Uber was behind one of the most anticipated IPOs in recent years when the stock become an NYSE-listed company in 2019. However, more than three years later, Uber is still trading below its original IPO price.

Nonetheless, those with the viewpoint that the ride-hailing firm represents a viable long-term investment will appreciate this beginner’s guide on how to buy Uber stock at 0% commission.

How to Buy Uber Stock With a Regulated Broker

To begin, this guide on how to buy Uber stock will explain the four steps required to invest in the company from the comfort of home via a regulated broker.

- ✅Step 1 – Open an Account With a Regulated Broker: First, the investor will need to select a stock broker to open an account with. Opt for a broker that not only supports NYSE-listed stocks, but low trading commissions. The brokerage account can be opened by entering some basic personal information.

- 🛂Step 2 – Upload ID: Most regulated brokers will require the investor to upload some ID for the purpose of complying with anti-money laundering laws. This can either be a passport, driver’s license, or state ID.

- 💳Step 3 – Deposit Funds: Once the brokerage account has been verified, the investor can make a deposit. Payment options will vary from one broker to the next and may include bank wires, ACH, debit/credit cards, and/or e-wallets. Some brokers have a minimum deposit policy, too.

- 🔎Step 4 – Research and Buy Uber Stock: Now that the account is funded, the investor can search for Uber and place an order. Many online brokers now support fractional ownership, meaning that the investor can buy a portion of an Uber stock.

Depending on the broker’s KYC process and accepted payment methods, the above process can take anywhere from five minutes to several days.

Nonetheless, further down in this guide, we offer a more detailed explanation of how to buy Uber stocks at 0% commission.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

To determine where to buy Uber stock, the investor must consider the many brokers that are active in this space. The best stock brokers offer low trading fees, small account minimums, and a simple interface.

To offer some insight into where to buy stock in Uber, readers might consider the popular brokers discussed below.

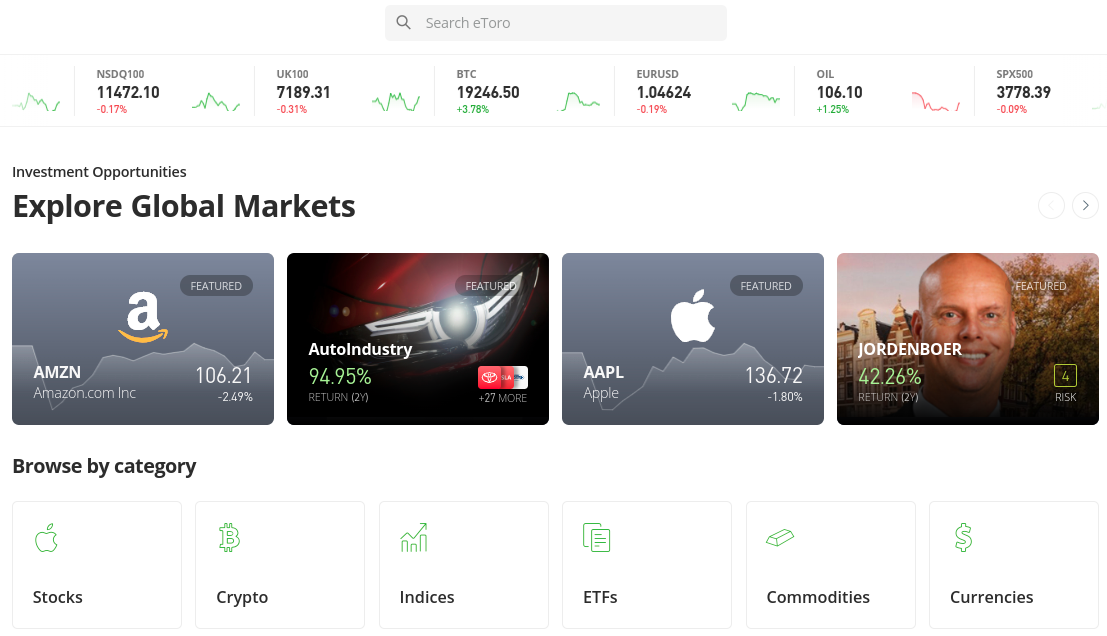

1. eToro

Furthermore, US clients are required to meet a minimum deposit of $10, and supported payment methods are inclusive of Visa, MasterCard, PayPal, ACH, and more. Once the account has been set up and funded, it is then possible to buy Uber stock without paying any trading commissions.

This means that the only direct trading fee is related to the spread. Through its fractional ownership model, eToro supports stock purchases from just $10. As is the case with Uber, when equities trade above this amount, the eToro user will be buying a portion of a stock. This is also the case with ETFs at eToro.

After buying Uber stock, the equities will appear in the investor’s eToro portfolio. This is where the investor can keep tabs on the value of their position through a handy Uber stock chart and profit/loss updates. Investors can also use eToro to perform technical analysis on Uber through chart drawing tools and economic indicators.

eToro also publishes relevant news and developments surrounding Uber stock. This enables investors to conduct adequate research on Uber before making an investment decision. In addition to Uber, eToro offers in the region of 2,500+ other stocks. Not only does this include NYSE and NASDAQ-listed stocks, but companies from more than a dozen international markets.

This covers stock exchanges in Europe and the UK, Asia, the Middle East, and more. We should also note that international stocks at eToro are also offered on a commission-free basis. Those looking to gain exposure to digital assets can invest in cryptocurrency at eToro from just $10, alongside a trading commission of 1%.

Traders can buy Bitcoin and 90+ other digital currencies online or via the eToro app. Another feature that is offered by eToro is its Smart Portfolios. These track a specific niche market from within the stock trading industry – such as Big Tech or oil and gas. The Smart Portfolio will be managed by the eToro team at no additional fee to the investor, and the minimum outlay is $500.

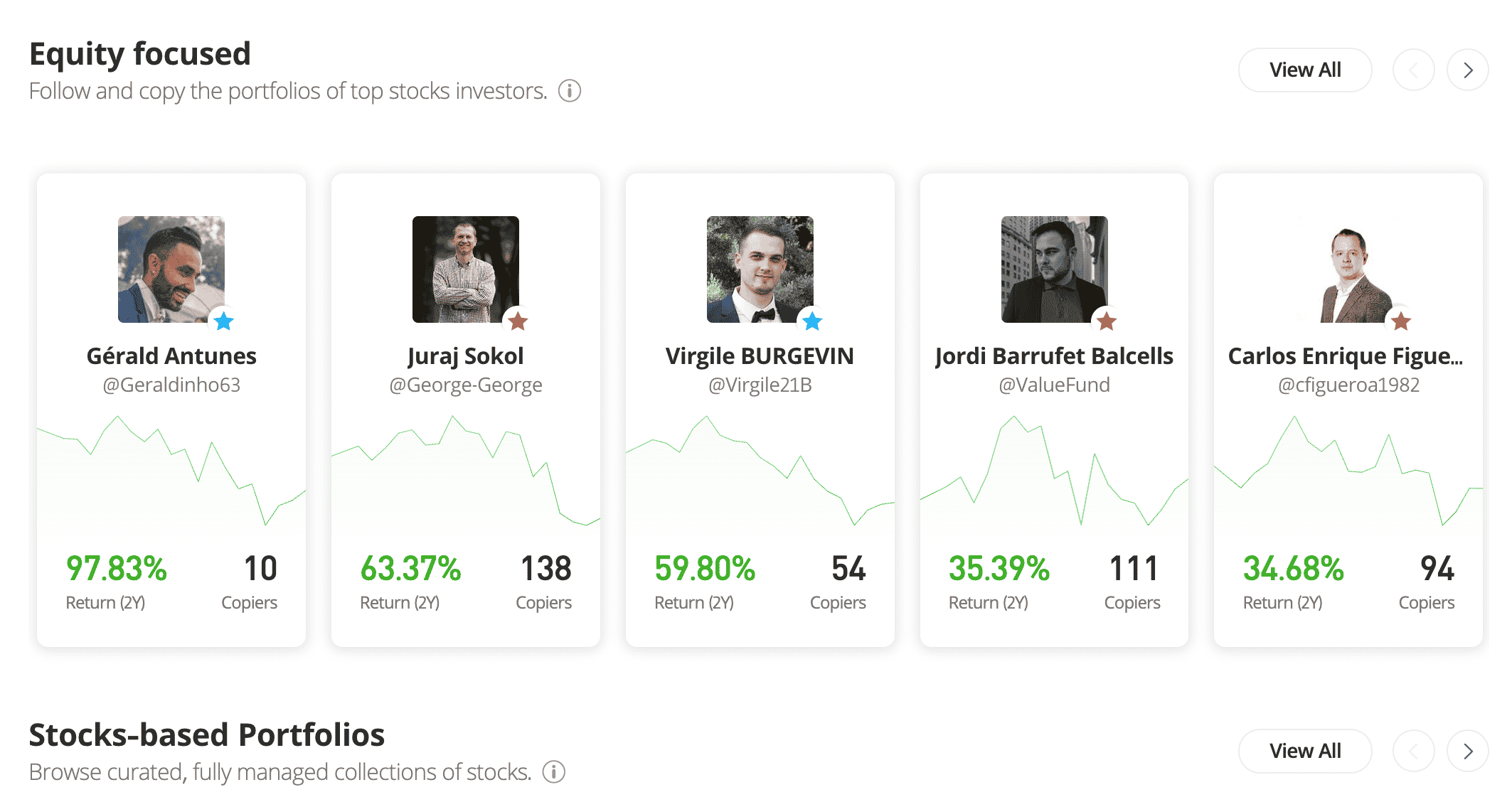

eToro also enables users to copy the positions of other investors that use the platform. The Copy Trading tool covers thousands of verified investors and the user can make a decision based on their risk score, preferred markets, average trade duration, and more. Copy Trading requires a minimum investment of $200 per trader.

As noted above, eToro offers a mobile app for both iOS and Android users. This will connect to the same eToro account and offers all of the same features and tools as found on the main website. eToro users also have the option of switching to ‘Virtual Portfolio’ mode. This enables investors to trade in a risk-free environment through the use of paper funds.

Read More: Check out our comprehensive eToro review here.

| Approx No. Stocks | 2,500+ |

| Min Deposit | $10 |

| Cost to Buy Uber Stock | 0% commission + spread |

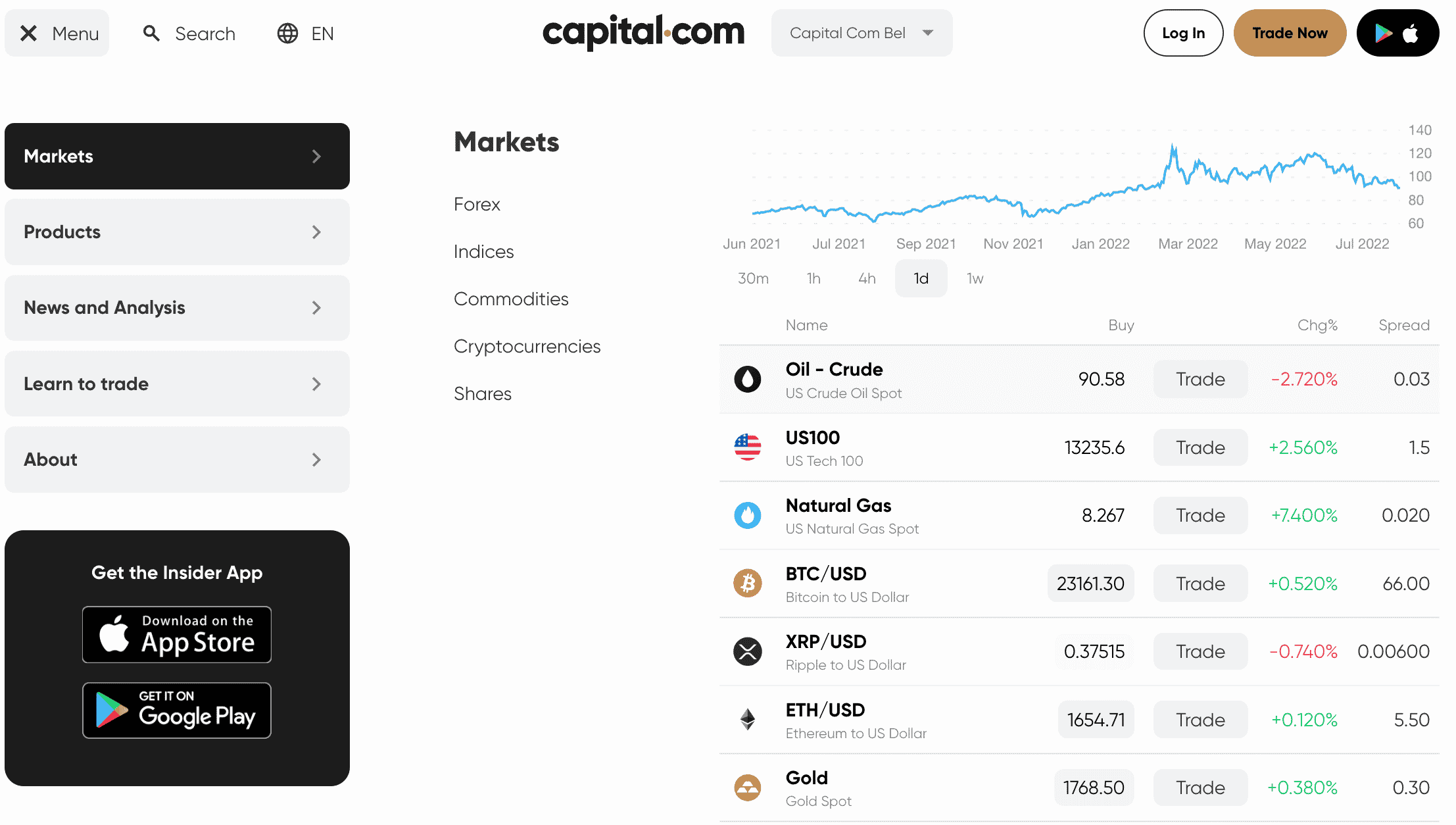

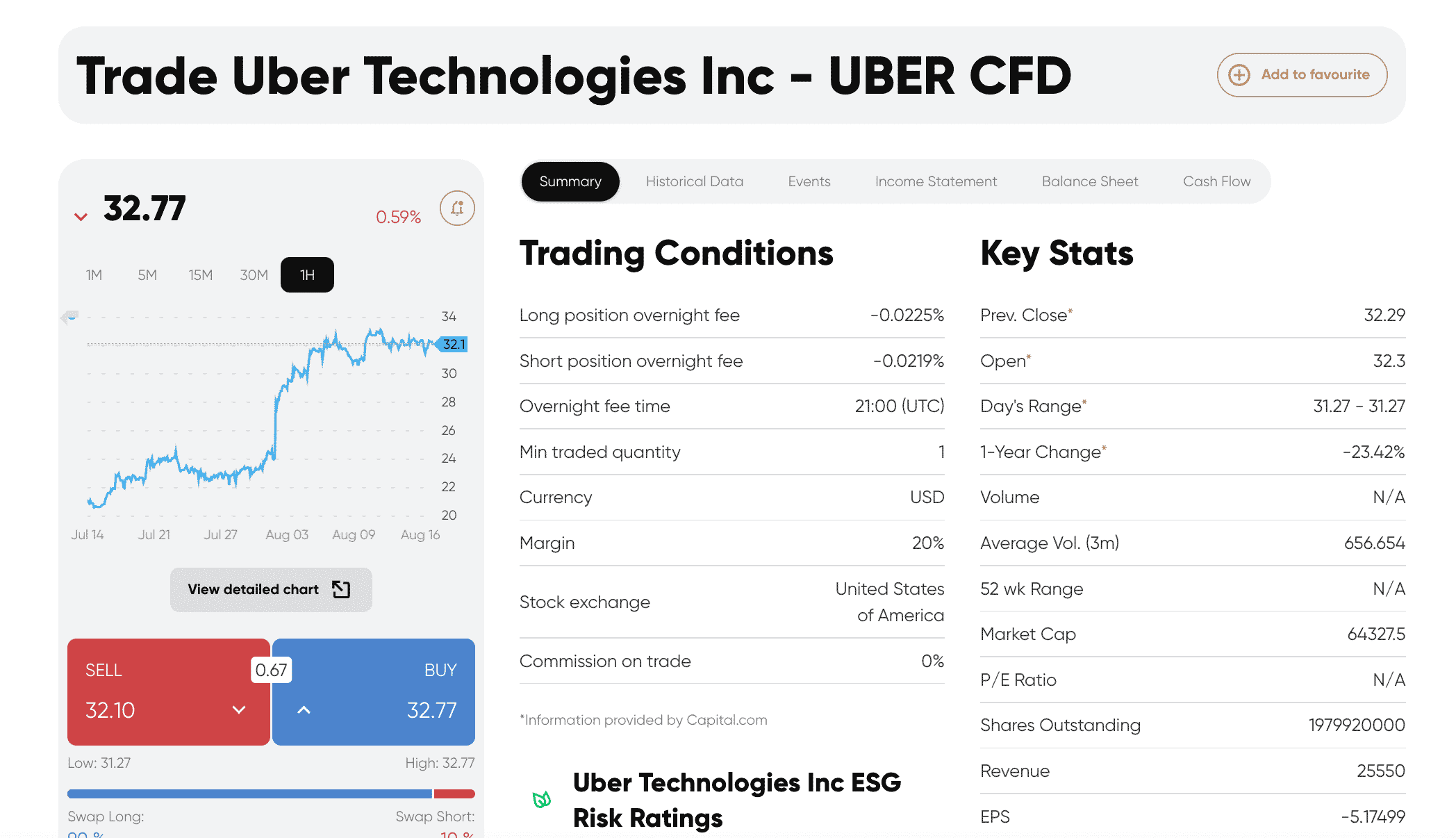

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. It offers more than 5,400 stock CFDs – including Uber. This covers stock exchanges from across the world – from the US and UK to Germany and Singapore. Capital.com enables users to speculate on the future value of Uber stock without owning any equities. This is because the Uber CFD will simply mirror the real-time price of the stock. This means that when entering a position, Capital.com users can choose from a buy or sell order. A buy or sell order will be placed depending on whether the user believes that the Uber stock price will rise or fall. Stock CFDs at Capital.com, although commission-free, are more suited for short-term positions. The reason for this is that Capital.com charges overnight financing fees like any other CFD platform. As such, for each day that the Uber stock trade remains open, a fee will be applied. Another metric associated with stock CFDs is leverage. At Capital.com, users can apply leverage of up to 1:5 when trading Uber stock. In other words, should the user stake $50 on an Uber buy order, then this will amplify the value of the position to $250. Leverage should be used with caution, as losses will be amplified on unsuccessful trades. Capital.com enables users to buy and sell Uber stock CFDs via its own native web trading platform, or via MT4. Both options enable users to access advanced trading tools – such as technical indicators. Moreover, Capital.com is home to regularly updated market insights, educational materials, and financial news. The Capital.com app permits mobile trading on both iOS and Android devices. There is also a Capital.com demo account for those wishing to learn the ropes of CFDs before risking any real money. On top of stocks, Capital.com also enables users to trade crypto (N/A for UK users), forex, indices, and commodities. Capital.com is regulated by ASIC, NBRB, CySEC, and FCA – and more than five million clients have opened an account with the platform.

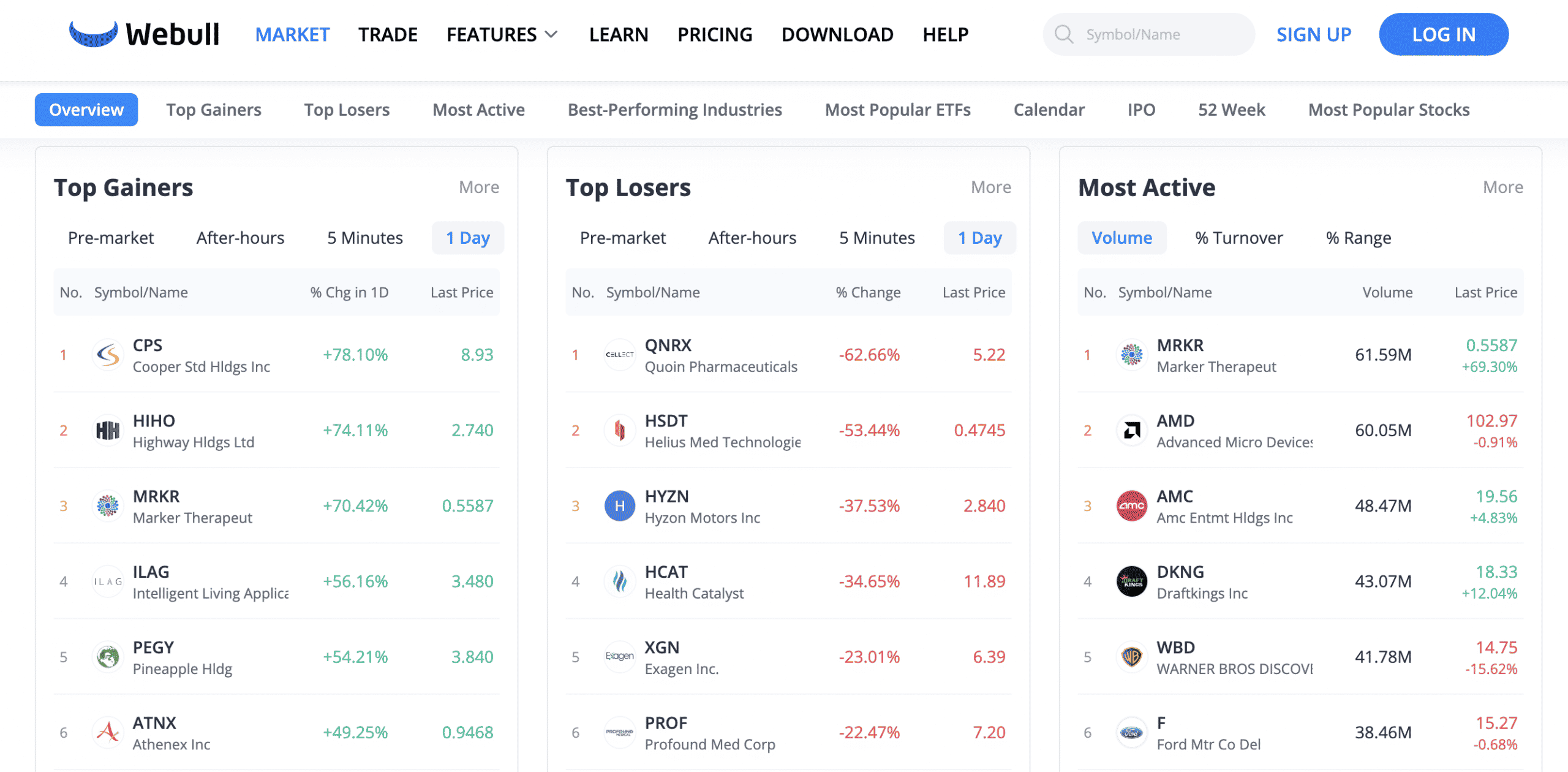

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. Domestic bank wires, on the other hand, will attract a deposit and withdrawal fee of $8 and $25 respectively. There is no minimum deposit requirement at Webull and the minimum Uber stock purchase is $5. This is the case with all other listed stocks on the Webull platform. When it comes to trading fees, Webull does not charge any commissions. Investors will have several options when it comes to selecting an account type. US clients that are looking to invest in a tax-efficient manner might consider a Roth or Traditional IRA – both of which Webull supports. Webull enables investors to trade via its website or its mobile app for iOS and Android. Both platforms link to the same account and come with the option of trading with demo funds. It is also possible to buy Uber stock – and other US-listed equities, on margin. As per US regulations, this will require a minimum margin balance of $2,500, and additional fees will apply. Webull also offers ample tools to analyze the financial markets via chart drawing tools, technical indicators, and insights on the best and worst-performing stocks of the day. Webull is also home to learning materials, which are aimed at beginners that wish to improve their stock trading knowledge. Read More: Learn where to buy stocks in the US without paying any commission.

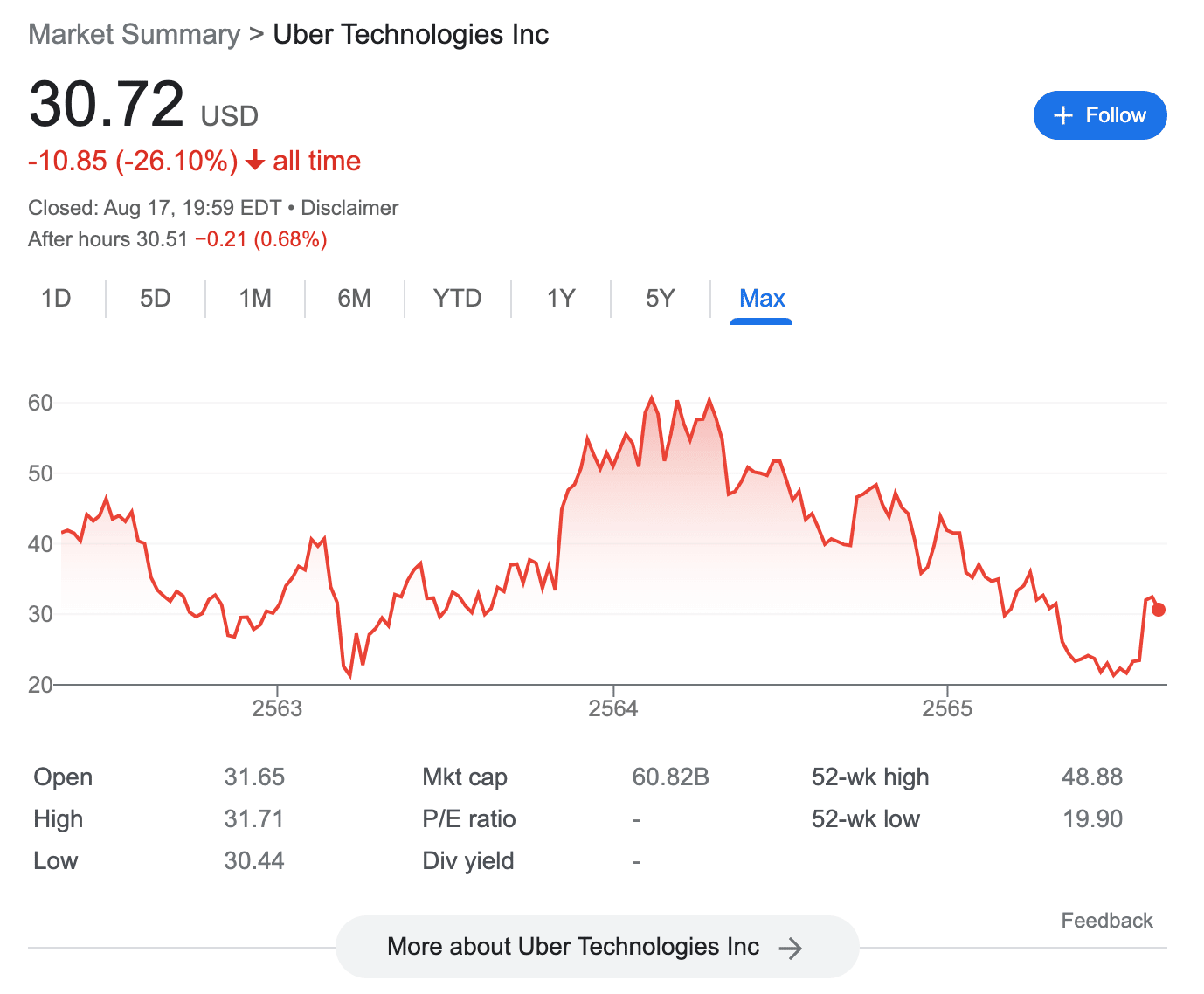

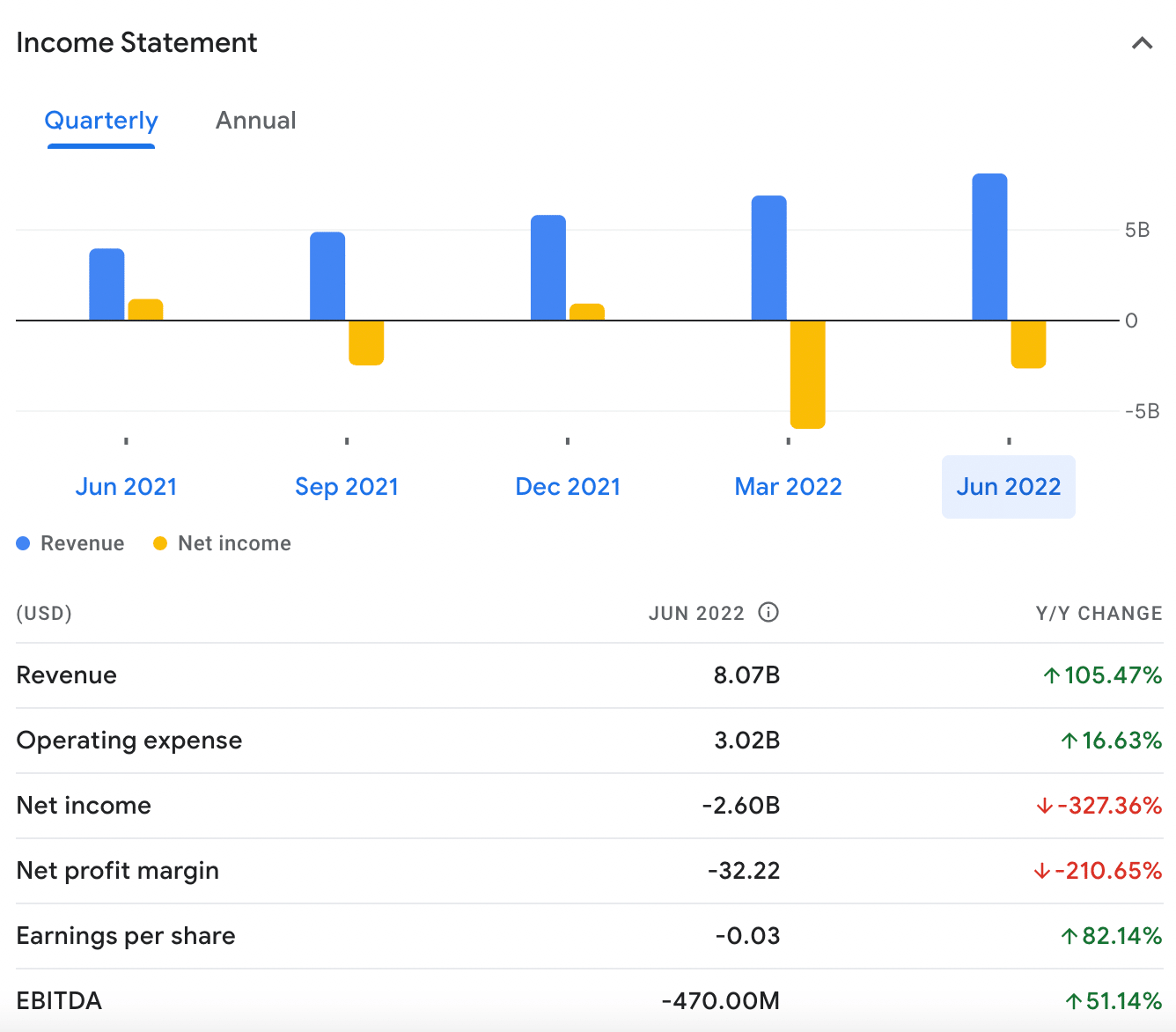

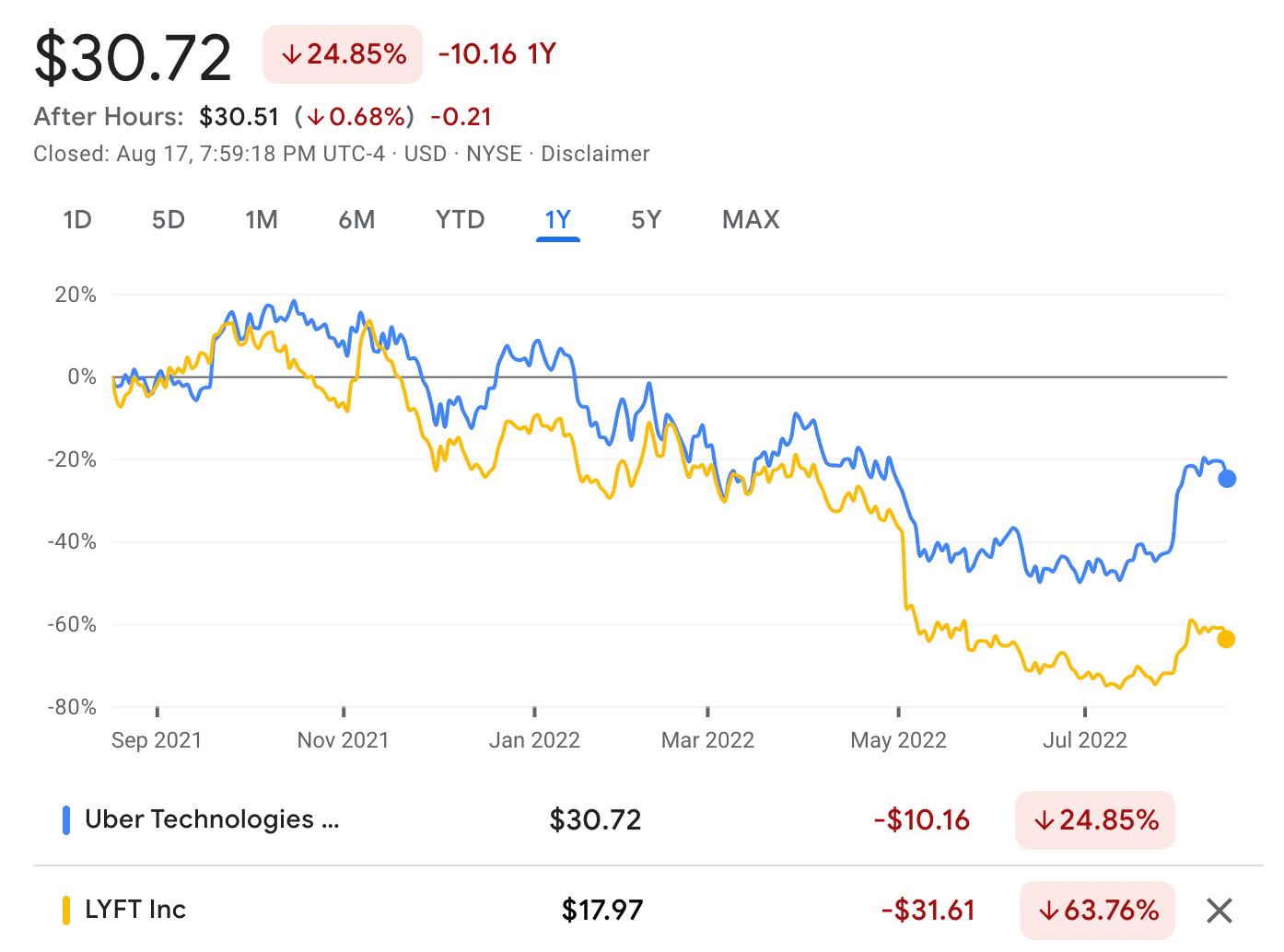

Your capital is at risk. To have a true understanding of how to invest in stocks online, traders must dedicate amp`le time to research. This is especially the case with a growth stock like Uber, which has seen its valuation remain below its 2019 IPO price for some time. Whether or not Uber is able to kick on in the coming years remains to be seen. When Uber was founded in 2009, it completely revolutionized the global taxi industry. In its most basic form, Uber sits between the taxi driver and passenger via its sophisticated mobile app. From the perspective of the passenger, ordering a taxi is as simple as opening the Uber app and specifying the collection and destination address. Previously to the Uber concept, passengers would need to call a local taxi firm to arrange collection. Alternatively, the passenger would need to flag a taxi. Either way, this was both an inefficient and cumbersome process. Moreover, there were also issues with the way that passengers would be charged for a taxi journey. The old meter system was flawed, insofar that if the driver – whether or not wittingly, took a longer route, this would result in the passenger paying a higher price. Taxi journeys through Uber, however, are charged a fair price – regardless of what route the driver takes. Another benefit that Uber brought to the taxi service table is that passengers can attach their debit or credit card to the app. This prevents the need to have sufficient cash and, from the perspective of the driver – ample change to give to the passenger. With that being said, Uber has since ventured into other products and services. At the forefront of this is Uber Eats. This enables consumers to order food from a variety of local restaurants, which will then be delivered to the user’s registered address. Nonetheless, the key challenge facing Uber – in addition to its ongoing lawsuits with various municipalities, is that the ride-hailing firm now operates in a hugely crowded marketplace. It took just 10 years for Uber to go from a private to a public company. Opting for the NYSE, its 2019 IPO offered 180 million stocks at $45 per share. This valued the company in the $75 billion region. After a brief, albeit, modest surge, Uber stock went on a downward trajectory. In fact, by November 2019, Uber stock was trading at lows of $27 – a 35% decline from its IPO price. Its valuation continued to decline for the proceeding months, before bottoming out at just over $21. The fortunes of Uber then reversed, with the firm hitting an all-time high of $60 in 2021. This represents an increase of 185% from its previous bottom, and 33% when compared to its IPO. Since peaking at $60, Uber seems to have continued its downward decline. In mid-2021, for example, the stock hit an all-time low of just under $20. According to the Uber stock price today, the firm has recovered to the $30-35 region. Crucially, although Uber stock carries a market capitalization of over $60 billion as of writing, the firm is overly volatile. On the flip side, based on pricing levels as of writing, Uber is still trading at an 87% discount when compared to its prior all-time high. Whether or not this represents a bargain will need to be determined through additional research. Those wondering “Should I buy Uber stock?” should explore the key financials of this growth company. One such way that this can be achieved is by exploring the earnings per share, or EPS. In its most recent earnings call of Q2 2022, Uber reported an EPS of -0.03. Although this is negative, the markets had forecast an EPS of -0.05 – so this beat expectation by over 40%. In Q1 2022, Uber once again beat Wall Street expectations. By reporting an EPS of -10 as opposed to the -0.14 forecast, this beat expectation by over 31%. In the two quarters previous, the EPS was beaten by 320% and 53%, respectively. To determine whether or not Uber stock is a buy, investors should also consider exploring the price to earnings, or P/E. However, because Uber is still a loss-making company, evaluating a reliable P/E ratio is not possible. On this note, Uber reported a net income loss of $2.6 billion in its most recent earnings call, and $5.6 billion prior to that. As a loss-making growth stock that is burning through billions of dollars in cash, it goes without saying that Uber does not pay dividends. Investors should expect this to be the case for the foreseeable future. After all, it remains to be seen when Uber will begin turning a profit. Perhaps the most important part of the research process when considering whether or not to buy Uber stock is the fundamentals. This should see investors explore the core aspects of the business – such as its market share in the ride-hailing space, revenue and net income growth over the prior quarters, and the firm’s relationship with short and long-term debt. Starting with the firm’s most recent earnings call of Q2 2022, Uber reported some impressive figures. At the forefront of this was Uber’s 105% revenue growth to $8 billion – when compared to the prior year. EBITDA and the EPS were up 51% and 825% respectively. In this regard, perhaps the EPS is a more reliable indicator of how Uber’s primary business model is performing right now. This sentiment is arguably being shared by Wall Street, with Uber stock showing gains of over 36% in the prior month of trading. The valuation of Uber still seems to be a topic of hot debate in the investment space. As of writing, Uber stock carries a market capitalization of approximately $60 billion. This is, however, still 20% lower than its IPO valuation of $75 billion. Therefore, for Uber to get back to IPO levels, this would require a further upside of 25%. Whether or not this represents a viable medium-to-long term target still remains to be seen – especially considering the stiff competition that Uber faces. As noted, Uber continues to operate as a loss-making company. Towards the start of 2022, Uber was burning cash at an annualized rate of $4 billion. Fast forward to 2022, and this figure is now floating above the $105 million level. Although not ideal, it is notable nonetheless that management at Uber has been able to reduce its cash burn-through rate by a considerable amount. One of Uber’s main competitors in the US marketplace is Lyft. When comparing the stock price action of these two ride-hailing firms, it is clear that investors seem to prefer Uber. Over the prior 12 months of writing, for example, Uber stock has declined by just under 25%. In comparison, over the same period, Lyft stock has seen a decline of 63%. One of the main strategies being employed by managed at Uber is to ensure that its so-called ‘super app’ continues to expand into new markets, products, and services. Then there is Uber Freight – which is another growing segment of the firm’s long-term expansion model. Through real-time data, this enables truck drivers to find cargo that needs shipping. When attempting to assess “is Uber stock a buy?” – investors should also consider how leading Wall Street analysts view the firm. According to sell-side analyst ratings over the prior three months, 93% have Uber stock as a buy, while 7% hold. 0% had Uber stock as a sell. As a result, based on the sell-side data extracted from the 27 analysts, the consensus is that Uber stock is a strong buy. These viewpoints are, of course, subjective and certainly not a reason to invest. In terms of the Uber stock forecast, sell-side analysts have an average target of $46.77. These ratings cover a low and high estimate of $27 and $75, respectively. Based on prices as of writing, Uber stock would require a further upside of approximately 50% to reach the average target. After performing research on Uber stock, investors will need to decide whether or not to proceed with an investment. For those that are bullish on the long-term outlook of the ride-hailing company, the guide below explains how to invest in Uber stock with a regulated online broker. After choosing a suitable broker to buy Uber stock, investors will need to register an account. This will require the investor to input some personal information and contact details, such as a name, residential address, and cell phone number. Regulated brokers will need to comply with laws surrounding anti-money laundering. In most cases, this means that investors will need to verify their identity through a KYC process. This means that the investor will need to upload a copy of their government-issued ID – such as a driver’s license or passport. Some regulated brokers also require proof of residency – such as a utility bill or recently issued bank account statement. Until the account is verified, the investor will not be able to deposit any funds. The good news is that many online brokers are able to verify identification documents in real-time. The next step is to make a deposit into the newly created stock broker account. Many online brokers do not have a minimum deposit requirement in place, which will suit inexperienced investors as well as those on a budget. However, be sure to deposit enough funds to cover the minimum stock investment requirement. In terms of deposit fees, this will vary depending on the broker and the payment method being used. While most online brokers support traditional banking methods – such as ACH or a wire transfer, some also accept debit and credit cards. After the brokerage account has been funded with trading capital, the investor can search for Uber stock on the respective platform. The final step is, therefore, to create a buy order. There are two options in this regard. First, to invest in Uber stock instantly at the next best available price, the investor can opt for a market order. Alternatively, a limit order enables the investor to buy Uber stock at a predefined price. However, the limit order will not be executed by the broker until the stated price is triggered by the market. Finally, the investor will need to confirm the order. Once the order is executed, the broker will add the stocks to the investor’s portfolio. The steps required to sell Uber stock are much the same as the aforementioned buying process – but in reverse. Investors can log into their brokerage portfolio and create a sell order and, once executed, the proceeds from the sale will be added to the account balance. Uber stock was behind a highly anticipated IPO in 2019 when it was listed on the NYSE. However, the stock has subsequently failed to live up to investor expectations, with Uber still trading below its original IPO valuation. With that said, its most recent quarterly earnings call was positive, with revenues up more than 100% year over year. The key issue facing Uber is that it is still a loss-making company. Q2 2022 figures, for instance, reported a loss of $2.6 billion. Uber is, therefore, a growth stock that remains to make a profit, and thus – investors should tread with caution when opting to invest in the ride-hailing company.2. Capital.com

Approx No. Stocks

5,400

Min Deposit

$20

Cost to Trade Uber Stock

0% commission + spread

3. Webull

Approx No. Stocks

5,000+

Min Deposit

$5

Cost to Buy Uber Stock

0% commission + spread

Step 2: Research Uber Stock

What is Uber?

Uber Stock History – How Much is Uber Stock Worth?

Uber Stock – EPS

Uber Stock – P/E Ratio

Uber Stock Dividends

Uber Stock: Fundamental Research

Q2 Earnings Report

Below IPO Levels

Cash Burning

Uber is Outperforming Lyft

Diversified Services

Analyst Ratings

Step 3: Open an Account & Buy Stocks

Open a Brokerage Account

Upload ID

Deposit Money

Buy Uber Stock

Sell Uber Stock

Conclusion

FAQs

Can I buy Uber stock?

How do I purchase Uber stock?

Which stock is better: Uber or Lyft?

How many shares of Uber stock are there?

Who has the biggest share in Uber?

Is Uber losing money?

Uber stock buy or sell?

What is the Uber stock ticket?