eBay is one of the world’s biggest online marketplaces, where shoppers can buy and sell a range of products. The company’s stock has increased by almost 13,500% since its IPO.

Today, we shed some light on how to buy eBay stock online with 0% commissibeon. We’ll also provide data about the financial health of the company to help traders decide whether eBay stock is a buy or sell.

How to Buy eBay Stock with a Regulated Broker

We’ve reviewed the most popular brokers in the market.

- ✅ Step 1: Open a Live Trading Account

Register for a trading account by heading over to your preferred broker’s website and clicking ‘Join Now’. A username, password, and contact details like a cell phone number and email address are required. The platform will also ask for the name and residential address of the investor and other basic details. Users can upload some ID after providing the necessary personal information. - 💳 Step 2: Deposit Funds

Most trading platforms’ supported deposit types include e-wallets, credit/debit cards, wire transfers, and ACH. The minimum deposit amount varies from broker to broker. - 🔎 Step 3: Search for eBay Stock

Type ‘eBay’ into the search bar and, when it shows in the drop-down list of markets, click ‘Trade’. - 🛒 Step 4: Research & Buy eBay Stock

The most experienced stock traders research the market thoroughly before making a financial investment.

Learning how to buy stocks on eToro, requires research. However, there is a more thorough walkthrough later on in this guide for those that are buying eBay stocks for the first time.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

Below are the most popular trading platforms from which to research eBay stock.

Within our reviews, we offer insights in terms of fees that traders might expect to pay, alternative markets, usability, and more.

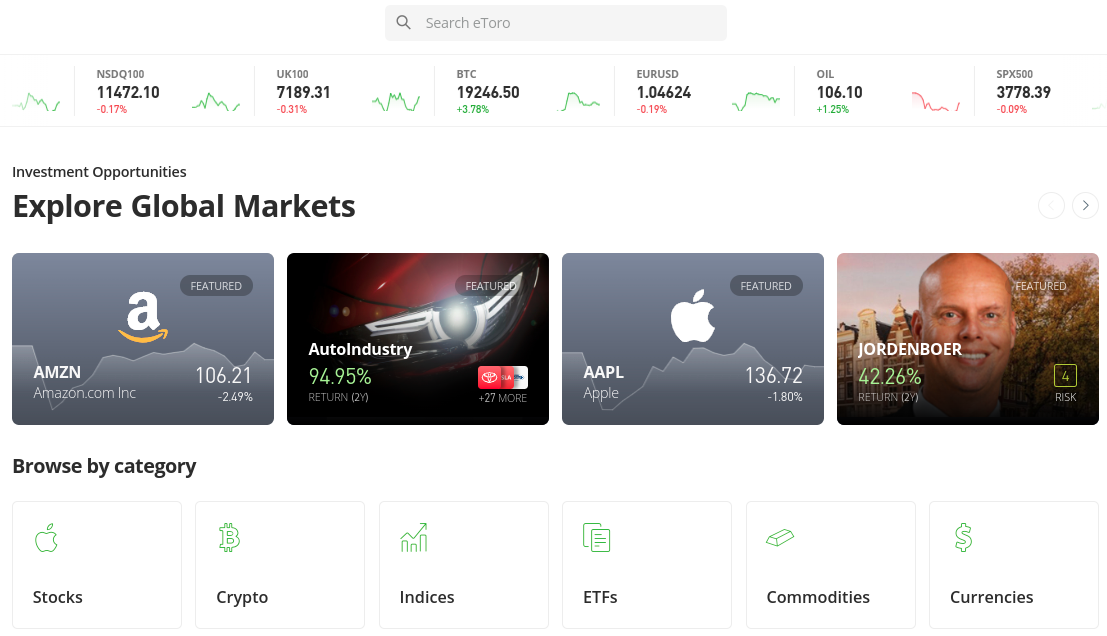

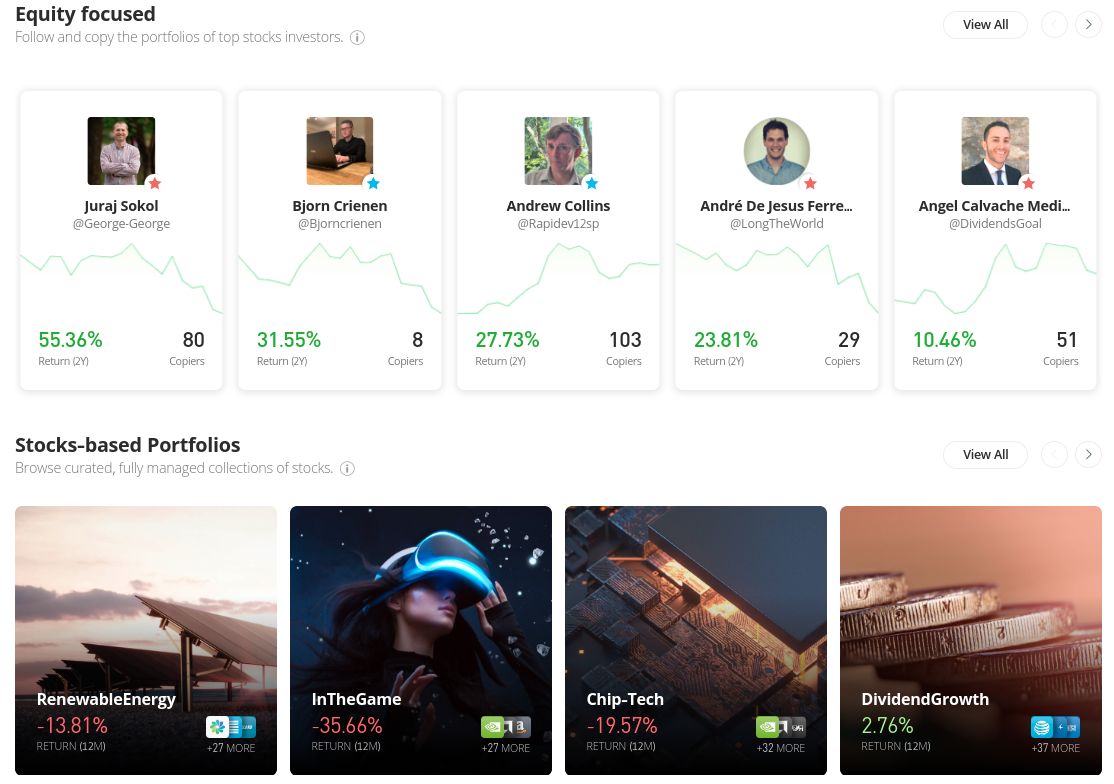

1. eToro

This guide found thousands of tradable assets, which include everything from ETFs and indices to cryptocurrencies and commodities. As well as asset diversity, regulation is important when deciding where to buy eBay stock.

The platform holds licenses from the SEC, FCA, CySEC, and ASIC. eToro is also registered with the US financial authority FINRA.

This is a social trading platform that allows eToro users to interact with each other. Like in a social media setting, people can follow each other and comment on the posts of like-minded traders. That said, the standout feature found on this platform is Copy Trading.

At eToro, anyone can mirror the buy and sell positions of a pro-investor by allocating just $200 or more. There are also multiple Smart Portfolios. Each tracks a basket of stocks. The collections are put together based on a theme or sector in most cases. As such, via Smart Portfolios, people can trade numerous stocks simultaneously by allocating $500 or more.

Residents of the US are not required to pay any deposit fees and can fund their eToro accounts with as little as $10 to start trading. eToro supports e-wallets, credit/debit cards, ACH, and wire transfers. The latter takes the longest to process, which will delay a trader’s ability to place an order to buy eBay stock by a few days.

E-wallets are fast and convenient and traders can fund their accounts via PayPal, Skrill, Neteller, and others. It’s possible to buy just a fraction of eBay stock at eToro. The broker allows fractional stock investing. This enables people to allocate a low minimum of $10 to each position if they wish.

Newbies can practice with the virtual account, which is loaded with $100,000 in paper trading funds. This is also accessible via the free cell phone app, which most people will find easy to use. At the time of writing, eToro is running a promotional offer that allows traders who deposit $5,000 or more to get their hands on a $250 bonus.

| Number of Stocks | 2,500+ |

| Deposit Fee | FREE for US clients |

| Fee to Buy eBay Stock | Commission-Free |

| Minimum Deposit | $10 |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. Unlike the other brokers on this list, Capital.com The lack of ownership allows people to benefit from falling stock prices as well as those on the up. The trader must decide whether they think eBay stock will rise or fall. If they believe the equity will fall, they can enter the market with a sell order to short it. CFDs also invite extra fees when people trade with leverage. Depending on the account type, Capital.com provides leverage of up to 1:5 on stocks. Importantly, an overnight financing fee is charged for each trading day that the leveraged CFD position is left open. The amount will depend on the asset, among other things, such as whether it’s a weekend. At the time of writing, the overnight fee for a short position on eBay is 0.0219%. A long position on eBay will attract an overnight fee of 0.0225% for each day it is left open. Notably, US clients looking to buy eBay stock will need to choose eToro or Webull, as CFDs have been prohibited by the SEC. Payment methods include credit/debit cards, e-wallets, and wire transfers. The account minimum is $20, however, people choosing a wire transfer need to adhere to a minimum deposit of $250. Finally, this reputable trading platform is regulated by the NBRB, ASIC, FCA, and CySEC.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. Webull is a little different from the other brokers on this list. At this brokerage, people can also save for retirement by buying stocks via an IRA. Webull offers Traditional, Rollover, and Roth IRAs and there are more account types in the works. Investors can contribute to a Traditional IRA using funds that they might be entitled to write off on their tax returns. Any growth will be tax-deferred until withdrawn for retirement. The Roth IRA at Webull offers tax-free earnings from investments. Contributions to this IRA are not deductible. The Rollover IRA allows investors to transfer money from their previous employer-sponsored retirement plan. Retirement assets maintain their tax-deferred status through an IRA rollover without incurring early withdrawal fees or current taxes at the time of transfer. The broker offers thousands of US stocks and also ADRs. The latter will attract fees between $0.01 and $0.03 per slide, so this is something to be aware of. That said, eBay is listed on the NASDAQ so is commission-free. Webull users can buy eBay stocks in fractional quantities starting at $5 per slide. Bank wire deposits and withdrawals attract fees at Webull. This is $8 and $25, respectively. US traders can avoid paying a fee by choosing ACH when funding the Webull account.

Your capital is at risk. To save traders a bit of time and research, below we discuss some fundamentals about eBay. This includes the company’s business model, eBay stock history, and dividends. We also studied recent earnings calls to see how the company’s finances are shaping up. US entrepreneur Pierre Omidyar founded this company in California in 1995. Initially, eBay was exclusively offering customer-to-customer auction services. However, it quickly became a multifaceted e-commerce platform that has now expanded to offer business-to-consumer services. After going public in September 1998, eBay managed to survive the dot-com bubble, making it one of the few success stories of the era. By 2001, eBay was regarded as the largest e-commerce website in the world. In the few years that followed, the company spent $1.5 billion on growing its business. Although it has since given up control of all three companies, eBay purchased StubHub, Skype, and PayPal. Since selling PayPal in 2014, eBay has concentrated on retaining its client base and increasing advertising income. These days, businesses can use the eBay platform to create a shop to sell goods. Individuals can also list items to sell that are new, second-hand, or homemade. People looking to make a purchase on eBay can buy products used or brand new in auctions. Alternatively, people can make instant fixed-priced purchases via the ‘Buy it Now’ function, instead of having to wait for the listing to end. eBay also has its own NFT marketplace. At the time of writing, eBay has around 142 million active buyers globally. eBay became a publically listed company in September 1998. When it was added to the NASDAQ, traders could buy eBay stock for around $18. Taking eBay’s five stock splits into account, the IPO price would be around $0.35. Let’s take a look at the eBay stock chart to give traders an indication of how it has performed over the years. Until 2015, eBay stock remained around $10 or under. eBay sold off its PayPal business in July 2015 and initially the stock increased, going from around $12 to $28 in less than a month. Fast forward to 2020 and the e-commerce industry was in an even better position. The COVID-19 pandemic was in full swing and more people were staying at home and shopping online. As a result, eBay raked in $10.2 billion in revenue, which was a year-on-year (YoY) increase of over 5%. By this point, eBay stock had grown to $81, up 62% from the start of 2021. In November 2021, eBay stock beat Q3 quarterly earnings estimates, however guidance for Q4 disappointed investors. As a result, by late December, the stock had nosedived to $64. Fears about a potential recession following rising inflation and ongoing conflict in Europe caused many stocks to fall in the first few months of 2022. After starting the year at a little over $66, eBay had fallen to $50 by the start of March. By the end of March 2022, tech stocks started to recover. However, the eBay stock price today per share is around 46% lower than its all-time high in October 2021. Part of the research process prior to opting to buy eBay stock is looking at the previous earnings calls. See some analysis taken from the last four financial reports below: Below is a list of eBay’s reported revenue from the same earnings calls: At the time of writing this guide, the P/E ratio of eBay is 2.57 times. This can be calculated by dividing the eBay stock price today per share by the latest reported EPS. At the time of writing, eBay has a market capitalization of almost $25 billion. As a result, this is classed as a large-cap stock. An alternative way for people to invest in eBay stock is via an index fund or an ETF. In the case of the latter, the ETF merely tracks the underlying basket of stocks. eBay is a holding in hundreds of ETFs. At eToro, the above-mentioned ETFs can be traded on a commission-free basis and in fractional quantities of $10 or more. Note: Learn how to trade ETFs here. While eBay isn’t the most prominent dividend stock in terms of yields, investors will receive a quarterly payment nonetheless. The running dividend yield at the time of writing is a little over 2%. The last payment received by investors in eBay was $0.16 per stock. Since eBay went public in 1998, it is one of the few early online businesses to have survived the dot-com bubble. In May 2021, eBay started enabling the purchasing and selling of NFTs on its platform. One of the most cutting-edge markets for non-fungible tokens (NFTs) is KnownOrigin. In June 2022, eBay declared its acquisition of the company. This is a big step forward. Investors are still interested in finding the most popular NFTs to buy and eBay is hoping to become the first port of call. As we touched on, eBay already has over 142 million buyers. The company is only second behind Amazon in the US as the biggest e-commerce player so is well-positioned to take advantage of the NFT trend. eBay was one of the first online marketplaces of its kind. The company has been active since 1995 and at the time of writing, has about 142 million active buyers. This guide has explained how to buy eBay stock with a regulated stock trading platform in 2023.2. Capital.com

Number of Stocks

5,000+

Deposit Fee

FREE

Fee to Trade eBay Stock

Commission-Free

Minimum Deposit

$20

3. Webull

Number of Stocks

5,000+

Deposit Fee

ACH – free / Bank wire – $8

Fee to Buy eBay

Commission-Free

Minimum Deposit

$0

Step 2: Research eBay Stock

What is eBay?

eBay Stock Price – How Much is eBay Stock Worth?

EPS and P/E Ratio

Market Capitalization

Index Funds

eBay Stock Dividends

eBay Stock: Fundamental research

eBay’s Technology-Led Re-Imagination is Well Underway

Conclusion

FAQs

How do you buy eBay stock?

Are eBay sales down in 2022?

Where can I buy eBay stock?

Has eBay stock ever split?