Funds

To buy Coinbase stock, you'll need to make sure you have the appropriate funds in your account. To do this, make a deposit by selecting one of the many payment types on the platform and then enter a monetary amount.

The minimum amount you can finance your account with is $5. You can choose between credit/debit cards, bank wire, Rapid Transfer, ACH, and e-wallets.

In terms of e-wallets, you can pick from PayPal, Skrill, and Neteller. Enter all the required information and confirm by selecting 'Deposit'. US traders are not charged any deposit fees.

Step 4: Search for Coinbase Stock

Placing an order to buy Coinbase stock is simple.

Click on the search bar, enter 'Coinbase' into the empty field and when you find it, click 'Trade' to confirm you wish to place an order.

Step 5: Buy Coinbase Stock

Once you've located it and pressed trade, you can complete your order and buy Coinbase stock.

Here, we are choosing to buy Coinbase by allocating $20. You can, however, risk as little as $5 when buying Coinbase stock.

Furthermore, as we've mentioned throughout this guide, you will not need to pay a commission when you buy or sell Coinbase stock at some brokerages.

Factors Affecting Coinbase Stock

There is a mixed sentiment on whether or not Coinbase stock is a buy or sell.

Those that are bullish like Coinbase for the following reasons:

- Coinbase serves over 98 million clients on its crypto platform, making it one of the biggest in the world

- The company has big plans for growth in the coming years and is in the midst of a global expansion. This expansion plan will include various parts of the Americas, Asia, Europe, Africa, and more

- When you buy Coinbase stock, you are able to indirectly invest in the cryptocurrency market without purchasing and storing digital assets

- The company is over 80% down from its IPO, which many believe makes it a cheap growth stock to buy

- Coinbase is busy building an NFT marketplace that is powered by Web3 - which has social media aspects to it

- NFT traders can buy unique digital assets with a credit or debit card directly thanks to the Coinbase Mastercard partnership

This should help you decide whether learning to invest in Coinbase stock is worthwhile. As you can see from the above recap, there is every chance that this already popular exchange will continue to grow and expand on a global scale.

Conclusion

In this guide, we talked in detail about investing in Coinbase stock. We also divulged the company's financials, stock price, and road map for the coming years.

When you're making your mind up on where to buy Coinbase stock, it's important to look at everything from fees and regulation to available markets and ease of use.