Want to buy Ethereum Classic (ETC)? You will have heard of ‘normal’ Ethereum (ETH), the second-biggest crypto behind Bitcoin. But did you know that Ethereum Classic is the original Ethereum? Champions of Ethereum Classic (ETC) say it will prove safer than Ethereum (ETH) in the long-run because of its insistence on ‘unstoppable’ smart contracts.

With our reviews of one top crypto broker and three crypto exchanges, we focus on how to buy ETC safely and simply with a regulated provider. You don’t need to understand how crypto works to reap rewards from investing in it. But here, however you choose to buy ETC, you will be going in with your eyes open.

How to Buy Ethereum Classic – Quick Steps

Want to buy cryptocurrency in 2022 with low fees and no hassle? Here’s how to buy Ethereum Classic (ETC) in less than five minutes:

- ✅Step 1: Open an account with eToro – Join 27m other investors and sign up with eToro. Sign in with Facebook or Google and get verified.

- 💳 Step 2: Deposit – You can buy Ethereum Classic with bank transfer, credit/debit card and a range of e-wallets. Unlike some exchanges, eToro does not charge a deposit fee.

- 🔎 Step 3: Search for Ethereum Classic – eToro hosts a collection of 60+ major cryptos including, of course, Ethereum Classic. Quickly search using eToro’s top toolbar.

- 🛒 Step 4: Buy – Buy Ethereum Classic and have eToro hold it for you – or transfer it to your free eToro Money crypto wallet. Check out eToro’s free crypto Smart Portfolio and CopyTrader services.

Where to Buy Ethereum Classic

Below we tackle the question of where to buy Ethereum Classic with a review of top broker eToro and three top crypto exchanges:

1. eToro – Best Broker to Buy Ethereum Classic with Tight Spreads

Particularly reassuring for crypto newcomers is that eToro offers a rare commodity in the crypto world: comprehensive regulation. eToro’s operations are overseen by the rigorous FCA in the UK, CySEC in Cyprus, ASIC in Australia and SEC/FINRA in the US. Regulation won’t stop your trades going south if the market moves against you, but it does mean you are dealing with a company you can trust. eToro’s security is tight and the broker has never been hacked.

eToro also offers a suite of free social trading facilities. Social trading is a way of supporting newcomers by giving them free ways to copy more experienced traders.

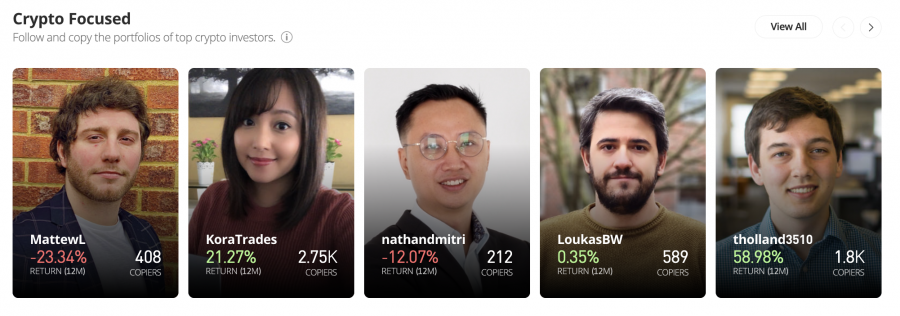

With eToro’s CopyTrader, you can pick from over 600 crypto traders and allocate funds to be used to copy their trades in real-time. You can copy as many traders as you like, and stop copying at any time. This gives the crypto newbie two benefits: i) at least some of their money is being invested by experts and ii) they can learn new trading techniques.

Similar to eToro’s CopyTrader are crypto signals, which is when crypto experts charge you for sending out messages (usually to Telegram) detailing positive trading opportunities. eToro’s solution is all in-house and automatic, which suits inexperienced traders better. Why not try both?

You can further benefit from crypto expertise by buying into one eToro’s 8 crypto Smart Portfolios. These allow you to diversify your crypto holdings according to a particular theme or strategy. These Smart Portfolios have attracted excellent twelve-month returns (see below).

Other freebies from eToro include a demo account for you to practise trading without risking any capital, a free smartphone app for cryptocurrency trading on the move, and the well-reviewed eToro Money crypto wallet, which allows you to send, receive, exchange and stake crypto.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Reputable Crypto Exchange with Beginner-Friendly Mobile App

Unlike broker Etoro, Crypto.com is a cryptocurrency exchange. Based in Singapore, an average of $1.7bn crypto business gets done every day with Crypto.com — so be assured that this is no small-time outfit.

With Crypto.com, you can buy over 250 different crypto. Want to buy Ethereum Classic with credit card? No problem. If you want to trade on the exchange, though, you will need to invest in some stablecoins (Tether/USD Coin), Bitcoin, or the exchanges’ native crypto CRO to get started. Crypto.com charges a 2.99% fee on credit card purchases; with broker eToro, on the other hand, you can charge your account with credit card with only a currency conversion fee to worry about.

When it comes to security, Crypto.com offers the reassurance of ‘cold’ storage in partnership with big name Ledger. ‘Cold’ storage means that funds and crypto are mostly held offline so they cannot be hacked. The exchange also boasts a $750m insurance fund as back up.

Where Crypto.com stands out is in its range of crypto trading and financing options (illustrated below). These might be a little daunting to the newcomer, but are simply ways of making the best of your crypto.

You can trade on margin with Crypto.com as well as explore futures contracts. And when it comes to financing, you can earn up to 14% APY on staking crypto with no lock-in period.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

3. Coinbase – Popular Cryptocurrency Exchange with Great Newbie Options

You may have heard of Coinbase because it was the first crypto exchange to go public on the stock markets with a 2021 IPO on the NASDAQ. With over 73m users, a daily trading volume of over $2bn, and 167+ crypto to choose from, California-based Coinbase is an exchange to be reckoned with.

Although it does not offer the depth of social trading facilities provided by eToro, Coinbase has an excellent reputation as being a friendly place for newcomers. With Coinbase you can earn crypto as you learn, by simply completing online learning modules. Further, you can increase your knowledge of the crypto sector by browsing Coinbase’s legendary database of crypto.

As with Crypto.com, Coinbase allows you to buy Ethereum Classic with credit card as well as receive an in-house credit card with which to spend your crypto in the real world as if it were cash. Security-wise, Coinbase was among the first exchanges to keep client funds in cold storage.

Where Coinbase comes in for criticism is in its dual fee structure which mixes flat fees with commission charges. This can be confusing, as well as expensive; Coinbases charges a 3.99% fee for credit card purchases. The exchange said last year that a new fee structure would be coming soon.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

4. Binance – Leading Exchange to Buy Ethereum Classic with Credit Card

Finally we look at the biggest crypto exchange of all: Binance, which boasts a daily trading volume of $11bn and a stellar range of 400+ crypto including Ethereum Classic. Because of its size, Binance can offer really low commissions on trades (0.1%). And, if you buy Binance Coin (the in-house crypto) you can get reductions on some trading fees.

Binance offers numerous ways to buy cryptocurrency including instant buy with credit card, deposit of fiat currency (as with eToro), crypto exchange and direct trade with other investors using P2P trading. Like Crypto.com, Binance’s finance options are impressive, with yield farming and crypto interest accounts allowing you to earn money from your existing crypto.

The major downsides with Binance are its lack of sovereign regulation and the complexity of its offering. To make things simple, choose the ‘Classic’ interface if you are trading via your desktop or the ‘Binance Lite’ option on the smartphone app.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

What is Ethereum Classic?

Ethereum Classic is often described as Ethereum’s little brother. But this is misleading. ETC was created out of a hard fork out of ETH back in 2016, but Ethereum Classic is actually the original blockchain. Like Ethereum, Ethereum Classic is a decentralised blockchain in its own right with the capacity to handle smart contracts and support DApps (decentralised applications). The focus for both Ethereums is on providing a backbone for DApps, although Ethereum Classic has come to be used as a ‘store of value’ like Bitcoin.

With a market capitalisation of just under $3.5bn, Ethereum Classic is the 30th-biggest cryptocurrency (according to crypto data specialists Coinmarketcap.com). An average of $375m in Ethereum Classic is traded every day.

Is Ethereum Classic a Good Investment?

Ethereum Classic vs. Ethereum

One way of summarising the difference between Ethereum and Ethereum Classic is to say that Ethereum Classic is the purist’s version of Ethereum.

Champions of Ethereum Classic say that it has a brighter future than Ethereum because of its insistence that ‘Code is Law’. This means that smart contracts must be run in such a way that they are ‘unstoppable’ once initiated, regardless of what happens. It is alleged that ‘normal’ Ethereum has lost this principle, and allowed other interests to rule how the blockchain is run, whereas Ethereum Classic has stuck to its guns and can therefore deal with future crises better.

The Ethereum Classic team comments that, ‘eventually all blockchains will face existential challenges that can only be overcome through an unwavering commitment to unstoppability.’

Ethereum Classic’s Proof-of-Work Protocol Safer

Both ETH and ETC have used Proof-of-Work protocols until now to validate transactions; this is ‘mining’, as with Bitcoin. Ethereum is currently undergoing an upgrade to more eco-friendly Proof-of-Stake protocols. But champions of Ethereum Classic say that big corporations will continue to favour Ethereum Classic because Proof-of-Work is safer than Proof-of-Stake (even though it is not as fast or as scalable).

Good Tokenomics

The supply of Ethereum is unlimited. The supply of Ethereum Classic, on the other hand, is limited to 210 million tokens. Under 60% are in circulation, with the remaining 40%+ yet to be mined. This means that the price of Ethereum Classic will always be positively supported by a situation of limited supply.

Get in on the DApp Phenomenon

Decentralised Applications (DApps) are a massive growth industry. DApps are essentially computer programs that work with blockchains, and use them to offer transactions and contracts which are unbreakable and impossible to cheat; this is really useful for big business in the real world. The DApp sector is projected to be worth over $360bn by 2027. The Ethereum Classic blockchain was built specifically to support DApps. Consider buying Ethereum Classic if you want to invest in the future of the DApp sector.

Buy the Dip

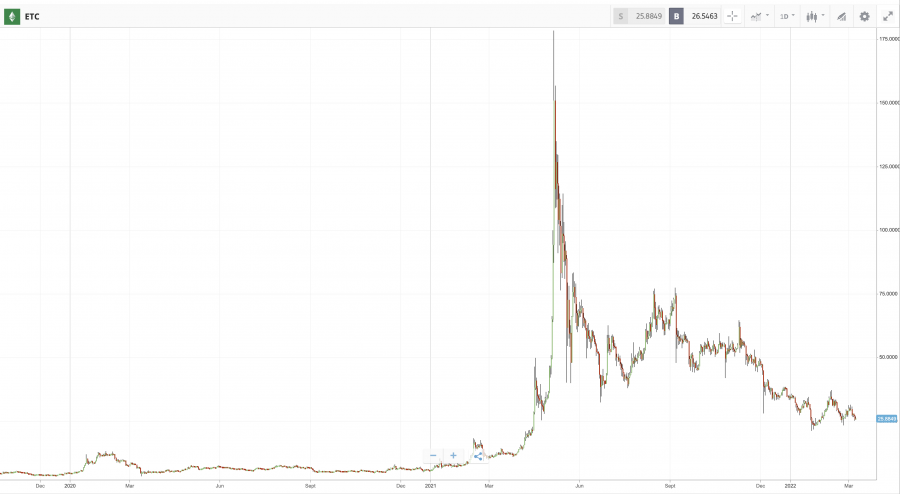

The crypto markets have taken quite a hit since 2021, as it has done many times in the past. It is not clear whether it will continue its downward price direction. But it is far better to make a crypto purchase now than during a boom period. Critically, at $28, Ethereum Classic has not been this cheap since April 2021.

Ethereum Classic Price

In the last 72 hours, Ethereum Classic’s price dropped 6.70 percent. Within the previous 24 hours, the price has risen 2.30 percent. The value has fallen by 0.11 percent in the last hour. The price of an ETC is now $26.26. The all-time high of $176.16 has been reached by Ethereum Classic.

Ethereum Classic Price Prediction

Ethereum Classic: buy or sell? From its present level under $30, some analysts see the price of Ethereum Classic hitting the $50 mark by 2024 (two years time). But long-term price forecasts are notoriously unreliable in the crypto sector.

In the short-term, a more reliable prognosis is that ETC will continue to follow the general direction of the crypto sector as a whole, which itself is increasingly following the direction of tech stocks rather than offering an inverse correlation to the stock market as it has done in the past.

Bear in mind that Ethereum Classic is not some newcomer which has borrowed the Ethereum name, or — worse — a meme coin with no functionality. Ethereum Classic is vintage Ethereum. This crypto has plenty of growth potential because it is set up to offer real value by managing smart contracts for developers, which allows them to build reliable DApps.

Ways of Buying Ethereum Classic

Buy Ethereum Classic with PayPal

US customers can buy Ethereum Classic with PayPal via Coinbase. With Binance, you can use PayPal for P2P trading. With Crypto.com, you can use PayPal to top up your Crypto.com Visa card. Instead of PayPal, eToro offers the convenience of the eToro Money wallet: with all your payment options in one place, this makes for more streamlined crypto transactions.

Buy Ethereum Classic with credit card or debit card

With eToro, you can use either a credit or debit card to charge your account and then buy Ethereum Classic; it takes seconds and, unlike its competitors, no card commission fee is charged. With Crypto.com, Coinbase and Binance you can buy Ethereum Classic with credit card with an ‘instant buy’, but commission is charged.

Best Ethereum Classic Wallet

A common misconception among crypto newcomers is that you need a crypto wallet to buy crypto. With broker eToro, you do not need a crypto wallet at all to buy Ethereum Classic — you can buy it and eToro will hold it for you (at no cost) until you want to sell.

All the vendors we have reviewed offer a free crypto wallet. You will need a wallet if you want to send or receive crypto, use crypto to buy items or services online, or stake crypto to earn rewards. We recommend the eToro Money crypto wallet as it is designed for beginners and, unlike many wallets, is regulated by the Gibraltar Financial Services Commission.

How to Buy Ethereum Classic – Tutorial

1. Choose a Broker or Exchange

How to buy ETC? It all begins with your choice of crypto exchange. Deciding where to buy Ethereum Classic begins with choosing between two main types of vendor: crypto exchanges and brokers. The hundreds of exchanges available globally tend to offer a larger range of crypto than brokers, but tend to be less well regulated. Brokers like eToro generally allow you to balance your crypto purchase with purchases of conventional stocks, ETFs and commodities and offer robust support for newcomers.

The bottom line is that brokers usually offer a simpler, safer route to crypto purchase, which is why we recommend leading broker eToro as a sound starting point for crypto newbies.

2. Sign up with eToro

Go to eToro.com. Sign up quickly using your Facebook or Google account. Or fill in a few personal details. As part of KYC (Know Your Customer) regulation, you will be asked a few questions about investing. This is to check that you are not likely to waste your money with bad trading decisions.

3. Verify your ID with eToro

Verifying your account with eToro is simple. You will need to upload scans of proof of identity (passport/ID card) as well as proof of address (bills, official letters). For quickest verification, use a scan of your valid passport.

You will receive a notification email once you are verified. You are now ready to deposit funds.

4. Deposit Funds with eToro

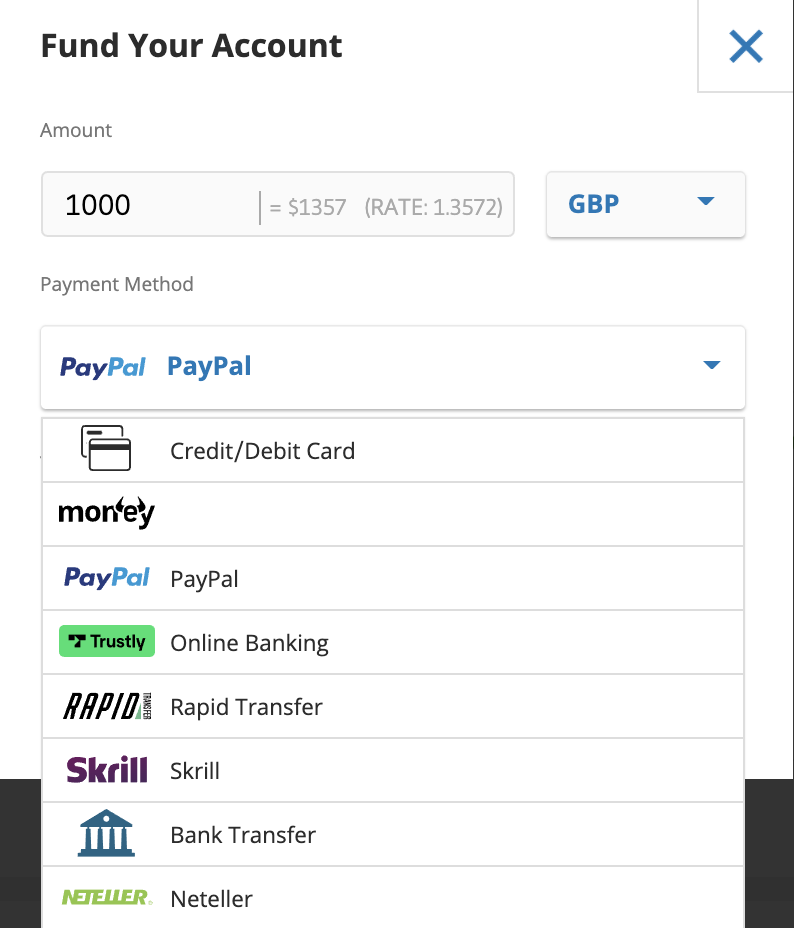

To deposit funds, sign into your eToro account. Press the blue ‘Deposit Funds’ button at the bottom left of your screen. This brings up your deposit options.

With eToro, you can deposit in up to 15 different currencies including GBP, EUR and USD. Your account will be run in USD, so any other currency will be automatically converted on deposit. Depending on your country of residence, you can deposit using bank transfer, credit/debit card and range of e-wallets. A currency conversion fee applies, but no deposit fee.

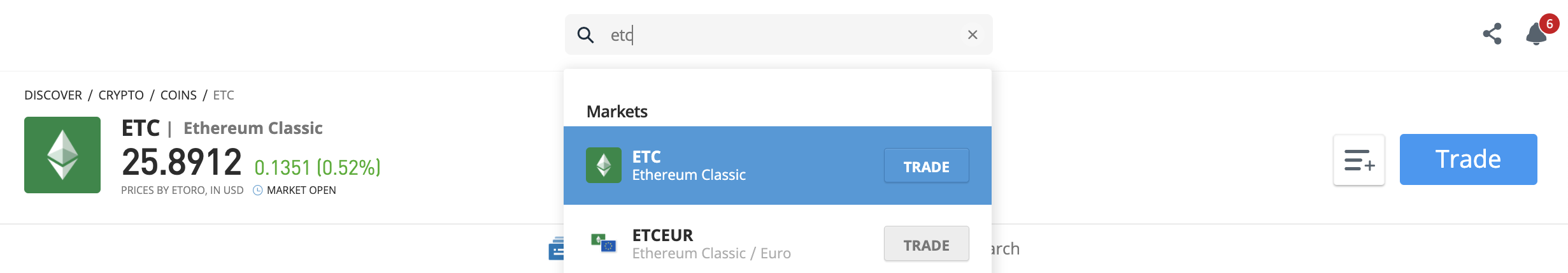

5. Buy Ethereum Classic with eToro

Find ETC by entering ‘ETC’ in the top toolbar and pressing Return. This takes you to the Ethereum Classic homepage where you can review stats, data, investing opinions from other eToro users and powerful charting options.

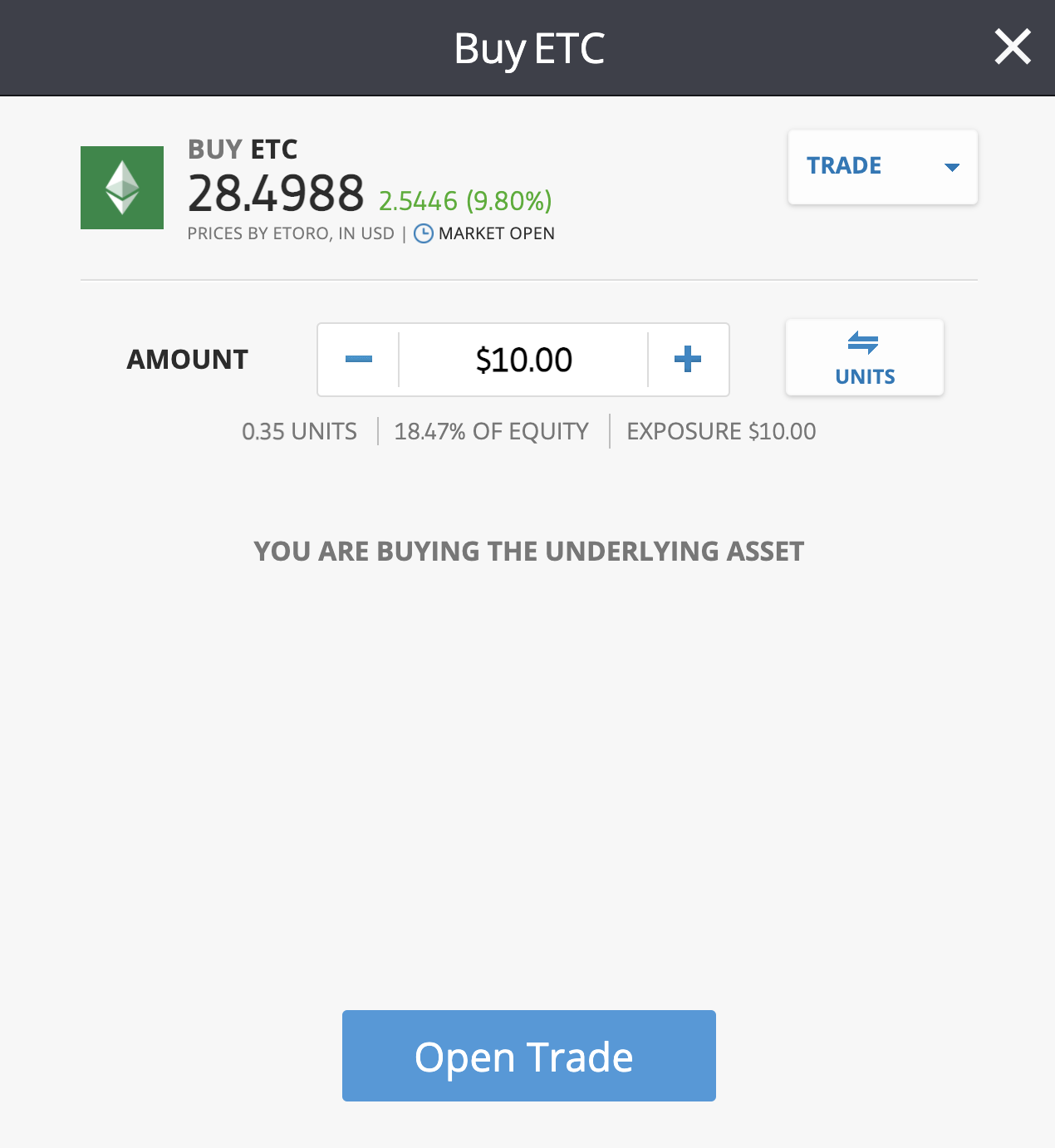

To begin your purchase, press the blue ‘Trade’ button. This brings up the purchase dialogue (shown below).

Here you decide how much money you want to spend. You can spend as little as $10 on crypto with eToro. Note that you must have money deposited in your eToro account to proceed.

To buy Ethereum Classic, enter the amount you want to spend and press the blue ‘Open Trade’ button.

Your trade will likely be executed instantly, or at least in seconds. You will receive onscreen notification. You can then review your ETC purchase in your eToro portfolio.

Cryptoassets are a highly volatile unregulated investment product.

How to Sell Ethereum Classic

Don’t worry that you will have to find a buyer for your Ethereum Classic when you are ready to sell. That is not the way it works. eToro will buy your ETC from you. To sell, navigate to your eToro portfolio. Locate your ETC:

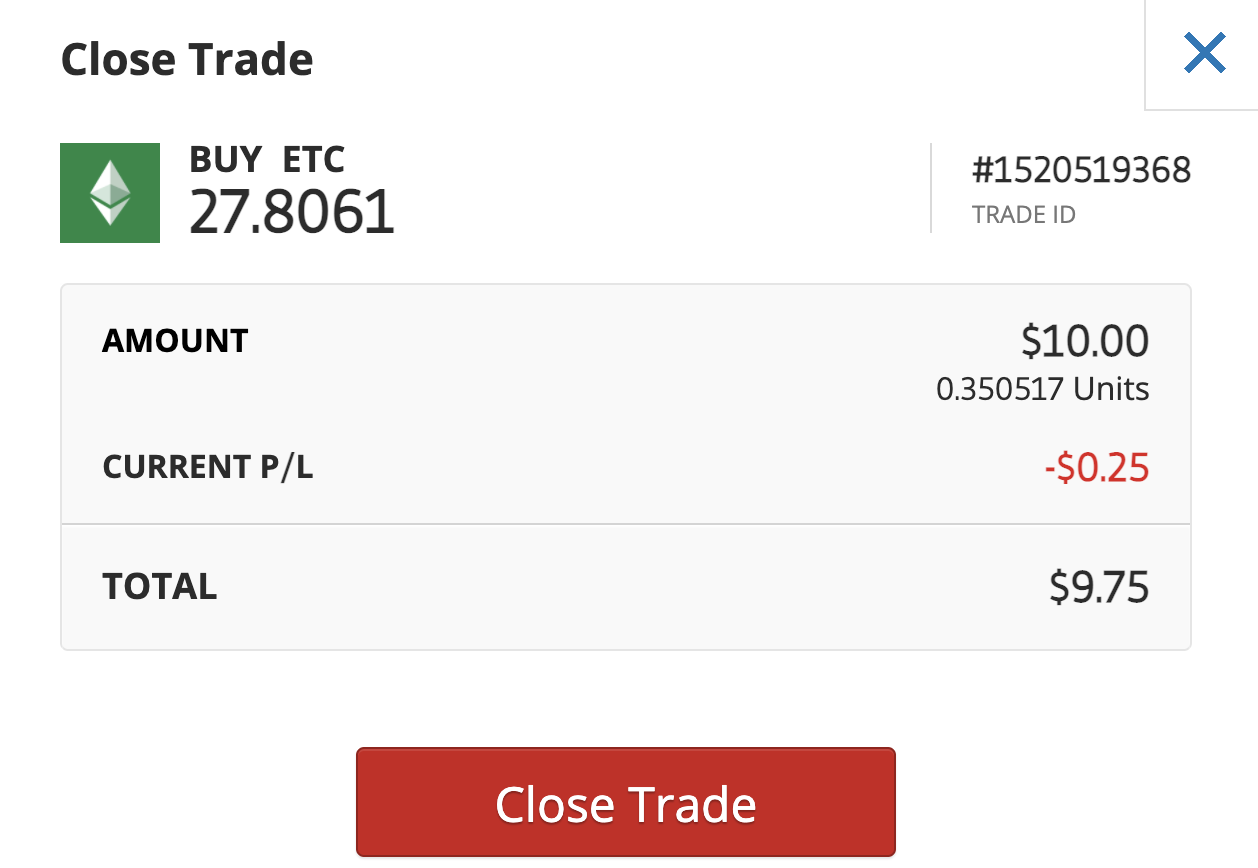

Press the blue cog icon to the far right and select ‘close’ from the pull down menu that appears. Once you have pressed ‘close’ you will be shown the details of your ETC purchase.

Press the red cross icon at the far right. If your trade is above $10, you will be able to close only part of your trade if you want to.

Press the red ‘Close Trade’ button to exit your position. Done! You will receive onscreen notification once your sale is completed. The funds will be added to your eToro balance immediately.

Conclusion

If you are considering how to buy ETC, you have plenty of options. More advanced crypto traders might find the sheer size of exchanges like Crypto.com, Coinbase and Binance a breath of fresh air. But for beginner investors we recommend broker eToro.

With eToro, beginners get the reassurance of stiff regulation, just 1% commission on crypto purchases and — best of all — social trading. With eToro’s in-house CopyTrader service, you can take a look at over 600 crypto traders and simply copy what they are doing. That’s a real bonus for beginners. And, with eToro’s Smart Portfolios, you can buy into a balanced crypto holding that has been designed by experts. Of course, you can go it alone too. With eToro, it is up to you how you trade. But there is always help and support on hand.

Cryptoassets are a highly volatile unregulated investment product.