US clients looking for a user-friendly and low-cost trading platform might consider eToro. This SEC and FINRA-regulated broker offers thousands of commission-free stocks and ETFs, alongside dozens of cryptocurrencies.

Plus, it takes just minutes to open an account and US clients are treated to fee-free deposits via debit/credit cards and e-wallets. In this eToro review, we explore how this popular broker compares in terms of supported markets, fees, payments, trading tools, and more.

eToro Review: Pros & Cons

The results of our eToro review and summarized in the following pros and cons:

Pros

- Regulated by the SEC and FINRA

- US clients can get started with a minimum deposit of just $10

- USD payments via debit/credit cards and e-wallets are fee-free

- Thousands of commission-free stocks and ETFs

- 70+ cryptocurrencies

- One of the best futures trading platforms

- Minimum trade size is just $10 across all supported markets

- Mobile app for iOS and Android

- Secure eToro wallet for crypto investments

Cons

- No support for third-party trading platforms like MT4

- US clients can not access forex, commodities, or indices

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Tradable Assets

US clients have access to three core assets at eToro – crypto, stocks, and ETFs. In this section of our eToro review, we explore each asset class in more detail.

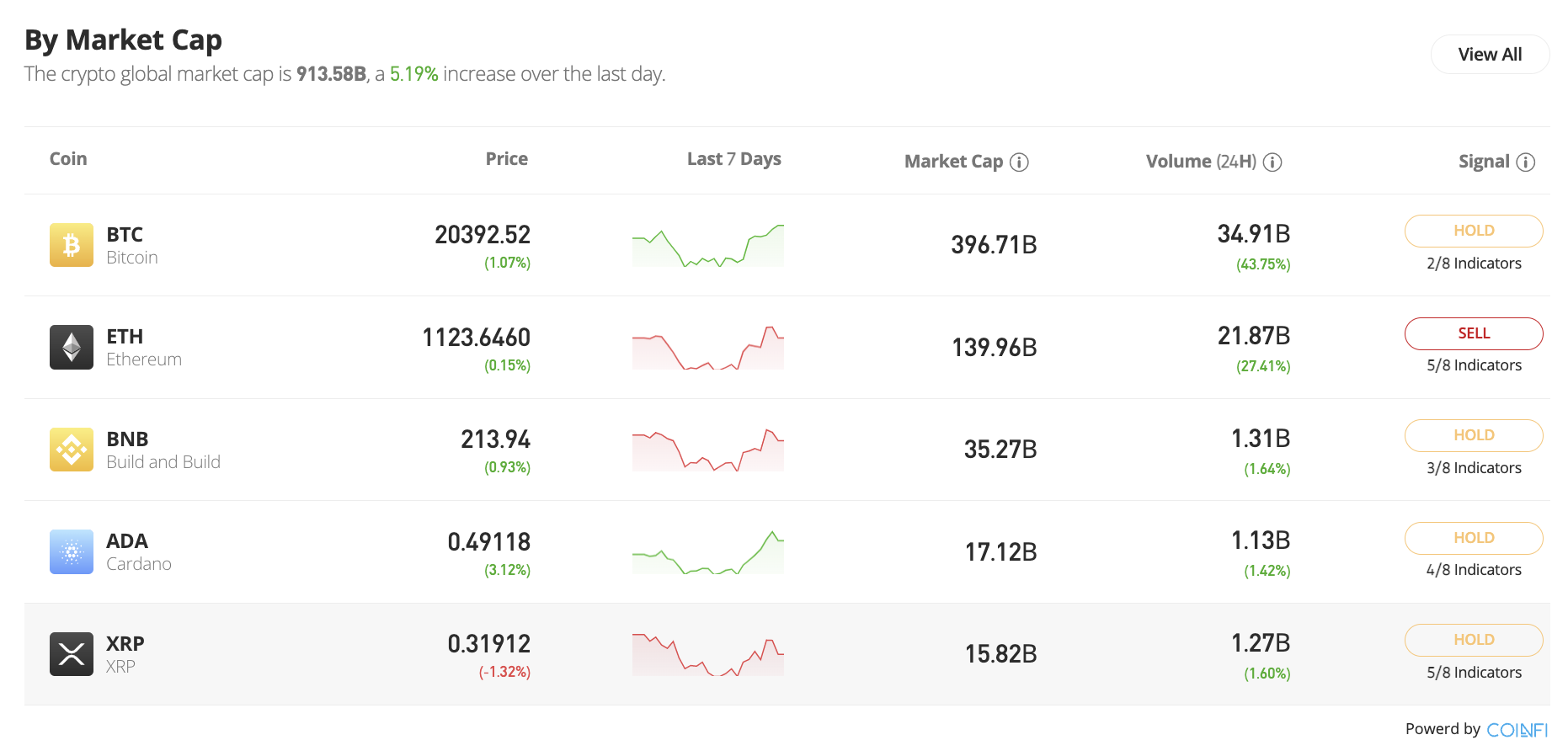

Crypto

eToro offers one of the best places to buy cryptocurrency in the US. The platform offers more than 70 digital tokens, with more being added on a regular basis.

Large-cap tokens – such as Bitcoin, BNB, XRP, Cardano, and Solana are covered, as are popular meme coins like Dogecoin and Shiba Inu. Those with an interest in the metaverse will appreciate that eToro supports the likes of Decentraland and The Sandbox.

Those that wish to buy Bitcoin on eToro, or any other supported token that carries a high-cost price will be pleased to know that the platform requires a minimum trade size of just $10.

For instance, if Bitcoin was priced at $10,000 and the user invests $10, this would mean that they own 0.1 BTC token. This will appeal to investors that wish to gain exposure to cryptocurrencies but with a small amount of capital.

Once crypto is purchased on the platform, our review of eToro found that the tokens are automatically added to the user’s portfolio. This means that when it comes to cashing the crypto out, the user can do this in a matter of seconds.

With that said, the platform also offers a separate eToro crypto wallet that can be downloaded as an iOS and Android app.

This offers more control over the purchased crypto, such as being able to send tokens from one wallet to another. The eToro Money app also allows users to swap one token for another at the click of a button.

Cryptoassets are a highly volatile unregulated investment product.

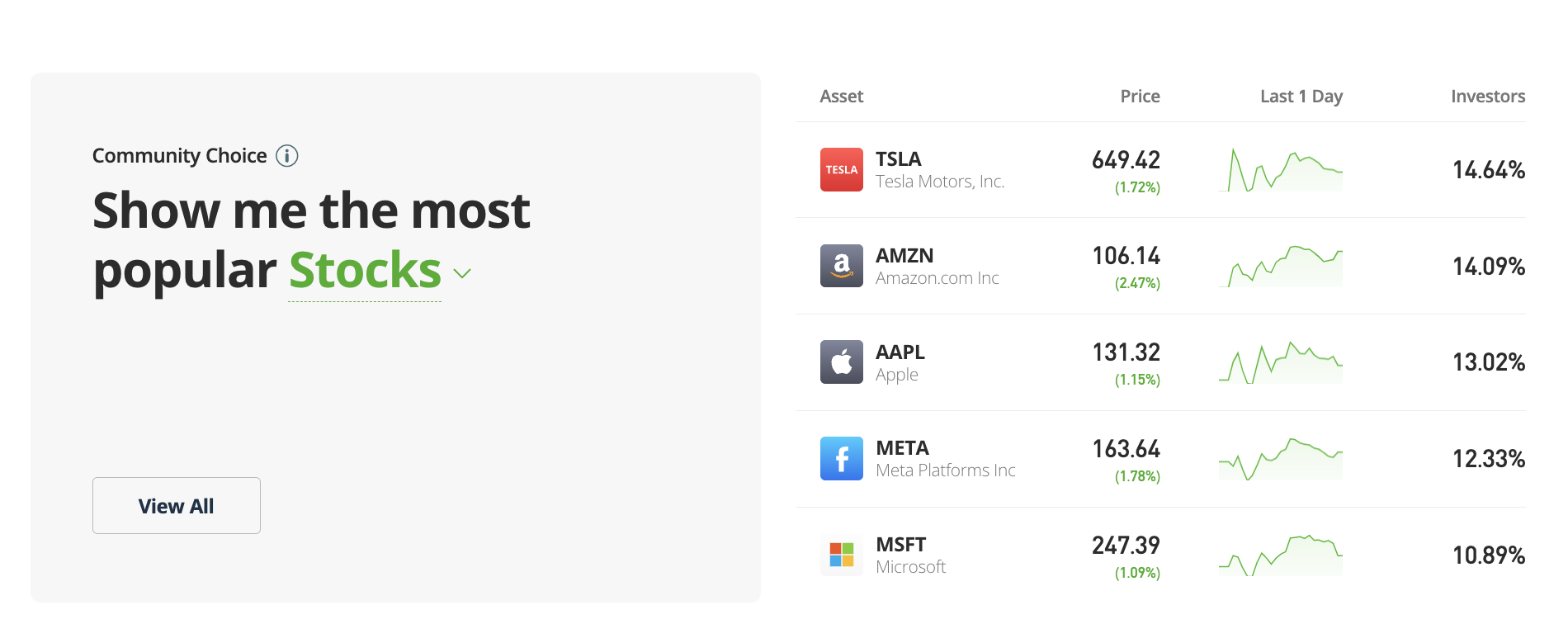

Stocks

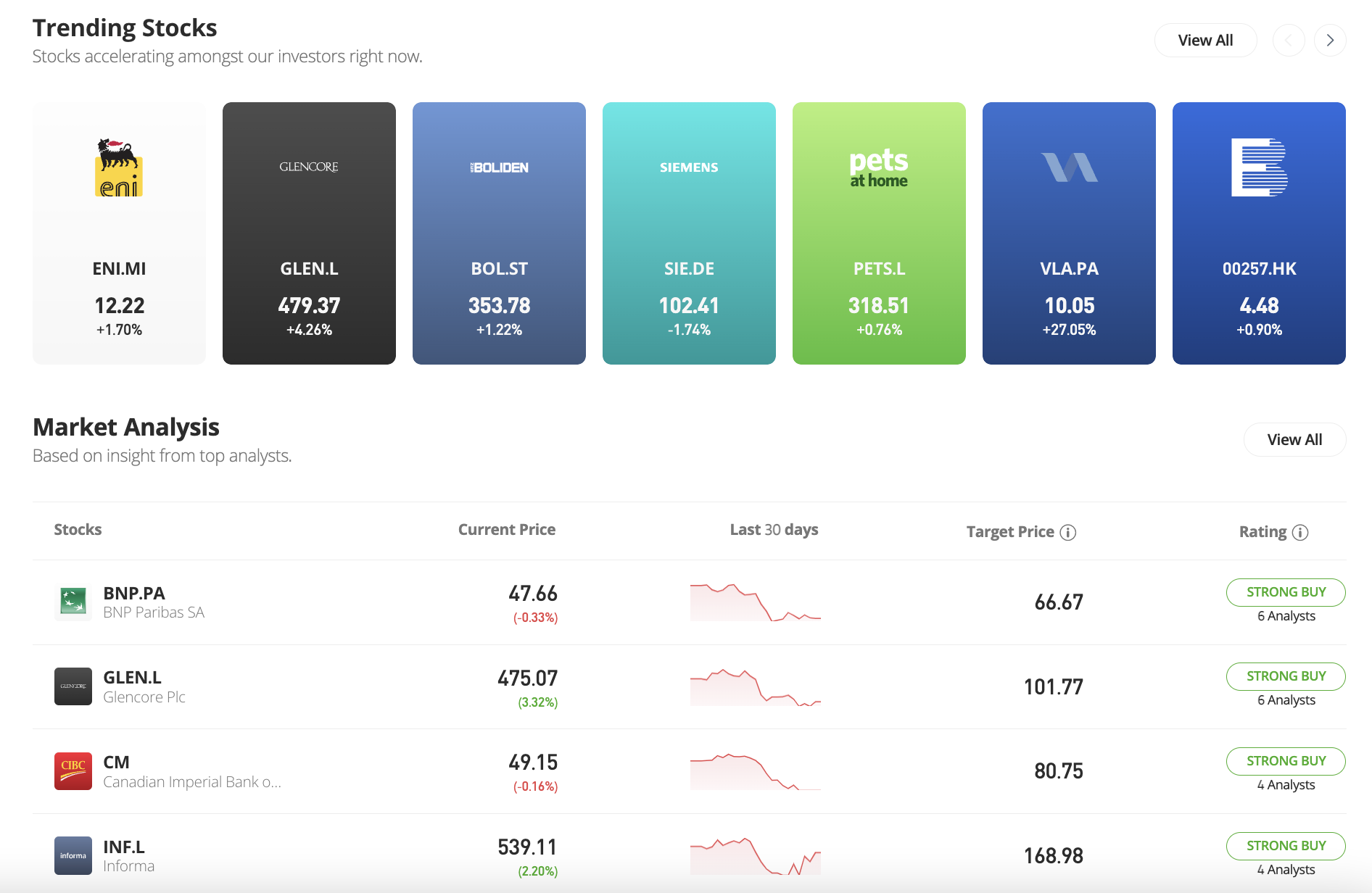

eToro offers a huge library of stocks that now covers over 2,500 equities. In the US, this covers both the NYSE and the NASDAQ. eToro also offers support for international stocks.

Unlike other brokers in the US, this does not come in the form of an ADR (American Depositary Receipt). Instead, eToro offers direct access to the exchange in question.

This covers stock markets in the UK, Germany, the Netherlands, Italy, Canada, Hong Kong, Saudi Arabia, and more. Just like crypto, eToro allows US clients to invest in stocks from just $10 per trade.

This will suit investors that are looking to buy stocks in expensive companies. For instance, the likes of Berkshire Hathaway, Alphabet, and Booking Holdings all trade for thousands of dollars per share.

Another important thing to mention about stocks at eToro is that all markets are commission-free. Not only does this include US-listed stocks, but all supported international exchanges too.

For those looking for inspiration of what stocks to buy, eToro offers numerous filters. For instance, investors can search for stocks by the respective industry or exchange.

eToro also lists stocks with the highest share price increase and decrease over the prior 24 hours.

ETFs

Ever asked yourself the question ‘What is ETF trading?‘ Our eToro review also found that the broker is strong in the ETF department. There are popular ETFs offered by iShares, SPDR, Vanguard, and many others. Markets cover everything from the S&P 500, dividend stocks, gold, silver, and more.

Wondering how much it costs to invest in ETFs with an eToro trading account? The minimum investment per ETF is just $10 at eToro. Once again, this is the case no matter how much the ETF is trading for. Just like stocks and crypto, eToro does not charge any trading commissions on ETF investments. This means you can gain exposure to carbon credit trading without having to pay a penny in commissions.

Assets Not Available to US Clients

eToro is also popular for its forex, commodity, and indices trading markets. However, these markets are offered in the form of CFDs (contracts for difference) on eToro, which are not available to US clients.

eToro also doesn’t offer CFD trading for crypto assets. If you’d like to margin trade crypto with high leverage see our Crypto.com exchange review.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

eToro Fees & Commissions

Our eToro review found that this best CFD broker offers some of the lowest fees in the market – especially to US clients.

For a full breakdown of the eToro fees to consider before opening an account – read on:

eToro Trading Fees

eToro fees for buying and selling assets are as follows:

Crypto Trading Fees

When users invest in crypto, eToro fees amount to 1% of the transaction size. For instance, buying $100 worth of Ethereum would yield eToro crypto fees of just $1. However, the specific fee is actually built into the trading price.

For example, let’s suppose that the market price on Ethereum is $2,000. In this scenario, eToro would display the price as $2,020 to the user.

This is also the case when the user decides to sell. For instance, let’s say that at the time of the sale, Ethereum carries a market price of $3,500. In this scenario, the user would sell Ethereum at a price of $3,535.

Although lower crypto trading commissions are available elsewhere, it is also important to take into account the fees related to USD deposits and also the level of regulation on offer.

As we cover in more detail shortly, debit/credit card and e-wallet deposits and withdrawals are fee-free for US clients and the platform is regulated by the SEC and FINRA. Therefore, paying a commission of 1% still offers tremendous value.

Stock Trading Fees

US clients can use eToro to buy and sell stocks on a commission-free basis. On the one hand, 0% commission trading on US-listed stocks is something offered by most online brokers these days.

However, where eToro really stands out is that it also offers commission-free trading on international stocks. This is the case regardless of if the stock is listed in the UK, Canada, Hong Kong, or any other supported market.

This means that US clients can build a highly diversified portfolio of stocks from multiple markets and economies without being hit with unnecessary fees.

With that said, eToro users will still need to take into account the spread – otherwise referred to as the difference between the bid and ask price of a stock. At eToro, we found that large-cap stocks come with a spread of approximately 0.20% per slide.

ETF Trading Fees

ETFs, just like stocks, can be bought and sold without incurring any commission. There will, however, be a requirement to cover the underlying expense ratio charged by the ETF provider.

This is the case at all online stock brokers. The good news is that when buying ETFs that are backed by the likes of iShares or Vanguard the expense ratio rarely amounts to more than a tiny fraction of a percentage.

| Asset | Trading Fee |

| Stocks and ETFs | 0% commission |

| Crypto | 1% commission plus the bid-ask price |

| CFDs | Not available to US clients |

eToro Non-Trading Fees

eToro fees on non-trading activities are as follows:

Account Funding

There are no fees to open an eToro account or maintain it. Furthermore, US clients will not be charged any deposit or withdrawal fees – irrespective of the payment method being used.

This even includes deposits and withdrawals made via a debit/credit card or an e-wallet. This is a major benefit of using eToro, especially for those that wish to buy and sell crypto with USD dollars.

After all, using a debit/credit card at a conventional crypto exchange can be very costly.

Check out the fee charged to use a debit/credit card to buy crypto at the following exchanges:

- Coinbase: 3.99%

- Bitstamp: 5%

- Gemini: 3.49%

- Binance US: 4.5% plus 0.5% buy fee

As is evident from the above, the 0% deposit fee system at eToro is highly favorable to US clients.

Inactivity Fees

Those that fail to enter their eToro login for at least 12 months will be hit with an activity fee. This stands at $10 per month and open positions will not be closed by the broker should the account balance sit below this figure.

| Type | Fee |

| Deposits | Free for US clients |

| Withdrawals | $5 fee. There’s also a minimum withdrawal amount of $30. |

| Inactivity | $10 per month after 12 months of no login activity. |

eToro Platforms

Some online brokers offer a variety of third-party platforms – such as MT4 or cTrader. eToro, on other hand, offers its own proprietary platform that can be accessed via a standard web or mobile browser.

This is particularly handy for beginners, as it’s just a case of logging into the eToro account with a username and password.

Is eToro User-Friendly?

When eToro was launched in 2007 its trading platform was built from the ground up with beginners in mind. The layout of the trading suite is very user-friendly and free from unnecessary investment jargon.

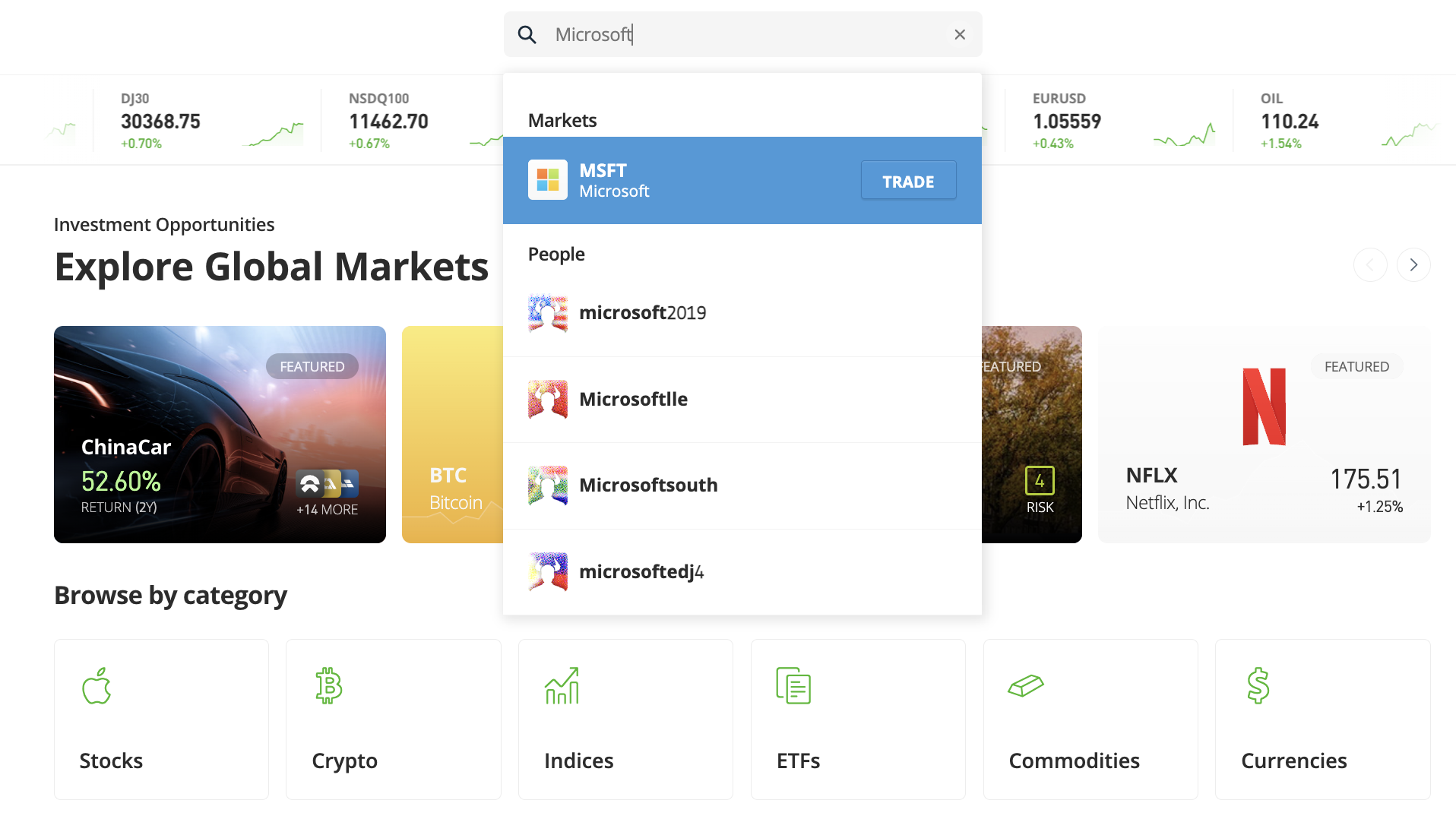

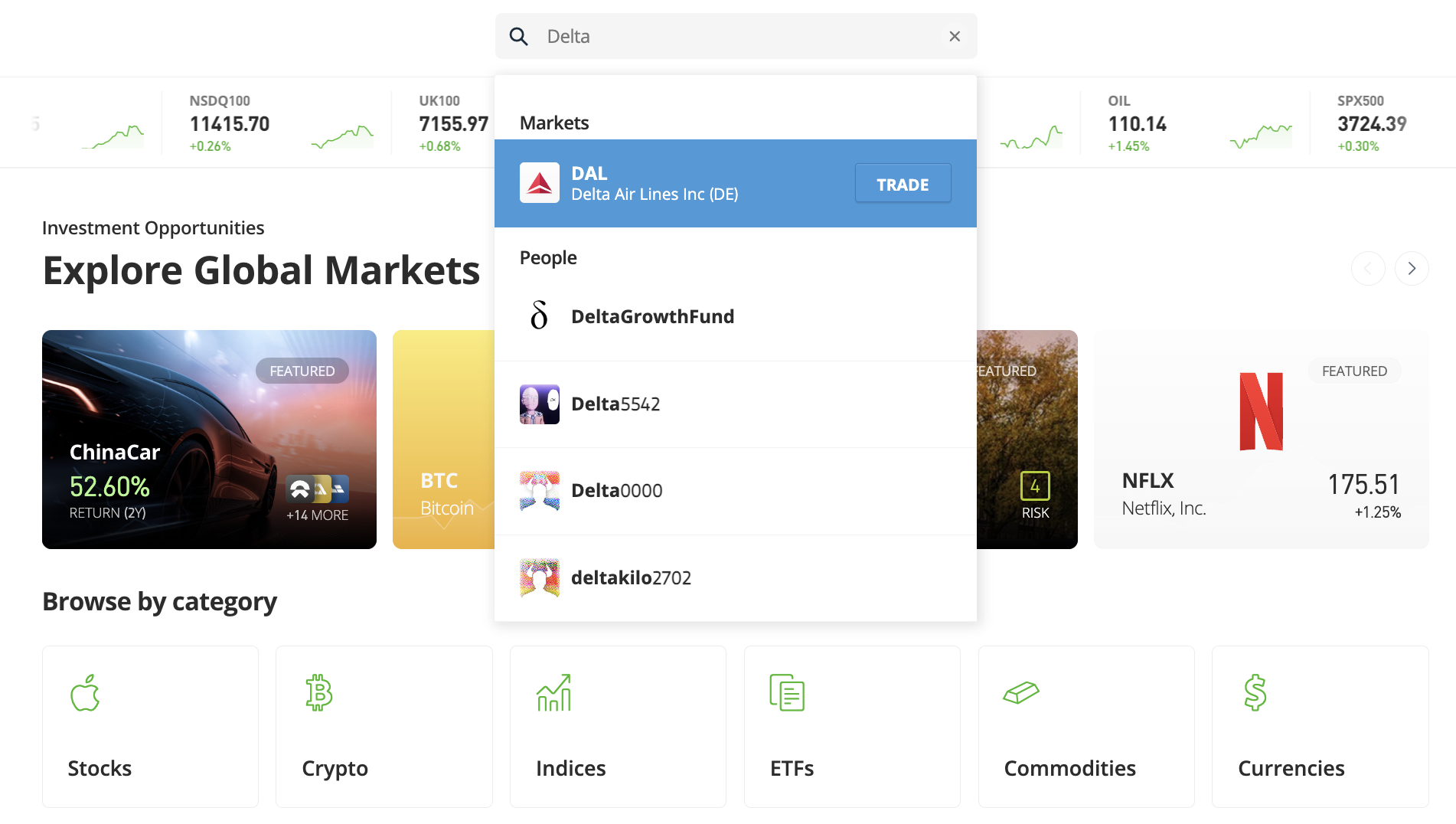

When users wish to find an asset to trade, there is a handy search box. This removes to need to browse through thousands of financial instruments. Those looking for inspiration in which stocks to focus on can use the eToro filter.

This allows users to filter down by the exchange or industry. As we briefly mentioned earlier, eToro also lists the best and worst-performing stocks from the prior 24 hours.

While many online brokers are somewhat intimidating when it comes to placing orders, this isn’t the case when using eToro. Market orders are the default, which means that as soon as an investment is confirmed, it is placed instantly at the next best available price.

This means that the user only needs to specify their investment stake and the order will be placed. Keeping tabs on the value of an investment is simple too and this can be accessed via the user’s portfolio.

eToro will list each and every outstanding position alongside its market value, based on real-time prices. This means that the investor can easily see how their eToro trades are performing in dollars and cents.

We also like that closing an outstanding investment requires just a couple of clicks. Again, this can be achieved via the user’s portfolio and once the sale is confirmed, the funds will be added to the account balance.

eToro Social Trading

eToro is a social trading platform. This means that it allows users to engage with other eToro investors. Underneath each asset on the eToro platform there is a tab marked ‘Feed’.

This operates in a similar nature to Facebook, insofar that it will display relevant posts made by eToro users. People then have the option of replying or ‘Liking’ the post.

eToro also enables users to view the market sentiment of eToro traders on a specific financial instrument. For instance, if 95% of eToro users are buying Meta Platforms stock, this illustrates that the general sentiment is very bullish.

It is also possible to follow specific eToro users to see what assets they are trading. This will also notify the user when a new post is made by the followed investor.

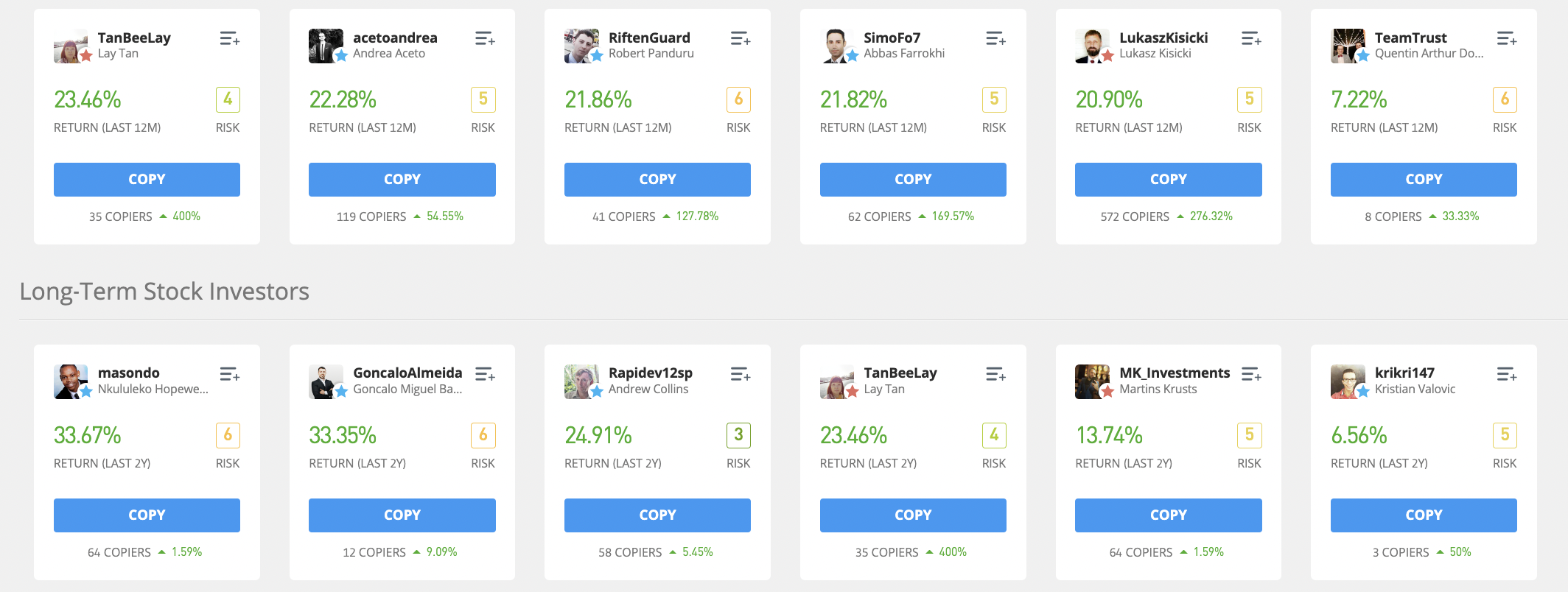

Copy Trading on eToro

eToro copy trading is a great tool to consider for those that wish to invest passively. Copy trading is a great alternative to quant trading. If you’re unsure as to what this is you can read our guide on what is quant trading. Copy trading will suit individuals that have little to no experience in trading or those that simply do not have the time.

In its most basic form, the copy trading tool is home to thousands of verified investors. Users can then research how each investor has performed each month since joining eToro.

They can also view the types of assets traded by the individual and the average length of time they keep a position open. Other metrics – such as the risk rating, maximum drawdown, and more can be viewed.

Once the user selects an investor to copy, they will then need to decide how much to invest – from a minimum of $200. Once confirmed, all future trades made by the individual will be copied over to the user’s portfolio.

Here’s an example of how to copy trade on eToro:

- An eToro user invests $5,000 into a crypto trader

- The trader risks 20% of their capital on Bitcoin

- The trader also risks 10% of their capital on Ethereum

- Automatically, the eToro user will see $1,000 worth of Bitcoin in their portfolio, as this amounts to 20% of their $5,000 investment

- The eToro user will also see $500 worth of Ethereum, as this amounts to 10% of their $5,000 investment

- When the trader closes either position, this will also be the case with the eToro user

- Therefore, any profits and losses will be mirrored in the user’s portfolio

Not only is copy trading affordable at eToro, but there are no additional fees applied. This means that the user will only need to pay the fee for the respective asset they are trading – proportionate to the stake.

Best eToro Traders to Copy

With thousands of options, knowing which eToro traders to copy can be challenging.

For inspiration, some of the best eToro traders are summarized below:

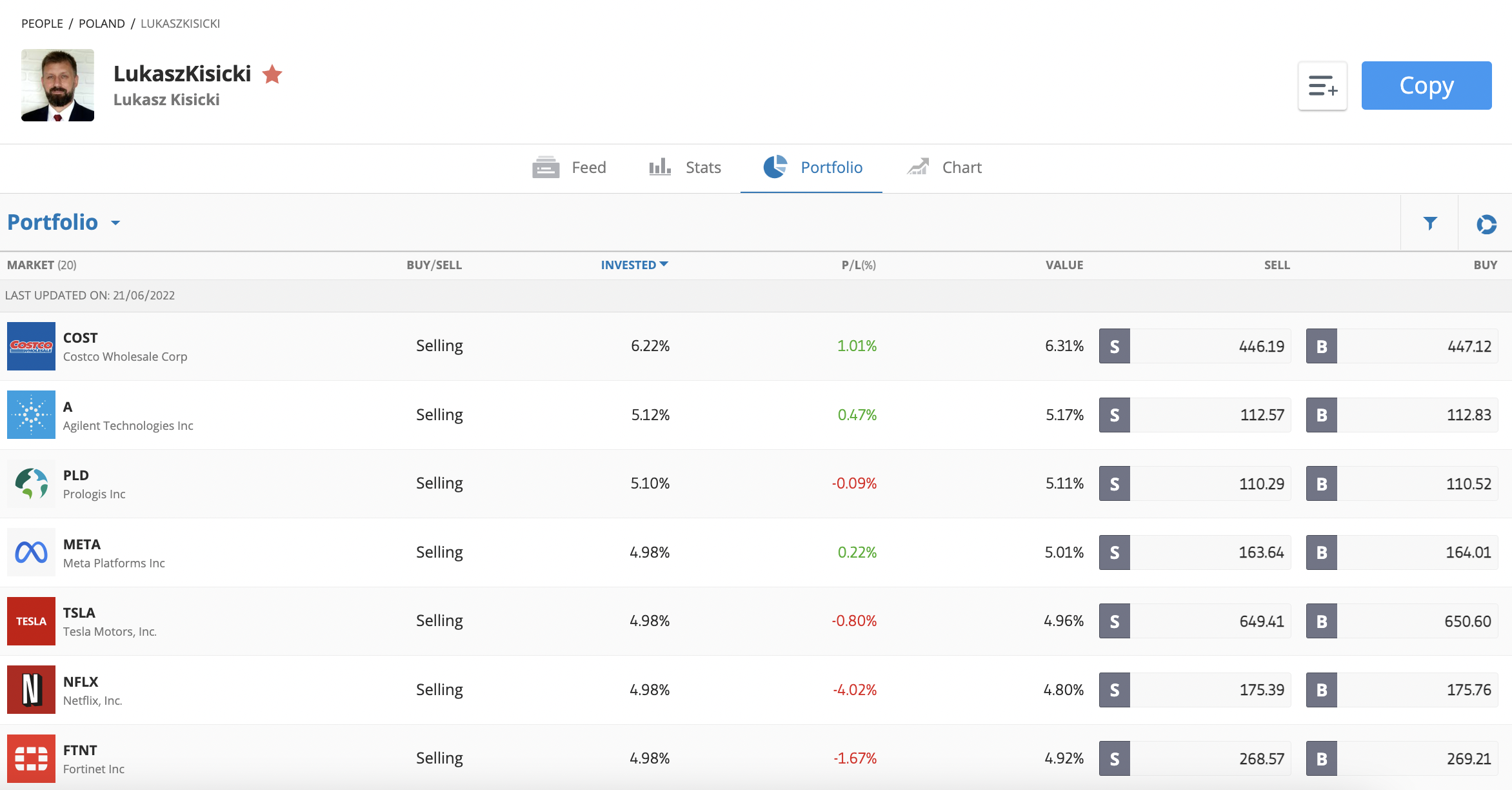

Lukasz Kisicki – Overall Best Trader to Copy on eToro

Lukasz Kisicki is a price action trader that focuses on trends. The trader is relatively new to eToro, joining the platform in September 2020. Nonetheless, Lukasz Kisicki finished the year with a profit of 23%. In 2021, the trader made gains of just under 18%.

During the first six months of 2022, Lukasz Kisicki increased the size of his portfolio by 15%. This is an impressive feat, considering that many portfolios are down in 2022. Lukasz Kisicki has a risk rating of 6/10, which is somewhat high. The trader states that he aims to keep this down to 4/10.

Other than the odd position in crypto and commodities, Lukasz Kisicki focuses on stocks. The average trade duration is 4.16 positions per week, with an average holding time of 2.5 weeks. Since joining eToro, the trader has witnessed 57 profitable weeks.

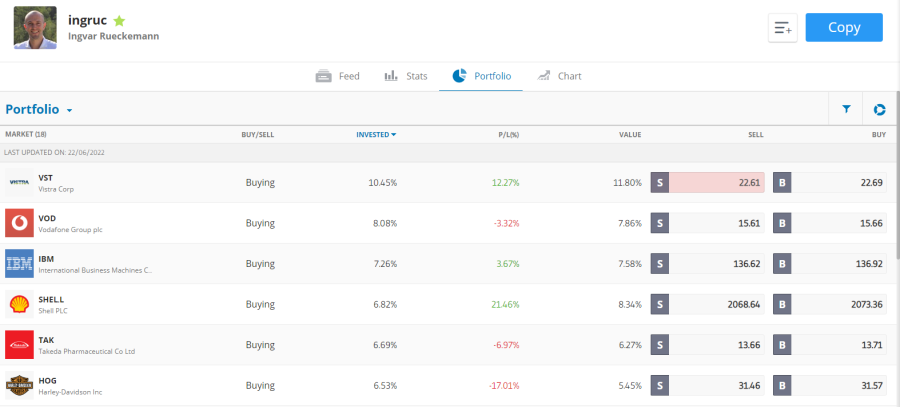

Ingvar Rueckemann – Specialist Stock Trader

Ingvar Rueckemann is another long-term investor that is popular with copy traders on eToro. The trader joined the platform in August 2020 and has since hit the ground running.

Ingvar Rueckemann finished 2020 with gains of 20% and 2021 was slightly better at 22%. 100% of the trader’s portfolio is held exclusively in stocks.

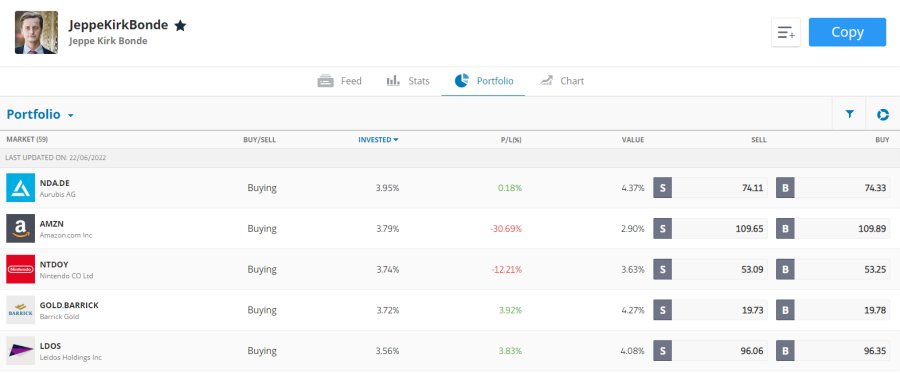

Jeppe Kirk Bonde – Most Popular Trader on eToro

With more than 23,000 followers, Jeppe Kirk Bonde is one of the most popular traders on eToro. The investor joined eToro back in 2013, so there is more than 8 years worth of trading history.

Crucially, the trader notes that since joining, he has generated an average annualized return of 28%. In 2020 and 2021 alone the trader made gains of 36% and 15% respectively.

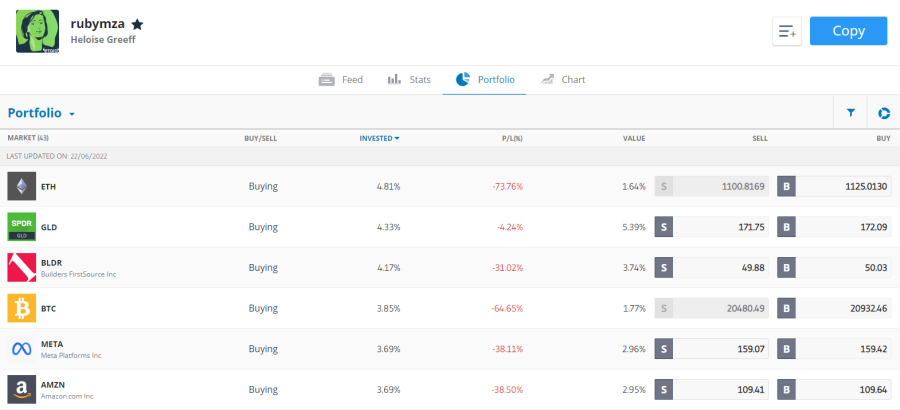

Heloise Greeff – Active Trader With Huge Gains Since 2017

Heloise Greeff is an active trader with 10 positions on average opened and closed each week. The trader has enjoyed an incredible run of form since 2017. In 2017, 2018, and 2019, the trader made gains of 39%, 4%, and 20%.

In 2020 and 2021, the trader generated profits of 45% and 17% respectively. Looking at the trader’s portfolio Heloise Greeff has exposure to large-cap stocks, crypto, and gold.

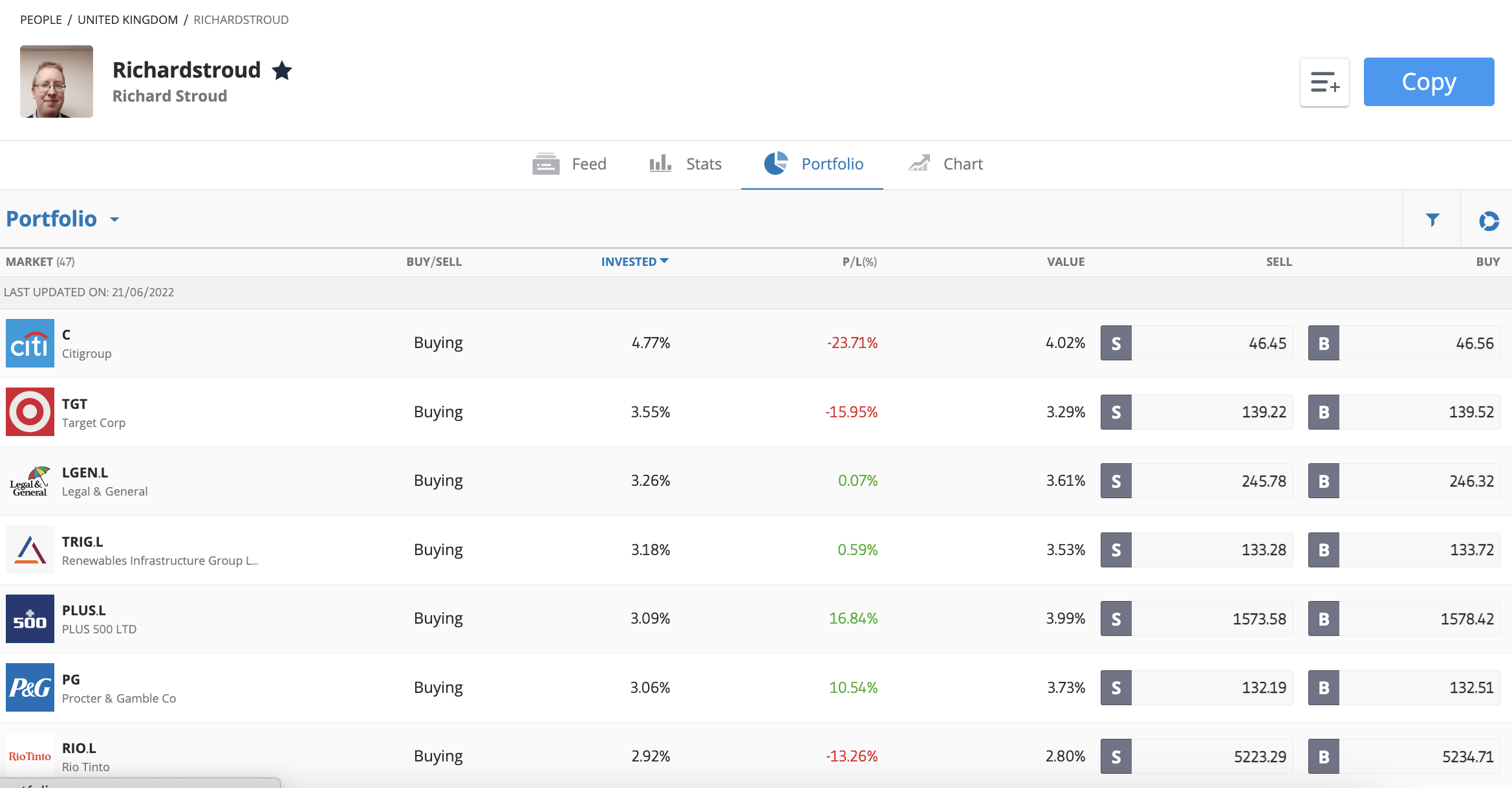

Richard Stroud – Top Trader to Copy for Long-Term Investments

Richard Stroud is another top-rated eToro trader to consider copying. This trader recommends a minimum investment of $500 and he suggests that all open positions should be copied when setting up the order.

Richard Stroud is a long-term investor and thus – he suggests keeping the copy trading investment open for at least one year. The trader joined eToro in early 2018 and finished the year at a 15% loss.

However, Richard Stroud has remained profitable every year since. In 2019 and 2020, the trader made gains of 41% and 60% respectively. 2021 was very modest, with gains of just 2%.

Nonetheless, Richard Stroud has over 11,000 copiers and a reasonable risk rating of 5/10. The investor places an average of 2.21 trades per week. The average holding time of each investment is 15 months.

eToro Smart Portfolios

eToro Smart Portfolios are another passive investment tool to consider. These are bundles of stocks or crypto that target a specific market.

For example, The ‘Utilities’ portfolio consists of a broad selection of companies that operate in the utility sector – most of which pay dividends. This includes National Grid, Duke Energy, Iberdrola, DTE Energy, and Public Service Enterprise Group.

Another option is the ‘Driverless’ portfolio. As the name suggests, this Smart Portfolio gives the investor access to stocks that operate in the driverless vehicle space. Examples include NVIDIA, Qualcomm, Alphabet, Baidu, and Rivian.

- Those interested in creating a diversified basket of crypto might also like the many Smart Portfolios that do just this.

- For instance, though a single trade, the ‘CryptoEqual’ portfolio offers access to Bitcoin, Litecoin, Cardano, Stellar Lumens, and many other tokens.

Irrespective of the strategy or target market, all Smart Portfolios are managed by eToro. This means that the broker will regularly rebalance the Smart Portfolio to ensure that it remains aligned with the respective objective.

The minimum Smart Portfolio investment is $500 and no additional fees apply.

eToro Charting and Analysis

Many investors that use eToro will simply want to buy and sell assets.

However, those that wish to take things to the next level might be interested in some of the research and analysis tools offered by the broker.

This is inclusive of:

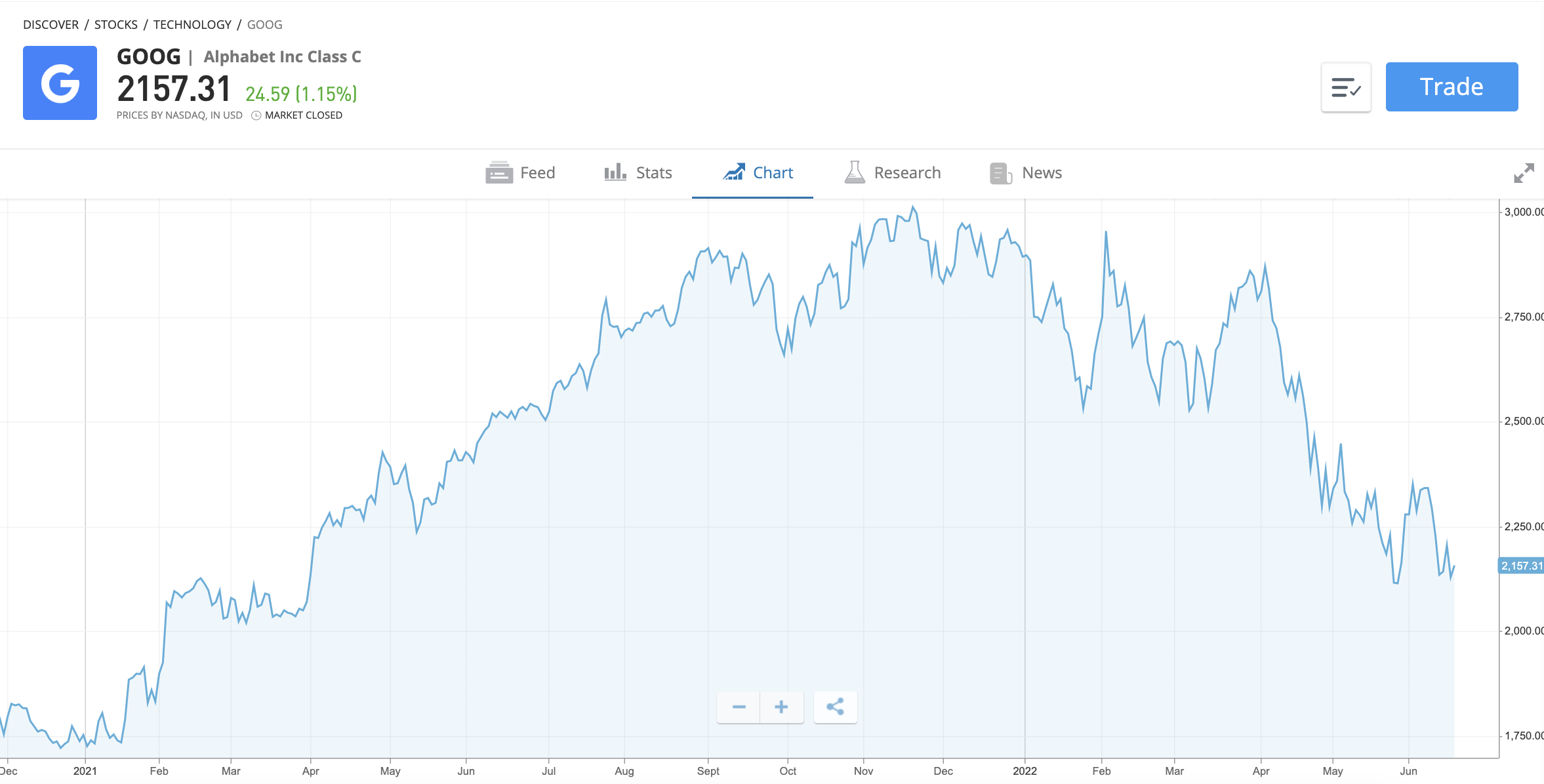

Pro Charts

Those that like to research the technicals of an asset will appreciate Pro Charts. This is charting software that was designed by the eToro team and can be accessed via a standard web or mobile browser. Users wondering what trend trading is will be happy to learn that eToro’s ProCharts enables investors to implement trend trading strategies into their trades.

This comes with the ability to customize the charting area – in terms of colors and the respective timeframe of each candlestick or line. There is also the option to deploy technical indicators like the RSI and MACD.

Those with little experience with technical analysis will likely find the basic charts offered by eToro more appealing. This comes with basic pricing information that is updated on a second-by-second basis.

News

eToro has integrated a plethora of third-party media sources into its platform. This means that when clicking on an asset, the user can view real-time news developments that are relevant to the market. This offers a great way to stay ahead of the curve.

Alerts

Another trading tool offered by eToro is its alert service. This is best accessed via the eToro app – which we discuss shortly.

eToro Account Types

eToro offers four account types, albeit, the vast majority of users will be placed on the standard plan. This is because the other account types are for Islamic traders, professionals, and corporations. For more information on the best Islamic brokers in 2023 read our guide today.

The standard eToro account offers access to all of the financial instruments discussed in this review. The minimum first-time deposit for US clients is just $10.

On the other hand, Islamic accounts require a minimum of $1,000, while in the case of corporations, this stands at $10,000.

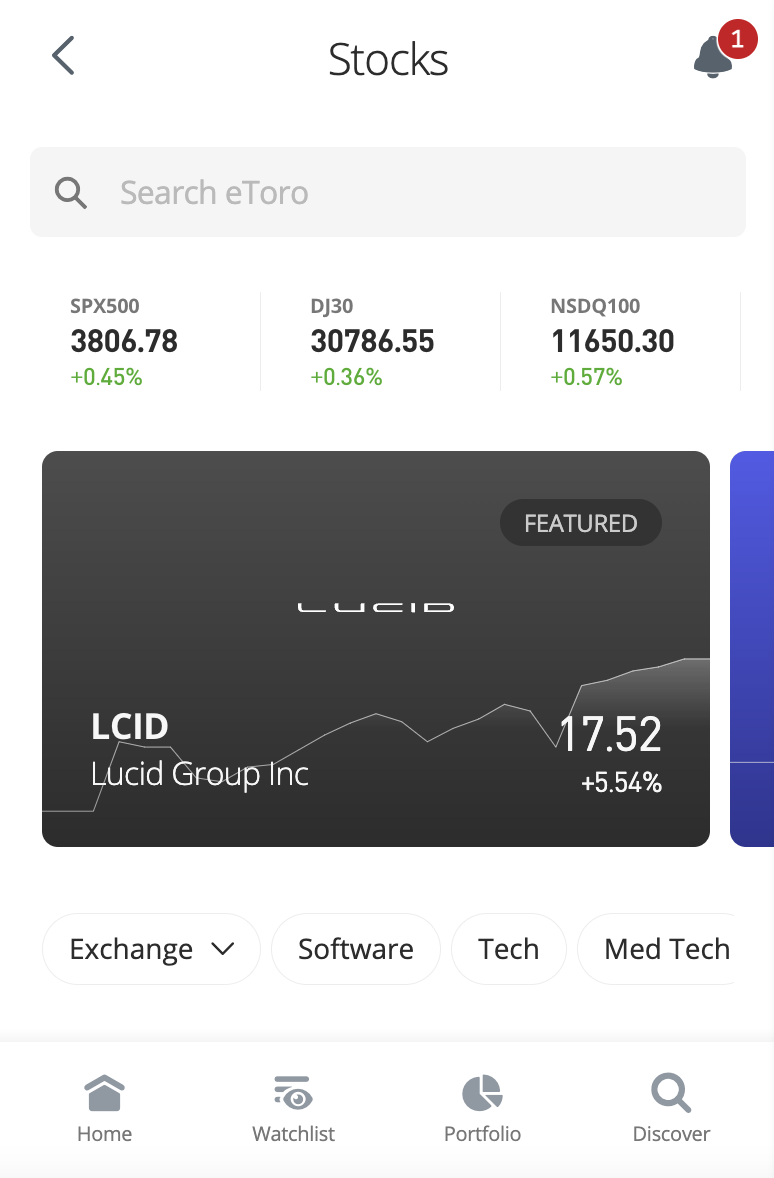

eToro App Review

Ever wondered what the best investment app for beginners in 2023 is? Seasoned traders will always ensure that have access to the financial markets on a 24/7 basis. And the best way to achieve this is to have a trading app installed on a smartphone.

Our eToro review team tested the app out and found that it offers a superb user experience. This was the case across both the iOS and Android versions.

Upon installing the app, the user can log into their account with their standard username and password. This will then connect the app to the user’s main eToro account.

Therefore, the eToro app can be used to buy, sell, and trade assets on the move. The app also comes in handy when the user wishes to check the value of their portfolio in real-time.

As we briefly noted earlier, the eToro app allows users to set up custom pricing alerts. For instance, the user might wish to be notified when Amazon stock surpasses $120, or when Ethereum goes below $1,000.

Either way, a notification will be sent to the user’s smartphone in real-time when the price alert is triggered. Just like the main eToro website, the iOS and Android app is very user-friendly.

All of the same search and filter tools are available, and users can even use the app to deposit and withdraw funds. Finally, eToro reviews of the mobile app are very positive in the public domain.

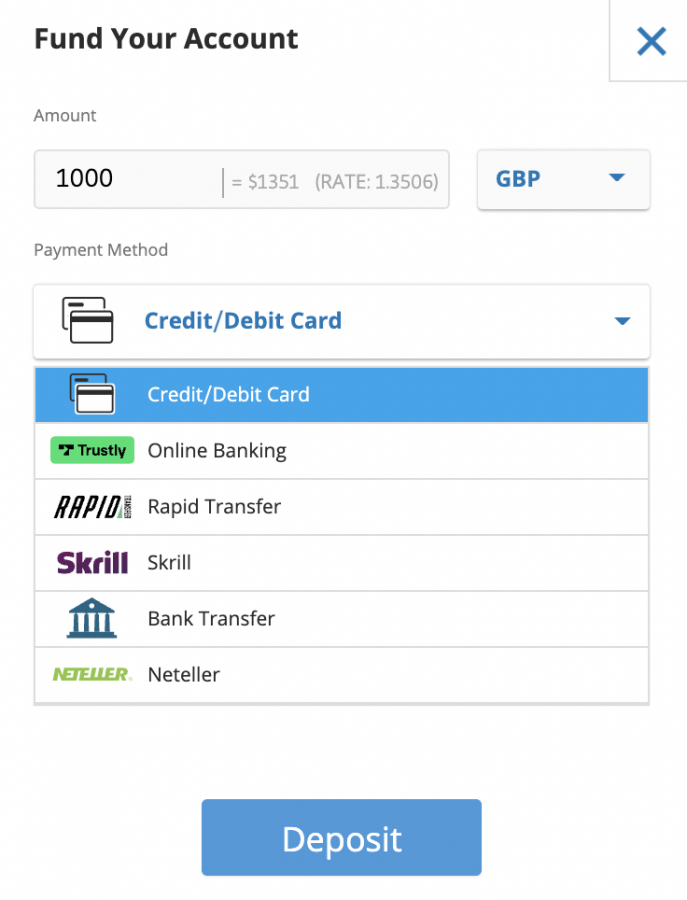

eToro Payment Methods

US clients not only have access to fee-free deposits and withdrawals but a full selection of payment types to choose from.

This is inclusive of:

Debit/Credit Cards

The easiest way to deposit funds into an eToro account is via a debit/credit card. eToro supports Visa, MasterCard, Maestro, and Visa Electron, but not American Express.

E-Wallets

eToro also supports e-wallets such as Paypal, Neteller, WebMoney, and Skrill. Just like debit/credit cards, e-wallet payments on eToro are processed instantly.

ACH

Those that prefer to deposit funds via ACH are covered too. Users simply need to select ‘Online Banking’ from the list of supported payment methods, before following the on-screen instructions for ACH.

| Type | Deposit Time | Minimum |

| Debit/credit cards | Instant | $10 |

| E-wallets | Instant | $10 |

| ACH | Not stated | $10 |

eToro Minimum Deposit

Upon opening an account, US clients are required to deposit just $10. This is the same amount that needs to be staked when trading stocks, ETFs, and crypto. Therefore, eToro is suitable for investors of all budgets.

eToro Withdrawal Times

Withdrawal times on eToro will depend on the payment method.

On the eToro website, the provider offers an estimated number of days for each method, which includes the time it takes for the payment issuer to reflect the payment.

Debit and credit cards take 10 days in total, which is also the case with bank wires. E-wallets like Paypal and Neteller take two days.

However, we found that withdrawal times are typically much faster than this, especially in the case of debit/credit cards and e-wallets. There are no eToro withdrawal fees for US clients on any supported payment methods.

eToro Bonuses & Promos

eToro offers existing US clients the opportunity to earn a referral bonus of $30 for each new user that signs up via their link or code.

The person that signs up must deposit at least $100. This bonus can be claimed by up to 10 different people – all of which must meet the terms and conditions of the promotion.

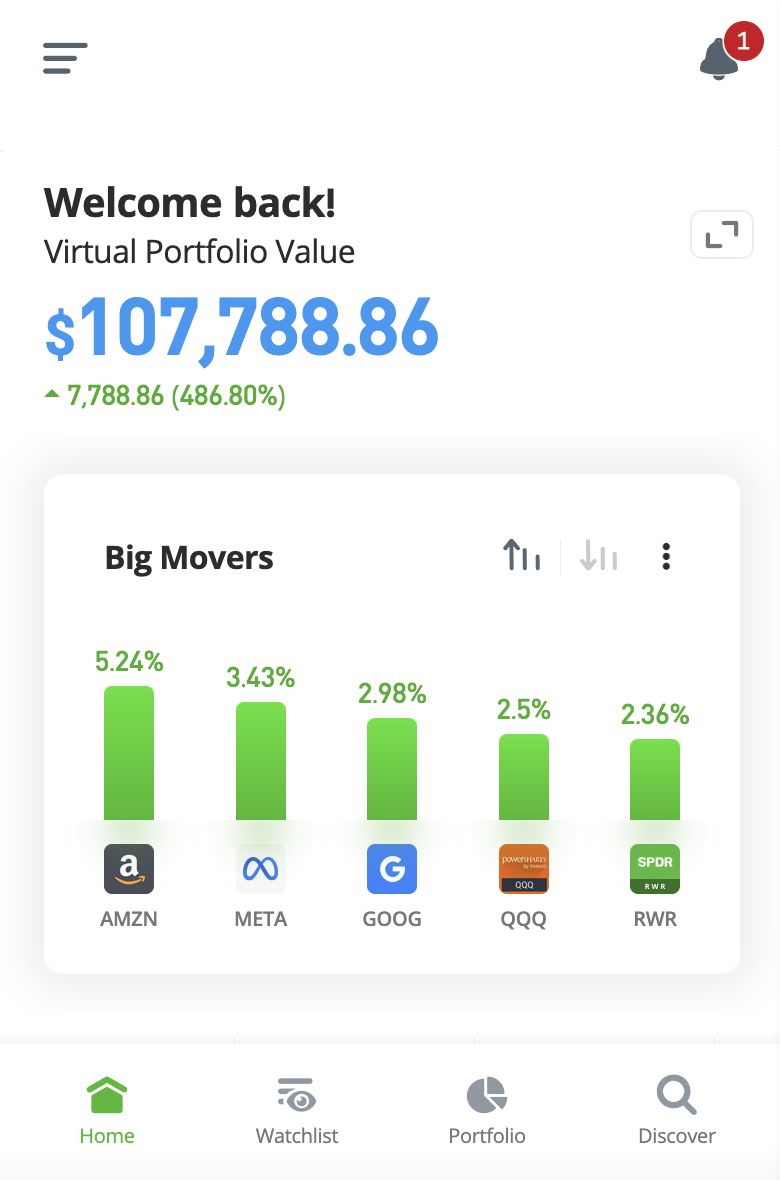

eToro Demo Account

Those that are completely new to eToro might wish to start off with a demo account. Our eToro review found that the demo account feature is available at all times, meaning that users can switch back and forth between ‘real’ and ‘virtual’ mode.

The demo account at eToro comes with a paper trading balance of $100,000. This offers access to live market conditions and all supported markets – including Copy Trading and Smart Portfolios.

This is a great way to get to grips with the eToro platform and mobile app, or perhaps to test out a new investment strategy. Either way, the demo account is 100% risk-free.

Cryptoassets are a highly volatile unregulated investment product.

eToro Customer Support

Our eToro review found that the broker offers customer support via a live chat feature. The user must be signed into their account to access this tool. Nonetheless, live chat ensures that account holders can speak with a real agent at any time.

Those wishing to speak with an agent over the telephone will be disappointed, as eToro does not have a call center. There is also the option to raise a support ticket via the eToro website.

eToro Licensing & Security

eToro is authorized and regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) to offer stock trading services in the US.

- The broker is also licensed outside of the US market for added regulatory oversight.

- This includes a license with the UK Financial Conduct Authority (FCA), Australian Securities & Investments Commission (ASIC) making it one of the best ASIC regulated forex brokers, and Cyprus Securities and Exchange Commission (CySEC).

eToro was launched back in 2007, so it has a trusted track record that now exceeds 15 years. It is also believed that eToro will become a public company in 2022 too.

eToro complies with all regulations surrounding anti-money laundering (AML) for the countries it operates in.

This means that when US clients open an account, they will need to get verified. This will take the user less than two minutes and simply requires a copy of a government-issued ID and proof of address issued within the prior three months.

eToro Accepted Countries

eToro is available in many countries including the USA, UK, India, Australia and most European nations.

Those based in a country other than those supported by the broker will not be able to use the eToro platform to trade.

How to Start Trading with eToro

This eToro review will now explain the process required to get started with this broker.

The detailed guide below will cover how to:

- Open an eToro account

- Get verified

- Make a fee-free deposit

- Search for an asset

- Place a trade

Let’s start with the account opening process:

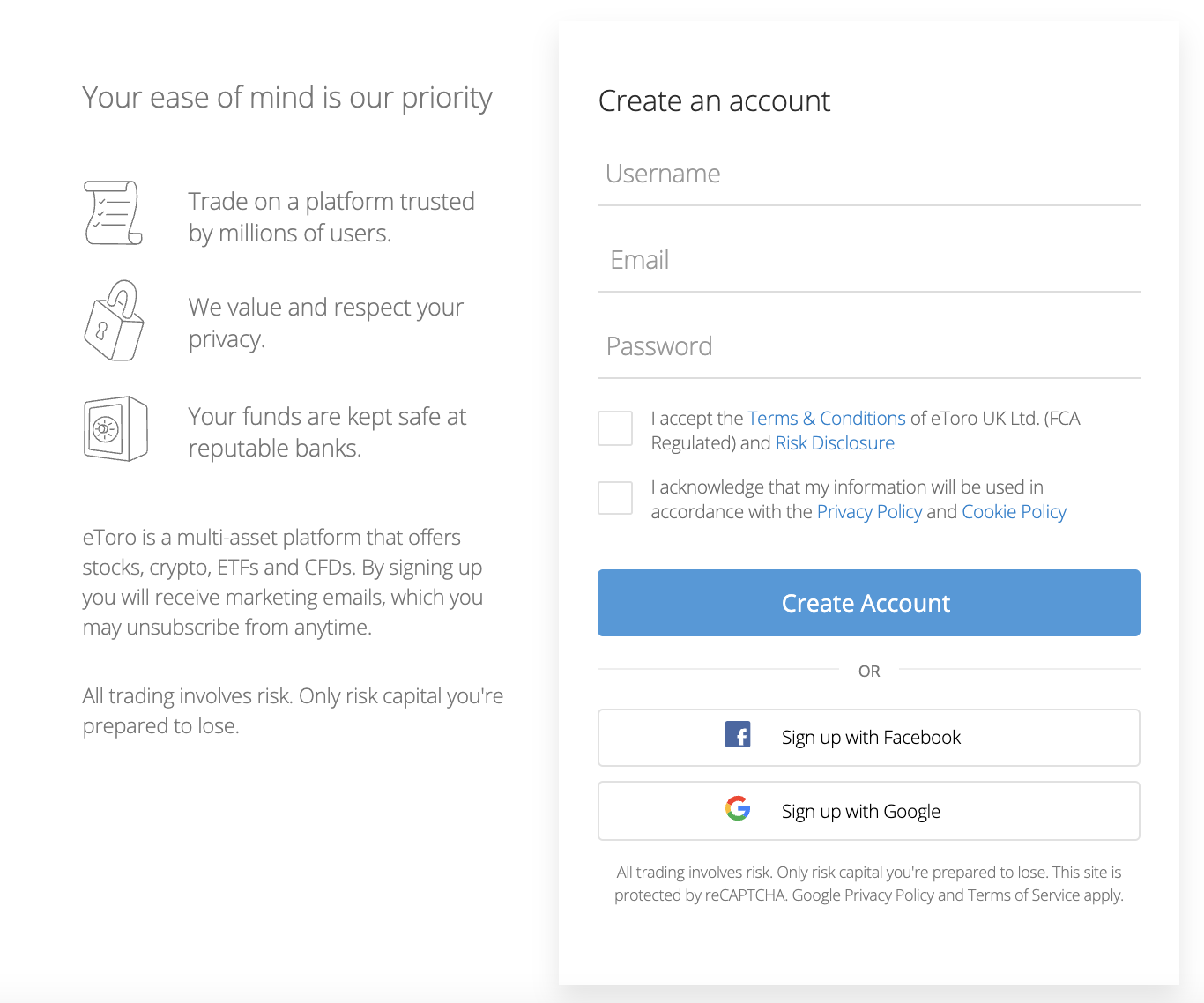

Step 1: Open an eToro Account

Visit the eToro website and look out for the ‘Join Now’ button. Click it, and type in a preferred username and password, as well as a primary email address.

Next, click on ‘Create Account’ and type in some personal information as prompted. This is inclusive of the user’s full name, nationality, home address, and social security number.

eToro also needs to verify the user’s cell phone number. A code will be sent via SMS – enter this when prompted.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Verify Account

The verification process at eToro is extremely convenient and fast. The broker will require a copy of a government-issued ID and a proof of address.

For the former, select from a driver’s license, passport, and state ID. For the latter, this can be a document issued within the prior three months, such as a bank statement.

Digital copies are accepted and a full list of eligible documents can be found on the eToro website.

Step 3: Deposit Funds

As noted earlier, US clients will be required to deposit at least $10 to activate the account. The user can, however, use the eToro demo account to get to grips with the platform.

Supported payment methods include e-wallets, debit/credit cards, and ACH. There are no deposit fees to pay on USD payments.

Step 4: Search for Asset

eToro lists thousands of markets across stocks, ETFs, and crypto. The user can utilize the search bar at the top of the page to locate the desired asset.

In the example below, we are searching for ‘Delta’ stocks.

Click ‘Trade’ to proceed.

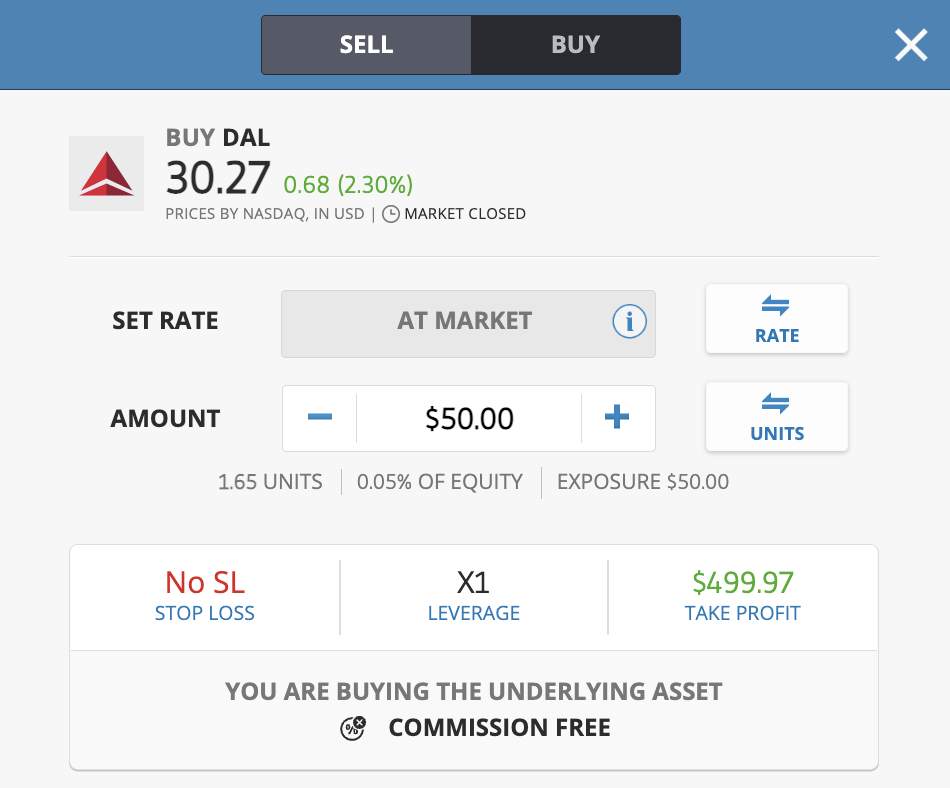

Step 5: Place Investment

The user will now need to enter the total investment stake in the ‘Amount’ box. When buying stocks, ETFs, or crypto at eToro – this can be any amount from $10.

To confirm, click on ‘Open Trade’.

Step 6: How to Sell on eToro

The asset that was purchased in Step 5 can now be found in the user’s portfolio. This is also the location that will allow the user to sell their investment.

To do this, the user can click on the ‘cog’ button and confirm the sell order. The funds will then be deposited into the user’s account balance – which can then be withdrawn ($30 minimum).

eToro Review – Conclusion

US clients yet to use the eToro platform to trade online are missing out on industry-leading fees and first-class customer support.

Our eToro review found that the broker offers thousands of US and international stocks and ETFs at 0% commission, and dozens of crypto markets at 1%.

All supported assets can be bought and sold from just $10 – and there are no fees to deposit or withdraw funds in USD. Safety is assured at eToro too, not least because the broker is regulated by the SEC and FINRA.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.