Roblox Corporation is a US video game developer founded in 2004. It is famous for developing the game Roblox, released in 2006. Since then, it has grown in size, employing over 1,600 people, and turning over revenues of almost $2bn in 2021. It first floated its shares on the market in March 2021 for $45 per share. Post-IPO, the shares jumped to over the $70 mark, rewarding early investors. Although the Roblox share price has fallen in 2022, could now still be the time to buy in?

In this guide we review whether you should buy Roblox stocks – i.e. is Roblox stock a buy in 2022? We also cover where to buy Roblox stock with low fees, Roblox’s price history, and popular regulated broker to invest in Roblox stock with. We then take you through a step-by-step guide on how to buy Roblox stock.

How to Buy Roblox Stock – Guide

Before we start, we are going to take a look at how you can buy Roblox stock. We will cover this in more depth later on in the article so don’t worry if this part seems too vague.

Step 1: Open an account with a Regulated Broker – Sign up using the form on the homepage. You will need to enter some basic personal details here.

Step 2: Upload ID – In order to add funds to your account, you need to verify it. This is done by providing some valid forms of government ID to validate your identity.

Step 3: Deposit – Now you have verified your account you can add funds. Funds can be added using a variety of payment methods including bank transfers, credit/debit cards, and e-wallets like PayPal and Skrill.

Step 4: Buy Roblox Stock – Search for Roblox stock and click on the ‘Trade’ button. Fill out the order form to add the position to your portfolio.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Where to Buy Roblox Stock – Most Popular Platforms

In order to buy Roblox stock, you need to set up an account with a broker. These will act as a middleman between you and the exchange. There are thousands of brokers out there, each boasting unique features. Therefore, it can be pretty daunting trying to pick the right one for you. To save you the hassle of researching yourself, we have selected our two brokers and reviewed them below:

1. eToro – Overall Most Popular Platform to Buy Roblox Stocks

In our opinion, the most popular place to invest in Roblox is eToro. It has been built to give traders a convenient experience, which makes it ideal for beginners.

Also, it is available on both iOS and Android, meaning that accounts are widely accessible. You can set up an account by visiting the website and following the on-screen instructions.

A benefit to eToro is that users can paper trade with a virtual portfolio of up to $100,000. This can be for trying out new trading strategies or informing beginners on how to correctly trade – all with zero risk. Once users feel confident, they can start trading with as little as $10 on eToro.

The platform itself gives users access to over 2000 financial assets, 60+ of which are cryptocurrencies. This makes the platform a choice for building heavily diversified portfolios. eToro operates in over 140 different countries and has a whopping 30 million users, highlighting its popularity.

One of the reasons we like eToro so much is because of its unique trading tools. Copy-trading and social trading really enhance the user experience. Copy trading is a tool that allows users to directly copy prebuilt portfolios from other users. These can be filtered for risk, return, and asset allocation as desired.

In order to use the copy trade function, users will have to deposit a minimum of $200. Social investing is a tool that connects investors and allows them to share posts on a community board. These posts often include tips, stock news, and recommendations, which can be for keeping up to date with the market. eToro also has a fractional stock function. This means that users can buy portions of shares (i.e., 1.5 shares) based on the funds they have available to them. This is for more flexible investing.

In terms of fees charged to users, eToro is a low cost option. It charges zero commission on all non-leveraged trades, and only 1% commission on crypto trades. Instead, eToro makes its money from charging a fixed spread on all trades. There is also a $5 withdrawal fee and a $10 inactivity fee if users leave their accounts untouched for over 12 months.

Finally, looking at security, eToro is one of the most popular options out there. In the UK it’s regulated by the FCA, meaning up to £85,000 of funds are insured. In the US, it’s insured through the FDIC which offers insurance of up to $250,000. There are also numerous blockchain protocols built into the crypto wallets to protect against fraudulent activity.

| Number of stocks | 2000+ |

| Pricing system | Zero commission – eToro charges a fixed spread to make its money. |

| Cost of buying Roblox | £0 |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull – Stocks with Zero Commission

Our second-most popular place to buy Roblox stock is Webull. It was founded in 2017 and has since grown to accommodate millions of users. With such a simple and easy setup, it is an option for beginner investors. Like eToro it is also available on both IOS and Android.

The platform is commission-free for all stocks and ETFs, which is a point to consider. More experienced investors can also enjoy the option of trading futures contracts and ADRs. There are a whopping 2085 financial assets currently available on Webull, including 11 cryptos.

The site seems to be geared towards slightly more experienced traders with features like integrated charting tools, technical indicators, advanced orders, and much more. All of these features are bundled into the platform. There are a very small number of educational videos, and also no access to mutual funds. These are both pretty basic features that exchanges usually have, so Webull is a little disappointing in this respect.

There are very high levels of security protecting all Webull accounts, which is a point to note. Two-factor authentication comes with all accounts and finger and face biometric recognition can be used to access accounts on supported phones. This high level of security has allowed Webull to not have a data breach for the last 4 years straight. Webull offers the same level of FCA and FDIC insurance, but also has its own private insurance, which protects up to $37.5m per individual account. This really sets it aside from a lot of other brokers.

It’s easy to set up an account by visiting the Webull website and following the on-screen instructions. When you set up an account with Webull, you get given 5 free shares, which can be for getting your portfolio up and running. If you encounter any problems whilst setting up your account, you can get in touch with Webull’s dedicated customer service team which is open 24/7. There is also a chatbot online which is also available at all times to solve any queries you may have.

| Number of stocks | 2,085 |

| Pricing System | Zero commission |

| Cost of Buying Roblox | £0 |

Your capital is at risk.

Should You Buy Roblox Stocks – Analysis

Before you purchase any stock, it is important to do the necessary research. It’s important to understand the stocks business plans, its company fundamentals, and the broader industry. You can also look at technical indicators for the stock, alongside financial metrics, which can help you to identify if the stock is under or overvalued compared to its competition. All of this information combined should help you decide whether you rate the stock a buy or sell opportunity.

What is Roblox?

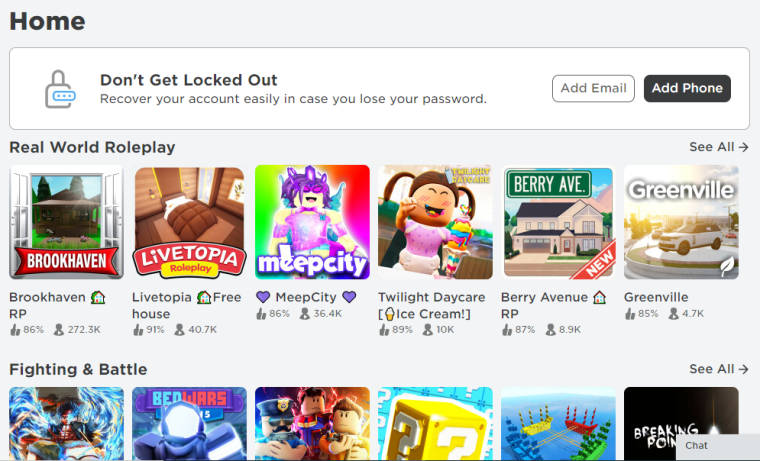

As mentioned, Roblox Corporation is a multinational game developer. Roblox itself is a game platform and game creation system created in 2006 by Roblox Corp. For most of its history, the Roblox game was pretty small, however, it started to take off during the second half of 2010, gaining millions of users rapidly. It became available to play on IOS in December 2012, then on Android in July 2014, before finally spanning out to Xbox in November 2015. Therefore, it is a widely accessible game and today it boasts over 22 million daily players.

The Covid-19 pandemic actually benefited Roblox massively. Due to it being a software-oriented business, it has little capital expenditure and little physical property. This meant that it was relatively unaffected by the pandemic’s hardship. In addition to this, with global lockdowns enforced, users began to spend more time online and hence the amount of Roblox accounts climbed dramatically. This helped the stock launch a successful IPO.

The company has also been noted for its online activism. Roblox’s co-founder Baszucki has used the platform to declare support for numerous anti-racism movements and climate change movements. Roblox also takes its customer experience very seriously, closely monitoring and banning any offensive content or accounts linked to extremist groups. There are currently 1,600 people working for Roblox to help monitor this problem and censor such content from other users. This helps the community stay strong and safe.

Roblox Stock Price – How Much is Roblox Stock Worth?

Roblox is currently a loss-making company, clocking in a $503,000 loss in 2021. Therefore, it doesn’t have any price-to-earnings ratios. It also has a net loss per share of $0.97 at the end of FY2021. However, Roblox does have a forward P/E ratio of 71, which is extremely high. For context, value stocks tend to operate with P/E values of under 10.

Looking at other financial metrics, the stock has a price to book (P/B) ratio of 31, which is very high. P/B ratios compare the firm’s market cap by its book value, which is equivalent to the assets it carries on its balance sheet. Comparing this with a close competitor, Unity Technologies, which operates on a P/B ratio of 8.2, Roblox does look expensive. However, Roblox operates with a much lower price to sales ratio (P/S) of 8, which is half of Unity Technologies P/S ratio. P/S ratios are calculated by taking the company’s market cap and dividing it by the total sales over the last 12 months.

These numbers are interesting; however, they don’t take into account some of the other tangible factors that Roblox has. It currently has negative 25% profit margins and over 1.2bn of debt on its balance sheet. With a debt to equity ratio of 1.75, the firm is burning through its cashflows which could halt it from paying back its debts. This doesn’t bode well in the current rising interest rate environment.

Whilst these numbers are pretty high, the tech industry tends to command higher multiples than other more traditional industries because there is less tangible information to work with. Considering both of these metrics it seems that Roblox stock may be fair value priced at $27.

Roblox Stock Price Prediction

It is very hard to predict the price of tech-based stocks, due to there being little tangible information available to analyze them. However, looking at the results presented above (which we will dive into further in the next section), it seems hard to give a bullish estimate on the stock.

Looking at city analysts’ price predictions, however, there does seem like there could be some upside for the stock. Deutsche bank currently rates the stock a buy, targeting a price of $60. Citigroup is also bullish on the stock, giving it a $59 price target. Big investment banks like this being bullish on the stock is a sign. However, other banks meet these bulls with skepticism. Morgan Stanley recently reduced its price target from $65 to $32, which is around 3% below the current Roblox share price. Other banks such as Jeffries rate the stock a hold, targeting a $50 target. Whilst analyst calls are not full proof, they do give interesting insight through expert knowledge to help make investment decisions.

One factor that could play to Roblox’s strength is the increased usage the platform has due to the pandemic. Before the pandemic, Roblox had between 15-20m daily users. In the most recent results, the firm highlighted that this number had skyrocketed to over 55m since the pandemic. With the Metaverse, blockchain technology, and Web 3 infrastructure all growing at an astonishing rate, Roblox could continue to grow in users and also utility if it is able to harness some of these initiatives. This could push the Roblox share price higher in the future.

Roblox Stock Dividends

Roblox only went public in 2021, so has only been trading on the stock exchange for a brief time. During this time, it has not paid any dividends as its currently loss-making. The most recent results don’t seem to indicate a quick change in profitability any time soon. Therefore, it is likely that Roblox will continue to not pay a dividend for the foreseeable future.

Is Roblox Stock a Buy?

We have taken a look at some of the factors which could push the Roblox share price up in the future. We are now going to compliment this by looking at some factors which could help determine whether Roblox stock is a buy or sell opportunity.

Technical Analysis

Looking at the technical analysis for Roblox, there are a few interesting trends. Firstly, there seem to be strong support and resistance lines, with multiple key inflection points. These are highlighted by the blue rectangles on the graph below. More recently, Roblox seems to be having trouble each time it hits the resistance line, shown by the three circled points at the end of the graph. If Roblox were to break this trend, then it could shoot up as a consequence. However, if it keeps finding resistance, it could struggle to push higher. Whilst this technical analysis method is not full proof, it does allow us some very interesting insight into the stock’s movements, which can be used to predict future growth.

Metaverse

As briefly mentioned, with Web 3 and the Metaverse growing rapidly, Roblox could find itself in favor. After its IPO, it was hailed as the first-ever metaverse IPO. Roblox itself is an in-game currency called Robux. Whilst this isn’t crypto or floated on any other exchange, it still acts as a payment method, hence reinforcing the idea of Roblox being a metaverse in itself. As Metaverse technology grows, we expect Roblox to continue to implement and work alongside it. This could help maintain its colossal popularity amongst users, and even draw in new users.

Results

The most recent set of Roblox results was issued on 15 February 2022. The firm reported that for FY2021, revenue grew by over 108% year on year reaching $1.9bn, which is an encouraging sum. Average daily users also increased, just shy of the 50m, and up 33% year on year. Hours engaged also rose by 35% year on year, reaching 41.5bn. Overall, these metrics should fill investors with confidence. Although the firm is not making any profits yet, it is doing a job at moving in the right direction.

Inflation

As mentioned, inflation is soaring across the world. In the US it is at 8.5% and in the UK it’s 7% – the highest figure it has been in 30 years. The way that central banks remedy this is by raising interest rates. Just this week, the UK and US central banks raised their rates to 1% and 0.75% respectively. This could hurt Roblox in two ways: Firstly the $3bn debt on its balance sheet has just become a lot more expensive as repayments will now increase. Secondly, people tend to turn away from risky investments during high-rate times. This is because they can earn a higher return on their savings or with safer assets like bonds. This has already taken a toll on the Roblox share price, which tumbled over 20% off the back of the rate hike news.

How to Buy Roblox Stocks – Tutorial

By this point, you may have decided you want to add Roblox stock to your portfolio. We are now going to take you through a step-by-step guide on how to set up an account and add Roblox stock to your portfolio.

Step 1: Set up an Account

The first step is to visit a regulated broker’s website and create a free account. From here you can follow the onscreen instructions to get your account up and running. You will have to enter some basic personal details at this stage.

Step 2: Verify your Account

Now you have set up an account, you must verify it in order to add funds. To do this, you need to provide h two forms of government ID. These are proof of identity (driving license or passport) and proof of address (utility bill or bank statement).

Step 3: Add Funds

Now you have successfully verified your account, you can deposit funds to it. Navigate to the ‘Add funds’ button on the left drop down menu and click on it to open a deposit page. Funds can be added using a variety of payment methods including bank transfer, debit/credit card, and e-wallets such as PayPal and Skrill.

Step 4: Buy Roblox Stock

Now you have a funded account, you can open a Roblox position in your portfolio. To do this, simply navigate to the search bar and type in Roblox. You can then select it from the drop-down list and click on the blue ‘Trade’ button. From here, fill out an order form and your Roblox position will be added to your account.

Roblox Stock Buy or Sell?

We have covered a great deal of information regarding Roblox stock. As we are reaching the end of our article, we must answer the all-important question: Is Roblox stock a buy or a sell?

Its most recent results were excellent, to say the least. With revenues, margins, and users all increasing, the future outlook for the company does look great. The next set of Roblox results is set to release in 5 months’ time (November 2022). If the company can deliver another set of results, then the stock could be in for a bullish ride.

The metaverse and growing Web 3/decentralised architecture is also a positive for Roblox. Roblox in itself is a metaverse and one which already has a well-established, loyal customer base. If it can harness the power of Web 3, perhaps integrating smart contracts and NFTs into the gameplay, it could become a frontrunner in the field.

Finally, there are some bullish investment bank analyst calls regarding the stock. It is always positive when some of the world’s largest institutions post bullish outlooks and price targets for your stocks. Whilst these calls are not guaranteed, they are based on highly technical, experienced analysis from the world’s most powerful institutions. Therefore, it could signal Roblox could be a buy.

While there are a number of positives for the firm, there are also some negatives that must be taken into consideration. Firstly, the technical analysis of the Roblox chart doesn’t look great. There are strong resistance and support lines that Roblox stock seems to be bouncing off of, which is creating a downward funnel. If it can break this cycle, then it could rise significantly, however, this will likely be tough to do, especially given some of the other risks the stock faces.

In addition to this, the macro economy seems to be pitted against Roblox. Inflation is soaring across the world, as a consequence, central banks are raising their interest rates. In the UK the rate has been hiked to 1% and in the US it was hiked by 0.5% – the biggest jump in 22 years – to 0.75%. As mentioned, the Nasdaq crumbled 5% off of the back of this news, and Roblox stock tumbled over 20%. The current macro-outlook signifies that interest rates could continue to rise in the future. If this is the case, it could place a lid on the growth of Roblox stock.

Buy or Sell Roblox – The Verdict

Many analysts are bullish on Roblox stock, as we saw above in the analyst calls section.

Conclusion

Throughout this article, we have taken a closer look at Roblox stock. After being founded in 2006, the platform has gained huge popularity, amassing a whopping 50 million daily users. It has issued some results and has serious metaverse capabilities. However, at current, it seems that rising inflation is likely to hold back this stock.