Crypto adoption is at its highest level ever, meaning that ‘crypto cards’ have entered the mainstream. These cards allow users to easily pay for goods and services using cryptocurrency – with the Crypto.com credit card being one of the most popular options on the market.

This guide will present our in-depth Crypto.com credit card review, highlighting its fees, rewards, and benefits before showing you how to set up your own crypto card today – all in a matter of minutes.

Crypto.com Credit Card Summary

What card network is used? Visa

What are the fees? No monthly or annual fees

Cons

Would we recommend it? Yes – the Crypto.com credit card is one of the best crypto credit cards on the market, enabling payments using 90 different cryptocurrencies and offering an array of tiers to ensure there’s an option for all users.

Cryptoassets are a highly volatile unregulated investment product.

How Does the Crypto.com Credit Card Score?

| Category | Our Score |

| Features | ⭐️⭐️⭐️⭐️⭐️ |

| User-friendliness | ⭐️⭐️⭐️⭐️⭐️ |

| Fees | ⭐️⭐️⭐️⭐️⭐️ |

| Customer service | ⭐️⭐️⭐️⭐️⭐️ |

| Overall | ⭐️⭐️⭐️⭐️⭐️ |

What is the Crypto.com Credit Card?

Aside from Crypto.com’s extensive investing features, the platform also offers a dedicated crypto card. The Crypto.com debit card is available to all users and acts in the same manner as a prepaid card. This approach means that the card does not need to be linked to an active bank account to facilitate transactions and can instead be topped up whenever the user pleases.

The critical distinction between crypto-backed cards like the Crypto.com Visa card, and traditional debit cards, is that the former allows users to fund their card balance using cryptocurrency. Ultimately, this means that users can buy Bitcoin (or any other supported digital currency) and then use it to pay for goods and services.

For users interested in obtaining a Crypto.com Visa card, the only requirement is that they must hold CRO tokens – Crypto.com’s native currency. Once CRO ownership is confirmed, users can apply for the card through the mobile app and Crypto.com will send it out for free. Finally, in terms visuals, the Crypto.com card is an aesthetically-pleasing metal card with no recurring fee attached – which is in stark contrast to many other metal card providers.

How Does the Crypto.com Card Work?

Using a crypto card for the first time can be slightly daunting, meaning it’s a good idea to understand how the card works before using it for transactions. Relating this to the Crypto.com card, users can easily top up the card’s balance through the Crypto.com App using a credit/debit card, FIAT currency, or cryptocurrency.

It’s important to note that Crypto.com offers flexibility for those who do not wish to use crypto – ensuring the card appeals to a broad audience of potential users. Another great feature is that US-based users can top-up the Crypto.com card instantly using PayPal, although a 2.1% transaction fee is attached to this process.

However, if you do wish to use crypto to make payments, this is extremely simple to do. As Crypto.com is one of the best crypto exchanges, users can instantly purchase crypto via the Crypto.com App and then use these crypto holdings to fund the card’s balance.

Once the card is funded with FIAT or crypto, it can then be used to pay for goods and services. During our research for this Crypto.com card review, we noted that the card can be used in over 40 million places worldwide, thanks to the power of the Visa network. Not only that but the Crypto.com card can also be used in any online store that accepts Visa cards. Crypto.com is now offering a $50 referral incentive; for more details read our Crypto.com Sign Up bonus guide now.

Finally, the Crypto.com card even allows users to make ATM withdrawals. This facility is available on any ATM that bears the Visa or Visa Plus logo.

Cryptoassets are a highly volatile unregulated investment product.

Crypto.com Card Tiers

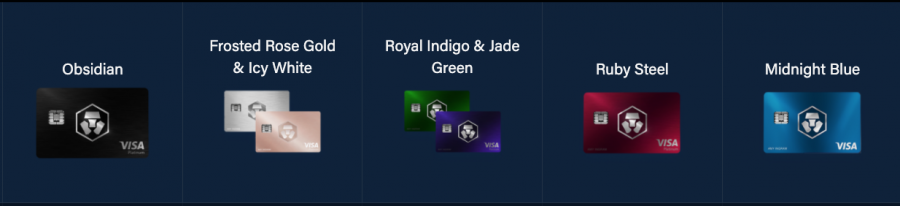

One of the Crypto.com card’s most noteworthy aspects to be aware of is its tiers. The first thing to note is that there are five versions of the card, equating to five distinct tiers. Each tier comes with a specific colour scheme, such as the Crypto.com Ruby card or the Crypto.com Obsidian card.

Each card tier will provide the cardholder with a specific set of features and benefits. However, Crypto.com requires a certain amount of CRO tokens to be staked to obtain cards from higher tiers. Staking requirements are expressed in FIAT rather than the specific number of tokens. In addition, users must maintain the staking level in perpetuity; otherwise, they will lose the benefits of the particular card tier.

Notably, the lowest card tier (Midnight Blue) does not require any CRO to be staked – making it an ideal option for beginner investors. At the other end of the spectrum, the Obsidian tier requires $400,000 worth of CRO to be staked. Ultimately, this selection of tiers and staking requirements ensures there’s an option for everyone.

In terms of the rewards themselves, these will differ depending on which tier your card is in. However, all tiers will receive cashback on local and overseas spending, ranging from 1% for Midnight Blue cards to 8% for Obsidian cards. Cashback is paid in CRO and automatically placed in the Crypto.com App’s native wallet – which is also one of the best crypto wallets for storing digital currencies long term.

Aside from cashback, the Crypto.com Visa cards also offer an array of additional benefits for certain tiers. These include 10% purchase rebates on Expedia and Airbnb bookings, 100% rebates on Spotify subscriptions, 100% rebates on basic Netflix subscriptions, and LoungeKey airport lounge access.

The table below presents a comprehensive breakdown of all five card tiers, showcasing their staking requirements, rewards, and fee-free allowances.

| Obsidian | Frosted Rose Gold & Icy White | Royal Indigo & Jade Green | Ruby Steel | Midnight Blue | |

| CRO Stake | $400,000 | $40,000 | $4,000 | $400 | $0 |

| CRO Rewards | 8% | 5% | 3% | 2% | 1% |

| Spotify | 100% | 100% | 100% | 100% | N/A |

| Netflix | 100% | 100% | 100% | N/A | N/A |

| Amazon Prime | 100% | 100% | N/A | N/A | N/A |

| Expedia | 10% | 10% | N/A | N/A | N/A |

| Airbnb | 10% | N/A | N/A | N/A | |

| LoungeKey Airport Lounge Access | Yes (+1 guest) | Yes (+1 guest) | Yes | N/A | N/A |

| Crypto.com Private | Yes | Yes | N/A | N/A | N/A |

| Earn Bonus Reward? | Yes | Yes | N/A | N/A | N/A |

| Exclusive Welcome Pack | Yes | Yes | N/A | N/A | N/A |

| Private Jet Partnership | Yes | N/A | N/A | N/A | N/A |

| Free ATM Withdrawal Per Month | $1,000 | $1,000 | $800 | $400 | $200 |

| Free Currency Exchange Transactions Per Month | Unlimited | €15,000 | €10,000 | €4,000 | €2,000 |

Where Can You Use the Crypto.com Card?

Since the Visa network powers the Crypto.com card, it can be used in over 40 million physical locations worldwide. According to the Visa website, the network is offered in more than 200 countries and territories, making the Crypto.com card ideal for frequent travellers. Notably, the daily spending limits are relatively high, with the lowest threshold being $10,000 for Midnight Blue cards.

Although there is a minimum top-up amount (via credit/debit card) of $20, card users can add up to $10,000 per day onto the card. Alongside using the card to pay for online and offline transactions, users can also make ATM withdrawals with the Crypto.com card. Each tier has a specific threshold of fee-free withdrawals, with the minimum being $200 for Midnight Blue cards.

Another great feature of the Crypto.com card is that when it is used to pay for goods and services overseas, users will receive the exact interbank exchange rate prevalent at the time. This means that there are no hefty transaction fees for making payments abroad. Each card tier has a specific threshold where this process applies, with anything over this threshold incurring a 0.5% transaction fee.

Crypto.com Card Rewards

As noted previously, each Crypto.com card tier comes with a specific set of rewards. Naturally, higher tiers will have the best rewards, with the Obsidian tier being the pinnacle. However, lower tiers will still accrue rewards, but on a lesser scale.

To receive rewards, users must undertake some crypto staking using CRO. As touched on earlier, users can unlock each tier by staking a specific amount of CRO, denominated in USD.

The rewards that cardholders receive are paid in CRO. During our Crypto.com Visa card review, we noted that these rewards were paid instantly, which is in stark contrast to some other providers that only make reward payments at the end of the month. Once rewards are delivered, they can be converted into other cryptos, converted into FIAT, or withdrawn. You can also lend stablecoins to earn up to 14% APY with the Crypto.com credit card, making it one of the best crypto lending platforms on the market in 2022.

Detailed below are the specific cashback rewards associated with each card tier:

| Tier | Rewards |

| Midnight Blue | 1% |

| Ruby Steel | 2% |

| Royal Indigo & Jade Green | 3% |

| Frosted Rose Gold & Icy White | 5% |

| Obsidian | 8% |

Features & Benefits

Our Crypto.com debit card review has simply presented a broad overview of how the card works and the various tiers. Let’s now dive into some of the card’s main features in more detail, highlighting why it’s such a popular option amongst crypto traders:

Rebates from Leading Companies

The Crypto.com card rebates are linked to major companies, such as Netflix, Spotify, Airbnb, and Expedia. These companies offer services that are used by a vast number of people – meaning cardholders will likely be able to receive cashback on their transactions. Although each rebate amount is capped (e.g. Airbnb is capped at $100 per month), these rebates will remain in perpetuity, as long as the corresponding amount of CRO is staked.

Easy Card Management via App

The Crypto.com credit card is managed through the Crypto.com App, making it easy to view your balance and top-up whenever you please. Since you can also invest in Bitcoin (and other cryptos) through the same app, the top-up process is streamlined and can be completed in seconds.

Crypto.com Private Membership

Members of the Frosted Rose Gold/Icy White and the Obsidian tiers will be provided access to Crypto.com Private. This exclusive club offers various perks for members, including research reports, inheritance services, access to industry events, priority customer service, and preferential rates on large OTC trades.

Virtual Card

Crypto.com also offer a handy ‘Virtual Card’ for users who have upgraded to a new tier and are waiting for their physical card to arrive. This virtual card will have its own set of card details, which can be used when paying for subscriptions and online purchases. Notably, virtual cards can be linked to Apple/Samsung/Google Pay to streamline the buying process.

Crypto Savings Account

Aside from the card, Crypto.com also offers other valuable benefits – including one of the best crypto interest accounts. This account allows users to earn up to 14.5% interest on eligible cryptos (and up to 14% on stablecoins) whilst also providing options for investors who do not wish to employ a lock-up period.

Staking Opportunities

Finally, Crypto.com also offers a dedicated staking service, which differs slightly from the service provided by crypto savings accounts. When staking with Crypto.com, users can lock up their CRO holdings and receive various benefits. More card rewards are offered to users who stake higher amounts of CRO, although staking also enables users to obtain better APR from the Crypto Credit and Crypto Earn services.

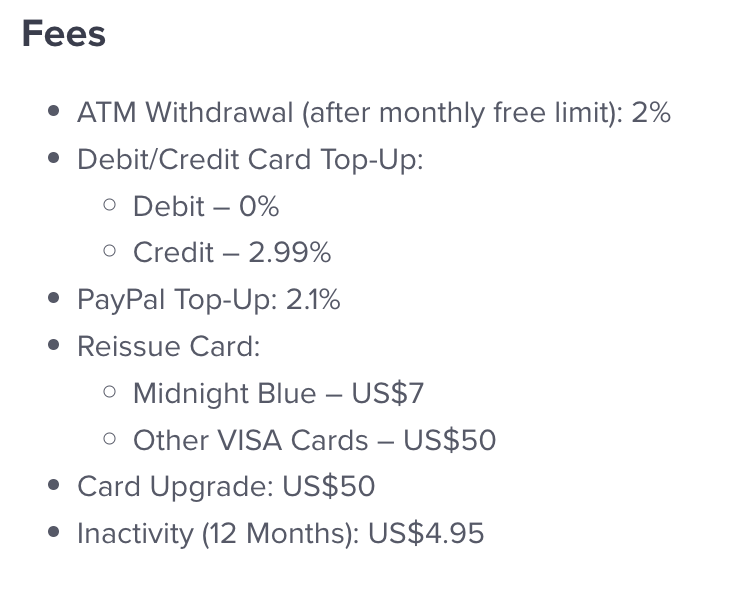

Crypto.com Credit Card Fees

In terms of the Crypto.com debit card fees, the critical thing to note is that there are no monthly or annual fees to be aware of. The card is completely free to obtain (assuming you have staked the appropriate amount of CRO) and has no ongoing costs for usage. There are also no transaction fees when using the card, whether locally or overseas.

However, there are some fees to be aware of that accrue when funding the card in a certain way. Firstly, Crypto.com card top-ups using a credit card will come with a 2.99% transaction fee. There will also be a 2.1% transaction fee if you decide to top your card up using PayPal.

If you lose your Crypto.com card, there will be a $7 reissue fee if it is a Midnight Blue card or a $50 reissue fee from any other tier. There is also a $50 fee to receive your new card if you move from one tier to another. Finally, Crypto.com will also charge an inactivity fee of $4.95 after an entire year or no transactions – although any transaction made will reset this for another 365 days.

Crypto.com Card Limits

When using the Crypto.com card, there are three primary limit types to be aware of:

- ATM Limits

- Top-Up Limits

- Point-of-Sale (PoS) Purchase Limits

ATM limits relate to the fee-free ATM withdrawal amount per month and the daily withdrawal limits and withdrawal frequencies offered by each tier. Top-up limits refer to the minimum and maximum amounts cardholders can fund their cards with. Finally, PoS limits pertain to the amount that cardholders can spend on their card daily or weekly.

A full breakdown of the specific Crypto.com card limits for US-based cardholders can be found HERE.

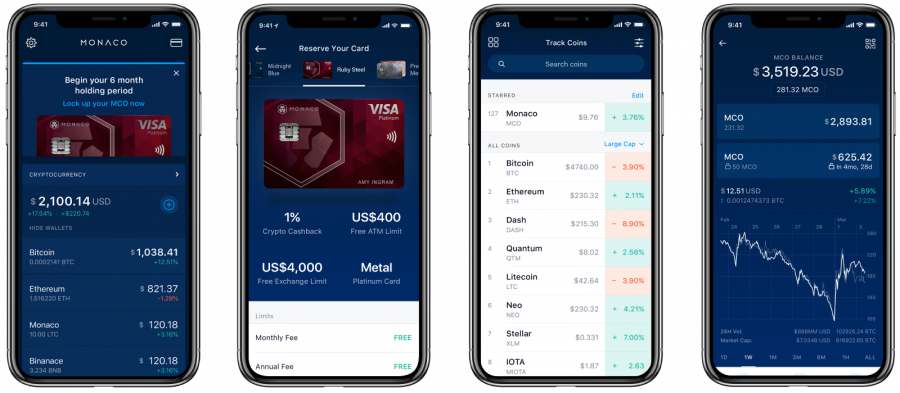

Crypto.com Card Mobile App

As noted earlier in this Crypto.com credit card review, the card itself can be managed through Crypto.com’s dedicated mobile app. The app can be downloaded for free via the App Store or Google Play and acts as the central hub for trading and account management. Users can access their card details by clicking the ‘Card’ tab on the bottom right corner of the homepage.

First-time users can apply for the card directly through the app’s interface, which will walk you through the exact steps you need to take to obtain the card. Conversely, if you already have a Crypto.com card, you easily top-up the card’s balance using your crypto or FIAT wallet funds. Finally, the mobile app will also show your current balance and a breakdown of the transactions you have completed on the card.

Cryptoassets are a highly volatile unregulated investment product.

Crypto.com Card Customer Service

Finally, Crypto.com’s customer service is also widely regarded, as users can utilize the dedicated ‘Live Chat’ option to speak to a team member. The waiting times to talk to someone are relatively short, with the live chat service being available through the website or the mobile app.

Alternatively, Crypto.com also has an extensive ‘Help Center’, which acts as a base for their FAQs section. The help center is a fantastic resource that answers most of the questions that a user may have about the Crypto.com card, the app, or any other element of the Crypto.com ecosystem. Finally, Crypto.com even provides an email address if users have a more complex question that requires a detailed answer.

How to Apply for a Crypto.com Card

Now that you have a solid understanding of what the Crypto.com card is and how it works, let’s turn our attention to the application process via the crypto app. The card itself is exclusive to CRO holders, so you must purchase CRO before being able to obtain the card.

With that in mind, the steps presented below will walk you through the entire application process – all of which can be completed from your smartphone.

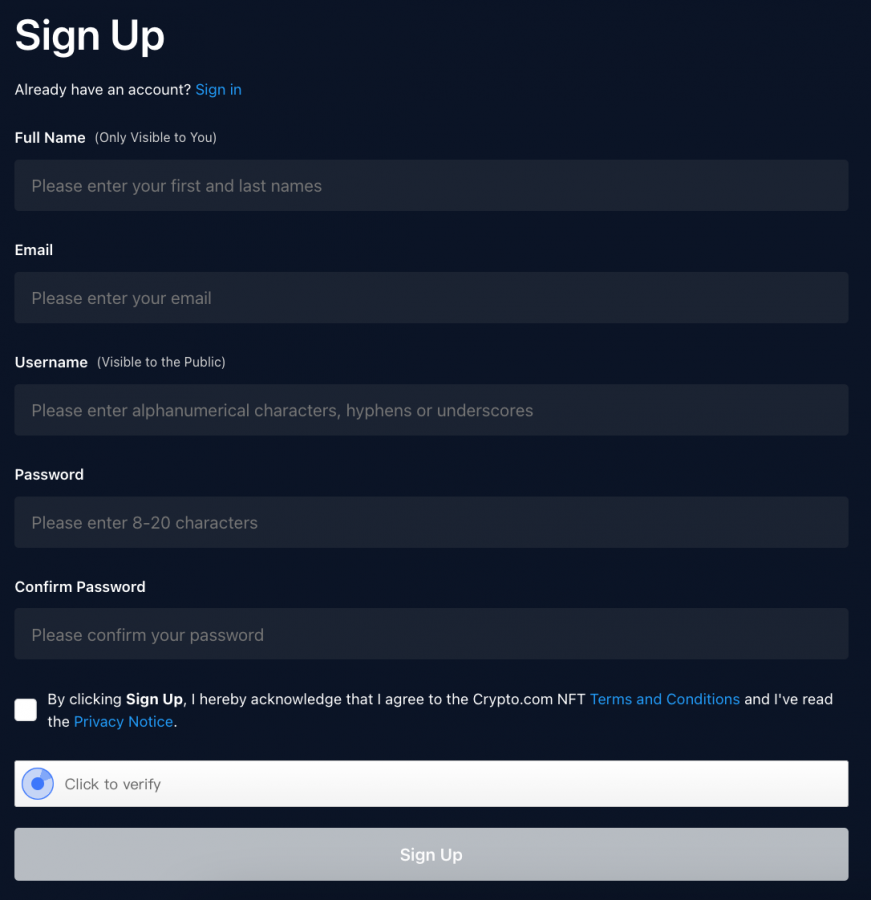

Step 1 – Sign Up

Visit the Crypto.com website and create a free account. Enter your full name and email address, then choose a username and a password for your account.

Once you have registered also download the Crypto.com mobile app via the links on the website.

Cryptoassets are a highly volatile unregulated investment product.

Step 2 – Verify Your Account

Before buying crypto through the Crypto.com exchange or app, you’ll have to verify your account. You will need to provide your full legal name and a picture of your government-issued ID (e.g. your passport or driver’s license).

Finally, you’ll also have to take a selfie to verify the accuracy of the documents. Once these tasks have been completed, Crypto.com will begin the verification process, taking anywhere from a few hours to multiple business days.

Step 3 – Purchase CRO

Once you are verified, you can proceed to purchase CRO. The easiest way to do this is via a credit/debit card, which you can link during the purchasing process. All you need to do is tap ‘Buy’ on the app, select CRO, and then follow the on-screen instructions to complete your purchase.

All users must own CRO to be eligible for the Crypto.com Visa card. However, the Midnight Blue tier does not require CRO staking, whereas the other tiers do, so make sure to obtain the necessary CRO for the tier you are interested in.

Step 4 – Apply for Card

After you have purchased CRO, tap the ‘Card’ icon on the bottom right of the homepage. You can then select the tier you’d like, stake the amount of CRO required for your tier, and confirm your delivery address. Once these steps are completed, Crypto.com will begin the process of shipping your new card.

Step 5 – Begin Using the Crypto.com Card

Step 5 – Begin Using the Crypto.com Card

You can easily keep tabs on your card by looking at the mobile app’s ‘Card Status’ section. US-based users can expect to receive their Crypto.com Visa card within 7-14 business days. Once the card arrives, click ‘Activate My Card’ on the Crypto.com App, enter your card’s 3-digit CVV number, and create a PIN. After this, you can top-up the card through the app and begin using it right away.

Cryptoassets are a highly volatile unregulated investment product.

How to Upgrade Your Crypto.com Card

If you wish to move up to a higher tier, you must first stake the required amount of CRO (e.g. $400 for the Ruby Steel tier). To do this, head to your CRO Wallet in the Crypto.com App and click ‘Upgrade’. You can then stake the required amount, after which your new Crypto.com card will be issued. Notably, a $50 fee will be charged as Crypto.com will have to allocate a new physical card.

Upgrading will close your current Crypto.com card – although Crypto.com will issue you with a virtual card so that you can continue spending while waiting on your physical card to arrive. You will receive an email when the virtual card is ready to use, confirming the transfer of funds from your old card to your new one. Finally, your upgraded card and the virtual card will both have the same expiry date and CVV, so you can use either one to make online purchases.

How Does the Crypto.com Card Compare to Others?

Before rounding off this Crypto.com credit card review, let’s look at how the card compares to other popular card providers. Through our research and testing, we’ve noted that the Crypto.com card does appear to stand out from the pack because it has zero monthly or annual fees and offers numerous exceptional rebates.

Other popular crypto cards, such as the ones offered by Gemini and Coinbase, do not provide rebates like this. Furthermore, cashback amounts for these cards tend to be lower. For example, Coinbase offers up to 4% cashback, whilst Crypto.com provides up to 8% cashback.

Some other crypto card providers require users to complete a credit check before being able to use the card. Crypto.com doesn’t need this, as the staking process is deemed evidence enough that users have the financial resources to use the card. Finally, certain crypto cards (such as the one offered by Wirex) require users to maintain a certain account balance – this is not necessary with Crypto.com.

Crypto.com Credit Card Review – Conclusion

To summarize, this Crypto.com credit card review has covered everything you need to know about the card. We’ve explored the various tiers on offer and the fees associated with card usage, ensuring you’ve got all the information you need to decide whether the card is right for you.

If you wish to get set up with the Crypto.com credit card today, you can do so by clicking the link below. There are no monthly or annual fees associated with card ownership, with free top-ups using FIAT or crypto, depending on your preference. See our Crypto.com review for more details about other features on the platform.

Cryptoassets are a highly volatile unregulated investment product.

Step 5 – Begin Using the Crypto.com Card

Step 5 – Begin Using the Crypto.com Card