With the Matterport stock price (MTTR) trading at low levels, investors are keen to know if the stock will repeat the 260% surge seen in 2021.

In this article we analyse the company’s fundamentals and provide a Matterport stock forecast for the short-term, medium-term and long-term and go through the process of buying Matterport stock.

Buying Matterport Stock – An Overview

The below the four-step guide below will detail the process of investing in Matterport stock using a regulated broker.

- Open an account with a broker – You can join most brokers in just a few minutes with only basic details.

- Upload ID – Established broker will keep its clients’ capital safe and secure by complying with financial regulations. Proof of address and identity verification documents can be uploaded without issue.

- Deposit – This can be done fee-free using a variety of methods such as credit and debit cards, bank wire transfers, PayPal, Neteller and Skrill.

- Buy Matterport Stock – With fractional investing, people can buy stock in Matterport with a low minimum transaction size of just $10.

Step 1: Choose a Stock Broker

Buying Matterport stock should be done with a high quality, regulated stockbroker that will keep investor capital safe and secure. The broker also needs to provide fast execution speeds, as well as low trading fees to keep overall costs low.

Below are two stockbrokers that fit these criteria to buy Matterport stock.

1. eToro

Since its launch in 2007, eToro has built a 20 million member community of investors. As one of the most popular stock trading platforms in the world, it provides a wide range of features useful to all types of investors.

eToro is authorised and regulated all over the world by the UK FCA, CySEC, ASIC and even FINRA. The eToro platform provides access to invest in more than 2,000+ stocks from some of the world’s largest stock exchanges.

Most importantly, clients can invest in stocks with 0% commission which is why eToro is is a viable option to buy MTTR stock.

The eToro platform also allows investors to trade on other asset classes such as commodities, indices, currencies, exchange traded funds (ETFs) and cryptocurrencies. One of the standout features of the platform is what eToro is most recognised for which is social trading and copy trading.

This enables investors to buy stocks on eToro in a more passive way by copying the trades of other successful investors. The eToro investment management committee also provides access to Smart Portfolios which enables theme-based investing.

Through eToro Smart Portfolios you can invest in the most popular dividend stocks or metaverse stocks. The web platform and mobile trading app are both simple to use and packed full of useful research tools and extra features.

| Number of Stocks: | 2,000+ globally |

| Pricing System: | 0% commission + Spread |

| Cost to Buy MTTR Stock: | Only spread fee from $0.04 cents |

| Non-Trading Fees: | Zero |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

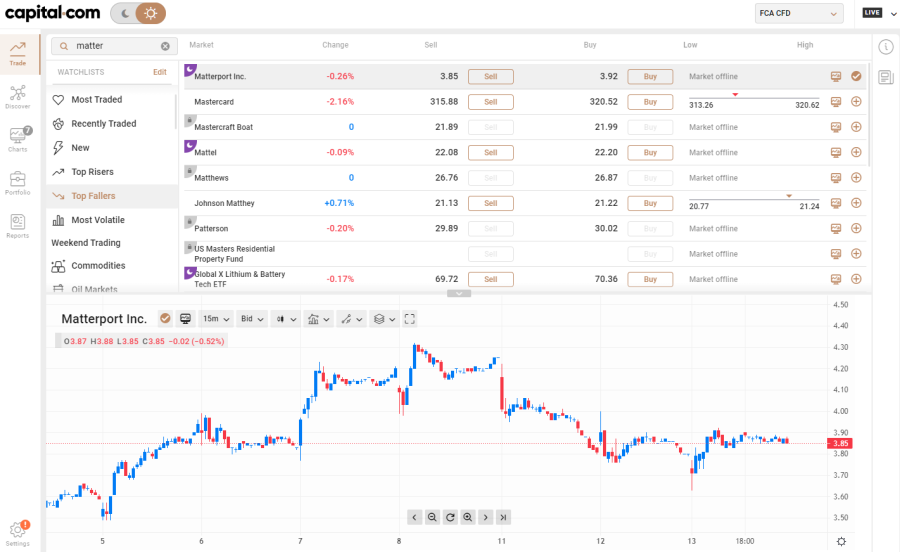

2. Capital.com

Capital.com is another broker providing a high level of safety of funds and execution as it is authorised and regulated by the UK FCA, CySEC, FSA and ASIC.

One of the benefits of Capital.com is that it provides margin trading via CFDs and Spread Betting (UK clients only). These products allow investors to speculate on the direction of a certain market enabling them to profit from rising and falling markets.

The products also enable investors to trade on margin by using the power of leverage. For example, to invest in Matterport stock with a position size of $5,000 the investor may only need to put up $1,000 of capital to be held as margin in order to control the larger investment size.

With Capital.com you trade on a variety of asset classes using leverage such as stocks, currencies, cryptos, indices, commodities and ETFs. Both the web platform and mobile trading app are simple to use and come with additional features such as trading ideas and live chart analysis tools.

| Number of Stocks: | 2,000+ globally |

| Pricing System: | 0% commission + Spread |

| Cost to Buy MTTR Stock: | Only spread fee from $0.07 cents |

| Non-Trading Fees: | Zero |

Your capital is at risk. 78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Step 2: Research Matterport Stock

In order to decide whether an investor wants to purchase a certain stock, ample research must be conducted. Below, we’ve inclucded a few factors a budding investor can look at to help them make a decision.

What is Matterport Inc

Matterport Inc (MTTR) is a technology company based in Sunnyvale, California. Since launching in 2011, the company serves customers in more than 177 countries around the world with remote offices in the United States, London and Singapore.

The core focus of Matterport is the engagement of spatial data to index physical spaces in a digital format. One of its leading products is a proprietary 3D setup that uses patented camera technology to capture images of interior spaces in 2D and 3D frames.

The technology can then layer images over a surface to create a 3D mesh of the interior space. This allows users to walk through the space and experience it as a 3D model. Some of Matterport’s clients include Marriott and Sotheby’s.

The Matterport stock symbol is MTTR which trades on the NASDAQ Stock Exchange.

Matterport Stock Price – How Much is Matterport Stock Worth

A useful way to answer the question is MTTR stock buy or sell is to analyse the company’s fundamentals to determine its worth and valuation. By analysing the Matterport stock history using financial ratios investors can gain useful insights into the future growth of the company and therefore the direction of its share price.

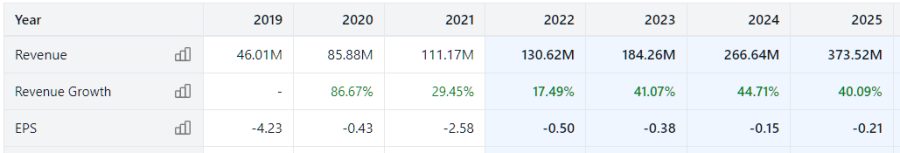

Matterport’s revenue has been growing steadily over the past several years. In 2020, revenue was reported at USD $85.88 million while in 2020 it was reported at $111.17 million – a substantial growth. So far, the current 12 month trailing return (TTM) is at $112.75 million highlighting the potential for a strong 2022.

While Matterport’s price to earnings ratio (P/E ratio) was -14.81 in 2021, the company’s market cap grew by 1,159%. Earnings per share figures are also expected to stabilise from 2022.

In 2021, earnings per share (EPS) came in at -2.58 with 2022 EPS forecasted at -0.50. However, this is in line with forecasts of positive revenue growth over the few years. From revenues of $46.01 million in 2019 to $373.52 million in 2025, it is clear why investors are wondering whether MTTR stock is performing well.

In the most recent Matterport forecast, the management team forecasts that growth is expected to continue in 2022 as recurring subscription revenues are rising and producing 31% to 34% year over year growth.

The company’s total subscribers in the fourth quarter of 2021 surged 98% to 503,000 compared to the fourth quarter of 2020 highlighting an increase in demand for its spatial computing products.

Matterport Stock Dividends

Matterport does not pay a dividend and therefore has no dividend yield. This is common for technology companies that have only recently become public. As these types of companies prioritise growth, any profits get reinvested back into its products and business operations.

To buy dividend stocks investors tend to favour more established and mature, bluechip stocks. For example, investors may opt to buy Pfizer stock which currently pays a 3.09% dividend yield.

Factors Affecting Mattersport Stock

With Matterport stock trading at low and revenue expected to grow exponentially, there are a lot of factors affecting Mattersport on the horizon.

While analysing the Matterport stock ticker and price chart is useful, the key to finding out the strength of Mattersport is to look at the prospects of the company’s future. Below are some key findings.

Subscriptions & Mergers Continue to Grow

2021 was a big year for Matterport. The company merged with special purpose acquisition company (SPAC) Gores Holdings VI helping to go public faster. The subscriber base doubled providing subscription revenue growth of 47% while also managing to increase Spaces Under Management by 54%.

The revenue from recurring subscriptions is important to Matterport’s financials as it represented 61% of total revenue. The balance sheet is also important as it provides capital for future growth.

Matterport redeemed its public warrants which boosted its balance with $104 million of cash. Alongside the $640 million in proceeds raised from the third quarter there is another capital to invest and accelerate growth over the next few years.

The company also announced the completed acquisition of Enview Inc which is a pioneer in artificial intelligence (AI) for 3D data.

New Product Launches Can Help to Accelerate Growth

Innovation in technology companies is critical. While Matterport has patented technology, shareholders will want to see new products being created to serve its current clients and to attract new ones.

New products such as Matterport Axis and Matterport for Android will help to bring 3D capture and digital twins to its clients all around the world with far more precision and accessibility.

In addition to these launches, Matterport announced partnerships with Amazon Web Services (AWS) and Autodesk. AWS customers can access Matterport’s digital twin technology, while a new plugin for Autodesk Revit customers will help them to create and manage information much more efficiently on bigger scale projects.

The company also introduced the Matterport Scan-to-BIM file which is an add-on service that helps to decrease the time and cost of Building Information Modeling (BIM) for different industries such as engineering and architecture.

Management Team’s Full Year Guidance is Very Strong

In Matterport’s most recent earnings call, the company provided very strong guidance and full year outlook for 2022. Total revenue is expected to range from $125 million to $135 million while recurring subscription revenue is expected to grow 31% to 34% year over year to between $80 million and $82 million.

The management team believe its new product launches will help to provide a broader adoption of Matterport in global real estate. New technology launches will help the digitizing and capture of physical spaces become simpler and accessible from any smartphone.

Less Affected by Higher Interest Rates as Balance Sheet Debt Free

In 2022, the US stock market recorded its worth first six months of the year since 1970. This has been largely attributed to the threat higher interest rates have a borrowing costs. Companies that have a high debt load will end up paying much more to service that debt.

Fortunately, Matterport is free of any debt and is, therefore, less likely to be affected by the cost of borrowing and higher interest rates. While the company could still borrow more capital in the future, there is enough cash in the bank to fund its activities and continue to grow.

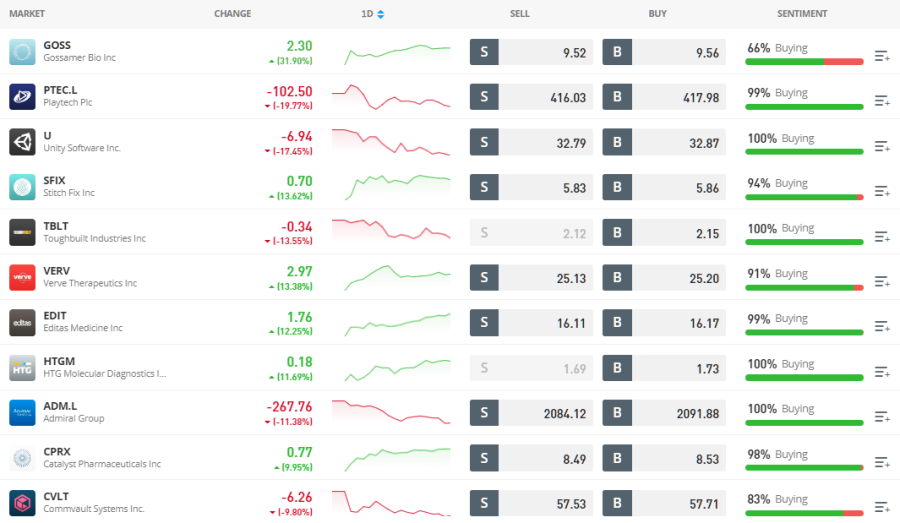

Analysts are Forecasting 320% Growth in Matterport’s Share Price

The consensus among 13 investment bank stock analysts providing a 12 month Matterport stock forecast is overwhelmingly bullish, although as a disclaimer is worth noting analyst price targets can change over time. Currently, the Matterport stock ticker’s price is $3.75.

The lowest analyst price target is $6.06 providing more than 61% potential upside. The average analyst price target is $9.18 providing more than 145% potential upside. The highest price target from all the analysts polled is $15.76 which provides more than 320% potential upside.

It is clear that institutional analysts are overwhelmingly bullish on the stock from current price levels. However, it’s always crucial to perform your own due deligence before investing.

Step 3: Open an Account & Buy Stock

Knowing how the analysts are forecasting Matterport’s stock price can help in building confidence. However, in order to successfully invest in a stock, it is important to have the right brokerage platform and tools to do so.

After all, the safety of your funds, transacting at the correct price and knowing the costs of your investments are key. Below is a brief guide on buying MTTR stock with a regulated broker.

1. Create Your Account

Opening an account with a broker is a very simple process. To get started, all that is required is a name and email address. This will start the account opening process which only takes a few minutes to complete.

2. Verify Your ID

Brokers regulated by the UK FCA, ASIC, CySEC and FINRA have some strict regulatory requirements clients will need to go through.

This can be done with most brokers as you can upload proof of address and identity documents from the web trading platform. It only takes a few minutes and you can be verified and compliant with Anti-Money Laundering regulations with ease.

3. Deposit Funds

To buy stock in Matterport funds are required. With large brokers you can deposit funds into your stock trading account fee-free using a variety of different methods. These include credit and debit cards, bank wire transfers and e-wallets such as Neteller, Skrill and PayPal.

4. Buy Stock in Matterport

Simply search for the stock (MTTR) in the toolbar at. Click on the name of the stock and the ‘Trade’ icon. This will open a trading ticket for Matterport stock.

The ticket allows investors to set their own price levels to buy or sell by using orders, as well as to set automatic stop loss and take profit price levels allowing for a degree of automated portfolio management.

Matterport Stock Strengths and Weaknesses

The company’s fundamentals, financial ratios and long term price targets are essential to know. Investing is known as a confidence game as investors need to be able to sit through up and down price swings in order to grow their capital.

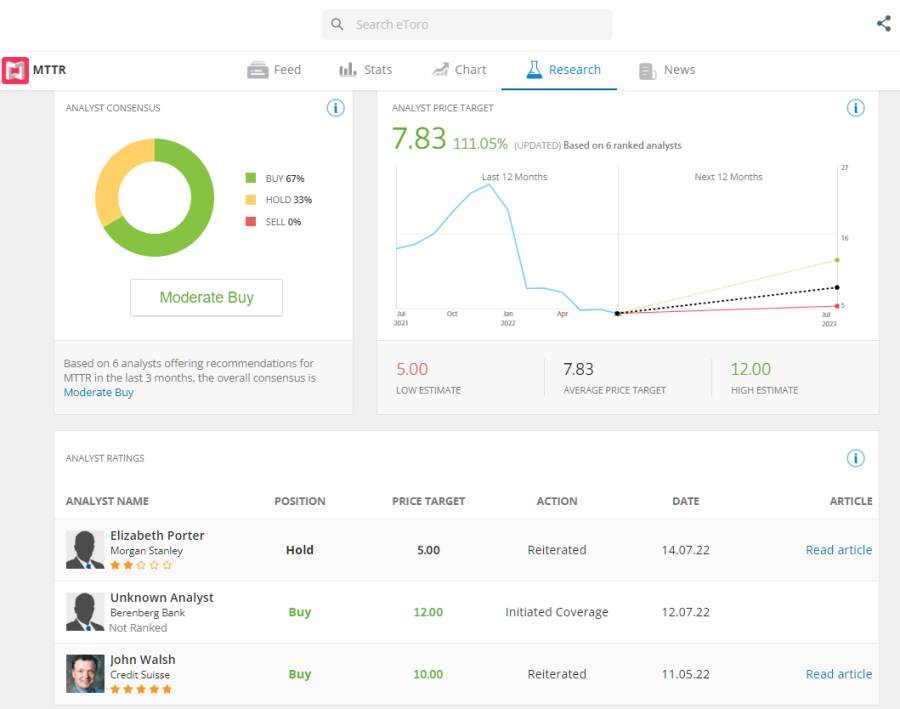

One simple way to build confidence is to learn what other analysts have to say about the Matterport stock price and where it could go in the future. Based on six analysts providing a Matterport stock forecast in the last three months, the overall consensus is a moderate buy.

The highest price target of $12.00 is from analysts at the investment bank Berenberg Bank. Analysts are Credit Suisse have placed a $10.00 price target on Matterport stock. Analysts at Morgan Stanley have placed a $5.00 price target on the stock.

All are above the current Matterport price level of around $3.75 (at the time of writing). The average price target of the analysts is $7.83 which represents a more than 110% move higher from current levels making Matterport stock one to watch.

New and upcoming product launches from Matterport will allow users to access their products without hassle. The company also has a debt free balance sheet which is rare for early technology companies but a huge positive in a world of rising interest rates and borrowing costs.

This is in addition to the doubling of its subscription revenue with makes up 61% of the company’s total revenue. The positive guidance from the management team is just one reason cited for the bullish stance on Matterport’s share price.

Matterport provides a product that is becoming increasingly important to real estate clients around the world. The ability to index physical spaces and create 3D models for users to walk through is the technology for the future. Analysts certainly seem to think so as well.

Conclusion

The bullish case for Matterport’s stock price is clear. The company is potentially trading at a comparatively lower price when taking future revenue forecasts and guidance in consideration. Analysts are also overwhelmingly bullish on the stock over the short-term and long-term. However, anything can happen in the stock market so performing your own research is crucial.

How you buy Matterport stock is also very important. Investing with high quality, regulated brokers that provide useful research tools and low fees is key to success. FCA regulated stockbrokers