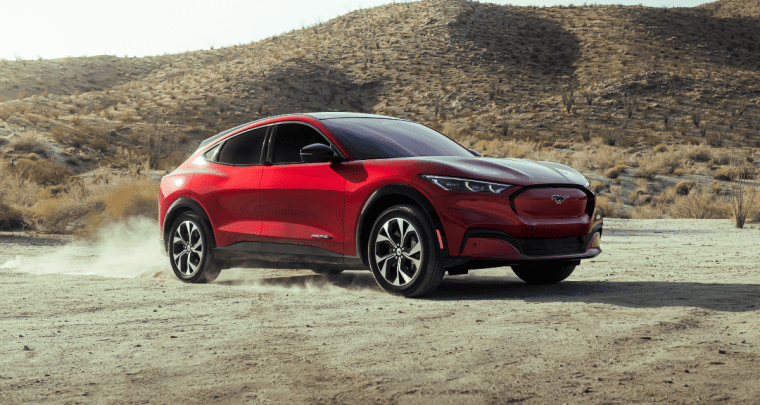

Just when markets were digesting a price war in the Chinese EV (electric vehicle) market, there are now fears of a price war in the US as well after Ford (NYSE: F) slashed Mustang Mach-E prices.

Ford has lowered Mach-E prices between $600-$5,900 and the average price cut comes to around $4,500. Simultaneously, the company announced a significant increase in Mach-E production.

In the release, Ford said, “With its new EV supply chain coming online, Ford is significantly increasing production of the Mustang Mach-E this year to help reduce customer wait times and to take advantage of streamlined costs to reduce prices across the board, making Mustang Mach-E even more accessible to customers and keeping it competitive in the marketplace.”

The company added that the price cuts would strengthen the company’s position as the second-largest EV company in the US.

Thanks to the flurry of new EV models, including the F-150 Lightning, Ford sold 65,000 EVs in the US in 2022 and moved to the second rank. Its sales are however way below that of Tesla which leads the US EV market by a fairly wide margin.

Ford has set ambitious plans for its EV business. It expects its annual EV production run rate to reach 600,000 by the end of 2023 and 2 million by 2026.

Bank of America is optimistic about the EV plans of both Ford and General Motors. It expects them to snatch market share from Tesla.

Ford Cuts Mach-E Prices to Remain “Competitive”

Ford’s price cut comes days after market leader Tesla lowered Model 3 and Model Y prices in the US and Europe. The Elon Musk-run company also lowered car prices in China, for the second time in three months.

Some Chinese companies like Xpeng Motors and BYD also cut prices after Tesla’s price cut announcements. Notably, among pure-play EV companies, only Tesla is making profits. As for legacy automakers, they don’t disclose the earnings of their EV business separately until now.

Incidentally, beginning this year Ford would begin to report the results of its EV business separately from the ICE (internal combustion engine). The company reports its Q4 2022 earnings this week and might face analysts’ questions on how the price cuts would hit its margins.

The company might also comment on its Germany plant. There are reports that Ford is looking to sell the plant to BYD.

EV Price War to Take a Toll on Automakers’ Profits

Markets speculate that after the price cuts some Mach-E models might not be profitable. Marin Gjaja, chief customer officer of Ford’s electric vehicle business said, “We want to make money. Don’t get me wrong, we absolutely want to make money.”

He added, “Believe you me, I know that we need to be trying to get more profitable because we will be publicly accountable for that number.”

Even Tesla admitted that the price cuts would dent its margins. However, the Elon Musk-run company hopes to offset that through economies of scale and lower raw material costs.

Tesla’s gross margins slumped in Q4 2022 as well. However, the company managed to somewhat make up with higher carbon credit sales. Tesla earned $467 million from sales of carbon credits in Q4, a YoY rise of nearly 50%.

All said, there are signs of a price war in the US market as more electric models hit the roads. Over the next few years, we’ll have dozens of all-electric models from both legacy automakers like Ford, as well as pure-play EV companies.

At some point in time, Chinese EV companies would also consider a foray into the US which is the world’s most profitable automotive market. NIO for instance has been quite open about an eventual entry into the US market.

Recently, Baillie Gifford also increased his stake in NIO. Many analysts see NIO as a worthy competitor to Tesla. There is a guide on buying NIO stock.

Related stock news and analysis

- Most Sustainable Cryptocurrency to Invest in 2023

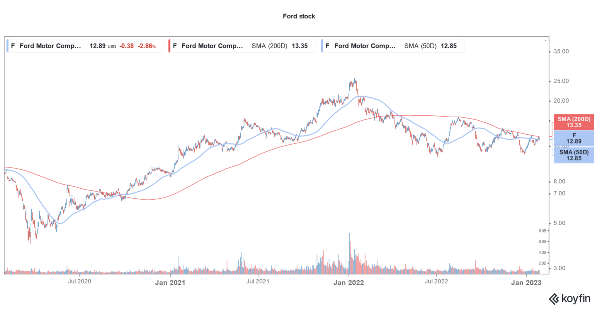

- How to Buy Ford Stock in 2023

- SoFi Stock Rises on Q4 Earnings Beat & Strong 2023 Guidance

FightOut - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $1M+ Raised

- Real-World Community, Gym Chain

Discuss This Article

Add a New Comment /Reply

Thanks for adding to the conversation!

Our comments are moderated. Your comment may not appear immediately.