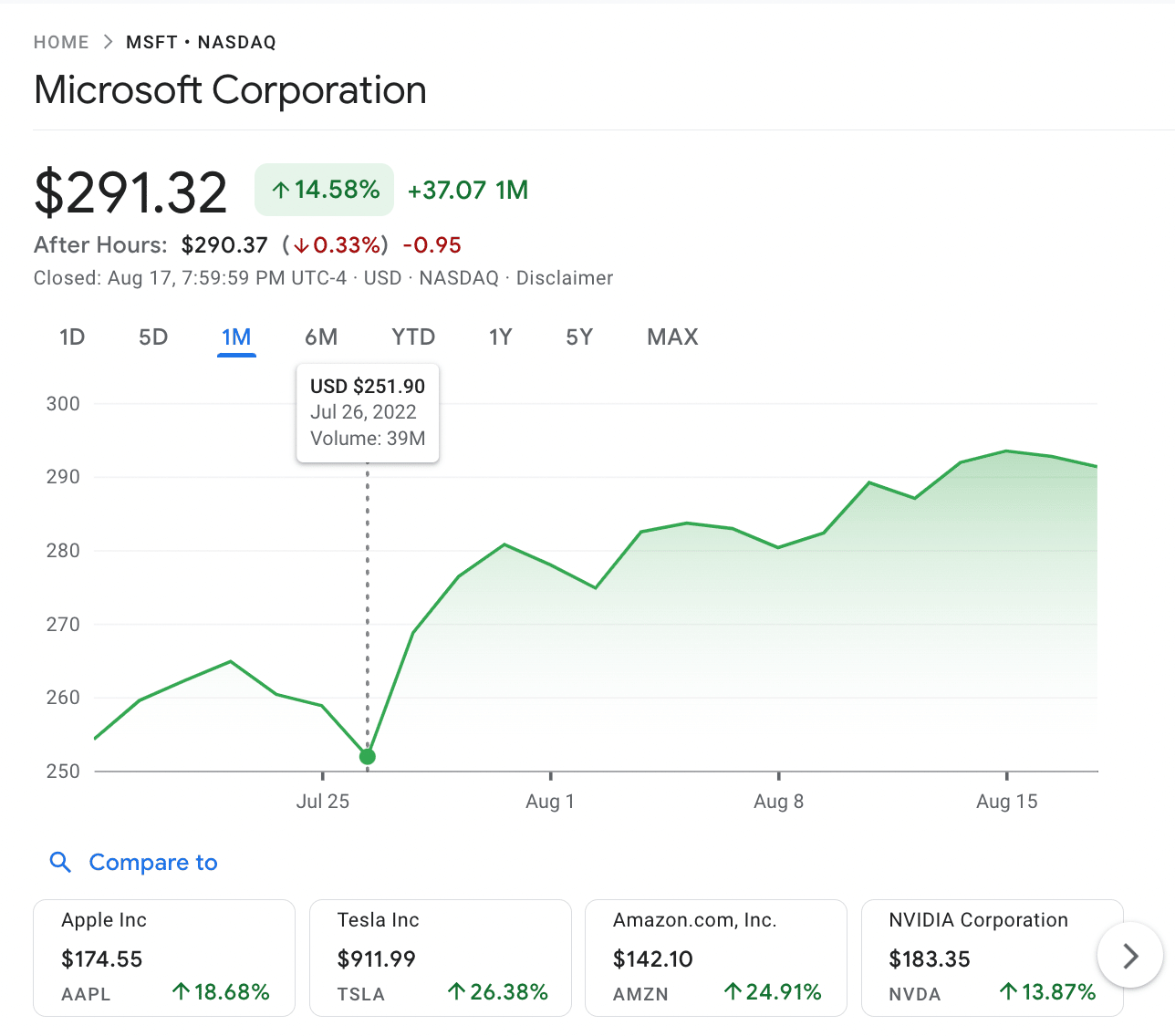

Microsoft is one of the largest companies globally, with a market capitalization of over $2 trillion.

Although a valuation of this magnitude would suggest that growth is limited, Microsoft stock has generated gains of over 300% in the prior five years.

This means that when compared to the S&P 500 over the same period, Microsoft stock has outperformed the broader market by more than four times.

In this beginner’s guide, we explain how to buy Microsoft stock at 0% commission alongside a full analysis of where this tech company is potentially headed in the coming months and years.

How to Buy Microsoft Stock With a Regulated Broker

As one of the largest and most traded stocks on the NASDAQ, investors can gain exposure to Microsoft across dozens of online brokers.

Below, we offer insight into how to buy Microsoft from a regulated broker in just four steps.

- ✅Step 1 – Open an Account With a Regulated Broker: After choosing a low-fee broker, the investor will need to open an account with the provider. This requires some contact details and personal information, alongside a social security number (or international equivalent). In most cases, it takes less than five minutes to open an account with a regulated stockbroker.

- 🛂Step 2 – Upload ID: To complete the account opening process, the investor will need to verify their identity. In most cases, this requires two documents – proof of address and identity. This could, for example, be a recently issued bank statement or utility bill alongside a passport or driver’s license.

- 💳Step 3 – Deposit Funds: In order to buy Microsoft stock from an online broker, the investor will first need to deposit some money into the account. Accepted payment methods vary from one trading platform to the next, albeit, the fastest option, if supported, is to use a debit/credit card or e-wallet. ACH and bank wires are typically supported too.

- 🔎Step 4 – Research and Buy Stock in Microsoft: Before placing an order to buy Microsoft stock, investors are advised to perform research on the company. This will ensure that Microsoft stock aligns with the investor’s long-term goals. To complete the investment process, search for Microsoft stock on the brokerage platform and place a buy order.

Further down in this guide, we offer a more in-depth walkthrough of how to buy Microsoft stock now.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

One of the most important steps to take when learning how to invest in stocks online is which brokerage website or trading app to use.

Investors should consider the fee structure and minimum trade requirement stipulated by the broker, alongside the user-friendliness of the platform.

In this section, we offer some insight on the best place to buy Microsoft stock, by reviewing a selection of popular brokers that offer access to the NASDAQ.

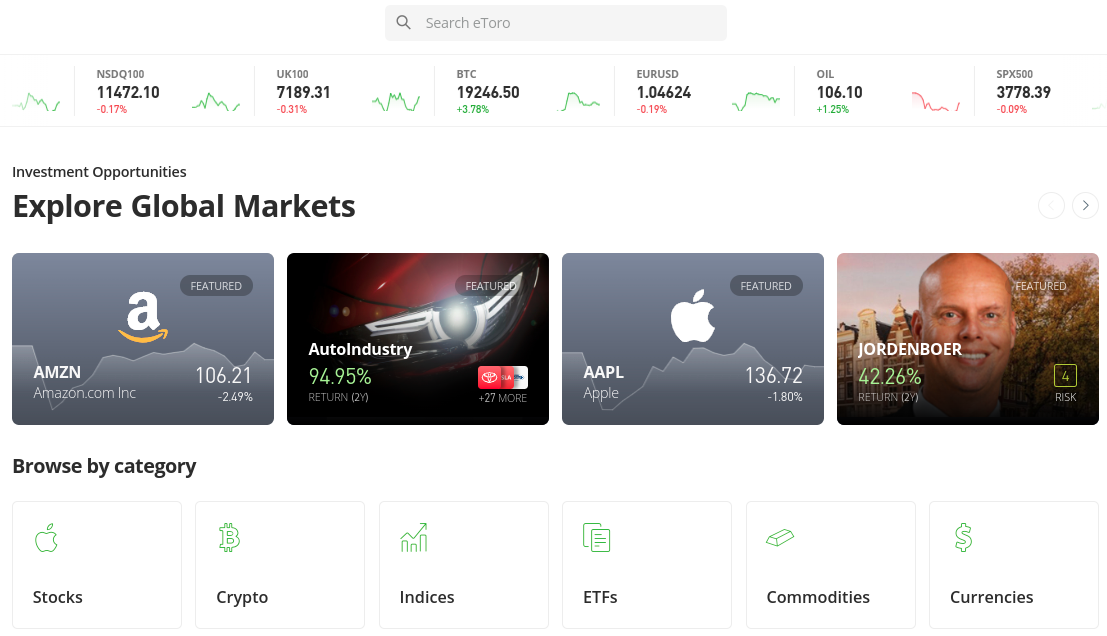

1. eToro

When buying Microsoft stock at eToro, investors will not be charged any trading commissions. This is the case across all listed stocks on the eToro platform – both domestic and international. Moreover, although Microsoft trades for several hundred dollars, investors have the option of buying a small fraction of a stock.

In fact, any amount can be invested into Microsoft stock as long as the minimum of $10 is met. After the purchase is made, the Microsoft stocks will be added to the eToro portfolio, where they will be eligible for dividends as and when the firm makes a quarterly distribution.

Another option to consider when attempting to gain exposure to Microsoft stock is to opt for the ‘Big Tech’ Smart Portfolio at eToro. In addition to Microsoft, this managed portfolio contains some of the largest tech stocks globally. This includes the likes of Amazon, Meta Platforms, NVIDIA, Alibaba, Apple, and Tesla.

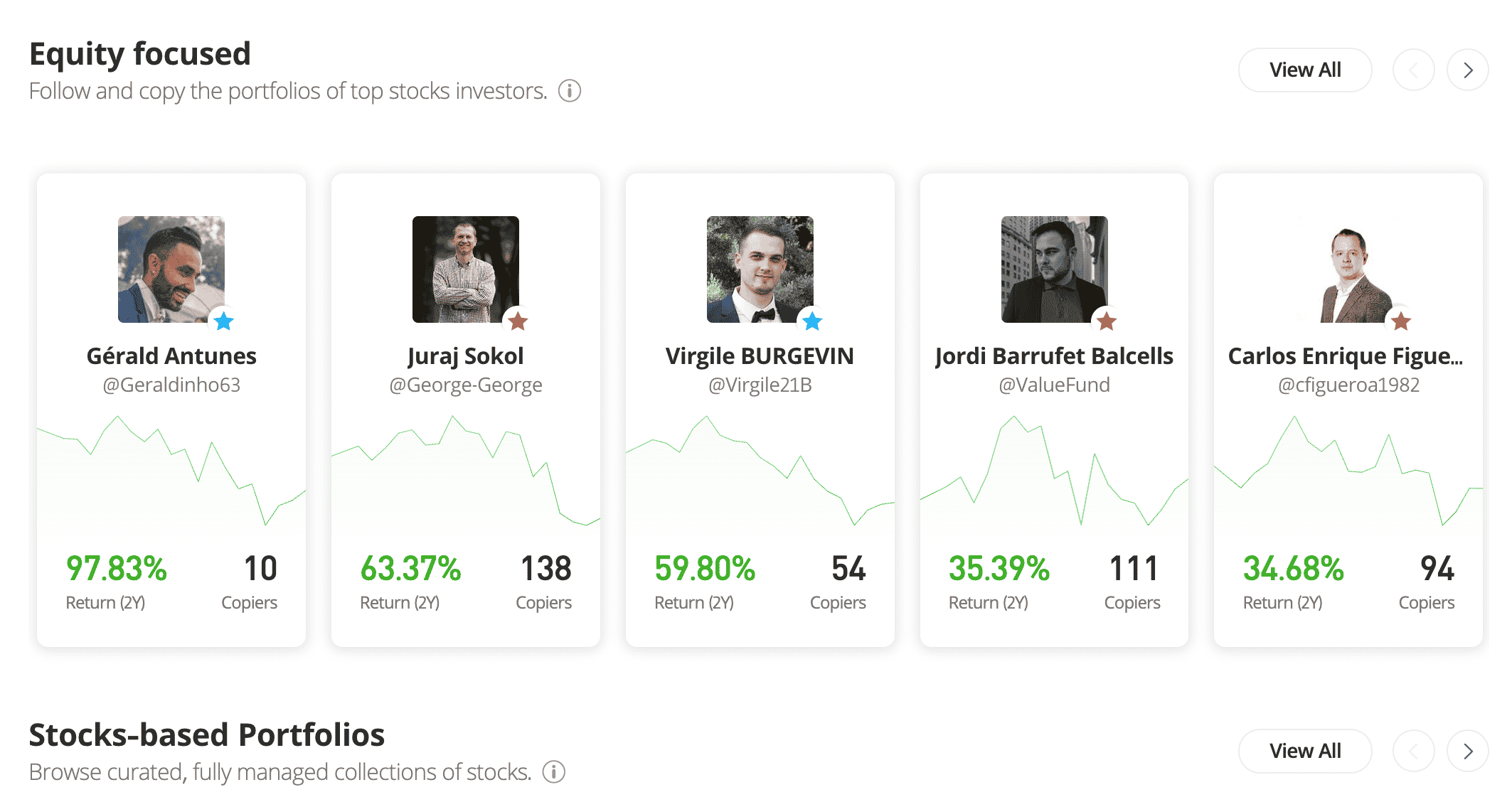

Within this eToro Smart Portfolio, Microsoft carries a weighting of 4.60% and the minimum capital outlay requirement is $500. Alternatively, eToro also offers a popular tool called ‘Copy Trading’. As the name suggests, Copy Trading enables investors to choose a popular trader to copy.

In other words, all positions entered by the copied trader will be mirrored in the user’s eToro portfolio automatically. This trading tool comes with a slight minimum requirement when compared to Smart Portfolios – at $200. In terms of the platform itself, eToro enables users to trade via its website or by downloading the mobile app for iOS and Android.

The eToro app comes with the advantage of being able to trade on the move, check the portfolio value at the click of a button, and set up and receive pricing alerts. Nonetheless, both the eToro app and website are connected to the same investment account. eToro users also have the option of buying and selling stocks in demo mode.

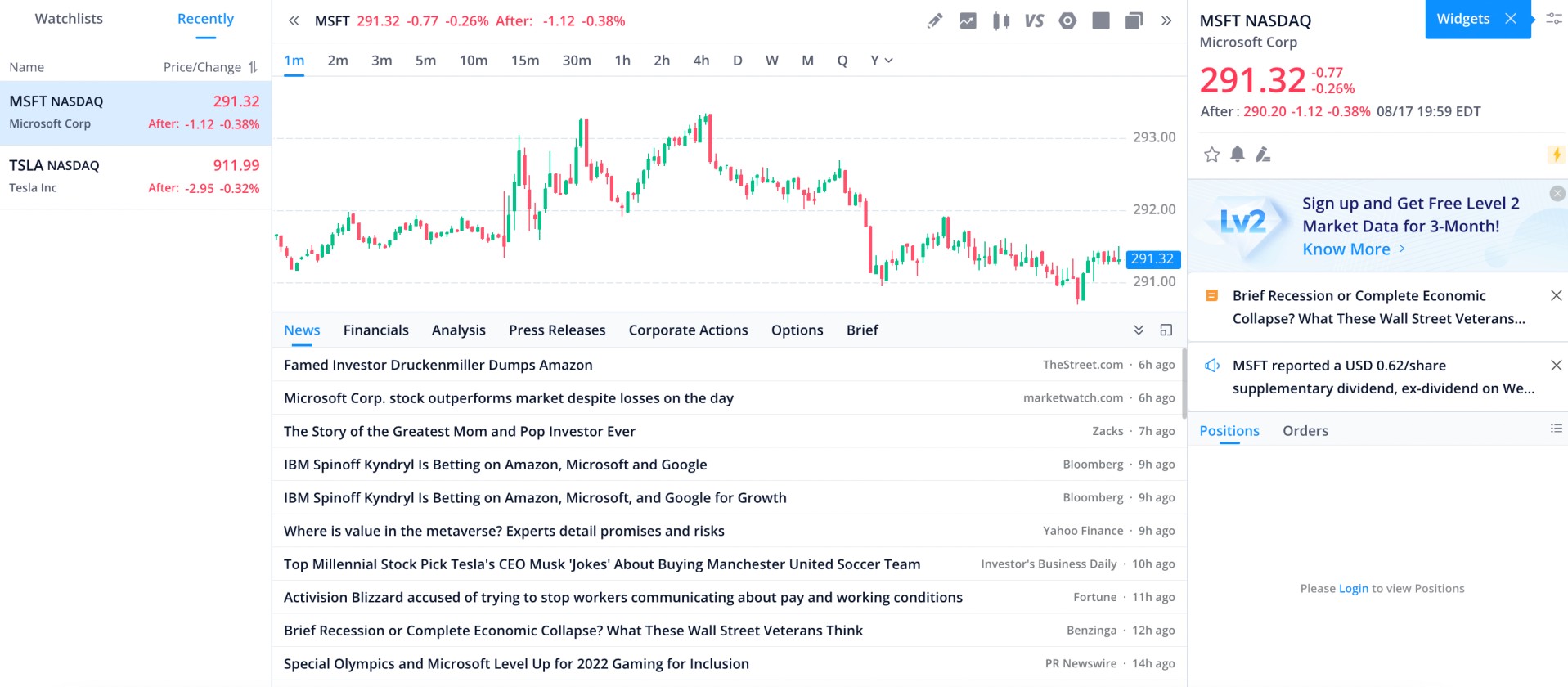

This means that instead of risking any of the account balance, investors can trade with ‘paper money’ from a preloaded balance of $100,000. In terms of analysis tools, eToro offers ProCharts, which come with customizable charting features, economic indicators, and real-time pricing action.

Moreover, eToro offers access to analyst sell-side ratings and pricing targets, alongside financial and stock trading news and insights. For complete beginners, eToro also offers educational guides and videos, in addition to regular webinars. In terms of other supported assets, eToro enables users to invest in cryptocurrency across more than 90 markets.

Irrespective of whether the investor decides to buy Ethereum, Bitcoin, Dogecoin, or Shiba Inu – cryptocurrency trading fees amount to 1% at eToro. It is also possible to buy Bitcoin and other high-value cryptocurrencies from just $10 per order via the eToro fractional tool. Moreover, eToro also supports commission-free ETFs.

Non-US traders will also have access to leveraged CFD markets, which cover everything from stocks and precious metals to oil and indices. When it comes to the account opening process, from start to finish, this usually takes less than five minutes – including the KYC verification stage.

The minimum deposit requirement at eToro is $10 for US and UK-based traders and $50 elsewhere. There are no fees charged on deposits and withdrawals made in US dollars, while other currencies attract an FX conversion rate of 0.5%. Supported payment types include debit/credit cards, ACH, and e-wallets. eToro is regulated by the SEC, FCA, ASIC, and CySEC.

| Approx No. Stocks | 2,500+ |

| Min Deposit | $10 |

| Cost to Buy Microsoft Stock | 0% commission + spread |

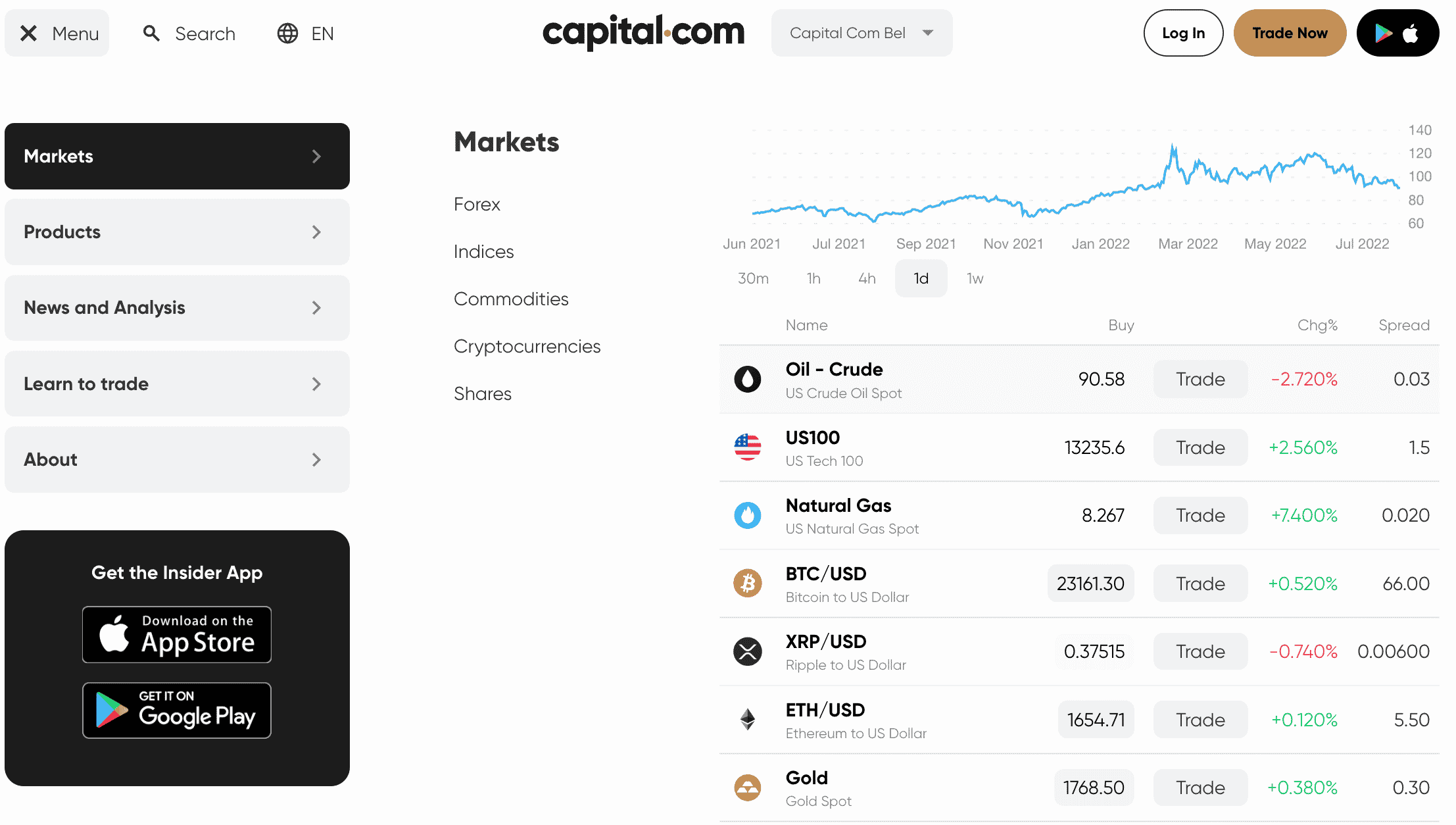

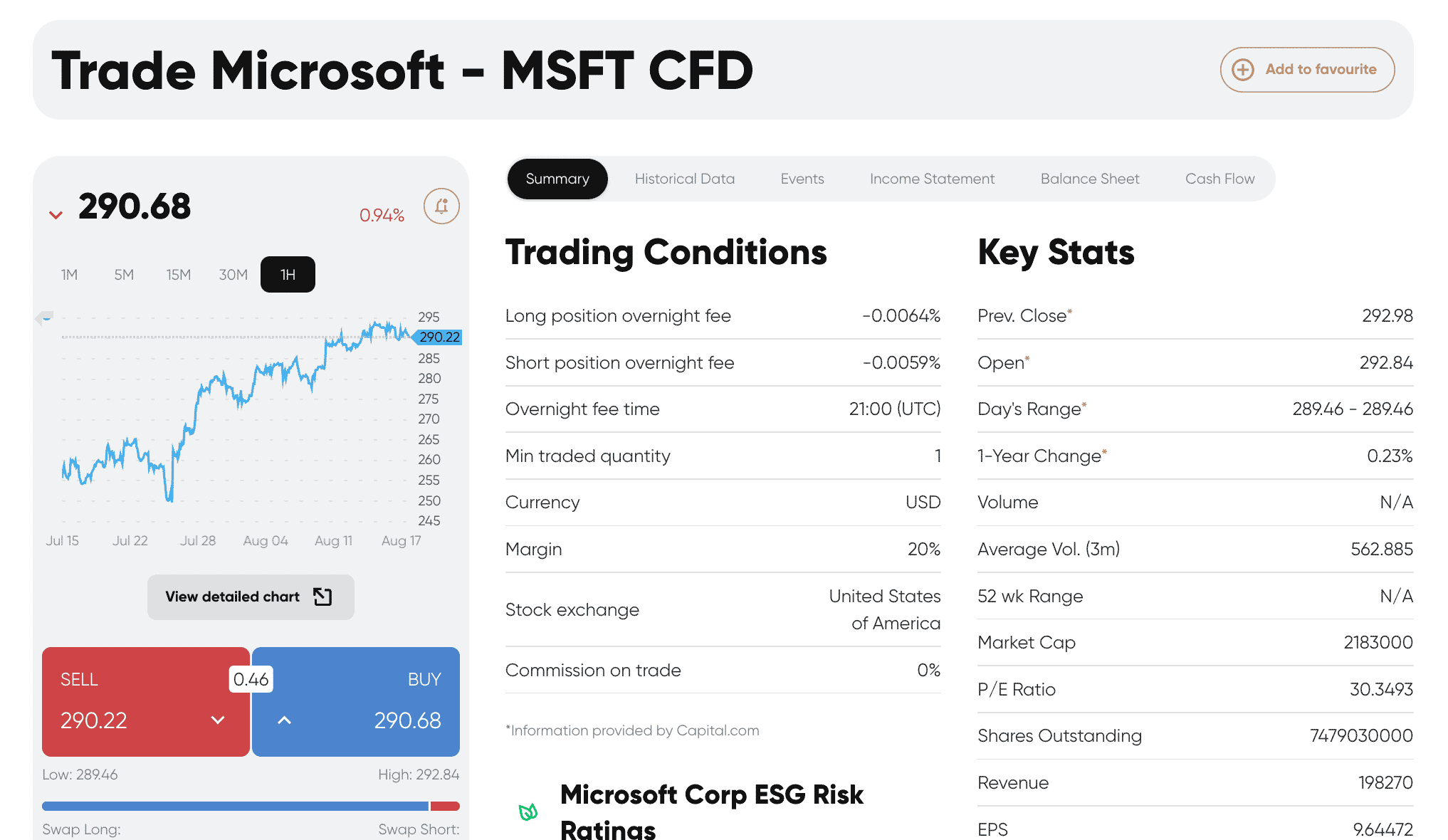

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. In doing so, traders will be able to speculate on the future value of Microsoft stock on a 0% commission basis, alongside competitive spreads. Fractional trading is supported at Capital.com, and when making a deposit with a debit/credit card or e-wallet, the account minimum stands at $20. Bank wire deposits require $250 or more. When trading Microsoft stock via a CFD instrument at Capital.com, eligible traders will have access to leverage. This is typically offered to retail clients at a limit of 1:5 – or 5 times the stake. For example, at 1:5, this would enable a $10,000 position on Microsoft stock to be opened with an outlay of $2,000. However, inexperienced traders should remember that leveraged positions can result in liquidation if the trade does not go to plan. Another tool that Capital.com offers to its account holders is the ability to enter positions in both rising and falling markets. This is because the trader can go long or short on Microsoft stock via a buy or sell order, respectively. When it comes to pricing, in addition to its commission-free offering, Capital.com does not charge any fees on deposits or withdrawals. With that said, traders should be aware that Capital.com charges overnight funding fees on CFD positions that are carried over to the next day. This is, however, a standard charge implemented by most CFD trading platforms. After trading Microsoft stock CFDs at Capital.com, traders might consider exploring its 5,400+ listed equity markets. This covers stock CFDs from exchanges globally – covering everything from the US, UK, and Singapore to Germany, Hong Kong, and South Africa. Traders will also have access to CFD markets covering forex, indices, ETFs, and cryptocurrencies. Leverage eligibility and limits will vary from one asset class to the next, so traders are advised to check the specifics before signing up. Traders will have the option of buying and selling CFDs via the Capital.com website, MT4, or a native mobile app for iOS and Android. The Capital.com website hosts various news and research resources, such as market insights and analysis of specific financial instruments. There is also Capital.com TV, which offers regular video updates on the broader markets. Finally, licensing of the Capital.com platform comes from the FCA, CySEC, NBRB, and ASIC.

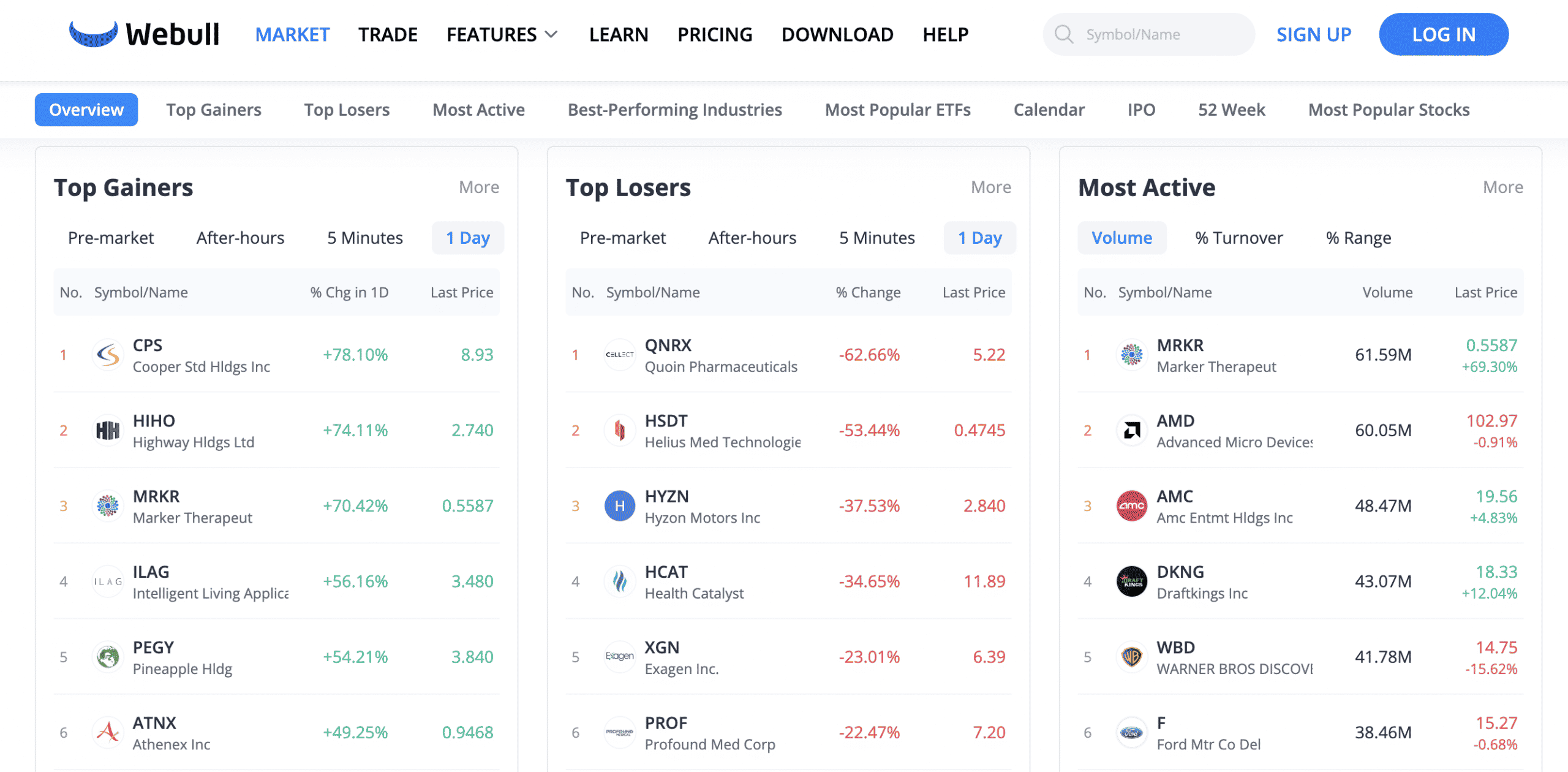

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. The minimum Microsoft stock investment permitted at Webull is $5. Based on the Microsoft stock quote at the time of writing, the minimum investment would enable the trader to obtain less than 2% of a share. This would, however, still entitle the investor to their share of dividends when a distribution is made. When it comes to fees, Webull does not charge any trading commissions when buying and selling stocks. There are no fees when funding an account with ACH, but domestic bank wires will cost $8 per transaction. Moreover, fees will apply when investors opt to buy Microsoft on margin. For positions of $25,000 or under, the annualized margin rate stands at 6.99% and this will decrease as leveraged volumes increase. Another option that Webull offers is the ability to short-sell a stock. The fees payable will depend on the stock and respective market conditions. Another factor to consider when joining Webull is that the broker supports IRA plans. This covers a Roth, traditional, and rollover IRA – all of which can be opened and maintained without attracting any annual fees. Although many investors choosing Webull to buy Microsoft stock will be long-term holders, the platform also hosts the required tools to day trade. For example, the Webull platform offers customized charts that present real-time pricing data, alongside drawing tools and technical indicators. It is also possible to compare two or more assets side-by-side and order types include limit, market, stop, and stop-limit positions. In addition to the US stock market, Webull account holders will also have access to options, ETFs, and cryptocurrencies. These asset classes can also be traded without paying any commission. For beginners, Webull offers educational tools and guides, in addition to mini-courses. Finally, Webull is a member of the SIPC and FINRA and is registered with the SEC as a broker-dealer.

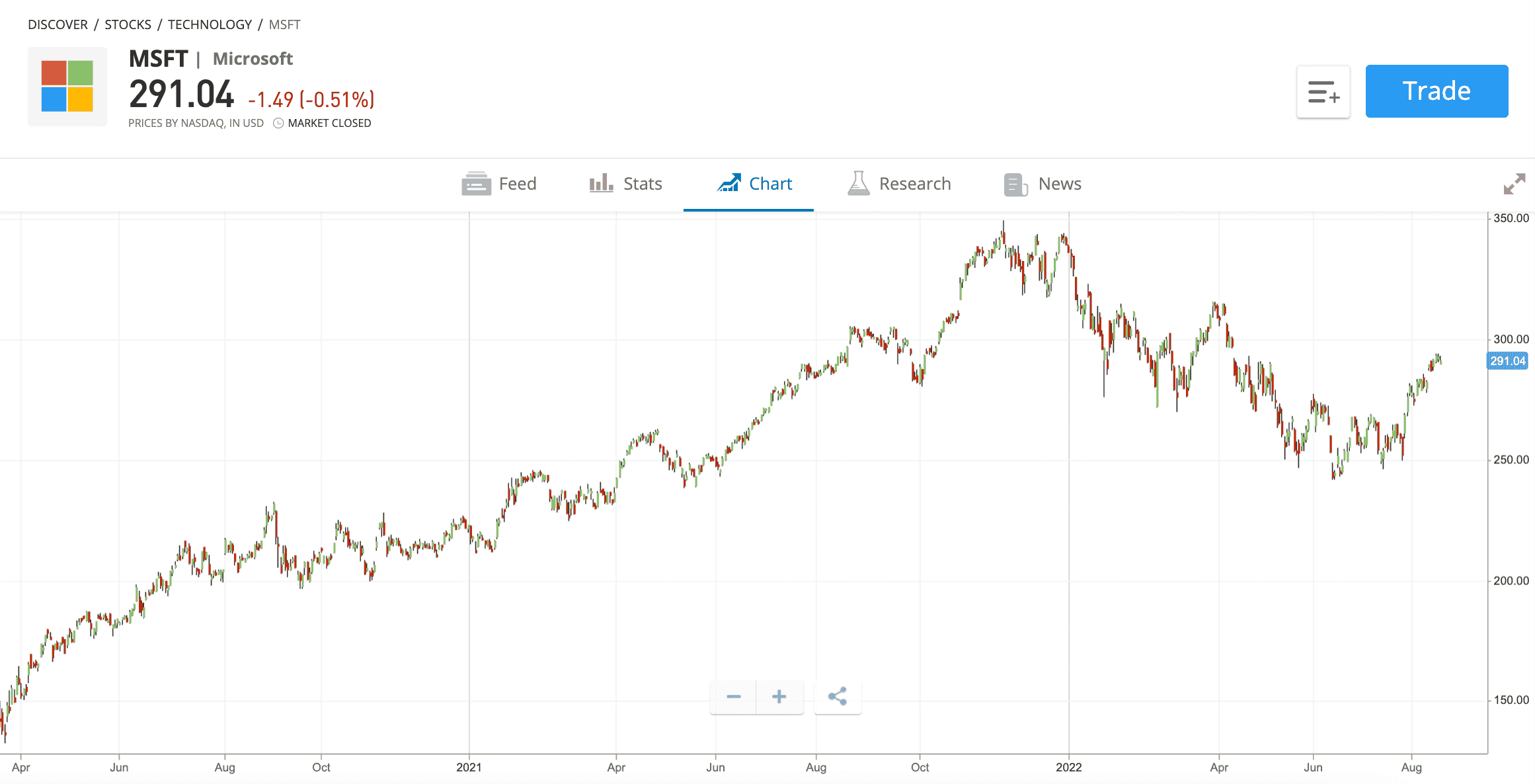

Those wondering “is Microsoft a good stock to buy?” will need to reach an investment decision by conducting independent research. In addition to the Microsoft stock price and dividend yield history, investors will need to assess the fundamentals of the tech firm, such as its revenue and income growth when compared to the broader market and prior quarterly results. Investors can consider the information discussed below when attempting to answer the question – is Microsoft stock a buy? Incorporated in 1981, Microsoft is the largest software company globally, with the firm best known for its Windows operating system. With that being said, Microsoft is behind a wide range of other products and services, which ensures that the firm continues to diversify into new markets. This is inclusive of the Windows suite of productivity software, such as Word, PowerPoint, and Excel. Moreover, Microsoft is also behind its Edge – formally Internet Explore, web browser. Microsoft is also behind a range of development platforms – such as Visual C# and the .NET framework. In addition to software, Microsoft is also a market leader in hardware products. This includes its own gaming console – the Xbox. Microsoft also aims to compete with Amazon for a share of the cloud computing market, with its Azure service. Many investors might also be surprised to learn that Microsoft has added a full range of notable brands to its subsidiary portfolio. This includes the 2013 acquisition of Nokia, which resulted in Microsoft rebranding the cell phone market under its own name. Other notable acquisitions include Skype, LinkedIn, Activision-Blizzard, and Nuance Communications. Although Microsoft is synonymous with its founder Bill Gates, the public figure stepped down from the board to focus on his charitable work. The CEO of Microsoft is Satya Nadella, who has been in the position since 2014. As per its most recent filing, Microsoft is home to more than 220,000 employees. The next step to take when attempting to answer the question – is MSFT a good stock to buy, is to evaluate its pricing action on the NASDAQ. Microsoft become a public stock in 1986, five years after the firm was incorporated. The IPO underwriters opted for a price of $21 per stock. However, for a more reliable analysis of the firm, we must take into account the nine stock splits that Microsoft has initiated since going public. The most recent Microsoft stock split was in 2003 when the firm opted for a 2-for-1 issue. Taking this into account, Microsoft stock was originally trading at an adjusted price of just $0.10 when it went public in 1986. Fast forward to 2022, where Microsoft stock is trading at the $300-ish level, this presents all-time growth of over 290,000%. This means that Microsoft is one of the best-performing stocks of all time. With that being said, in line with the broader tech stock sell-off, Microsoft is down 12% year-to-date. Over a 12-month period, based on the Microsoft stock price today per share as of writing, the firm is up just 0.20%. However, over a five-year period, Microsoft stock has generated gains of just over 300%. In comparison, over the same period, the S&P 500 has grown by 76%. This means that Microsoft has outperformed the broader markets over the prior five years by almost four times. On the other hand, Microsoft is still trading below its 52-week high of just under $350. At the time of writing, the stock is trading at a discount of 16% when compared to its previous high. Another core area to focus on when deciding whether or not to buy Microsoft stock is the EPS or earnings per share. Although the EPS fell short of expectations for the first time since 2016, other areas of its quarterly financials were impressive. As we cover in more detail shortly, there was a year-over-year revenue growth of 12.38% alongside a 1.71% rise in net income. The P/E, or price-to-earnings ratio, is another financial metric that investors can consider when researching whether Microsoft stock is a buy or sell. Those relying on the P/E ratio alone would perhaps argue that Microsoft is slightly overvalued. However, in order to determine a fair valuation of Microsoft stock, investors will need to explore a wide range of other metrics. Nonetheless, what we can do is explore the average P/E ratio for some of Microsoft’s main competitors, such as IBM, Google, and Apple. These tech stocks, at the time of writing, are carrying P/E ratios of 22, 22, and 28 times respectively. Microsoft is considered a so-called Dividend Achiever. the reason for this is that across 14 consecutive years, it has not only paid a dividend to stockholders, but it has increased the size of its annual distribution. This will potentially appeal to those in the market for stocks with a prolonged and consistent dividend policy. However, Microsoft still requires a further 11 years of increased annual payments to be defined as a Dividend Aristocrat. Furthermore, based on price as of writing, Microsoft is offering a rather modest running dividend yield of just 0.85%. On the flip side, many other Big Tech companies in this space – namely Google, Amazon, and Meta Platforms, do not pay dividends and have never done so. Read More: Check out our market insight on the best dividend stocks for 2022 in terms of yields and consistency. In this section, we will explore the fundamentals surrounding Microsoft stock. This will enable investors to determine what the future potentially holds for the firm, in terms of its medium-to-long-term growth on the NASDAQ. Microsoft, like many Big Tech companies, has a highly robust balance sheet. As per its most recent quarterly report, Microsoft is holding more than $104 billion in cash and short-term investments. Although this is nearly a 20% decline year over year, this is still a considerable amount of cash to have on hand. Not only does this enable Microsoft to weather unfavorable ecosystem storms, but most importantly, this allows the firm to continue its strategic acquisition policy. Furthermore, although Microsoft carries $198 billion in liabilities, the firm is also home to $364 billion in assets. Regarding the latter, this is a 9.31% increase year over year, as per its most recent earnings call. Now on to the income statement – as per Microsoft’s most recent quarterly report. As we briefly noted earlier, revenue was up 12.38% for the quarter, year over year. Although operating expenses were up 14.05% to $14.9 billion, net income rose by 1.71% to $16.74 billion. Regarding the EPS, there was a 2.76% increase year over year. EBITDA was up 13.85% to $24.65 billion. As per the Microsoft stock chart above, since its most recent earnings report was published on July 27th, 2022 – the firm has seen its valuation increase by 15%. This is based on prices at the time of writing. Nonetheless, this highlights that increase could well be linked to its positive quarterly results. Across 30 sell-side analysts over the prior three months, the consensus on Microsoft stock is as follows: As per the sell-side viewpoints above, this translates into a strong buy. There is ample upside on the table according to sell-side Microsoft stock price forecasts. Across the 30 sell-side analysts, there is an average price target of just over $325 per stock. This consists of a low and high price target of $275 and $400, respectively. Based on prices at the time of writing, Microsoft stock would require an upside of just over 11% to reach the average price target of $325. Another factor to consider when learning how to invest in Microsoft stock is that the firm, as noted earlier, has increased the size of its annual dividend payment for 14 consecutive years. This is especially notable considering that during the pandemic, many large-cap stocks – some of which carry a blue-chip status, either cut or suspended dividend payments. This indicates that even when broader economic conditions are bearish, Microsoft has the resources to meet its long-term dividend ambitions. This is further supported by the firm’s strong cash position of over $104 billion. We mentioned earlier that in the five years of trading prior to writing, Microsoft has generated returns of over 300%. We also mentioned that during the same period, the S&P 500 has grown by 76%. As a result, Microsoft continues to outperform the broader market. Moreover, some of its main competitors, such as IBM and Google, have generated returns of 3% and 158%, respectively. One of the key metrics to the long-term success of Microsoft is that it continues to diversify into new products, services, and markets. For example, although Microsoft is best known for its Windows operating system – which is utilized by more than a billion devices globally, the firm is also involved in cloud computing, video gaming consoles, office software, and more. Microsoft also continues to diversify through ongoing acquisitions, some of which have included Nokia, Skype, and LinkedIn. There is no reason to believe that this won’t continue, considering the huge amount of cash that Microsoft holds on its balance sheet. Considering that Microsoft has been trading on the NASDAQ for more than three decades, the numbers speak for themselves. That is to say, Microsoft has gone through many bear cycles and broader recessions, but has already recovered. This includes the infamous Dot.com bubble, which saw the value of Microsoft stock plummet for several years. Another area in which Microsoft has paid particular attention to is that concerning net zero emissions. By 2030, the corporation wants to have net-zero emissions, and by 2050, it wants to have offset all of its earlier emissions. As such, MSFT stock stands as one of the most popular ethical stocks of 2023. This section of our guide will explain how to buy MSFT stock through a regulated broker. Investors that are still deciding where to buy stocks can scroll up to read our reviews of popular trading platforms that offer access to Microsoft. Nonetheless, the investment process is largely the same across all online stock brokers – as we highlight in the step-by-step walkthrough below. After selecting a broker, the next step is to open an investment account with the provider. The entire process can be completed online and oftentimes will take no more than a few minutes. Some of the information that the regulated stock broker will require from the investor includes: In some cases, the investor will need to provide details about any prior investment experience. In order to verify the newly created brokerage account, the investor will need to upload a couple of documents. While some online stock brokers take several days to validate ID documents, others can complete the process instantly. The next step is to deposit some funds, ensuring that the brokerage minimum is met. With that said, many brokers require a minimal first-time deposit of just a few dollars, while others have no minimum in place at all. Most stock brokers in the US only support payments via a bank wire, ACH, or in some cases – a cash deposit. A select number of brokers will also support e-wallets like Paypal alongside debit and credit cards. Now that the investor has funds in their brokerage account, the next step is to search for the Microsoft stock ticket – MSFT. After finding the stock, the investor will need to set up a buy order by entering the amount of money that they wish to invest in Microsoft. Minimum order sizes vary from one broker to the next, but popular platforms in this space now support fractional stock purchases. This means that from just a few dollars, the investor can buy a small fraction of a Microsoft stock. After confirming the Microsoft stock purchase, the equities (or fraction of an equity), will be added to the account portfolio. This beginner’s guide has discussed the investment process required when learning how to buy Microsoft stock. We have also reviewed a selection of popular brokers offering access to this stock, alongside some fundamental research on Microsoft itself. Although Microsoft is a large-cap stock with a blue-chip status – which carries a robust balance sheet with more than $104 billion in cash, investors still need to perform adequate research prior to making an investment.2. Capital.com

Capital.com specializes in financial derivatives that are traded as contracts-for-differences or CFDs. Therefore, as CFDs are prohibited in the US, Americans will not have access to the Capital.com platform. Nonetheless, non-US investors can open an account with this platform in under five minutes.

Approx No. Stocks

5,400

Min Deposit

$20

Cost to Trade Microsoft Stock

0% commission + spread

3. Webull

Approx No. Stocks

5,000+

Min Deposit

$5

Cost to Buy Microsoft Stock

0% commission + spread

Step 2: Research Microsoft Stock

What is Microsoft?

Should I Buy Microsoft Stock? Microsoft Stock History

Microsoft Stock – EPS

Microsoft Stock – P/E Ratio

Microsoft Stock Dividends

MSFT Stock Buy or Sell? – Fundamental Research

Robust Balance Sheet

Positive Earnings Report

Microsoft Stock Forecast

Consistent Dividend Increases

5-Year Returns

Diverse Portfolio of Products and Services

Long-Term Stock for Uncertain Economic Times

Step 3: Open a Trading Account & Buy Microsoft Stock

Open a Brokerage Account

Upload ID

Deposit Money

Buy Microsoft Stock

Conclusion

FAQs

How do you buy Microsoft stock?

Can I buy Microsoft stock directly?

Can you buy fractional shares of Microsoft?

Who owns the most Microsoft stock?

Will Microsoft stock split again?

When did Microsoft start paying dividends?

What will Microsoft stock be worth in 5 years?

Is it a good time to buy Microsoft stock?

Is Microsoft stock expected to rise?