The share price of Upstart stock is down 90% over the last year. We delve into Upstart Holdings financials to find out more about this company.

For investors who decide to take the plunge and invest in UPST, we outline how to buy Upstart stock with a regulated stock broker.

How to Buy Upstart Stock in 2023

- ✅Step 1: Open a live trading account with a regulated broker – Fill in a few personal details to open an account in seconds.

- 🔑Step 2: Verification – Supply some ID to access higher deposit limits and satisfy KYC regulations.

- 💳 Step 3: Deposit – Deposit funds in USD, GBP, EUR or AUD with plenty of deposit methods available.

- 🔎 Step 4: Search for Upstart Stock – Find Upstart stock instantly using the broker’s search function and check out its homepage.

- 🛒 Step 5: Research and Invest in Upstart Stock – Research the market and the company and then decide how much to invest.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

Deciding which stock to buy is one thing, but where to buy stocks is a key consideration too.

Investors looking to buy Upstart stock should consider online brokers with:

- Thorough regulation.

- Zero commission on stock transactions.

- Tight spread fees.

1: eToro

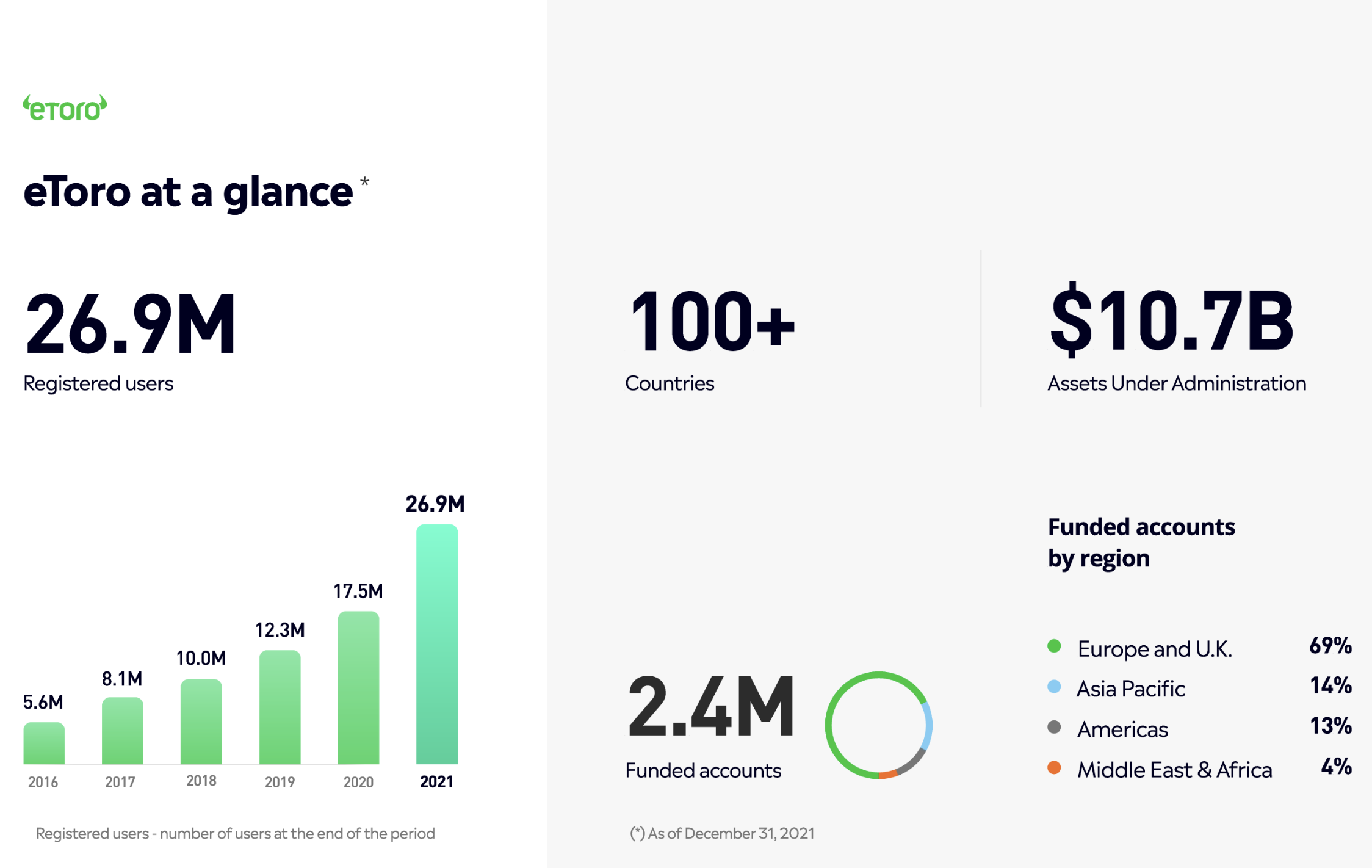

As well as ETFs, crypto, commodities, indices and forex, eToro offers a range of 3,000+ stocks. Roughly two-thirds are US-based. The remainder are traded on 15 international stock markets.

eToro tends to work hard to bring the new stocks to market. Looking for cannabis stocks, for example?

Investors looking to invest in stocks in particular will be pleased to learn that eToro charges no commission on stock trades. So, for example, an investor wanting to buy Upstart stock would need only pay a tight spread of 0.42%.

In the area of non-trading fees, eToro charges no deposit fee, and a flat withdrawal fee of just $5.

Investors who buy stocks on eToro may be tempted too by the in-house CopyTrader facility. This allows users to learn the ropes of investing by using some of their funds to copy more experienced traders. Users can allocate as much money as they like, and the software will copy trades in real-time.

Another feature offered by eToro is its range of 65 Smart Portfolios. These portfolios allow investors to invest in a strategic spread of shares in one go.

| Number of Stocks: | 3000+ |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying Upstart: | Spread fee of just 0.42% |

| Deposit Fees: | NA (but currency conversion fee applies if not a USD deposit) |

| Withdrawal Fees: | $5 Flat fee |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

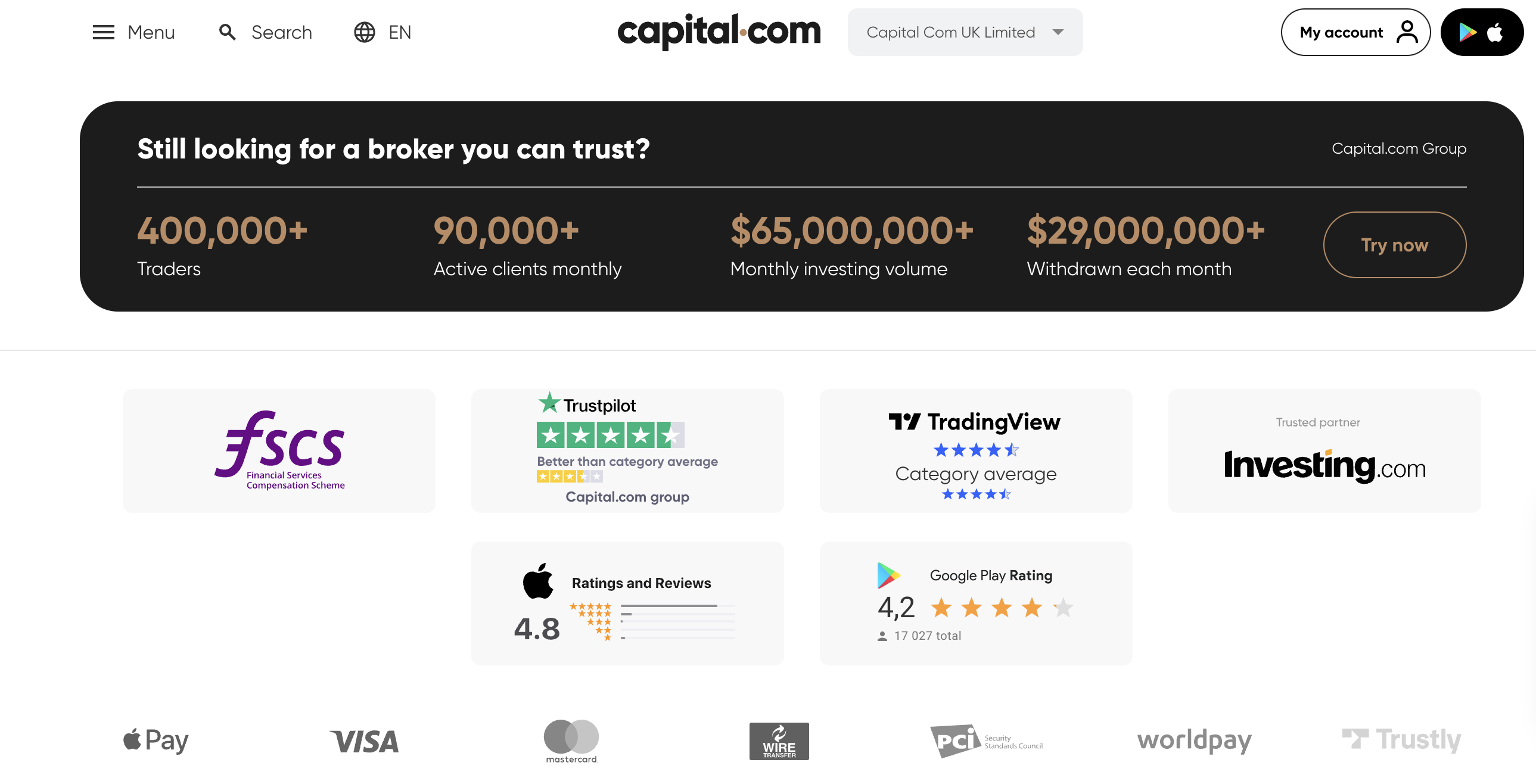

2: Capital.com

With 90,000 active clients every month, Capital.com is something of a niche provider compared to full-service eToro. But that is not to say that it does not pack a punch when it comes to its range of assets. 5,000+ stocks are available with Capital.com, as well as forex, indices, commodities and crypto (including the metaverse stocks).

Capital.com is something of a specialist because it offers CFD trading only. CFDs allow traders to go short on stocks as well as long, which is an advantage in today’s bear markets.

For example: instead of choosing to buy Tesla stock and hoping the price goes up, the investor may go short on Tesla with Capital.com and benefit if the Tesla price falls.

eToro offers CFD trading on some stocks, so Capital.com’s offering is not unique. Further, CFD trading with both brokers comes with overnight fees; these can add up. Hence CFD trading is for ‘scalping’, which means getting in and out of trades quickly whilst leveraging gains.

Newcomers to investing should have little problem finding their way around Capital.com. The interface is neat and the broker’s blog posts and market analyses are excellent and educational too.

When it comes to fees, Capital.com charges zero commission. Its spread fees tend to be very tight on Nasdaq stocks (as with eToro). But they are, sometimes, too expensive for the cheap stocks with low liquidity.

| Number of Stocks: | 5000+ |

|---|---|

| Pricing System: | Spread fee + Overnight fees for CFDs |

| Cost of Buying Upstart: | 0.3% Spread + 0.023% overnight fee |

| Deposit Fees: | NA |

| Withdrawal Fees: | NA |

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Step 2: Research Upstart Stock

Should I add Upstart stock to my watchlist? One way for an investor to answer this question is to do some market research.

Below we outline:

- What Upstart does to generate revenues.

- Where Upstart stands in terms of its balance sheet.

What is Upstart?

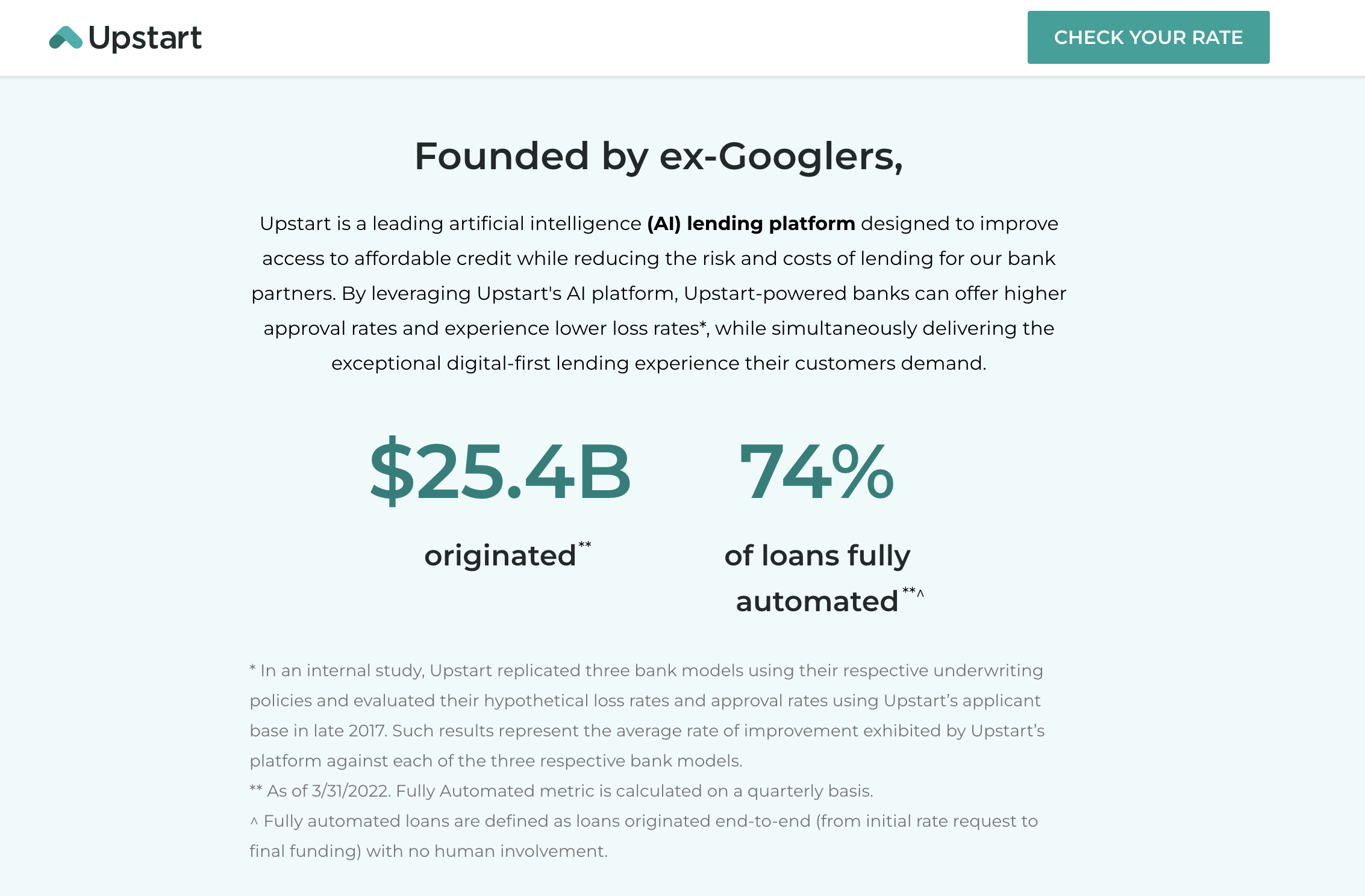

Upstart is a US consumer lending company. The firm partners with banks to provide consumer loans. At the centre of Upstart’s business is AI (Artificial Intelligence) modelling to predict the credit trustworthiness of loan applicants.

Founded in 2012, Upstart is headquartered in San Mateo, California, US. The firm has approximately 1,500 employees. It is headed by CEO Dave Girouard, who was previously a product manager at Apple as well as President of Google Enterprise.

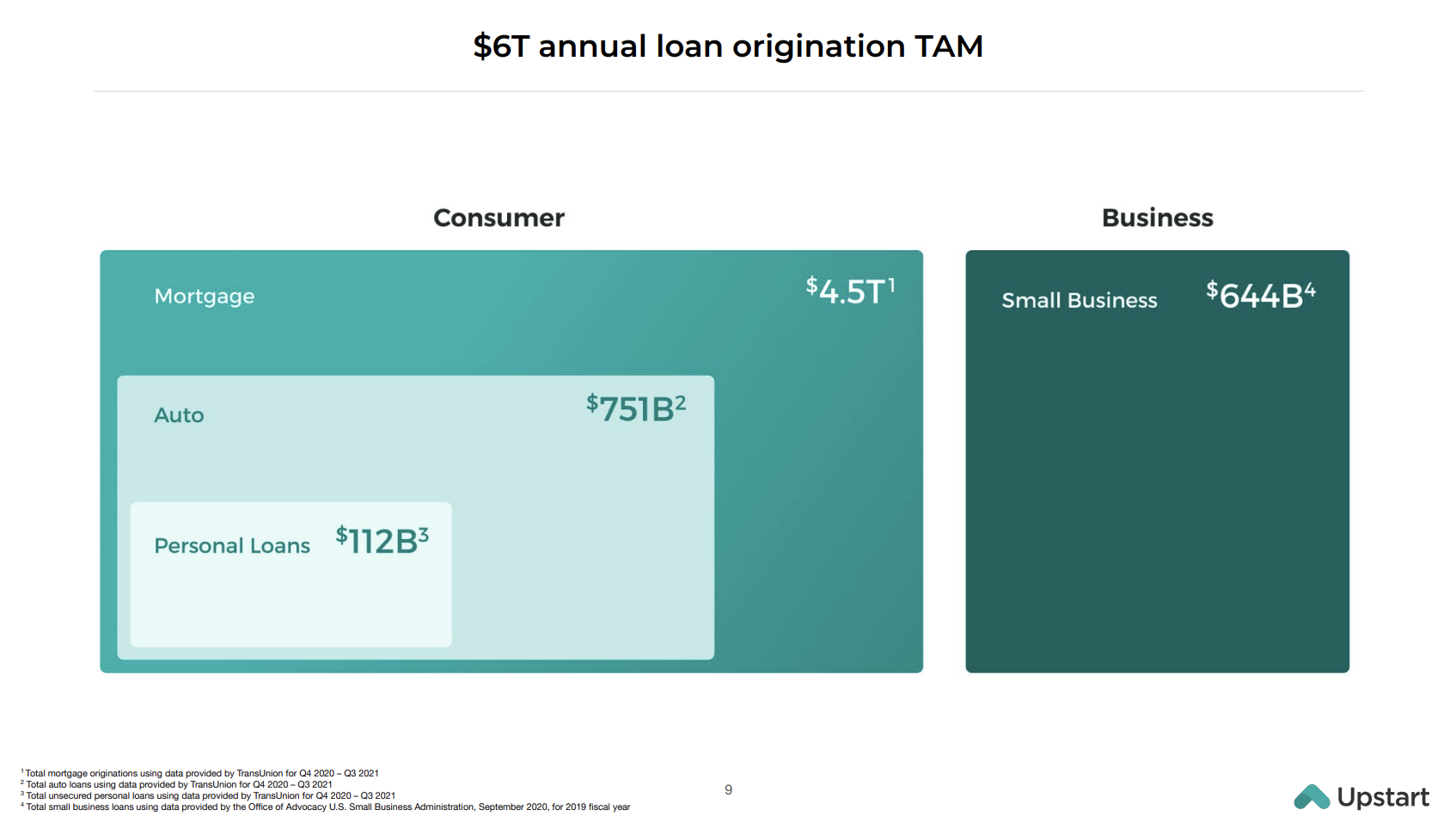

Upstart: Set to Operate in a $6 Trillion Market

Upstart currently deals with personal and auto loans. It has been reported that it may move into mortgage and business loans too.

Between 2020 and 2021, a total of $6 trillion in loans were originated in the US:

- Mortgages made up the bulk with $4.5 trillion.

- Auto loans accounted for $715 billion.

- Small business loans made up $644 billion.

- Personal loans made up $112 billion.

What is Upstart’s Business Model?

Upstart positions itself between consumers and lending banks.

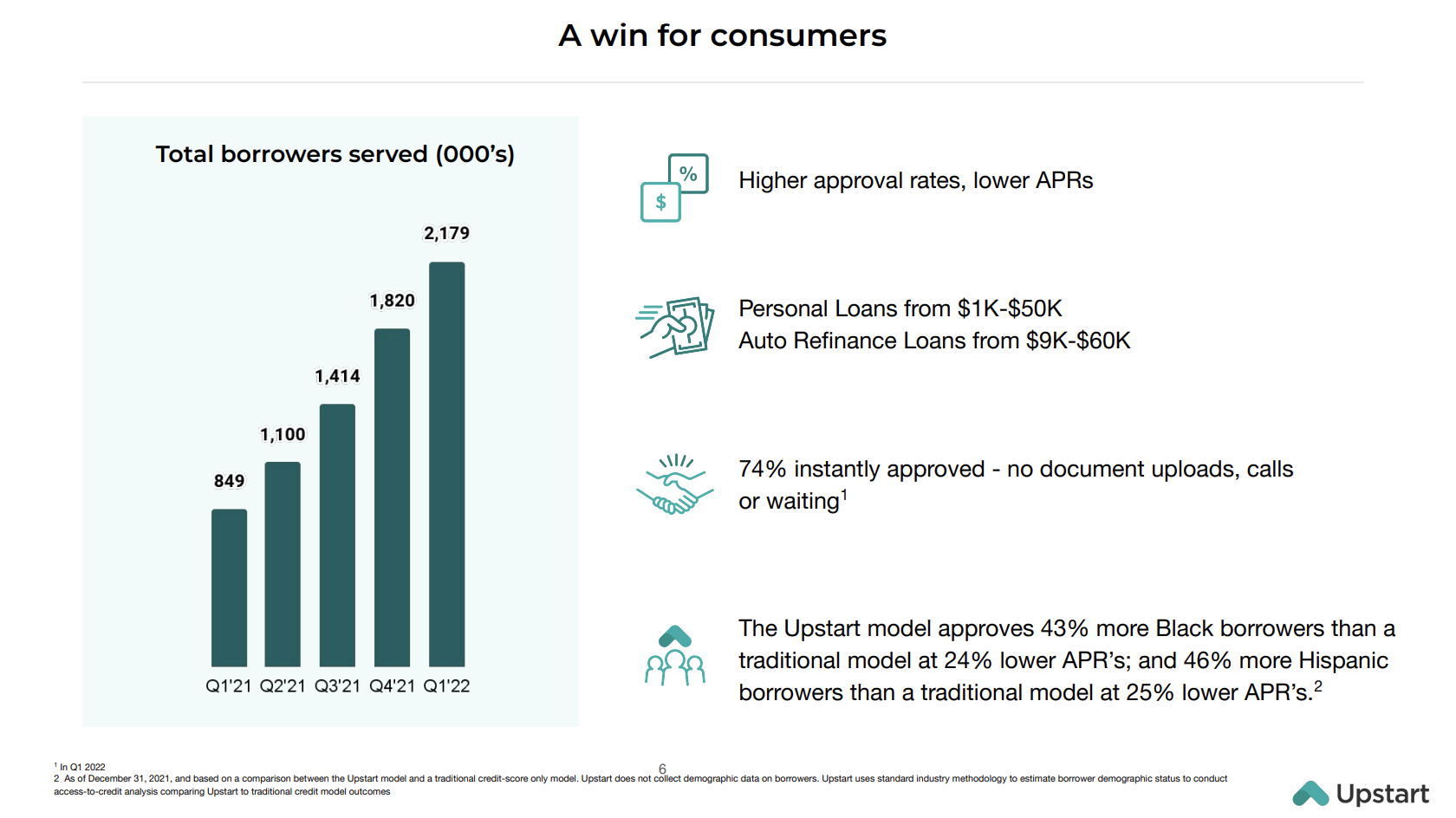

- To consumers, it aims to offer a higher chance of getting a loan at a reasonable rate of interest.

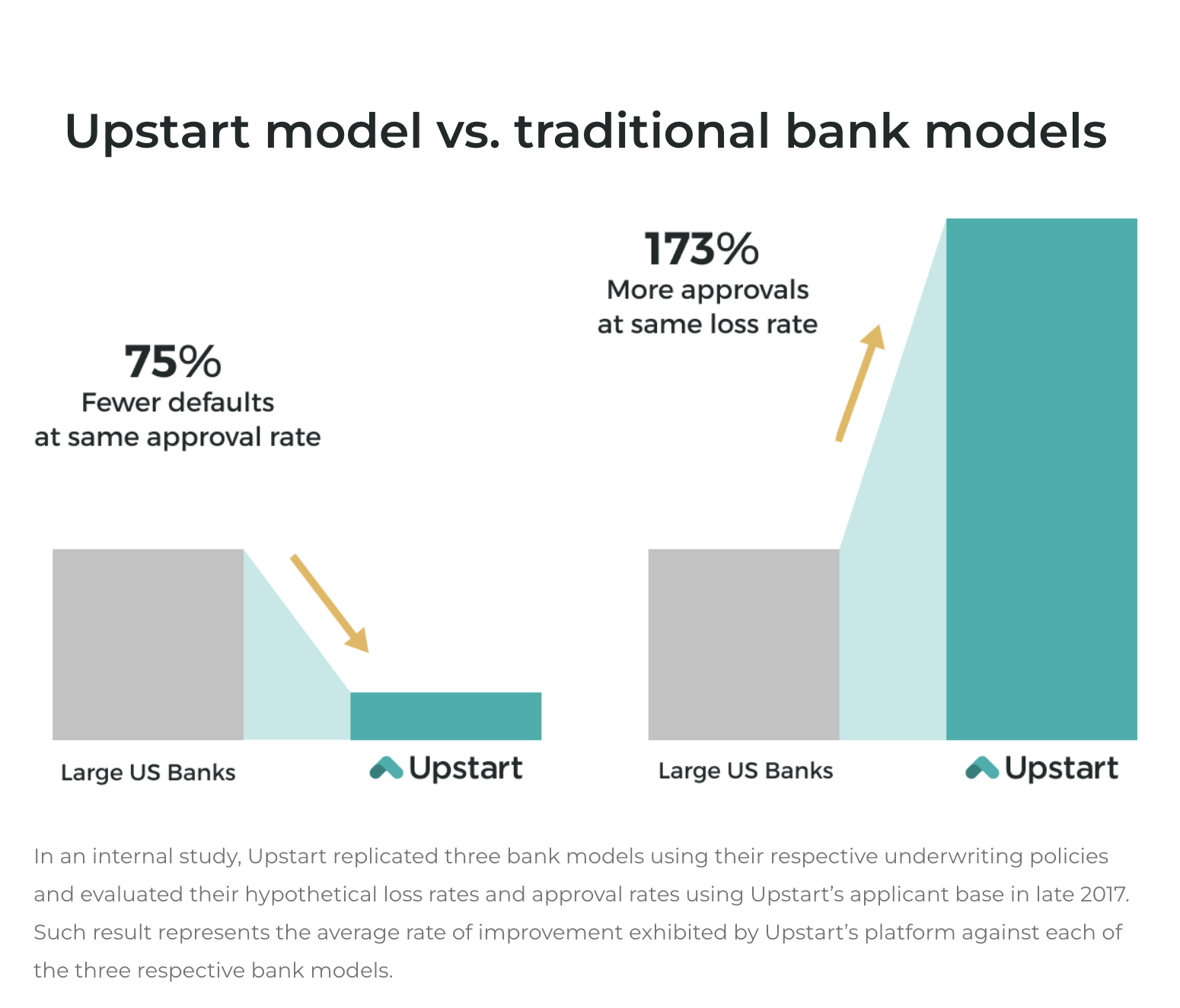

- To the lending banks, the firm aims to offer more accurate credit scoring than the traditional FICO credit scoring system and thus deliver fewer clients who default on loans. Upstart says that it delivers 75% less defaults than normal credit scoring.

- Upstart does not generate money by lending money itself; rather, it takes fees from the banks that lend the money to the borrowers which it introduces.

- Between 2017 and 2021, Upstart revenues have delivered an outstanding compound annual growth rate of 85%. Revenues have risen from $57m in 2017 to $849 in 2021.

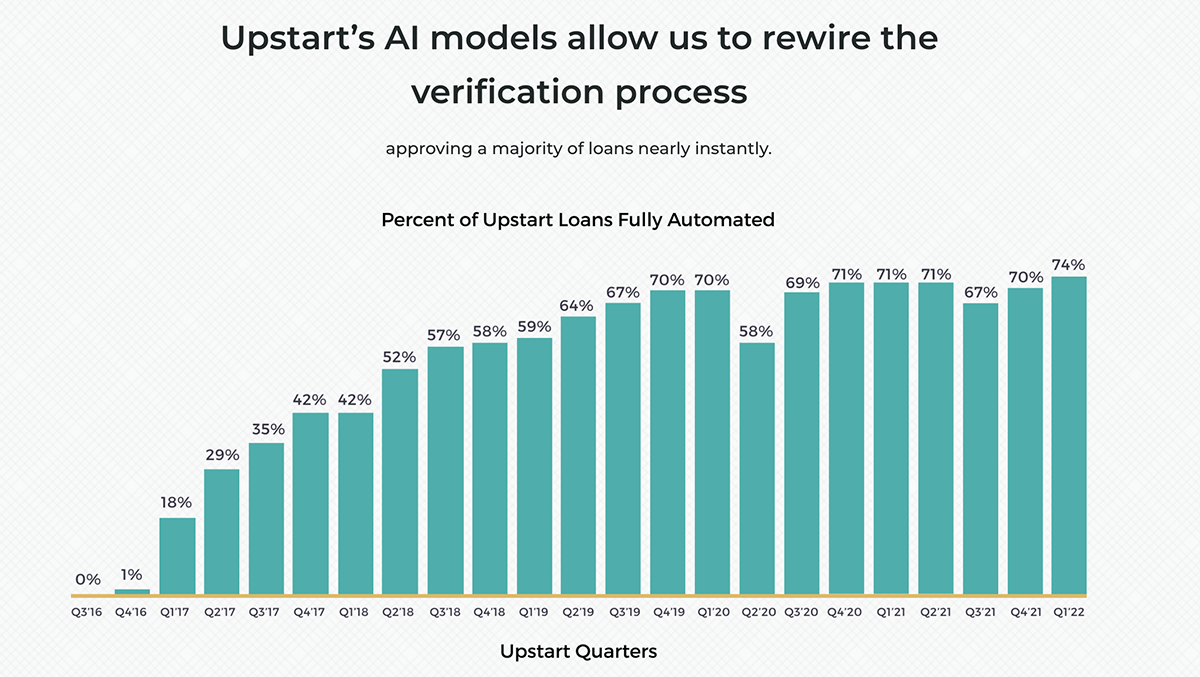

- In Q1, 2022, 74% of loans arranged by Upstart were fully-automated i.e. instantly approved.

- Although it does not affect Upstart fees, the loans which Upstart broker do not offer conspicuously-low interest rates. The company confirms that, ‘the average 5-year loan offered across all lenders using the Upstart platform will have an APR of 24.74% and 60 monthly payments of $26.35 per $1,000 borrowed.’

Upstart Stock Price — How Much is Upstart Stock Worth?

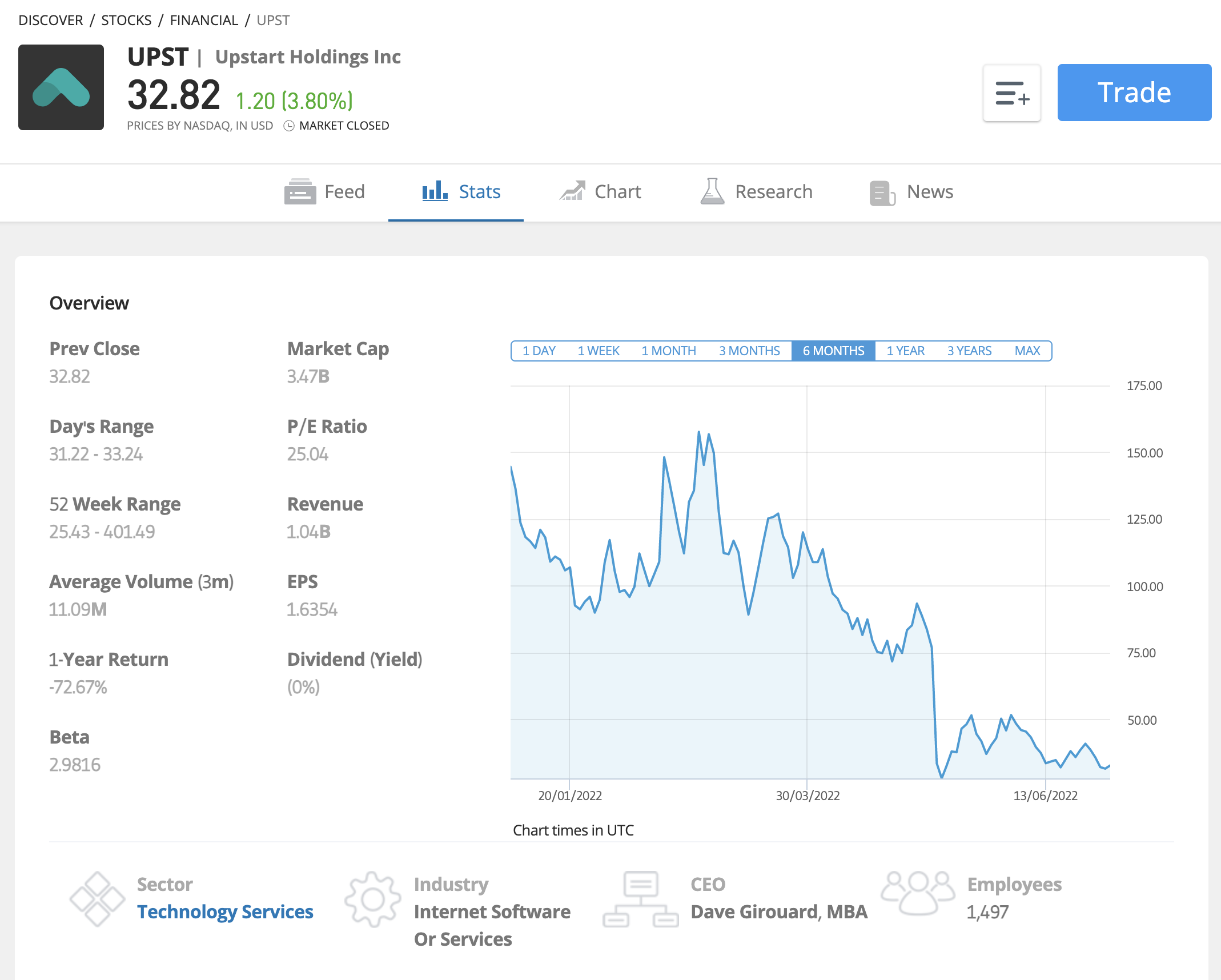

From the Upstart stock chart below, we can see that the closing Upstart stock price on Monday 4th July, 2022 was $32.82.

- The Upstart stock symbol (otherwise known as the Upstart stock ticker) is ‘UPST’.

- Upstart stock has a total market capitalisation of $3.47 billion.

Upstart Stock History

- Upstart came to market in December 2020 at $20 a share.

- In under a year it rocketed to an intra-day all-time-high of $401 —that is a return of 2000% for smart investors who had chosen to buy Upstart stock.

- The price has since collapsed by 90%. Why? Because, in Q4 2021, Upstart released an outlook which spooked investors – just as, in the face of rising interest rates, there has since been a broader sell-off of even the tech stocks in the market.

- Worrying news about the effectiveness of the Upstart AI model then rocked the price in May 2022 (as we investigate fully below).

- Then on June 29th, 2022, the stock fell again (by 11%) after Morgan Stanley analyst James Faucett downgraded Upstart from ‘equal weight’ to ‘underweight’. In simple terms, this means Faucett thinks the stock will underperform its sector index.

Three Key Financial Metrics

Is Upstart making money? Has the firm taken on too much debt? These are key questions for the investor asking themselves:

Here investors figuring out how to invest in Upstart stock can review:

- An overview of Upstart finances (for the previous year).

- Upstart Income Statement highlights.

- Upstart Balance Sheet highlights.

- Upstart Cash Flow highlights.

- Overview of hedge fund activity in Upstart stock trading.

- Overview of insider buys and sells.

We can pick out just three metrics to assess the general health of Upstart stock.

Table: 3 Key Financial Metrics to Assess Any Stock

| Metric | Definition | Shows? |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

| Quick Ratio | Current assets divided by current liabilities | The ability of a company to pay off its short-term debts within 90 days |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Upstart EPS (Earnings Per Share): $0.34

The EPS figure for a company is a general measure of profitability.

The EPS figure of $2.3667 in eToro’s summary shown above relates to the 12 months of 2021.

A more recent figure available is the Upstart EPS for Q1 2022. This was $0.34. This represents a 44% decrease on the previous quarter, but a 209% increase year-on-year.

EPS growth is a key driver of a rising share price. So this 209% year-on-year rise is a green flag for investors considering how to buy Upstart stock.

Upstart P/E Ratio: 25.04

Upstart’s P/E ratio of 25.04 means that investors are paying $25.04 for every $1 in profit that the company makes.

- The higher the P/E ratio, the more expensive the company. Expensive companies reflect market confidence that revenues are likely to increase over time. And this is certainly borne out in Upstart’s case, with its Q1 2022 revenues of $228m up 250% year-on-year.

Just last October, Upstart had a P/E ratio of 500+. This means it was 25 times more expensive (compared to earnings) than it is now. This reflected market enthusiasm for the company’s potential to increase revenues steadily as it challenges the existing FICO credit scoring system.

This enthusiasm has since died down with the onset of rising interest rates, which is likely to lead to consumers and businesses alike taking out less loans – and thus reducing Upstart’s Total Addressable Market (TAM).

With such a drastic reduction in P/E ratio, investors looking to buy Upstart stock may conclude that it is one of the most undervalued stocks.

Upstart Quick Ratio: 1.02

Any Quick Ratio over 1 means that a company could, if forced to, liquidate enough assets to cover its immediate debts.

- With a Quick Ratio of 1.02, Upstart does not therefore present the potential investor with a red flag in terms of short-term debt.

In terms of long-term debt, we note that Upstart has a long-term debt to equity ratio of 10.37%.

- This means that Upstart has roughly ten times more shareholder equity than long-term debt. It is not highly-leveraged, in other words.

- Companies with high long-term debt to equity ratios currently face the problem that interest rates are on the rise, which means debt is getting more expensive. Upstart is not in so much debt that this is a significant challenge.

Upstart Stock Dividends

Investors looking for the dividend stocks will need to look elsewhere.

Companies must choose between rewarding investors with dividends, or re-investing profits in growth. Upstart is currently choosing to do the latter. The firm says, ‘We currently do not expect to declare or pay any dividends, as we intend to retain available funds and future earnings for use in the operation of our business.’

Can Upstart Defend Against Class Action Challenge?

In a class action helmed by US law firm Bragar, Eagel and Squire, shareholders are accusing the company of misleading investors. In question is the effectiveness of the AI model at the centre of Upstart’s business.

Allegation: Management Failed to Reveal AI Flaw

Upstart uses AI to assess the credit status of consumers. Shareholders say that ‘material adverse facts’ about this AI model have been hidden by the company: specifically that the model ‘could not adequately account for macroeconomic factors such as interest rates.’ In other words, the company is accused of hiding the fact that the AI model is flawed.

This deficiency came to light when Upstart announced its Q1 2022 financial results. This was on May 9th, 2022. The firm reduced its forecast for revenues for the year, with the Chief Financial Officer citing ‘rising interest rates and rising consumer delinquencies putting downward pressure on conversion.’

The share price fell by 51% overnight. It closed at $76.85 on 9th May and opened at $36.91 on 10th May. It has since not recovered.

Impact: Upstart Conversion Rate Down

Upstart’s conversion rate is a key sales metric. It measures, as a ratio, the number of loans approved via Upstart versus loan applications.

Conversion on loan requests was 21% in Q1 2022 – down from 22% in Q2 2021. That is only a decrease of 1% year-on-year. But this is a red flag for investors, who expect to see key metrics get better, not worse.

The flaw in Upstart’s AI has, as the CFO revealed, impacted the conversion rate negatively. But investors bringing the class action say that they did not know this when they invested. Further, they say that, as a result of the flaw, the firm is more likely to use its own balance sheet to fund loans and has thus misrepresented its financial position.

- The deadline for shareholders to join the class action is July 12th, 2022.

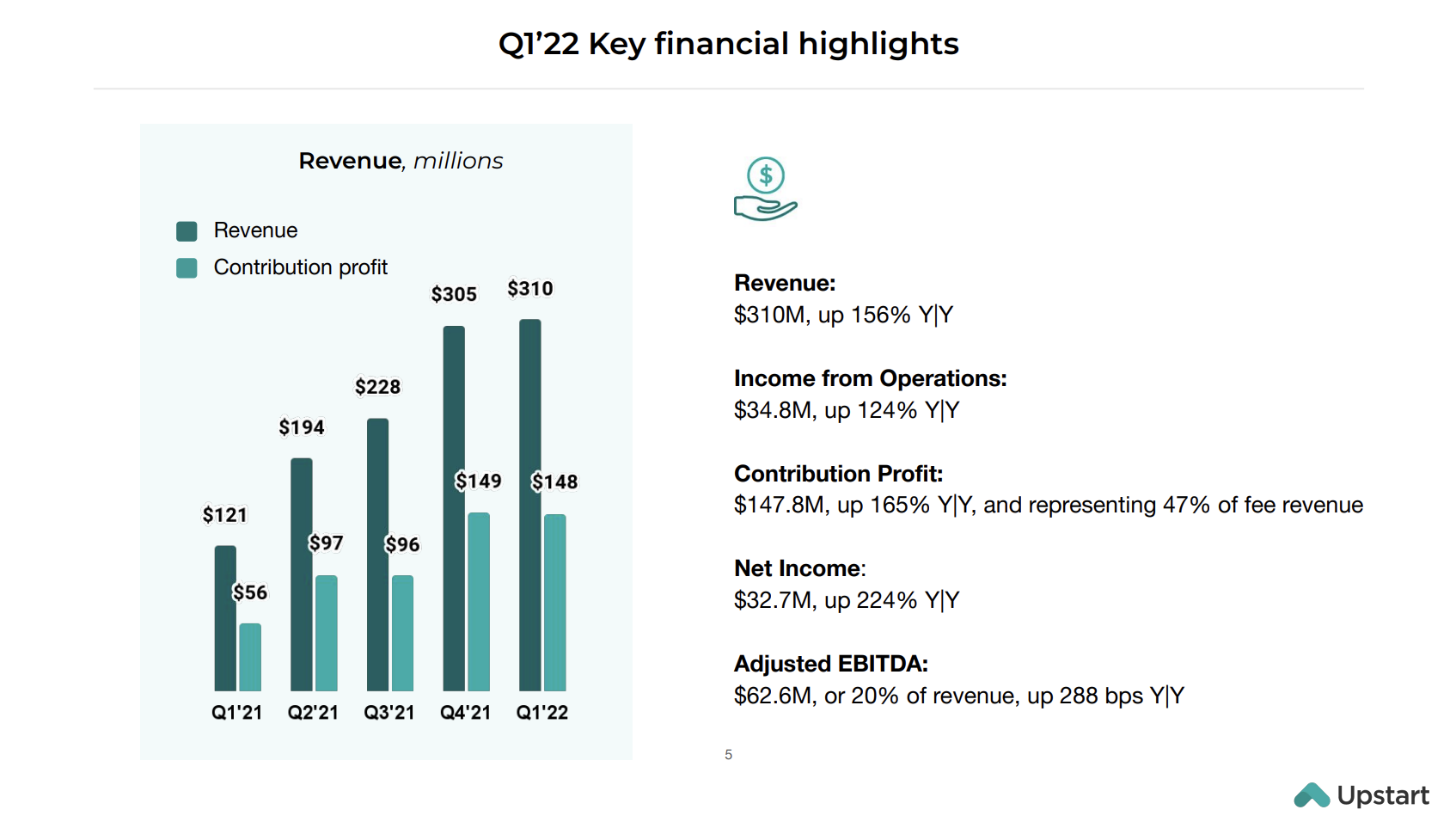

Despite this significant blow to investor confidence, Upstart announced excellent financial results for Q1, 2022, as well as positive news in critical sales areas.

Impressive Q1 2022 Financial Results

- Revenues were up 156% year-on-year at $310m.

- Net income was up by 124% year-on-year to $34.8m.

- The number of loans originated by lending partners rose by 174% year-on-year.

- Contribution Profit – which is a measure of profit that averages out the cost of doing the business – was up 165% at $147.8m.

Borrowers on the Rise

In the five quarters Q1 2021 to Q1 2022, Upstart has increased the number of borrowers it serves by 157%.

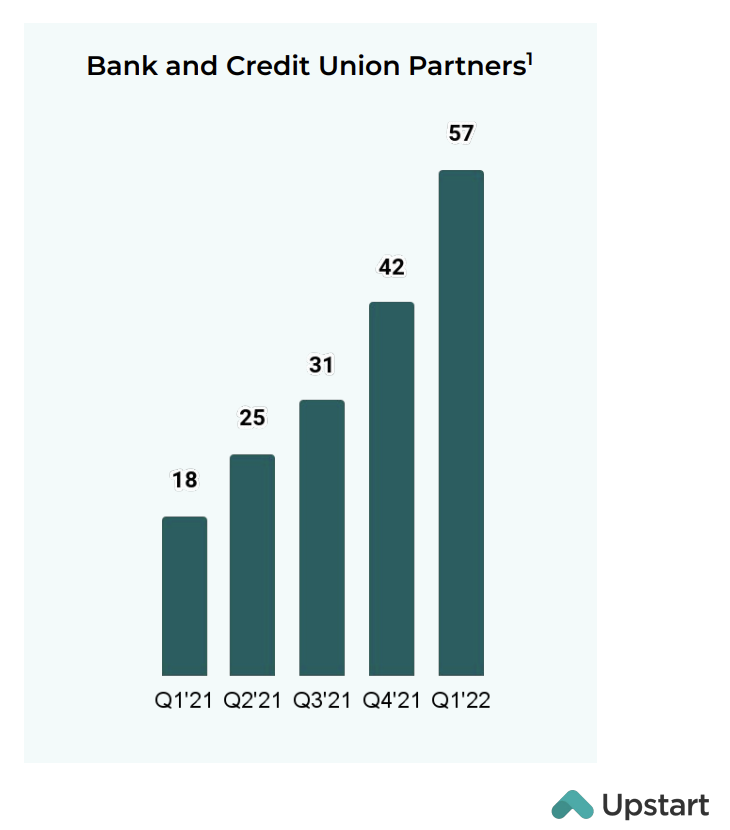

Lending Partners on the Rise

The number of lenders using Upstart has tripled in the 12 months between Q1 2021 and Q1 2022.

Despite the class action hovering over Upstart regarding its AI scoring system, three new lenders have signed up during Q2 2022:

- Firelands Federal Credit Union: personal loans and auto refinance.

- MIDFLORIDA Credit Union: personal loans.

- Mascoma Bank: personal loans.

Upstart vs. FICO

Upstart by name, upstart by nature: the firm has had much success in convincing lending banks that it offers a superior alternative to ‘FICO’, the credit scoring system that is used by 90% of US lending institutions. FICO has been in use for 33 years.

Whereas FICO uses 5 main variables to score a consumer’s credit, Upstart’s AI uses 1,600. The firm explains, ‘Upstart goes beyond the FICO score, using non-conventional variables at scale to provide superior loan performance and improve consumers’ access to credit.’

Instant Approvals on the Rise

74% of Upstart loans were instantly approved in Q1 2022. This is the highest level the company has ever achieved.

- This is a plus for borrowers.

- But, for the banks lending the money, it is not relevant. Indeed, if Upwork’s AI model is flawed (as the CFO implied in May, 2022) then the last thing lenders want is the automatic verification rate to rise. The risk might be that consumers likely to default on loans are mistakenly being given loans.

Auto Loans on the Rise

A key growth sector for Upstart is in auto loans.

Upstart had 162 dealer ‘rooftops’ (ie. car dealer clients) in Q1 2021. This figure had risen to 525 by Q1 2022, with 35 auto manufacturers now using the company’s software.

Step 3: Open an Account

Where to buy stocks is up to the individual investor. Most online brokers nowadays offer a similar onboarding process:

- Sign up

- Verify ID

- Deposit Funds

- Search for Upstart Stock

- Buy Upstart Stock

Investor sentiment

Above we have reviewed where to buy Upstart stock as well as looked at some key financial and operational metrics.

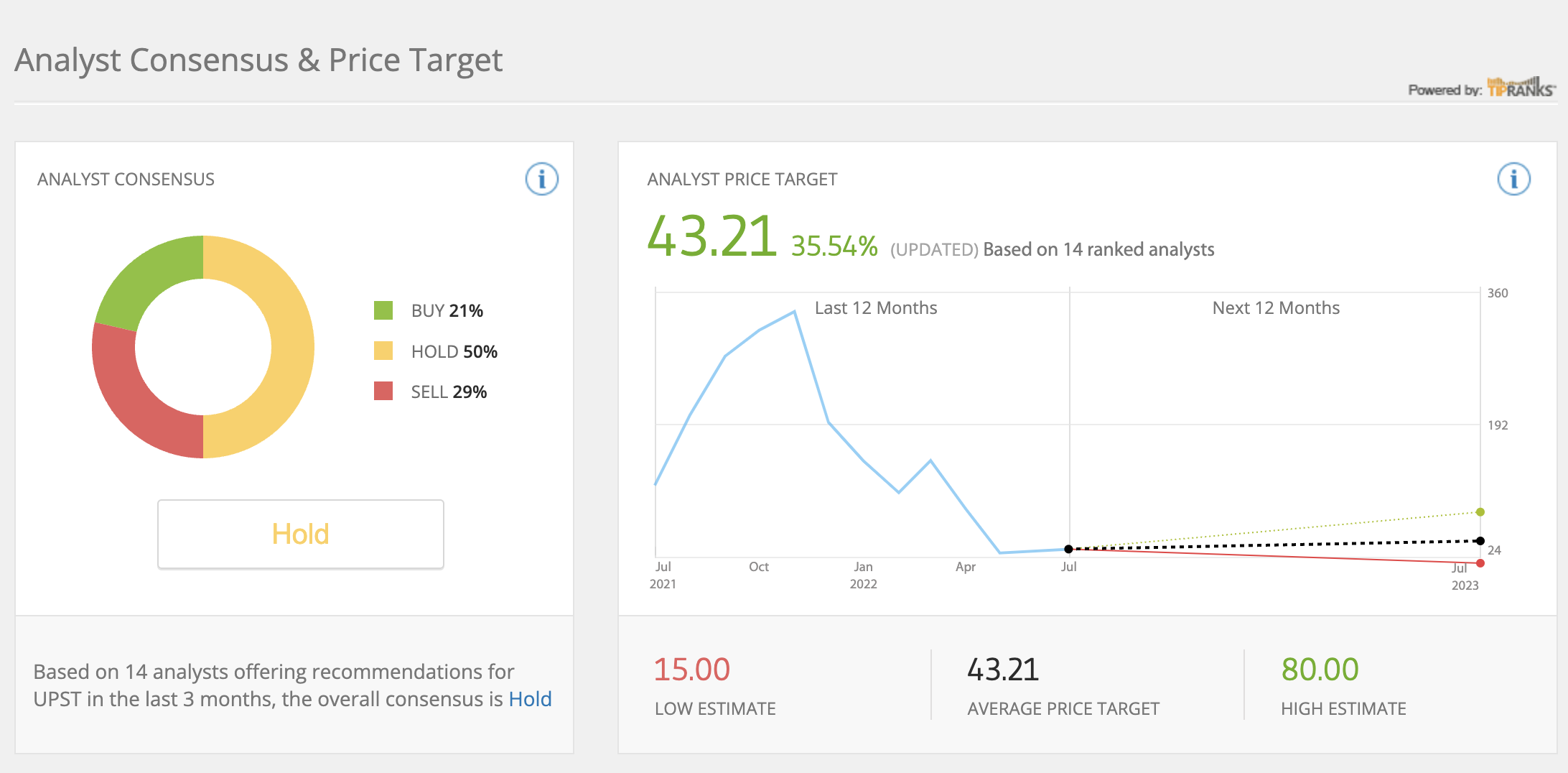

BUY: Experts Neutral to Bullish

Analysts appear to be divided over the prospects for Upstart stock. But the consensus is that the price will rise by 35%+ over the next 12 months.

Of 14 investor notes compiled by eToro:

- 21% are ‘Buy’ recommendations.

- 50% are ‘Hold’ recommendations.

- 29% are ‘Sell’ recommendations.

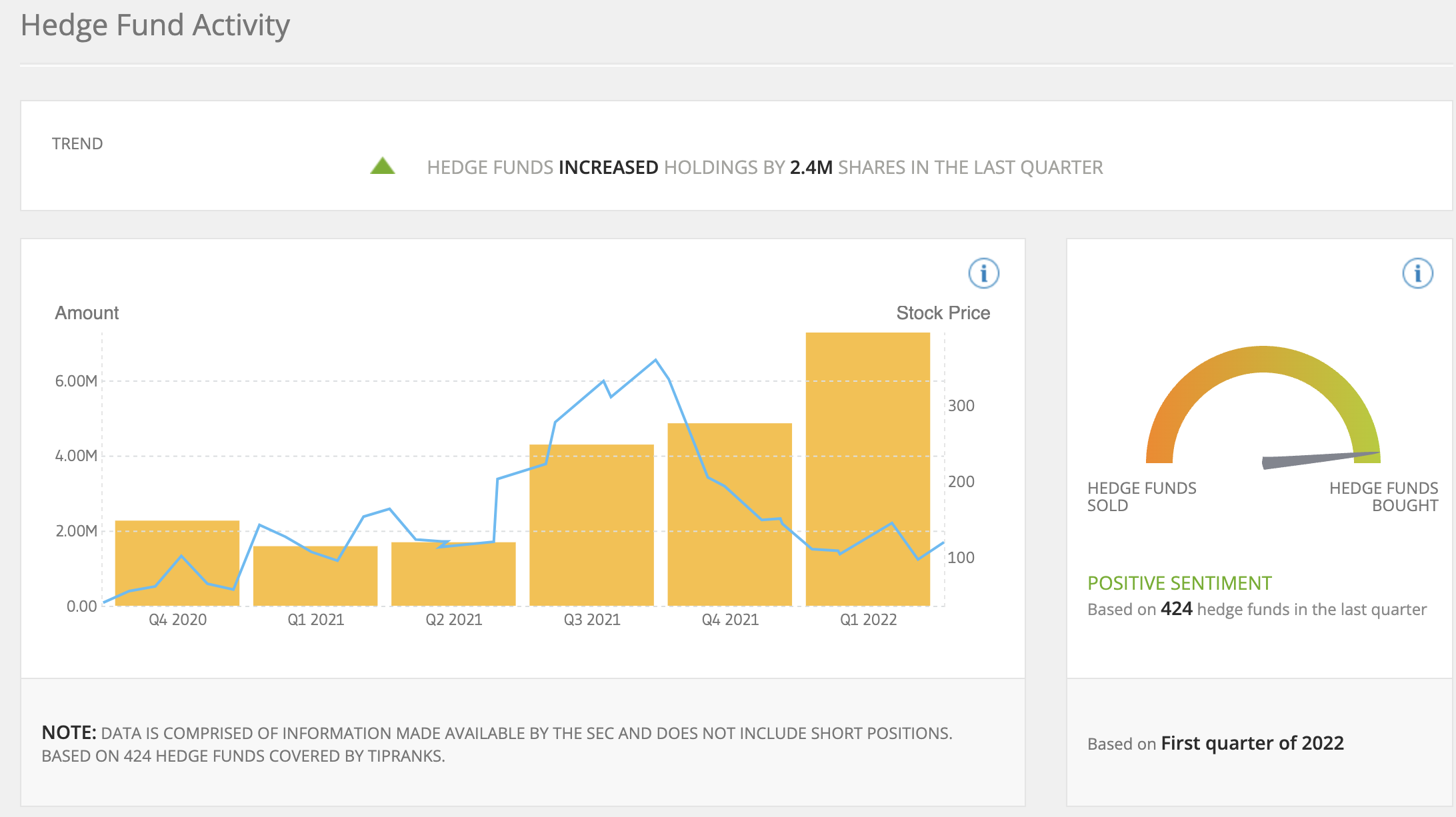

Hedge funds have been more bullish. Hedge fund holdings in Upstart increased by 2.4m shares in Q1 2022.

Even as the Upstart share price (blue line) tanked from Q4 2021 onwards, hedge fund holdings (yellow columns) continued to increase.

SELL: Gloomy Predictions for Q2 2022

It is not only the impending class action that has rattled Upstart investors.

- Upstart has predicted that it will see less revenues in Q2 2022 ($295m-$305m) than it generated in Q1 2022 ($310m).

- The firm also predicts that its contribution margin (which is the average profit per product sold) will decrease from 47% to 45%.

Upstart’s Q2 2022 results will come out on August 9th, 2022. eToro users can simply follow Upstart in their watchlist to receive updates and reminders.