The Decentraland metaverse platform is powered by its native token, MANA crypto. MANA tokens can be used to purchase both virtual land plots and in-world products and services in Decentraland. A metaverse is a shared virtual world where users can socialize, interact, learn, and play.

In other words, Decentraland is a decentralized world where users explore land owned by users, experience scenes and structures, trade virtual assets, and connect. If the MANA coin interests you and you want to learn more about how to invest in Decentraland, this guide explains how to buy MANA on an exchange.

How to buy Decentraland – Quick Steps

If you are looking to invest in Decentraland one way to do so is to buy Decentraland native coins, i.e. MANA tokens. The FCA regulated eToro platform is one option. It has listed the Decentraland cryptocurrency so you can securely buy MANA coins with a debit card, Paypal, or bank transfer.

- ✅ Step 1: Making an account on eToro: To begin, sign up for an account on eToro.com. Fill in the required information. Then, upload a copy of your ID to authenticate your account.

- 💳 Step 2: Deposit: eToro charges no fees for USD deposits, and US consumers must fill their accounts with just $10. You can pay with a debit/credit card, PayPal, bank wire, or any other way that is supported.

- 🔎 Step 3: Search for Decentraland (MANA) token: Search for ‘Decentraland (MANA)’ to get right to the correct investment page. The MANA page will open, and you must click on ‘Trade’ to proceed.

- 🛒 Step 4: Purchase Decentraland Token: Finally, tell eToro how much money you want to put into Decentraland (MANA) – starting at $10. To confirm, click ‘Open Trade.’

Where to Buy Mana – Full Reviews

In order to buy Decentraland (MANA), several crypto exchanges support this popular metaverse coin. Below we review some of the top exchanges where you can buy Decentraland’s native coin.

1. eToro – A well-regulated platform that offers safety and security

eToro is a well-known online brokerage that specializes in cryptocurrency

Today, eToro’s popular online trading platform supports more than 75 cryptocurrency assets, as well as an enterprise-grade crypto exchange for professional traders and a multicurrency crypto wallet. Making it the top answer for people asking where to buy MANA coins from.

Customers can deposit fiat currency from a debit card or bank account and start trading right away using eToro’s easy web-based platform and well-designed mobile app. Users may examine current prices and buy, sell, or convert cryptocurrency using the simple “Trading” tab.

eToro is perhaps most known for its social trading and copytrading features, which allows users to replicate elite traders’ portfolio holdings and trades. Although eToro provides basic market and limit orders, it lacks several of its competitors’ more powerful conditional orders, advanced charting features for TA, and cryptocurrency pairs. Day traders might want to open a second account on Binance exchange.

It does support crypto staking on several assets, currently Ethereum, Cardano and Tron.

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Pioneering payments and cryptocurrency platform

In 2019, Crypto.com, a pioneering payments and trading platform revealed

On the Crypto.com exchange platform, MANA joined 250+ cryptocurrencies and stablecoins, including Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Ripple (XRP), TrueUSD (TUSD), PAXOS (PAX), and its own CRO token.

Users can now acquire MANA at true cost with USD, EUR, GBP, and 20+ fiat currencies by credit card or bank transfer, thanks to the addition of MANA to the Crypto.com App.

Crypto.com also offers the MCO Visa Card, which extends MANA’s functionality by allowing customers to change cryptocurrencies into fiat currencies and spend at over 40 million merchants worldwide.

Cryptoassets are a highly volatile unregulated investment product.

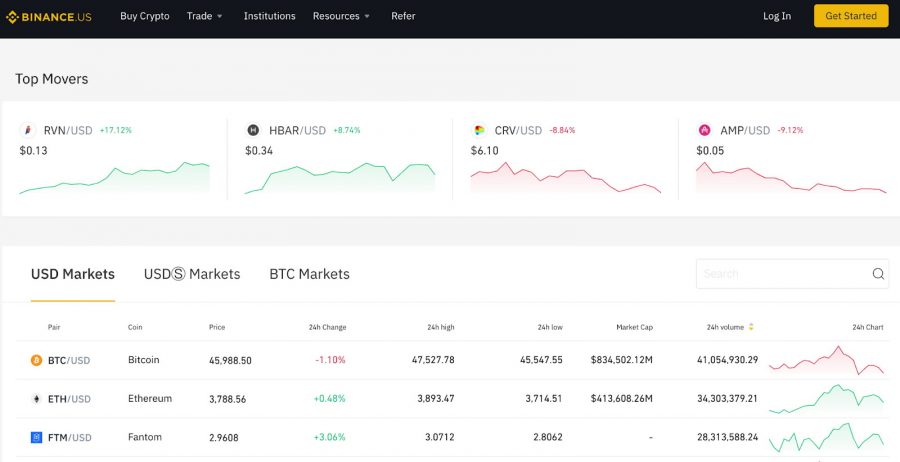

3. Binance – World-renowned platform for dealing in Cryptocurrency

Binance is one of the world’s largest and best-known cryptocurrency exchanges.

They raised funding for the exchange by running a successful initial coin offering (ICO) at the time. Since then, they have established themselves as one of the most well-known and trustworthy exchanges in the industry.

Binance, based in Malta, has quickly become one of the most popular crypto exchanges for traders, thanks to its reputation for transparency, a diverse choice of cryptocurrencies, and low exchange costs.

The advantages of buying Decentraland (MANA) on this exchange include lower costs and improved liquidity, allowing you to purchase and sell rapidly to take advantage of market-moving news.

This exchange is ideal for investors from Australia, Canada, Singapore, the United Kingdom, and other countries. US traders can use a more scaled down version of the platform, Binance US.

Cryptoassets are a highly volatile unregulated investment product.

4. Coinbase – One of the early entrants in the crypto industry

Coinbase is a publicly-traded cryptocurrency exchange that is listed on the New York

Coinbase has seen over 70 million users trade over 460 billion dollars in volume. With 98 percent of customer funds housed in secure offline storage, security is a top priority. The platform is simple to use and is available on desktop, Android, and iOS, with over 140 cryptocurrencies, including Decentraland, to trade (MANA).

Coinbase provides two trading platforms. The normal Coinbase platform is more user-friendly, making it ideal for novices. Customers who choose Coinbase Pro can examine real-time order books, use charting tools, and save money on fees.

Coinbase is a highly functioning and user-friendly mobile app that allows users to purchase, sell, and manage their Bitcoins from anywhere, and its crypto wallet also supports storing NFTs.

Cryptoassets are a highly volatile unregulated investment product.

What is Decentraland?

Users may create and commercialize content and applications on Decentraland, a 3D virtual reality platform. Decentraland is a blockchain-based project that aspires to create a network that is owned by its members and provides an immersive experience. Users can buy virtual pieces of land on the platform, which is a shared metaverse.

A metaverse is a shared virtual world for business and leisure. Decentraland is one of the first and leading decentralized worlds where people can explore the land they own, buy non-fungible tokens (NFTs), interact with scenes and constructions, trade virtual assets, and connect.

Explore the Decentraland metaverse

As people spend more time in virtual worlds for work and play, the network regulations and content flow are managed by large centralized corporations. In exchange, the creators and developers are often paid a pittance.

To address this, Decentraland provides a decentralized infrastructure for users to gather, share content, and play games, as well as enabling artists to receive full compensation for their work. Advertisers may showcase their goods, artists can create virtual galleries for their digital art and much more on the site.

Is Decentraland a good investment?

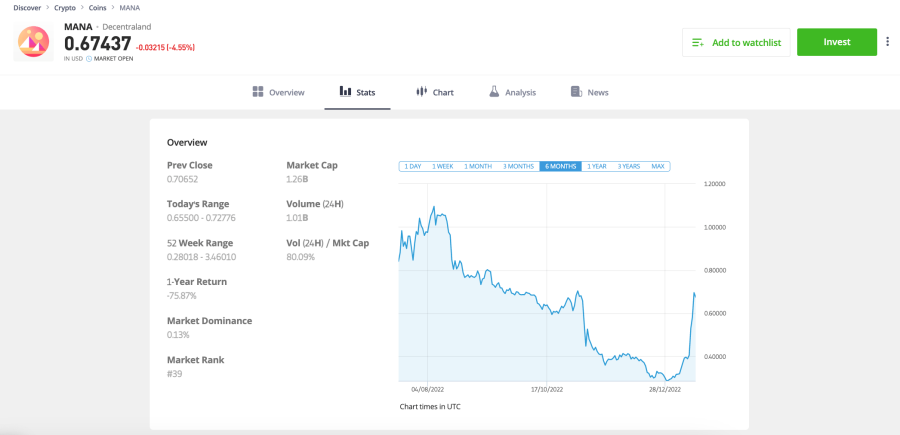

In terms of market capitalization, the Decentraland currency, MANA, is one of the most valuable cryptocurrencies, ranked #39 on Coinmarketcap.

MANA has been one of the best-performing tokens over the past few years. Luxury labels such as Gucci, Burberry, and Louis Vuitton have previously entered the metaverse via NFTs, boosting their popularity.

It has already attracted huge institutional investors like Grayscale, and it has enormous growth potential. Furthermore, as the metaverse grows in popularity, Decentraland may be one of the best platforms to capitalize on this craze.

However, MANA is down around 88% from its all-time high hit in November 2021, following a correction in the wider crypto markets throughout the majority of 2022.

Since then Bitcoin has recovered some of its losses and so has MANA – its value also increasing recently as a result of the revelation that Samsung has partnered with Decentraland for their planned Metaverse project. It’s possible the MANA price chart has found a bottom and will resume its bull market throughout 2023.

Unique Gamified Experience

Decentraland provides users with a gamified experience that is distinctive, rare, and free of centralized authority limits. Users are in charge of generating their own experiences, and they profit from the added value.

Smart contracts are managed by a decentralized autonomous organization that allows users to vote on improvements to ensure decentralization. Within the metaverse, users genuinely own their collectibles.

Strong Momentum

MANA began 2021 at a price of $0.08 and was trading for $0.03 on exchanges in 2020. Since then it’s made over 100x gains. The volatile rises and falls in MANA’s price provide opportunities to earn from trading.

However, due to the pervasive ‘risk-off’ sentiment within the markets, MANA’s price tanked throughout 2022. This downtrend does appear to have ended, as of January 2023, with the price of MANA skyrocketing in recent weeks.

Lucrative Virtual Land Sale

Republic Realm, a part of the online investment platform Republic, purchased 259 plots of virtual property in Decentraland for $913,228.28, the largest virtual land transaction ever. This sale represents Decentraland’s largest LAND acquisition to date. It depleted the MANA supply by 1,295,000 tokens.

With future LAND purchases, more MANA will be removed from the market. This will reduce MANA’s circulating supply while simultaneously reducing the number of tokens available for purchase. Scarcity might push MANA’s price to new all-time highs.

Famous Institutional Investors

Grayscale Investments, the world’s largest digital currency asset manager, introduced Grayscale Decentraland Trust on March 17, 2021, alongside four new digital currency investment trusts. Grayscale is presently managing $8.4 million in MANA assets. Their return on investment (ROI) is 76 percent, which is even more amazing.

These figures are available to the public and may persuade other institutional investors to invest in the token. Large investments by well-known corporations are often key drivers of asset price and could provide long-term support for MANA.

Potential for growth

Software engineers and developers are creating a growing number of interactive 3D games and applications thanks to a variety of technologies. After Chiliz (CHZ) and Enjin Coin, Decentraland (MANA) is ranked third in the market valuation of NFT crypto trading assets.

Many traders believe MANA is trading at a lower price than its real value. As a result, the MANA token is a good investment for value investors looking to profit on the difference between market and intrinsic value. While there are many compelling reasons to invest in MANA, it’s crucial to be aware of the hazards involved.

History of Great Returns

It is really surprising that MANA had a trading price of $0.08 on January 1, 2021. MANA had returned 4000 percent by the end of 2021, according to data gathered from Coindesk. MANA hit an all-time high of $5.90 on November 25, 2021, according to CoinMarketCap.

This gives tremendous potential for cryptocurrencies and day traders to earn passive revenue from the crypto trading asset in a short period of time.

MANA might become one of the best cryptocurrencies you’ve ever included in your investment portfolio by taking advantage of its volatile nature, which sees the asset undergo dramatic spikes and unforeseen losses in minutes.

Competition in the NFT Market

Decentraland is not alone in being one of the first virtual reality platforms. From the beginning, Litecoin, Dogecoin, and Dash competed with Bitcoin. When it came to smart contracts, Ethereum faced competition from Tron, Binance, and another Ethereum killer, Cardano.

The market is still dominated by major businesses like Axie Infinity, Chiliz, and Enjin. Decentraland is thus currently playing second fiddle to another NFT Marketplace. MANA’s price may rise over time as the project acquires experience and its crypto trading asset adapts to the crypto trading ecosystem.

AXS and other innovative tokens issued by issuing NFT markets may continue to dominate the market. This does not speak well for MANA in the long run. Because there are so many coins in the decentralized market, any investment could result in losses that are not recoverable.

Decentraland Price

During the November 2021 NFT boom, Decentraland price valuations soared. The price of MANA increased by more than 764 percent – including a 266 percent increase in a single day.

However altcoins are volatile and the MANA price later corrected back to retest its previous peak around the $1.75 area.

As touched on earlier, the MANA price has been on a sustained downtrend since early 2022. Price is now 88% below November 2021’s all-time highs – yet a reversal may be on the cards after optimistic CPI data was released.

MANA Price Prediction

The MANA asset is currently attempting to halt the bearish trend and resume its overall bull cycle. If the MANA price continues to rise at its current rate, it could revisit the $4 to $5 trading range by the end of 2023 – especially as interest rate increases may be coming to an end.

A long term price prediction for MANA, in the bullish case, could see further price discovery above its ATH and expansion above $10 before 2030.

Risks of buying MANA

In comparison to major cryptocurrency assets like Bitcoin or Ethereum, any low cap altcoin like MANA is a more ‘risk on’ asset.

Decentraland also faces competition from other virtual reality environments such as Meta’s Horizon Worlds and Microsoft’s The Sandbox. Compared to Decentraland, both companies have greater resources and reach.

Decentraland and Meta, for example, are in different stages of their metaverse journeys. However, Decentraland has some disadvantages, such as high fees. The Sandbox and Horizon Worlds are both more user-friendly than Decentraland. While this may change as the platform matures, its flaws could impact user retention.

Ways of Buying MANA

There are many ways to buy MANA, depending on your preferred payment method:

Buy MANA with Credit Card or Debit Card

One of the most popular payment methods to buy cryptocurrency is debit and credit cards. It is, in fact, one of the most efficient ways to purchase Decentraland on eToro. The broker will not charge you any deposit fees in this situation, but your card issuer may charge you a modest transaction facilitation fee.

When buying MANA on eToro, the minimum trading amount is $10. It’s also a good idea to convert your foreign cash into US dollars before making the deposit.

Buy MANA with Paypal

Decentraland may be purchased using PayPal on crypto trading platforms like eToro. Even still, the PayPal deposit option is limited to countries that offer both eToro brokerage and PayPal.

The trade limit for buying MANA using PayPal on eToro is set at $10, as it is for the rest of the allowed payment methods. You can deposit as little as $10 and as much as $10,000 into the brokerage using PayPal. You should also make USD deposits to avoid being charged a 2% currency conversion fee.

Buy MANA without ID Verification

Most crypto exchanges and brokerages will not allow you to buy Decentraland anonymously due to growing calls for crypto regulation around the world.

The handful that allows you to acquire Decentraland anonymously (without ID verification) will keep trade limitations low.

Best Decentraland (MANA) Wallet

When it comes to security, hardware wallets are the most secure and convenient way to store your Decentraland MANA (MANA). These hardware wallets were created with the purpose of securely storing private keys. Because they do not link to the Internet at any moment, they are regarded as safer than desktop or smartphone wallets.

Because malevolent parties cannot meddle with the device remotely, these qualities drastically decrease the attack vectors open to them. A few examples of such wallets would be Ledger, Coinbase, Token Pocket, Hyper Pay, Free Wallet etc.

eToro wallet – One of the safest for storing crypto and NFTs

Apart from the abovementioned wallets, one of the most popular Decentraland wallets is eToro. You’ll need to consider how you want to store your digital assets once you’ve learned how to invest in MANA coin.

For verified eToro platform users, eToro offers one of the best wallets. It supports over 120 cryptocurrencies and lets users save, receive, purchase, transfer, and exchange over 500 different currency pairs. Multi-signature security, such as distributed denial-of-service (DDoS) protection and standardization protocols, are also included.

Cryptoassets are a highly volatile unregulated investment product.

How to buy Decentraland Crypto – Tutorial

Below is a detailed guide on how to buy MANA from start to finish.

1. Open an account on eToro

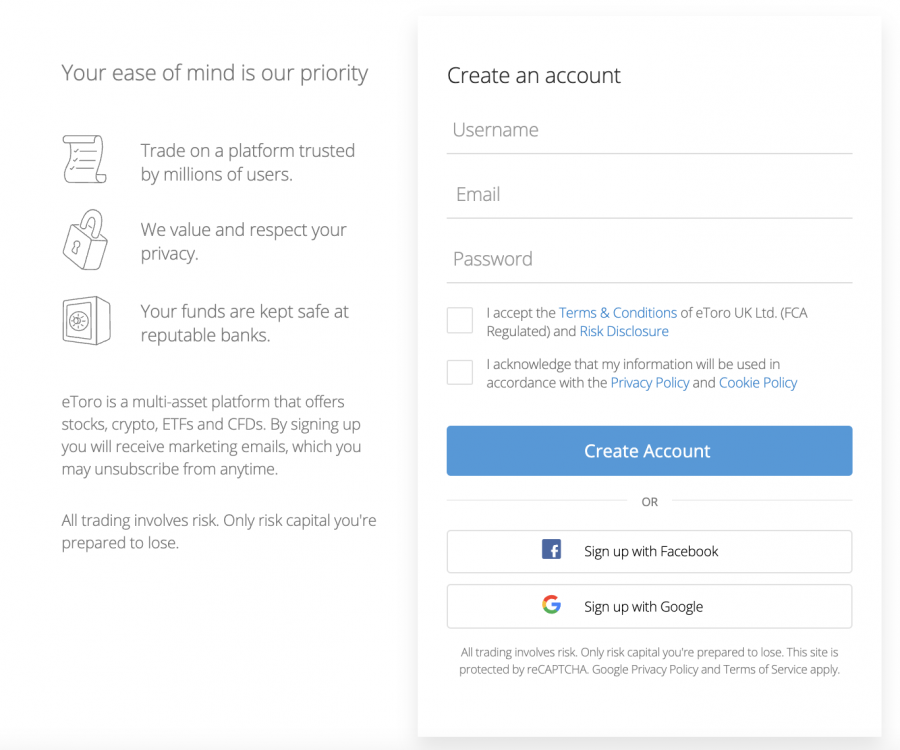

To get started, you must first create an account with eToro. Fortunately, the technique is straightforward and does not necessitate lengthy registration procedures. Simply go to eToro’s website, click the ‘Join Now’ button, and fill out your personal information.

2. Finishing the Account Verification Process

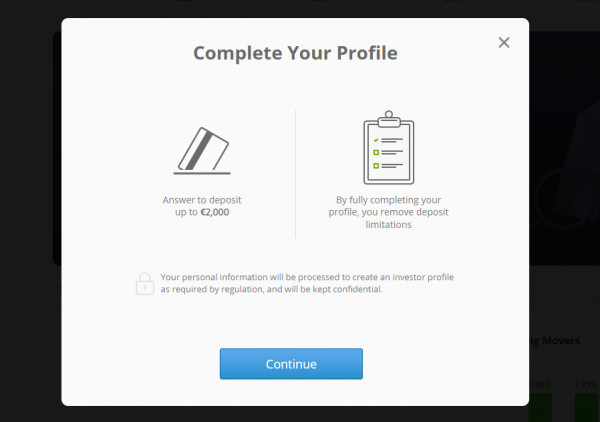

You must authenticate your identity after you have completed the signup process and validated your email address.

This is because eToro is regulated by the FCA and must follow all of the British regulator’s KYC processes. As a result, you must provide evidence of identity and proof of address to validate your new eToro account.

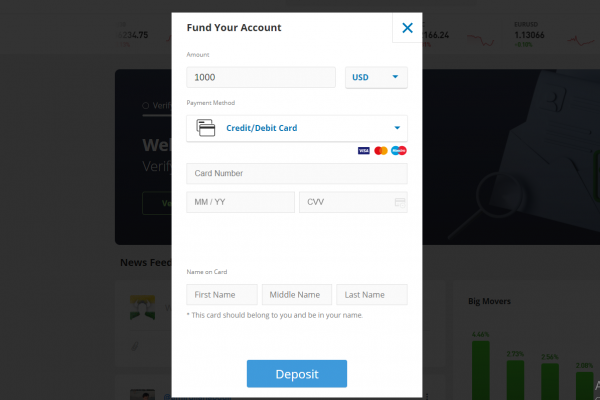

3. Adding funds to your account

You can now make deposits into your account. However, keep in mind that eToro offers an unlimited sample account, allowing you to switch between the genuine and demo versions at any time. If you are a newbie, we recommend that you practice on the eToro demo account before investing real money.

Nonetheless, once you’re ready to deposit, go to eToro’s trading dashboard and click the ‘Deposit’ option, then select one of the available payment methods: credit/debit card, PayPal, bank wire transfer, Neteller, or Skrill. Then you must make a deposit of at least $10 (about £8).

4. Buying Decentraland Coin

To purchase a Decentraland cryptocurrency on the eToro platform, type Decentraland or MANA into the search field, then select the first result from the drop-down menu. Navigate to the ‘Buy’ button on the Decentraland instrument page, enter the amount you wish to invest, and then click the ‘Open Trade’ button to finalize your MANA buy.

MANA Coin on eToro

To place a stop loss and take profit order, go to the portfolio area and place these orders that will help you manage your position and limit risk.

To confirm your investment – click on ‘Open Trade’.

Cryptoassets are a highly volatile unregulated investment product.

How to sell Decentraland (MANA)?

Selling MANA is just as simple as the process to buy MANA tokens and can also be done on eToro.

If you followed the steps above your MANA tokens are securely held on eToro and can be sold back into cash at any time, by again selecting ‘Trade’ and ‘Open Trade’. No storage fees are charged by eToro and you can also optionally use the copytrader or Smart Portfolios tool to put your MANA investment to work.

That way professional investors will make buys and sells on your behalf or adjustments to your portfolio allocation depending on the market conditions.

Latest Decentraland News

Finally, let’s take a look at some of the most pressing news items related to Decentraland for the week beginning January 16th 2023:

- It’s been an excellent week for MANA investors, as the token’s price has rocketed by over 81%. At the time of writing, MANA is now hovering around the $0.67 level.

- On January 30th, CME Group will launch reference rates for three metaverse cryptos – including MANA. This will allow investors to track pricing more accurately.

- Finally, Decentraland’s price has benefitted from recent CPI figures, which hinted at a slowdown in inflation. This is excellent news for MANA (and other cryptos), as further rate increases may not be needed – meaning ‘risky’ assets will look more appealing.

Conclusion

If you are looking to become a virtual real estate agent and flip land parcels at a potential profit then investing in Decentraland by buying MANA coins might be a great option for you. Or if in general you’d like to invest in metaverse tokens and the projects they power.

FCA regulated crypto platform eToro supports many metaverse coins such as Axie Infinity Shards, Enjin, The Sandbox, and also MANA. It’s Smart Portfolio geared towards metaverse coins is known as ‘MetaverseLife’ and allows to invest in MANA alongside other related metaverse crypto coins.

Cryptoassets are a highly volatile unregulated investment product.