Investors can trade online in Nikola shares and buy into the booming Electronic Vehicles (EV) sector. Alongside established EV manufacturers like Tesla and BYD, Nikola is an EV start-up (like Lucid, Rivian and Fiskar) which specialises in EV truck production. Nikola has a commitment to hydrogen-powered batteries.

Below we delve into Nikola’s financials. We ask whether this company has recovered from the tarnish to its reputation caused by ex-CEO Trevor Milton getting indicted for fraud in 2021. Most importantly, we aim to pin down where to buy Nikola stock by reviewing two regulated brokers accessible in the US.

First, let us outline how simple it is to get started with online brokers.

Buying Nikola Stock — An Overview

- ✅Step 1: Open an account – By heading first to a regulated broker’s online platform, investors can open an account in seconds. A few personal details are all that are needed to get started.

- 🔑Step 2: Verification – Regulated brokers are obliged to ask for ID from users. An automated process takes the applicant through uploading proof of ID and proof of address.

- 💳 Step 3: Deposit – Once verified, investors can deposit USD in a variety of methods (including credit/debit card, wire transfer and e-wallets).

- 🔎 Step 4: Search for Nikola Stock – Finding Nikola stock among thousands of other stocks is simple . Users need only enter Nikola’s stock symbol ‘NKLA’ in the toolbar.

- 🛒 Step 5: Buy Nikola Stock – Simply decide how much to invest and press buy. Transactions take seconds to complete usually, and the broker will hold the stock until the investor wants to sell.

Step 1: Choose a Stock Broker

Below we review two brokers with a lot in common. Both are regulated and solid choices.

1: eToro

A regulated broker like eToro has oversight from sovereign authorities as well as compensation cover in place in the event of fraud. eToro is regulated in the US by the SEC. Investors are covered against fraud with up to $500,000 insurance provided by the SIPC.

With a selection of 3,000 international stocks, 250+ ETFs, commodities, indices and crypto, eToro is the destination of choice for 25m+ investors. 79,000 users follow Nikola stock on eToro.

Most importantly, investors can buy Nikola stock from eToro and pay zero commission. Only a spread fee applies of 0.5% — which is very competitive.

Beginners and veterans alike who buy stocks on eToro benefit from the broker’s emphasis on Social Trading. Social Trading means empowering investors to trade safely whilst learning from each other.

Each asset on sale with eToro comes with a comprehensive homepage featuring a newsfeed, financial data, analyst opinions and powerful charting tools. Investors can flag up interesting assets — including popular tech stocks — and keep an eye on them in their personal watchlist.

eToro’s CopyTrader and Smart Portfolio tools allow users to benefit directly from traders with more experience.

- With CopyTrader, investors can copy other investors’ trades for free with automatic mirroring of real-time trades.

- With eToro’s 65+ Smart Portfolios, investors can buy into strategic positions on particular sectors in one go (similar to, but not the same as, an ETF). Investors finding out about investing in Nikola stock might want, for example, to check out eToro’s Driverless Smart Portfolio.

| Number of Stocks: | 3000+ (international) |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying Nikola: | Spread fee of just 0.5% |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2: Webull

Webull offers zero commission on share transactions (like eToro) — although exact spread fees for each stock are more difficult to track down.

Webull offers a stellar selection of 5,000 stocks. The slight downside of this range (which includes new stocks, oil stocks and all other key sectors covered) is that the selection is overwhelmingly US-orientated. Some foreign shares can be bought via ADRs (American Depositary Receipts). eToro, on the other hand, offers 900+ shares from 15+ international exchanges outside the US.

Non-trading fees with Webull are not as impressive as those offered by eToro. Bank wire deposits cost $8 with Webull, but are free with eToro. Withdrawals to bank accounts with Webull cost $25 each (which is high by industry standards); again, eToro is cheaper, with a flat withdrawal fee of $5 regardless of withdrawal method.

In summary, investors wanting to buy Nikola stock and other stocks can look forward to an all-round professional experience with Webull.

| Number of Stocks: | 5000+ |

|---|---|

| Pricing System: | Spread fee, no commission |

| Cost of Buying Nikola: | Spread fee: not available |

Your capital is at risk.

Step 2: Research Nikola Stock

What is Nikola

Nikola is a US manufacturer in the Electronic Vehicles (EV) sector. Founded in 2015, the company is headquartered in Phoenix, Arizona, US.

Nikola produces the powered cabs for semi-trucks (also known as articulated lorries).

Two types of semi-trucks are offered:

- Electric-powered: the Tre BEV (daycab)

- Hydrogen-powered: the Tre FCEV (daycab) and the Tw0 FCEV (sleepover)

The electric-powered Tre BEV is available for sale. The hydrogen-powered Tre FCEV and Two FCEV are planned for release in 2023 and 2024 respectively.

The firm has a manufacturing facility in Coolidge, Arizona. By 2023, this is expected to have a production capacity of 20,000 trucks per year.

Nikola also invests in electric and hydrogen infrastructure:

- Partnered with TravelCenters of America (TA), Nikola will build hydrogen refuelling infrastructure in TA’s existing station along Interstate 10 in California.

- In 2022, Nikola teamed up with TC Energy in planning a hydrogen production hub in Crossfield, Alberta.

- In 2023, Nikola plans to build another hydrogen production hub in Arizona.

Tech Terms

- ‘BEV’ stands for Battery-powered Electric Vehicle.

- ‘FCEV’ stands for Fuel Cell-powered Electric Vehicle.

Nikola Stock Price — How Much is Nikola Stock Worth

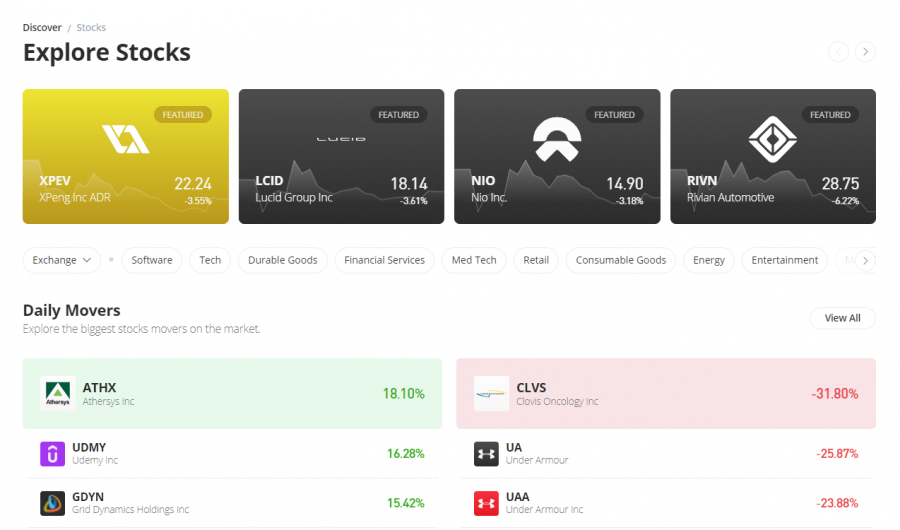

As we can see from the Nikola stock chart below, the Nikola stock price today is currently riding a bull wave.

The Nikola stock history has been a volatile one. And the general direction of travel has been down. This downward trajectory, though, is not uncommon for startups at the beginning of their commercial journey. This is particularly the case in the EV market, which is in its infancy.

Until companies like Nikola and its fellow startups Rivian, Lucid and Fisker start selling vehicles in quantity, investors cannot be sure that the potential of their product will be realised. The stock price therefore tends to drift downwards until news of practical progress emerges.

- Nikola came to market in June 2020 having merged with a SPAC (Special Purpose Acquisition Company). Shares peaked above $90 per share.

- In July, 2021, the SEC brought fraud charges against Nikola founder and former CEO, Trevor Milton.

- In December, 2021, Nikola produced its first truck.

- In the same month, the company agreed to pay a $125m penalty for former CEO Milton having, as the SEC judged, ‘falsely given investors the impression that Nikola had reached certain product and technological milestones.’

Buy NKLA Stock: Three Key Financial Metrics

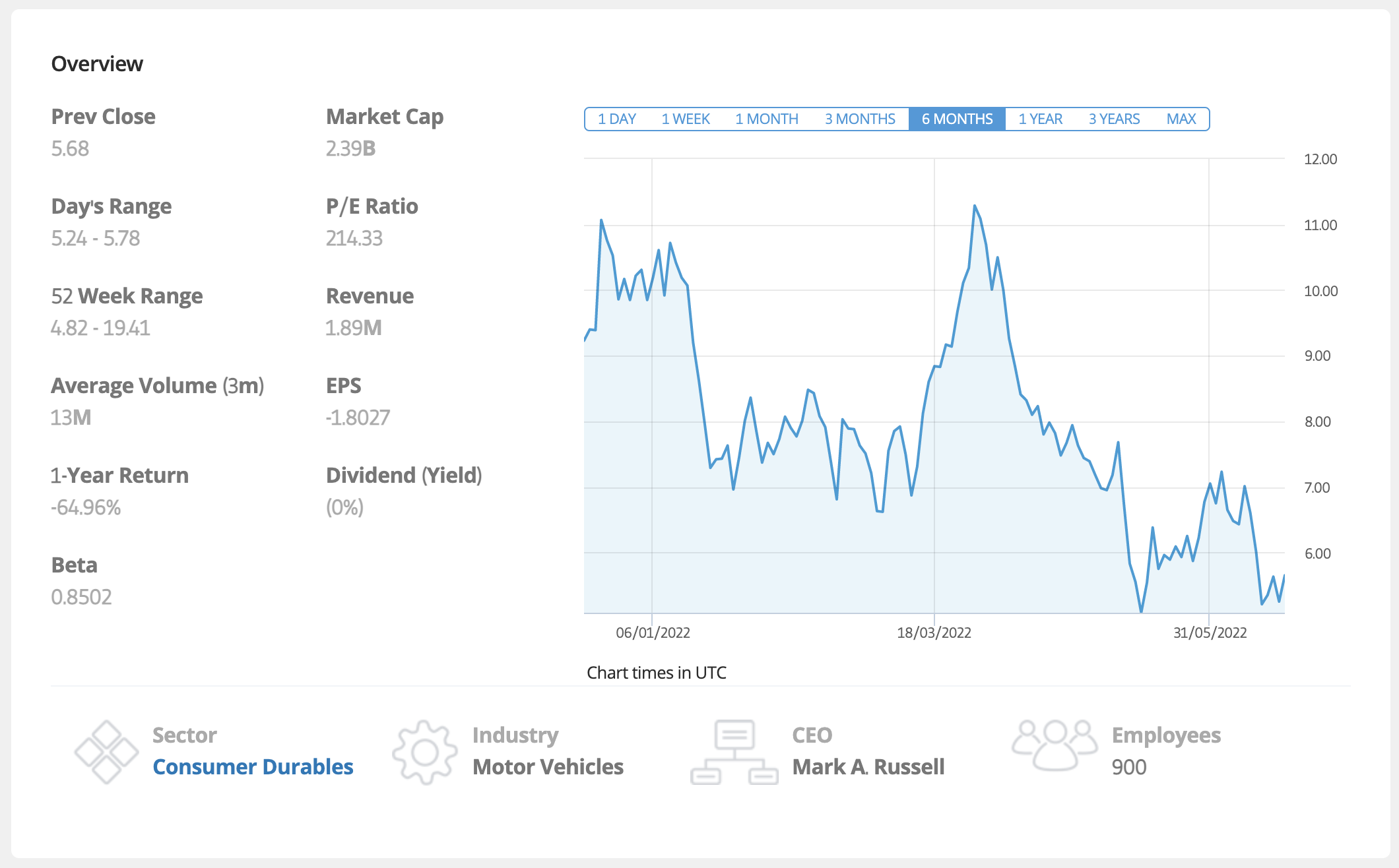

For investors wondering where to buy Nikola stock, eToro offers the significant advantage of providing key financial information about the company.

The summary above is just the beginning of what is available with eToro when it comes to financials. With income statements and balance sheet information available too, we can get an overview of Nikola’s financial health by picking out 3 metrics in particular.

| Metric | Definition | Shows |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

| Debt-to-Equity Ratio | Long-term debt divided by shareholder equity | How much debt the company is in as a proportion of shareholder equity |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Nikola EPS (Earnings Per Share): -1.8

Nikola’s negative EPS value means that, in simple terms, the company is currently running at a loss. This is to be expected, given its first product, the TRE BEV, is only just coming online and its two FCEV-based trucks will not be into production until next year.

Nikola P/E Ratio: 214.33

The higher the P/E ratio, the more expensive the company compared to how much income it is generating. With just $1.78m income announced for Q1 2022, Nikola has barely got started. The firm’s stratospheric P/E ratio reflects the fact that investors are pricing in future potential earnings.

Nikola Debt-to-Equity Ratio: 4.52%

This figure shows us how much debt Nikola is in. The proportion of its debt vs. the sum remaining should it pay off all its debt is just 4.52%. This means that the company is not massively leveraged with debt. Below we observe that the Nikola is seeking to further bolster its balance sheet against a possible recession by releasing 200m extra shares onto the market.

Nikola Financials Summary:

- Nikola has yet to generate any significant revenues: just $189m in Q1 2022. This is because it has only just got started producing vehicles.

- With such low revenues, the firm’s P/E ratio is extremely high: 214.33. This shows us that shares in Nikola are very expensive based on its current earnings.

- The firm is not overburdened by debt. Nikola’s debt-to-equity ratio of 4.52% is excellent.

Nikola Stock Dividends

Dividends are payments that companies sometimes pay out to stockholders. Firms are under no obligation to pay out dividends.

The most popular dividend stocks are generally established companies that can afford to reward investors. It is no surprise that, just starting its commercial journey, Nikola has yet to pay any dividends.

The effect of the Coronavirus Pandemic cooled down dividend payments across many sectors, including the automotive market. Giant General Motors, for example, paid a quarterly dividend between 2014 and 2020. But since then it has not paid any dividends.

Factors Affecting Nikola Stock

Investors seeking to buy Nikola stock may already have spotted reasons to invest in the firm. There are four reasons why Nikola may offer more intrinsic value than its current price indicates.

1: The EV Market Holds Tremendous Potential

Nikola is an EV producer. As such, it is well-positioned to benefit from the anticipated rise in EV use.

- The global EV market is set to be worth in the region of $800bn by 2027 (according to Allied Market Research).

- There could be around 230m electric vehicles in use by 2030 (according to the International Energy Agency).

As part of the Green movement to decarbonise world manufacturing, Electronic Vehicles stand to benefit from continued government incentives in the future.

It is fair to say, however, that it is currently only the well-established firms making big sales that currently offer high share price performance.

- These include Warren Buffet-backed Chinese firm BYD, which sold almost 300,000 EVs in Q1 2022. Tesla sold roughly the same amount.

- In stark contrast, serial production of Nikola’s Tre BEV only began in March, 2022, and 11 saleable trucks were shipped to dealers in April.

2: Nikola Stands Out Among the Startup Competition

Nikola is among a clutch of EV startups that have come to market over recent years:

- Lucid Motors: Luxury EV saloons — Lucid Air Range. Stock ticker: LCID.

- Fisker: SUVs — Ocean model. Stock ticker: FSR.

- Rivian: Pickup truck and SUV — R1T and R1S. Stock ticker: RIVN.

Nikola stands out for two reasons:

- Nikola produces semi-trucks only.

This means that it is not in direct competition with Lucid, Fisker or Rivian. But Nikola will be in direct competition with Tesla if the Tesla Semi goes into production in 2023 as planned. - With the Tre FCEV and Two FCEV, Nikola is pioneering the use of hydrogen-powered trucks.

With its conventional battery-powered Tre BEV available already too, this means that the firm is investing in two technologies at once. Investors considering whether to buy stock in Nikola might consider this as sensible risk management. Nobody knows whether hydrogen-powered transport will take off. But, if FCEVs do become popular, Nikola is well-placed to take commercial advantage — with the security of investment in conventional BEVs too.

3: Nikola Bolstering Finances Against Possible Recession

Nikola is in the enviable position of having a solid Quick Ratio: ie. it could pay off its outstanding debts if required. It is, however, currently seeking more investment in order to be ready for a possible downturn in the global economy.

In May, 2022 Nikola announced a £200m investment from funds advised by Antara Capital.

The firm is currently appealing to existing stockholders to approve a move to expand the existing shares outstanding from 600m to 800m. This would raise more capital.

Rival Lucid has also bolstered its balance sheet by entering into a new $1bn revolving credit agreement with lenders.

Over the course of 2022, Nikola plans to deliver 300 to 500 Tre BEV trucks as well as complete testing on its Tre FCEV model. It also plans to begin construction on its planned hydrogen production hub in Arizona.

Step 3: Open an Account and Buy Nikola Stock

Investors wanting to buy Nikola stock can get started by opening an account with an online broker.

There are many brokers nowadays. What they generally have in common is an automated onboarding process. This tends to follow the same format:

- Sign up

- Verify ID

- Deposit Funds

- Search for Nikola Stock (or other assets)

- Buy Nikola Stock (or other assets)

Below we guide you through this process with a regulated broker.

1: Sign up

- Head to the broker’s website.

- Supply some personal details (name/email/phone number) plus create a password.

- Sign up with Facebook or Google if preferred.

- Press ‘Create Account’.

Note that to toughen up account security, it can worth enabling Face ID and Touch ID. These features can be set up once the account is opened.

2: Verify ID

- KYC (Know Your Customer) rules mean that regulated brokers must ask for ID.

- New joiners must supply proof of personal ID (passport/government ID card) and proof of address (rent/utility bill, letter from authority, etc.)

- These documents must be scanned and uploaded — just follow the instructions onscreen.

- Once verification is complete, the broker will send a confirmatory email.

3: Deposit Funds

- Sign into the account.

- Click the ‘Deposit Funds’ button.

- Select which currency to deposit, how much to deposit, and how.

- For US investors, bank transfer, credit/debit card and a variety of e-wallets are accepted.

- The broker will usually send an email to confirm that a deposit has been received.

- The investor is ready to buy Nikola stock.

4: Search for Nikola Stock

To buy Nikola stock, the investor will first have to find it. With thousands of available stocks, the investor might assume this is difficult — but actually it takes just seconds.

- The investor first needs to log into their account.

- Then simply enter the Nikola stock symbol ‘NKLA’ in the toolbar.

- Press enter. This takes the user to the Nikola homepage. This features stats, research, newsfeed, and charting tools.

- To get straight down to making a trade, press the blue ‘TRADE’ button.

5: Buy Nikola Stock

- Here investors must set how much they want to spend.

- Stop Loss and Take Profit levels can also be set here. But this is not mandatory.

- Depending on their country of residence, investors can further set leverage levels for their trade. This means gearing the result of the trade to amplify the gain or loss. This is not advised for beginners.

- Once the investor is happy with all the details, the blue ‘Open Trade’ button needs to be pressed. This executes the trade.

- The trade usually goes through in seconds. Then an onscreen notification pops up.

- The Nikola stock purchase may then be reviewed in the portfolio.

Nikola Stock Strength

Buying Nikola stock is simple with a regulated broker. We highlight one advantage and disadvantage for investors wondering whether to buy Nikola stock or not.

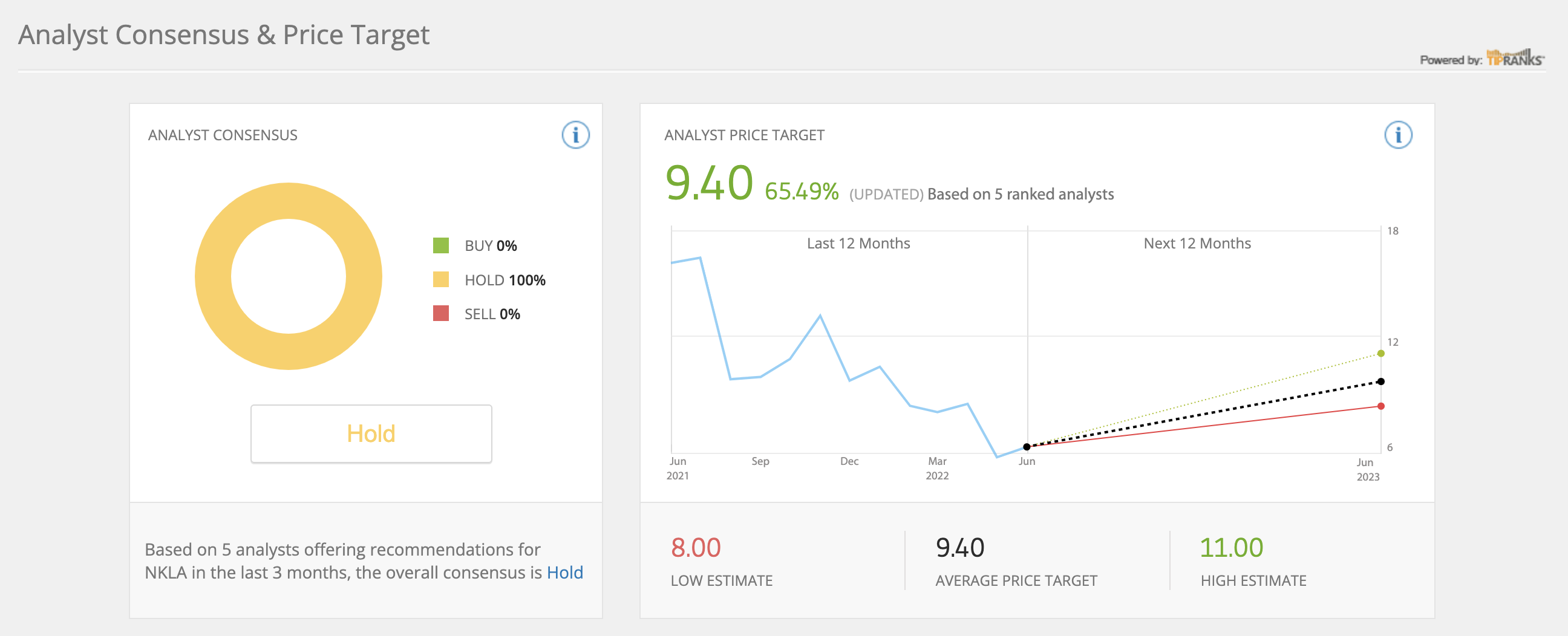

BUY: Professional Analysts say ‘HOLD’

Investors wanting to buy Nikola stock can check Nikola’s homepage on eToro and check out what the professionals are saying about the stock.

From the screenshot below, we can see that the consensus is to ‘HOLD’.

SELL: Nikola —Tarnished Reputation

Investors wondering whether to buy Nikola stock should know that the firm has endured a massive bash to its reputation.

In September 2020, a company called Hindenburg Research issued a report claiming that Nikola was an ‘intricate fraud’, citing various pieces of evidence showing that the firm had misled potential investors about its technological progress.

In the first demonstration of the Nikola One semi-truck, for example, Nikola claimed that the vehicle was fully-working. But the firm later admitted that the truck had been put on slight downward hill to pretend that it was self-propelled.

- In the same month, Nikola founder and CEO Trevor Milton resigned.

- As a result of this negative publicity, Nikola’s plans to build a ‘Badger’ FCEV pickup in conjunction with General Motors were shelved. NKLA stock fell 24% on the news.

- In July 2021, Milton was indicted by a Federal Grand Jury on 3 counts of criminal fraud.

- In December 2021, the SEC hit Nikola with a penalty of $125m for Milton’s actions.

To be fair, most company’s take liberties when it comes to marketing their products. US news outlet CNBC confirms that ‘Nikola was one of at least four EV companies under investigation by federal agencies about potentially misleading investors.’

Further, the malefactor in the case — ex-CEO Milton — has left the company.

Any Nikola stock forecast should bear in mind that investors will likely value the company on the basis of its future production and financial results, rather than the scandals of its past.

Conclusion

Above we have aimed to supply an overview for investors looking at buying Nikola stock. We have isolated a few key financial metrics, which show that Nikola is largely free of debt but plans to bolster its position with a new share offering. Nikola stock is currently very expensive in terms of earnings, but that is not surprising given how the company has only just started selling products.

We have focussed on two brokers: eToro vs. Webull. With a solid reputations, zero commission on stock transactions and wide selections of stocks, both brokers have plenty to offer. However, any large, regulated broker can be a reasonable choice. It’s always worth doing some research before committing to a specific broker.