The collapse of the Terra ecosystem was one of the most significant ‘black swan’ events in the cryptocurrency market’s history, highlighting the inherent problems that algorithmic stablecoins have. However, Terra’s founder has recently attempted to save the project by launching a brand new network dubbed ‘Terra 2.0’ – which also comes with a new iteration of the LUNA token.

This guide will discuss how to buy Luna 2.0 in detail by highlighting which platforms offer the token, exploring what the token does, and showcasing all the steps within the investment process.

How to Buy Luna 2.0 – Quick Steps

To invest in cryptocurrency, an account is needed with a respected and licensed trading platform. The four quick steps below highlight how to buy Luna 2.0 on the Crypto.com exchange – all in a matter of minutes.

- Step 1 – Open an account with Crypto.com: Head over to Crypto.com’s exchange homepage, click ‘Sign Up’, and enter the required details to create an account.

- Step 2 – Deposit: Go to the ‘Wallets’ section of your account, click on the currency that you’d like to deposit, and then use either the QR-code feature or make a transfer from your crypto wallet.

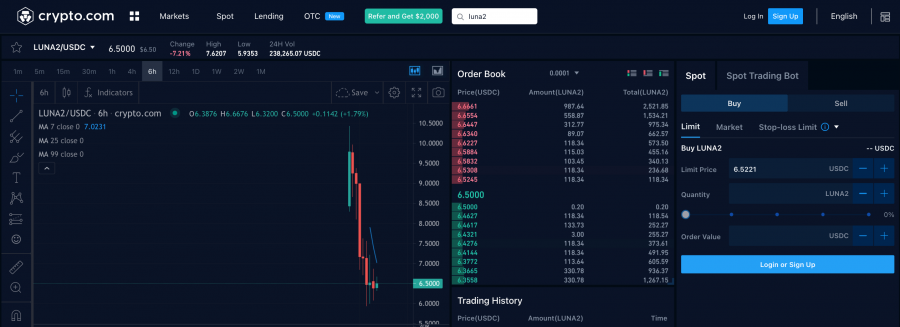

- Step 3 – Search for Luna 2.0: Type ‘LUNA2’ into the search bar and choose the ‘LUNA2/USDC’ pair.

- Step 4 – Buy: In the order box on the right side of the screen, enter how much you’d like to invest in LUNA2 and confirm the transaction.

Cryptoassets are a highly volatile unregulated investment product.

Where to Buy Luna 2.0

Since launching in late-May 2022, many investors have clamoured to invest in Luna 2.0 to try and recover some of the losses made from the original token. Due to the connotations of the Terra/Luna ecosystem, many of the best crypto exchanges have not yet offered Luna 2.0 as a tradable asset.

However, some exchanges do offer the token, and we’ve narrowed down the selection to our recommended pick – reviewed in detail below:

1. Crypto.com – Overall Best Place to Buy Luna 2.0

Crypto.com enables users to buy Luna 2.0 token through the exchange segment of the platform, which charges a maker/taker fee based on the trader’s 30-day trading volume. For monthly volume less than $25,000, the maker and taker fees are both 0.4%. Notably, Crypto.com allows users to gain a 10% discount on these fees by paying them in CRO – the platform’s native token.

As one of the best altcoin exchanges on the market, Crypto.com also offers over 250 alternative cryptocurrencies to trade, making it easy to create a diversified portfolio. Deposits are entirely free to complete on Crypto.com’s exchange, and over 20 cryptocurrencies are accepted as a funding method – including BTC, ETH, and XRP.

Investors can also trade through Crypto.com’s mobile app, allowing instant crypto purchases using a credit or debit card. Although the app does not allow users to buy Luna, it does offer a selection of other cryptos which can be purchased instantly – although this does come with a 2.99% transaction fee. However, Crypto.com waives this fee for the first 30-days of trading for each user.

Finally, Crypto.com is also packed with several additional features, such as one of the best NFT marketplaces for low-cost NFT trading. Users can even download Crypto.com’s free non-custodial crypto wallet app, which supports over 100 tokens and is protected by Biometric and Two-Factor Authentication.

Cryptoassets are a highly volatile unregulated investment product.

What is Luna 2.0?

So, what actually is Luna 2.0? As the name suggests, Luna 2.0 is the second iteration of the failed LUNA token that was part of the initial Terra ecosystem. Luna 2.0 is the native token of the new Terra blockchain, which is entirely separate from the original blockchain that was at fault during the ‘black swan’ event in May 2022.

Investors can still buy Terra Luna (the original version) from certain exchanges, yet the price remains down by over 99% from previous highs. The new iteration of the Terra ecosystem has been released by TerraForm Labs following a proposal from founder Do Kwon. The most crucial distinction between the two versions is that Terra 2.0/Luna 2.0 has severed all ties with the UST stablecoin.

The Luna 2.0 price began at around $5 when it was launched in late-May 2022, yet immediately rocketed by over 90%. The token’s price movements will be discussed in detail later in this article. However, it’s essential to understand that Luna 2.0 was essentially given for free to investors who held LUNA or UST in the pre-attack and post-attack periods.

According to CoinMarketCap, 210 million Luna 2.0 tokens are currently in circulation – although there is a maximum supply of 1 billion tokens. These tokens will be gradually distributed throughout the next six months to ensure the stability of the new ecosystem. The old blockchain network will still run in the meantime, although it has since been rebranded to ‘Terra Classic’ – with the old Luna token being changed to Luna Classic (LUNC).

Is Luna 2.0 a Good Investment?

Risk-seeking investors looking to make money with crypto may naturally gravitate towards Luna 2.0 due to the amount of media attention it is receiving and the token’s relatively low price. However, can Luna 2.0 be considered a good investment opportunity? Let’s dive in and look at some of the key elements to keep in mind regarding this token:

Free Airdrops

Investors who held LUNA or UST before the downfall have already received airdrops of Luna 2.0 as compensation for the event and also as a gesture of goodwill for sticking with the project. A total of 35% of the Luna 2.0 supply will be given to pre-attack LUNA holders, whilst 10% will be given to pre-attack UST holders.

Investors who held LUNA post-attack will receive 10% of the total supply, whilst those to held UST post-attack will receive 15%. The remaining 30% of the collection will be placed in the community pool – with developers receiving 10% of this amount.

Potentially High Returns

As with any low-cap crypto, returns can be extremely high during the early stages of a project. This has already been evidenced with Luna 2.0, as the coin’s price soared by over 90% in its first hour of trading.

Since then, LUNA has dropped and skyrocketed again – highlighting how volatile the token can be. Ultimately, this aspect will likely appeal to risk-seeking investors looking to generate double-digit (or even triple-digit) returns.

Strong Community

Although Terra’s downfall has been drastic, the ecosystem still retains tremendous support from areas of the crypto community. A prime example of this is the Terra/Luna subreddit, which boasts over 80,000 members.

The official Terra/Luna Discord server has nearly 50,000 members, whilst the ecosystem also has vast support on Twitter, Instagram, and Telegram. Even though many of the people involved in these social channels may not be overly bullish on the project, it highlights the attention paid to Luna 2.0 by retail traders.

Intense Media Attention

The dissolution of the previous Terra ecosystem was discussed heavily on various platforms, including many of the best crypto YouTube channels. This discussion even spread over to the mainstream media, with widely-respected outlets like Forbes running articles on the project.

Although much of the attention was negative, it still illuminated the project to a new demographic that might not have heard of Terra/Luna before. As such, this new audience will likely be paying attention to Luna 2.0 over the next few weeks – potentially intending to invest in the token.

Upgrade from Previous Ecosystem

Finally, Luna’s downfall was thanks to the ‘algorithmic stablecoin’ elements that eventually caused UST to de-peg. Since algorithmic stablecoins are not backed by any ‘real’ assets, such as USD or gold, any significant fluctuations in supply can cause drastic consequences.

Luna 2.0 does not have any connection to UST anymore, meaning this shouldn’t be an issue in the future. At present, Luna 2.0 doesn’t have much utility except for being native to the Terra 2.0 blockchain – although as the project recovers, there’s undoubtedly scope for additional use-cases to emerge.

Luna 2.0 Price

The Luna 2.0 price has had a rocky start, which is to be expected given the remarkable events that happened with the previous iteration of the token. Many market commentators still believe that LUNA could be one of the best low cap crypto gems, which seemed to be the case when the coin launched and then surged by over 90% in its first hour of trading.

Investors who held the previous iterations of LUNA and UST were airdropped tokens for free. Thus, when the price surged, it immediately fell again as many investors would have looked to ‘cash out’ and recoup some of their losses.

After hitting a low of $5.40 a few days after launching, many investors began to buy Luna 2.0 token yet again, causing the price to increase by 124% in one day. This pushed Luna 2.0 to an all-time high of $19.54 – yet the high was short-lived. At the time of writing, LUNA is trading around the $6.50 level, which is 46% below previous highs.

Luna 2.0 Price Prediction

Investors wondering how to buy Luna 2.0 will likely be interested in figuring out whether the token will be the next cryptocurrency to explode – or whether it will fall by the wayside like the previous version. At the time of writing, Luna 2.0 has only been trading for a few days, so it’s challenging to make any lasting assumptions based on the limited price data.

As we know, TerraForm Labs will be vesting more tokens throughout the year, thereby increasing the circulating supply. This could place downward pressure on price if demand remains the same. On the other hand, if the migration of dApps from the old chain goes through smoothly, it’ll provide a reason for the community to buy Luna – which could prop up the price.

A minor support level does appear to be holding around the $5.30 region, which is close to where price debuted at. Looking ahead, if greater volumes of traders start to buy Luna 2.0, we’ll likely see the token return to around the $20 level in the short term. However, over the longer period, the coin could go much higher – yet this will be contingent on TerraForm Labs delivering on their promise of a stable ecosystem.

Cryptoassets are a highly volatile unregulated investment product.

Ways of Buying Luna 2.0

Finding where to buy Luna crypto can be challenging since only a few platforms currently offer the token. However, it’s also wise to look into the purchase methods available to traders. With that in mind, presented below are two of the most common ways to buy Luna 2.0:

Buy Luna 2.0 with PayPal

Unfortunately, our recommended broker, Crypto.com, doesn’t accept PayPal as a deposit method on its exchange service. However, it is possible to connect PayPal to the Crypto.com App and make a FIAT deposit. Once that deposit goes through, the FIAT currency can be exchanged into crypto – which can then be used to trade the LUNA/USDC pair on the Crypto.com Exchange.

Buy Luna 2.0 with Credit Card or Debit Card

Many of the best crypto apps will also allow users to purchase digital currencies instantly using a credit or debit card. This removes the need to make a FIAT or crypto deposit, significantly streamlining the investment process.

Crypto.com offers this service through the Crypto.com App, although it is not possible to buy Luna 2.0 directly using a credit/debit card. Instead, users can purchase USDC instantly via card and then use this crypto to trade the LUNA2/USDC pair on the Crypto.com Exchange.

Best Luna 2.0 Wallet

After purchasing Luna 2.0 (or any other cryptocurrency), the coin(s) must be stored in a crypto wallet. Crypto wallets are pieces of software (or hardware) designed to keep cryptocurrencies safe. A common misconception is that these wallets actually store users’ crypto holdings inside – but that isn’t the case.

Instead, the best crypto wallets store the user’s private key – which links to the crypto holdings on the blockchain. Thus, whoever has the private key is essentially the ‘owner’ of the crypto. Due to this, private keys must be protected and never shared with third parties.

There are a variety of different wallet types, although presented below are two of the most popular ones:

- ‘Hot’ Wallets: Hot crypto wallets are always connected to the internet and tend to be offered in the form of a mobile app or browser extension. These wallets can either be custodial or non-custodial, with the latter meaning that the provider does not have access to your private keys. Although these wallets are considered user-friendly, they are more vulnerable to cyberattacks since they are always online.

- ‘Cold’ Wallets: On the other hand, cold crypto wallets are a type of offline storage solution, usually coming in the form of a USB-type device. These wallets are available to purchase from third-party suppliers and are not connected to the internet – meaning a cyber-attacker can’t access the user’s private keys. However, since these wallets are offline, they tend to be less convenient than hot wallets.

One of the most popular wallets today is the ‘eToro Money’ wallet from eToro. This wallet is free to download on iOS or Android and supports hundreds of crypto-assets. Users can also exchange one coin for another directly within the wallet’s interface, streamlining the investment process.

Although eToro’s wallet is a ‘hot’ wallet, it is secured by high-level standardization protocols and DDoS protection. It even features an unlosable private key which provides a way to recover access to the wallet if the private key is forgotten.

Cryptoassets are a highly volatile unregulated investment product.

How to Buy Luna 2.0 – Tutorial

As with all cryptocurrencies, investors looking to buy Luna 2.0 will have to create an account with a safe and reliable cryptocurrency exchange to facilitate their investment. When it comes to where to buy Luna coin, only a select few platforms currently offer the token – with Crypto.com being our recommendation.

With that in mind, the steps below highlight how to invest in Luna 2.0 using Crypto.com – all in a matter of minutes.

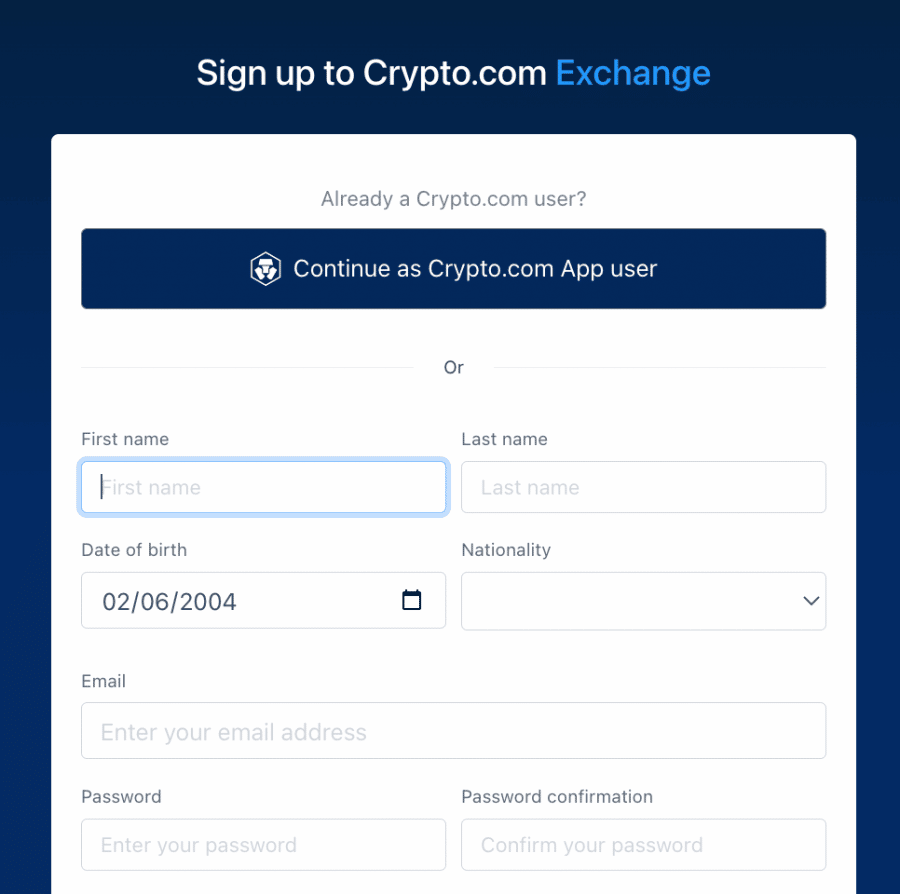

Step 1 – Create a Crypto.com Account

The first step when it comes to how to buy Luna crypto is to create a Crypto.com account. Importantly, Luna 2.0 is only available through Crypto.com’s ‘Exchange’ service, not the mobile app. Thus, an account must be created through your web browser.

Head over to the Crypto.com Exchange’s homepage and click ‘Sign Up’. You’ll then be asked to enter some personal details and choose a password for your account.

Step 2 – Verify your Crypto.com Account

The Crypto.com verification process is completed exclusively through the Crypto.com app – so you’ll need to download it from the App Store or Google Play to proceed. Once downloaded, log in using the details you created in the previous step and opt to verify your account.

Crypto.com will require three pieces of information during the verification process:

- Full legal name

- Picture of government-issued ID (e.g. passport)

- Selfie

Once these are provided, Crypto.com will begin verifying them and email you once complete.

Step 3 – Fund Your Crypto.com Account

Once verified, head to your account dashboard, click ‘Wallets’, and click ‘Deposit’. Following this, choose the cryptocurrency you’d like to deposit from an external crypto wallet and complete the transfer via QR code or through your wallet address.

Note: Crypto.com only offers the ‘LUNA2/USDC’ trading pair, so you’ll have to either fund your account in USDC or exchange another crypto into USDC before investing in LUNA2.

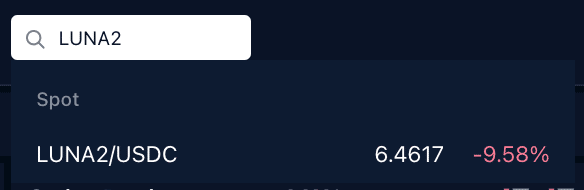

Step 4 – Search for Luna 2.0

Type ‘LUNA2’ into the search bar at the top of the screen and click on the ‘LUNA2/USDC’ trading pair in the drop-down menu.

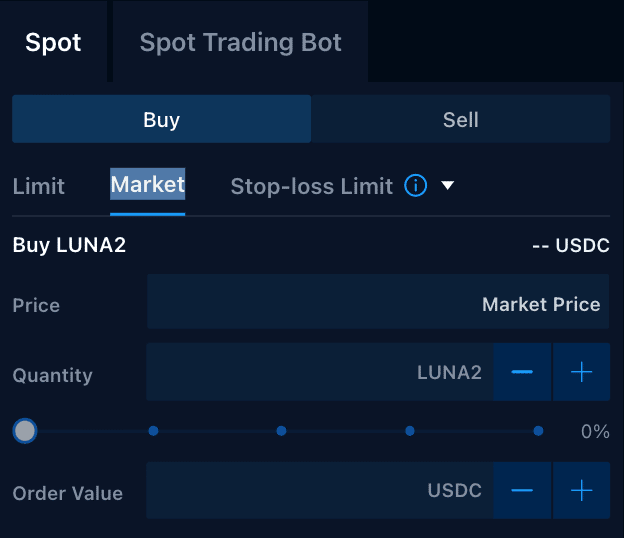

Step 5 – Buy Luna 2.0

To buy Luna 2.0, all that’s left to do is enter your investment details into the order box. Make sure you’re on the ‘Market’ portion of the order box so that your trade is placed instantly. Enter the quantity of LUNA2 you’d like to purchase, check everything is correct, and confirm the transaction.

Cryptoassets are a highly volatile unregulated investment product.

How to Sell Luna 2.0

When researching where to buy Luna coin, it’s also essential to review the selling process. With Crypto.com, it’s just as easy to sell cryptocurrency as it is to buy cryptocurrency. All that’s required is to click on the ‘Positions’ panel at the bottom of the trading dashboard to view all open positions.

To close the position immediately, click the ‘Market’ button, after which the proceeds of the trade will be placed in your account balance. If you’d like to close the trade when it hits a specific price, enter your chosen price into the ‘Limit’ box and then click ‘Close’ to set the order.

How to Buy Luna 2.0 – Conclusion

This article has discussed how to invest in Luna 2.0 today, touching on which platforms offer the token and the best way to buy Luna 2.0 with low fees. Although this token still has some negative connotations attached to it, it remains highly regarded by the Terra community – making it an intriguing prospect for risk-seeking investors.

Crypto.com allows users to invest in Luna 2.0 today with low trading fees, starting from only 0.4%. However, these fees can be reduced by 10% when paid in CRO. What’s more, Crypto.com even offers 250 alternative cryptocurrencies to invest in – making it quick and easy to create a well-rounded portfolio.

Cryptoassets are a highly volatile unregulated investment product.