IOTA is a distributed ledger that records and executes transactions between machines and IoT (Internet of things) devices. By facilitating transactions within the IoT ecosystem, this crypto project has gained popularity within the industry over the years, especially those with an interest in blockchain tech.

The MIOTA price (the native coin of IOTA) went on an almost 1000% bull run in the first four months of 2021, from $0.27 to $2.67, before retracing over 80% of the move. So as well as where to buy MIOTA, some investors are asking – is MIOTA a good investment? Will IOTA go up again in 2023?

How to Buy IOTA – Quick Guide

- ✅ Step 1: Open the account: First, visit the official eToro website and open an account. The process is simple and only requires you to enter a few personal details and upload ID documents.

- 💳 Step 2: Deposit: The FCA regulated eToro platform requires a $10 minimum deposit in the US and UK. You can deposit to buy IOTA by bank transfer, debit or credit card, Paypal, Neteller, Skrill and other payment methods.

- 🔎 Step 3: Search for IOTA: Go to the search bar and enter ‘IOTA’ or the ticker symbol MIOTA. After you land on IOTA page, click on the ‘Trade’ button.

- 🛒 Step 4: Buy IOTA: Enter the amount of money you want to invest in IOTA. Once you have decided, click ‘Open trade’. eToro will send the IOTA coins to your account balance.

Where to Buy IOTA – Best Platforms

You can choose from a wide range of crypto exchanges that have listed IOTA since it has been popular since the 2017 crypto bull run. In terms of where to buy IOTA with low fees and safely we consider the best platforms to be:

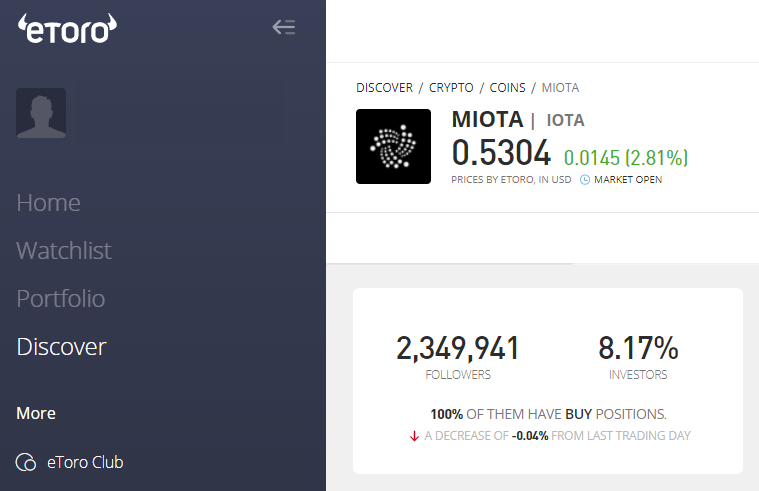

1. eToro: Overall Best Place to Buy IOTA

It is a good choice of crypto platform for novices and veterans alike as it hosts 60+ different digital assets. eToro works on a spread-only basis rather than asking for standard commissions when you buy cryptocurrency.

eToro is known for its beginner friendly, simple UI and educational materials including the eToro Academy.

Newcomers to the crypto markets will find it easier to navigate this crypto trading platform than others. Its collection of blogs and guides provide all the details a beginner needs to start investing in digital assets.

It offers both a copytrading and copy portfolio feature – allowing users to copy the trading strategy of other traders or their portfolio allocation.

Regulated by CySEC, the FCA, and ASIC, eToro works within the norms of government regulations, making it optimal for investors who are afraid their funds will be hacked or the coin they invest in will be a scam – eToro only lists verified projects and hasn’t been hacked in its long history.

eToro is also supports crypto staking, currently on ETH, ADA and TRX. More staking coins may be added over time. eToro also constantly adds new assets, recently adding ApeCoin and ENS.

Cryptoassets are a highly volatile unregulated investment product.

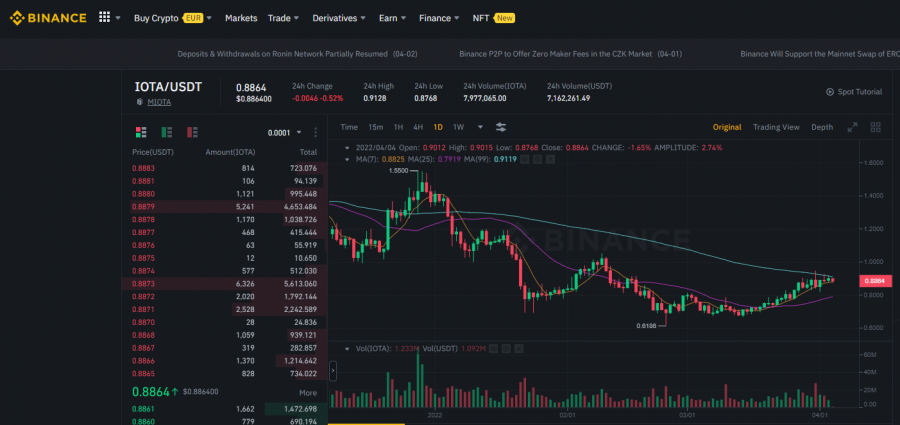

2. Binance: Trade IOTA at 0.10% Trading Fees

Binance is the largest crypto trading platform in the world. It listed IOTA on 30th September 2017. Since then, it has become one of the most popular crypto exchanges for IOTA and over 600 other altcoins.

Beginners tend to choose trading platforms that have low fees. For that reason, Binance has attracted over 90 million users – its maker / taker trading fees are only 0.1%, and less if you buy Binance Coin (BNB) to use to pay the fees.

The initial deposit can be more expensive though. When buying IOTA using a debit or credit card, prepare to pay a 3.5% fee. That being said, ACH deposits are free of charge.

Also what makes Binance different from other exchanges is the withdrawal fee; it is different for different cryptocurrencies. For example, the fee for withdrawing IOTA is 0.5 IOTA.

Binance has a secure Trust Wallet that users can use to store their IOTA tokens. For those who actively day trade and want to use leverage, Binance also has perpetual futures pairs for margin trading.

Cryptoassets are a highly volatile unregulated investment product.

3. Huobi – Reputable Exchange to Buy IOTA

Huobi Global is a cryptocurrency trading platform founded in 2013.

Huobi hosts an extensive array of cryptocurrencies, including the largest crypto assets such as BTC and ETH, alongside DeFI coins such as Aave.

It is considered one of the most liquid crypto trading platforms globally, providing deep liquidity for ETH/USDT and BTC/USDT trading pairs.

Founded in 2013 in Beijing, Huobi soon became China’s leading crypto exchange. However the transforming regulatory landscape forced Huobi to move its headquarters to Singapore to expand into Asian markets.

Despite experiencing that setback, Huobi has created a thriving crypto-asset ecosystem that includes the Huobi Eco Chain – Huobi’s Blockchain, and the Huobi Token HT.

Huobi charges a 0.2% base fee. Holders of the Huobi native oken (HT) receive a discount on the trading fees. The discount percentage increases with the amount of HT a user holds.

To provide security to the client’s funds, Huobi stores them in multi-signature cold wallets and has set up a 20,000 BTC security reserve to compensate clients in case of security incidents.

Cryptoassets are a highly volatile unregulated investment product.

What is IOTA?

IOTA is a distributed ledger that records microtransactions between machines and IoT devices. It’s powered by the native token MIOTA – some people just refer to the token itself as IOTA as well.

IOTA runs on Tangle – an “evolved” version of Blockchain and offers almost 100% free transactions, at scale, which has allowed the IOTA crypto project to be considered a competitor to giants such as Bitcoin and Ethereum, known for its gas fees.

It is not based on Blockchain but on Tangle, which the developers call an enhanced version of Blockchain. The transaction speeds that IOTA is capable of make it faster than standard Blockchain technology.

It was founded by four individuals of diverse backgrounds. Sergey Ivancheglo, a software engineer from Belarus, Russian mathematician Serguei Popov, Norwegian entrepreneur David Sønstebø, and German entrepreneur Dominik Schiener.

IOTA started as Jinn Labs to create efficient microprocessors for IoT (Internet of Things). The popularity of this concept was so much that the developers sold 100,000 JINN tokens to materialize the project.

Then regulatory concerns came to light that prompted the developers to shift their strategy and make the project fall within regulation. With that idea, they launched IOTA in 2015, intending it to become the platform for choice for transactions between IoT devices.

There is no concept of Blockchain in IOTA. Instead, it follows a DAG – Directed Acyclic Graph- architecture. No miners are required, and thus, no fee is necessary for smaller transactions. This is why it can provide a limitless throughput at minimum expense.

In some respects, this seems like a potentially revolutionary but also a very experimental technology. Knowing that, should you buy IOTA?

Is IOTA a Good Investment?

IOTA’s new and radical nature has compelled many to ask the same question. Crypto is a field susceptible to rapid changes with modifications in the community’s moods or the DeFi ecosystem. Also, IOTA doesn’t follow along the same lines as standard blockchain technology.

It is based on Tangle, a technology touted as an evolution of the standard Blockchain. The market performance and the fee-less transactions have helped IOTA earn a lot of trust from a cult following of crypto enthusiasts. That being said, interest has dropped somewhat as the price of IOTA didn’t move much in 2019 – 2020. It did in 2021, although most crypto projects did that year.

Increased Transaction Speed

Bitcoin and blockchain technology has some transaction issues. To be fair to miners and ensure that every transaction is given enough time to be verified, transaction speeds are low. The transfer rates are in double digits, which has led to crypto projects trying to outperform that.

IOTA utilizes an exponential increase system. The more users engage with the platform, the more the speed increases. The unique consensus protocol it implements accelerates the verification and authentication speeds possible.

Free Micro Payments

The transaction fee has always been high for BTC and ETH. With transaction fees of Bitcoin going into double digits and higher for Ethereum, some ask how those using these currencies to perform small transactions like buying groceries or taking a cab be viable.

IOTA follows a different – free transaction fee – approach. Because it is not based on Blockchain, no mining is required. And when no mining is required, the transaction fee diminishes.

In other words, smaller transactions would cost users very little or nothing. IOTA-enabled free micropayments could make it viable for crypto to be part of our everyday lives.

Scalability

One of the most significant challenges that Blockchain faces is scalability. As more users enter the space, the harder it gets to perform a transaction. Consequently, the verification process takes longer – making scaling a pain-staking concept.

IOTA has taken this concept and turned it on its head. The DIAG approach it follows has conceived a processing module that becomes faster as more users interact with the platform.

In the alternative ‘IOTA Blockchain’ (Tangle), after the data identification, the data execution time becomes zero. IOTA effectively removes the scalability issue plaguing the current blockchain space.

A Future Ready Coin

The blockchain sector is expensive. If you’re not an enthusiast or don’t have access to disposable income, the chances of you interacting with any crypto sector are low. And although this has become more inclusive due to affordable altcoins, the current level of security doesn’t instill confidence in some newcomers who constantly hear about people being scammed by fake airdrops or phishing links. Many are still apprehensive about stepping into the crypto sector.

IOTA is different though. It has the same decentralization concept in mind but follows a Tangle architecture powered by DAG, allowing it to provide a great alternative with low cost, more speed, and most importantly, higher security.

Safety

Decentralization is the mantra of the Blockchain space, even though it is far from a reality. Blockchain is not genuinely decentralized as the developers holding its control can modify it in their favor. Proponents of IOTA consider it to be closer to true decentralization.

It is democratic, has a low cost, and provides community-powered security. It is becoming more and more viable for any industries seeking to maintain data immutability.

Cryptoassets are a highly volatile unregulated investment product.

IOTA Price

The IOTA price opened 2022 at $1.36 shortly before dropping under it, and it has ranged from $0.50 – $1 since then. Partly that was due to Bitcoin crashing in January, continuing its move down from November 2021’s high of $69k.

At the time of writing the price of IOTA is ranging from $0.55 – $0.6 with a marketcap of $1.5 billion, down from $2.5 billion just weeks ago so that may recover. It is now ranked the #57 crypto by market capitalization.

IOTA trading volume in the in the last 24 hours is $62 million. The total supply of IOTA coins is 2,779,530,283 and 100% of the supply is unlocked and in circulation.

IOTA Price Prediction

The IOTA supply all circulating is an argument for the bullish case for IOTA – token unlocks usually lead to a deflation in price.

All IOTA tokens being on the market could lead to a supply shock if most is held by whales or committed investors that won’t sell, even when the stock market and Bitcoin are looking unstable, as they have been in Q2 2022.

The bottom on the IOTA price chart was $0.16

The current price of IOTA in 2022 is still around 400% higher than the bear market bottom, hit in late 2019.

IOTA, in the past, grew to become one of the top five cryptos with a $15 billion market cap in early 2018. At the time it ranked #4 on Coinmarketcap, and Bitcoin was $12k. If it reaches the same historical valuation again, it would put the IOTA price back to $5-$6, around its all-time high.

That is not hard to imagine in crypto – debatably the long sideways trading range in 2019 and 2020 was an accumulation cycle which IOTA broke out of in 2021, and now support is being retested in 2022.

IOTA uniquely focuses on creating an evolved version of decentralized finance where cryptocurrencies become viable for everyday transactions. If it achieves what it set out to do and gains traction with new market participants, it could revisit its all time high again.

IOTA Video Analysis

See our full IOTA price prediction here.

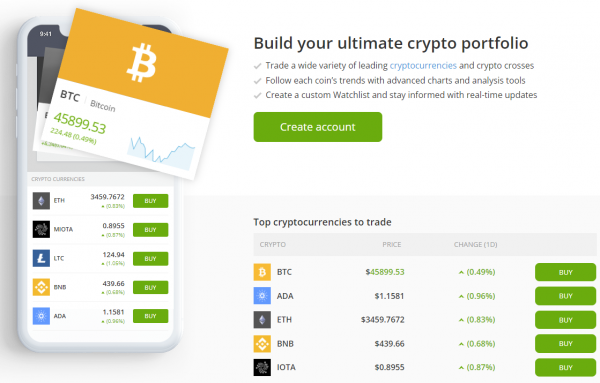

Best Ways to Buy MIOTA

When you buy MIOTA, be careful about selecting the best payment method. Fast methods are often pricey and the cheaper methods may take more time.

Buy MIOTA with Debit / Credit Card

Crypto.com charges 2.99% for bank cards and Coinbase 3.99% (although it hasn’t listed IOTA yet). In general using a bank transfer is cheaper than a card, but may take longer to process depending on your country.

Buy MIOTA with Paypal

Paypal transactions are supported on eToro as well as the widest range of payment methods in the industry.

Buy MIOTA without ID

IOTA is listed on Changelly so you can buy IOTA without ID there. You’ll need a wallet address to receive the funds though as it’s just a platform to ‘swap’ cryptos rather than hold them.

Best IOTA Wallet

There are many IOTA wallets to choose from. We recommend a beginner-friendly wallet with all the tools you need to trade and engage with the market, such as the eToro Money crypto wallet.

It is free of charge for iOS and Android users and supports 120+ cryptos including IOTA. For those who often forget their private keys, eToro has an unlosable private key and free recovery service. It can be downloaded via links on the desktop website.

Cryptoassets are a highly volatile unregulated investment product.

How to Buy IOTA – Full Tutorial

Here is a comprehensive guide on how to buy MIOTA tokens step by step.

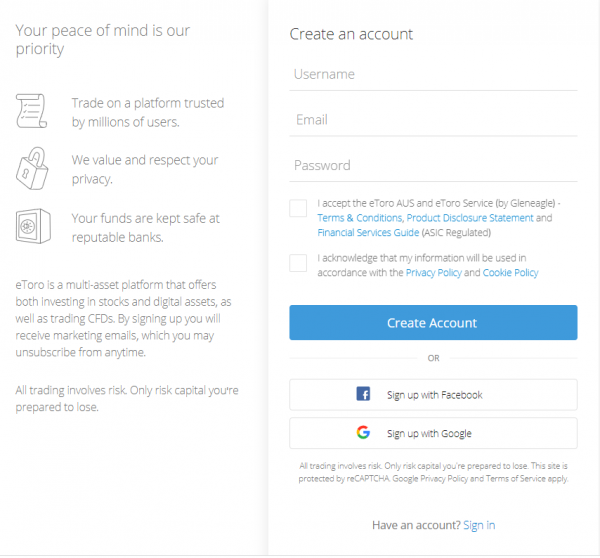

Step 1: Create Your Account on eToro

First, visit eToro.com and create an account. You will first see a registration form that you’ll need to fill out with a username, email address and password.

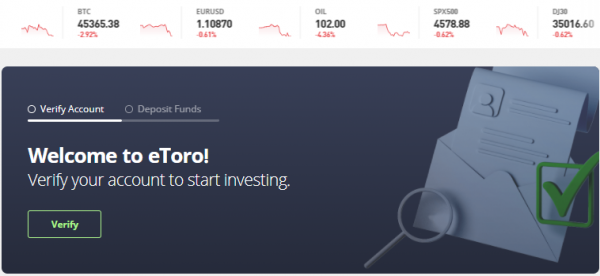

Step 2: Upload ID

Once you have entered your credentials, you will get a notification to upload KYC documents. The verification stage is mandatory if you want to invest in IOTA or other crypto assets. The documents you’d need are a government-issued ID, passport, and proof of residence.

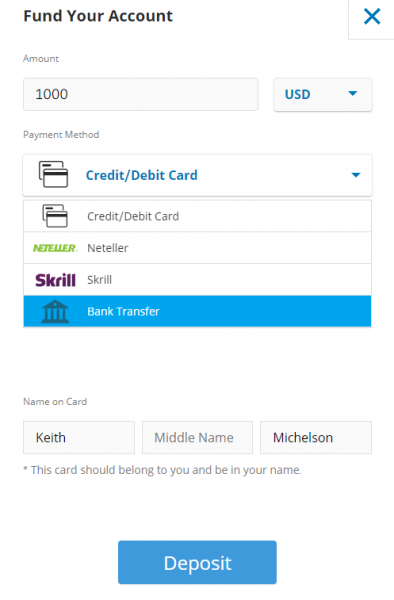

Step 3: Deposit Funds

You can only start investing in IOTA via eToro if you have sufficient funds in your eToro account. Make at least a $10 minimum deposit to start trading. The eToro platform provides multiple payment methods, from Visa and Mastercard to bank transfers and Neteller.

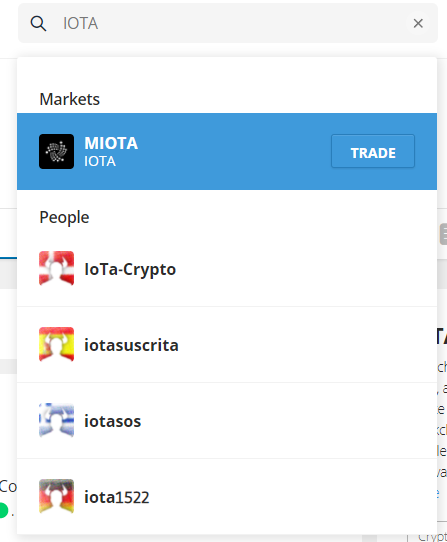

Step 4: Search for IOTA

After entering your dashboard, search for “IOTA” (or MIOTA) in the search bar. When you see the option, select it. Once you land on the IOTA trading page, click the “Trade” button.

Step 5: Buy MIOTA

eToro allows crypto users to use fiat money – traditional currency – to invest in IOTA. So you’ll trade MIOTA against USD or your account currency.

Move the slider to the amount you want to invest in IOTA. Finally, click on “Open Trade” to confirm your buy order.

Cryptoassets are a highly volatile unregulated investment product.

How to Sell IOTA

The process of selling IOTA is the same as buying on eToro, simply use the ‘Trade’ button again to sell IOTA.

When you sell IOTA it may be categorized as a taxable event depending on your country, for example as capital gains tax.

Conclusion

IOTA has its advocates and its critics. In terms of where to buy IOTA an advantage of eToro is you can network with more experienced pro traders and follow their IOTA investing strategy.

On the social trading site you’ll have a news feed and profile, as will other IOTA buyers and sellers – helping you to potentially time the market swings and compound your position by keeping up to date with how the market is responding to the IOTA price action.

Cryptoassets are a highly volatile unregulated investment product.