The Inflation Reduction Act, a comprehensive tax, health, and environmental bill, was approved by the US Senate in August 2022. The plan calls for record spending of $370 billion on energy and environmental measures. Some climate change stocks will invariably benefit from this investment.

Therefore, this guide will explore 11 popular climate change stocks to watch in 2023. We look at a range of metrics, from the ESG rating and key partnerships to the business model of the company in question.

Below is a list of considerations for those keen on investing in climate change stocks. As is clear from the list above, potential investments in this space include smart storage providers and wind and solar generators, in addition to well-known alternative energy stocks like Tesla. We analyze each of the above-listed ESG investing stocks in full next to help investors choose the right option for their own portfolio of assets.

Some governments are investing billions of dollars in fighting climate change. This – as well as the social and environmental responsibility aspect, is leading some investors to buy climate change stocks. There are many companies that focus on creating a cleaner planet. To aid the research process – we’ve analyzed a list of popular climate stocks to watch in 2023. This includes companies that are involved in various aspects of reducing the impact of global warming. The IMPT project offers investors an alternative to climate change stocks. IMPT is a carbon-neutral platform that was created using blockchain technology. As such, users benefit from greater project security and transparency. Polygon, one of the greenest blockchains, is the foundation for IMPT. Furthermore, the IMPT whitepaper states that this initiative provides each user with a range of ways to obtain carbon credits. Both businesses and climate-change-conscious individuals are able to use the platform. To assist customers in offsetting their carbon impact when shopping, IMPT has worked with more than 10,000 of the world’s largest retailers and brands. The consumer can select brands based on how effectively they reduce CO2 emissions. Moreover, IMPT will provide points and incentives that users obtain for making a beneficial impact on the environment. In fact, points will be awarded to users for a variety of actions taken on the platform. Users can purchase carbon credits with the IMPT tokens they earned through their purchases. Once they have reached the required amount, they will receive a carbon credit NFT with the appropriate value. Anyone can visit the IMPT platform and purchase IMPT tokens using cryptocurrency or fiat money such as US dollars. The user can gather these IMPT tokens and then use them to purchase carbon credits. There is also the option of selling or keeping carbon credits as an investment. Furthermore, this climate-change focussed project compensates users for retiring their carbon credits. Additionally, users can select from hundreds of environmental initiatives that have already been vetted on the IMPT platform. Overall, this climate change focussed social platform encourages and rewards people and businesses for taking better care of the environment. IMPT also includes it in its roadmap that it aims to create a score to allow everyone to better gauge their individual carbon footprint impact. Users of the site will be able to measure and track their influence using various ranks and levels. More information is available about the product on the IMPT Telegram channel.

As one of the best renewable energy companies in 2023 NextEra Energy was founded in 1984 and is the largest producer of renewable energy, inclusive of wind and solar, worldwide. Florida is the main location of its power plants, however, it also manages other parts of the power resource system. In addition to selling to end users, NextEra Energy trades under PPAs. This is one of the renewable energy stocks to watch as it anticipates a cleaner future and consistently invests in climate change to make it happen. In fact, NextEra Energy has published its Zero Carbon Blueprint, with a set goal of operating Net Zero by 2045. This is a thorough strategy that has been created to drive the $4 trillion market opportunity for decarbonizing the US economy and substantially enhancing the deployment of renewable energy. In five years of trading, and based on its price at the time of writing, NextEra Energy stock has increased by almost 126%. Furthermore, by increasing its yearly dividend rate for more than 25 years in a row, NextEra also received the aristocrat distinction in 2022. The latest dividend payment distributed to investors was $1.70 per share. MSCI ESG Rating: AA

78% of retail investor accounts lose money when trading CFDs with this provider. Tesla was founded in 2003 and needs little introduction to anyone researching climate change stocks. This company designs and manufactures a range of electric vehicles (EVs) and also concentrates on energy generation and storage. We touched on the Inflation Reduction Act earlier, and this also includes credits for individuals looking to reduce their carbon footprint by buying EVs. Specifically, a tax credit of $4,000 is offered for those buying a used EV, and $7,500 is offered to those purchasing a new model. For obvious reasons, this could be a potential benefit for EV manufacturers like Tesla. With a 68% share in the first half of 2022, Tesla leads and controls the US EV market and enjoys the highest brand support in the sector. The company has a longer waiting list for its EVs than any other US company in the sector. For instance, the company’s Cybertruck is sold out until 2027 and has between 1.2 and 1.5 million bookings. As we mentioned, Tesla is also behind energy generation and storage products. This is possible via the enormous Tesla-owned giga-factories in California, New York, Nevada, Texas, Shanghai, and Berlin. These facilities supply battery packs and motors for the company’s own range of vehicles as well as energy storage. The Shanghai facility alone is able to manufacture in excess of 750,000 EVs. In terms of production goals, the company has stated that it aims to meet 2 million units by the end of 2022. Moreover, Tesla has established a strong EV metals supply chain with a number of off-take arrangements. Those that invest in Tesla will also expose their portfolio to Solar City, which the EV and battery company purchased in 2016. Tesla could also be counted among the climate tech stocks category. The company also produces photovoltaic shingles in addition to conventional solar panels, making it a two-for-one green investment. Moreover, regulatory authorities grant emissions credits to businesses like Tesla. As such, this stock offers an indirect way to invest in carbon credits. Tesla has been among the most popular climate change stocks to watch. Over the last five years, Tesla stock has increased by over 1,220%. MSCI ESG Rating: A

78% of retail investor accounts lose money when trading CFDs with this provider. ChargePoint Holdings was founded in 2007 and operates a huge network of EV charging stations. These are independently owned and span over a dozen countries. The ChargePoint Holdings business model covers everything from providing software and hardware for charging stations, to services for business, fleet, and residential users. With such a large network of charging stations for EVs, ChargePoint Holdings is one of the most popular alternative energy stocks. We also mentioned that ChargePoint Holdings provides services. As they prepare to join the new fueling network, fleets, drivers and companies turn to the ChargePoint Holdings team for technology, information, and resources surrounding EV charging. More than 4,000 businesses and fleets use ChargePoint Holdings, and the company has provided 133 million charging stations to date. However, this is just the beginning. By 2030 and 2040, respectively, it is projected that $60 billion and $192 billion will have been invested in EV charging infrastructure in the US and Europe. Although this company began in 2007, ChargePoint Holdings became a climate change SPAC stock when it merged with Switchback Energy Acquisition Corporation. This is when the company changed from Inc to Holdings and was subsequently listed on the NYSE in 2021. Based on its trading price at the time of writing, this climate change SPAC stock has increased by more than 80%. MSCI ESG Rating: N/A – Not disclosed

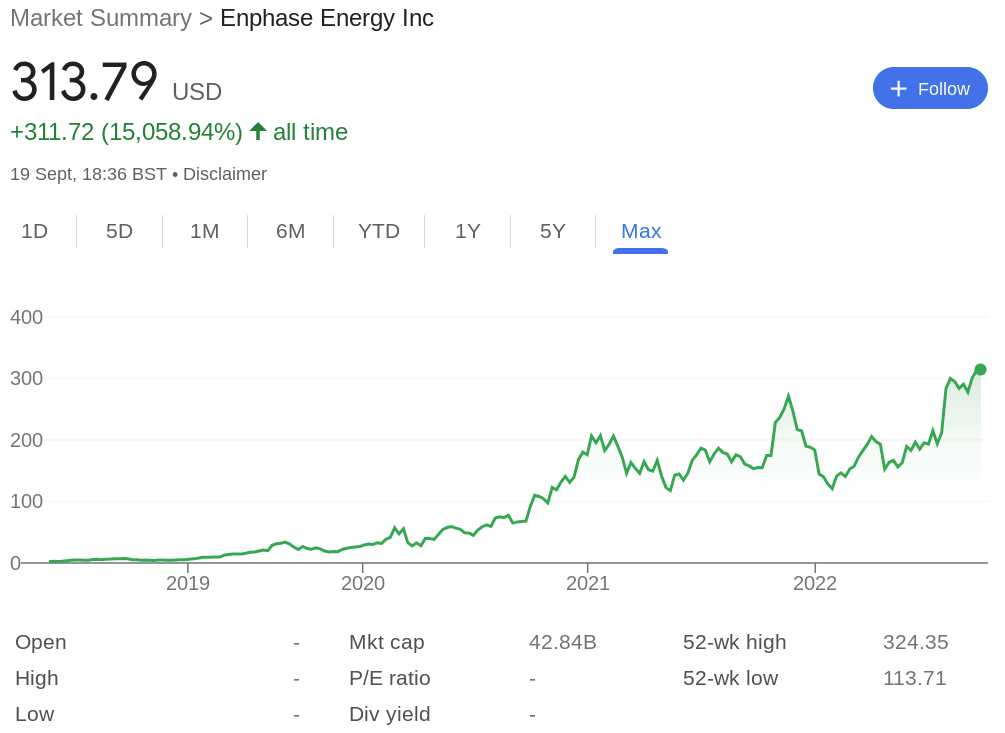

78% of retail investor accounts lose money when trading CFDs with this provider. Enphase Energy was founded in 2006 when it transformed the solar power sector and became the first company to commercialize micro-invertors. For those unaware, micro-inverters are essential to transforming energy from the sun into a reliable, scalable, and safe source of power. In late 2021, the company introduced the all-in-one Enphase Energy System with IQ8TM solar microinverters for the North American market. This micro-invertor technology can use only sunlight to build a microgrid in the event of an electric blackout. At the time of writing, more than 48 million solar micro-inverters have been shipped by the company, mostly to markets in Europe, Australia, and North America. The company’s plants offset emissions of 31 million tones of carbon dioxide-equivalent (CO2e), which equates to supplying electricity for 3.5 million households per year. Enphase Energy was listed on the NASDAQ in 2012. Based on its price at this time, over the last five years of trading, Enphase Energy stock has increased by more than 15,000%, MSCI ESG Rating: BBB

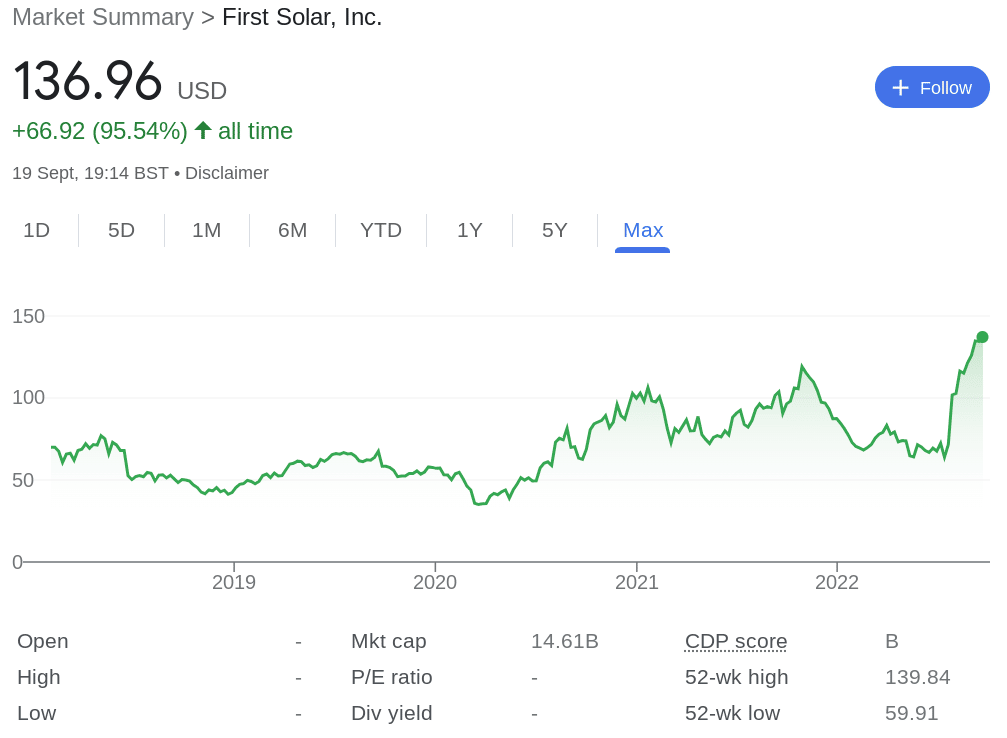

78% of retail investor accounts lose money when trading CFDs with this provider. This company was founded in 1990 as Solar Cells. In 1999 it was purchased and rebranded as First Solar. The company manufactures economically efficient solar panels using low carbon and silicone. On a life cycle basis, First Solar’s thin-film PV modules have an impressive environmental profile. These panels are produced using less energy, water, and semiconductor material than the c-Si solar option. This results in up to 2.5 times lower carbon footprint. As well as up to 3 times lower water footprint. First Solar has the largest solar manufacturing footprint in the western hemisphere at the time of writing. In terms of upcoming projects, fresh from the news of the aforementioned Inflation Reduction Act, the company announced a third solar panel factory is scheduled to open in Ohio in the first half of 2023. A further factory, which will be the company’s fourth in the US, is anticipated to be commissioned in 2025. In fact, by 2025, the company’s worldwide manufacturing capacity will exceed 20 gigawatts (GW). This will consist of operations spread across the US, India, Malaysia, and Vietnam. First Solar stock was listed on the NASDAQ in late 2006. In the five years prior to writing, this sustainable energy stock has increased by over 95%. MSCI ESG Rating: N/A – Not disclosed

78% of retail investor accounts lose money when trading CFDs with this provider. Clearway Energy was founded in 2012. It owns a full-scope development and operations platform that engages in all phases of a solar and wind project’s lifespan. This spans conception and development, building and financing to long-term ownership, management, and operations. This company is one of the major developers and owner-operators of utility-scale renewable energy projects in the domestic market. It has 3.5 GW of wind and 1.3 GW of utility-scale solar in operation, not to mention a sizable pipeline of projects in development and construction. Clearway Energy is creating a 19 GW pipeline of brand-new renewable energy projects around the US. With its wind, solar, and energy storage assets, the company expects to save its clients the equivalent of around 10 million metric tons of carbon emissions each year. This is among the climate change stocks that pay dividends. The running dividend yield at the time of writing is 3.8%. The last payment received by investors was $0.36 per share. Over the prior five years of trading, Clearway Energy stock has increased by nearly 91%. MSCI ESG Rating: N/A – Not disclosed

78% of retail investor accounts lose money when trading CFDs with this provider. Stem was founded in 2009 and became listed on the NYSE in 2021. This is a publicly traded pure-play smart energy storage firm. Stem provides and manages battery storage solutions that maximize renewable energy generation and aid in the development of a cleaner, more dependable grid. Project developers, independent power producers, utilities, and Fortune 500 corporations are a few of Stem’s typical clients. In order to maximize renewable energy, Stem operates smart battery storage systems. Advanced artificial intelligence (AI) and machine learning are used by its Athena software to help cut emissions. This allows it to effortlessly switch between on-site generating, battery storage, and grid electricity. As a result, the grid is stabilized, carbon emissions are decreased, energy prices are also lower and renewable energy intermittency is improved. To clarify, Stem does not produce batteries. Instead, it buys them from other manufacturers. Stem then integrates Athena with third-party batteries to provide a hardware and software solution for its clients. Through measurable carbon footprint reduction and resilience enhancement, Stem assists customers in achieving their sustainability and climate goals. As we touched on, Stem was publicly listed in 2021. Based on its price at the time of writing, this sustainable energy stock has increased by almost 71% since its IPO. MSCI ESG Rating: N/A – Not disclosed

78% of retail investor accounts lose money when trading CFDs with this provider. This company is an electric vehicle manufacturer that was founded in 2016 and revived from the ashes of Fisker Automotive’s bankruptcy. Fisker is classed as a climate change SPAC stock as it became publicly traded off the back of a merger. The CO2-neutral facility owned by Magna is essential to Fisker’s goal of creating a sustainable business. Fisker’s manufacturing facility was built in the CO2-neutral Magna Steyr unit in Graz, Austria. With 50 vehicles now on the production line, the facility is turning out high-quality Fisker Ocean EV prototypes. As such, Fisker could be considered an alternative energy stock to Tesla. Deliveries of the Fisker Ocean will start in the US and Europe towards the end of 2022. Fisker has received close to 60,000 reservations for its Ocean SUV, and by the end of 2022, it anticipates at least 80,000. The goal of Fisker is to create the most environmentally friendly EVs on the market. The Fisker Ocean SUV generates an estimated 1,500 miles of power from its full-length solar roof annually. Following the merger with Spartan Energy Acquisition in 2020, Fisker stock was listed on the NYSE. The stock has fallen by a little over 11% in this time. However, there could be potential for this alternative energy stock to grow. At the time of writing, it’s in its early stages, and deliveries of its EVs are yet to start. MSCI ESG Rating: N/A – Not disclosed

78% of retail investor accounts lose money when trading CFDs with this provider. US company QuantumScape was founded in 2010 and became publicly listed when it was added to the NYSE in 2020. The company develops and manufactures solid-state lithium batteries for EVs. QuantumScape is partnered with Volkswagen and counts Bill Gates among its investors. Transportation is one of the top contributors to global greenhouse gas emissions. Many of today’s EVs lack the performance, safety, and cost required for mass-market adoption of zero-emissions vehicles. The main technological advancement of QuantumScape is a separator constructed of a special flexible ceramic material. This material is resistant to dendrites which give the batteries higher thermal stability and means they are unlikely to catch fire. The QuantumScape EV batteries enable fast charging to be done repeatedly over hundreds of cycles without suffering significant losses in discharge energy retention. In a nutshell, the company’s lithium-metal solid-state batteries have been developed to charge faster, last longer, go farther, and operate more safely than many EVs and gas-powered vehicles. With its non-combustible anode-free lithium-metal technology, batteries can charge from 10% to 80% in just 15 minutes. QuantumScape hopes to replace conventional lithium-ion batteries entirely. Based on its price at the time of writing, this green energy stock has increased by over 13% in around two years of trading. MSCI ESG Rating: N/A – Not disclosed

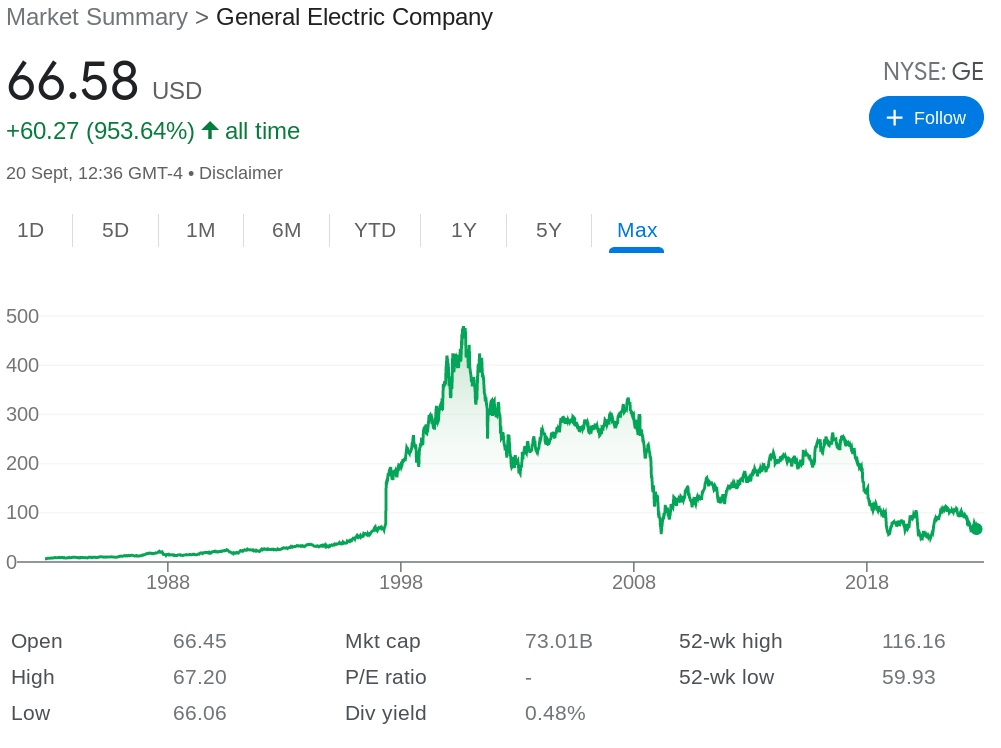

78% of retail investor accounts lose money when trading CFDs with this provider. General Electric is well-known in the US. It was founded in New York in 1892 and sold electric home appliances for many years. In recent times, however, General Electric has made significant investments in clean and green programs, making it an alternative energy stock. To create the most effective offshore wind turbine, the business has spent more than $400 million on technology and infrastructure. The levelized cost of energy (LCOE) for offshore wind farms is anticipated to decrease as a result. General Electric has installed more than 400 GW of capacity worldwide, spanning onshore and offshore wind, hydropower, and cutting-edge technology. Other green projects in this company’s portfolio include grid solutions, clean power storage, and also renewable energy services. Engines for aircraft, financial services, and electronic equipment are some further products offered by General Electric. In the last five years of trading, this stock has fallen by over 66%. MSCI ESG Rating: BB

78% of retail investor accounts lose money when trading CFDs with this provider. The heat from the sun is trapped as greenhouse gas emissions cover the planet. Climate change and global warming are the results of this. The earth is heating up more quickly than at any time in recorded history. This is where climate stocks come in: Many businesses that are involved in fighting climate change are publicly listed, meaning their stock is offered on exchanges such as the NYSE and can be invested in. This is quite literally a climate change stock in a nutshell. An increasing number of investors are focused on businesses that offer a greener future as part of efforts to reverse climate change. Businesses that support renewable energy such as the solar subsector, or those focused on carbon credits are some of the investments leading the way in this category. Those who invest in climate change stocks may do so to contribute in some way to the global cause. That said, many will choose to allocate funds to climate change stocks in the hope they see a return on their investment – whether in the long or short term. The US Senate’s approval of one of the most significant climate change support packages in US history occurred on August 8, 2022. This inflation reduction plan is inclusive of programs and incentives of over $370 billion. The goal is to accelerate energy and climate action over the next ten years. Why does this matter for those investing in green energy stocks? As with any other marketplace, there are no guarantees when buying a climate change stock. That said, it’s hard to argue that the world’s increasing concerns about climate change won’t potentially give many of these stocks a push in the right direction. Not to mention the previously mentioned Inflation Reduction Act. Sustainable investing funds that contain multiple green energy stocks have also gained a lot of popularity among environmentally aware investors. Prior to buying climate change stocks, investors will need to create an online brokerage account with a regulated platform. This should give the investor peace of mind that they are dealing with a professional platform that has been approved to offer financial services and has access to the stock exchange. When reviewing places to invest in stocks in safety, we look at regulatory standing, fees, the type of sustainable assets available, and factors surrounding features, tools, and customer support. eToro is a well-known social trading platform that’s regulated by the SEC, FCA, ASIC, and CySEC. The platform enables clients to buy climate change stocks we’ve analyzed today on a commission-free basis. The broker lists over 2,500 equities from multiple domestic and global stock exchanges. Traders can also buy and sell many ESG investing funds on a commission-free basis. Other markets include commodities, currencies, indices, and sustainable cryptocurrency tokens. Investors must pay a commission of 1% on each cryptocurrency transaction made on the platform. It’s also possible to invest in a basket of green energy stocks via Smart Portfolios such as RenewableEnergy. This particular collection of stocks includes First Solar, NextEra, Enphase, Clearway Energy, and 26 others. Put simply, investors can choose a Smart Portfolio to suit their goals and allocate $500 or more to it. eToro will copy the Smart Portfolio and its weighted holdings into the investor account automatically. Another option is to allocate funds to Copy Trading to mirror the individual stock positions of a seasoned investor. In this case, choose an equity-focused stock trader to copy and allocate a minimum of $200. The top stock investors to copy can be filtered down by metrics surrounding returns over a specific time frame, as well as the number of copiers, and risk rating. There are customizable price charts and indicators available for performing technical analysis and as we said – eToro is a social trading platform. This is like social networking for investors. As such, novice investors could gain insight from successful traders. It’s also possible to ‘follow’ and ‘like’ other traders, as well as ‘comment’ on an asset or the posts of others. To invest in green energy stock at this trading platform, fund the account with $10 or more. Some of the payment types accepted by eToro include ACH, wire transfer, and e-wallets such as PayPal, Skrill, Neteller, and others. The platform also supports major credit and debit cards. US clients will not be charged a fee when making a deposit.

78% of retail investor accounts lose money when trading CFDs with this provider. This guide has explored numerous options when it comes to investing in sustainable climate change stocks. This includes well-known EV makers and companies that are focused on renewable energy sources like hydro, wind, and solar. We also discussed infrastructure, battery, and micro-inverter companies that are climate-conscious and in some way benefit the green energy movement. Part of the research process for those looking to invest in climate change stocks will usually be to assess the ESG score, relevant partnerships, and in some cases supply capacity. That is to say, climate change stocks will release information such as new and existing facilities and their capabilities. We rank IMPT as the best climate-friendly investment asset right now – click below to learn more.

11 Popular Climate Change Stocks to Watch in 2023

A Closer Look at Climate Change Stocks

1. IMPT – Best Climate-Friendly Investment Asset

2. NextEra Energy – Global Leader in Wind and Solar Generation and Dividend Aristocrat

3. Tesla – US Multinational EV Manufacturer Focused on Climate Change

4. ChargePoint Holdings – EV Infrastructure Company With a Network of Charging Stations

5. Enphase Energy – Company That Makes Cutting Edge Solar Micro-Invertors

6. First Solar – Large-Scale Low-Carbon and Silicone Solar Panel Manufacturer

7. Clearway Energy – Owner and Operator of 5,000 net MW of Solar and Wind Production Projects

8. Stem – Pure Play Automated Smart Energy Storage Provider

9. Fisker – Austrian Company Focussed on Entirely Climate-Neutral Automobile

10. QuantumScape – Solid State Lithium Battery Manufacturer for EVs

11. General Electric – US Multinational Conglomerate With a Portfolio of Clean Initiatives

What Are Climate Change Stocks?

Why do People Invest in Climate Change Stocks?

Regulated Stock Brokers Offering Sustainable Energy Stocks

eToro – Regulated Renewable Energy Stock Broker

Conclusion

FAQs

What is a climate change stock?

What are some climate change stocks?

What is climate change investing?