Forced to temporarily close its theme parks, the large brand weathered some tough times over the pandemic. It now faces pressure in the competitive streaming sector. Its stock price is at a 52-week low; so is it time to pounce on Mickey Mouse and invest… With our overview of the strengths and weaknesses of Disney stock, we find out below.

What’s more, we give you the details on buting Disney stock safely and cheaply. We review two regulated brokers where you can buy Disney stock with zero commission and learn about stock investing as you go. Let’s begin with a brief overview of how simple it is to buy shares online:

Buying Disney Stock – An Overview

- ✅Step 1: Open an account with a regulated broker– Kickstart your Disney stock journey by entering a few details.

- 🔑Step 2: Verification – As a regulated broker, KYC (Know Your Customer) procedures are used to keep fraudsters out. Have some personal and address ID ready.

- 💳 Step 3: Deposit – Choose from credit/debit card, ACH, bank transfer or e-wallet.

- 🔎 Step 4: Search for Disney Stock – Find Disney stock (ticker label: DIS) immediately by entering ‘DIS’ in the toolbar.

- 🛒 Step 5: Buy – Enter how much USD you want to spend and activate your trade.

Step 1: Choose a Stock Broker

Online there are a bewildering choice of stockbrokers.

The most popular stock trading platforms usually offer:

- Thorough Regulation

- Zero Commission on Stock Purchases

- Tight Spread Fees

1: Thorough Regulation

Regulation by a sove

In the US, regulation often means that investors are covered for compensation claims to some extent in the event of a company going bust.

Look for:

- Regulation with the Securities & Exchange Commission (SEC).

The SEC is the definitive regulatory body in the US when it comes to financial assets. - Regulation with the Securities Investor Protection Corporation (SIPC).

This gives you compensation coverage up to $500,000. - A broker that keeps investor funds in a Tier 1 bank covered by the Federal Deposit Insurance Corporation (FDIC).

This gives you compensation coverage up to $250,000.

Both brokers we review below — eToro and Webull — feature a robust complement of regulation in the US and beyond.

2: Zero Commission on Stock Purchases

Commission is a trading fee that brokers often charge. It is a percentage fee of your transaction that the broker claims for themselves.

For example, if you were to buy one of the popular new stocks with a broker, the commission fee for that stock might be 2%. That means that, if you buy $100 of stock, you will be charged $2 by the broker.

Note that commission fees usually apply to selling as well as buying stock. But, with the two brokers we review below, no commission fee at all is charged when you buy Disney stock, or any other stock.

3: Tight Spread Fees

Like commission, spread fees are a trading fee. All brokers, including the ones we review below, charge spread fees. That’s because a spread fee covers the cost of your transaction.

A spread fee can be a little tricky to understand because it isn’t a fee that is charged separately. It is, strictly speaking, a difference in price that will affect your trade.

Here’s how a spread fee works:

- At any given time with a broker, there is a difference between the price you can buy a stock at (sometimes called the ‘bid’ price), and the price you can sell it at (sometimes called the ‘ask’ price).

- This difference is called the spread.

- The spread fee is this difference divided by the buying price, expressed as a percentage.

- You want this percentage to be as low as possible.

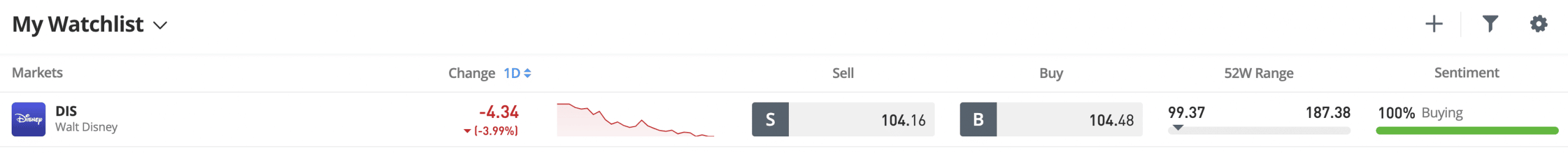

Spread Fee Example: Disney Stock

- The Disney Sell price (S) = $104.16

- The Disney Buy price (B) = $104.48

- The Disney Spread = $104.48-$104.16 = $0.32

- The Disney Spread Fee = $0.32/$104.48 x 100 = 0.3%

This means that, after you have bought and sold Disney stock and taken a profit (or a loss), eToro will have claimed 0.3% of what you have made (or lost).

As the Disney stock price goes up and down, the spread fee offered by brokers will generally (but not always) stay the same. This depends on liquidity ie. how much stock is being traded. For a big stock like Disney, liquidity is generally not a problem.

eToro offers particularly tight spreads on NASDAQ stocks.

1: eToro — Where to Buy Disney Stock at Zero Commission

You can buy as little as $30 of Disney stock (which is just under a third of a share) with this broker at a spread fee of just 0.3%. Unlike many other brokers, eToro does not charge commission on stock purchases.

3,000+ stocks are offered by eToro in all, with 900+ of them traded outside the US on 15+ worldwide exchanges like the London Stock Exchange, the Hong Kong Stock Exchange and the Paris Euronext. In terms of sectors there is a range, encompassing the popular tech stocks, family favourites like Disney and the popular new stocks too.

In addition to its stock offering, eToro provides ETFs (Exchange-Traded Funds), commodities, indices, forex and crypto. If you are a beginner, it can be worth for you look into trading ETFs in particular, as these allow you to minimise your risk by buying shares of different companies at once.

Apart from its reassuringly-high levels of regulation both inside the US and beyond, what makes eToro stand out is its commitment to beginner investors.

The eToro interface is really simple to use and uncluttered. A Watchlist allows to keep an eye on hot stocks at a glance. eToro offers two powerful Social Trading tools: CopyTrader, and Smart Portfolios.

CopyTrader allows you to copy other, more experienced, traders for free. And eToro’s Smart Portfolios, crafted by experts, allow you to invest in a strategic selection of shares from different companies in one go (similar, but not the same as, ETFs).

| Number of Stocks: | 3000+ (international) |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying Disney: | Spread fee of just 0.3% |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2: Webull

With Webull, you can choose from over 5,000 stocks (compared to eToro’s 3,000+). The downside is that the majority are in the US, although you can buy international stocks with Webull (including biotech stocks) using an ADR (American Depositary Receipt).

Apart from stocks, Webull offers other financial assets, including IRAs (Individual Retirement Accounts) and stock options (for advanced traders). eToro’ strength, on the other hand, is in offering a wide range of commodities, indices, forex and crypto.

You can buy stocks via credit card with Webull and eToro by simply charging your account balance with a card. But this comes with a $8 fee with Webull. And withdrawal via bank wire comes with a hefty $25 fee compared to a flat eToro withdrawal fee of $5 for all withdrawal methods.

Overall, we judge that Webull is a slick operation with plenty to offer the investing newbie. But, with its excellent Social Trading options, eToro takes the cake.

What We Like about Webull

| Number of Stocks: | 5000+ |

|---|---|

| Pricing System: | Spread fee, no commission |

| Cost of Buying Disney: | Spread fee: not available |

Your capital is at risk.

Step 2: Research Disney Stock

What is Disney

Last century, Disney made a name for itself as the leading producer in the world of animated feature films. Since then, it has diversified widely into live-action feature films, televisual content and theme parks.

Disney’s operations are divided into two main segments:

- Disney Media and Entertainment Distribution

Making, streaming and licensing its own content. - Disney Parks, Experiences and Products

Disney describes this segment as ‘the global hub that brings Disney’s stories, characters, and franchises to life through theme parks and resorts, cruise and vacation experiences, and consumer products.’ Leading Disneyland resorts exist in Florida, California, Paris, Shanghai and Hong Kong.

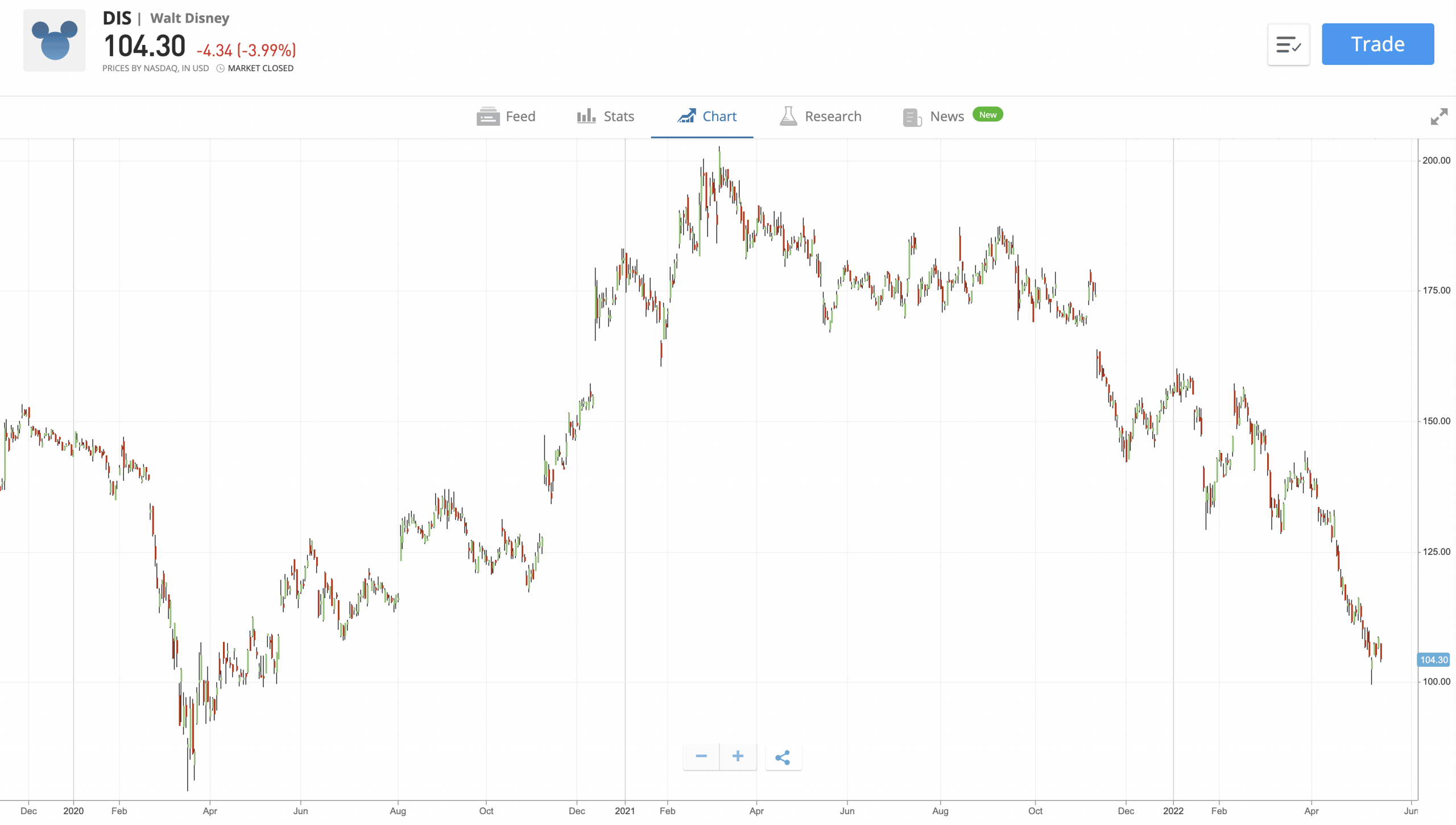

Disney Stock Price – How Much is Disney Stock Worth

The Disney stock price is currently $104.30. This is a 52-week low. In the year preceding April 2022, Disney had been the worst-performing of the 30 companies that make up the Dow Jones Industrial Average, having lost over 30% of its value.

- Disney is now down almost 50% on its March 52-week high of just over $200.

Let’s look at some key financials to get a clearer picture.

Disney: Three Key Financial Metrics

With broker eToro, you can access all sorts of data on Disney on its eToro homepage.

You can access a stock overview as well as an income statement, balance sheet overview and cashflow statement.

This can all be totally overwhelming for the beginner investor.

Here are three key financial metrics that can begin to give us an idea of whether Disney is overvalued and due for further slides in its share price — or rather one of the most undervalued stocks:

| Metric | Definition | Shows |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

| Debt-to-Equity Ratio | Long-term debt divided by shareholder equity | How much debt the company is in as a proportion of shareholder equity |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Disney EPS (Earnings Per Share): $1.08

There are many complexities to how companies calculate their EPS. Disney, for example, presents a diluted EPS figure, which does not take into account certain calculations.

However, what this figure of $1.08 means for the investor is that a) Disney is making a profit and b) more specifically, for every one of its 1.821bn shares in the market, it has been making roughly a dollar of profit in the previous 3 months.

Disney’s expected EPS for this reporting quarter was 10% higher than reported at $1.19.

Disney P/E Ratio: 74.9

Disney has a P/E ratio of 74.9. This means that the market rates Disney stock relatively highly in comparison to the profits it makes. There are many factors behind this high valuation, including the fact that Disney is a legendary brand as well as one with plenty of plans for the future.

- Close rival to Disney, Comcast, has a P/E ratio of 13.56.

- Paramount Global, another media giant, has a P/E ratio of just 5.27.

- Apple, media company by market capitalisation ($2.2trn) as a P/E ratio of 22.89. This means that Disney is effectively three-times more expensive than Apple when profits have been taken into account.

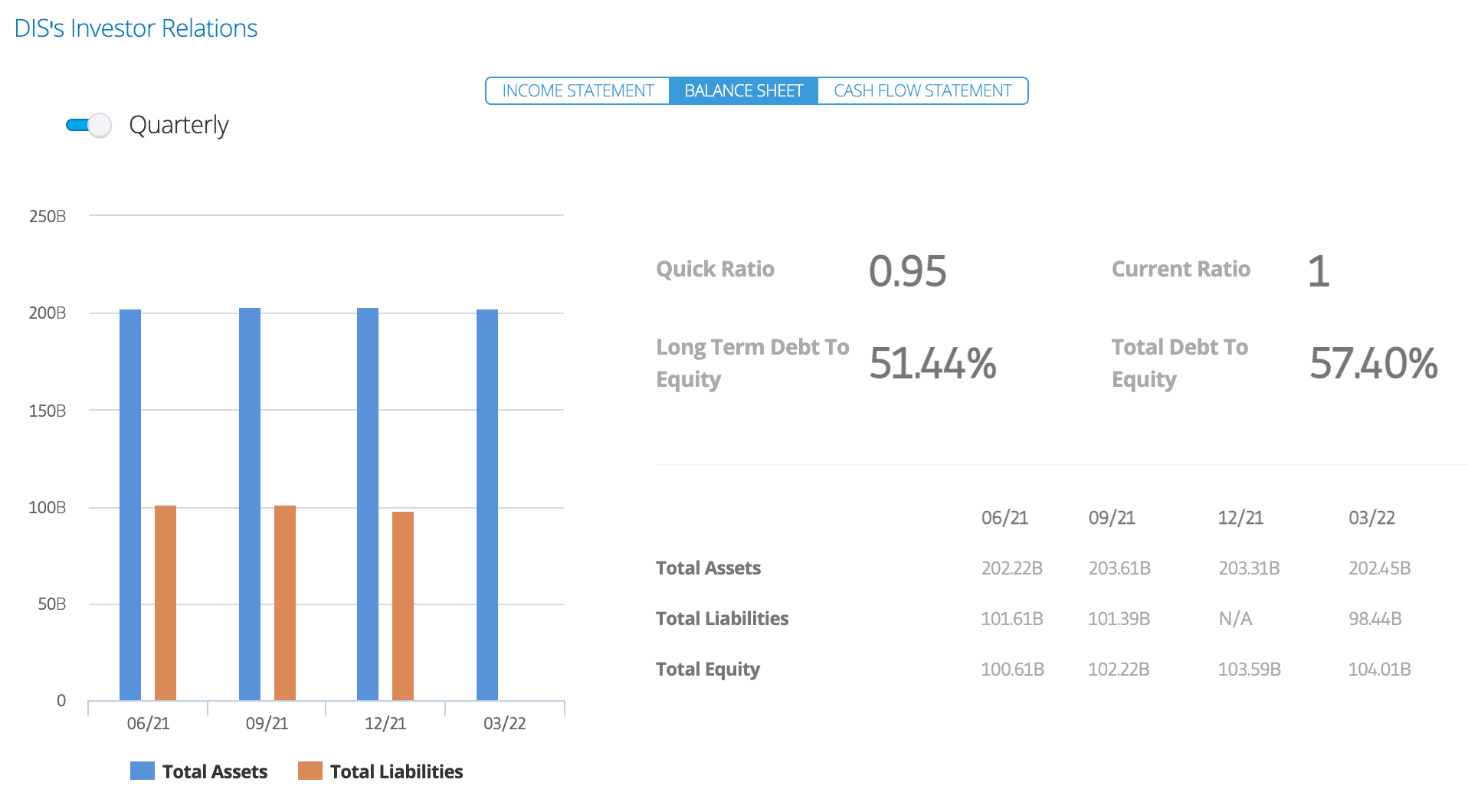

Debt-to-Equity Ratio: 57.4%

Simply put, Disney has roughly half as many debts as shareholder equity. Further, it has $202bn in assets, and $108bn in debts. It has a ‘quick ratio’ of 0.95, which measures its ability to pay off all its debts instantly. A quick ratio of at least 1 is considered strong.

Overall, Disney presents no obvious short-to-medium term financial risks.

Disney Stock Dividends

Dividends are payments that some companies pay out to shareholders on a quarterly or semi-annual basis.

To be eligible to receive a dividend payment, investors have to be holding stock at the time of the ‘ex-dividend’ date.

Disney used to be among the most popular dividend stocks, paying out dividends on a semi-annual basis. But in July 2020, it suspended its dividend payments after 40 years of payouts. This was down to financial pressures caused by the pandemic.

Disney had generally paid a dividend of between 1.2% and 1.8%. This dividend yield is relatively low in the media industry. But it doesn’t mean that Disney is stingy: historically Disney has also generated investor returns by share buybacks, which offer investors the advantage of tax deferral.

Although investor hopes were dashed that Disney would be paying dividends from Q4 2021, the dividend prospects are ample for the future. In 2021, Disney CFO Christine McCarthy said, ‘longer-term, we do anticipate that both dividends and share repurchases will remain a part of our capital allocation strategy.’

Factors Affecting Disney Stock

A ‘Strong Stock’ means different things to different investors. It all boils down to risk.

High Risk/Reward

If you are an investor with an appetite for high risk and high reward, then Disney would not be your first choice.

Disney is an established brand with a massive market capitalisation of just under a fifth of a trillion USD. Whatever happens next to its share price, it is unlikely to spike like a crypto stock to double or triple its value any time soon. Likewise, given its size and prestige, its value is unlikely to vanish overnight. That’s particularly the case given its very reasonable debt leverage (see below).

High-risk investors might prefer to take the risks involved with buying cheap stocks or even penny stocks, particularly in the area of biotech.

Medium Risk/Reward

Investors with a medium appetite for risk might be looking to buy Apple stock, for example.

Apple is in the risky area of tech provision, which has taken a beating on the stock markets since the beginning of the year. But, like Disney, Apple is a brand with unparalleled brand recognition among consumers as well as a leading provider in its various tech fields of computing and entertainment.

We might consider Disney stock to be a worthy alternative to Apple stock in terms of risk/reward (even though Apple, with a market capitalisation of $2.2trn, is over 10x bigger than Disney).

Low Risk/Reward

Disney is not a low-risk stock. Despite its supremacy as a brand known about the world, it is in the media industry. This is intrinsically more risky than many other sectors. One way of minimising risk whilst buying Disney stock would be to buy into it as part of an ETF. Broker eToro provides a selection of over 260 ETFs.

Disney — Dual Business Focus

Since transitioning from an out-and-out animation production house, Disney has divided itself into two business segments. One makes and sells entertainment content, and the other segment runs theme parks and cruises. This dual business focus makes the stock resilient. If one half of the business runs into trouble, there is always the other to rely on for revenue.

What’s more, Disney has conducted an aggressive policy of acquisitions.

Disney — Resilience through Acquisition

Giving it a deal of depth as an investment, Disney owns many key media companies:

- Televised Disney content is distributed via ABC, Disney, ESPN, Freeform, FX, Fox, National Geographic and Star.

- Disney film content is produced and marketed via Walt Disney Pictures, Twentieth Century Studios, Marvel, Lucasfilm, Pixar and Searchlight Pictures.

- Streaming content direct-to-consumer is provided by the Disney+, ESPN+ and Star+ brands.

In Q2, 2022, Lightshed analyst Rich Greenfield said that Disney should acquire Netflix to buttress its position in the hugely-competitive streaming sector.

Disney — Resilience in its Balance Sheet

A slightly worrying feature of Disney’s balance sheet is that it operates with a low net profit margin of just over 10%. That means there is not a lot of room for error.

On the plus side, the Disney balance sheet also reveals that Disney has a long-term debt to equity ratio of 51.44%. That means that it has roughly half as many debts as shareholder equity.

Rival Comcast, by contrast, has a less favourable long-term debt to equity ratio of 103.08%.

(Ideally, of course, a company should have no debts. But companies need to invest in future products. The less debt a company has, the more resilient it is and the more upwards pressure there is therefore on its share price.)

Disney vs. the Competition: the Jury is Out

Disney’s closest rival is Comcast, another international multimedia giant that offers the same business blend of motion picture production, TV and streaming brands, and theme parks.

- Currently, Disney just inches Comcast in terms of market capitalization ($189bn vs. $188bn).

- Both companies have almost identical staff levels. Disney has 190,000. Comcast has 189,000.

- In terms of EPS — which analysts use as a measure of profitability — Comcast offers a superior figure of 3.10 vs Disney’s figure of 1.09.

- With a P/E ratio of 13.56, Comcast shares are viewed as far less expensive than Disney’s (Disney P/E ratio: 71.91).

- In terms of share price, since the beginning of September 2021, Disney has shed 44% of its value. Comcast has shed 31% of its value. This is in line with a general stock market correction brought about by fears over inflation and, most recently, the Ukrainian crisis.

- Both companies have experienced a bottoming out of share value (it appears) since the beginning of May, 2022; Comcast’s support level just under $40 per share is more distinct.

Paramount Global is another key rival to Disney. You can buy Comcast (CMCSA) and Paramount Global (PARA) with broker eToro.

Disney Revenues Rebounding from Pandemic Pressures

As a provider of theme parks, Disney was hard hit by the Coronavirus Pandemic. Because of fears over Covid transmission and lockdowns, Disney had to close its parks.

- In July 2020, Disney suspended its usual dividend payments to ensure the financial survival of the company.

- In August 2021, Disney’s theme parks opened again.

The firm registered a loss of $2.8bn in 2020 and $2.02bn in 2021. But we can see from the company’s financial report for the second fiscal quarter 2022, that revenues have been increasing year-on-year as the pandemic lessens.

- During the six months ending April 2nd, 2022, revenues generated by Disney Media and Entertainment Distribution over the last 6 months were up 12% on their 2021 figure, at $28,205m.

- Revenues from Disney Parks, Experiences and Products were up over 100% on the year before, standing at $6,761m.

Step 3: Open an Account and Buy Disney Stock

When you are setting out to buy stocks, there are many online stockbrokers to choose from.

The positive news is that signing up for one stockbroker involves much the same process as for another.

To buy stocks, you need to follow a straightforward process:

- Sign Up

- Verify Your ID

- Deposit Funds

- Search for Disney Stock

- Buy Disney Stock

1: Sign up

- Online, go to a regulated broker.

- Click on the button that says ‘Join’.

- Fill out a few personal details, and choose a username and password.

- Tick the boxes to acknowledge you have read the legal info.

- Press ‘Create Account’.

2: Verify Your ID

Some brokers that are properly regulated are obliged to run stiff verification procedures. This is stop fraudsters in their tracks. But these KYC (Know Your Customer) protocols can be a little intimidating for the beginner investor — particularly as the process is automated.

Just make sure that you have to hand:

- ID proving who you are: passport/government ID card.

- ID proving where you live: rent/utility bills etc.

Follow the onscreen instructions. Once you have uploaded your ID, you can expect a reply fairly soon (ie. within hours).

3: Deposit Funds

Once you are verified, the broker will send you an email. Be sure to check your spam in your email inbox.

You can deposit funds. Using credit/debit card, ACH, bank wire and some e-wallets you can deposit USD. Deposit times vary: credit card is fastest.

4: Search for Disney Stock

Simply log into your account and enter ‘dis’ in the toolbar. Press Enter. A drop-down menu will then allow you to choose Disney stock:

- To access the Disney homepage on eToro, click the logo.

- To go straight to your buying options, press the blue ‘Trade’ button.

5: Buy Disney Stock

On the Disney homepage you can access stats, research and news on Disney. Here too you can access your chatfeed, where any mentions of Disney by other investors will come up. You can also access powerful charting options.

When you press the blue ‘Trade’ button, the following box comes up:

Here you finalise your Disney purchase. Simply enter how much USD you want to spend.

You can set other options too:

Leverage

Leverage is not for beginners. It means borrowing money from a broker to amplify the possible gains or losses on your trade. To be safe, ensure that the leverage says ‘x1’. That means no leverage is applied.

Set Stop Loss

You can set this now, set it later or leave it altogether. Setting a stop loss means telling the software to sell your stock automatically when the price falls to a certain level. This stops losses — hence the name.

Set Take Profit

As with ‘Stop Loss’, you can leave this altogether or do it later. This function tells the software to sell your Disney stock if the price rises to a certain level. This allows you to take profits — hence the name.

Open your Disney Position

You are almost there. When you are happy with your trade details, click the the blue ‘Open Trade’ button. This will execute your trade.

You will receive onscreen notification as soon as your trade goes through. On your portfolio, you can review your Disney purchase.

Disney Stock Strengths & Weaknesses

In the Disney stock price chart below, we have used powerful charting tools to plot two lines:

- Red line: Disney’s 50-day moving average.

- Green line: Disney’s 200-day moving average.

We can see that in the third week of September 2021, the red line dips below the green line. This means that the moving 50-day moving average became less than the 200-day moving average. That means, in simple terms, that the stock price started to do worse than it had done for some time.

It can be difficult to determine how Disney is performing.

Let’s ask the experts …

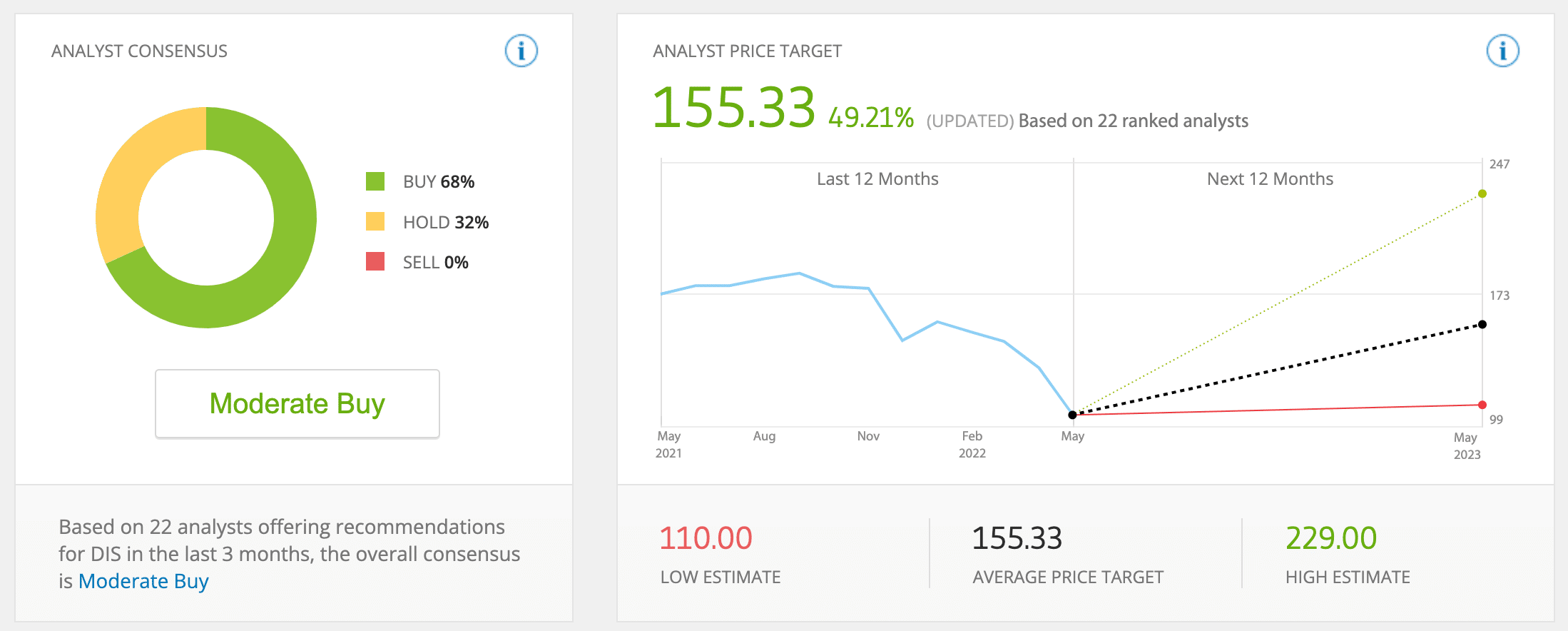

BUY: ‘Moderate Buy’ is the Consensus of Investment Analysts

Another one of eToro’s neat tools is the ability to get an overview of what the experts think the Disney share price will do next.

You can access this by pressing on ‘Research’ on the Disney homepage.

With 22 analysts having recently offered an opinion, the consensus is that Disney is a ‘moderate buy’. That means if you are holding Disney stock, hold on a little longer; and, if you are not holding, perhaps consider buying Disney stock.

Disney’s current share price is $104. The average expectation of the analysts covered here is that the Disney share price will be at $155.33 in 12 months time. The most optimistic estimate is $255.

BUY: Disney+ Streaming Service Gets Q1 2022 Boost

Among streaming providers which provide subscriber data (which excludes Amazon and Apple), this makes Disney+ the fastest growing platform right now and puts Disney+ in second-place behind Netflix.

| Streaming Service | Q1 2022 Subscriber Growth |

|---|---|

| Disney+ | 7.90m |

| Paramount+ | 6.40m |

| Peacock | 3.5m |

| HBO Max | 3.0m |

| Discovery+ | 2.0m |

| ESPN+ | 1.0m |

| Hulu | 0.3m |

| Netflix | -0.2m |

- Disney+ offers over 1000 films, more than 1500 series and 200 exclusive original films from the Disney, Marvel, Star Wars, and Pixar studios.

- Disney+ launched in new market South Africa in May 2022.

| Streaming Service | Total Subscribers |

|---|---|

| Netflix | 221.6m |

| Disney+ | 137.7m |

| HBO Max | 76.8m |

| Paramount+ | 62.4m |

| Hulu | 45.6m |

| Peacock | 28.0m |

| Discovery+ | 24.0m |

| ESPN+ | 22.3m |

(Data compiled by eToro Copied Trader @tvpotter)

SELL: Disney loses Florida Legal Exemption

Sky News reports that Disney has fallen from favour in Florida ‘over its opposition to a contentious new state law which limits discussion of LGBTQ issues in schools.’

SELL: Disney CFO Warns of Weaker Growth in 2022

Despite the impressive news that Disney+ subscribers had risen by 7.9m, Disney shares fell 2% on May 11th when Q1 2022 financial results were announced.

Disney CFO Christine McCarthy said, ‘At Disney+, while we still expect higher net adds in the second half of the year than in the first half, it’s worth mentioning that we did have a stronger than expected first half of the year. The delta we had initially anticipated may not be as large.’

CFO McCarthy explained that production costs for Disney’s direct-to-consumer programmes would increase by $900m over 2022, ‘reflecting higher original content expense at Disney+ and Hulu, increased sports rights costs, and higher programming fees at Hulu Live.’

But, after Netflix shares tanked on news that it would likely lose 2m subscribers this year, spooked investors in streaming providers are looking for decisive results, not investment.

By the end of 2024, Disney expects to have increased its subscriber base from its current level of 137.7m to 230m-260m and have achieved profitability.

Conclusion

As an entertainment and media company, Disney operates in tough sectors. But, if you want to buy Disney stock, you can rest assured that there is plenty to be optimistic about: its low debt leverage, its established brand status and its ongoing willingness to acquire related brands and expand. After an extended period of price correction, Disney shares have a bright future, analysts are agreed.