Although Netflix was a well-performing stock in the midst of COVID lockdown measures, the world’s largest streaming service has since seen its valuation take a major hit.

With that said, Netflix still carries a sound business model, and thus it worth considering.

In this guide, we’ll show you how and where buy Netflix stock in a matter of minutes.

Buying Netflix Stock – An Overview

If you’re confident that Netflix represents a viable investment for your stock portfolio, you will be pleased to know that you can complete your purchase at a regulated broker.

Follow the simple steps below to learn about buying Netflix stock in less than five minutes.

- ✅ Step 1: Open an account with a regulated broker

First, you will need to register an account by providing some personal information. You’ll also need to upload a copy of your government-issued ID to get your account verified. - 💳 Step 2: Deposit Funds

If you’re based in the US, you can deposit funds via a debit/credit card, e-wallet, or bank transfer without paying any fees. - 🔎 Step 3: Search for Netflix Stock

Now you can search for Netflix and hit the ‘Trade’ button to load an order box. - 🛒 Step 4: Buy Netflix Stock

Let the broker know how much money you want to invest in Netflix stock. To finalize your Netflix stock investment, click ‘Open Trade’.

As you can see from the above steps, learning about buying stocks is very straightforward.

With that said, if you’re looking for a more comprehensive and detailed explanation of buying Netflix stock online – read on.

Step 1: Choose a Stock Broker

The first step to consider when learning about investing in stock online is to choose a suitable broker. Netflix is a large-cap stock listed on the NASDAQ exchange, so you can choose any US-based brokerage site for this purpose.

However, research is paramount in this department, as a broker should offer low fees, small account minimums, and support for your preferred payment type.

As such, in the sections below, we discuss where to buy Netflix stock today – should you still be in the hunt for a solid broker.

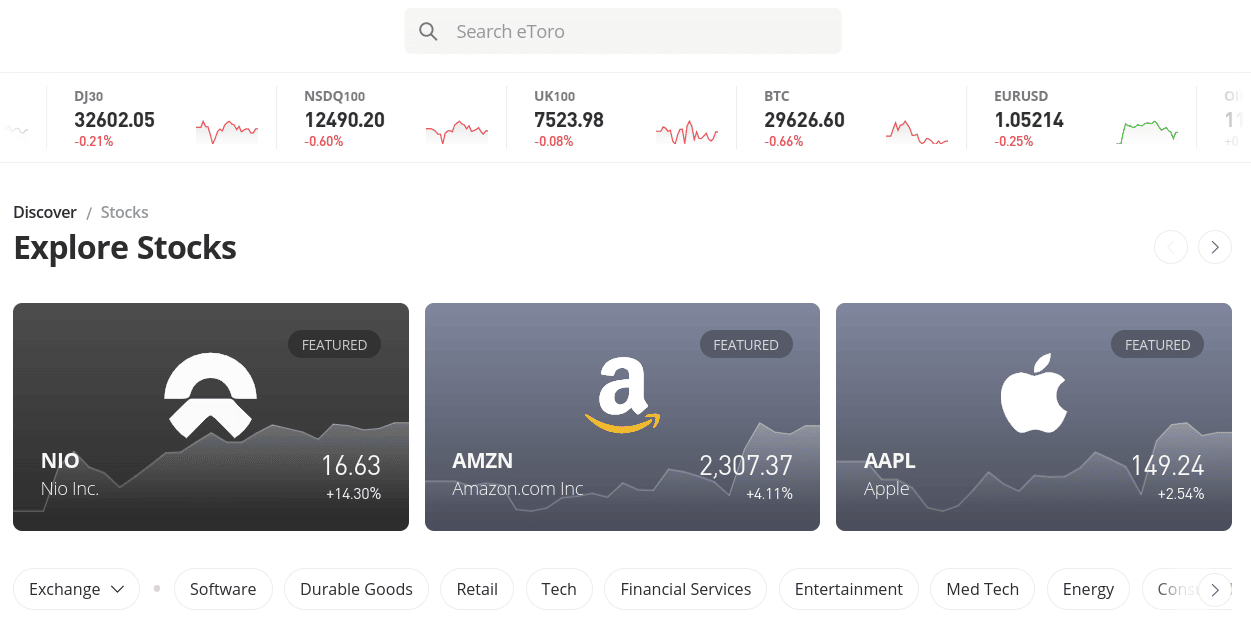

1. eToro

If you’re looking to buy Netflix stock in the cheapest way possible without risking large sums of capital – then eToro is an option in this marketplace. In choosing eToro, you will be able to buy Netflix stock from just $10 should you wish. Therefore, you have the option of investing in a fraction of one equity.

Not only that, but eToro does not charge trading commissions – so you can invest in Netflix in a low cost manner. If that wasn’t enough, US-based clients are treated to fee-free deposits across all supported eToro payment methods. In addition to bank wires and ACH, this is inclusive of e-wallets and even debit/credit cards.

To help you determine whether or not Netflix represents a solid addition to your portfolio, eToro offers a wealth of free analysis and research materials. This includes real-time news developments and market insights from leading hedge funds. Once you have purchased Netflix stocks, you might then consider adding alternative assets to your eToro portfolio.

In addition to Netflix, eToro offers thousands of other stocks. Not only does this include US-listed equities, but more than a dozen international exchanges. And, unlike other brokers serving US clients, international stocks at eToro are also available on a 0% commission basis. This is also the case with hundreds of ETFs offered by the likes of Vanguard and SPDR.

You might also be interested in the variety of passive investment tools offered by eToro – all of which are available at no additional fees. For instance, the Copy Trading feature allows you to choose a eToro trader and have all of their future positions mirrored in your own account. This requires a minimum capital outlay of just $200.

Alternatively, you might consider an eToro Smart Portfolio. These represent pre-built portfolios that track a specific market – like growth stocks. eToro will automatically rebalance your chosen Smart Portfolio on your behalf, to ensure that it continues to align with the target strategy. Smart Portfolios start at a minimum capital outlay of $500.

In terms of safety, eToro is authorized and regulated by the SEC and FINRA to offer US clients stock trading services. This broker – which is used by more than 25 million clients, is also regulated by UK, Australian, and European licensing bodies. To get started with an eToro account, you can register online or via the provider’s iOS/Android app.

Either way, getting a verified account takes less than five minutes, as your government-issued ID will be validated in real-time. Finally, we should also mention that eToro offers a place to buy cryptocurrency. Across over 60+ supported digital assets, you can invest in cryptocurrency from just $10 at a fee of 1%.

| Number of Stocks | 2,500+ |

| Deposit Fee | FREE for USD payments |

| Fee to Buy Netflix Stock | Commission-Free |

| Minimum Deposit | $10 |

Your capital is at risk.

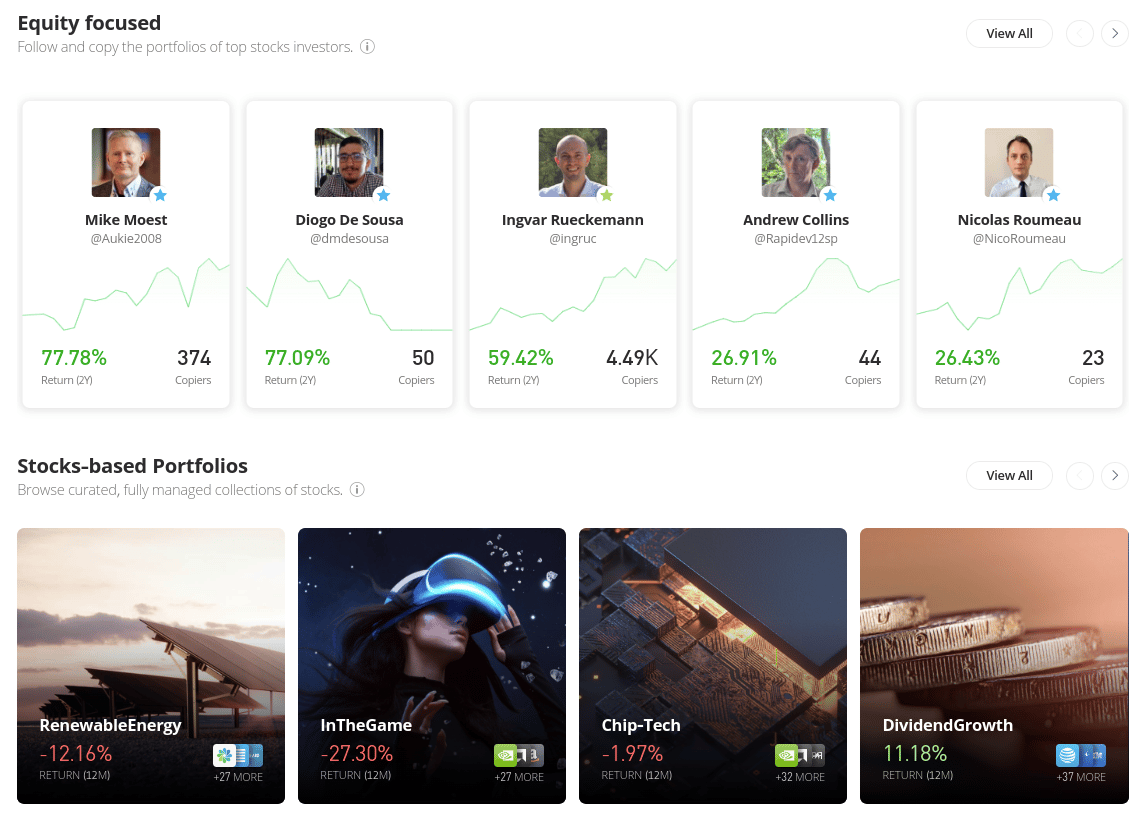

2. Webull

Moreover, you won’t need to risk too much capital as Webull requires a minimum investment outlay of just 45 when buying equities. If you consider yourself a complete novice in the stock investment space, you might also like that Webull does not have a minimum deposit requirement in place.

All that being said, Webull does come with a number of clear drawbacks. First and foremost, you won’t be able to fund your investment account with a debit/credit card or e-wallet. If like many Americans, you choose to make a deposit via a domestic bank wire, you will be hit with a rather hefty fee of $8.

In many ways, this makes it unviable to buy Netflix stocks with a small amount of money. Furthermore, Webull charges a withdrawal fee of $25 when opting for a bank wire. The only way around this is to opt for ACH – which comes with fee-free deposits and withdrawals.

Another drawback with Webull is that it does not give you direct access to international stocks. On the contrary, the platform offers a small number of American Depositary Receipts and these are not included in Webull’s commission-free offering. Nonetheless, we do like Webull for its margin trading accounts – which give you access to additional capital.

We also like Webull for its support for retirement accounts. In addition to stocks, Webull also gives you access to US-listed ETFs and options. The platform also offers more than a dozen digital currencies – which includes everything from Bitcoin and Litecoin to Uniswap and Shiba Inu. The minimum crypto trade requirement here is just $1.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Netflix Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research Netflix Stock

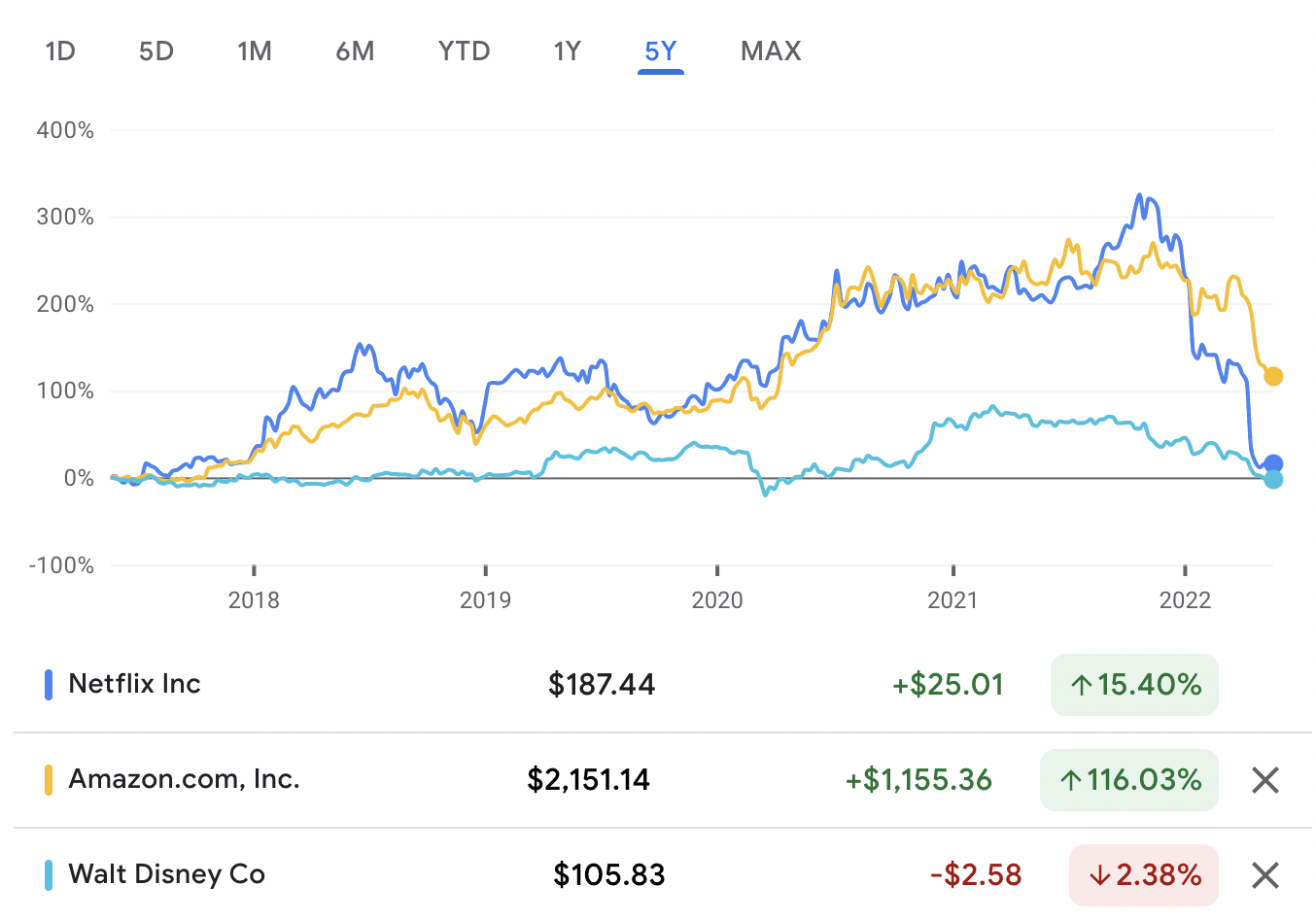

Netflix has experienced volatile highs and lows over the past couple of years. On the one hand, the stock performed extremely well in 2020 in response to global lockdown measures. However, the valuation of Netflix stocks has since dropped significantly.

While some market commentators argue that this is in line with a broader tech stock sell-off, others point to the fact that Netflix faces fierce competition from the likes of Amazon Prime and Disney+.

Therefore, before you elect to buy Netflix stock, you will need to conduct some personal research.

What is Netflix

Although Netflix is still arguably a growth stock with an emerging business model, the firm was actually formed in 1997.

- Back then, Netflix was behind a completely different product range when compared to its current form – as the firm specialized in a DVD rental subscription service.

- The main concept with Netflix during its early years was that for a monthly fee, users could request to have a DVD posted to their home.

- Then, when the customer was finished watching the content, they would return the DVD via mail.

Management at Netflix learned that this was not a business model fit for the future of the digital age. And therefore, the firm diversified into its online streaming service.

Today, Netflix is home to over 220 million subscribers from all corners of the globe. The firm has since expanded into original content, with popular titles including House of Cards, Squid Game, The Queen’s Gambit, Ozark, and Stranger Thing.

This is in addition to its conventional library of movies and TV series created by external producers.

Netflix Stock Price – How Much is Netflix Stock

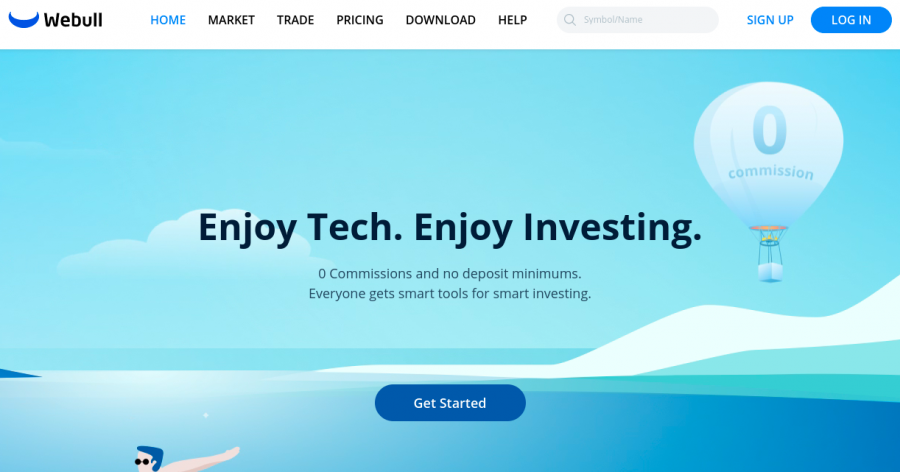

Netflix become a public company on May 23, 2002 – opting to list on the tech-heavy NASDAQ exchange. The firm opened at $15 per share, however, Netflix has since executed two stock splits. The first took place in 2004 at 2-for-1. The second was initiated in 2015 at 7-for-1.

And as such, for the purpose of analyzing the growth of Netflix stock since its IPO, this gives the firm an original listing price of $1.21. Since its IPO, Netflix has gone on to become a large-cap stock. In fact, in late 2021, Netflix stock hit an all-time high of $700. Compared to its adjusted IPO price, this represents end-to-end gains of over 57,000%.

This is yet another example of how lucrative growth stocks can be when you enter the market early. With that being said, Netflix stock has since retreated from its prior peak of $700. In fact, the firm has declined to 52-week lows of $162. This represents a drop of over 76%. In terms of its 1-year returns, Netflix stock is down 62%. Over a 5-year period, Netflix stock is up just 15%.

In comparison, the NASDAQ exchange is down 15% over the prior year and up 85% on a 5-year basis. Therefore, when compared to the broader market, Netflix stock is performing poorly.

EPS and P/E Ratio

As per its most recent quarterly earnings report, Netflix is carrying a diluted EPS of 3.53. This represents a year-over-year decline of 5.8%.

In terms of its P/E ratio, as of writing, Netflix at 17 times.

In comparison, major competitor Disney is carrying a P/E ratio of over 73 times. Amazon, which is another key competitor in the streaming service space, is also heavy at a P/E ratio of over 52 times.

Market Capitalization

Netflix is a solid large-cap stock – even when you factor in that the firm has since hit 52-week lows of $162 – a decline of over 76% from its prior high.

Index Funds

As one of the largest stocks on the NASDAQ exchange, it goes without saying that Netflix is held by a magnitude of index funds. At the forefront of this is the S&P 500.

In terms of ETFs, some of the most prominent funds with exposure to Netflix stock include the Vanguard Communication Services ETF and the Invesco Dynamic Media ETF.

Netflix Stock Dividends

Although Netflix has been a public company for over two decades, the firm has never paid a stock dividend. This is no different from other leading tech stocks – such as Amazon and Facebook.

Read More: If you seek regular income on your equity investments, read this guide to discover dividend stocks in the market.

Factors Affecting Netflix Stock

Now that you have read through the fundamentals of what Netflix stock can bring to your portfolio, you will need to perform some additional research with the view of assessing what the future holds for the firm.

The key objective here is to determine whether Netflix stock has the potential to generate sufficient returns for your investment goals.

Current Valuation Might Never Be Seen Again

First and foremost, it goes without saying that Netflix has had a torrid time in recent months – largely due to investor fears of declining subscriber numbers of rising debt levels.

However, whether or not a decline of nearly 70% is justified remains to be seen. In fact, many investors will look at the current Netflix stock price as being low.

After all, at the $150-$200 stock level, these prices have not been seen since pre-2018. Netflix has come a long way since then.

Netflix Dominates Market Share

As we cover shortly, although Netflix announced that it had lost over 200,000 subscribers in its most recent earnings report, the firm still dominates the global content streaming industry.

Estimates suggest that Netflix holds just over a 45% share in this space, with its nearest rivals Amazon Prime and Disney+ still with a long way to catch up.

Moreover, it is important to remember that content streaming still only makes up a very small segment of TV viewing time – especially in the lucrative US market.

And, with the streaming industry still growing year-on-year, Netflix is in a prime position to grow its customer base in the coming quarters.

Strong Focus on Quality Content

Management at Netflix has made its intentions clear in terms of focusing on quality over quantity. And at the forefront of this is allocating resources to Netflix Originals.

Not only does this allow Netflix to differentiate itself from its competitors, but its Original content is more profitable for the firm. This focus on quality hasn’t gone unnoticed, with Netflix cleaning up at the Emmy awards last year.

Debt Levels are Manageable

Netflix carries in the region of $15 billion worth of debt on its balance sheet. While at first glance this might concern you as a potential stockholder, there are two important considerations to make.

First and foremost, Netflix has $6 billion worth of cash on its books. Second, and perhaps most importantly, much of its debt isn’t due until at least 2025. This should give Netflix sufficient time to reshape its finances.

P/E Ratio

Further supporting the thesis that Netflix stock can be purchased on the cheap is the fact that as of writing, the firm is carrying a P/E ratio of just 17 times.

As we mentioned earlier, Disney – which is one of Netflix’s closest rivals in terms of subscriber numbers, is trading at over 73 times. Moreover, the NASDAQ composite, on average, trades with a P/E ratio of just under 20 times.

Risks to Consider When you Buy Netflix Stock

Before you buy Netflix stock, it is imperative that you consider the risks of investing in this firm.

The key risks that we identified are discussed in the sections below:

Subscriber Numbers

As per its most recent earnings report, the markets had anticipated an additional 2.7 million subscribers for the quarter. In contrast, Netflix reported a loss of 200,000 subscribers.

However, perhaps even more alarming is that in the same earnings report, Netflix noted that it expects to lose a further 2 million subscribers by the end of the next quarter.

When you consider that the value of Netflix as a company is largely dictated by the number of paying customers it has on its books at any given time, these subscription losses should be a cause of concern for investors.

Growing Competition

Although Netflix is still the market leader in the content streaming industry, it has some serious competition chipping away at its dominance. While you also have the likes of HBO Max, Paramount+, Hulu, and Discovery+, the biggest threat to Netflix are Amazon and Disney.

- Amazon, for instance, reportedly has over 200 million paying customers on its Video Prime subscription service.

- This is just 20 million fewer than Netflix has on its books.

- Most importantly, Amazon has a seriously robust balance sheet with vast cash reserves on hand.

- Furthermore, Amazon isn’t over-exposed to the video streaming industry like Netflix.

- The firm has a diversified portfolio of products and services, which covers everything from online retail and home deliveries to consumer electronic and cloud storage.

In terms of Disney+, the firm is already catering to just under 130 paying customers as per its most recent figures.

And, just like Amazon, Disney has a diversified business model that covers everything from broadcast networks and original movie content to theme parks and cruises.

2025 Debt Obligations

It is important to recognize that while Netflix’s balance sheet looks okay, this might not be the case as the firm moves into 2025.

As we mentioned earlier, this is the period that some of Netflix’s most notable debt obligations will need to be repaid. In fact, over a three-year period from 2025, more than $7 billion worth of debt will mature.

Therefore, as a Netflix investor, this is something that you will want to keep a very close eye on. The way of doing this is to ensure that you read through the firm’s quarterly earnings reports when they are released.

Step 3: Open an Account & Buy Stock

If you have read this guide up to this point – then you will know that there are plenty of considerations to make before you invest in Netflix.

If you are confident that the firm represents a solid investment, this section of our guide will explain the process of buying Netflix stock at a regulated broker.

Step 1: Open an Account with a Trusted Broker

Before you can buy Netflix stock , you will need to register an account. Initiate the registration process and fill out the form that appears on your screen.

After clicking ‘Create Account’ you will be asked for some further personal information. In addition to your cell phone number, you’ll need to specify your first and last name, home address, nationality, and date of birth.

Step 2: Upload ID

Regulated brokers need to verify your identity and residential status before it can allow you to deposit any funds. You can get verified instantly by uploading the following two documents:

- Government-issued ID, such as a passport or driver’s license

- Recently issued proof of address, such as a bank statement

Step 3: Deposit Funds

Most large, regulated brokers support a range of payment methods like bank wires and ACH, but even Paypal, Neteller, and debit/credit cards.

The minimum deposit amount for US clients is a mere $10. Other than bank wires and ACH, all other deposit types are processed instantly.

Step 4: Search for Netflix Stock

If you have funds in your account, you can type ‘Netflix’ into the search bar. When you see Netflix appear, click on the ‘Trade’ button.

This should then populate an order box – even if the NASDAQ is currently closed.

Step 5: Buy Netflix Stock

Unless you are planning to buy Netflix stock at a specific entry price via a limit order, all you need to do here is enter your investment stake in the ‘Amount’ box.

Once you click on the ‘Open Trade’ button, the broker will execute your stock order at the market price.

The Netflix stocks will then be added to your portfolio.

Netflix Stock Strengths and Weaknesses

It goes without saying that Netflix stock has experienced a major correction in recent months, with the firm hitting 52-week lows of $162. This amounts to a decline of almost 70% from its prior all-time high of $700.

As we noted earlier, even bearish sell-side analysts have Netflix at a target price of $235. At the higher end, bulls are looking at a target of $405. Based on prices as of writing, this represents an upside target of over 115%.

On the flip side, although Netflix has $6 billion available in cash reserves, from 2025 onwards it will have nearly $7 billion in debt that will mature within three years.

Perhaps even more alarming is the fact that Netflix estimates that it will lose a further 2 million subscribers before its next quarterly earnings report.

With all that being said, Netflix is still the market leader in this space, and with management focusing on quality over quantity – especially in its Originals division, this stock is worthy of consideration.

Conclusion

This guide has explained everything you need to know about buying Netflix stock for your portfolio. In addition to discussing the advantages and drawbacks of buying this stock, we’ve explained the simple investment process.

In choosing a regulated broker to buy Netflix stock today, you can do so safely and with a broker that supports fractional investing, you can buy Netflix from just a few dollars.

FAQs

How do I buy Netflix stock?

Where can I buy Netflix stock?

Can I buy one dollar of Netflix stock?

Read more: Netflix Eyes Asia to Address Subscriber Growth Woes