Spotify is one of the world’s best-known brands within the music industry, offering a platform that makes audio streaming simple for millions of people worldwide. After revolutionizing how people listen to music, Spotify has recently expanded into the podcasting niche, aiming to capitalize on changing consumer behaviour.

This guide discusses how to buy Spotify stock in detail, highlighting which platforms offer the lowest fees before providing a step-by-step showing how to invest in Spotify from a laptop, tablet, or smartphone.

How to Buy Spotify Stock – Guide

Investors looking to buy stocks must create an account with a licensed broker or exchange. With that in mind, the four steps below highlight the investment process.

- Step 1 – Open an account with Regulated Broker: Head over to their website, click ‘Start Investing’, provide a valid email address, and then choose a username and a password.

- Step 2 – Upload ID: New users must verify their accounts by completing some KYC checks and uploading proof of ID (e.g. passport) and proof of address (e.g. bank statement).

- Step 3 – Deposit: US-based traders can deposit via credit/debit card, bank transfer, or e-wallet.

- Step 4 – Buy Spotify Stock: Search for ‘Spotify’ using the search function. In the order box that appears, provide the appropriate position size, check everything is correct, and click ‘Open Trade’.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

Traders wondering how to invest in Spotify stock must first choose a stock broker to partner with that can facilitate trades cost-effectively. Many of the most popular trading platforms offer these characteristics, which can mean that the decision-making process isn’t straightforward.

To help smooth this process, we’ve completed all the necessary research and testing, narrowing down the selection to our two brokers for investors looking to buy Spotify stock – both of which are reviewed below.

1. eToro – Overall Most Popular Place to Buy Spotify Stock in 2023

Much of this growth has been fuelled by eToro’s cost-effective fee structure, which allows all users to invest in stocks (and other assets) with zero commissions. The only trading fee that users must be aware of is the bid-ask spread, which tends to be relatively tight for traded stocks like Spotify. Furthermore, due to eToro’s handy ‘fractional investing’ feature, users do not need to purchase a full share – instead being able to buy ‘fractions’ of a share.

eToro also offers one of the most popular stock apps on the market, allowing users to buy SPOT stock whilst on the go. The app is available on iOS and Android and features real-time price charts, in-depth price alerts, and a variety of technical indicators to boost analysis. Users can also trade via eToro’s web-based platform, which has a dedicated newsfeed and social trading features.

Regarding deposits, eToro accepts funding via credit/debit card, bank transfer, or e-wallet (PayPal, Skrill, Neteller). The minimum deposit is only $10, with no deposit fees when funding in USD. There are also no monthly account fees, and withdrawals cost only $5 to make.

| Approximate Number of Stocks | 2,500 |

| Pricing Structure | 0% commissions (just the spread) |

| Cost to Buy Spotify Stock | Market spread |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull – Popular Place to Buy Spotify Stock with SEC Regulation

Like eToro, Webull charges no commissions when users place a stock trade. There are also no non-trading fees to be aware of (e.g. account fees, inactivity fees), making this platform extremely cost-effective to trade with. Aside from Spotify, Webull also has thousands of alternative stocks to invest in – including some of the most popular penny stocks.

There is no minimum deposit threshold with Webull, and the platform offers fractional investing, meaning that positions can be opened from as little as $5. In terms of account funding, users looking to buy SPOT stock can make deposits in USD via ACH transfer and wire transfer – although the latter will cost $8 when made domestically. Users who wish to acquire their profits can withdraw at any time – with no fees attached.

Webull’s trading experience is also exceptional, with the web-trader platform offering customizable widgets, watchlists, numerous order types, and price alerts. The mobile app also has many of these features, all secured via a two-step login. Finally, Webull also offers a host of research and analysis features – including a handy ‘Trading Ideas’ section that shows the prevailing analyst opinion on a particular stock.

| Approximate Number of Stocks | 3,000+ |

| Pricing Structure | 0% commissions (just the spread) |

| Cost to Buy Spotify Stock | Market spread |

Your capital is at risk.

Step 2: Research Spotify Stock

Spotify has long been considered one of the most popular tech stocks on the market due to its sheer market share within the audio streaming sector. The company has also recently expanded into podcasts and audiobooks, looking to bolster its appeal to new demographics. However, like all growth stocks, SPOT shares have been hampered by adverse macroeconomic conditions.

To help provide more insight for investors looking to buy Spotify stock, this section will cover the following:

- What is Spotify, and what does it do?

- Overview of the Spotify stock price over the past few years

- Our Spotify stock forecast for the weeks and months ahead

- Whether Spotify pays a dividend or not

- Reasons why Spotify could be considered an investment opportunity

What is Spotify?

Spotify only began taking off in 2010, when it received critical acclaim within the UK that ultimately forced the company to stop taking on new users due to how fast the platform was growing. Spotify’s service was launched in the US the following year, which followed a similar trend to the UK’s launch. The company’s ‘Freemium’ service was warmly received by consumers, as it offered an option for those who wished to listen for free and also those who wanted to listen without ads.

In terms of Spotify’s library, the platform offers over 82 million songs and an abundance of podcasts, which have been the company’s main focus over the past year. Spotify pays artists through ‘royalties’, based on how many streams an artist’s song gets relative to the total number of songs streamed on the platform. Although many artists have criticized this approach, the company does give around 70% of its revenue back to musicians, according to an article in the LA Times.

Spotify went public through a direct listing on the NYSE in April 2019, opening at $165.90 per share. The Spotify stock symbol is ‘SPOT’, which has made the company easy to recognize from an investment perspective. At the time of writing, Spotify’s market cap is $22.35bn, according to Yahoo Finance.

Spotify Stock Price – How Much is Spotify Stock Worth?

Before diving into our Spotify stock forecast, let’s analyze the stock’s current valuation, given the prevailing macroeconomic trends. Whether Spotify can be considered one of the most undervalued stocks is still up for debate due to the company’s lack of profitability and bearish price trend. However, let’s explore Spotify’s price history and financials to gain further insight:

Spotify Stock Price History

As mentioned above, Spotify went public via a direct listing in April 2018, meaning no new shares were created. Instead, existing shareholders could sell their shares on the NYSE – thus creating demand for the company’s equity. Although the pre-sale price was quoted at $132 per share, Spotify debuted around 25% higher than this price point.

Spotify rose during its first few days of trading before losing around 47% of its value in the following months. Between December 2018 and March 2020, the Spotify stock price traded in a narrow range between $100 and $160 – although this all changed in March 2020. This was around the same period that COVID-19 lockdowns were occurring worldwide, meaning that people were stuck indoors – therefore using streaming services more.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Between 16th March 2020 and 19th February 2021, SPOT shares soared a remarkable 253%. According to MacroTrends, this culminated in an all-time high of $364.59 being reached on the latter date – with the company hitting a market cap of over $69 billion. However, this high was short-lived, and there has been a dramatic Spotify stock drop ever since.

At the time of writing, the Spotify stock price today is $116 – 70% below all-time highs. Numerous explanations have been put forward to explain the Spotify stock drop, including the removal of COVID-19 restrictions, poor company investments, and rising inflation. However, there doesn’t appear to be one single cause; instead, an amalgamation of all of the above.

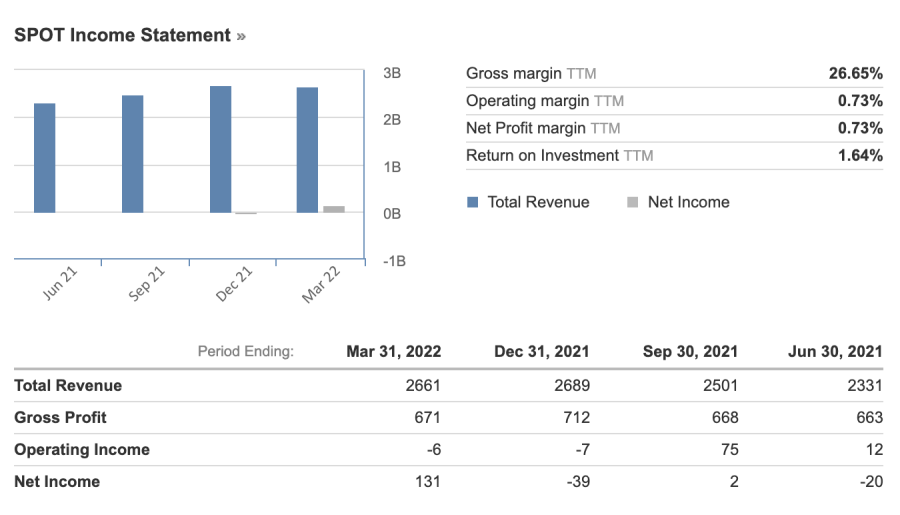

Spotify Financials

Given the Spotify stock price today and its downward trajectory, investors would be forgiven for thinking that the company was in dire straits financially – but this isn’t the case. Spotify has produced over $2.5 billion in revenue during each of the past six quarters and even topped $3 billion during Q4 2021. However, the company’s profitability has become a concern for investors.

Spotify has made a loss every year since going public in 2018 – with the latest net loss being $40 million for the calendar year 2021. It goes without saying that investors would be expecting a company as established as Spotify to be nearing profitability, yet this prospect still seems far away. However, the company is still growing gross profits every year and recently made over $3 billion in 2021.

To gain further clarification on Spotify’s financials, let’s take a closer look at some key metrics:

- Earnings per share (EPS) – EPS is a company’s net profit divided by the number of shares it has outstanding. This metric is often used to showcase a company’s profitability – the higher the EPS figure, the more profit it makes. In Spotify’s case, the company’s annual EPS is currently negative due to the net loss. However, Spotify did turn a small profit during Q1 2022 – meaning its quarterly EPS sits at $0.24.

- Price-to-Earnings Ratio (P/E ratio) – A natural progression from a company’s EPS is its P/E ratio, which is the ratio of its current share price relative to EPS. Although the P/E ratio doesn’t say much about a company when used on its own, it can be compared to other P/E ratios of companies within the same industry. Naturally, Spotify’s P/E ratio over the trailing twelve months (TTM) is 0.00 due to the lack of a net profit.

- Forward P/E Ratio – In Spotify’s case, use the forward P/E ratio due to the company not being profitable. This uses estimated earnings rather than actual earnings to forecast profitability. Unfortunately, according to Yahoo Finance, Spotify’s forward P/E ratio is still 0.00, as analysts do not believe the company will make an annual profit in 2022.

Spotify Stock Dividends

Investors looking to buy Spotify stock may also be curious about the potential for passive income through regular dividend payments. Unfortunately, Spotify cannot be classed as one of the most popular dividend stocks since the company has never provided dividend payments – and this likely won’t change in the near future.

The reason that Spotify does not pay a dividend is that the company is currently unprofitable. Furthermore, it’s relatively common for tech companies and growth stocks to reinvest any accrued profits into the business, allowing for expansion. Thus, passive income investors may wish to look elsewhere or bolster their portfolio with other stocks that pay dividends.

Is Spotify Stock a Buy?

Now that we have covered what Spotify does and its financials, let’s discuss some of the main reasons why some analysts consider Spotify shares to be a buy:

Heading Towards Profitability

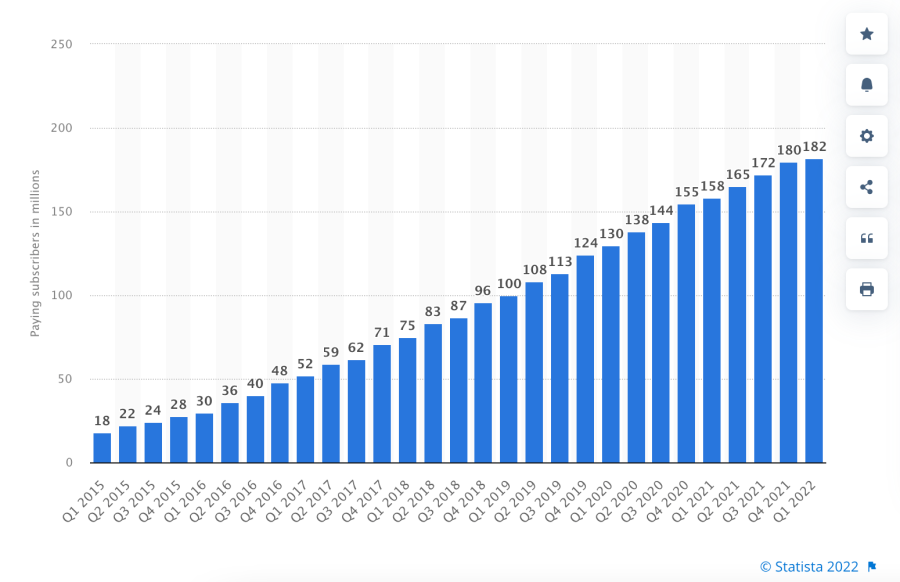

Spotify’s management team have set a lofty goal of hitting 1 billion monthly active users whilst growing annual revenue by more than 20%. This would undoubtedly enable Spotify to become consistently profitable, given that the company is expanding its ad revenue every quarter and still benefits from passive income streams through its premium subscription service.

Over 40% of Spotify’s users have a premium subscription, meaning that as the platform expands, so should recurring revenue. This may become even more relevant now that Spotify has expanded into podcasts, as the premium subscription allows users to listen ad-free. If this growth trend continues, there’s no doubt Spotify could become one of the most popular cheap stocks on the market.

Expansion into Podcasting

One of the main reasons that many investors are bullish on Spotify is the company’s recent expansion into podcasting. For years, the go-to podcast player for listeners worldwide was the built-in Apple Podcasts app on iPhones, iPads, MacBooks, and iMacs. However, Spotify’s aggressive expansion within this area has enabled the company to improve its market share and add a new revenue stream.

The Spotify Audience Network (SPAN) is mutually beneficial for the company and podcasters, making revenue generation easy through paid ads. Not only will this bring in names within the podcasting space (e.g. Joe Rogan), but it will also bring in more active users. This approach has already paid dividends, with Spotify’s ad revenue growing by over 30% during Q1 2022.

New and Exciting Services

Finally, Spotify isn’t happy with just music and podcasts – the company’s management wishes to expand into ‘new’ forms of audio. One of the prominent rumours circulating is that Spotify will soon begin offering audiobooks, which seems to be confirmed now that the company has acquired the distribution platform, Findaway.

Aside from audiobooks, Spotify has become a popular platform for hosts who wish to offer live podcasts. This service, called ‘Spotify Live’, allows hosts to live stream conversations and adds another reason for people to download the Spotify app.

Step 3: Open an Account & Buy Stock

Before we round off by discussing the question “Is Spotify stock a buy or sell?”, let’s turn our attention to the investment process. To invest in stocks safely, partner with a licensed and regulated platform within the US – as these platforms offer the highest level of investor protection.

1. Create an Account

Visit the website of a regulated broker, which will then ask for a valid email address, username, and password – which will be used as login details going forward.

2. Verify Account

New users must verify themselves before trading. To do so, click ‘Complete Profile’ and fill in KYC checks. Following this, upload proof of ID (e.g. passport) and proof of address (e.g. utility bill) for verification purposes.

3. Make a Deposit

Once eToro has emailed saying that verification is complete, users can now make a deposit.

4. Search for Spotify Stock

Click into the search bar and type in the Spotify stock symbol (SPOT). When Spotify appears in the drop-down menu, click ‘Trade’.

5. Buy Spotify Stock

An order box will then appear, much like the one below. Investors must enter their position size in this box and decide whether to employ a stop-loss or take-profit level. Once everything is correct, click ‘Open Trade’ to complete the Spotify investment.

Spotify Stock Buy or Sell?

Putting everything together, is Spotify stock a buy or sell? It’s challenging to say, given that equity analysts are still butting heads over whether to be bullish or bearish on SPOT stock. As with most growth stocks, sentiment is relatively negative right now due to the adverse macroeconomic conditions.

Spotify’s management team has set high goals of reaching 1 billion monthly active users and achieving more than 30% gross margins. At present, these do seem difficult to achieve, especially given the record-high inflation rates. Furthermore, the so-called ‘cost of living’ crisis continues to rage on, ultimately affecting subscription services like Spotify.

However, scratching below the surface will highlight that Spotify may be performing better than many people expect. Revenues increased by 24% in Q1 2022 compared to the same period in 2021, whilst diluted EPS turned positive for the first time. Monthly active users also grew, which is essential for subscription-based apps.

Spotify’s price-to-sales ratio, which compares its share price to current revenues, is only 1.92. Furthermore, CNET recently reported that co-founder Daniel EK purchased $50 million of SPOT stock.

Overall, there’s no doubt that Spotify’s shares have been through a challenging period lately. However, given the company’s improving financials and exciting platform upgrades, there is scope for a rebound. Although it’s difficult to provide a Spotify stock forecast 2025, there’s certainly an argument that the price could turn bullish in the weeks and months ahead.

How to Buy Spotify Stock – Conclusion

To summarize, this guide has discussed how to invest in Spotify stock in great detail, reviewing some of the most popular brokers to choose from and presenting a step-by-step walkthrough of the investment process. Although Spotify has gone through a turbulent period recently, it remains a vital part of many investors’ portfolios – and could bounce back in the months and years ahead.