Energy exploration, generation, and distribution are the main priorities of hundreds of public corporations. Prior to investing in energy stocks, it’s wise to gain a clear understanding of what’s out there in terms of variation and upside potential.

In this guide, we discuss 10 of the most popular energy stocks to watch in 2023.

We take a closer look at each company’s role in the energy sector and what the future potentially offers from an investment perspective, as well as its performance on the stock market to date.

Below, we’ve curated a list of the most popular energy stocks to watch in 2023. This includes alternative energy stocks, as well as some of the largest and most well-known companies in this sector. The list above features companies that are involved in various aspects of the energy sector. A review of each can be found next. You can invest in these and other energy stocks using a regular stock broker like eToro.

Below is our full analysis of the above-mentioned energy stocks to watch in 2023. We have included information on each company’s business model, finances, performance, and both ongoing and future projects. This information should enable those looking to invest in energy stocks to make the most suitable choice for their portfolio. IMPT is an environmentally conscious platform that aims to improve the way we offset our carbon footprint. Blockchain technology underpins the cutting-edge ecosystem and both individuals and businesses can be a part of it. The platform has partnered with over 10,000 brands with an environmentally conscious mindset. This includes well-known companies such as Lonely Planet, DYNY, Topshop, New Balance, Chanel, MAC, and Tom Ford. Some of the other big names that have agreed to build a sustainable future with IMPT include Microsoft, Virgin, and Levis. As a result of their efforts to lessen their carbon footprint, consumers and organizations shopping on and using the platform will earn ‘impact points’. This platform is innovative, in that it will mint rewards into NFTs. Furthermore, because IMPT is on the blockchain, users can rely on a transparent and secure ecosystem that is also highly efficient. According to the IMPT whitepaper, the project is also launching a native cryptocurrency. Online shoppers can earn IMPT tokens when buying products on the platform, which can be converted into carbon credits. As we mentioned, carbon credits come in the form of NFTs. This means that they can be listed, bought, sold, and traded on the IMPT marketplace. IMPT whitepaper is also partnered with third-party payment providers. These platforms will allow investors to buy IMPT tokens with a credit/debit card or digital currencies such as Binance Coin, Bitcoin, Ethereum, and more directly on the IMPT platform. The latest information about this project is available on the IMPT Telegram channel.

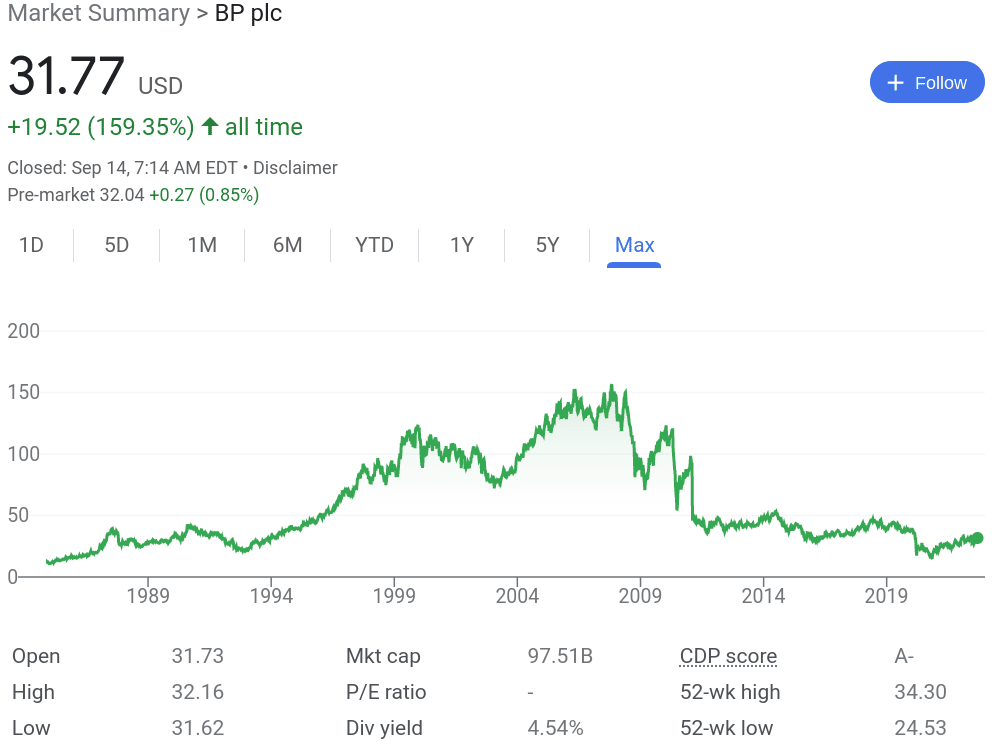

British Petroleum, most commonly referred to as BP, is one of the most integrated oil and gas businesses globally. It’s also among the largest energy stocks by market capitalization. At the time of writing, BP’s market capitalization stands at almost $100 billion. From energy product exploration to sales and marketing, this corporation is involved in practically every phase of the global oil and natural gas supply chain. BP also manufactures a range of petrochemical products. This is in addition to producing renewable energy through its own wind farms. As such, this could also be considered as part of a ESG investing or renewable energy stock portfolio. Several subsidiaries are owned by the BP corporation. For instance, BP acquired Amoco, one of the US’s largest producers of oil and natural gas. Moreover, most of ARCO’s assets, including convenience store chain AMPM, are owned by the US subsidiary of BP. BP also owns Castrol, a business whose lubricants are offered at petrol stations and car part stores in more than 150 nations. BP also owns Aral, which is the largest fuel station chain in Germany and Luxembourg. The company has around 2,300 gas stations in Germany alone. Based on its price at the time of writing, in the last year of trading, this energy stock has increased by almost 30%.

78% of retail investor accounts lose money when trading CFDs with this provider. Devon Energy is one of the most popular energy stocks to watch in 2023. According to 30 sell-side analysts over the last 90 days, Devon Energy is a strong buy. In a nutshell, Devon Energy is a notable US oil and gas producer with a prestigious multi-basin portfolio. The company’s portfolio is actively growing and so is investor interest in its stock. In order to strengthen its position in the energy industry, the business recently elected to purchase Validus Energy, an operator in the Eagle Ford Shale. The deal set Devon Energy back $1.8 billion, and as a result, the company expects to acquire 42,000 net acres. This will be close to its current leasehold in the Eagle Ford Formation. By 2023, Validus production is projected to reach 40,000 barrels of oil equivalent (BOE) daily. Devon Energy anticipates that this acquisition will add sizable sums to its annual cash flow. Furthermore, inventors looking to buy energy stocks for extra income should know this is also a dividend-paying company. At the time of writing, Devon Energy offers a running dividend yield of 6.75%. In August 2022, Devon Energy approved a dividend payment of $1.55 per share. In the last year, this popular energy stock has increased by almost 145%.

78% of retail investor accounts lose money when trading CFDs with this provider. Occidental Petroleum is another option to consider on our list of energy stocks to watch in 2023 – and Warren Buffest seems to agree. Berkshire Hathaway owned over 20% of the company prior to the latest regulatory filing. However, in August 2022, Warren Buffet gained regulatory approval to purchase 50% of Occidental Petroleum. As a result, this fast became one of the most popular energy stocks to watch. The stock price went from around $57 at the start of August, to $75 by the end of the same month. That’s a 32% increase in less than four weeks. Moreover, various catalysts have resulted in soaring oil and gas prices in early 2022 which is why many are interested in buying energy stocks. Pandemic-related travel restrictions have all but been lifted, and so, demand has increased. Additionally, sanctions on Russia’s energy exports have added to the strain on supply. According to its Q1 financial reports, this has done wonders for Occidental Petroleum. It was able to generate a free cash flow of $3.3 billion. This was used wisely as the company paid off a substantial amount of its debt. Moreover, Occidental Petroleum boosted its dividends by 1,200% in early 2022, going from $0.01 to $0.13 per share. In the past year of trading, Occidental Petroleum’s stock has risen by almost 150%.

78% of retail investor accounts lose money when trading CFDs with this provider. Pioneer Natural Resources is an independent oil and gas exploration and production firm. At this moment in time, the corporation operates in the US, Canada, Nigeria, South Africa, Tunisia, and Equatorial Guinea. This company also owns numerous acres of land in the Permian Basin, which produces significant amounts of hydrocarbon. With a projected average length of over 10,500 feet in 2022, the company has raised the forecasted drilled lateral, which represents an increase of 4% over 2021. Pioneer Natural Resources is a component of the S&P 500 and is also the highest paying dividend stock within the fund. At this time, the running dividend yield is over 10.5%. Based on its price at the time of writing, Pioneer Natural Resources stock is trading at over 52% more than it was a year ago.

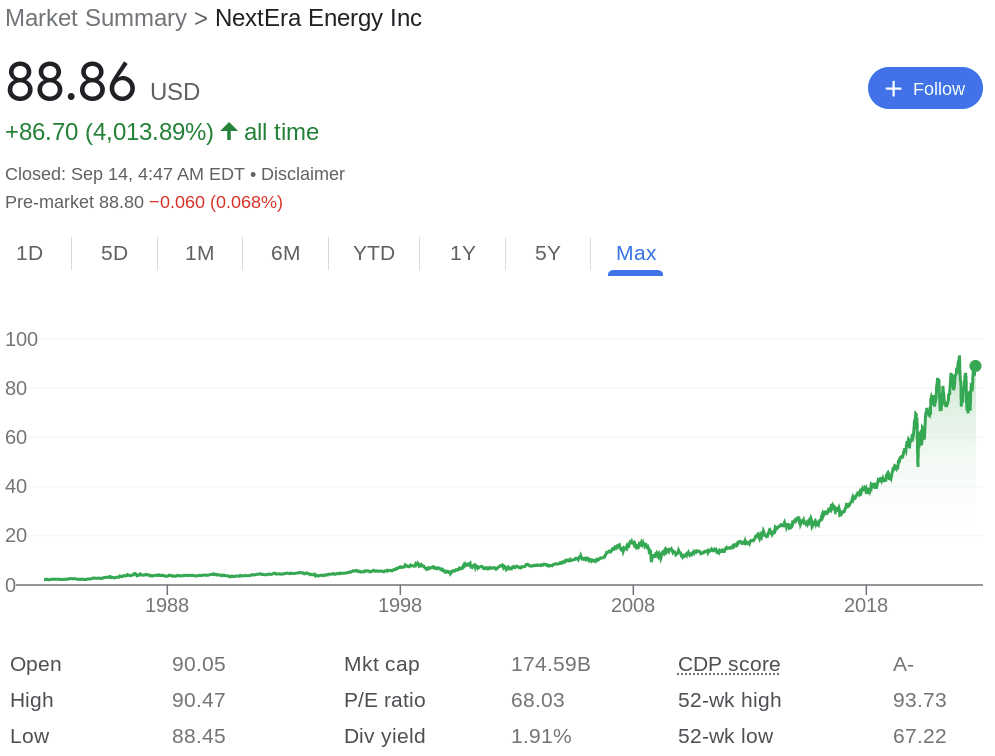

78% of retail investor accounts lose money when trading CFDs with this provider. NextEra Energy is both a climate change stock and one of the biggest utility companies globally. Furthermore, the largest electric utility in the US, Florida Power & Light Company, is also owned by NextEra Energy. This company sells more electricity than any other utility and serves more than 12 million people with dependable, cheap, and clean electricity. This company is becoming one of the leading energy stocks to watch in terms of decarbonization. This is because the US’s decarbonization is something that NextEra Energy wants to spearhead. The company already ranks among the top producers of wind, solar, and battery storage in the country. The so-called ‘Real Zero’ objective, which NextEra Energy announced in mid-2022, calls for the company to end all carbon emissions from operations by 2045. Moreover, according to that proposal, the Florida-based electric provider would increase the 500 MW of battery storage capacity it now has to more than 50,000 MW. At the time of writing, NextEra Energy is trading around 5% higher than it was a year earlier.

78% of retail investor accounts lose money when trading CFDs with this provider. Daqo New Energy is a producer of high-purity polysilicon. This is an alternative energy stock in the sense that the company is based in China. It is, however, listed on two stock exchanges – Shanghai and the NYSE. The business employs an improved hydrochlorination technique together with a chemical vapor deposition procedure (CVD). The hydrochlorination technique is a cutting-edge solution that reduces the complexity of resource and project management consumption. This is sold to producers of solar modules and cells. The company released its Q2 2022 earnings report in August 2022. According to the report, revenue and net income attributable to shareholders almost tripled year over year. Daqo New Energy says this growth was fueled by increased economies of scale, higher manufacturing efficiency, and lower polysilicon production costs. In early 2022, Daqo New Energy announced a new deal with a large solar manufacturer in China. The agreement will see Daqo New Energy supplying high-purity mono-grade polysilicon totaling about 30,000 to JinkoSolar. The deal is ongoing between 2022 and 2026. This alternative energy stock has seen a modest increase compared with the others on this list, with a rise of just over 1.54% over the past year of trading.

78% of retail investor accounts lose money when trading CFDs with this provider. Clearway Energy is one of the best renewable energy companies and developers of utility-scale sustainable energy projects in the US. As such, Clearway Energy is also one of the most popular energy stocks for those wanting to invest in greener utility companies. It owns 4.7 GW of renewable energy projects, including 1.2 GW of utility-scale solar, 3.2 GW of wind, and 300 MW of community and distributed solar. According to the company, 7,000 megawatts of facilities for the generation of wind, solar, and natural gas-fired power make up Clearway Energy’s portfolio of environmentally friendly assets. This company has been very strategic in growing its portfolio to advance its growth ambitions. For instance, in Q4 2021, it executed a number of investments. A $335 million transaction for the remaining 50% of a Utah solar energy portfolio served as its centerpiece. Clearway Energy completed a project to repower a wind farm and increase its output. The company bought a 25% stake in a solar project and acquired a 50% interest in two additional wind energy operations. Additionally, in 2022, Clearway Energy said that it had completed the $1.9 billion sale of its thermal division to KKR. With an increasingly diverse client base and long-term PPAs behind it, Clearway Energy provides reliable cash flow. Moreover, Clearway Energy has agreed to spread out its investment of $600 million among multiple projects. Based on its value at the time of writing, over the last year, Clearway Energy’s stock price has increased by around 25%.

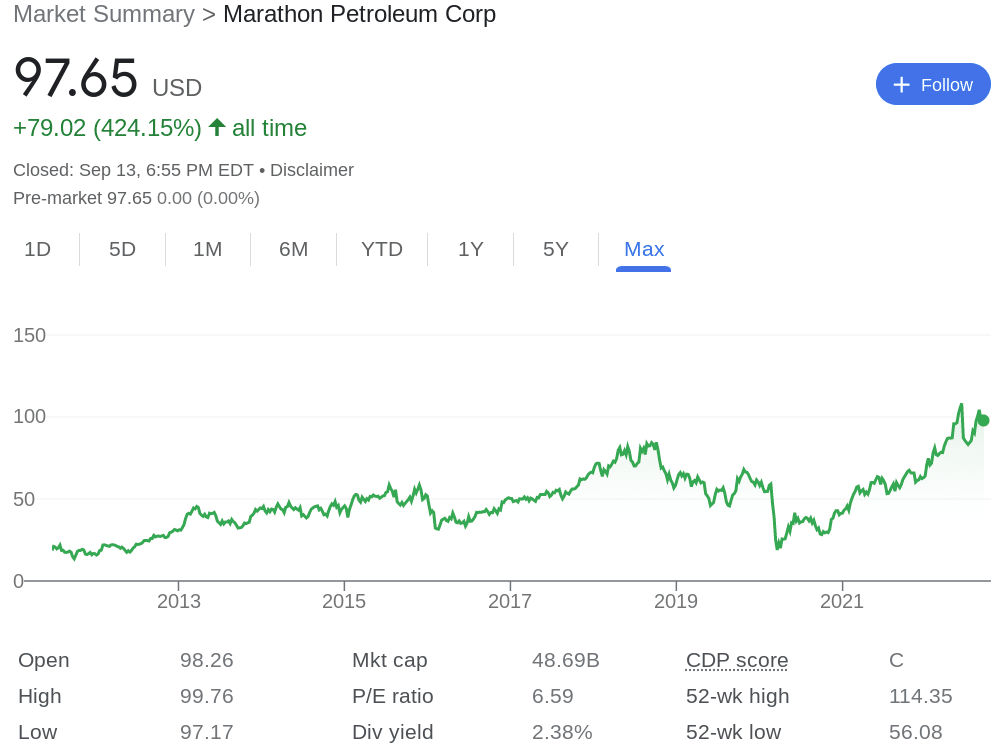

78% of retail investor accounts lose money when trading CFDs with this provider. Marathon Petroleum is headquartered in Ohio and is a prominent, integrated downstream energy corporation. Marathon Petroleum successfully closed a $23.3 billion agreement to acquire its competitor Andeavor in 2018. As such, Marathon Petroleum now has the biggest oil refining company system in the US. As well as refining, Marathon Petroleum also markets and transports petroleum. As readers will be interested to know, a recent spike in price momentum indicates that institutional investors are becoming more exposed to this company. As such, at the time of writing, Marathon Petroleum is among the most popular energy stocks for momentum investors. Furthermore, the company’s revenues have increased due to the aforementioned rising oil and gas prices. In its Q2 2022 financial report, Marathon Petroleum beat its ESP expectations by almost 25%, and revenue illustrated a positive surprise of almost 23%. Based on the price at the time of writing, Marathon Petroleum’s stock has increased by almost 70% in the past year alone.

78% of retail investor accounts lose money when trading CFDs with this provider. EOG Resources is involved in the discovery, advancement, production, and selling of natural gas, liquids, and crude oil. Exploiting shale prospects in the US has been the emphasis in recent years. The business has estimated around 11,500 net premium spots that have not yet been drilled, which has improved the output forecast. The company found 1,900 undrilled premium areas in the Eagle Ford shale play alone. Meanwhile, the upstream company found 6,300 drilling opportunities in the productive Delaware Basin. EOG Resources has outlined a target to produce $6.4 billion in free cash flow throughout 2022, at a price of $80 per barrel for West Texas Intermediate crude. Capital return to shareholders is a top priority for EOG Resources. The company has agreed to pay out monthly dividends of $1.7 billion. Moreover, EOG Resources has the potential to improve its bottom line. The company hopes to do this by using premium drilling to lower its cash operating expenses per barrel of oil. EOG Resources has proven to be one of the most popular energy stocks to watch in 2022. A year prior to the time of writing, this stock was trading at around $70. It has since increased by around 76%.

78% of retail investor accounts lose money when trading CFDs with this provider. Valero Energy is one of the largest refiners globally. The company is looking to advance the future of sustainable energy, as it’s also one of the biggest producers of renewable fuels in the US. Valero Energy refineries may be found throughout the US, Canada, and the UK. The overall throughput capacity of the 15 petroleum refineries in which Valero holds ownership stakes is about 3.2 million barrels per day. The Diamond Green Diesel (DGD) joint venture is part of VLO’s renewable diesel business sector. The DGD is one of North America’s top producers of renewable fuels. Global low-carbon fuel regulations are largely boosting demand for renewable diesel, which is what powers Valero’s renewable diesel business segment. The company has more projects in the pipeline too, such as a 55,000-barrel-per-day delayed sulfur and coker recovery facility. This is expected to be up and running in 2023 and should reduce lost margin opportunities caused by maintenance and increase processing capacity. Over the past year of trading, Valero Energy stock has gone up by over 72%.

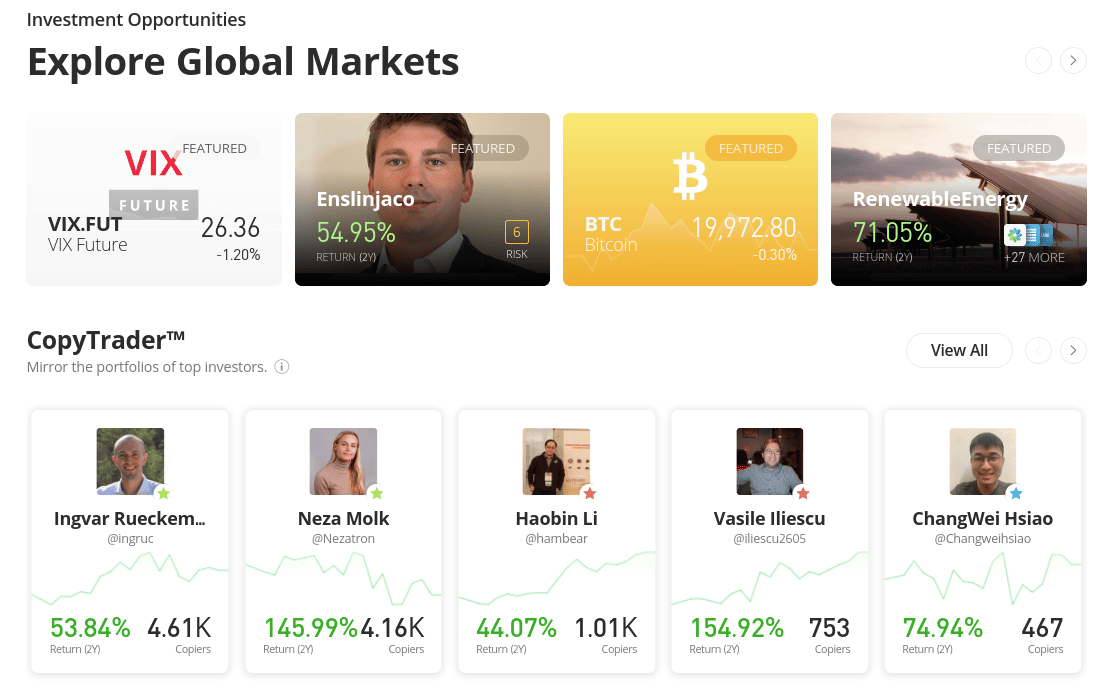

78% of retail investor accounts lose money when trading CFDs with this provider. Buying energy stocks means investing in a company that produces or markets power sources. Companies engaged in the following activities are included in the energy stocks category: Prior to investing in energy stocks, it’s crucial to carry out thorough research on any chosen companies. We’ve reviewed the most popular energy stocks today to aid the decision-making process – so readers can scroll up for a recap of our findings. Additionally, users can also explore our article on the best green investment funds to watch in 2023. One of the top reasons to invest in energy stocks is that the global economy depends on this sector. That is to say, the companies behind energy stocks generate and deliver the power and fuels required to keep the economy running smoothly. The cost of fuel has increased significantly in the first part of 2022, partly as a result of Russia’s invasion of Ukraine. Many of the energy stocks we’ve reviewed in this guide have experienced growth because of this. Some investors may still be uncertain about whether the biggest energy stocks are worth adding to a portfolio, because of the enormous volatility the industry has faced. With this in mind, investors will need to consider their goals and appetite for risk prior to allocating any of their funds to an energy company. After all, if the global price of oil declines substantially, this is likely to have a major impact on the broader value of energy stocks. As the price of oil continues to rise and the climate crisis threatens to change the world as we know it many investors have also started looking at popular uranium stocks. Prior to investing in energy stocks, it’s also necessary to find a regulated brokerage with a variety of assets and reasonable fees. As such, we’ve reviewed the popular trading platform eToro to offer some insight into where to buy energy stocks. At eToro, investors will find many of the equities we’ve analyzed today, which even include alternative energy stocks such as Daqo New Energy. Investors keen on diversifying later can also narrow their search down to specific sectors such as transportation, utilities, minerals, processing, and/or technology. Additionally, stock investors have the option of taking a hands-off approach. This is due to the fact that eToro is a CopyTrading platform. This means that it’s possible to automatically mirror the trades of a seasoned trader by choosing an investor and allocating some funds to them. Every time they place a buy or sell order, the proportionate amount will be copied across to the user’s portfolio. eToro also acts as an automated trading platform. This is because it’s possible to choose and invest in a curated collection of stocks. This passive trading option is called Smart Portfolios and notable options include Utilities, Renewable Energy, and OilWorldWide. Investors can filter down the results to suit their own interests. For instance, it’s possible to only view Smart portfolio’s that focus on say utilities, or manufacturing. The minimum fund allocation to invest in a Smart Portfolio is $500. Investors can, however, start buying energy stocks on an individual basis from just $10. Payment types include everything from credit/debit cards, ACH, and wire transfers, to multiple e-wallets. Deposits made in USD dollars are free of transaction fees. The eToro platform is regulated by the SEC, FCA, CySEC, and ASIC. It is also registered with FINRA in the US.

78% of retail investor accounts lose money when trading CFDs with this provider. Today, we’ve ranked and analyzed 10 popular energy stocks. This includes some much-needed insight into the business model of each energy stock discussed, in addition to ongoing and upcoming projects. Some of the most popular energy stocks to watch in 2023 are BP, Devon Energy, and Occidental Petroleum. However, we recommend IMPT as the best asset for anyone interested in energy-friendly investments – click the button below to learn more about this innovative new project.

11 Popular Energy Stocks to Watch in 2023

A Closer Look at Energy Stocks

1. IMPT – Alternative to Energy Stock Investing

2. BP – Among the 10 Largest Global Oil Companies Globally

3. Devon Energy – Prolific Oil and Natural Gas Producer

4. Occidental Petroleum – Warren Buffett-Backed Carbon Management and Petroleum Producer

5. Pioneer Natural Resources – Independent Hydrocarbon Exploration and Production Company

6. NextEra Energy – Leading Utility Company and Producer of Solar and Wind Energy

7. Daqo New Energy – Leading Producer of Polysilicon for Solar PV

8. Clearway Energy – Renewable Energy and Storage Provider

9. Marathon Petroleum – Downstream Energy and Refining Company

10. EOG Resources – US Energy Company Focused on Hydrocarbon Exploration

11. Valero Energy – Producer and Marketer of Energy, Petrochemicals, and Transportation Fuel

What are Energy Stocks?

Why do People Invest in Energy Stocks?

Regulated Stock Brokers Offering Energy Stocks

eToro – SEC and FCA Regulated Energy Stock Provider

Conclusion

FAQs

What is an energy stock?

What are the biggest energy stocks?

Is investing in energy a good idea?