Looking to get involved with carbon credit trading? Although it’s mostly corporations and sovereign governments trading carbon credits, retail investors can get involved too. The trick is in finding a regulated broker that can offer access to carbon credit futures.

Below we review one such broker – which offers a full range of other commodities and assets too. We further investigate how the big institutions trade carbon credits with a look at a professional carbon credit exchange. Most importantly, we aim to answer the big question: how does carbon credit trading work?

What are Carbon Credits?

Carbon credits are pieces of evidence that one metric ton (1000kg) of carbon dioxide has been removed from the atmosphere.

Key to the foundation of carbon credits was the Kyoto Protocol of 1977. By this agreement, 192 countries agreed to reduce carbon emissions, and carbon credits value was established. A carbon credit became a tradable asset.

What is Carbon Cap and Trade?

A 'cap and trade' policy evolved as a result of the Kyoto Protocol.

- The cap: the upper limit of carbon emissions that any company is permitted to produce.

- The trade: companies may sell carbon credits (if they have a surplus allowance of carbon emissions) or buy carbon credits to raise their cap.

Kyoto allowed for four types of tradable asset:

- AAU: Assigned Amount Units - carbon emissions.

- RMU: Removal Units - carbon removed as a result of land-use or forestry.

- ERU: Emissions Reduction Unit - generated by a joint implementation project.

- CER: Certified Emission Reduction - generated by a clean development project.

Each asset relates to 1 metric ton (1000kg) of CO2.

So initially, carbon cap and trade evolved as a way for businesses to manage their carbon emissions in line with the Kyoto Protocol. The marketplace then evolved as a forum for trading carbon credits as investable assets. Retail investors may now trade the equivalent of carbon credits - just as they might invest in stocks - using a broker like eToro or some of the best futures brokers.

Carbon Credits Explained: Timeline

1997: Kyoto Protocol legitimates the creation and trading of carbon credits.

2015: Article 6 of the Paris Agreement reinforces carbon credit trading between countries to achieve their NDCs (Nationally Determined Contributions relating to carbon emissions). The International Emissions Trading Association (IETA) estimates that carbon trading according to Article 6 could be saving countries $250bn a year by 2030.

2021: The Glasgow Climate Pact is signed at the UN's Cop 26 (Conference of the Parties). One of its resolutions is to organize a global carbon credit trading market.

What is Carbon Capture and Sequestration?

- 5bn tons of CO2 must be removed from the atmosphere every year until mid-century if we want to limit this temperature rise to 1.5C.

'Carbon capture and sequestration' describes one way of reducing the amount of carbon dioxide in circulation. This process tackles industry in particular. It involves capturing the carbon dioxide produced in industrial processes, transporting it, and storing it safely.

Many other ways of reducing the amount of CO2 in the atmosphere are underway, including:

- Afforestation: planting more trees.

- Direct Air Capture (DAC): Removing carbon dioxide from the air with machines.

- BECCS: BioEnergy plus Carbon Capture and Storage.

How does Carbon Credit Trading Work?

Corporations can trade carbon credits using a carbon credit exchange like CTX reviewed below.

For retail investors, some online brokers offer a rare chance for users to invest in carbon credits. With a broker like eToro, for example, trading carbon credits works like trading other investable assets.

Carbon trading credits are offered as Contracts-For-Difference (CFDs) or as carbon credit ETFs. The use of CFDs means that investors have two key options when they sign up with one of the best CFD brokers:

- They can choose to 'go long' - which means invest in the hope that the price will rise.

- Or they can 'go short' - which means invest in the hope that the price will fall.

CFDs also allow the investor to leverage their trade. This means effectively borrowing money from the broker to amplify the impact of the initial investment (which is called the 'margin'). Leveraged trading is high-risk, and is not recommended for newcomers to investing.

A Closer Look at Carbon Credit Trading

To get started in carbon credit trading, investors need to get one thing clear: carbon credits are often traded as futures.

Carbon Credits Futures Trading

Futures are a financial instrument that are priced according to how the market thinks an asset will be priced in the future. Nowadays investors can buy futures contracts as easily as if they were to buy Apple stock, for example.

Examples of Carbon Credit Futures include the California Carbon Allowance (CCA) Futures Contract, the European Union Allowance (EUA) Futures Contract and the Regional Greenhouse Gas Initiative (RGGI) Futures Contract.

Full-blown futures contracts can get complicated. So it is wise for beginners in particular to stick with the simple presentation of them offered by brokers like eToro - or opt to buy into popular renewable energy stocks instead.

Trading Carbon Credits - Simple 4-Step Process

The investor:

- Signs up with a broker like eToro; other brokers are available.

- Deposits funds. With eToro, for example, credit card, wire transfer and a range of payment wallets are accepted.

- Invests in a carbon credit. With eToro, carbon credits are offered as a single commodity. The investor needs to instruct the broker to either 'go long' or 'go short' and eToro will then hold the asset on behalf of the investor.

- Sell the carbon credit. When the time is judged to be right, the investor can sell the CFD back to the broker - hopefully at a profit.

Trading Carbon Credits - Example

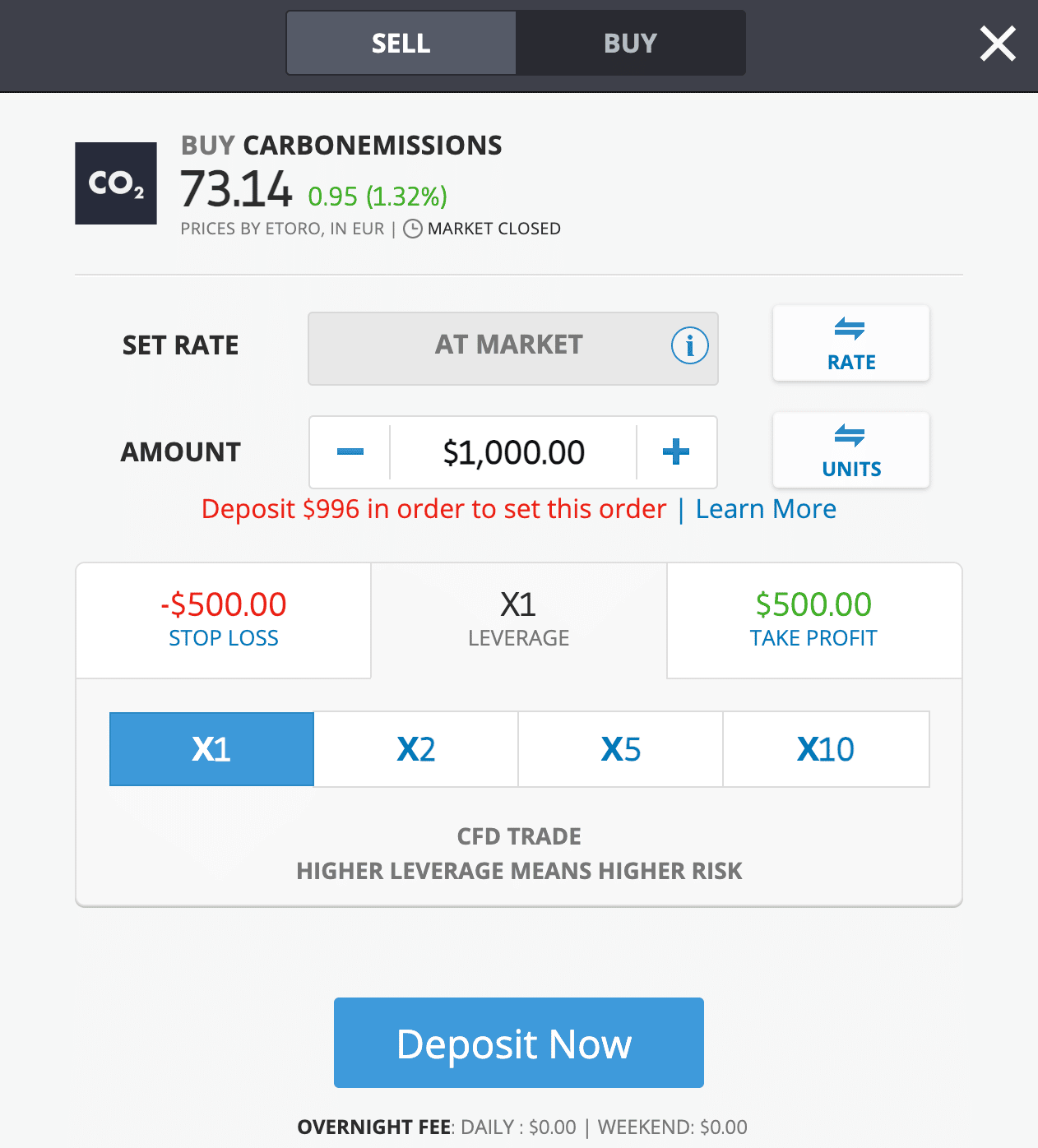

Investors with eToro can trade off the carbon market by buying into eToro's 'CarbonEmissions' commodity.

We can see from the image above that this asset is offered with a spread of $0.24, which is roughly 0.3% of the price at which it can be bought.

The investor needs to sign up with eToro, deposit funds and then search in eToro's top toolbar with the search term 'carbon'. The asset can also be found by heading to the 'Commodities' section.

Offered as a Contract-For-Difference (CFD), this asset can either be bought with the expectation that it will rise in value (BUY) - or invested in as a SELL with the expectation that it will fall in value.

A minimum investment of $1,000 is required. But investors may invest as little as $100 and apply x10 gearing to achieve the minimum. This involves effectively borrowing money from eToro, and is not recommended for beginners.

Risks of Carbon Credits Trading

The risk with carbon credits from an environmental point of view is that the credits themselves are generally offsets. This means that somewhere along the line, carbon dioxide has been removed from the atmosphere. But the same company which has invested in this removal may well be churning out carbon dioxide at a rate of knots.

For investors, there are two main risks with carbon credit trading:

1. Price Volatility

As we can see from the eToro price chart below, carbon futures are as volatile in terms of price as other commodities.

- On 22nd August, 2022, the price opened over $98.

- On the 16th September, 2022, the price opened under $73.

- That is a fall in value of over 25% in just 3 weeks.

- That fall follows a sharp increase of value of 22% between 28th July and 22nd August.

Any investment in commodities - including carbon credits - should be balanced by investment in financial assets with much lower risk and price volatility. Investors can for example buy stocks on eToro to balance their risk, as well as research how to trade ETFs.

2. Uncertainty Over Regulation

Currently the voluntary carbon credits market is fragmented geographically, with different markets operating in Europe, the US and even California having its own sector. Without a centralized market, there is always the risk for investors that certain markets will fall out of favour, and prices will drop.

When it comes to accreditation, numerous independent bodies are involved, including:

- Verra's Verified Carbon Standard (VCS): based in the US, Verra is considered to be the top accreditor. Verra is responsible so far for having accredited the removal of 630m tons of carbon dioxide.

- Gold Standard has issued more than 125m carbon credits from projects based across 60+ countries.

- Climate Action Reserve (CAR) is a US body responsible for over 150m carbon credits.

Other accreditation bodies exist. Confusing the issue too is that many carbon offset programs and projects are touted as being in alignment with UN Sustainable Development Goals. And the result is a grand mess of conflicting authorities.

The risk for investors - particularly large scale investors - is that accreditation bodies may fall out of favor, and the credits they have authorized will become less valuable.

Why Trade Carbon Credits?

The reason to trade carbon credits depends on who is doing the trading:

- Sovereign governments can move towards fulfilling their climate change obligations by buying carbon credits. And countries with a head-start in environmental issues can gift their advancements to other nations using carbon credits.

- Corporations can buy carbon credits to offset carbon emissions their businesses produce unavoidably. They can also make money by selling credits which show that their business has successfully removed carbon from the atmosphere.

- Retail investors can theoretically buy and hold carbon credits to offset their own carbon footprint. But it is much easier to sign up for a monthly subscription with one of the many firms that offers carbon offsets for consumers, like Ecologi, CarbonClick, Climeworks and Wren.

As an alternative to trading carbon credits directly, retail investors can also check out the most popular carbon credit ETFs. These offer exposure to the carbon market, and often other ESG (Environmental, Social and Governance) commodities like clean wind, solar and geothermal energy.

Similar opportunities exist with popular sustainable investing funds.

Where to Trade Carbon Credits with Low Fees

Retail investors may trade a form of carbon credits using any popular carbon credit broker.

Below we review eToro - a popular broker which offers access to the carbon market - as well as cast an eye over the Carbon Trade Exchange, where institutions can offer up and trade carbon credits.

1. eToro - Full-Service Broker Offering Zero Commission on Stocks and ETFs as well as Copy Trading

For the environmentally-conscious investor, eToro offers further ESG investing opportunities:

Clean Energy ETFs - like the iShares Global Clean Energy ETF. This is a tracker ETF which follows the S&P Global Clean Energy Index. It has 138 holdings in companies involved in clean energy.

The Renewable Energy Smart Portfolio - this is a strategic portfolio position that investors can buy into on a rolling basis featuring shares in renewable energy companies. Its top holding of 30 equities is a 7.27% allocation to Gevo Inc. - a US company which develops bio-based alternatives to gasoline and diesel. (Note that eToro's Smart Portfolios work differently from ETFs, and a minimum investment of $500 applies.)

Clean Energy Shares - A number of individual shares in clean energy firms is available, including Enphase Energy (ENPH), FuelCell Energy (FCEL) and Ballard Power Systems (BLDP).

eToro is considered one of the most popular copy trading platforms. eToro's CopyTrader function allows investors to copy other traders' activity - in eToro's case, for free.

| Fee Model | Spread Fee (zero commission) |

| Deposit Methods | Credit card, buy stocks with PayPal (Europe only), wire transfer |

| Deposit Fees | NA but currency conversion fee applies if depositing other than USD |

| Tradable Assets | One Carbon Emissions Future, stocks, ETFs, indices, commodities, crypto |

| Cost of Investing in Carbon Emissions Future | Spread Fee + minimum investment of $1,000 (can include x10 gearing) |

78% of retail investor accounts lose money when trading CFDs with this provider.

2. Carbon Trade Exchange (CTX) - Carbon Trading for Corporates

Founded in 2009, CTX caters for the professional market in voluntary carbon credit trading. The company launched in London, then Sydney in 2010. CTX was granted an Australian Financial Services License (AFSL) in 2012. The CTX group of companies is responsible since 2009 for the offsetting of over 100m tonnes of carbon dioxide.

CTX is a members-only exchange. Its members number brokers, project developers and big corporations. Annual membership fees apply ($1250 for small companies, $1995 for large corporations). The exchange promises that sellers 'receive 95% of proceeds' when selling carbon credits, which equates to a 5% selling fee.

Members may offer up carbon credits their company has earned, as well as buy credits that other companies have earned. CTX is connected to registries in 4 continents: Europe, US, Africa and Asia. Five types of carbon credit are traded:

- EUAAs (EU Aviation Allowances).

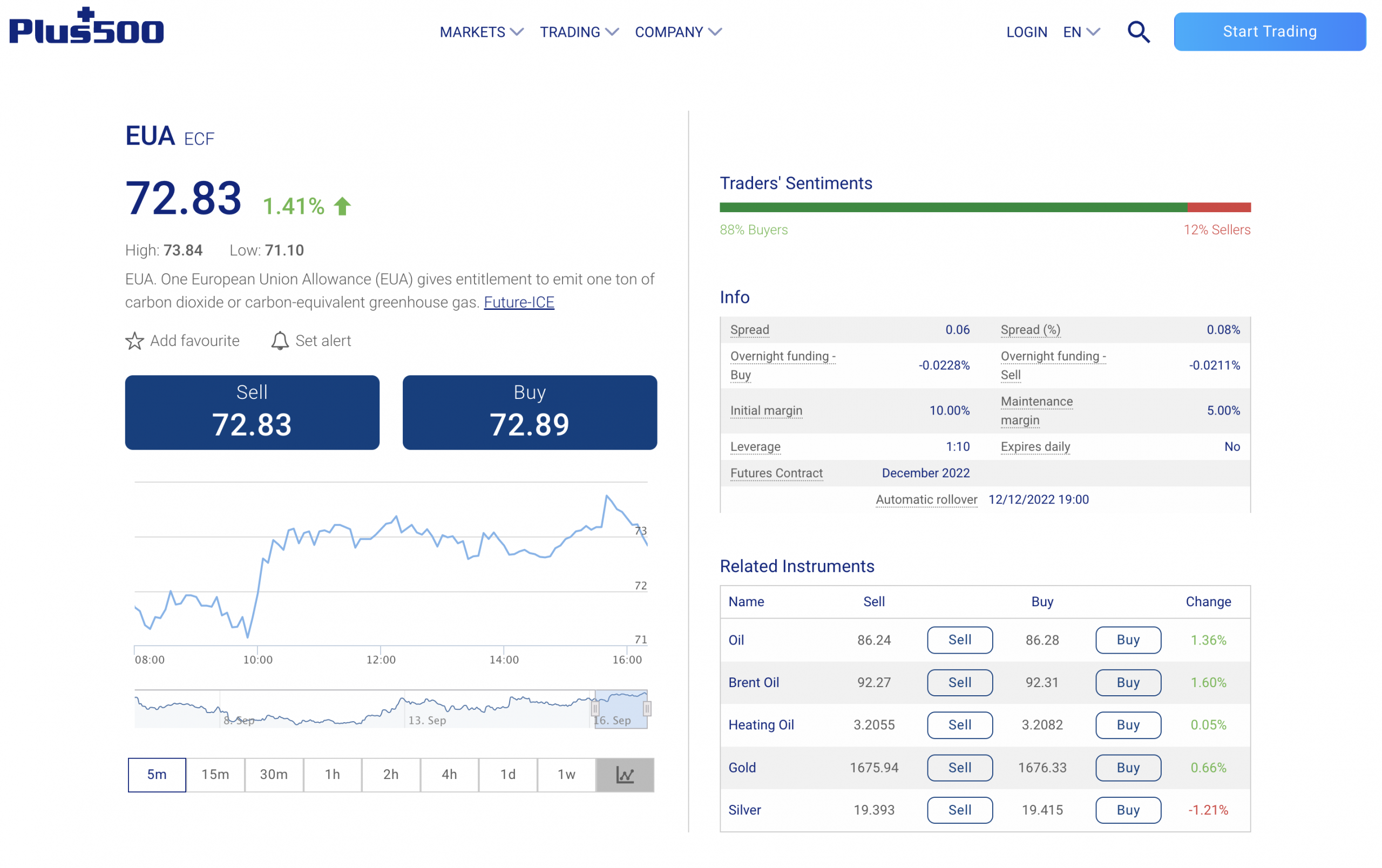

- EUA (EU Allowances) - retail investors can trade these with broker Plus500.

- VCUs (Verified Carbon Units).

- CERs (Certified Emission Reductions).

- VERs (Voluntary Emission Reductions).

Credits traded here must be accredited by one of the top carbon verification bodies: Verra VCS, Gold Standard, ACR, CAR and the United Nation's Clean Development Mechanism (UNFCCC). In 2017, CTX was the first exchange to secure the right to interface with the UNFCCC.

A minimum trade of a lot of 100 tons of CO2 applies. Other carbon exchanges set a higher minimum of at least 1,000 tons.

| Fee Model | Membership fees: Small companies and project developers - $1250 per annum Large Corporations - $1995 per annum Selling Fee: 5% on credit sales |

| Deposit Methods | Bank transfer to escrow |

| Deposit Fees | Varies |

| Tradable Assets | Carbon credits verified by Verra VCS, Gold Standard, and the UN CDM |

| Cost of Investing in Carbon Emissions Future | Annual Membership Fee plus Trading Fee |

How to Trade Carbon Credits - Step-by-Step Guide

Professionals and companies may trade carbon credits and other ESG commodities on exchanges like:

- Carbon Trade Exchange (based in Europe and reviewed above).

- Xpansive CBL (based in New York).

- AirCarbon Exchange (based in Singapore).

(ESG commodities are commodities which relate to Environmental, Social and Governance objectives. CO2 is a key ESG commodity, because reducing CO2 is seen to be a key environmental responsibility).

But what about retail investors? Some popular investment apps like eToro and Plus500 offer carbon futures contracts for trading.

The process to trade carbon credits involves four simple steps:

- Sign up with a Broker that Offers Carbon Credit Products.

- Deposit Funds.

- Buy Into a Carbon Credit Futures Contract.

- Sell Your Contract.

78% of retail investor accounts lose money when trading CFDs with this provider.

Below we use the example of broker Plus500 (with whom we have no ties) as a generic example of how easy it is to get started with carbon credit trading:

Sign up with a Broker

Investors need to supply a few personal details first. Then they will be required - with regulated brokers - to provide proof of ID and address. This process is managed by either scanning or uploading documents, or by using one's desktop/phone webcam to photograph them.

Deposit Funds

Brokers make it easy for investors to deposit funds - as otherwise they cannot do business!

- Plus500, for example, accepts debit/credit cards, electronic wallets PayPal and Skrill and bank transfer.

- eToro, for example, accepts debit/credit cards, a range of electronic wallets, and bank transfer.

Buy into a Carbon Credit Futures Contract

With Plus500, investors can buy into a futures contract based on one European Union Allowance (EUA). This 'gives entitlement to emit one ton of carbon dioxide or carbon-equivalent greenhouse gas'.

Note that a spread fee of 0.08% applies. In other words, there is a 0.08% difference between the price you can buy at and the price you can sell at - at any given time. Also, overnight fees apply because this is a Contract-For-Difference (CFD).

Sell Your Asset

Investors may sell their asset at any time during which the markets are open.

- Simply access your onsite portfolio, select the asset, and execute a 'Sell' order. This process varies from broker to broker, but is fundamentally the same.

Conclusion

eToro offers a great way for retail investors to get started in carbon credit trading with zero commission charged on trades (although spread and CFD overnight fees apply).

The broker offers a way for private investors to get a piece of the carbon market which is otherwise limited to institutions and even sovereign governments.

And, because eToro provides a suite of other commodities as well as stocks, ETFs, and proprietary Smart Portfolios, the smart investor can balance their investment in carbon and spread their risk sensibly.

78% of retail investor accounts lose money when trading CFDs with this provider.