For readers unsure about Exela Technologies as an investment, we pull no punches with our XELA stock discussion below. With its share price down 97% in a year, this small-cap provider of Business Process Automation is under threat of delisting from the Nasdaq Exchange.

What’s more, we pinpoint how to invest in XELA with a regulated broker. We review two popular brokers — eToro and Capital.com. And we begin with a guide showing how to sign up with an online broker and invest in XELA today.

How to Buy XELA Stock with a Regulated Broker in 2023

- ✅Step 1: Open an account with a regulated broker – Heading to your preferred broker’s website and fill in just a few personal details.

- 🔑Step 2: Verification – For regulated brokers to keep fraudsters at bay, investors need to verify their ID as part of the KYC process.

- 💳 Step 3: Deposit – Minimum deposits vary depending on the trading platform.

- 🔎 Step 4: Search for XELA Stock – Pinpoint XELA stock from the supported assets. Just enter its stock ticker in the search toolbar and start researching.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Step 1: Choose a Stock Broker

Investors considering where to buy XELA stock should look out for three things in particular:

1: Thorough Regulation

2: No Commission on Stock Transactions

Brokers must make their money somehow. But, nowadays, investors can hope to be charged zero commission on stock transfers from most popular brokers. Watch out for non-trading fees, though, like deposit and withdrawal fees — as well as the ubiquitous spread fees.

3: Tight Spread Fees

The tighter the spread, the cheaper the deal: this is what investors need to remember. The spread is the difference between the price an asset can be bought at from a broker and the price it can be sold at.

1: eToro

eToro users wanting to invest in stocks can choose from a range of 3,000+. Roughly two-thirds are US-based, with the remainder picked from 15 international stock exchanges.

To beginners and advanced traders alike, eToro offers three key features:

1: Zero Commission on Stock Trades

Investors who buy stocks on eToro pay no commission. Only a spread fee applies. Spread fees vary according to liquidity, but are generally low. Users can get their hands on XELA at a current spread of just 0.26%.

2: Globally Regulated

eToro is regulated in the US by the SEC, FINRA, and FinCEN. In Europe, CySEC is its regulator. The UK’s stringent FCA also oversees eToro — which perhaps explains why eToro is the most popular trading app in the UK. In Australia, eToro is regulated by ASIC.

3: Social Trading

Social Trading is an approach to investing that aims to arm all investors with the facts — as well as linking them to other investors for support.

- CopyTrader is a function that eToro has had in place since 2008. This powerful tool allows users to copy the trades of other users for free. Experienced investors can sign up to be copied and earn rewards. Less confident users can simply allocate some funds, pick a guru, and the software automatically matches the latters’ trades in real-time.

- Smart Portfolios are portfolio positions that each take a unique strategic angle on a particular sector. There are 65+ to choose from, with a minimum investment of $1,000.

CopyTrader and Smart Portfolios are a popular way to learn without trusting to beginner’s luck. And there’s a raft of other helpful tools here too.

We especially like the eToro homepage dedicated to each asset. Each homepage hosts a chatfeed, financial overview, analyst research and charting tools. Useful also is the Watchlist facility, where investors can flag up assets and keep an eye on them.

| Number of Stocks: | 3000+ |

|---|---|

| Pricing System: | No commission. Spread fee only |

| Cost of Buying XELA: | Spread fee of just 0.26% |

| Deposit Fees: | NA (but currency conversion fee applies if not a USD deposit) |

| Withdrawal Fees: | $5 Flat fee |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2: Capital.com

With 400,000 registered users and 90,000 active clients monthly, Capital.com is a much smaller broker than eToro. Like eToro, though, Capital.com is a cinch to use, is extensively regulated and offers zero commission on stock trades. Investors may choose from 5,000+ shares as well as trade opportunities in forex, indices, commodities and crypto.

eToro offers plenty of scope for advanced traders. But, of the two brokers, Capital.com is more suited to investors with some experience — particularly those interested in ‘scalping’ assets.

Scalping is a delicate art. It is not suitable for beginners. Scalping centres on getting in and out of positions swiftly as well as using leverage to maximise gains from small movements in stock price.

- Virtually all trading on Capital.com is offered via CFDs (Contracts-For-Difference). CFDs offer flexibility, because investors can go short on assets. But CFDs come with overnight fees, which apply every 24hrs a CFD is held. This means that investors looking to buy-and-hold any stock from the tech stocks to the oil stocks, for example, are penalised.

- Many stocks on Capital.com are only available for trading with leverage. This means that gains may be made from small movements in stock price. But, equally, losses may be made too.

| Number of Stocks: | 5000+ |

|---|---|

| Pricing System: | Spread fee + Overnight fees for CFDs |

| Cost of Buying XELA: | 11.36% Spread + 0.023% overnight fee |

| Deposit Fees: | NA |

| Withdrawal Fees: | NA |

Note that Capital.com’s spread fees are usually very reasonable. The high spread fee for XELA is a result of its low liquidity as a small-cap stock. Spread fees for Google stock, for example, are currently just 0.07% and, for Microsoft, 0.11%.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Step 2: Research XELA Stock

What is XELA?

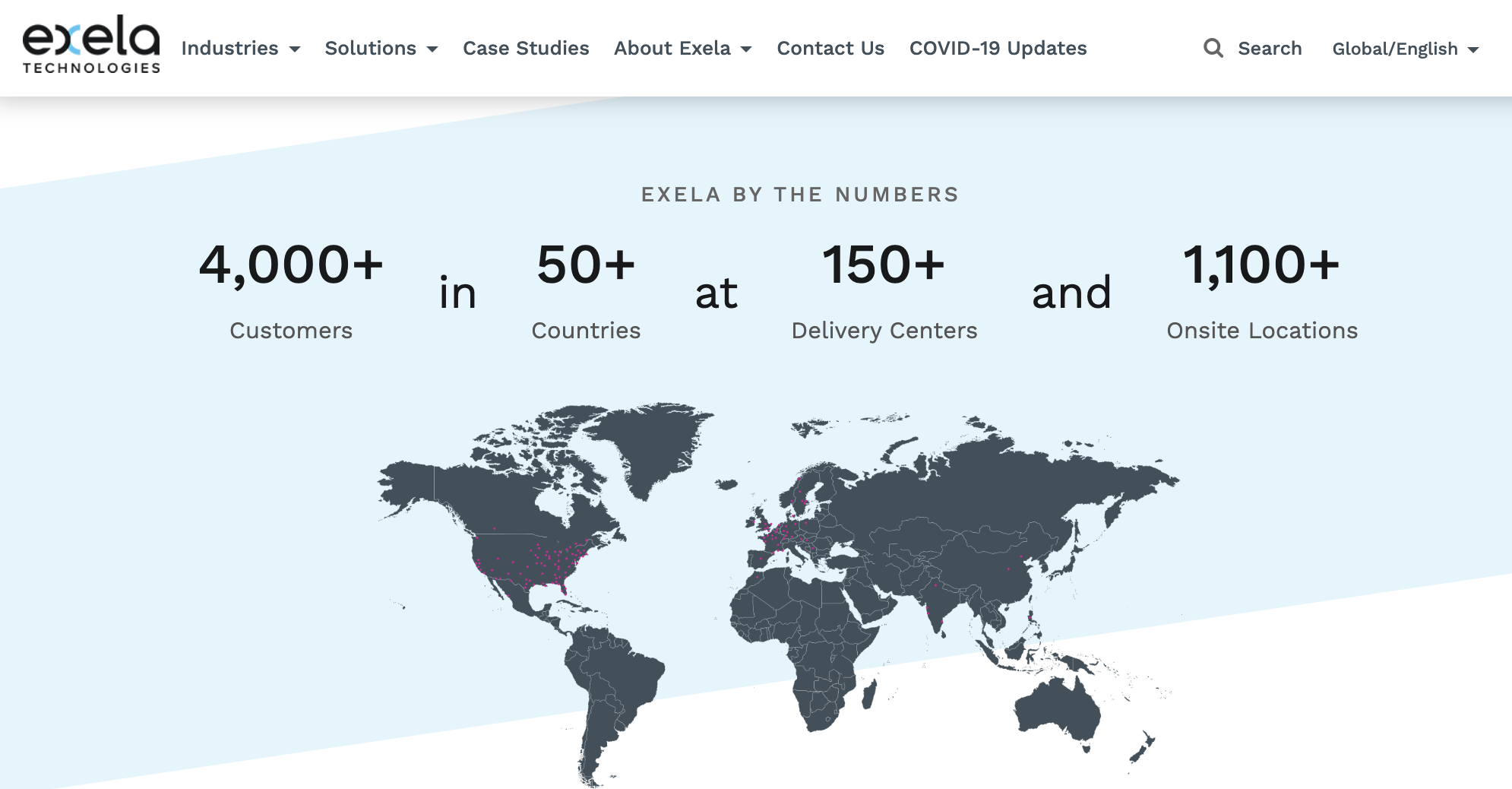

Headquartered in Irving, Texas, Exela Technologies is a small-cap business in the field of Business Process Automation. This means, in a nutshell, that XELA generates revenue by providing solutions to the administrative challenges of other companies.

- 17,000 employees in 23 countries.

- 4,000 clients in 50 countries.

- 40% of companies in the Fortune 100 use XELA.

What Does XELA Do?

As an outsourcing and IT provider, XELA serves corporate and institutional clients from 14 industries across 7 areas:

- Data management.

- Facilities and logistics.

- Finance.

- HR.

- Legal.

- Marketing.

- Back office.

- Customer Service.

For accounting purposes, XELA divides its operations into:

- Transaction Processing Solutions (ITPS).

- Healthcare Solutions (HS).

- Legal and Loss Prevention Services (LLPS).

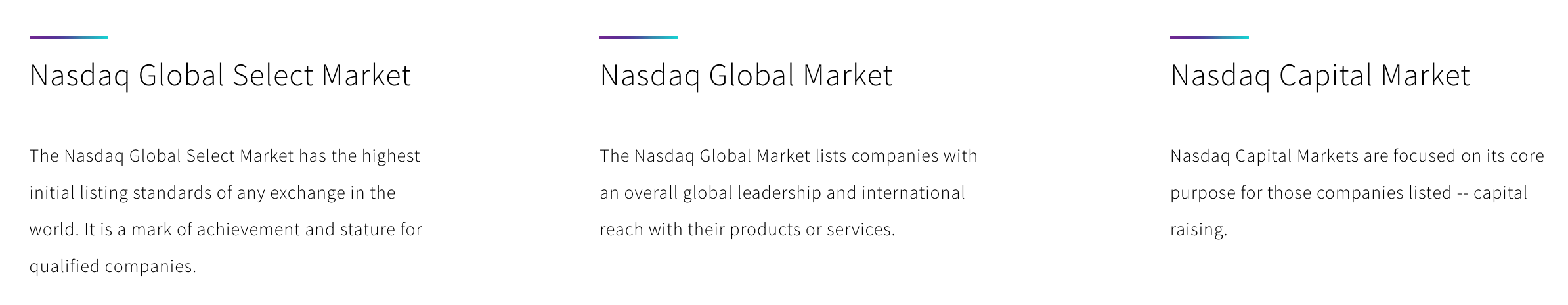

How is XELA traded?

- ‘XELA’ is the stock ticker for Exela Technologies.

- XELA is traded on the US Nasdaq Capital Market (CM).

The tech-heavy Nasdaq Stock Market is arranged in 3 tiers:

- Nasdaq Global Select Market.

- Nasdaq Global Market.

- Nasdaq Capital Market.

(Known as the Nasdaq SmallCap Market until 2005)

The higher the tier, the more exacting the requirements for inclusion. Thus, XELA’s listing on the Nasdaq CM marks it as a low-cap stock looking to raise capital through investment.

- To buy XELA stock, investors do not need to trade directly on the NASDAQ. Instead investors should sign up with a regulated broker like eToro who will conduct trades on their behalf. (We show how easy this is to do below.)

- Investors sometimes refer to Exela stock mistakenly as ‘XELA technology stock’.

XELA Stock Price — How Much is XELA Stock Worth?

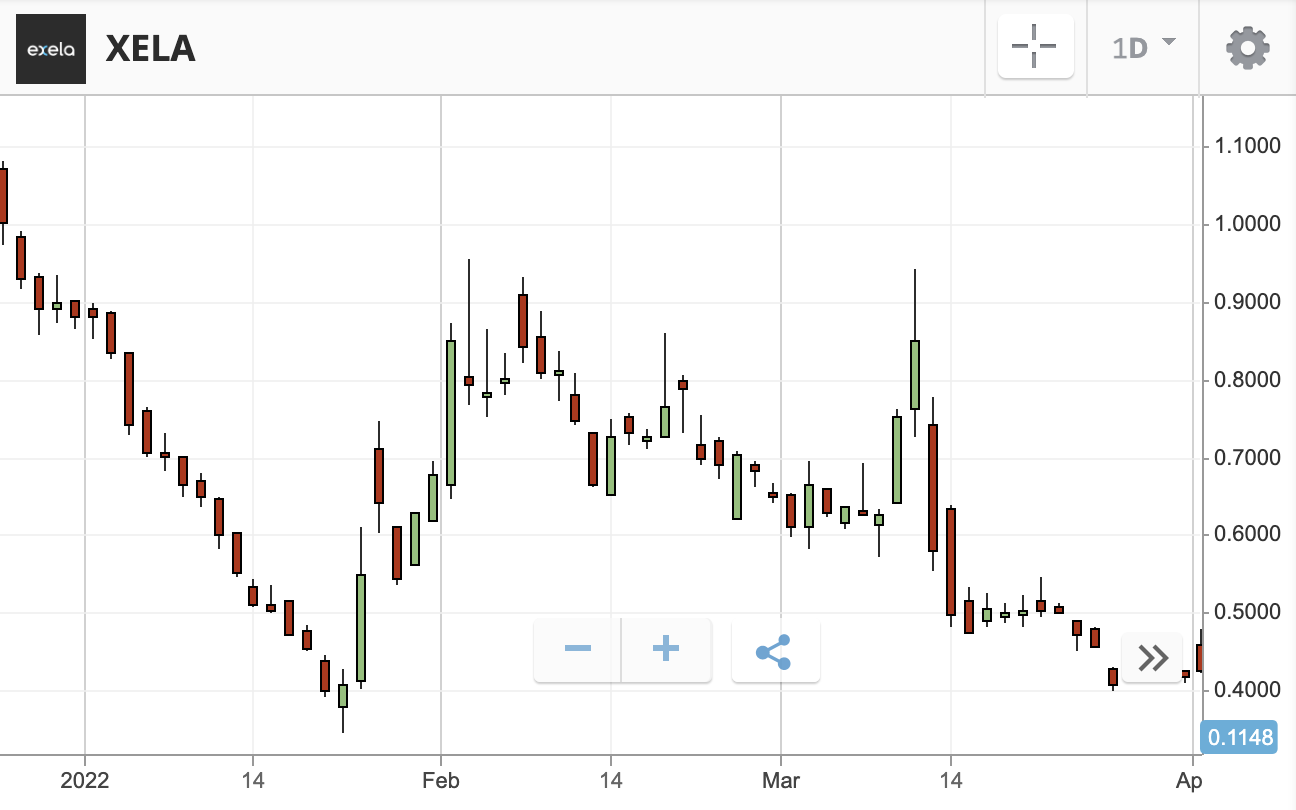

The XELA stock price today is $0.1148. With a value of less than one US dollar per share, this classes XELA as a penny stock. But is it one of the penny stocks? Below we aim to find out.

XELA Stock History

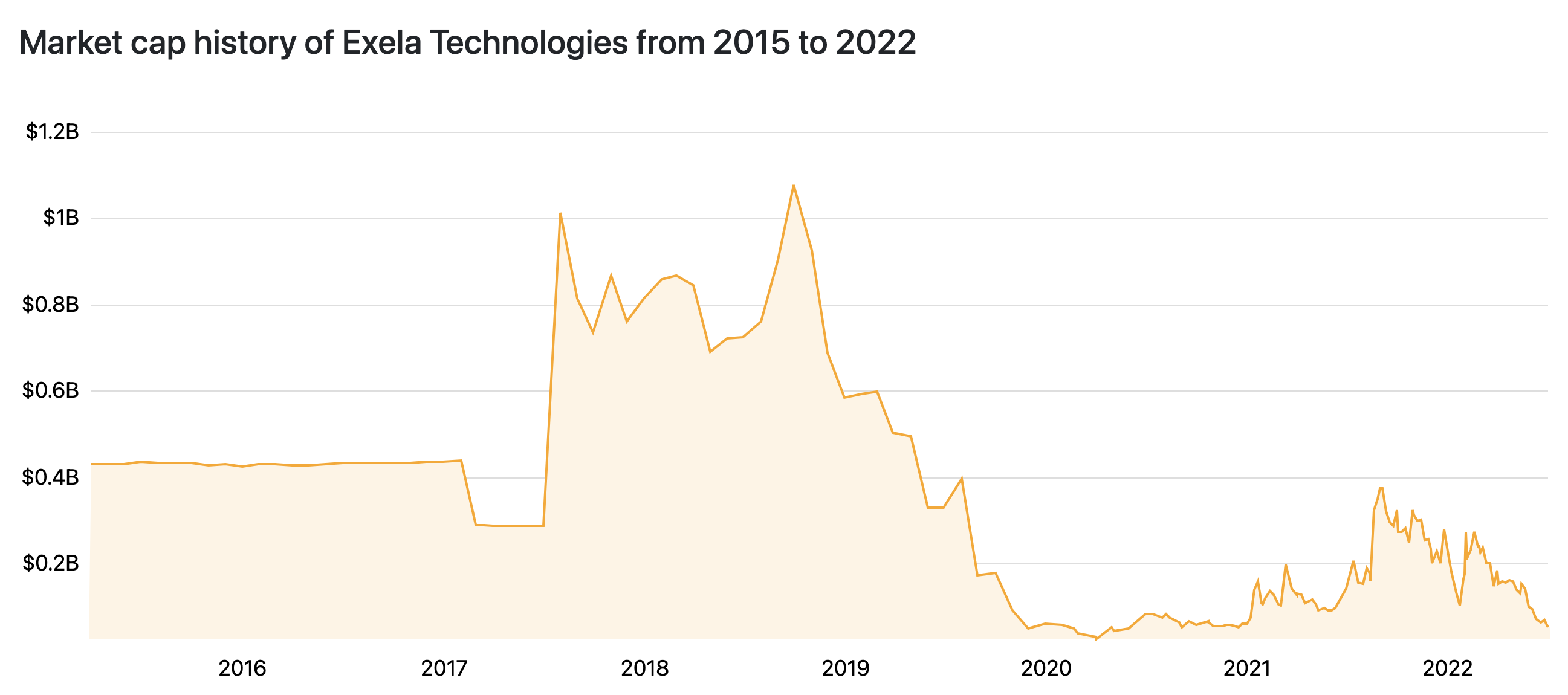

XELA’s market capitalisation is currently not much more than $50m. Its stock value has fallen massively since its heyday of 2019 when it topped $1bn, as we can see from the chart below.

Source: companiesmarketcap.com

In recent highlights:

- XELA’s stock price plunged in late January 2021. XELA closed at at $6.572 on 27th January 2021 and opened on the next day at $2.1136. The firm had just completed a reverse stock split: so, for every 3 shares owned by an investor, they would be left by just 1. This did not boost the share price, as one might have expected.

- Mid-2021 saw a brief revival culminating in a spike above $5 in July. But, since then, XELA stock has been on the decline.

Buy XELA Stock: Three Key Financial Metrics

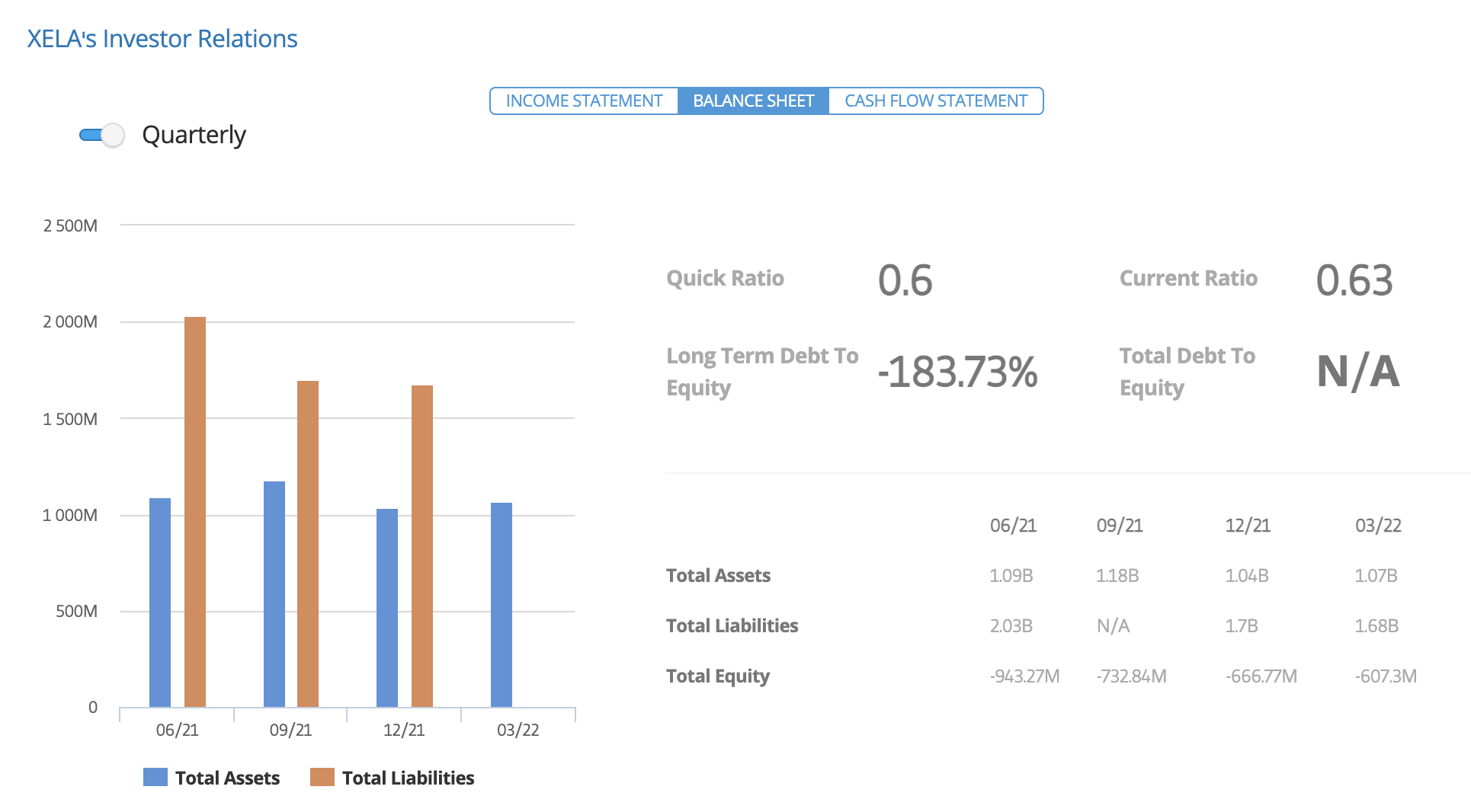

Below we can see the financial summary provided for XELA. From it we can see key metrics. Some are current, and some relate to 2021 annual performance. We can use this summary, as well as the balance sheet and income statement for XELA provided by eToro, to get a picture of XELA’s overall health.

Table: 3 Key Financial Metrics to Assess Any Stock

| Metric | Definition | Indicates approximately |

|---|---|---|

| EPS (Earnings Per Share) | Profit divided by number of shares outstanding | How much profit a company is making |

| P/E Ratio (Price/Earnings Ratio) | Price of a share divided by EPS | How much the company is valued at by the markets |

| Debt-to-Equity Ratio | Total liabilities divided by shareholder’s equity | How much the company is in debt |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

XELA EPS (Earnings Per Share): -0.17

XELA’s EPS figure for Q1 2022 is -0.17. (eToro’s reported EPS in the summary above relates to 2021).

- Any negative EPS figure is a red flag for investors. It means that the company is not making money relative to the shares owned in it.

- This EPS figure represents a 77% increase year-on-year. But it still negative. And, what is worse, the figure came in over 50% lower than analysts’ expected figure of -0.11.

- XELA expects its EPS figure to remain in negative figures until at least 2023.

XELA P/E Ratio: NA

Since XELA’s EPS figure is negative, it does not have a P/E ratio.

The P/E ratio shows how much a company is valued in relation to its profits. But XELA had a negative income of -$57m in Q1 2022, so the figure does not apply.

As with its EPS ratio, XELA’s effectively negative P/E ratio is a sign of financial weakness.

XELA Long-Term Debt to Equity Ratio: -183%

A negative Debt to Equity Ratio means that a company is in trouble.

XELA has more liabilities ($1.68bn) than assets ($1.07bn). And its debt comes with high interest payments.

XELA Stock Dividends

XELA is not one of the dividend stocks. On common stock, it has never paid a dividend.

However, in March, 2022 the firm introduced some Series B stock which now trades under the ticker ‘XELAP’. A dividend of $0.36 per share was paid on this Series B XELAP stock on June 30th, 2022.

XELA Stock – Fundamental Research

XELA faces two critical challenges:

- To avoid a NASDAQ delisting imminent in August, 2022.

- Reduce its debt burden and the crippling interest payments that come with it.

Although revenues have fallen over 2021, XELA has announced a raft of new sales contracts over Q1 2022. It has also taken steps to reduce its debt burden.

Will a Reverse Stock Split Save XELA from Imminent Nasdaq Delisting?

XELA’s spiralling share price has put it in danger of being thrown out of the Nasdaq exchange.

XELA’s current price is just above $0.11. By August 8th, 2022, its closing bid price needs to be almost ten times that at $1.00 for ten consecutive days — or its risks delisting.

During Q1 2022, XELA planned to conduct a reverse stock split to tackle this situation. A reverse stock split is a financial device that reduces the amount of shares outstanding in a company. This can boost the share price. However, the company then announced in early April, 2022 that it was not going ahead with the shareholder vote to approve this stock split.

Then — the U-turn. The vote on the reverse stock split was back on. And, on the June 27th annual meeting, shareholders voted in approval.

The Board of Directors explained in a 2022 statement that, ‘in addition to establishing a mechanism for the price of our Common Stock to meet Nasdaq’s minimum bid price requirement, we also believe that the Reverse Stock Split will make our Common Stock more attractive to a broader range of institutional and other investors.’

Pro-active Steps to Reduce Debt

XELA has been busy trying to placate investors on the one hand, and reduce its debt burden on the other:

- March 22nd, 2022: XELA converted 18m+ common stocks into a new Series B stock (XELAP).

- March 29th, 2022: Paid off a Revolving Loan Agreement dating back to 2017. This was a significant step, as it means XELA will face no significant debts maturing in 2022.

- April 18th, 2022: XELA announced a stock buyback of up to £100m shares. The share value spiked 10% intra-day, but fell back quickly.

- Q1 2022 saw the company reduce its total debt by $35m.

- In Q1 too, XELA took a new $150m securitization facility from PNC, reducing their overall interest burden by $6m annually.

The focus remains on reducing the debt burden, as Executive Chairman Par Chadha explains: ‘Our cost of long-term debt is too high, and it is an important objective for us to lower it … Our plans can now expand to enable refinancing both our long-term debt and our securitization facilities at more attractive rates while continuing to invest for growth in our business.’

Healthy XELA Stock News

Although XELA revenues were down 6.9% year-on-year in Q1 2022, the company has attracted new business and made a big change at the top of the company.

XELA has seen declining revenues since 2018.

Table: XELA Revenues (2017-2021)

| Year | Revenue ($) |

|---|---|

| 2021 | 1.17bn |

| 2020 | 1.29bn |

| 2019 | 1.56bn |

| 2018 | 1.59bn |

| 2017 | 1.15bn |

This long-term decline in revenues has been presided over by CEO Ronald Cogburn. But he left the company in May, 2022. Par Chadha, Executive Chairman has taken up the reins. Maybe this change in leadership will lead XELA onto safer ground?

What’s more, Q1 2022 saw XELA’s Total Contract Value (TCV) increase by over 130% year-on-year. This was XELA’s TCV figure for 5 quarters. TCV measures how much business a company has won. 41 new clients were added in all. Also:

- In March, 2022, XELA also acquired payment platform Corduro and invested in UBERDOC, a medical patient access firm.

- XELA has recently been named as a member of the Gartner Magic Quadrant for Finance and Accounting Business Process Outsourcing.

BUY: Value and Momentum Potential

Two ways of looking at investment are value investing and momentum investing:

- Value investing means investing in the cheap stocks and holding them for the long-term.

- Momentum investing means investing in companies whose share price is on a roll.

XELA: Value Potential?

In late June, 2022, the XELA Board of Directors received approval from shareholders to execute a reverse share split. The exact ratio of this split and the date of its execution has yet to be decided.

The XELA Board is authorized now to execute a share split gearing of up to 1 for 20. This would reduce the number of shares by 20 times. This could well boost the share price well above the $1 mark it needs to reach by late July, 2022 to avoid Nasdaq delisting.

If XELA survives on the Nasdaq, its 130%+ increase in contracts won over Q1 is encouraging. It is fair to say, though, that its historical lack of revenue growth is matched by ongoing unprofitability. Only at a push, therefore, might we consider it as one of the most undervalued stocks.

XELA: Momentum Potential?

XELA’s 52-week high is $5.45. That means that, less than a year ago, this stock was worth 48 times more than it is valued now. We know from XELA’s beta of 1.53 that the stock is volatile (any beta over 1.0 means that a stock is more volatile than the market average).

So, in terms of momentum trading, investors could hope to make substantial gains with XELA if positive news emerges.

From the price chart detail below, we can see for example that, between late January and mid February 2022, the price more than doubled; from under $0.40 to over $0.80.

SELL: Too Risky?

Right now, investors investigating where to buy XELA stock need to be clear that some analysts have suggested it is a very high-risk stock.

With negative Earnings per Share plus a negative Debt to Equity Ratio, this is a company struggling to turn a profit thanks to its debt interest payments. This has resulted in stock price performance so bad that XELA might get kicked out of the Nasdaq.

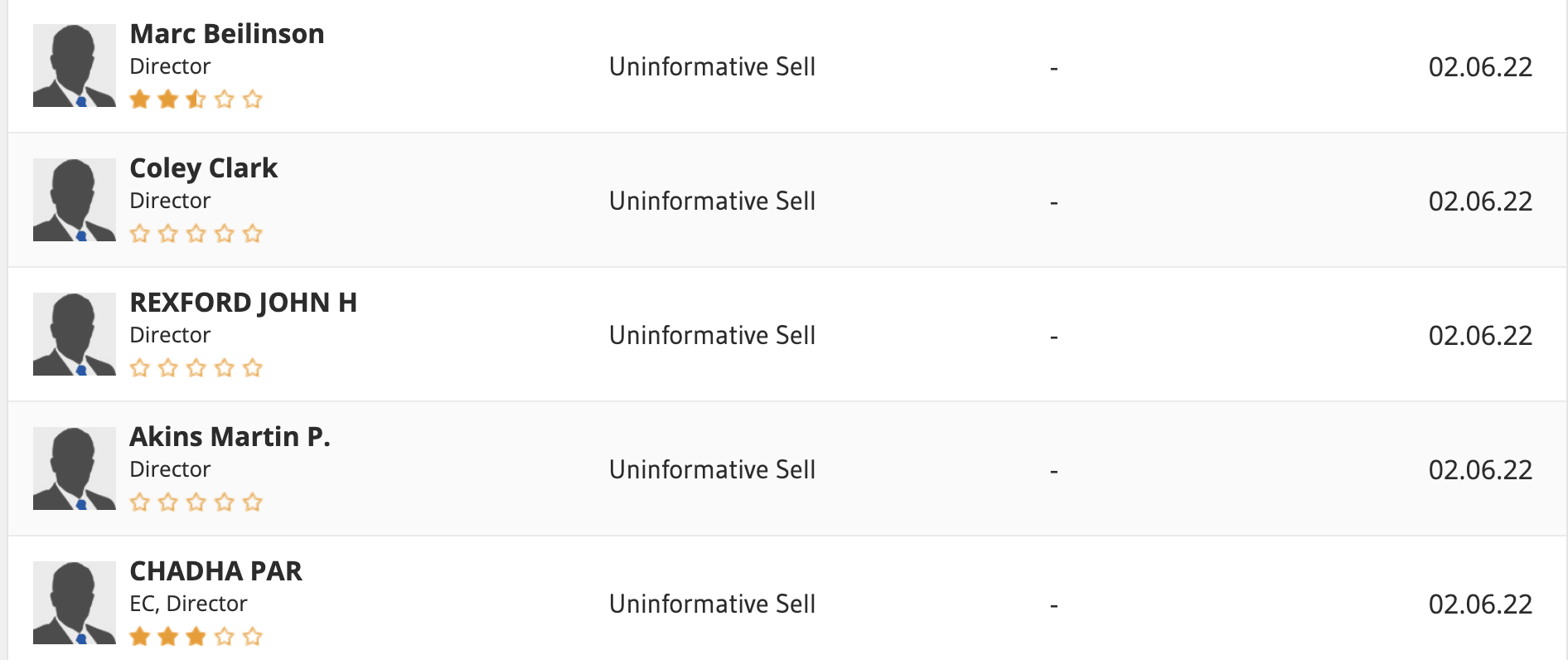

We also note from eToro‘s XELA homepage that no less than 6 XELA insiders sold shares in the company at the beginning of June, 2022.

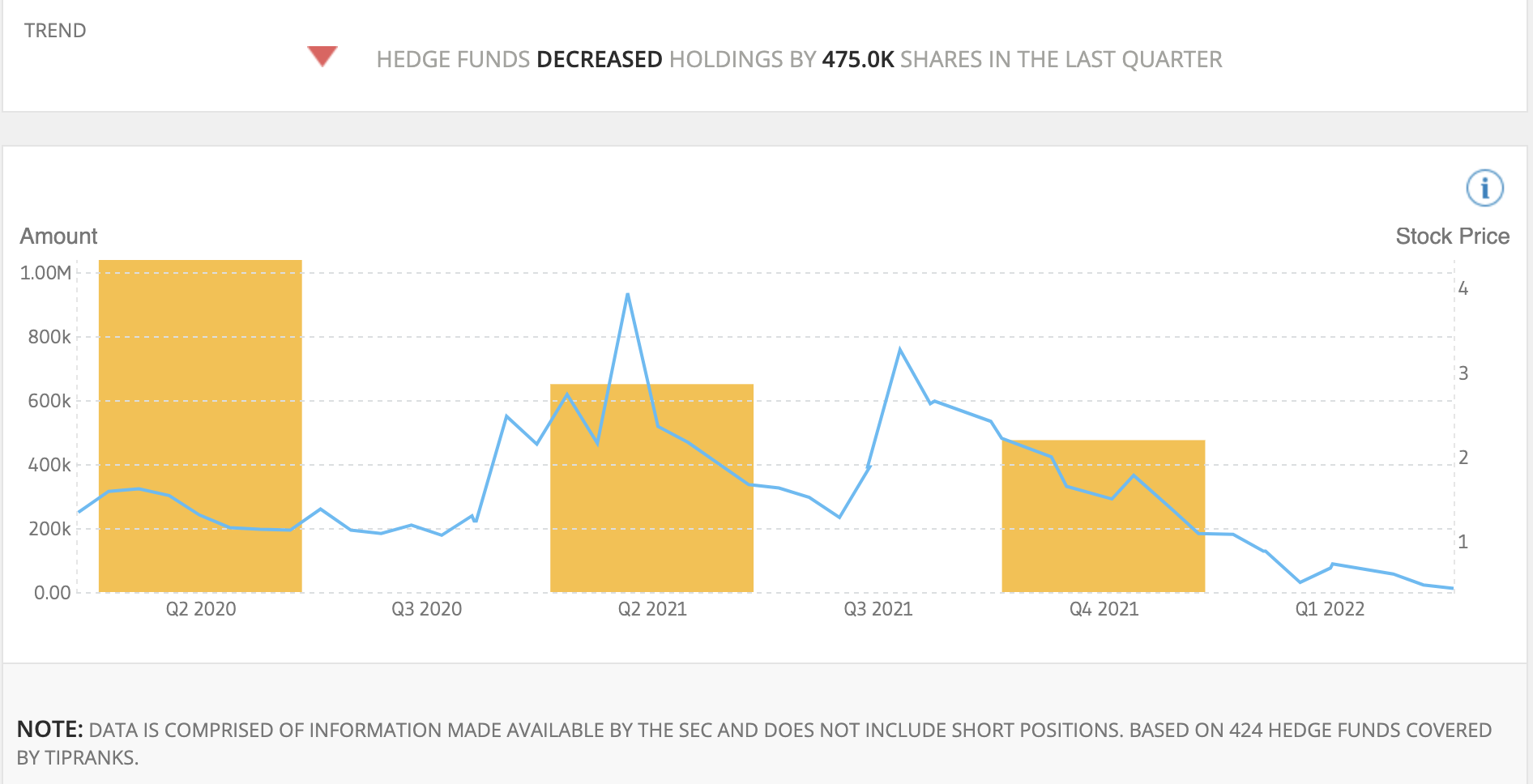

What’s more, hedge funds have been decreasing their holdings in XELA since 2020.

One way of diversifying a portfolio is to spread investments around asset types as well as invest in ETFs, which invest in many stocks at once. Also bear in mind that brokers like eToro provide Smart Portfolios which bring an expert touch to stock diversification.

Conclusion

When it comes to how to invest in XELA stock, we have reviewed two popular brokers: eToro and Capital.com.

Both brokers offer:

- High levels of regulation.

- Literally thousands of shares to trade, as well as other financial assets.

- Zero commission on stock trades.