Electro-optical System (EOS) is a blockchain-based architecture that allows developers to create, host, and run decentralised apps. Dan Larimer, the co-founder of Bitshares and Steemit, is the brain behind EOS.

EOS, like Ethereum, provides an operating system that makes the process of developing Decentralized Applications, or DApps, much easier. Unlike Ethereum, though, EOS aims to be more scalable and versatile, making it easier for developers to create decentralised apps.

In this guide we’ll cover where to buy EOS at regulated crypto exchanges and ask is EOS a good investment.

How to Buy EOS – Quick Steps

If you’re looking to buy EOS with low fees, follow the steps below:

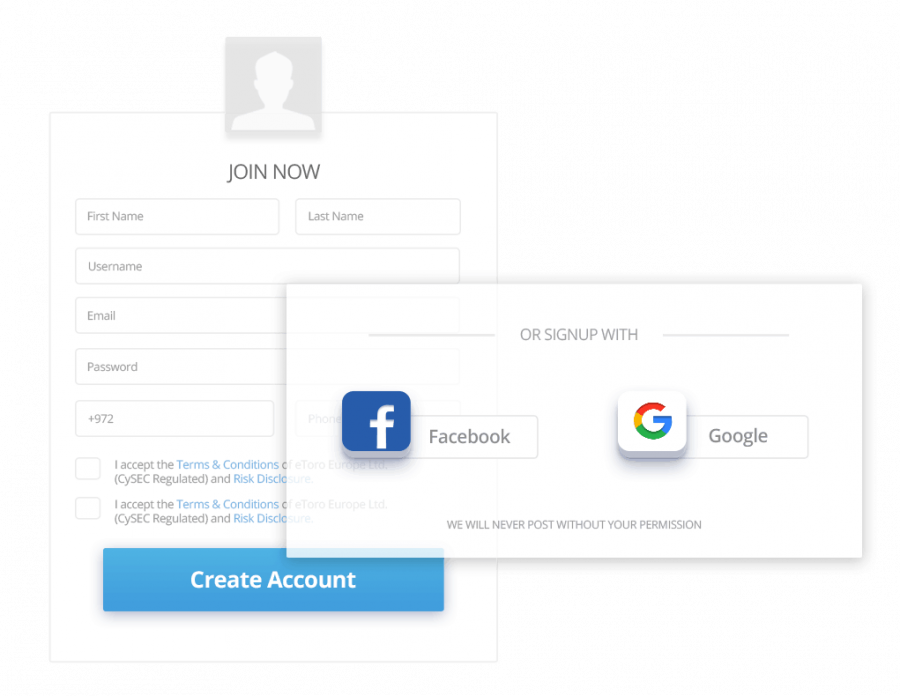

- ✅ Step 1 – Create an eToro Account: To begin, sign up for an eToro account and fill in the required information. Upload a copy of your ID to authenticate your account.

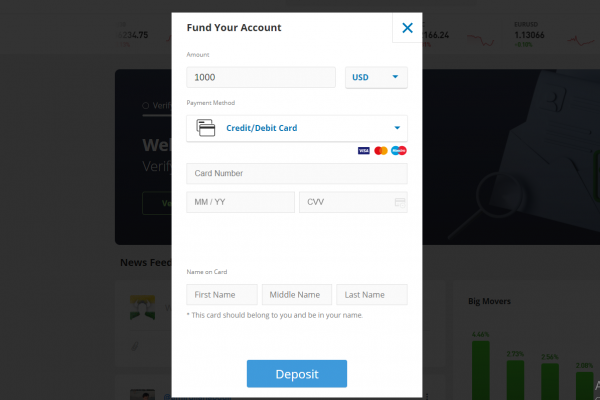

- 💳 Step 2 – Deposit Funds in your account: eToro charges no fees for USD deposits, and the minimum deposit is $10. You can use a debit/credit card, PayPal, bank wire, or eWallet.

- 🔎 Step 3 – Search for EOS coin: Search for ‘EOS’ and click ‘Trade’.

- 🛒 Step 4 – Buy EOS: Enter much money you want to use to buy EOS then click ‘Open Trade.’

Where to Buy EOS coin – Best Platforms Reviewed

The platforms below made our top ten list of the best crypto exchanges and have all listed EOS:

1. eToro – Overall Best Place to Buy EOS

With over 27 million members globally and over 20 million crypto transactions completed on

Even for beginners, the eToro platform is quite simple to use. On all trades, eToro offers competitive pricing. They don’t charge any commissions and don’t have any hidden fees.

Spreads, which start at 0.75 percent for Bitcoin and 1% for altcoins, are used by eToro to price its trades. It’s worth noting that most brokers charge a spread both when buying and selling an asset, whereas eToro simply charges one spread (when you buy).

eToro supports credit/debit cards, bank transfers, and e-wallet deposits, as well as PayPal. Beginners will appreciate that eToro has a dedicated education program called ‘eToro Academy,’ which offers a large number of free articles and videos to help them understand the trading process.

eToro offers all users a free crypto wallet, which is available on iOS and Android and can be used to safely store your cryptocurrency holdings.

It’s also a crypto staking platform for holders of ETH, ADA or TRX and has copytrading features if you want to copytrade pro investors.

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Margin Trade EOS on Leverage

C

It also has some unique aspects, thanks to its multiple benefits and features. For example, holding a large amount of CRO, Crypto.com’s own cryptocurrency means lower trading fees and greater rewards on the Crypto.com Visa card which you can use to pay for items in stores with your crypto funds.

Crypto.com’s creators anticipate a future in which cryptocurrency is a common investment class rather than a novelty. Crypto.com can assist you in incorporating cryptocurrencies into your financial life, it’s also a platform to earn interest on crypto even without trading.

Trading fees are lower than those charged by several significant industry competitors. On trades with a total monthly trading volume of less than $25,000, new Crypto.com customers without any CRO staking will be charged 0.4 percent.

To keep user accounts safe, Crypto.com employs a variety of security procedures, including multi-factor authentication (MFA) and whitelisting.

Crypto.com also allows users to connect different digital wallets to their account, as well as offering its own crypto holding tools. The Crypto.com DeFi Wallet is one of them, which allows users to earn rewards on tokens used in blockchain-based decentralised finance applications.

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – One of the most renowned name in Crypto space

Coinbase was founded in 2012, three years after Bitcoin was created, and has since grown to become the

While Coinbase’s transaction and trading costs are greater than those of some of its competitors, it remains one of the most popular crypto investment platforms.

It also offers a free signup bonus of $10 to test out the Coinbase platform.

Coinbase has one of the lowest minimum balance requirements of any cryptocurrency exchange, at just $2, making it an appealing option for beginning investors.

Users can earn Stellar Lumens, the Flexa Network’s Amp tokens, and the Graph’s GRT tokens through the Coinbase Earn tool, which allows users to view brief educational films, complete tiny quizzes about them, and earn free crypto assets.

When it comes to consumer security, Coinbase employs industry-leading security standards to safeguard customer funds and assets.

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Most trusted crypto platform worldwide

Binance is another popular crypto exchange to consider. According to CoinMarketCap, Binance is the largest cryptocurrency exchange in the world in terms of volume, with over $19.7 billion in trading volume in the last 24 hours.

Over 600 cryptos, including niche cryptocurrencies and ERC-20 tokens, are available to invest in on this exchange. Binance only charges a 0.1 percent cost when opening and closing a trade, therefore all of these cryptos can be exchanged with low fees – for example EOS can be traded on an EOS / USDT pair (against Tether), and against ETH, BUSD, USDC, BTC and fiat currency.

Users can save an additional 25% on fees provided they possess BNB which is Binance’s native cryptocurrency. Also sign up via a Binance referral link for additional trading fee discounts.

Binance accepts free crypto deposits and FIAT deposits, which are likewise free provided you fund your account in US dollars. Trust Wallet is Binance’s official wallet, a free app for storing crypto that has received great ratings on Google Play and App Store.

Cryptoassets are a highly volatile unregulated investment product.

What is EOS?

The EOS cryptocurrency, which was launched in July 2017, is the token for the EOSIO network. EOSIO, like Ethereum and NEO, allows developers to create blockchain-based applications, with a focus on decentralised apps (DApps), smart contracts, and decentralised autonomous businesses.

EOS.io intends to provide developers with easy-to-use tools for constructing DApps by combining aspects from both the Ethereum and Bitcoin blockchain platforms.

The EOS crypto was once ranked within the top 10 of all cryptos on Coinmarketcap, but has underperformed BTC and other top altcoins since 2021 and is currently ranked #51.

While most people are familiar with the financial part of cryptocurrencies, the blockchain component has contributed to the success of several of the most popular cryptos, like Ethereum, NEO, Ripple Labs, and Stellar. These firms facilitate the development of real-world blockchain applications in addition to cryptocurrencies with large market capitalizations.

Block.one made its EOS token available via an Initial Coin Offering (ICO) that lasted over a year and raised $700 million to ensure it cast a wide net when launching its development platform.

The project was a huge success. The revenues from the ICO will be used to further build Block.one’s EOS.IO platform, according to the company.

Is EOS a Good Investment?

EOS is widely regarded as a key and direct competitor to Ethereum, which has a wide range of applications in the decentralised finance sector. EOS promises to be better and faster than Ethereum, which now offers 15 transactions per second, with millions of transactions per second being the goal.

EOS is the second-most popular decentralised app development platform as of 1 April 2022, according to data from State of the DApps. The platform has been used to launch a number of applications, with use cases ranging from gaming to NFTs.

In recent years, its price prognosis has stayed unchanged. Your expectations, circumstances, and risk tolerance will determine whether the EOS token is a good fit for your cryptocurrency portfolio. As a result, before investing, you should determine how much risk you are willing to take.

Transactions are free

The majority of blockchain solutions have transaction fees attached to them. This is not the case with EOS. EOS allows processes or services to be performed without incurring any expenditures. This translates to no transaction fees. For dApps service costs but the block-producer model will be employed.

Governance Structure Model

To keep EOS as adaptable as feasible, it employs a voting method based on a governance structure model. This means that the regulations can only be changed through a voting method. For a blockchain of this size, it’s a fantastic feature.

Change is sometimes required, and this is where it comes into play. Due to a lack of a voting mechanism governance model, Ethereum experienced this problem and failed to recognize it.

Ability to develop dApps

EOS allows developers to create full-fledged dApps. It functions as a decentralised platform, which means that anyone may create a decentralised application (dApp) and execute it on the EOS blockchain platform.

It functions similarly to an app store, with the exception of decentralisation. Smart contracts are used to fuel dApps in most cases. Smart contracts, on the other hand, are not required with EOS. Instead of smart contracts, it employs dApp transactions, which are more efficient.

Faster Scaling Times

EOS is a very scalable platform. The EOSIO ecosystem has a maximum transaction rate of 10,000 per second (TPS). EOS, along with the TRON Network, is one of the few blockchains that has been able to eliminate transaction costs due to its unique structure. According to some sources, EOSIO has outperformed Ripple in terms of transaction speed. This explains the 820,502 transactions recorded in the last 24 hours.

Because EOS is both a transactional currency (utility token) and a network token, the cryptocurrency’s creators and users will continue to add more activity to the digital asset. The price of the crypto trading asset could rise to new heights in the future as a result of this demand.

Strong Collaborations

Cryptocurrency partnerships are critical market drivers. Galaxy Digital is one of EOS’s most well-known collaborations. This is a multi-strategy investing firm that specializes in digital assets and blockchain. SVK Crypto and FinLab are two others.

Blockchain technology and cryptocurrencies are gaining traction as a result of these collaborations. With further agreements leading to the formation of DAPPS in a variety of sectors, the potential for EOS as a cryptocurrency trading asset is high.

Quite convenient for developers

EOS is built in such a way that it is relatively simple to work with for developers. It comes with a web toolkit and built-in features like role-based permission systems. A developer may simply create dApps (decentralised applications) using these technologies.

Concerns regarding centralization

EOS governance is meant to have only 21 block producers at any given moment, and the network’s general operation is based on stakeholder voting.

The EOS platform’s democratic governance principle is called into doubt by the extremely limited number of block producers as well as the likelihood of low voting attendance. Furthermore, the fact that users can’t audit the network without operating a full node makes decentralisation claims suspect.

The Co-Founder’s Exit

Dan Larimer, the business’s co-founder and CTO, is a blockchain enthusiast who believes that the majority of tokens should be distributed to the general public rather than being held by a single person or company. His resignation from the team on January 10th, 2021, did not bode well for EOS’s future, and the company’s lack of development since then has made his decision somewhat justified.

What are the risks of Buying EOS?

So, now that we’ve covered the key advantages of including EOS in your portfolio, let’s look at the main concerns to be aware of.

You will be able to make an informed decision about whether or not to acquire EOS currency today if you consider the hazards risks described below.

Risk related to market sensitivity

The beta coefficient of EOS compares the volatility of the crypto coin to the systematic risk of the entire stock market, which is represented by your chosen benchmark.

In mathematical terms, beta is the slope of a line through a regression of data points, each of which represents the returns of the EOS crypto token versus your chosen market. In other words, EOS’s beta of 1.15 gives an investor an idea of how much risk the crypto coin might bring to one of their existing portfolios.

Volatility

The rate at which the price of EOS or any other equity instrument rises or falls for a given set of returns is known as volatility. It is calculated by calculating the standard deviation of annualized returns over a certain time period and indicates the price range in which EOS may rise or fall.

In other words, it works in a similar way to EOS’s beta indicator in that it assesses the risk of EOS and aids in the estimation of short-term volatility. So, if the price of EOS fluctuates swiftly over a short period of time, it is said to have high volatility, and if it swings slowly over a longer period, it is said to have moderate volatility.

EOS Price

EOS price history on CoinMarketCap

The current EOS price range in 2022 is $2.20 – $2.90. There are 986 million EOS coins currently in circulation, which is most of its total supply of 1,051,995,856 coins.

EOS’s initial coin offering (ICO) was a significant one. It took Block.one over a year to run an ICO for EOS that generated a record-breaking 7.12 million ETH, the Ethereum blockchain’s native currency, worth a whopping $4.2 billion back in 2017.

At the end of the ICO, 900 million tokens were distributed during 350 distribution periods, each involving the issuance of at least 2 million tokens. ICO participants received 90% of all EOS tokens, with the remaining 10% going to the EOS development team.

EOS is an inflationary asset because of its limitless production. Delegated Proof-of-Stake (DPoS) is a blockchain paradigm that uses staking incentives to generate EOS, which is then used to fund transactions and pay block users. The DPoS system has a 5-percent-per-year inflation cap.

EOS Price Prediction

EOS spiked to around $15 during the 2021 crypto bull run but since then has returned to its 2018 lows. The EOS / BTC pair has also been in a bearish downtrend since mid 2018.

In the long-term EOS may move up to retest its all-time high of just over $20 and the 0.001 level on the EOS / BTC pair, however at the current time there seems little investor interest in EOS.

Almost all of the total supply of EOC being already in circulation could, in theory, create a supply shock that results in the EOS token price moving up in value. Some would therefore argue now is a good time to ‘buy the dip’, with prices back at historical lows.

Check our list of the best DeFi coins as decentralized finance related projects are in high demand in 2022.

Ways of Buying EOS

If you do want to invest in EOS, let’s look at how you get your hands on EOS tokens in the first place. Your chosen payment method will determine the best way to purchase EOS. You can choose from the following deposit kinds when you use one of the top-rated brokers listed above:

Buy EOS with Credit or Debit Card

On eToro, you can purchase EOS with a credit card or debit card. The service is presently ranked as one of the best methods to buy EOS on the platform and is available in areas where eToro has a strong presence. Many traders choose to buy EOS with cards since they are convenient, the payment transmission is rapid, and the network charges low transaction fees.

When you buy EOS with a credit card or a debit card on eToro, you will not be charged a deposit processing fee. You will only be responsible for a portion of the payment processing fee imposed by your card company.

Buy EOS with Paypal

PayPal is one of the most simple online payment options, and you can buy EOS with PayPal on a variety of crypto trading platforms, including eToro. Because of the simplicity it provides traders, most trading platforms choose this payment option. It is easily accessible, simple to use, and has inexpensive trading expenses.

When you buy EOS on eToro with PayPal, you won’t be charged any deposit processing costs. The service is only available in nations where eToro and PayPal are both well-established.

Best EOS Wallet

The EOS wallet is a place where you can save your EOS currency. There are numerous sorts of wallets that may be used to store EOS in a secure manner. If you decide to acquire EOS to diversify your cryptocurrency portfolio, you’re definitely thinking about a secure storage option. Some of the best crypto wallets for EOS are EOS Authority Wallet, Ledger Nano X, Exodus, Anchor, or you can hold EOS on eToro since it’s a safe regulated platform.

eToro wallet – One of the safest for storing crypto

eToro wallet allows you to transmit and receive crypto assets to and from other wallets, convert one crypto asset to another crypto asset, and buy crypto assets with the eToro wallet.

How to Buy EOS- A tutorial

If you’re looking for a step-by-step guide on how to buy EOS in a safe and low-cost way, the instructions below will walk you through the process using top-rated broker eToro.com.

Step 1: Creating an account on eToro

You only need to submit your e-mail address and phone number to signup to the eToro platform. If you opt to deposit funds with eToro later, you’ll be asked to submit some more information to authenticate your identity.

After you complete this step, you will receive an email from eToro with a link to complete your registration.

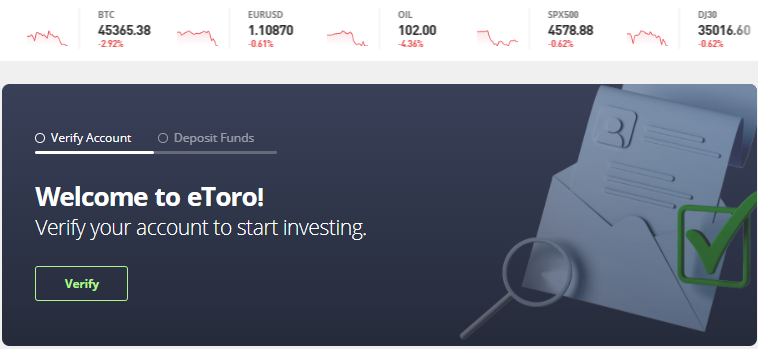

Step 2: Completing your eToro profile

You will be able to log in to your eToro account and explore the eToro platform when you have verified your account through email. If you wish to begin trading, you’ll need to complete your eToro profile by supplying some additional personal information.

This is required because eToro is a licenced organisation that must follow AML and CTF standards. To get started, click “Complete Profile” under your username.

Step 3: Funding your eToro account

After you’ve finished filling up your profile, you may fund your account and begin trading EOS.

Keep in mind that eToro only accepts $200 as a minimum deposit (or equivalent in other currencies). eToro provides many ways to fund your account like through debit card, Paypal, e-wallets etc.

Step 4: Buying EOS

You’re ready to trade EOS on eToro once your deposit has cleared. Choose “Crypto” from the “Trade Markets” section of the navigation bar. A list of all the cryptocurrencies accessible on eToro will be displayed below.

After finding EOS and choosing “Buy” you’ll have the option to fine-tune the trade’s settings. You can pick between “Trade” and “Order” in the top right corner. If you choose “Trade,” you’ll be placing a market order (purchasing at the best price currently available). You can specify the price you want to buy if “Order” is chosen.

How to Sell EOS

Buying and selling EOS follow the same process on eToro. When you’re reading to take profit on your EOS investment, open a trade in the same way to sell it.

Since eToro is a social trading platform you can network with other investors to find out their EOS price forecast and when might be a good time to sell EOS based on the current market movements.

Conclusion

EOS is one of the most commonly utilised blockchain platforms on the market. All blockchain-based decentralised applications provide services with real-world utility and benefits. EOS is a pioneer in the development of gaming and gambling software, as well as a wide range of other applications for ride-hailing, music sharing, fitness tracking, digital payment, and other uses.

EOS has upside potential in the future because of its capacity to disrupt sectors, however is yet to outperform Bitcoin and other cryptos in 2022. How much to invest in EOS depends on an investor’s risk appetite and comfort level.

Traditional blockchain apps have been quickly replaced by EOS dApps, which are safer, faster, and more inexpensive. EOS has emerged as a well-known name in blockchain technology, based on current trends, and could deliverbenefits for a wide range of business demands in the future.

Cryptoassets are a highly volatile unregulated investment product.