Using a credit card is one of the popular ways to buy stocks onlne. This is because your deposit will be processed instantly and you can conveniently buy your chosen stocks without delay.

In this guide, we explain how to buy stocks with a credit card instantly without paying any transaction fees or trading commissions.

How to Buy Stocks with Credit Card

If you’re looking to buy stocks with a credit card right – you can complete the process in four simple steps.

- ✅ Step 1: Open a Trading Account

Head over to a suitable brokerage of your choice and start the registration process. Enter your persona details and choose a username and password. - 💳 Step 2: Deposit Funds

Choose ‘Credit Card’ from the list of supported payment methods. - 🔎 Step 3: Search for Stock

In the search bar, you can type in the name of the stock that you wish to buy or its ticker. Then, click on the ‘Trade’ button. - 🛒 Step 4: Buy Stocks

Finally, you will be able to enter the amount you wish to enter into the trade and confirm your transaction.

Where to Buy Stocks With Credit Card

Although many brokers in the US allow you to buy stocks on a 0% commission basis, very few support credit card payments. Instead, you are often required to deposit funds via ACH or a domestic bank wire. The sections below review a popular stock brokers that supports credit cards as a payment option for buying stocks.

1. eToro

When it comes to low transaction fees and zero commissions, eToro is the industry leader. This broker enables you to deposit funds instantly with a credit card without paying any fees. It only takes a few minutes to register a verified account.

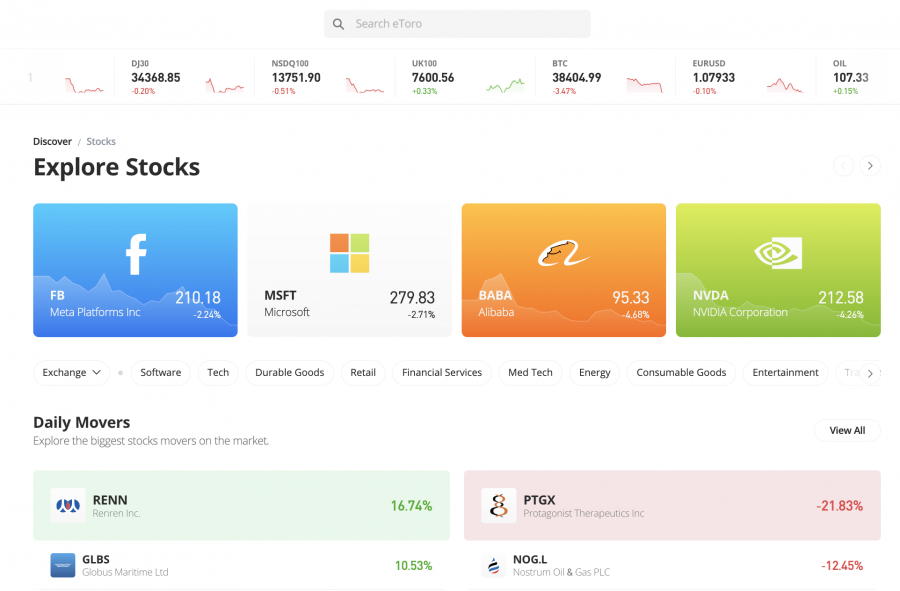

With eToro, users can purchase thousands of stocks without paying any trading commissions – which is inclusive of both US and internationally-listed equities. For example, with an eToro trading account you can buy the popular biotech stocks with low fees on this stock app.

The latter includes exchanges in the UK, France, Hong Kong, the Netherlands, Canada, and more. eToro also supports fractional shares – where the minimum stock investment is just $10. This means that you can buy expensive stocks like DocuSign, Adobe, Etsy, Nikola, XELA stock, Samsung, Matterport, NRG, Tesla or Alibaba, or you can buy oil stocks without needing to risk over a thousand dollars. As such you’ll have access to the popular cheap stocks and the popular meme stocks on the market, and you’ll be able to gain exposure to these equities without breaking the bank.

Once you have made a deposit with your credit card and bought a portfolio of stocks, you can access eToro’s social and copy trading tools. The former allows you to share trading insights with other investors in a social media setting. You can also copy the trades of your favorite eToro investors.

Another option that you have when it comes to passive investing is the eToro smart portfolio tool. This allows you to invest in pre-made portfolios that are managed by the eToro team. There are many strategies to choose from – and several smart portfolios focusing on growth areas like cannabis stocks.

All eToro features can be accessed online or via the provider’s native stock app for iOS and Android. The eToro platform is authorized to operate in the US and is regulated by several tier-one bodies. This means that you can deposit funds with your credit card in complete safety.

| Minimum Deposit | $10 |

| Fractional Shares? | Yes – $10 minimum |

| Pricing System | 0% commission on all stocks |

| Credit Card Deposit Fee | FREE for US clients |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Features of Buying Stocks With Credit Card

There are many features and factors for purchasing stocks with a credit card.

This includes:

Speedy Investments

Using credits as a payment method is typically faster than other options.

This means that you can then proceed to buy your chosen stocks without delay. In comparison, it can often take 1-3 working days for ACH and domestic bank wire deposits to be processed.

Checks are even slower – as you will often need to wait for at least 7 working days before the funds are deposited into your brokerage account.

Indirect Margin Account

Another reason why you might decide to buy stocks with a credit card is that you are effectively obtaining a margin account.

In other words, you will be investing in stocks on credit, which offers the opportunity to increase your exposure to the markets at a greater level than you currently have available in cash.

Secure

Credit cards are perhaps the safest payment method to use online – even more so than debit cards. This is because credit card providers in the US are mandated to offer certain safety nets to their customers.

For example, if somebody uses your credit card fraudulently, then the card issuer will refund the transaction in full. Moreover, when you use a credit card to invest in stocks at an online broker, the transaction will be encrypted.

In simple terms, this means that although you are typing your credit card details into the platform when making a deposit, the broker will not be able to see the information.

Fast Withdrawals

Stockbrokers that accept credit card deposits will also allow you to withdraw your funds back to the same payment method. You should find that after making the withdrawal request, the funds will appear back on your credit card within 1-3 working days.

Small Minimums

When using a credit card to buy stocks, you can often get started with a small amount of money.

How to Buy Stocks With Credit Card

If you’re ready to buy stocks with a credit card – the sections below will walk you through the process step-by-step.

Step 1: Open an eToro Stock Broker Account

The first part of the process is to register an account with a stock broker.

Users can head over to the website of their preferred brokers and enter their personal details. To confirm the account, create a username and password.

Step 2: Upload ID

Another part of the registration process that is required across all SEC brokers is the KYC procedure. All this requires is a copy of your passport/driver’s license and proof of address.

Step 3: Deposit Funds

The next step for users is to deposit funds into the account. Choose one of the available payment methods and then deposit money into the trading account.

Some of the available payment methods may include credit/debit card options, bank transfers or e-wallets like PayPal.

Step 4: Buy Stocks

The final step is to begin purchasing the stocks. Search for the stocks name on the platform’s search bar and click “enter”. For example, if you wanted to buy the best cybersecurity stocks in 2023 all you have to do is search for your preferred stock via the search bar. Users can create a new buy order position. Enter the amount you wish to enter into the position and confirm the transaction.

Conclusion

It’s possible to buy stocks with credit card instantly. After registering an account with a suitable broker, users can search for their preferred stocks and use credit options to make the payment.