iRobot Corporation is one of the world’s leading manufacturers of robot technology.

So, is this a good time to invest in iRobot stock? In this guide, we offer an analysis of this company, taking a closer look at its future prospects.

We also explain the steps to follow to buy iRobot stock with a regulated broker in under five minutes.

How to Buy iRobot Stock With a Regulated Broker

The best way to invest in iRobot stock is to go through a regulated broker that offers cost-effective investments.

After choosing a suitable broker, investors can take the following steps to buy iRobot stock.

- ✅Step 1 – Open an Account With a Regulated Broker: To get started with a stock broker, investors will first need to set up an account with the platform. This requires providing some personal details, such as a full name, date of birth, and contact details.

- 🛂Step 2 – Upload ID: Regulated brokers also require their users to get verified before they can buy stocks. This means that investors will have to submit proof of identity(such as a passport) and a document that verifies their address (like a utility bill).

- 💳Step 3 – Deposit Funds: After completing the verification process, investors can proceed to fund their brokerage account. This is often possible by linking a bank account, using a credit/debit card, and in some cases – paying via an e-wallet like Paypal.

- 🔎Step 4 – Research and Buy iRobot Stock: Next, use the search function on the brokerage platform to find iRobot stock. The best brokers in this space often provide some basic information about the stock, along with price charts and other indicators that help users perform technical analysis. When ready, elect to buy iRobot stock and enter the amount to invest in the company. Complete the purchase by confirming the order.

iRobot stock is listed on the NASDAQ exchange under the ticker IRBT. This means that the broker will be able to execute the order only when the NASDAQ exchange is open.

If it is, the order will be completed right away, and the newly purchased iRobot stock will be updated to the investor’s portfolio – from where they can track the performance of the asset.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

Experienced investors might already have a list of top brokers they prefer to buy stocks from. For beginners, however, the first concern would be to figure out where to buy stocks.

- When looking for a top stock broker, the most important factor to consider is the security offered by the provider.

- Therefore, it is always in the best interest of investors to stick to regulated brokers.

- On top of this, investors should also evaluate aspects such as brokerage fees, accepted payment methods, and the level of customer service offered.

Below, we have included a short review of three popular stock brokers that enable investors to buy iRobot stock.

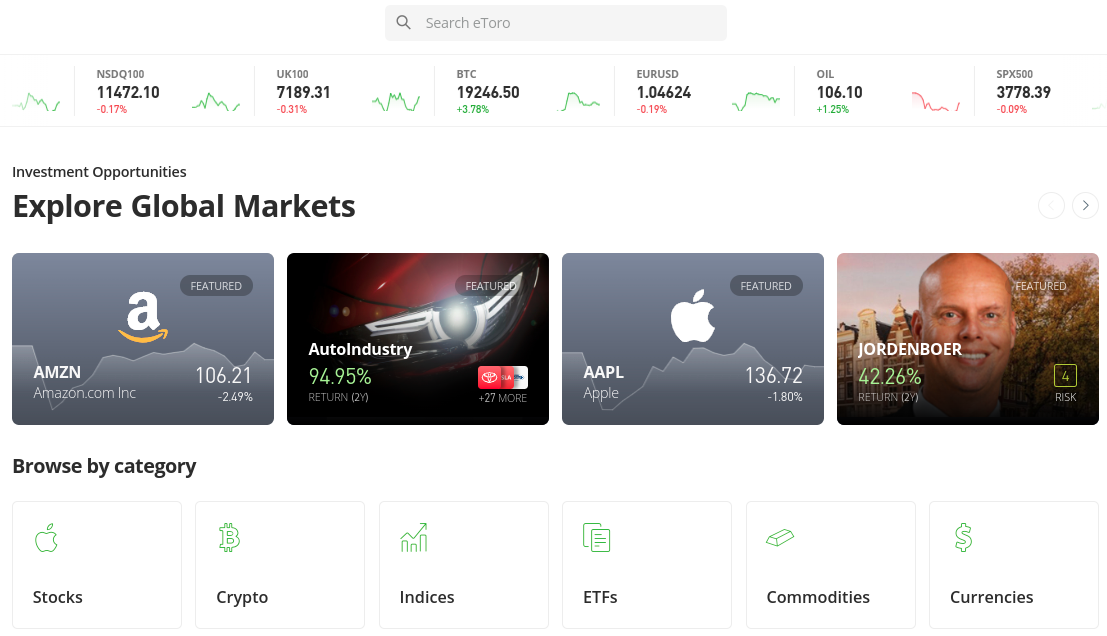

1. eToro

eToro not only lists US-based stocks like iRobot, but also companies trading in international markets. In fact, the broker comes with access to 17 global exchanges. And there is no need to pay any commission when buying or selling stocks on eToro – no matter where the stock is listed.

This means that when buying iRobot stock, investors only need to concern themselves with the spread. Moreover, eToro is also flexible when it comes to payment methods. It enables users to buy stocks via a bank transfer, or by using a credit/debit card.

eToro also supports e-wallets, allowing investors to buy stocks with PayPal, Neteller, and Skrill. Moreover, payments made in US dollars are fee-free on eToro. While it accepts deposits in euros, British pounds, and other fiat currencies, the platform charges a 0.5% forex exchange rate for these transactions.

eToro enables investors to open a new account with as little as $10. Moreover, the minimum stake required to buy stocks in iRobot is also $10. This means that eToro users can benefit from fractional investing without having to risk large amounts.

The platform also offers a free demo account to all users, which comes loaded with $100,000 in paper money. Investors can use this demo account to learn their way around the platform or to test their trading strategies in real-market conditions.

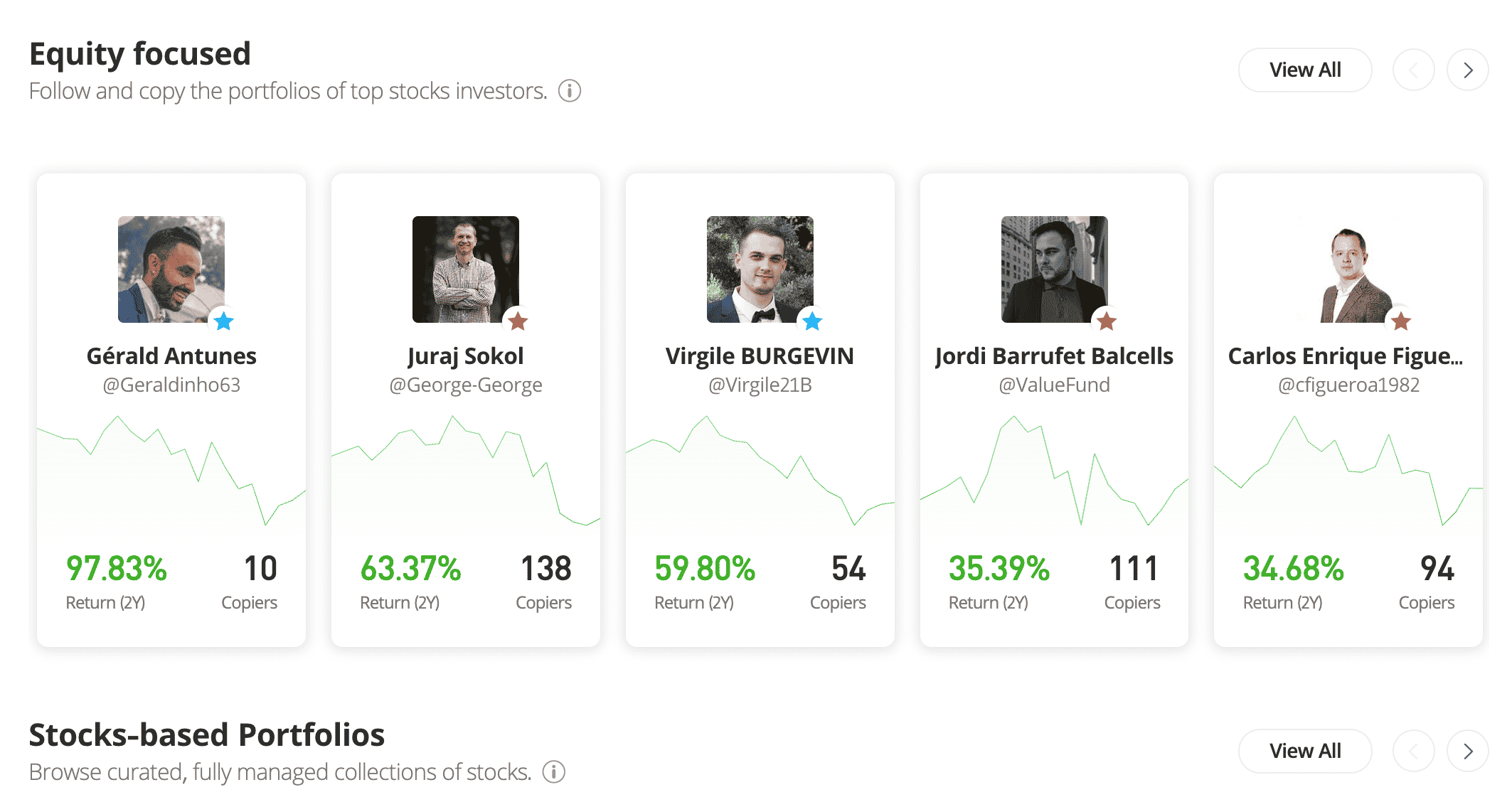

In addition to this, eToro also has a Copy Trading feature that enables its users to put their portfolios on auto-pilot mode. Essentially, investors can elect to copy the trades placed by other eToro users after reviewing their past performance, trading style, and recent positions.

This way, any time the chosen trader opens or closes a position, the same will be repeated in the user’s eToro portfolio. Moreover, eToro does not charge any additional fees for this feature. Instead, users can get started by meeting the minimum investment amount, which is set at $200.

Apart from this, the broker also offers access to Smart Portfolios, which are automatically managed and regularly rebalanced by the eToro team.

Finally, eToro is heavily regulated. It holds licenses from top-tier financial authorities – such as the SEC in the US, FCA in the UK, CySEC in Cyprus, and ASIC in Australia. Altogether, we found that eToro could be a good match for both beginners and experienced investors to buy iRobot stock.

| Approx No. Stocks | 2,500+ |

| Min Deposit | $10 |

| Cost to Buy iRobot Stock | 0% commission + spread |

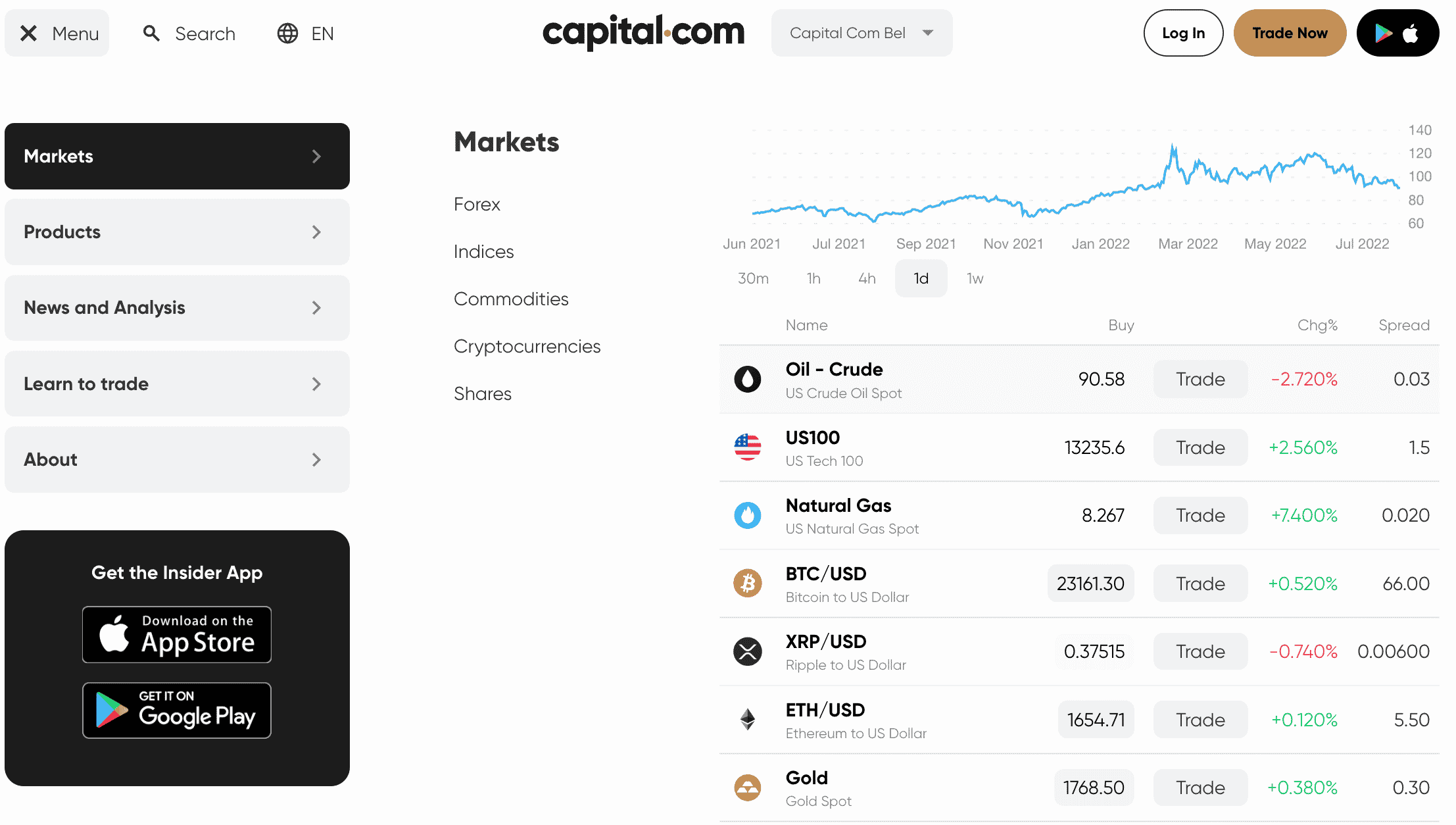

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. So, if trading iRobot stock via Capital.com, users will not be buying and selling the equities of this company directly. Instead, they will be trading CFDs that represent the price of iRobot stock. This way, traders do not have to take ownership of the stock but will still be able to capitalize on price movements. This strategy also allows investors to speculate on the rising and falling prices of iRobot stock. Like eToro, Capital.com is also regulated by top financial bodies. This broker is licensed by CySEC, FCA, ASIC, and NBRB. Moreover, our Capital.com review pointed out that this broker does not charge any commissions. However, if keeping a trading position overnight, the platform will charge ‘swap’ fees. Therefore, bear in mind that when adopting a long-term investment strategy for stocks, Capital.com might not be the most suitable broker out there. On the other hand, this platform is often preferred by short-term traders. Apart from supporting stock CFDs, Capital.com also gives its users access to forex, commodities, and cryptocurrencies. Users of Capital.com can trade via MT4 and gain access to over 70 technical indicators, thousands of charts, and set price alerts. To get started, Capital.com requires users to make a minimum deposit amount of $20. If depositing money via bank transfer, the minimum requirement increases to $250. That being said, Capital.com processes all deposits for free – no matter the chosen payment method.

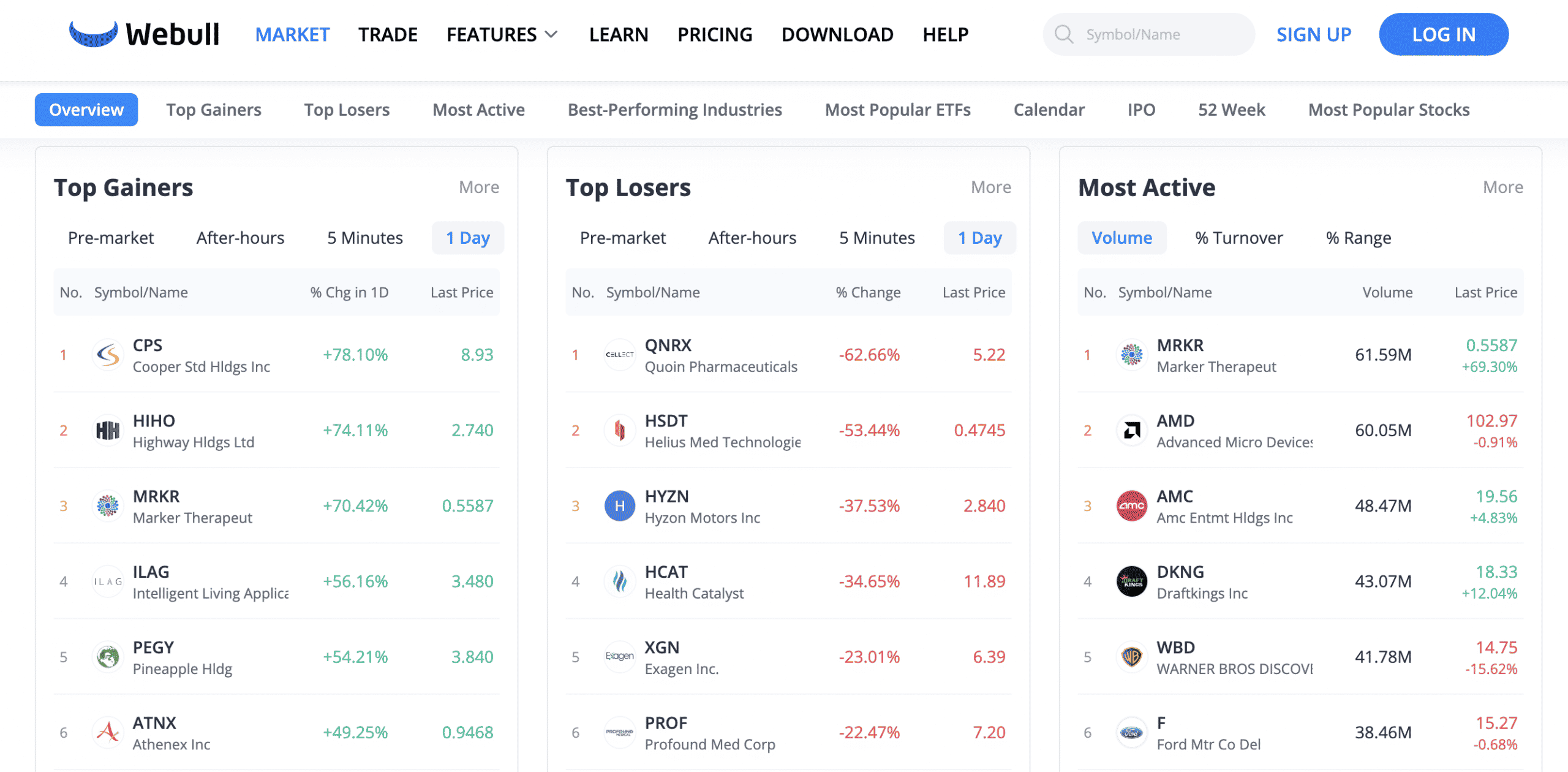

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. This broker, like eToro and Capital.com, charges no commission for stocks and ETFs. Moreover, Webull does not stipulate any minimum deposit amount. This means that users can sign up with whatever amount they feel comfortable with. The only condition is that the investment amount to buy iRobot stock has to be at least $5. Webull also gives its users access to thousands of other stocks. However, the majority of them are listed on the NYSE or the NASDAQ. While there are a few foreign stocks listed, there are offered as ADRs. Moreover, investing in ADRs is not commission-free. This might be a potential drawback for investors looking to diversify into international markets. The platform accepts payments via ACH and domestic wire transfer. However, when moving money via a wire transfer, users will have to pay additional fees for both deposits and withdrawals. Webull also provides demo stock trading accounts for its users to practice investing without risking any real money. When it comes to its regulatory status, Webull is licensed by the SEC in the US. It also has a large library of educational resources that beginners can use to learn how to day trade stocks and other assets. Apart from stocks, Webull supports options trading and cryptocurrencies.

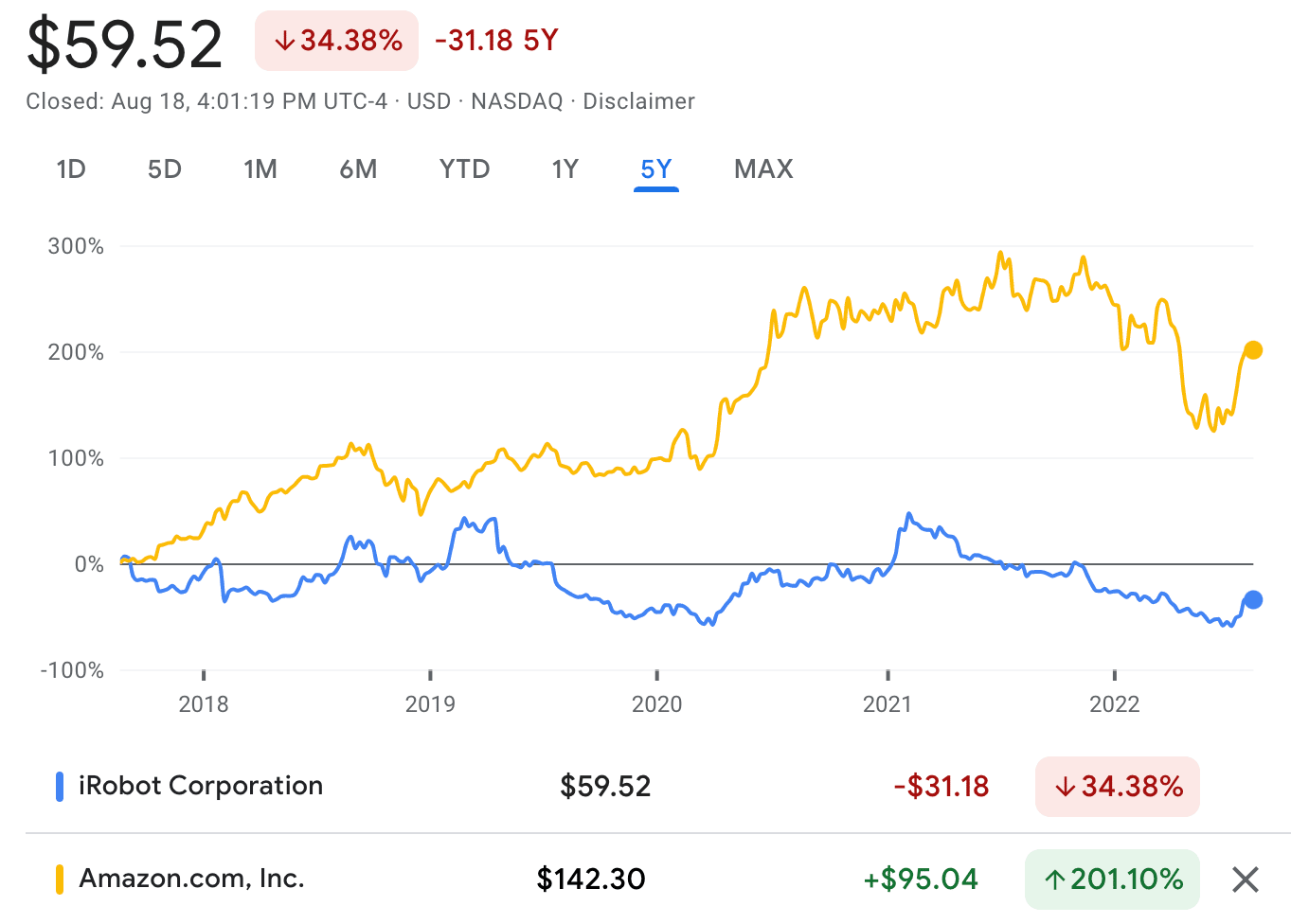

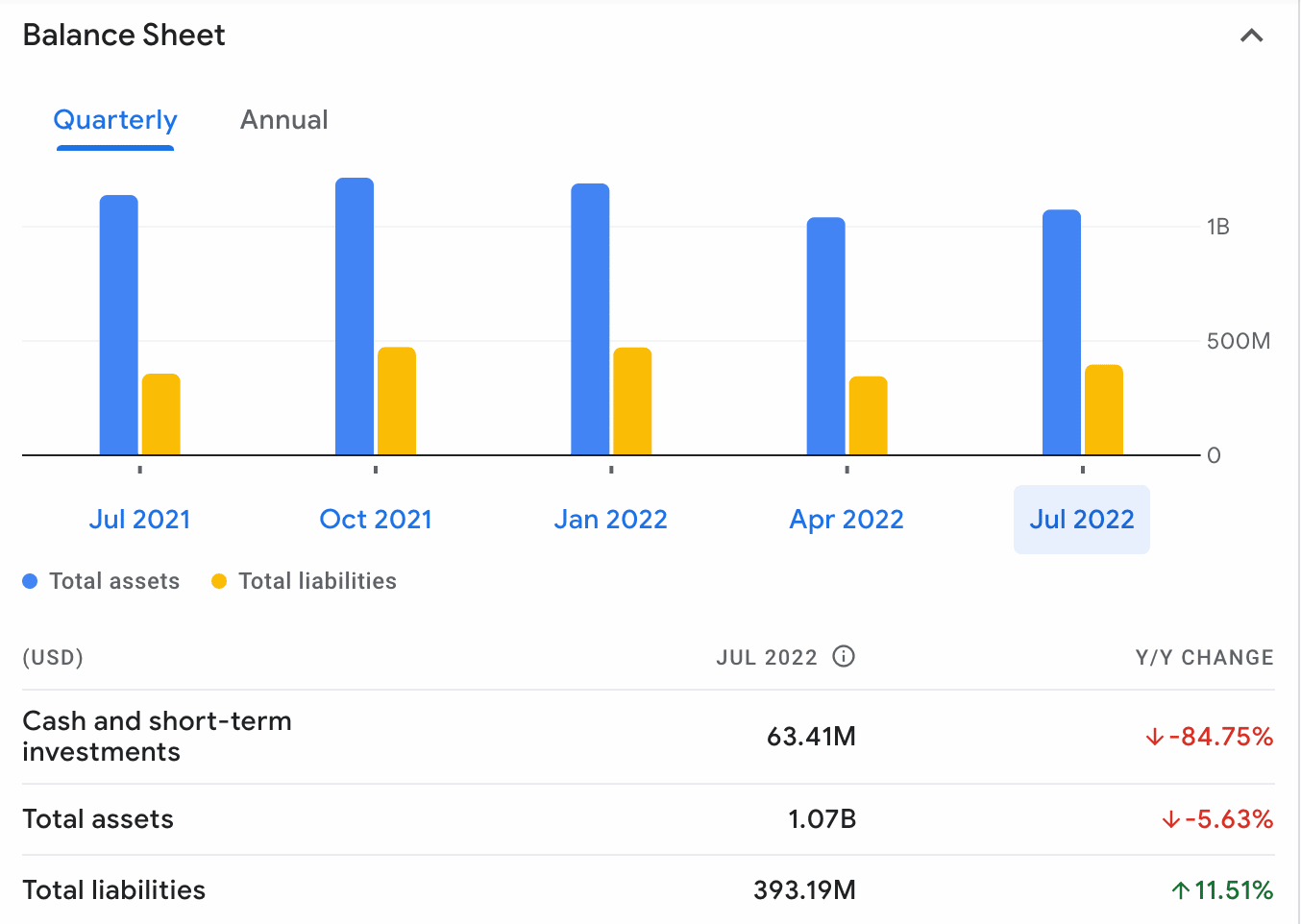

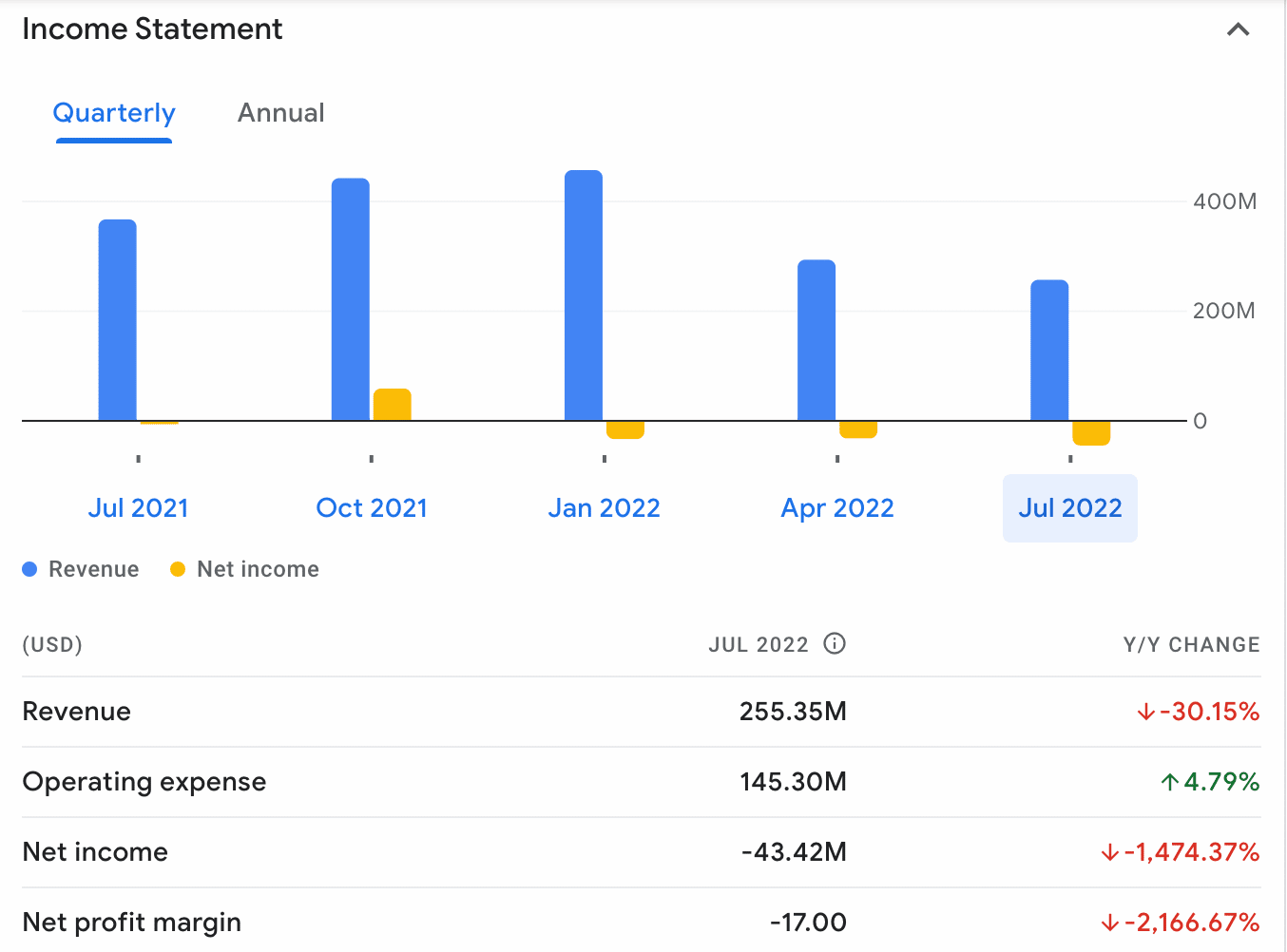

Your capital is at risk. Before investing in iRobot stock, it is imperative to acquire an understanding of how the business works. As an investor, one should be able to clearly explain the chosen firm’s business strategy, its value proposition, and how it makes money. In other words, every investment decision should be supported by sufficient research. Below, we have gathered some basic information about iRobot stock that will help investors with their decision-making process. iRobot is an American company known for its global consumer robotic products. The firm was founded in 1990 by three MIT roboticists. Over the years, iRobots has designed a variety of robots, contributing to projects of high significance. For example, iRobot has helped explore the Great Pyramid of Giza, found subsea oil in the Gulf of Mexico, and even inspired NASA’s first Micro Rovers. iRobot was also responsible for bringing the first self-navigating FDA-approved remote presence robots to hospitals. Over the course of three decades, iRobot has evolved to become a global enterprise that has sold over 40 million robots in different sectors across the world. That said, among consumers, the company is best known for its home robot, Roomba. It is also the iRobot’s best-selling product to date. One way to decide whether iRobot is a buy or sell is to study the performance history of this stock. iRobot held its IPO nearly 17 years ago at $24 per stock. In the subsequent years to follow, the company’s stock price hit lows of $7 The value of the iRobot did not see much growth until 2017, when a bullish run resulted in the stock hitting $102. Between 2017 and 2020, the price of iRobot stock went through considerable volatility. At the beginning of 2020, iRobot stock plunged significantly, along with the wider market. However, its stock price then began increasing gradually, and by January 2021, it hit an all-time high of around $161. This translates to growth of around 570% from the IPO price. This trend did not last for long. iRobot has since seen its stock value decline over the past year. At the time of writing, iRobot stock is trading at around $59 per share. Nonetheless, when compared to its IPO price, iRobot stock has gained around 150% in value. During the same timeframe, the S&P 500 increased by around 240%. In other words, iRobot stock has underperformed to the wider market. Both the P/E and EPS ratios are metrics often used by investors when making stock trading decisions. In other words, iRobot is losing money, as is evident from its latest earnings report. Having said that – while ratios such as the EPS and P/E can shed light on how the stock is valued, it is important to consider these numbers with respect to the company’s future growth prospects. However, in the case of iRobot, the company does not have any investments or plans that can make significant changes to its bottom-line growth in the near future. When considering long-term investments, many traders will screen for stocks that offer a high dividend yield. Although iRobot has been around for over three decades, this company has not paid any dividends to its stockholders. In fact, the firm has never been profitable enough to pay dividends through the use of retained earnings. For investors seeking passive income, we have prepared a guide on dividend stocks. Fundamental research can help investors study the financial health of a company. And this is the most important step in deciding if iRobot is a buy or sell. In this section, we analyze iRobot stock based on factors such as the company’s revenue, profit margins, future growth potential, and other core metrics. The most recent and perhaps most important development related to iRobot stock is its impending acquisition by Amazon. In August 2022, the e-commerce giant Amazon announced that it is planning to acquire iRobot. The offer was made at $61 per stock in an all-cash deal, which was 22% higher than the price at the time of the announcement. However, today, as of writing, iRobot stock is trading at around $59 – which is only around 3% below Amazon’s offer price. When considering that iRobot has struggled with slowing consumer demand, the acquisition will be welcome news for stockholders. That being said, bear in mind that the deal has not yet been approved by the Federal Trade Commission as of writing. As such, the iRobot stock might face more volatility in the coming months. As noted above, the FTC has not approved the Amazon acquisition, and there is every chance that the deal will fall through. After all, in the business world, anything can happen – take the Musk-Twitter deal, for example, which never came to fruition in the end. So, before diving into buying iRobot, it is imperative to gain an understanding of how this company makes money and whether it can survive as an independent firm. iRobot benefits from a diversified product portfolio. The company has three segments – home robots, defense and security, and remote presence. However, the company generates the majority of its revenue from consumer robots. The two main product categories of iRobot include autonomous vacuum cleaners (Roomba) and mops (Braava). Although these are market-leading products, the downside here is that iRobot is primarily a hardware company that has only just entered the software space. We have already established that iRobot is mainly known for its hardware products. However, the company is slowly making changes to its business structure that could help iRobot diversify into new markets. This offers a compelling reason for users to download the app and keep using it on a regular basis. Moreover, it also opens a way for iRobot to start delivering subscription services in the future, which could help the company set up a recurring revenue model. iRobot reported sales growth for 2021; however, since then, earnings have declined. The company reported a sharp drop in both revenue and profitability in Q2, 2022. While iRobot indeed faces competition, the company has already positioned itself as one of the top providers in this niche market. In other words, declining profits are not because of competition in the consumer robotics space but rather due to supply chain issues and semiconductor chip shortages. Furthermore, if taking a closer look at the sales trends, it is clear that the company is facing more challenges in the European segment, where the revenue has declined the most. The war in Ukraine and inflation might play a significant role in this. Although sales in the US and Japanese markets are generally down, the situation isn’t as bad as in Europe. Once these macroeconomic headwinds die down, iRobot might be able to grow again. That being said, the company still has a long way to grow before it achieves a double-digit operating margin. As is evident, iRobot indeed faces an ongoing struggle. In order to boost revenue, the company is already in the process of restructuring its operations. The measures being taken by the board include: These moves are expected to deliver net savings of between $5 to $10 million in 2022 and more in 2023. Moreover, it can help the company drive innovation and optimize inventory levels. However, if implemented, it will lead to a net reduction of around 140 employees, which represents 10% of the company’s workforce as of mid-2022. There is no way to predict whether there will be any backlash from this shift which might affect the stock market performance of iRobot in the short-to-medium term. In a nutshell, iRobot investors should have concerns over the profitability of the company. After Amazon’s announcement, the company’s management reported that it would not be providing any financial guidance for the future. Given this uncertainty, iRobot is an overly risky investment. However, investors and traders could always consider different strategies to profit from the short-term volatility of the stock – until the Amazon deal is set in stone. At this stage of our guide, traders should have a better understanding of iRobot and whether or not they should invest in this company. If electing to buy iRobot stock, it is best to do so via a regulated broker. Below, we have included a detailed step-by-step breakdown of how to buy iRobot stock from the comfort of home. The first step is to open an account with the chosen online broker. We suggest using a regulated broker for this purpose, and one that is convenient to use and charges competitive fees. To get started, visit the website of the chosen broker and sign up by providing an email address and a password. After verifying the email, users will have to provide some personal information, which includes a first and last name, date of birth, phone number, and residential address. In addition to this, the broker will also ask some questions about the investor’s prior trading experience. This enables the broker to offer tailored products suited to the investor. Regulated brokers also require new users to go through an identity verification process. This might seem like an inconvenience, but this measure is to ensure the platform complies with anti-money laundering laws. Nonetheless, completing the KYC process will take only a couple of minutes on most platforms. Investors will have to provide two forms of documentation: Some brokers also require users to take a selfie. Regardless, the verification process can be completed right away – given that the documents uploaded are in order. The next step is for the investor to deposit funds to buy iRobot stock. Although iRobot stock is trading at around $59 at the time of writing, the majority of online brokers support fractional investments from $5. Meaning, that investors do not need to buy an entire iRobot stock. Instead, they can purchase a fraction of a stock. To fund the account, investors can make a bank transfer. It is sometimes possible to buy stocks with a credit card, PayPal, Neteller, or Skrill – depending on the broker. Next, investors can look for iRobot stock on the brokerage platform. To do this, most brokers offer a search function that will help investors locate the iRobot stock trading page. When the order page loads up, choose to buy iRobot stock and specify the amount to be invested. After confirming the order, the broker will execute it right away – assuming that the NASDAQ exchange is open. iRobot continues to be a popular manufacturer of consumer robotic products. However, lately, the company is struggling to generate a profit. But things took a turn when Amazon announced that it would be acquiring iRobot in an all-cash deal worth $1.7 billion dollars. In light of this new development, iRobot stock seems to be going through a volatile phase. Therefore, before making an investment decision, traders should conduct independent research – while keeping their financial goals and risk tolerance in mind.2. Capital.com

Approx No. Stocks

5,400

Min Deposit

$20, $250 via bank transfer

Cost to Buy iRobot Stock

0% commission + spread

3. Webull

Approx No. Stocks

5,000+

Min Deposit

$5

Cost to Buy iRobot Stock

0% commission + spread

Step 2: Research iRobot Stock

What is iRobot?

iRobot Stock Price – How Much is iRobot Stock Worth?

iRobot Stock – EPS and P/E Ratios

iRobot Stock Dividends

iRobot Stock: Fundamental Research

Amazon’s Acquisition

Revenue Model

Shift to DTC

Concerns with Profitability

Cost Reductions

Step 3: Open a Trading Account & Buy iRobot Stock

Open a Brokerage Account

Upload ID

Deposit Money

Buy iRobot Stock

Conclusion

FAQs

Can you buy iRobot stocks?

How much does it cost to buy iRobot stock?

How much is iRobot worth in 2022?

Is iRobot a good stock to buy?

When to buy iRobot stock?