Pfizer is a 170-year-old global pharmaceutical and biotechnology business based in the US. It is recently known for developing its COVID-19 vaccine, but the firm also makes a plethora of other products.

In this guide, you will learn the ins and outs of buying Pfizer stock by staking just $10 and without paying any trading commission.

Buying Pfizer Stock – An Overview

To give you an indication of how simple it is to buy Pfizer stock, you can take a look at an overview of the process below.

- ✅ Step 1: Open an Account with a Regulated Broker

Look for the registration link on the homepage of a regulated broker and complete the online form that appears upon clicking it. The broker will need to know some information about who you are as well as a username and password of your choosing. - 💳 Step 2: Deposit Funds

You can fund your account with as little as $10 to buy Pfizer stock. Select a payment method, enter your details and add the amount you wish to deposit. Deposit types include credit/debit cards, wire transfers, ACH, and e-wallets. There is no deposit fee for US stock traders. - 🔎 Step 3: Search for Pfizer Stock

You can use the search bar to locate and buy Pfizer stock. As you type it in, a list of available markets will appear – click ‘Trade’ next to Pfizer. - 🛒 Step 4: Buy Pfizer Stock

The final step is to complete a trading order. Enter the monetary amount you wish to allocate to Pfizer stocks and confirm your order. There is no commission to pay when buying and Pfizer selling stocks with some brokers.

If you need more assistance before making a decision on where to buy Pfizer stock – read on. Next, we offer a full review of the cheapest, and most reputable trading platforms in the US.

Step 1: Choose a Stock Broker

When you are familiarizing yourself with investing in Pfizer stock, you will notice that there are lots of options when it comes to brokers offering US-listed stockss.

To help you make an informed choice, you will find reviews of stock trading platforms for beginners below. Each offers US-listed stocks with 0% commission alongside a simple trading platform.

1. eToro

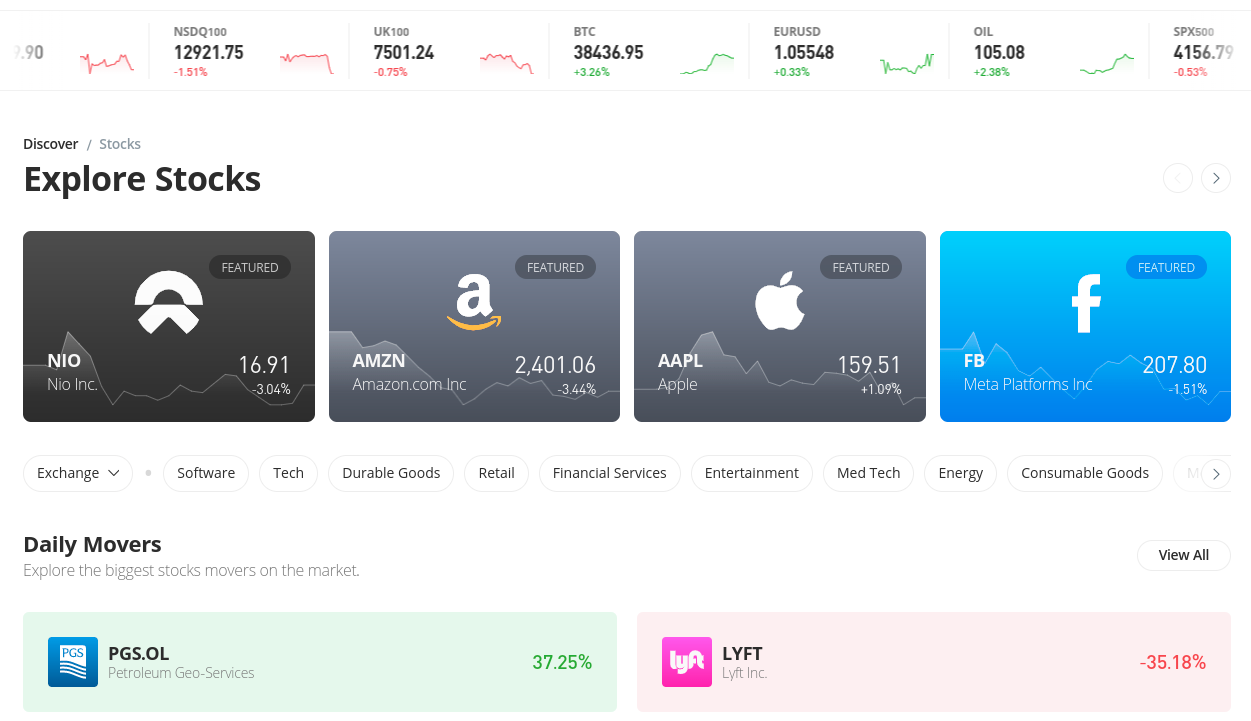

eToro offers a trading platform from which to buy Pfizer stock. On this platform, US stock trading is regulated by the SEC and FINRA. As such, you can rely on the broker to handle your funds and investments in a fair and professional manner.

This stock broker facilitates fractional share trading which allows you to stake small amounts of $10 or more in Pfizer. It also doesn’t charge commission – so will only have the spread to pay.

It’s simple to buy stocks on eToro, and the platform offers a tight spread that rarely exceeds 0.25%, so the platform is a low-cost place to begin your stock trading endeavors. If you’re based in the US, the minimum deposit is just $10 when opening an account and thereafter.

Furthermore, clients in the US do not have to pay a fee when making a deposit. Speaking of which, you can buy stocks with PayPal on this platform. Other e-wallets include Skrill and Neteller. This broker also accepts ACH, bank wire transfers, and debit/credit card payments. As such, there are plenty of options when it comes to funding your account.

We mentioned above that Pfizer stock can be bought commission-free. This is also the case for 2,500+ stocks from the many exchanges you will have access to at eToro. US clients are also able to buy and sell ETFs without paying a commission. This includes the Health Care Select Sector SPDR Fund for instance, which includes Pfizer and a range of other relevant stocks.

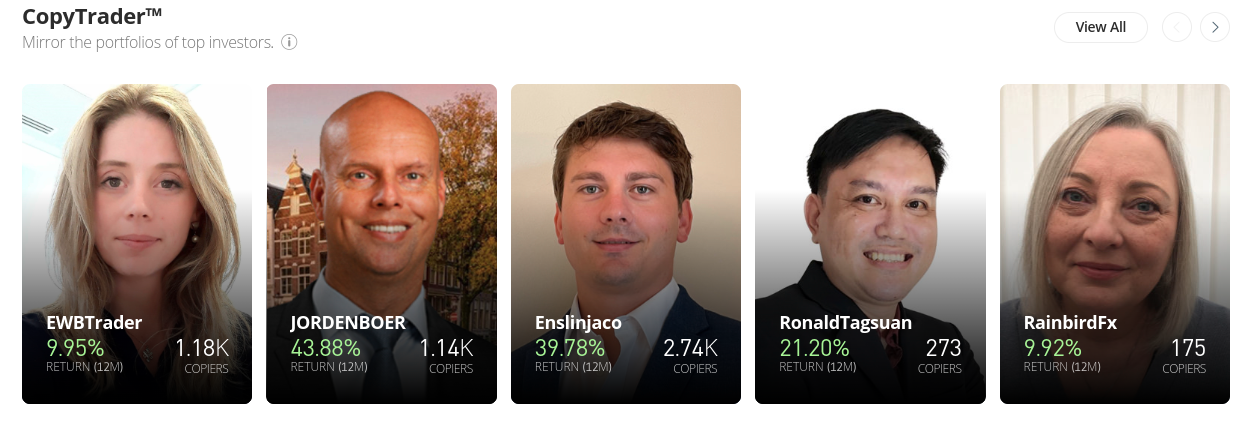

One of eToro’s stand-out passive investing features is copy trading. This offers newbies a way to shorten the learning curve, and seasoned traders a chance to diversify with little effort. All you need to do is allocate $200 or more to a pro-investor. You can elect to copy up to 100 separate individuals. You’ll find a list of participants under ‘Discover’, followed by ‘Copy Trader’.

After allocating some funds, all of their stock trading positions will be copied over to your own eToro portfolio. The monetary amount dedicated to each position will be proportionate to the size of your investment. If you wish to invest in a basket of stocks to diversify your holdings, you should check out eToro’s many smart portfolios.

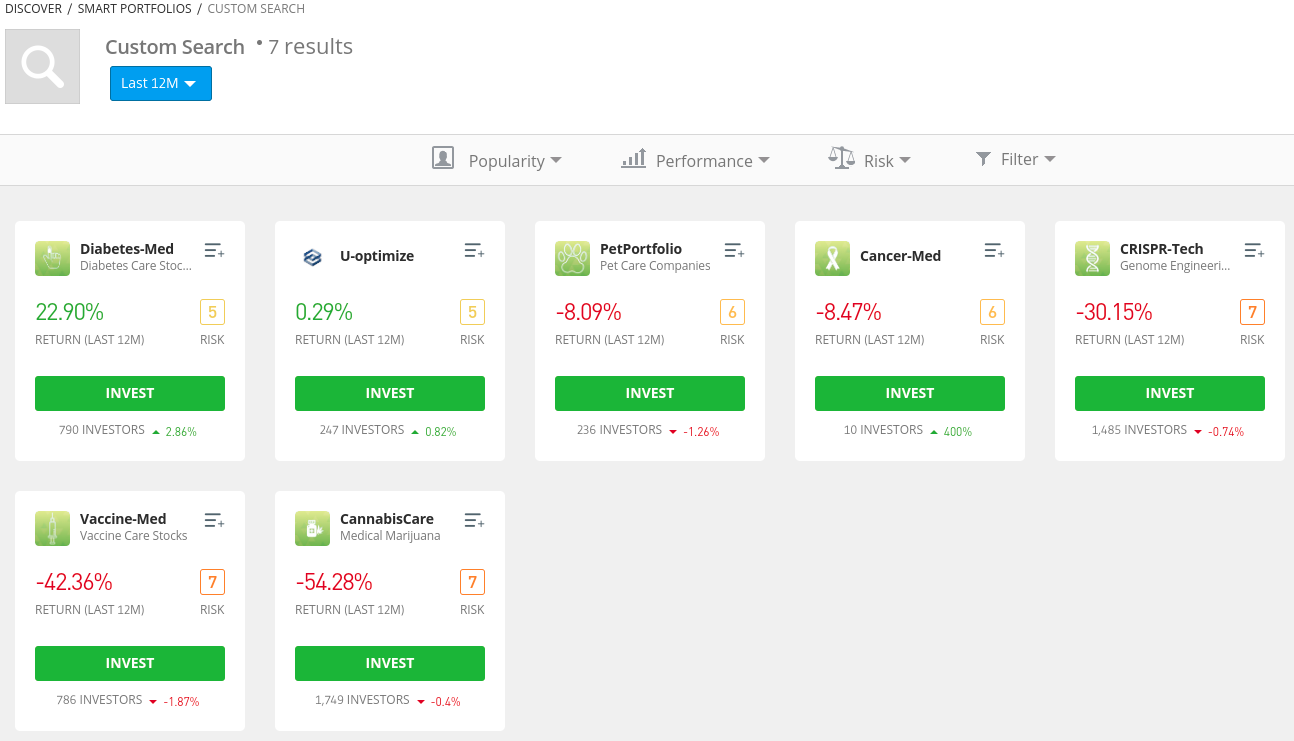

There are 68 to choose from at the time of writing. Because you are looking to buy Pfizer stock, you may want to allocate some funds to a portfolio that focuses on this type of company. The way to find a smart portfolio that suits your goals is to click ‘Discover’. Look for smart portfolios and then click ‘View All’.

You can either find one this way or filter by interest. For instance, the ‘Med Tech’ section includes managed portfolios centered on everything from biotech stocks and medical marijuana to veterinary companies and genome engineering firms. If you want to buy Pfizer stock from your cell phone so you can trade on the go, download the free eToro app.

| Number of Stocks | 2,500+ |

| Deposit Fee | FREE |

| Fee to Buy Pfizer | Commission-Free |

| Minimum Deposit | $10 |

Your capital is at risk.

2. Webull

Please note that you can also access a range of international stock exchanges here. However, foreign stocks are offered as ADRs, and you will need to pay fees to do so. As such, you will need to check the fees prior to investing. Alternatively, buy internationally listed stock at eToro where all stocks are offered commission-free.

When it’s time to fund your account so that you can place an order to buy Pfizer stock, you only have ACH and bank wire transfers to choose from. Importantly, the latter commands a fee of $8 on each deposit transaction, and a further $25 on withdrawals using the same method. There is no minimum deposit in place at this brokerage.

If you were hoping to invest passively, you won’t find any copy trading tools at Webull. You will however have access to basic guides, customizable price charts, and other analysis tools such as technical indicators. Webull is available on desktop and there is also a free cell phone stock app so you can check the Pfizer stock price and place orders on the move. Finally, Webull allows you to buy cryptocurrency commission-free if you are looking to diversify your investment portfolio.

| Number of Stocks | 5,000+ |

| Deposit Fee | ACH – free / Bank wire – $8 |

| Fee to Buy Pfizer Stock | Commission-Free |

| Minimum Deposit | $0 |

Your capital is at risk.

Step 2: Research Pfizer Stock

Prior to buying stocks in Pfizer and much like if you were to buy amazon stock, it is crucial that you perform some thorough research surrounding its history, business model, finances, and stock performance.

To save you some online legwork we have compiled some important information about Pfizer stock for you to study prior to investing.

What is Pfizer

Pfizer was founded in 1849 by Charles Erhart and Charles Pfizer as a pharmaceutical business. The company has since developed a number of well-known medications.

For instance:

- Iodine, chloroform, and morphine were among the drugs produced by Pfizer as early as the 1800s

- They were employed in the growing area of medical photography (X-Rays) as well as for therapeutic purposes

- To satisfy the demands of the Federal Army during the US civil war, the firm increased the output of its disinfectants, preservatives, and painkillers

- Pfizer-developed tartaric acid was carried in soldiers’ combat kits and used to heal wounds

- By the late 1800s, Pfizer had also begun producing citric acid, used in beverages like Coca-Cola, Pepsi, and Dr. Pepper

- Citric acid became Pfizer’s major product and the springboard for the company’s subsequent expansion in the decades that followed

- Pfizer was the first corporation to find a means to mass-produce well-known antibiotic penicillin

- Pfizer products include Advil, Bextra, Celebrex, Diflucan, Lyrica, Robitussin, and Viagra

- Preparation-H and Chapstick are two more of the company’s most well-known products

Pfizer has been around for over 170 years and has had many so-called firsts.

For example, in late 2020, the firm made history when it became the first company to acquire emergency use permission from the FDA (Food and Drug Administration) for a vaccination designed to protect people against getting seriously ill from the COVID-19 virus.

This is what many people know the company for. Additionally, the FDA authorized the Pfizer-BioNTech booster vaccine in August 2021, and it will be sold as Comirnaty.

Pfizer Stock Price

Pfizer became a publically listed company back in 1942, at which time 240,000 stocks were made available to everyday investors. Stocks remained under $10 apiece until 1998. At the end of March 1998, the FDA approved the use of Pfizer’s then breakthrough new product Viagra.

By the end of the year, the stock was valued at around $40 per share and it hasn’t fallen below pre-1998 levels since. More recently, over the last five years of trading, Pfizer stock has increased by almost 57%.

By 2020, the COVID-19 pandemic was spreading throughout China. In March of the same year, Pfizer stock fell by around 10% in a short time. The slowdown in China affected Pfizer stock almost immediately. This is due to its strong ties to the country via its generic established medicines business Upjohn, which is based in Shanghai.

That said, by May 2020, Pfizer stock was on the up. This was largely because, at this time, the race was well and truly on to manufacture a vaccine for COVID-19 as quickly as possible. Along with Moderna, Pfizer was at the forefront of this research. By December 2020, the Pfizer-BioTech vaccine shot was available to the first eligible age group and rollouts continued into 2021.

Pfizer stock was flying high in 2021 following breakthroughs in the COVID-19 vaccination. At the start of 2021, you would have paid $40 per Pfizer share. The stock reached an all-time high of around $60 in December of the same year.

At the start of 2022, Pfizer stock began to fall following news the company would discontinue Vupanorsen, a drug the biotech firm has previously expected to add revenue of over $15 billion. That said, Pfizer has more in the pipeline, which we talk about shortly.

In fact, by March 2022, Pfizer stock was on the increase, following news of the FDA’s approval of the company’s booster jab. The company has also created Paxlovid, an oral antiviral pill to treat COVID-19. The US government is in the process of finalizing its rollout to pharmacies at the time of writing.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

EPS and P/E Ratio

Let’s take a look at some of Pfizer’s financial results, specifically the EPS and P/E ratio.

The information provided below is from Pfizer’s recent earnings call:

- The P/E ratio of Pfizer is 11.18 at the time of writing

- In quarter four of 2021, EPS was beaten by 23.56%

- The expected EPS for quarter one of 2022 was 1.5

Over five years, the company has grown its EPS by 28% annually. You could also research previous quarterly financial reports yourself to compare and get a gauge of how Pfizer stock is performing.

Market Capitalization

At the time of writing, Pfizer’s market capitalization is over $275 billion. Pfizer sits within the top 30 US companies by market cap and is also the biggest pharmaceutical firm of its kind.

Index Funds

Pfizer is a component of many indices and the ETFs that track them.

To offer a few examples:

- You’ll find Pfizer included in the S&P 500 Health Care Sector

- This stock is also a component of the Russel 1000 and 3000.

If you like the sound of investing in Pfizer stock and a basket of other stocks simultaneously, consider one of the many commission-free ETFs at eToro.

Some beginners opt for ETFs over index funds as they are widely considered to be more flexible. If you are unfamiliar with this type of asset, you can learn to trade ETFs here.

Pfizer Stock Dividends

For investors looking for dividend stocks, you will be pleased to learn that Pfizer is a dividend-paying company. As such, when you buy Pfizer stock, you will receive a payment every quarter.

Pfizer has increased its dividend distributions at a rate of around 7.2% over ten years. At the time of writing, the running dividend yield is 3.2%, and the quarterly amount per share is $0.40.

Factors Affecting Pfizer Stock

You will need to decide for yourself whether it’s smart to buy Pfizer stock, based on thorough research.

With that said, in the sections below, we offer some insight into the potential advantages of educating yourself on investinvest in Pfizer:

Pfizer Has a Strong Portfolio of Products

As we touched on earlier, Pfizer’s portfolio of products is vast. The company’s COVID-19 vaccine was approved by the FDA in 2020, but there are plenty more revenue streams.

- Some of the products manufactured by Pfizer include Viagra, Advil, Dimetapp, Xanax, Celebrex, Eliquis, Neosporin, Enbrel, EpiPen, Zmax, Depo-Provera, and Xeljanz

- The biotech company also focuses on diabetes, cancer, and heart medicines

- It also manufactures drugs for the neurological system as well as testosterone and hormone replacement therapies

Ultimately, Pfizer is a pharmaceutical company that produces over 350 different products. As such, you would be mistaken if you thought it was only a vaccine manufacturer.

Pfizer Beat Q1 Profit Estimates

Pfizer forecasts profits of $6.25 to $6.45 per share for the year, down from $6.35 to $6.55 in the previous forecast. However, overall revenues for 2022 are expected to be between $98 billion and $102 billion.

Furthermore, robust sales of Pfizer’s COVID-19 vaccination and oral antiviral therapy helped to boost the company in its first-quarter results report. This is one of the reasons new investors are looking to buy Pfizer stock.

- When compared to the same period in 2021, the company’s first-quarter revenue increased by 77% to more than $25 billion

- Owing to $1.5 billion in sales of its oral antiviral medicine Paxlovid as well as $13.2 billion raked in from the COVID-19 vaccine

- Paxlovid has been approved by regulators in over 60 countries, and Pfizer is in talks to expand the oral antiviral’s market reach

- Prescriptions have increased tenfold in the US

- Approximately 80,000 patients were treated in the week ending the 22nd of April 2022, compared to around 8,000 in the week ending the 25th of February

- Pfizer has a 90% market share in long-term care, retail, and mail-order pharmacies in the US

In the first half of 2022, the business plans to produce 30 million courses, with 120 million by the end of the year.

FDA Approval of COVID-19 Drugs

The FDA increased the Emergency Usage Authorization for Pfizer’s COVID-19 vaccine to include use as a second booster dose.

- Pfizer will benefit from this because Comirnaty alone generated $36.9 billion in total sales in 2021

- This was approximately 45% of the company’s overall income for the year and more than any other therapy

- With the inclusion of a booster injection, the vaccine is expected to provide strong income for at least a few more quarters

- Pfizer stated in mid-April that it had secured $22 billion in contracts for Paxlovid, the aforementioned COVID-19 tablet, and $32 billion for Comirnaty

Moreover, Pfizer has said that data from a study of its COVID vaccination in children aged 6 months to 4 years old will be submitted to US authorities by early June 2022 at the latest.

Potential Time to Buy Pfizer at a Bargain Price

According to many market analysts, Pfizer stock is set to rise again. As such, this could present investors with a chance to buy Pfizer stock at a discount. The 52-week high of the stock at the time of writing is almost $62, while the low stands at $34.5.

Pfizer stocks cost around $49 at the time of writing. This means Pfizer stock is trading around 21% lower than the aforementioned 52-week high.

Step 3: Open an Account & Buy Stock

Opening a trading account from which to buy Pfizer stock is a fairly straightforward process via the right brokerage.

Step 1: Open an Account with a Regulated Broker

Open the broker’s homepage and you will see a button used to begin registration. Click this to create an account from which to buy Pfizer stock today.

Type in your chosen username and password so that you can access your account at a later date.

You will also need to complete a form that entails entering your full name, address, email, cell phone number, nationality, and date of birth.

Step 2: Upload ID

Any trustworthy broker is going to ask you for some ID so that you can buy Pfizer stock.

The main point of this is to keep the platform safe and free from illegal activity.

- Brokers use automated ID validation so this process usually takes a matter of minutes to complete

- To start, take a photo (or scan) of your passport, state ID, or a driver’s license and upload it when prompted

- Next, do the same with a utility bill, tax letter, or bank statement

- The document must show an issue date within three months, as well as your name and address.

There are quite a few documents supported on this trading platform, so check the list if you don’t have the ones we’ve mentioned.

Step 3: Deposit Funds

To deposit some funds, select a payment method and enter your details.

Some stock brokers will allow you to buy stocks with a credit card. Other options include debit cards, ACH, wire transfers, and e-wallets.

Supported e-wallets comprise Skrill, PayPal, and Neteller.

When researching where to buy Pfizer stock, you might have noticed that some trading platforms charge deposit fees, or support a limited number of payment methods.

Step 4: Search for Pfizer Stock

Carrying out a search to buy Pfizer stock is simple.

Just look for the search bar in the center of the main dashboard and enter ‘Pfizer’. As you begin to type, you’ll see Pfizer appear.

Click the button labeled ‘Trade’ to confirm your decision to buy Pfizer stock.

Step 5: Buy Pfizer Stock

To buy Pfizer stock today with 0% commission, enter the US dollar amount you are willing to allocate to this company.

Here, we are choosing to partake in fractional share trading, so are allocating $15.

You can add just $10 worth of Pfizer stock to your portfolio if you like.

Finally, click on ‘Open Trade’ to confirm your order.

Pfizer Stock Strength

During the last year of trading, Pfizer stock has grown by over 24%.

In terms of the company’s financials, Pfizer surpassed the expectations of market analysts in the first quarter of 2022.

To help you decide whether to buy Pfizer stock, see some considerations below:

- Pfizer =estimates profits per share of $6.25 to $6.45 this year. This is down from $6.35 to $6.55 per share previously indicated

- On the other hand, Pfizer reported a first-quarter profit that was above expectations. This was thanks to high sales of its oral antiviral medicine and COVID vaccination

- In the first quarter of 2022, Pfizer sold $1.5 billion of Paxlovid and $13.2 billion of COVID vaccination and Comirnaty

In 2021, Pfizer officially became the biggest pharma company in the world thanks to the $36.9 billion worth of sales of Comirnaty throughout the year. Pfizer believes that COVID-19 sales will continue to drive growth as late as 2030.

Taking all of this into account, the general consensus on Pfizer is that this is a solid dividend-paying firm that can be a defensive stock to add to your portfolio.

Conclusion

Pfizer has been operating since the 1800s and is the biggest pharmaceutical company globally.

The company was one of the first to develop and manufacture a COVID-19 vaccine, not to mention gain emergency use authorization from the FDA. Crucially, Pfizer exceeded many market analysts’ expectations in its latest earnings report.