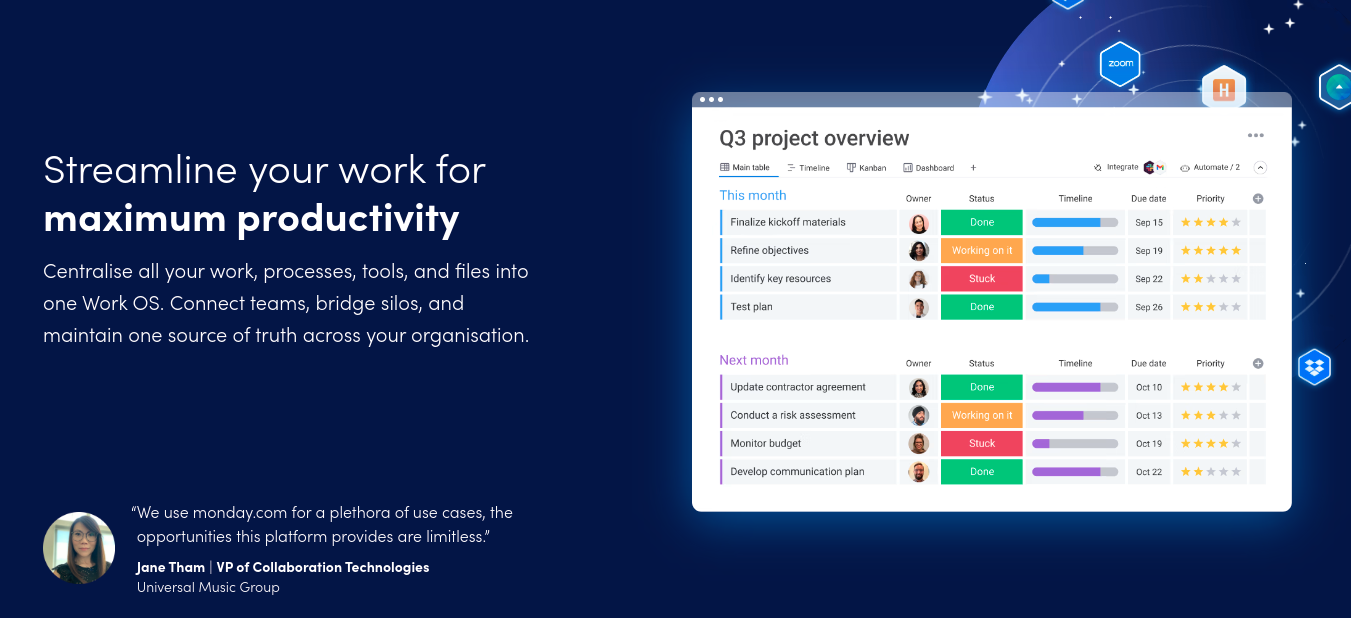

Monday.com is a cloud-computing platform that allows companies to build the tools and software apps they need to manage every element of their team.

In this guide, we explain how to buy Monday.com stock and review some regulated and popular brokers in 2023.

We also talk about the performance of Monday.com stock as well as other key metrics.

How to Buy Monday.com Stock in 2023

When traders are educating themselves about how to invest in stocks, it’s important to choose a professional brokerage to fulfill orders.

The guide below shows how to invest in Monday.com stock today with most regulated stock trading platforms:

- ✅ Step 1: Open a Live Trading Account

Go to the trading platform of your choice to sign up and invest in stocks. Regulated brokers will require information surrounding the new user’s identity, as well as a username and password. Traders can upload a photo ID and proof of address to complete the KYC process in minutes. - 💳 Step 2: Deposit Funds

The minimum deposit for US clients varies from broker to broker. There is a long list of accepted payment methods to choose from, which is inclusive of debit/credit cards, ACH, and numerous e-wallets. - 🔎 Step 3: Search for Monday.com Stock

The Monday.com stock ticker is MNDY. Type this into the search bar, and once found, click it to confirm the selection. - 🛒 Step 4: Research Monday.com Stock

Most experienced stock traders conduct their own market research before investing in equities. Once you’ve found the stock you want to invest in simply allocate funds and click invest.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

Traders researching how to buy Monday.com com stock for the first time may find the task of choosing a suitable broker daunting.

With this in mind, we’ve reviewed some popular trading platforms to access Monday.com equities.

This should aid the decision-making process for anyone deciding where to buy Monday.com stock. We examine fees, available markets, supported payment types, and much more.

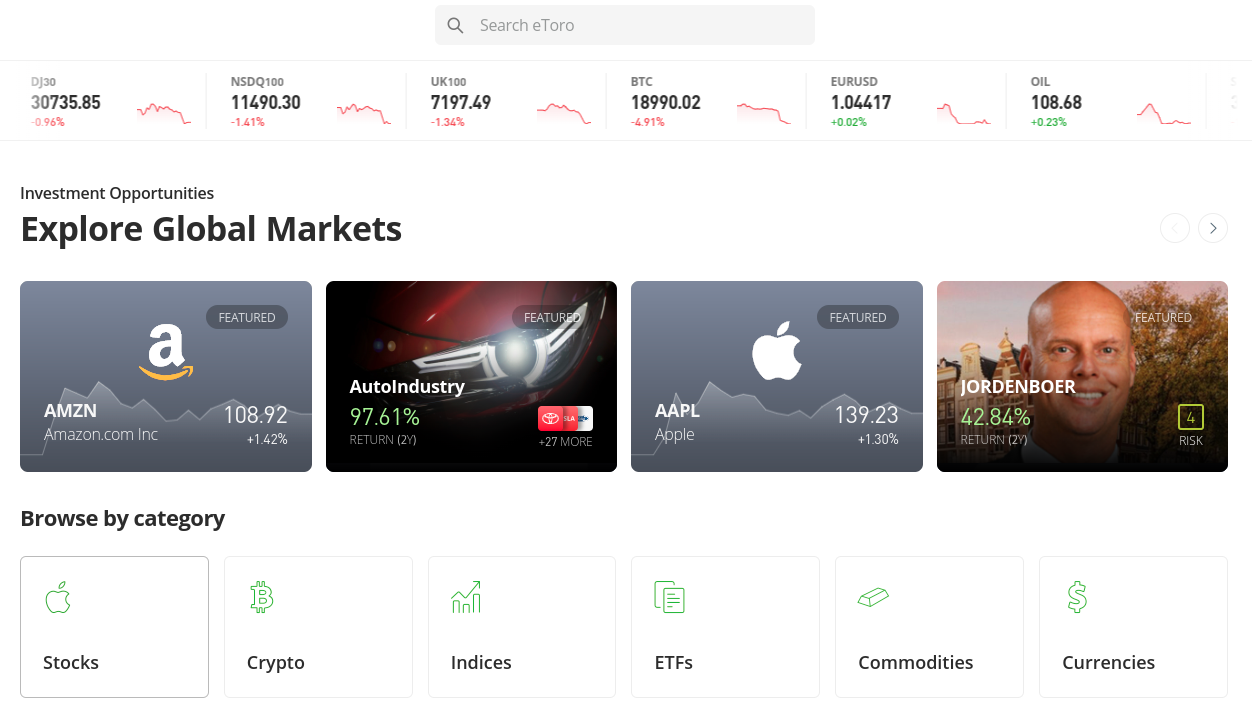

1. eToro

eToro has been an active stock broker since 2007 and has more than 25 million registered clients globally. After learning how to buy Monday.com stock, US traders can open an eToro account and place an order with $10.

As we touched on, this allows investors to buy just a fraction of a share in Monday.com. Not only that, but all the 2,500+ stocks listed on this platform are offered on a commission-free basis.

This stock platform is subject to regulatory oversight from top-tier authorities, including the SEC, the FCA, ASIC, and CySEC. As such, traders can rely on eToro to adhere to strict guidelines and provide a clear and fair service.

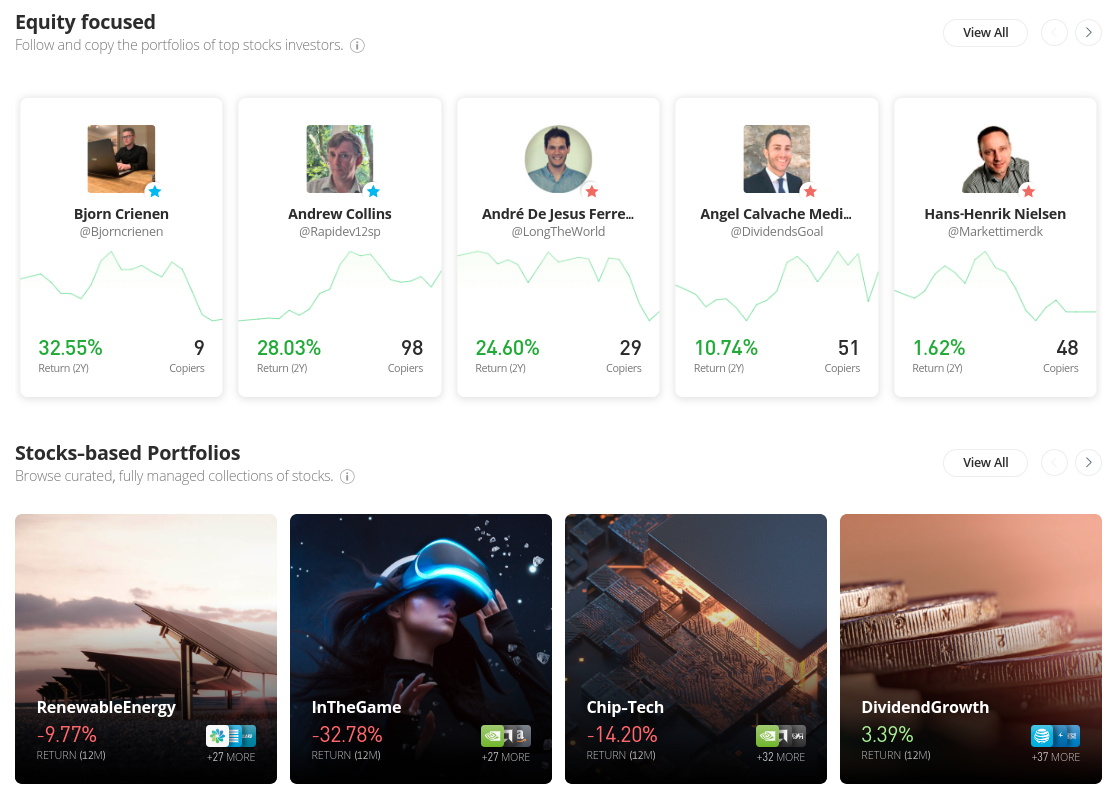

There are also many other financial markets accessible at eToro. This includes indices, cryptocurrencies, forex, and ETFs. Traders can also take a passive approach and invest in Copy Trading.

Smart Portfolios are similar, however, instead of copying a person, it entails investing in multiple assets at once. At the time of writing, there are 50 stock-focussed Smart Portfolios. Pick one, invest $500 or more, and a full portfolio of stocks is added to the eToro account.

This is managed automatically so allows people to passively add multiple holdings whilst only having to make a single investment decision. When it’s time to make a deposit to buy Monday.com stock, traders have lots of options. This includes e-wallets like PayPal, Skrill, and Neteller. eToro also supports credit/debit cards and ACH.

The minimum account balance is just $10 for traders in the US and there is no deposit fee. The free cell phone app from eToro allows people to buy and sell stocks and any other asset on the go. This is available for Android and iOS users.

| Number of Stocks | 2,500+ |

| Deposit Fee | Free for US Clients |

| Fee to Buy Monday.com | Commission-Free |

| Minimum Deposit | $10 |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull

This platform offers US-listed stocks without commission. However, internationally-listed shares are offered as ADRs and will attract a fee.

That said, the brokerage doesn’t stipulate a minimum deposit, and the platform is designed with new traders in mind. Webull also offers a package of features. This includes market news, stock screeners, and analysis tools like adaptable price charts and technical indicators.

Webull is competitive when it comes to fees. However, it’s worth noting that funding a Webull account with a domestic wire transfer will attract an $8 fee on each transaction. The broker also charges a fee on domestic wire withdrawals. In this case, $25 per transaction.

Alternatively, to avoid a fee, US traders can opt for an ACH deposit. This broker also has an app for iOS and Android. Moreover, alternative tradable markets include options and ETFs. Webull also offers Roth, Traditional, and Rollover IRAs for those that want to save for retirement.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Monday.com | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research Monday.com Stock

It’s important to carry out extensive research before allocating funds to buy Monday.com stock.

This includes studying Monday.com stock history, price forecast, the company’s operations, and financials like the P/E ratio and EPS.

We cover all of these topics in the subsequent sections of this guide.

What is Monday.com?

Monday.com was founded in 2012 in Israel. It is a software provider and cloud-based platform.

On the cloud computing platform, Monday.com, some of the biggest businesses in the world create software applications and project management solutions to increase productivity within their teams.

Here is the company’s business model in a nutshell:

- The Monday.com Work OS platform connects individuals to systems and procedures in a simple way

- Monday.com’s goal is to enable teams to flourish in all facets of their job while fostering an atmosphere of openness in the workplace

- Members of the team can access important information, such as the company’s quarterly roadmap

- Monday.com has offices in Tel Aviv, London, Tokyo, Chicago, New York, Sydney, San Francisco, Miami, and more

- At the time of writing, over 150,000 clients utilize the platform

- Its client base spans 200 countries and sectors

The Monday.com platform is completely configurable to fit any business vertical. The company’s presence is growing globally, too. For instance, Monday.com opened its second UK office in 2022.

The company also operates an app marketplace. This contains apps from the team as well as those from third-party developers.

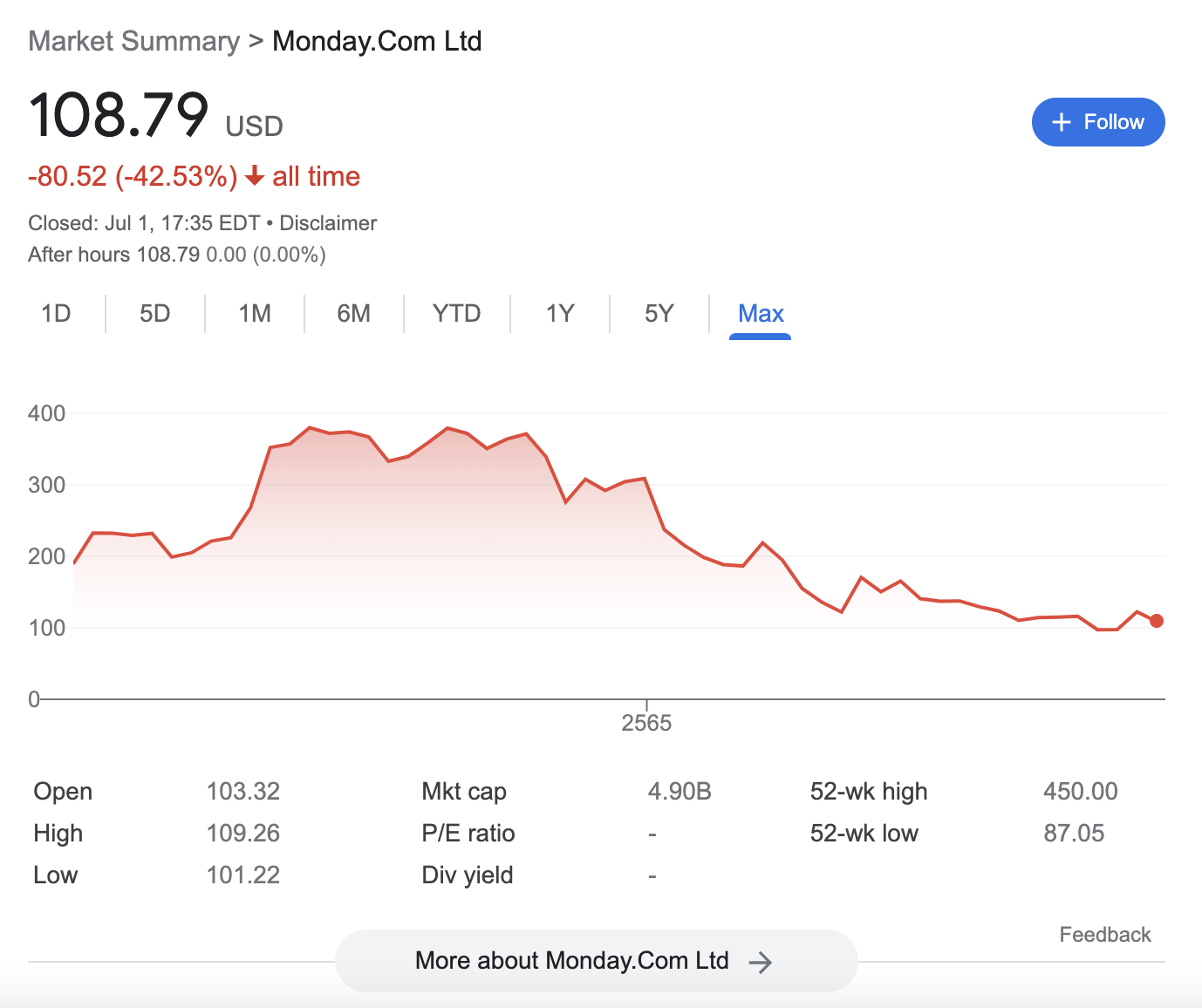

Monday.com Stock Price – How Much is Monday.com Stock Worth?

Monday.com is listed on the NASDAQ exchange. The Monday.com stock symbol is MDNY. The company’s IPO was held in June 2021 and it debuted at just over $170 per share. The stock started off well, trading above the $200 level for several months.

In August 2021, the company reported its financial results for Q2 2021. The results illustrated that the company had beaten analysts’ expectations and had high revenue growth. This led more people to buy Monday.com electronics stock, which of course resulted in its valuation climbing in an upward direction.

From the Monday.com stock chart, we can see that the all-time high occurred shortly after, in November 2021. At this time, it reached highs of just under $445 per share. However, like many other stocks, Monday.com plummeted in early 2022.

Between February and March 2022, the Monday.com stock price fell by almost 36%. The drop coincided with the Federal Reserve’s indication that it was going to increase its short-term benchmark rate. This was in a bid to fight inflation.

In the stock market, any assumptions surrounding inflation or increasing interest rates invariably make the current value of a company’s future earnings look less appealing.

Uncertainty like this usually affects growth stocks the most. The Monday.com stock price today is 75% lower than the aforementioned all-time high.

EPS and P/E Ratio

When researching how to buy Monday.com stock, traders should check the quarterly financial reports of the company.

These are available on all publically-listed companies so that investors have a clearer picture of the health of the firm they wish to buy stocks in.

There are a few stock valuation metrics to look for, such as the P/E ratio (Price-to-Earnings) and EPS (Earning Per Share).

First, let’s take a look at the EPS of Monday.com stock, as reported in its last four quarterly earnings calls:

- Q2 2021, the expected EPS was -1, -26 was reported. EPS was beaten by 74.11%

- Q3 2021, the expected EPS was -0.60, -0.26 was reported. EPS was beaten by 56.43%

- Q4 2021, the expected EPS was -0.52, -0.26 was reported. EPS was beaten by 49.73%

- Q1 2022, the expected EPS was -1.01, -0.96 was reported. EPS was beaten by 5.37%

In terms of revenue:

- Q2 2021, the reported revenue was a surprise of 13.69%

- Q3 2021, the reported revenue was a surprise of 11.15%

- Q4 2021, the reported revenue was a surprise of 8.82%

- Q1 2022, the reported revenue was a surprise of 7.09%

Note that if the P/E ratio of a stock is blank or listed as 0, this is because the company has reported negative earnings. As is clear from the above financial information, Monday.com is still reporting a negative EPS.

Market Capitalization

At the time of writing, the market capitalization of Monday.com is just under $5 billion. This makes it a mid-cap stock.

Index Funds

Many stocks are included in indices and the ETFs that track them. As such, another way to buy MNDY stock is via an index that holds it.

Below are some of the most notable ETFs that include Monday.com stock:

- ARK Next Generation Internet

- Invesco NASDAQ Next Gen 100

eToro lists the above-mentioned ETFs at 0% commission and from a minimum investment of just $10.

Read More: Here is a beginner’s guide on how to trade ETFs, for anyone who is unsure where to begin.

Monday.com Stock Dividends

Monday.com does not pay dividends. This is largely because the company is a tech start-up that is not yet profitable.

Note: eToro offers access to popular dividend stocks in the market with a range of trading tools.

Monday.com Stock Fundamentals

Many things can affect the value of a stock. Traders should consider their goals and how the investment might fit with long-term objectives.

We’ve already looked at the Monday.com stock price, analysts’ predictions, financials, and what the company does.

Next, we look at some of the core fundamentals.

New Native Monetization Feature for Work OS

Monday.com has announced a new feature that allows developers to monetize apps directly within the platform’s Work OS.

- The native monetization option for the Monday Apps Marketplace will enable developers and partners to manage numerous payments and subscriptions

- This can all be done from their current Monday.com accounts

- The Monday.com platform has a low/no-code framework that is flexible and allows developers to create, commercialize and publish apps from within a single workspace

This feature allows Monday.com’s vendors to use their app to accept payments from customers without setting up a third-party system.

As such, Monday.com is now able to handle the entire billing and payment service. The company notes that this also includes currency conversion and VAT.

Monday.com has Some Big Names as Clients

Monday.com has more than 152,000 customers.

Some of the most recognized firms globally use its Work OS platform to boost their team’s productivity and efficiency.

Just some of the brands that use Monday.com are listed below:

- Tesla

- Coca-Cola

- The NHS

- Universal Music Group

- Adidas

- Uber

- Vogue

- Samsung

- Lonely Planet

- My Supermarket

The extensive list also includes banks, marketing firms, hotels, telecommunications companies, and more. There are lots more teams using this company’s software and the number of new businesses signing up is growing.

The ability to connect all people working remotely on the same team without any hitches has never been more imperative.

During the height of COVID-19, many people were forced to work from home.

According to analysts at Forbes, this trend is likely to continue. Around 25% of all jobs in North America are expected to be remote by the end of 2022.

The Company is Still Growing

Due to the rapidly expanding market it serves, Monday.com stock still has a lot of future potential.

- Monday.com announced revenue of $308.2 million for 2021

- The total addressable market for Monday.com is estimated at several trillion dollars and thus – the company has only begun to scratch the surface

- Monday.com’s expansion of its enormous client base of over 152,000 teams is one strategy it uses to take advantage of this

- According to Monday.com, almost 1,000 of the firm’s clients spend more than $50,000 every year

- At the time of writing, Monday.com’s apps marketplace has surpassed 190,000 installations and one million visitors

Moreover, as per Q1 2022, the company has a net dollar retention rate of over 125%. This displays the company’s ability to excel in receiving repeat business. As the customer base of Monday.com increases, so should its gross margin.

Monday.com can be Integrated With a Huge Number of Apps

The fact that Monday.com integrates with almost all apps is what makes it unique.

- Whether an HR team needs information from Microsoft’s Linkedin or a marketing department requires data from Hubspot, Monday.com is able to use its software to integrate data effectively

- Other compatible apps include Quickbooks, Google Docs and Sheets, Apple Keynote, Adobe PDF, and many more

- Having everything on one platform like this makes it simple to access and use critical data

- This should increase a team’s productivity as the business can combine data from hundreds of applications

- The company can also provide other departments with access to that data for whatever purpose they see fit

With these integrations, Monday.com is transformed into a single hub where staff members may access practically all of the company’s information.

Key Technology Alliance With KPMG

A global strategic alliance between Monday.com and KPMG will see the latter using the Work OS system with all of its clients.

Software companies including Microsoft, Salesforce, Appian, Workday, and Oracle ServiceNow are among the notable members of KPMG’s technology alliance.

As Monday.com broadens its enterprise network globally, this is set to be an important alliance for the company.

Monday.com Stock – Key Facts

See a recap below:

- With more than 152,000 customers, Monday.com serves a growing market within the realm of cloud-based software

- Some of Monday.com’s biggest clients include Tesla, Uber, Samsung, Adidas, and Coca-Cola

- According to Monday.com’s own data, as of March 2022, the company’s net dollar retention rate was over 125%

- By including a built-in monetization framework, Monday.com has eliminated the necessity for end-users to learn the complicated payment procedures of numerous premium apps

- In essence, consumers of Monday.com may control all of their purchases and subscriptions from their current payment accounts

- Monday.com’s platform can be integrated with the majority of apps used by teams in corporations, including Google Sheets and Docs, Quickbooks, LinkedIn, and Adobe PDF

Monday.com has outperformed analysts’ forecasts in each of its last four quarterly financial reports by a margin ranging from 5.37% to 74.11%. Sell-side analysts over the prior 90 days give Monday.com stock an average price target of over $190.

Conclusion

This beginner’s guide has covered the step-by-step process of how to buy Monday.com stock. The firm offers a valuable cloud-based service to businesses all over the world. Clients can also customize workflows to increase productivity and speed.