eToro is a leading online broker that is regulated by the FCA and covered by the FSCS.

It allows beginners and experienced traders alike to invest in thousands of commission-free stocks and ETFs, alongside low-cost markets on forex, commodities, indices, and cryptocurrencies.

In this eToro review UK, we explore everything there is to know about the broker – covering supported markets, fees, account minimums, user-friendliness, safety, payments, and more.

eToro Review UK: Pros & Cons

Our eToro UK review found that the broker offers the following pros and cons:

Pros

- Regulated by the FCA and covered by the FSCS

- 0% commission trading on thousands of stocks and ETFs

- Low-cost trading markets on forex, commodities, indices, and crypto

- Very user-friendly and perfect for beginners

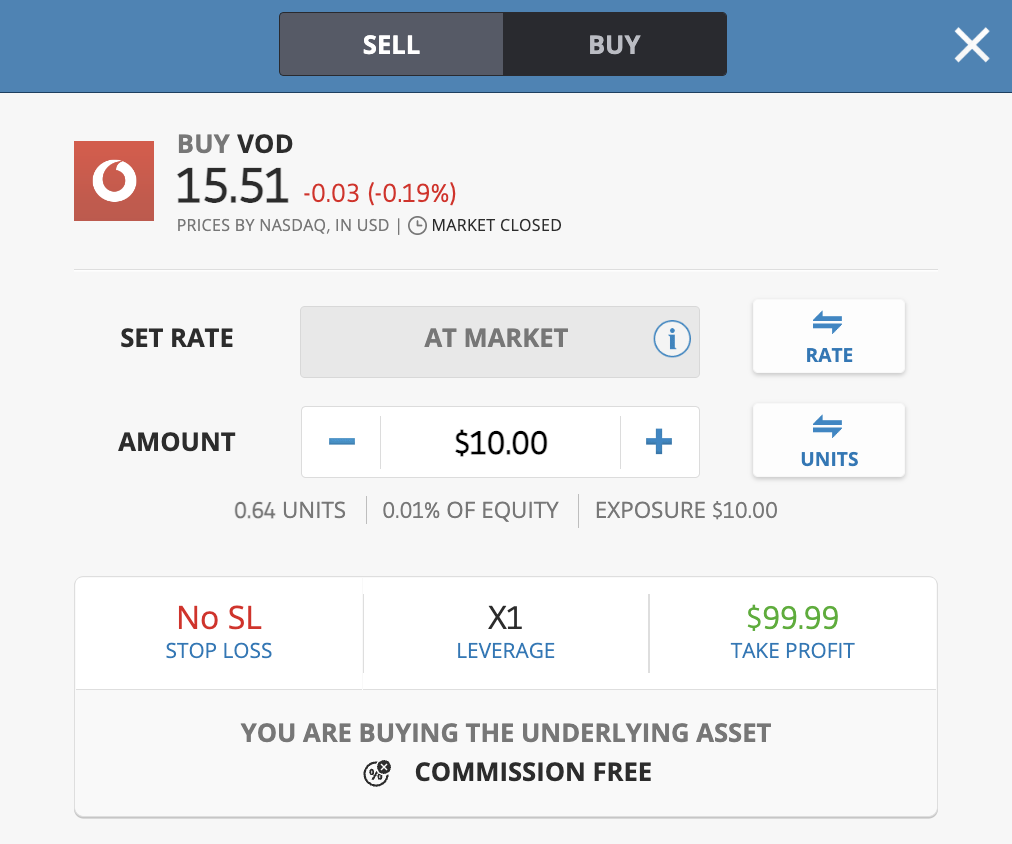

- Small minimum trade size of just $10 (about £8)

- Accepts UK debit/credit cards, e-wallets, and local bank transfers

- Top-rated stock trading app UK for iOS and Android

- Secure eToro wallet for crypto

Cons

- No support for third-party trading platforms like MT4

Cryptoassets are a highly volatile unregulated investment product.

Tradable Assets

In the first section of this eToro review UK, we will explore what trading markets users have access to.

Crypto

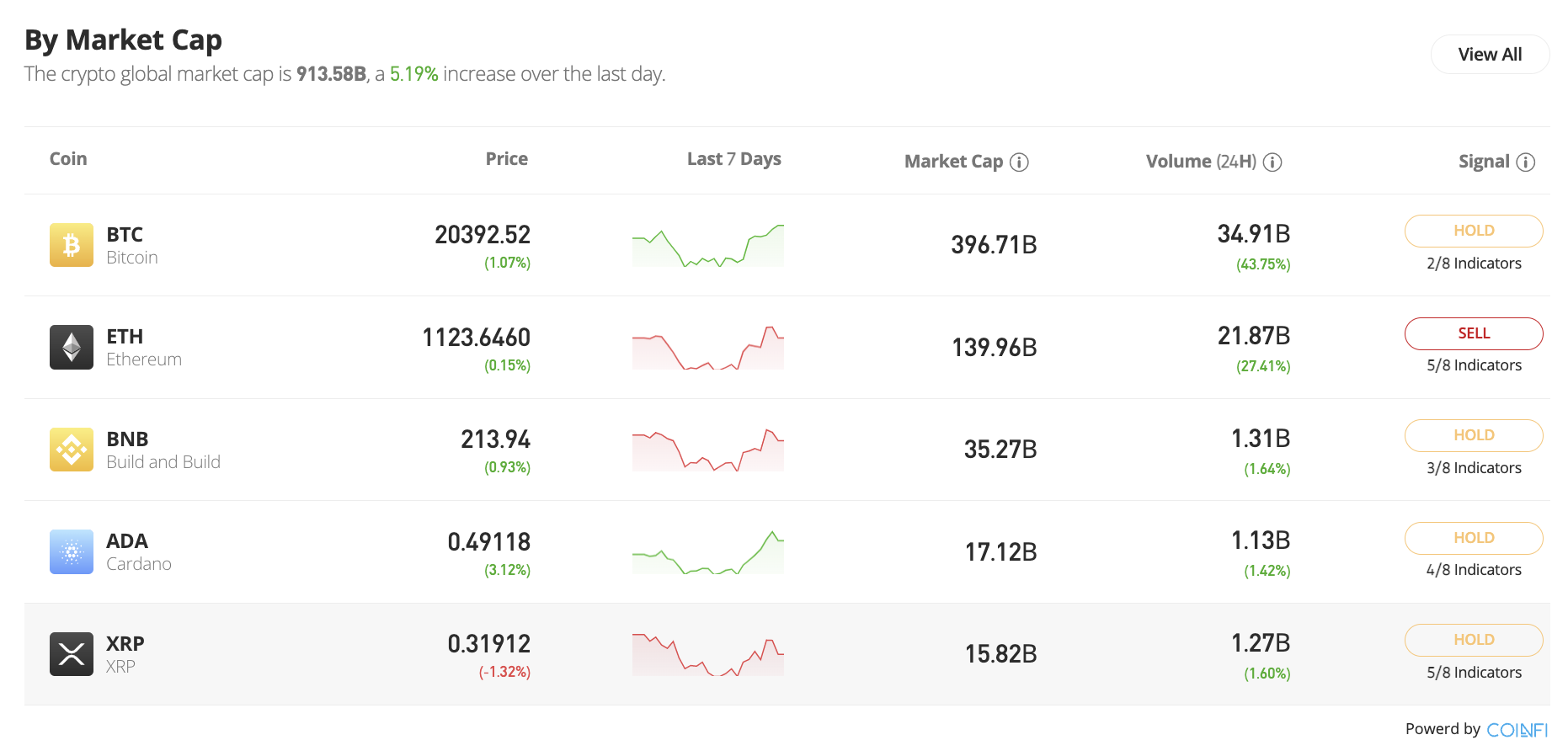

Those looking to gain exposure to digital currencies will likely find that eToro is the overall best place to buy crypto in the UK. The eToro crypto platform supports more than 70 tokens as of writing, albeit, this number continues to grow as per client demand.

Not only can users buy Bitcoin on eToro alongside other large-cap tokens – like Ethereum, Cardano, and Dogecoin, but plenty of DeFi tokens too. Examples here include Decentraland, Uniswap, Compound, and The Graph.

What we really like about the crypto department at eToro is that the platform requires a minimum trade size of just $10 (about £8). This means that UK investors can gain exposure to expressive tokens like Bitcoin, which trades for thousands of dollars.

As we explain in more detail shortly, eToro also offers crypto-centric Smart Portfolios. This means that through a single trade, UK residents can invest in a broad basket of cryptocurrencies, which is managed and maintained by the eToro team.

Previously, eToro also offered leveraged crypto CFDs. However, as per FCA regulations, only professional clients can access this product.

Shares

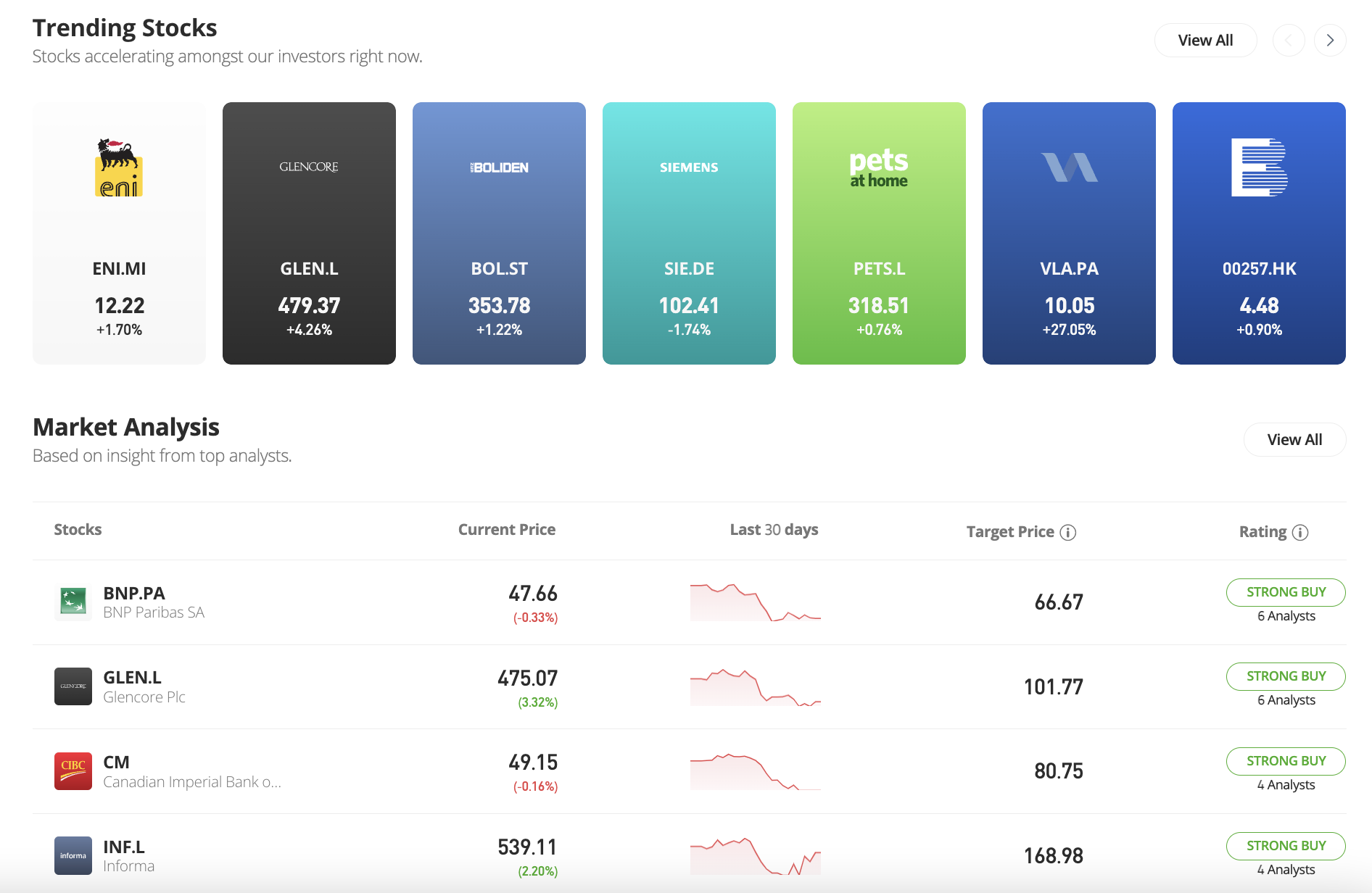

Our eToro review UK found that the broker really stands out when it comes to shares. First and foremost, eToro is home to more than 2,500 shares from a variety of markets.

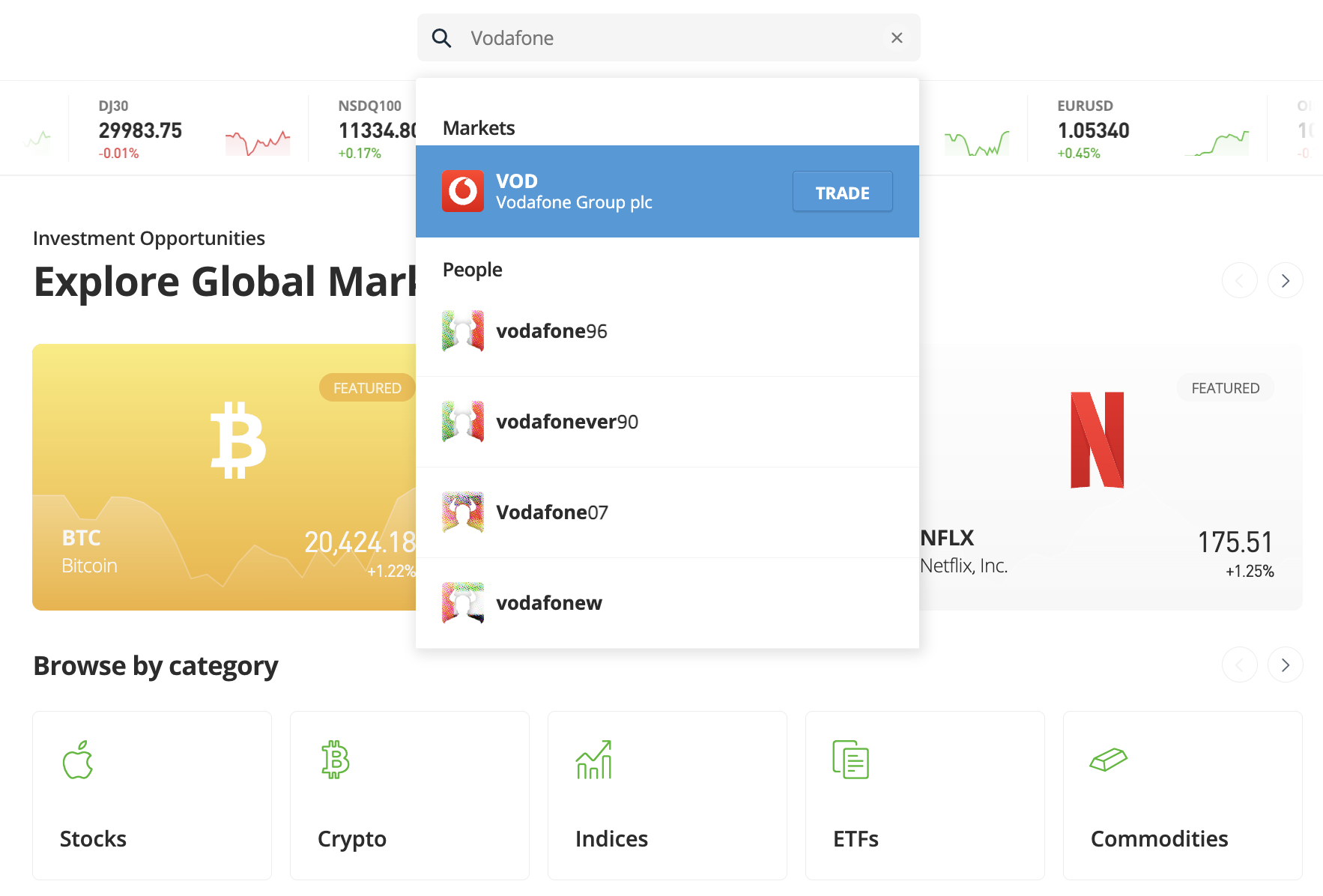

This covers most companies listed on the FTSE 100, with popular shares including Vodafone, BP, BT, Royal Mail, GlaxoSmithKline, and Rio Tinto. With that said, many UK investors will use eToro to invest in shares from overseas markets.

This is inclusive of both the NYSE and NASDAQ, which means that it is possible to buy shares in Amazon, Apple, IBM, Tesla, Microsoft, Nike, Disney, and more. Investors looking to add carbon credits to their portfolios will also be able to buy carbon credit stocks and ETFs in the UK with a live trading account at eToro.

Additionally, eToro also offers access to markets in Germany, France, the Netherlands, Hong Kong, and more.

- In terms of minimums, eToro offers fractional shares from just $10.

- This means that instead of needing to buy a full share, eToro users in the UK can invest just a few pounds.

- This will suit newbie traders that wish to access the share markets without breaking the bank.

- Furthermore, this also makes it a breeze when it comes to creating a diversified portfolio.

- For instance, a deposit of $150 (about £120) would allow the user to buy shares in 15 different companies.

Although we cover fees later in this eToro review UK, we should note that all shares listed can be traded at 0% commission and without stamp duty tax. This is the case with both UK and international shares.

Another thing to note about shares at eToro is that it offers dozens of Smart Portfolios. This will be covered later, but to recap, this offers the chance to invest in a diversified portfolio of shares that is managed by eToro.

When buying dividend stocks and shares on eToro, users will receive their payments directly. This will be reflected in the trader’s account balance, which can then be used to buy more shares or request a withdrawal.

Note: Shares can also be accessed via CFD trading on eToro This means that UK residents can apply leverage of up to 1:5 on a position and even elect to short-sell a company.

Cryptoassets are a highly volatile unregulated investment product.

ETFs

Exchange-traded funds (ETFs) are also popular at eToro. This financial instrument allows UK residents to invest in a group of assets via a single trade. Not only does this include shares, but commodities like gold and silver too.

At eToro, there are hundreds of ETFs, many of which are managed by tier-one institutions like iShares, Vanguard and SPDR. To invest in an ETF at eToro, just $10 is required.

ETFs will potentially suit those that wish to invest in a broader stock market index, like the FTSE 100, Dow Jones, or S&P 500. This is because dozens or even hundreds of shares can be purchased via an ETF through a single trade.

Note: ETFs on eToro can also be traded via CFD instruments. This means that UK residents can apply leverage of up to 1:5 on a position and even elect to short-sell an ETF.

Forex

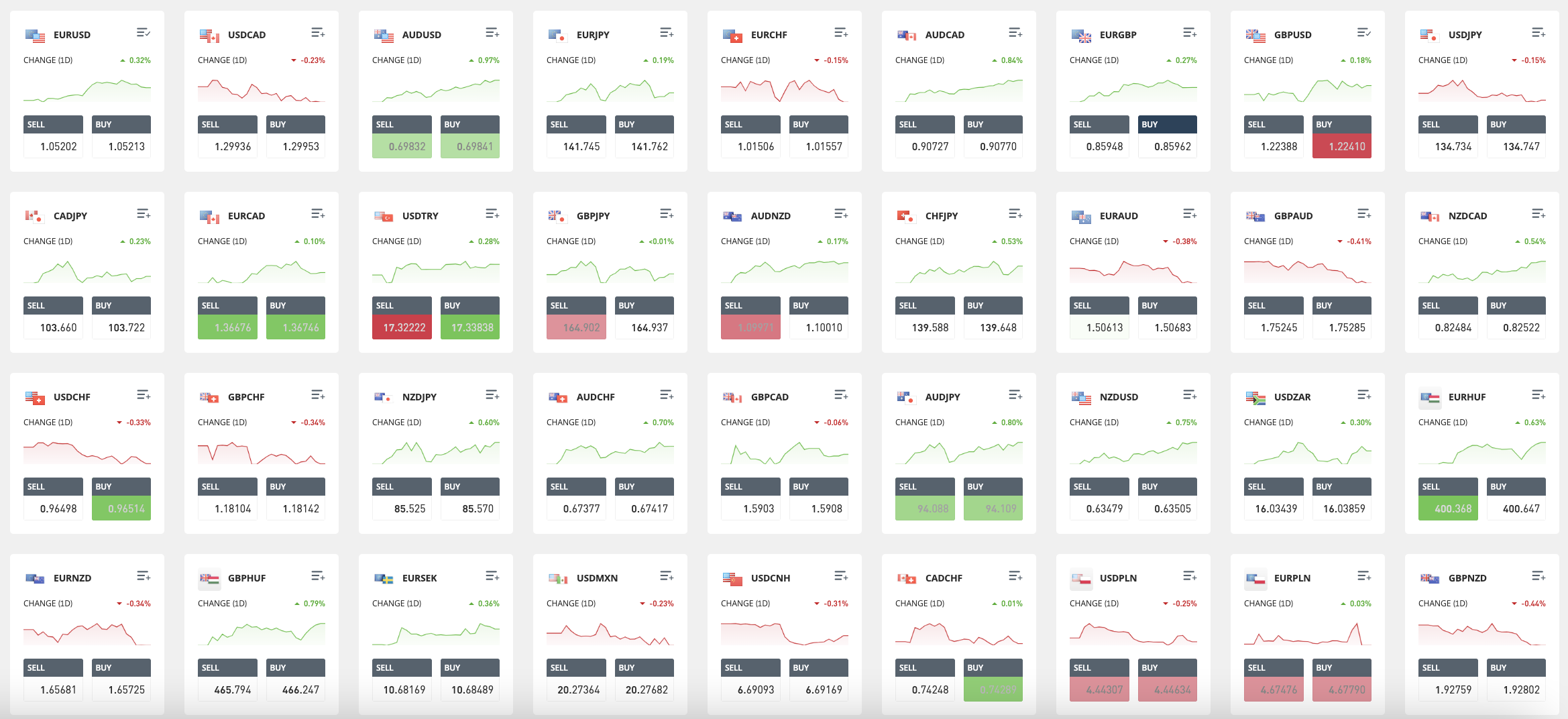

Ever wondered what the best forex broker in the UK is? Forex is the largest trading marketplace globally and consists of investors buying and selling currency pairs like GBP/USD or AUD/USD. If forex trading is of interest, UK investors will be pleased to know that eToro offers dozens of pairs.

All major and minor pairs are covered, as well as a good selection of exotics. The latter includes currencies like the South African rand, Hungarian forint, and Mexican peso.

It is important to note that the forex department on eToro is represented by CFDs. This means that UK residents can trade the future value of a forex pair without owning the underlying asset.

This also means that users can apply leverage of up to 1:30 on majors and 1:20 on minors and exotics. For instance, a £100 stake on a major pair GBP/USD could be amplified by 30 times, which would take the trade value to £3,000.

In terms of minimums, forex pairs at eToro need to be traded at a stake of at least $1,000 (about £815). However, when applying the maximum rate of leverage at 1:30, the minimum capital outlay is reduced to $33.33 (about £27).

Indices

Another popular financial instrument that can be traded via CFDs at eToro is indices. These are specifically linked to index funds such as the Dow Jones or FTSE 100.

Unlike ETFs that track stock market indexes, indices at eToro are more suitable for short-term traders. This means that they give UK investors the opportunity to speculate on whether the indices will rise or fall.

In total, eToro offers access to 15 different indices from a wide variety of markets. This is inclusive of the China 50 and Hong Kong 50, which are both great for gaining exposure to the Asian economies.

The EURO STOXX 50 is also supported here, which is an index that tracks 50 large-cap companies from the European single market.

The minimum trade size on indies at eToro is $200. With that said, indices positions can be entered with leverage of up to 1:20.

Commodities

Our eToro review UK found that the platform also offers an impressive commodities trading suite. This covers the three core commodity types – metals, energies, and agricultural products.

Metals are inclusive of gold, silver, copper, palladium, and platinum. Energies are inclusive of oil and natural gas. Agricultural products include sugar, cocoa, and cotton.

It is also possible to trade oil via futures, with eToro supporting a range of expiry dates. Commodities on the eToro platform are backed by CFD instruments.

Once again, this means that UK investors have the opportunity to go long or short on a commodity without taking ownership. Gold can be traded with leverage of up to 1:20, while other commodities come with lower limits at 1:10.

Those that wish to invest in commodities directly can opt for a suitable ETF. For example, eToro offers access to the SPDR Gold ETF and the iShares Silver Trust.

eToro UK Fees & Commissions

Now that our eToro review UK has covered supported assets and markets, we can now explore what fees the broker charges.

eToro Trading Fees

eToro fees on trading activity will depend on the asset class, as per below:

Shares and ETFs

Both shares and ETFs can be bought and sold without paying any trading commission. This makes eToro a cost-effective option when it comes to investing, as platforms like Hargreaves Lansdown charge £11.95 per share trade.

Perhaps even more impressive is the fact that the commission-free offering on shares and ETFs extends to international markets.

This means that it is possible to buy shares in the likes of Amazon and Tesla without being hit with premium fees. This is almost always the case with other stock brokers in the UK.

Another thing to mention is that when buying shares listed on the London Stock Exchange, UK residents are required to pay a stamp duty tax of 0.5%. However, eToro waivers this fee for its customers.

Cryptocurrencies

While cryptocurrencies cannot be traded commission-free on the platform, eToro fees in this department are still very competitive. All of the 70+ tokens supported can be bought and sold at a commission of 1% plus the market spread.

To make things easier for the investor, eToro builds this 1% into the buy and sell price of the respective token. As such, the price offered is what will be applied to the order.

When buying cryptocurrencies on eToro, the tokens will be transferred to the user’s portfolio. The respective tokens are therefore safeguarded by eToro in cold storage wallets. There are no eToro crypto fees on wallet storage.

Forex, Commodities, Indices, and Other CFDs

When trading CFDs at eToro – which is inclusive of forex, commodities, and indices, there are no commissions to pay. Instead, users will simply need to cover the spread. This is the gap between the bid and ask price of the asset being traded.

The specific spread will not only depend on the asset class, but also on the market. For example, when trading major forex pairs like EUR/USD and USD/JPY, the minimum spread that will be paid is just 1 pip. However, when trading a minor pair like NZD/USD, the minimum spread increases to 2.5 pips.

Energies like oil and natural gas can be traded from 5 pips and 10 pips respectively, while gold starts at 45 pips. Naturally, higher valued assets will come with a higher spread in pip terms.

Indices trading at eToro is particularly competitive, with the spread starting at just 0.75 points. If electing to trade stocks via CFDs, the minimum spread amounts to 0.09%.

Read more: If you’re looking for spread betting brokers in the UK read our article on the best spread betting platforms in the UK for 2023.

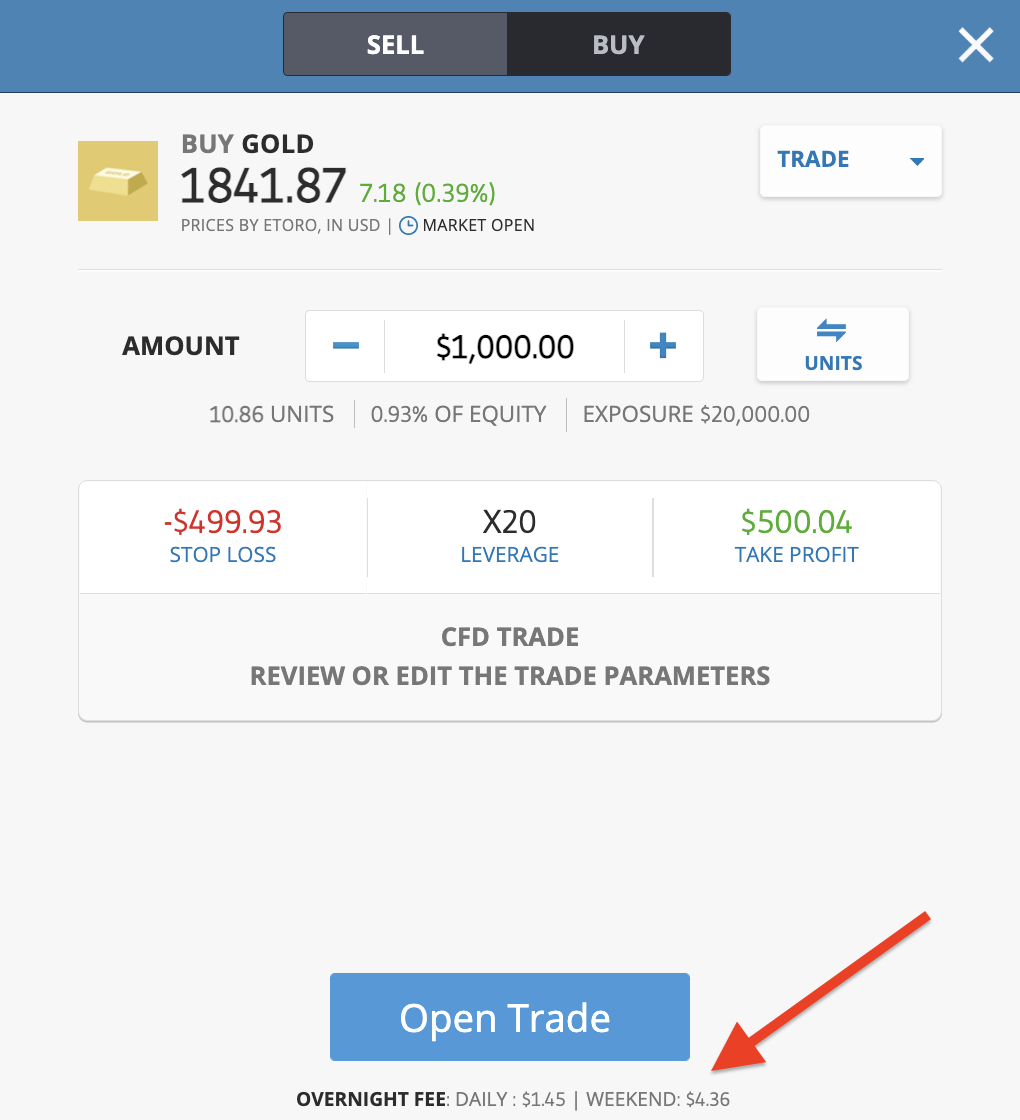

Overnight Financing Fees on CFDs

The best CFD brokers in the UK all charge overnight financing fees. It is important to note that when trading CFDs, overnight financing fees apply. This fee is payable for each day that the CFD trade remains open – irrespective of whether or not leverage was applied.

Overnight financing fees at eToro are typically higher when positions are kept open over the weekend. Moreover, fees will increase in line with the stake and leverage levels applied to the trade.

What we really like about eToro in this department is that before placing an order, the broker will state in dollars and cents what the overnight financing charges amount to.

For example, in the image above, we are placing a $1,000 order on gold CFDs with leverage of 20x. Therefore, the eToro order box tells us that the daily overnight fee amounts to $1.45 between Monday and Friday and $4.36 over the weekend.

| Asset | Trading Fee |

| Stocks and ETFs | 0% commission |

| Crypto | 1% commission built into the bid-ask price |

| CFDs | Spread-only – varies depending on market |

eToro Non-Trading Fees

Non-trading eToro fees are as follows:

Deposit Fees

When it comes to eToro fees on deposits, GBP payments are charged a flat fee of 0.5%. The reason for this is that eToro offers access to both the UK and international markets.

And therefore, instead of constantly having to change GBP to other currencies, eToro does this at the point of the deposit. This means that by depositing pounds, the funds will be converted to US dollars.

The fee of 0.5% means that for every £100 deposited, just 50p is payable.

Note: By downloading the eToro Money app, the broker allows UK residents to deposit funds on a fee-free basis.

eToro Withdrawal Fees

Regardless of the amount being cashed out, eToro fees on withdrawals amount to just $5 (about £4). There is, however, a minimum withdrawal requirement of $30 (about £24).

Inactivity Fees

As is the case with many online brokers, eToro charges an inactivity fee. This will be the case if the account remains inactive for a period of 12 months. By inactive, this means failing to place a buy or sell order.

However, it is important to note that the inactivity fee will not apply if the user has assets in their portfolio. The inactivity fee amounts to $10 per month.

| Type | Fee |

| Deposits | 0.5% (GBP to USD) |

| Withdrawals | 0.5% (USD to GBP) |

| Inactivity | $10 per month after 1-year |

Cryptoassets are a highly volatile unregulated investment product.

Is eToro User-Friendly?

In a nutshell, this eToro review UK found that the platform is very user-friendly. This extends to all areas of the platform – from opening an account and making a deposit to searching for an asset and placing an order.

Therefore, those that are looking to invest in the financial markets for the first time should find the eToro platform easy to use. The account registration process, for instance, can be completed in just five minutes from start to finish.

This simply requires some personal information and the entire process is conducted via a step-by-step walkthrough.

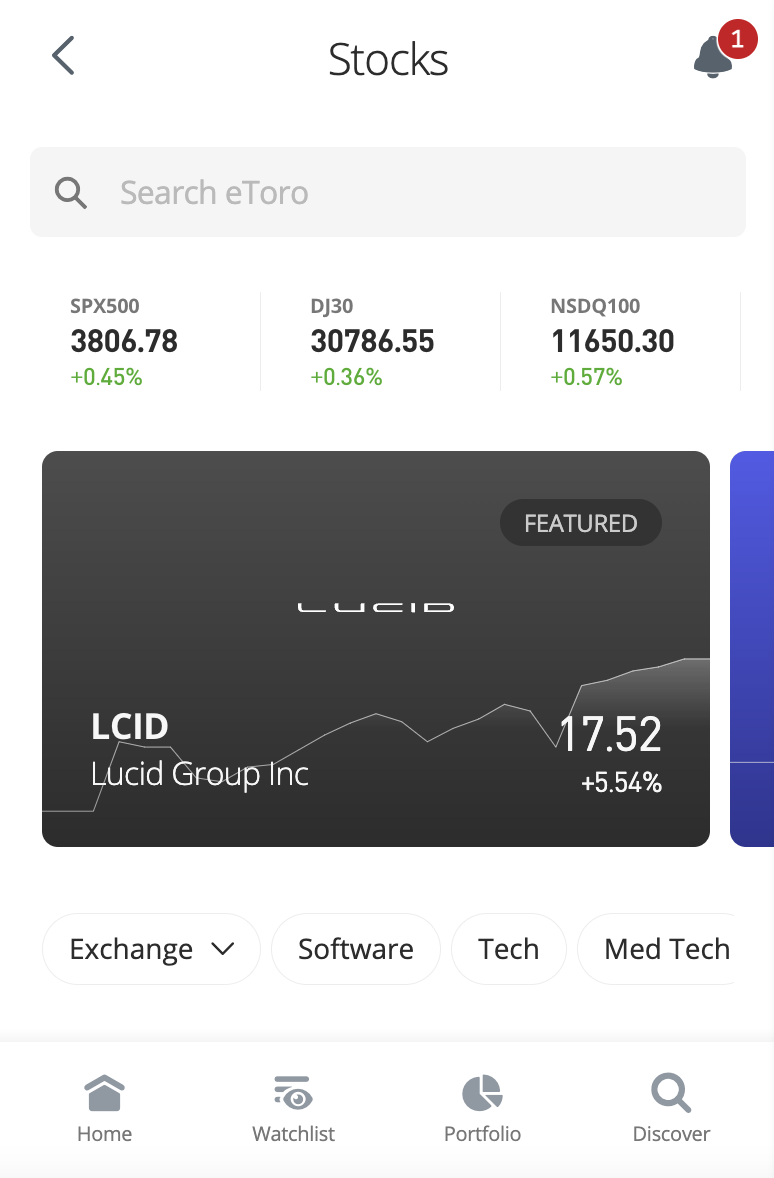

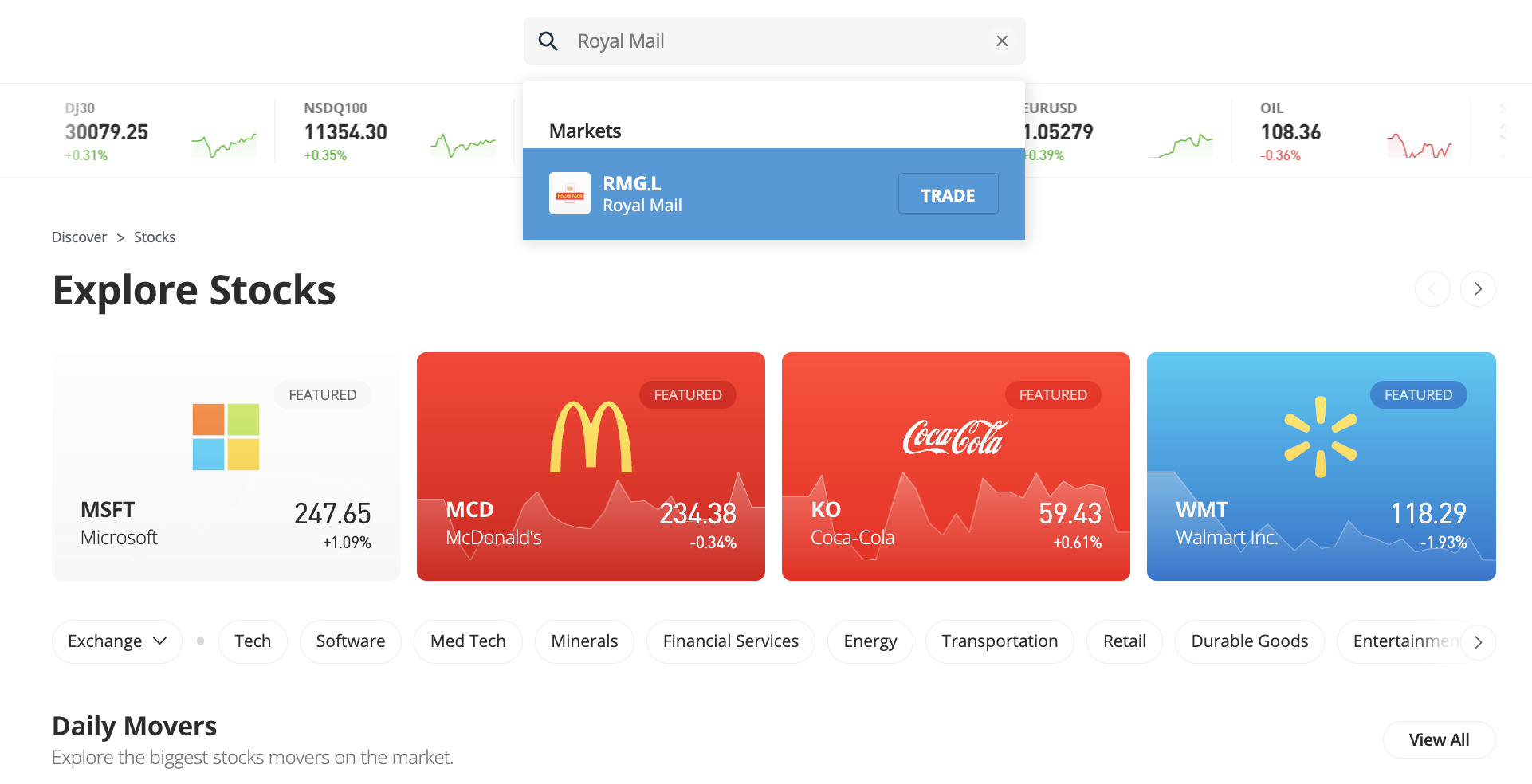

Moreover, as is shown in the image above, the eToro search bar can come in handy when the user knows which asset they wish to buy. In our example, we are searching for Vodafone shares.

After clicking on the ‘Trade’ button, this indicates to eToro that we wish to place an order. And in doing so, it’s simply a case of entering the desired investment size and confirming the position.

To aid newbies further, eToro offers a comprehensive help center that explains all of the functionalities of its platform. There is also an educational hub that offers beginner-friendly guides and videos on core investment topics.

All of this is in conjunction with eToro’s support for fractional investing, which requires a minimum trade size of just $10. There is also the option of switching the eToro account over to ‘Virtual Portfolio’ mode.

This allows users to test the eToro platform out by investing in and trading assets risk-free.

eToro UK Social Trading

eToro is a popular social trading platform that in many ways, follows the same concept as LinkedIn. This is because eToro clients can engage with other users of the platform.

For example, it is possible to leave a comment on a specific asset, expressing thoughts about whether the market will rise or fall in the coming days. In turn, other eToro users can reply to the comment, and even ‘Like’ it.

Copy Trading on eToro

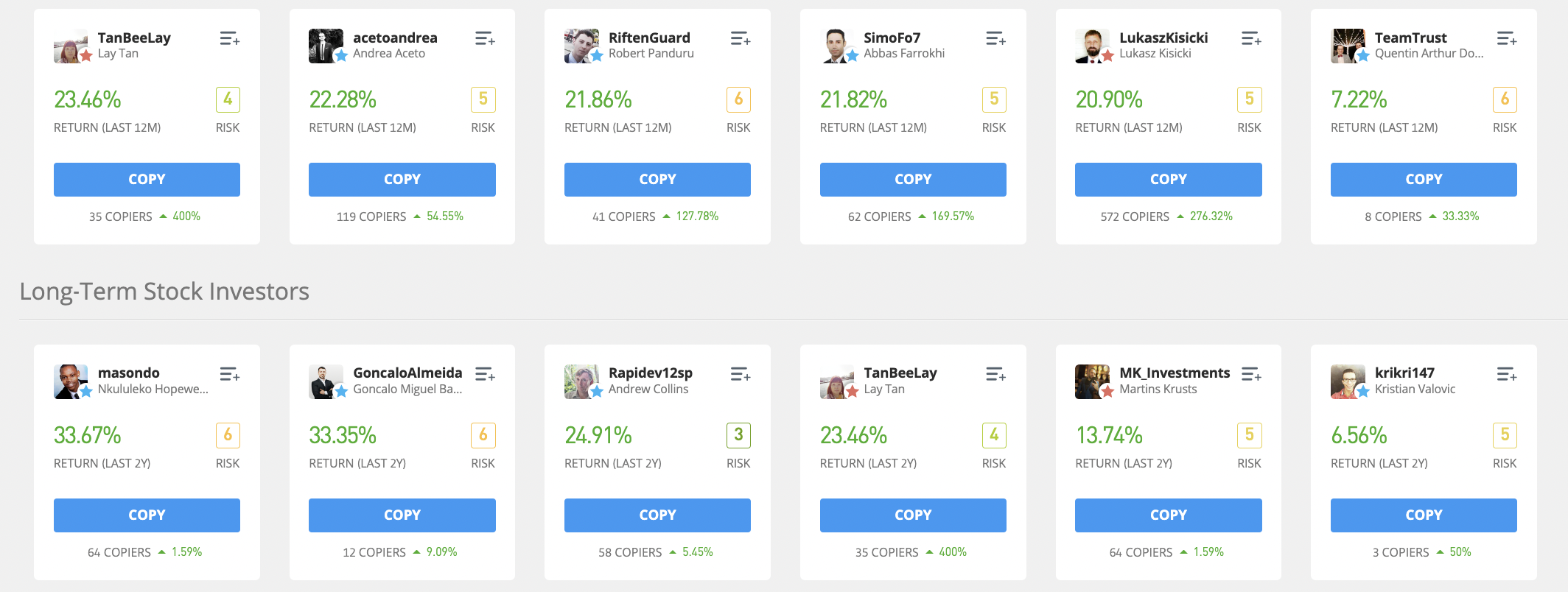

The copy trading tool on the eToro platform is perhaps the most popular feature offered by the broker. In its most basic form, this allows UK investors to ‘copy’ the eToro trades of another person. This promotes passive income, insofar that the chosen trader will determine which assets to buy and sell, and when.

All the eToro user needs to do is select the trader that they wish to copy, alongside the desired stake, and the rest is taken care of. There are thousands of verified traders that can be copied on the eToro platform, some of which have a significant following. While some traders focus on individual assets like stocks or crypto, others take a more diversified approach.

Either way, finding a suitable trader to copy on eToro is very simple. This is because the platform offers a plethora of filters – such as the amount of profit made in the prior year and the assigned risk rating. The minimum copy trading investment at eToro is just $200 for each individual that is mirrored.

Furthermore, the size of each copied position will be proportionate to the amount invested. This ensures that copy trading is suitable for all budgets.

Those completely new to the copy trading concept will appreciate the example given below:

- An investment of $1,500 is made into an eToro stock trader with a great track record on the platform

- The trader allocates 10% of their portfolio into BT shares. They also allocate 30% to Amazon shares.

- On an investment of $1,500, this means that automatically, the eToro user allocates $150 (10% of $1,500) to BT and $450 (30% of $1,500) to Amazon.

Now let’s see what happens when the trader cashes out their Amazon shares:

- Amazon shares have subsequently increased by 50%, so the trader sells their position

- The eToro user invested $450 into Amazon, so at gains of 50%, they make a passive profit of $225

- The BT shares will remain in the portfolio until sold

When it comes to fees, eToro does not charge anything for its copy trading tool. Any standard fees regarding commissions, spreads, or overnight financing will simply be incorporated into the profit or loss of each position.

For inspiration on the best eToro copy trading investors, consider one of the following:

- Jeppe Kirk Bonde – This trader has averaged annualized gains of 28% since becoming an eToro client in 2013. Jeppe Kirk Bonde largely focuses on stocks.

- Analisisciclico – With a risk rating of just 2, Analisisciclico is one to follow should investors seek a conservative approach to the markets. This investor largely focuses on major forex pairs, albeit, indices and commodities are traded too.

- Terence Loh – This trader specializes in crypto assets. In 2020, the trader made gains of 99%, while in 2021, this stood at 52%.

- Fmorbel – Specializing in both crypto and stocks, this trader is up over 70% in 2022, while the broader markets are down.

- CPHequities – While the name suggests that CPHequities is largely involved in stocks, this trader focuses heavily on major forex pairs. CPHequities has a great track record on eToro, with gains of 43% in 2020 and 35% in 2021.

Just remember, when learning how to copy trade on eToro, the past performance of the above traders does not guarantee future results.

Cryptoassets are a highly volatile unregulated investment product.

eToro Smart Portfolios

Formally known as copy portfolios, smart portfolios offer an alternative way to invest in the stock markets. Each smart portfolio consists of a basket of assets that are hand-picked by the eToro team, with the view of tracking a specific market.

For example, the ChinaTech smart portfolio gives investors access to a basket of leading technology shares that are based in China. This includes everything from Tencent and Alibaba to JD.com and Baidu.

In another example, the DividendGrowth smart portfolio allows investors to gain exposure to a basket of high-yield dividend shares. There are dozens of other strategies to choose from, some of which include cryptocurrencies.

In most cases, smart portfolios require a minimum investment of $500 (about £410). Once the investment is made, eToro will manage and rebalance the respective portfolio on behalf of investors. This ensures that the investment remains passive.

eToro UK Charting and Analysis

Although eToro is an ideal online broker for beginners that wish to invest for the first time, the platform also offers an abundance of charting and analysis tools that will appeal to more experienced traders.

Charting and Technical Analysis

Our eToro review UK found that each and every asset supported by the platform comes with a fully interactive pricing chart. This offers real-time pricing on a second-by-second basis.

By expanding the standard chart, an assortment of tools can be accessed. This includes dozens of technical indicators like the moving average, MACD, and RSI.

The chart can be customized in terms of its colour and background, and users can switch between candlestick bars and traditional lines. Moreover, the timeframe can be selected from 1-minute to 1 week.

Therefore, eToro offers all of the required charts and tools to perform high-level analysis.

Financial News

Being able to pick the right assets and know when to enter and exit the market requires the assistance of financial and economic news.

Our eToro review UK was therefore pleased to see that the platform offers news developments throughout the day for most of the assets that it supports. Users simply need to click on ‘News’ button displayed within the trading page for the respective market.

News stories are extracted from leading media sources automatically, so eToro users can ensure that they are kept abreast with key developments at all times.

Market Insights

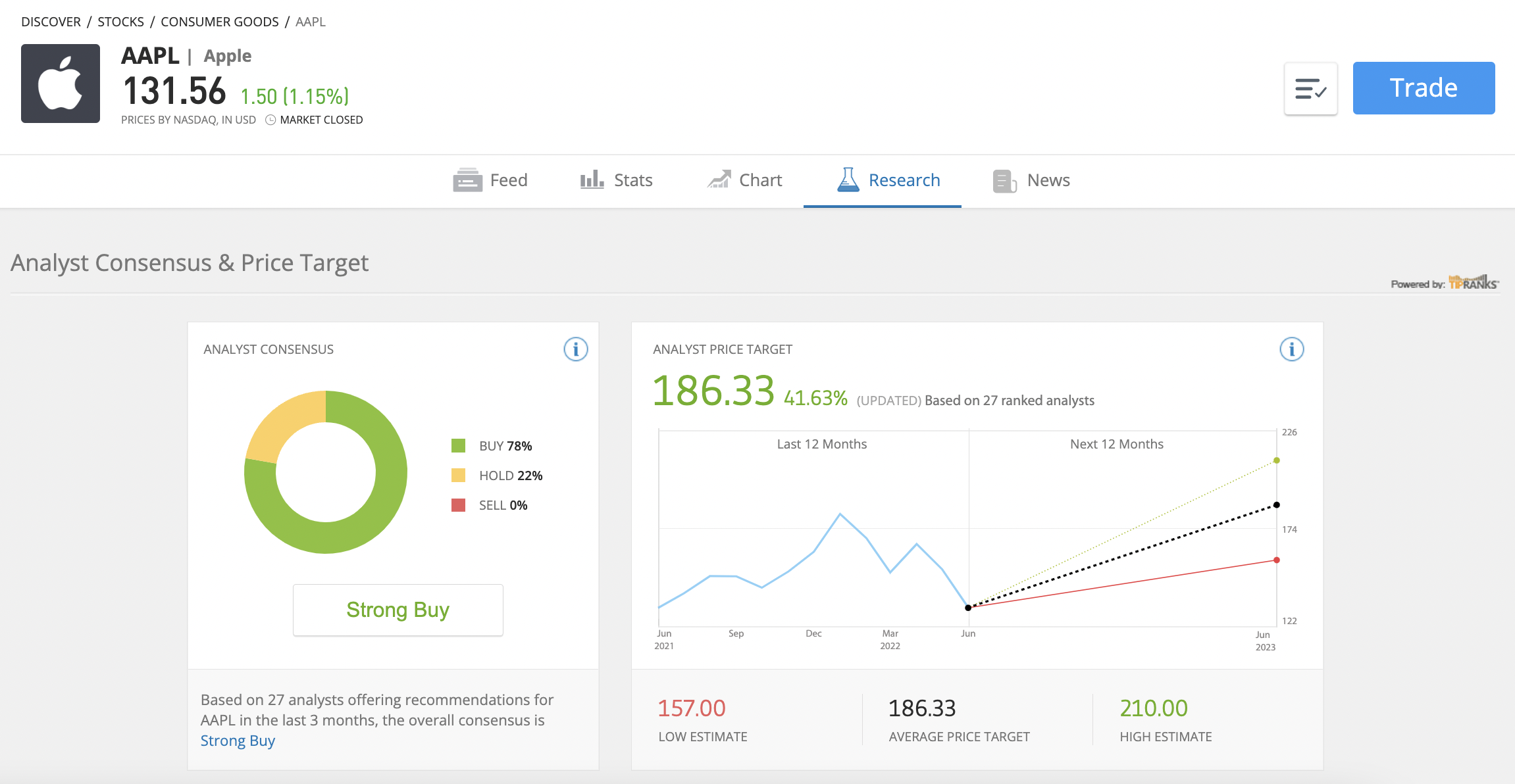

Many of the assets supported by eToro come with solid market insights from leading investors. For instance, major stocks come with price predictions that have been generated by established sell-side analysts.

This offers a lower, higher, and average price estimate for the stock in question. Moreover, eToro also displays whether the market sentiment views the stock as a buy, hold, or sell.

Market Sentiment

Another useful research tool offered by eToro is its market sentiment bar. This is offered on each and every supported market and it highlights what percentage of eToro users are buying and selling the respective asset.

eToro Account Types

The vast majority of investors in the UK will have access to just one account type on eToro. This is a standard account that offers access to the vast majority of supported markets.

The main exception to the rule is if the individual wishes to register as a professional client. This will give the user access to higher leverage limits, as well as the ability to trade crypto derivatives.

eToro also offers Islamic accounts, which come with a minimum first-time deposit of $1,000.

eToro App Review

More and more investors in the UK are turning to investment apps for the convenience that they offer. eToro is no different here, as the platform offers a fully-fledged mobile app for both iOS and Android devices.

The app is free to download and once installed, it will connect to the user’s main eToro account. We found that the app is just as user-friendly and easy to navigate as the primary platform.

For instance, everything has been optimized for the respective operating system, and finding an asset is as simple as using the search bar.

Placing orders via the eToro app is also straightforward. Just like the main website, users simply need to type in their total stake and confirm the investment.

The eToro app also allows users to set up pricing alerts. This means that a notification will appear when a price target is triggered. For example, the user might wish to be notified when BP shares go below 350p or Bitcoin surpasses $25,000.

We also found that the eToro makes the process of checking in on a portfolio a breeze. In fact, the user simply needs to open the app and select ‘Portfolio’ to get a real-time update on its current market value.

Cryptoassets are a highly volatile unregulated investment product.

eToro UK Payment Methods

When it comes to payments, our eToro review UK found that the broker supports the following deposit and withdrawal methods:

Debit/Credit Cards

eToro supports debit and credit cards issued by Visa, Visa Electron, MasterCard, and Maestro. The payment will be processed instantly.

Withdrawals onto debit/credit cards are processed by eToro quickly, but it might take a number of working days to be credited by the respective bank.

E-Wallets

Another payment type supported by eToro is in the form of e-wallets. All accepted e-wallets are processed instantly. This is inclusive of Paypal, Skrill, Neteller, and WebMoney.

Banking

eToro also supports traditional bank transfers. However, do note that it can take several days for the funds to arrive. Rapid Transfer is also an option.

| Type | Deposit Time | Minimum |

| Debit/credit cards | Instant | $10 |

| E-wallets | Instant | $10 |

| Banking | 4-7 working days | $10 |

eToro Minimum Deposit

The eToro minimum deposit for UK residents is just $10 – or about £8, across all supported payment methods. This makes eToro an affordable option for investors of all budgets.

eToro Withdrawal Times

According to eToro, withdrawal times are as follows for each supported payment type:

- Debit/credit cards: Up to 10 business days

- Bank transfer: Up to 10 business days

- PayPal: Up to 2 business days

- Neteller: Up to 2 business days

- Skrill: Up to 2 business days

Ordinarily, the above withdrawal times are often much faster.

eToro Bonuses & Promos

As of writing, eToro does not offer any sign-up bonuses to new customers based in the UK. It does, however, offer a referral promotion.

Put simply, for each new customer that signs up with the user’s referral link or code, a $50 (about £40) bonus will be given to the referer. This can be taken advantage of with 10 different customers, so the total bonus is worth $500 (about £400).

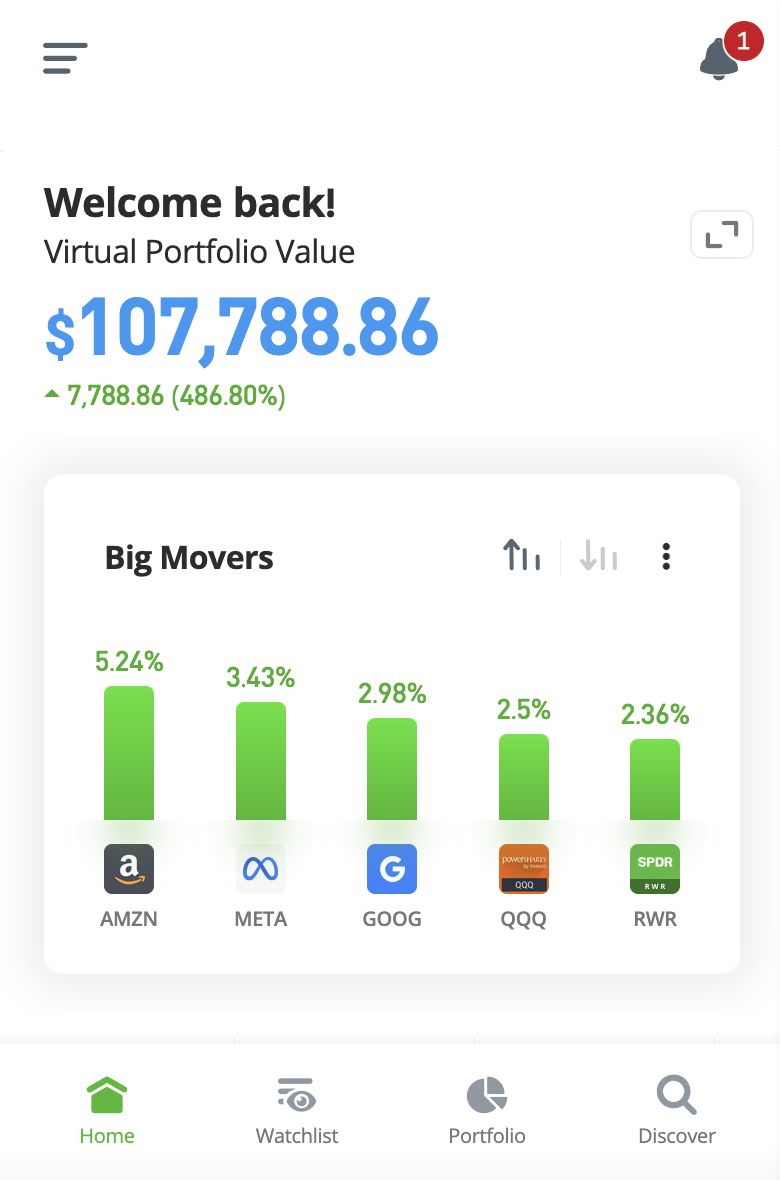

eToro UK Demo Account

Another stand-out feature offered by eToro that investors of all experience levels will appreciate is the free demo account. This comes preloaded with $100k in paper trading funds and can be accessed any time by switching over to ‘Virtual Portfolio’ mode.

In doing so, eToro users can buy, sell, and trade assets in live market conditions without risking any personal funds. This can be a great way to explore the many features and tools offered by eToro.

Moreover, for complete beginners, the eToro demo account can be an invaluable source to get to grips with how online investments work.

The demo account balance can be topped up at any time by contacting the eToro support team. With that said, there should be no reason for the user to burn through a balance of $100k.

Cryptoassets are a highly volatile unregulated investment product.

eToro UK Customer Support

eToro prides itself in offering top-class customer service to all of its 25+ million clients. Before making contact, the first port of call should be to check out the extensive help centre. This covers a plethora of FAQs and most queries should be resolved here.

If not, UK residents can contact eToro via its live chat feature. This will allow users to speak directly to an eToro agent in real-time. Only registered users can utilize the live chat tool.

The other option is to raise a support ticket via the eToro UK login account.

eToro Licensing & Security

When choosing an online stock broker, it is crucial to assess how safe the investment funds are prior to opening an account and most certainly before making a deposit.

- First and foremost, our eToro review UK found that the broker is authorized and regulated by the Financial Conduct Authority (FCA).

- The FCA is the primary body that regulates the UK financial services industry.

- In addition to this, eToro is also regulated by the SEC (US), ASIC (Australia), and CySEC (Cyprus).

- This offers regulatory oversight on multiple fronts and as such – users can be sure that they are trading in a safe and secure environment.

- Not only is eToro heavily regulated, but UK residents also enjoy coverage from the Financial Services Compensation Scheme (FSCS).

- This means that if eToro went bust, UK account holders would be covered up to the first £85,000. However, do note that the FSCS does not cover crypto assets.

eToro also stands out when it comes to customer safety. All new clients are required to get verified by uploading a copy of their passport or driver’s license.

All in all, eToro is as safe as it comes in the UK brokerage scene.

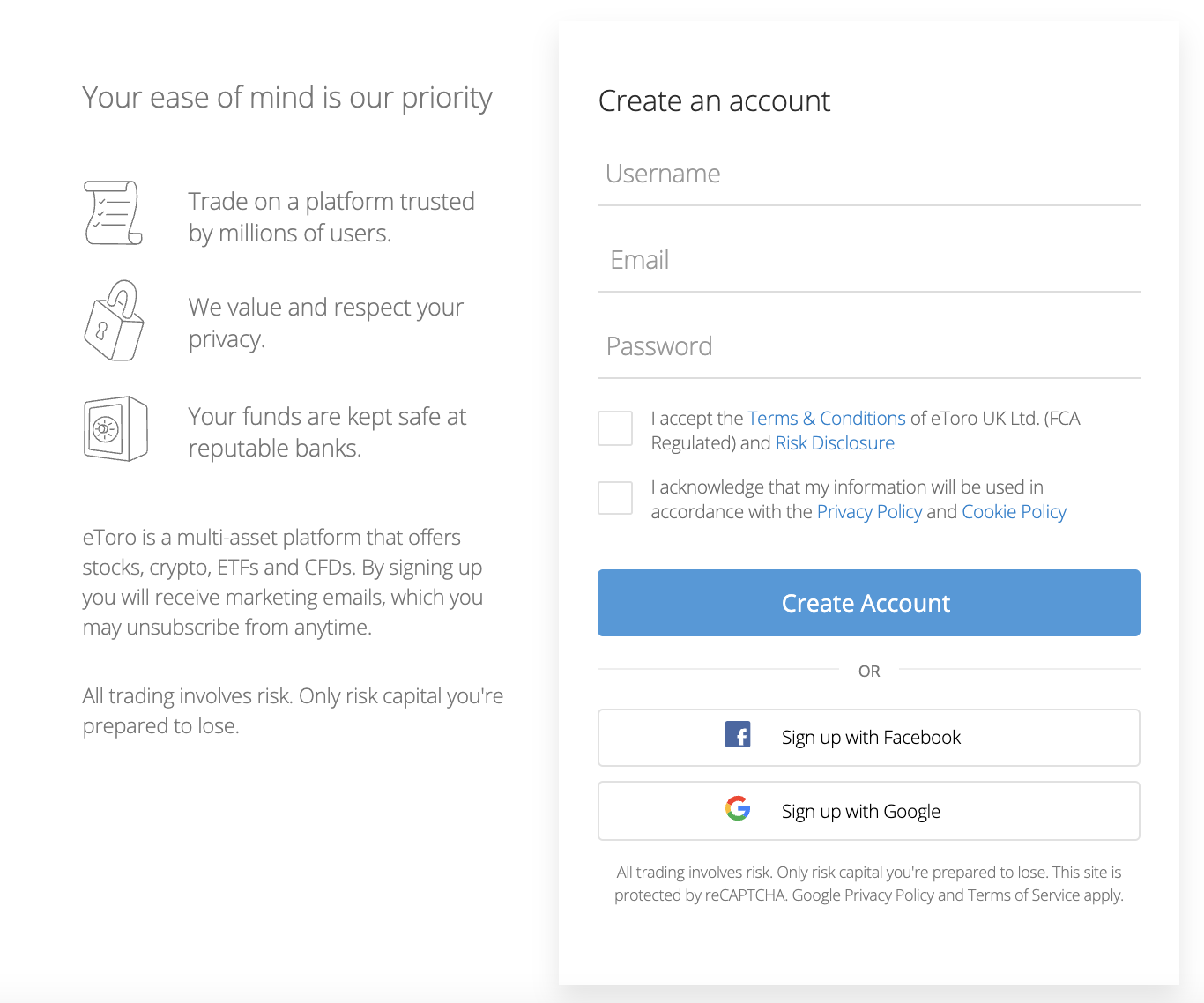

How to Start Trading With eToro in the UK

Those investing in the financial markets for the first time will appreciate the guide below – which offers insight into how to buy shares on eToro.

We cover the account registration process, making a deposit, finding a suitable investment, and placing an order. From start to finish, the walkthrough should take no more than five minutes to complete.

Step 1: Open an eToro Account

A single account on eToro gives the user access to all supported markets. Click on ‘Join Now’ via the eToro homepage and type in an email address and a preferred username and password for future login purposes.

After clicking on ‘Create Account’, confirm the email address and enter some basic personal information when prompted. Enter and verify a UK mobile number before answering a few questions about any prior investment experience.

Cryptoassets are a highly volatile unregulated investment product.

Step 2: Verify Account

eToro will now ask for a copy of the user’s passport or driver’s license for verification purposes.

UK clients can add the required document later if they do not have it to hand right now – as long as the initial deposit does not exceed $2.000 (about £1,700).

Step 3: Deposit Funds

The deposit process at eToro can be completed instantly when selecting a UK debit/credit card or e-wallet. The minimum deposit is just $10 – or about £8.

Bank transfers are supported too, but this can take 4-7 days to arrive.

Step 4: Search for Asset

Those that know which asset they want to buy can type it into the search bar and click on ‘Trade’ when it appears.

In our example, we are searching for Royal Mail shares.

To see which assets are trending right now, click on ‘Discover’ for some inspiration.

Step 5: Place Investment

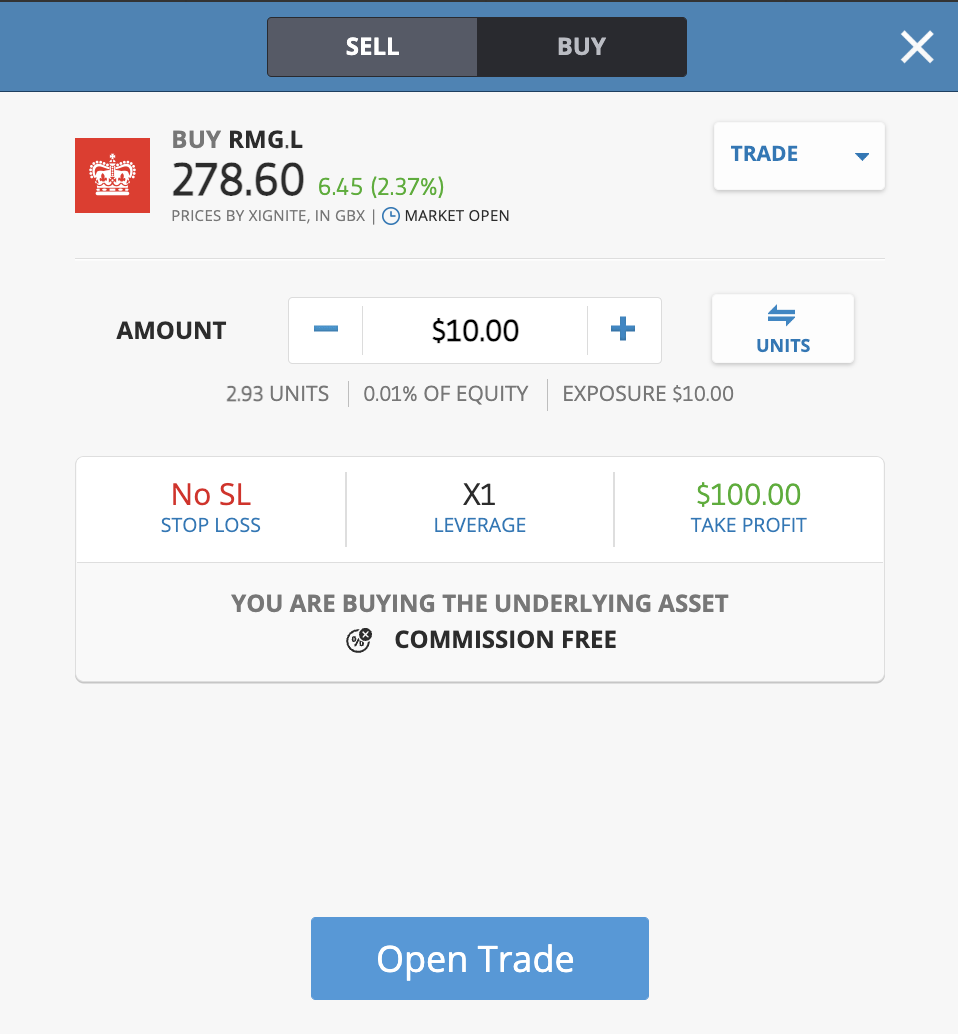

Upon clicking on the ‘Trade’ button, an order box will appear like in the image below.

This is where the user will need to enter the total investment amount. This should be stated in US dollars and the minimum trade size is just $10.

Click on the ‘Open Trade’ to place the investment.

Step 6: How to Sell on eToro

To sell an investment on eToro, head over to the portfolio section of the dashboard. The user should then scroll down and look for the asset that they wish to sell.

After confirming the sell order, eToro will execute instantly – assuming that the respective market is open. If not, the sale will be conducted in real-time as soon as the market reopens.

Either way, upon selling on eToro, the cash will be added to the user’s account balance.

eToro Review UK – Conclusion

This eToro review UK has covered everything there is to know about the broker. We have examined the platform from top to bottom in terms of supported assets, account types, payments, fees, regulations, and more.

All in all, we found that eToro is arguably the overall best broker in the UK for a variety of reasons.

Not only does the platform offers thousands of commission-free stocks and ETFs, alongside low-cost markets on forex, commodities, and indices – but it is regulated by the FCA and covered by the FSCS.

We also like that UK residents are required to invest and stake just $10 (about £8) and the platform accepts payments via debit/credit cards and e-wallets.

Cryptoassets are a highly volatile unregulated investment product. 68% of retail investor accounts lose money when trading CFDs with this provider