When it comes to investing, a diversified portfolio is vital. Evest allows you to invest in stocks, commodities, currencies, cryptocurrencies and indices, all from one platform.

This Evest review will examine how it works, its pros and cons, fees and payment methods and much more. Let’s begin.

What is Evest?

The signup process is simple, and within minutes, users can begin investing in a wide range of instruments – from the leading stocks to Bitcoin and even the best altcoins. But not only that, Evest offers 0% commissions on stock investments!

Evest is a CFD trading platform. CFD stands for Contract for Difference, meaning you purchase a contract mimicking an asset’s price. In other words, you do not actually own the asset.

But there are multiple advantages to this, such as the ability to leverage, extra security and there being no need to manage the asset yourself.

There are mobile and web app versions of Evest available and a desktop edition compatible with MT5 – the most robust trading application on the market. With this in mind, Evest is a great option if you are looking for the best crypto exchanges in UAE.

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.

We will get more into the different versions of Evest later, but let’s start with the platform’s pros and cons.

Evest Pros & Cons

Pros

- Regulated by The Vanuatu Financial Commission (VFSC).

- Get started with a deposit as low as $50.

- Easily and securely deposit funds from your bank.

- 0% commission on stocks.

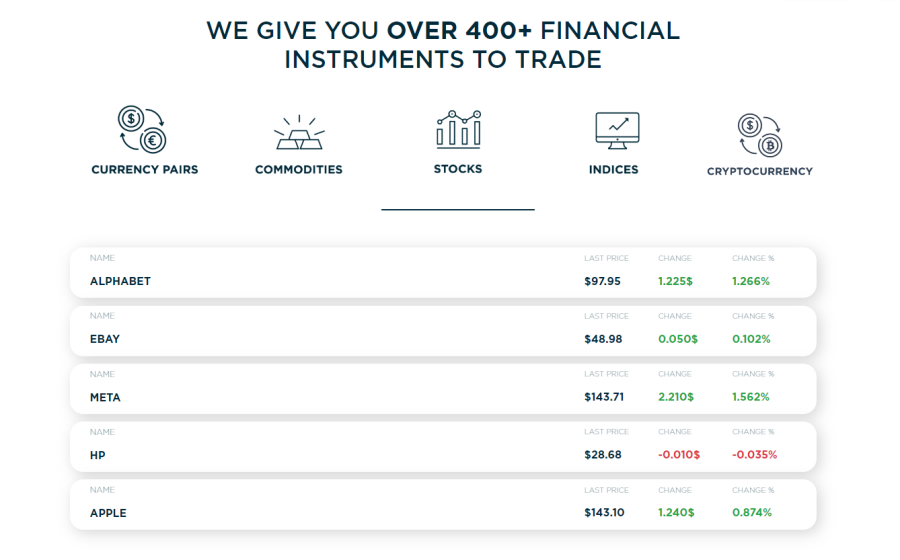

- Access to over 400 financial instruments to trade.

- It’s free to open an account.

- Start with a $25000 demo account.

- One of the best trading platforms for the CCG region.

- An easy, user-friendly way to invest in over 130 financial markets.

- Available on mobile and desktop.

Cons

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.

Evest Trading & Investment Products

Evest offers a diversified range of products, including common instruments such as stocks and crypto, to more abstract instruments like investment baskets.

Stocks

Wondering how to buy stocks in Saudi Arabia? Evest offers a wide range of popular stocks, such as AMAZON, APPLE and TESLA, so it is an excellent way for investors to purchase blue-chip long-term stocks.

As mentioned earlier, Evest offers 0% commission on stocks, meaning you can buy the best stocks at the lowest cost.

Due to the platform being CFD-based, users can trade stocks with leverage. As the stock market is less volatile than markets such as cryptocurrency and Forex, leverage allows short-term traders to make larger returns.

Also, it means users can speculate on the price of a stock going up or down, meaning users can profit, no matter the stock market’s direction.

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.

Cryptocurrency

Everybody and their grandmother have heard about cryptocurrency over the past two years. The issue with crypto investing is that it is complicated, risky, and involves using shady crypto exchanges. Overall, it could be more beginner friendly.

But with Evest cryptocurrency CFDs, users can trade crypto from a trusted and regulated broker on the same account as their stock and commodity investments.

Users can speculate on the price of crypto assets going up or down and can apply leverage when needed.

The platform offers access to Bitcoin, Ethereum and other top altcoins like Litecoin and XRP. But for those who enjoy speculating on the virality of meme coins, you can do that too. In this regard, Evet offers the best long-term cryptocurrencies.

With that being said, Evest is an easy and accessible way for beginner investors and advanced day traders to access the cryptocurrency markets. Its straightforward user interface and compatibility with MT5 make it suitable for all levels – something that the cryptocurrency industry lacked before Evest.

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.

Currencies (Foreign Exchange)

The currencies market is the largest market in the world, with over $6 trillion in daily volume.

With such massive numbers, there are always opportunities for traders and investors.

Evest has a minimum purchase amount per trade of 0.01 lots, which in the case of EUR/GBP, means users can invest for as little as $0.10.

Multiple pairings are available for the most common currencies like AUD, CAD, EUR, GBP, NZD and USD.

Evest does not list more exotic pairs, but this is for a good reason. Due to the low liquidity of such pairs, investors are always at risk of price impact, wide spreads and possible market manipulation. By providing the most popular currency pairs, the platform effectively protects investors.

Evest offers all the most significant currency pairs on an easy-to-use platform. In this regard, we find it among the best forex brokers in UAE.

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.

Indices

Indices offer investors exposure to an entire market segment in one order. Some of the most popular indices include the SPX500, FTSE100 and NASDAQ100. Simply put, indices are an easy way to invest a diversified range of assets in one transaction.

Evest delivers indices trading, including the aforementioned instruments, and more on the same platform where they trade cryptos, stocks and commodities.

Indices are excellent long-term investments. Still, the customizable price chart offered by Evest and the ability to leverage trades make it a viable option for short-term trading.

The minimum purchase for indices is 0.01 lots, meaning investors could purchase NASDAQ100 contracts for as little as $0.10, for example.

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.

Commodities

Finally, Evest offers commodities trading on its platform too. This means you can invest in assets such as gold, silver, sugar and cacao.

Generally, commodities investing can be more predictable than others due to known seasonal trends. This makes it a great way to diversify from those more risky assets like cryptocurrency and forex.

Commodities can hedge against other investments because they rise with inflation. And Evest’s CFD commodities offer users more choices on capital allocation to hedge their portfolio due to the ability to leverage.

Evest provides a wide range of instruments, touching all bases and allowing investors and traders access to everything they need for a safe and diversified investment portfolio.

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.

Evest Fees & Charges

Like investing with any broker, you should know the fees to maximize your investing potential.

There are two main types of fees you might incur on Evest, trading and non-trading fees.

Let’s start with trading fees:

But first, the good news. There are no fees for trading stocks.

On Evest, there are two forms of trading fees. Spreads and standard fees.

Accounts are split into different levels based on how much capital they have. Higher accounts are offered tighter spreads. The accounts range from Silver, Gold, Platinum, Diamond and Islamic.

The Islamic account level works slightly differently because it is not based on the amount you invest, but users can opt for this account type for Islamic-friendly investing.

The specific spreads vary between each asset for each account level, but you can find the complete list here.

Below are the lowest pip spreads for each instrument, along with the account level.

| Account Type | Crypto | Stocks | Indices Spot | Future Commodities | Future Indices | Currencies | EIB |

| Silver | 3.1 | 4.5 | 40 | 0.5 | 50 | 1.7 | 2.1 |

| Gold | 3.1 | 4.5 | 40 | 0.5 | 50 | 1.4 | 2 |

| Diamond | 3.1 | 4.5 | 40 | 0.5 | 50 | 1.1 | 2 |

| Platinum | 3.1 | 4.5 | 40 | 0.5 | 50 | 0.8 | 2.1 |

| Islamic | 3.1 | 4.5 | 40 | 0.5 | 50 | 1.7 | 2.1 |

When it comes to the standard trading fees, each specific fee can be found on the link mentioned above. However, fees can be as little as 10 points (or one pip), or they are totally free for stocks.

One pip counts as 1%, so on an asset trading against the US Dollar, the fee could be $0.01.

Next, let’s take a look at the non-trading fees.

| Type | Fee |

| Deposits | Free |

| Withdrawals | $5 |

| Conversions | 2% |

| Inactivity | $75 at the end of the second month. From the third month onwards, it will cost $50 per month. |

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.

Trading Tools & Features on Evest

Evest offers multiple trading experiences users can choose from. Ranging from a user-friendly IOS mobile application to the most advanced trading application on the market – MetaTrader 5.

Investors can purchase from the web or mobile app or install the MetaTrader 5 trading platform on their device and execute orders through that.

Both methods have their advantages. Mainly, for the web and mobile app, this gives a “light” feel where users can log in and make trades without too much prior knowledge of trading platforms.

In comparison, MetaTrader 5 offers everything a trader could ask for, from one-click trading to a multi-threaded strategy tester.

Some other tools available on the Evest desktop version include 12 timeframes, 38 built-in indicators, news streaming and full-data backups.

Interface & User Experience

Evest has three separate interfaces, suitable for all levels of traders. The mobile app, the web app and the Evest MetaTrader 5 integrated platform.

For the mobile and web app, the interface is seamless, easy to follow and self-explanatory, even for new traders. Most users would begin with the mobile or web app, which is suitable for everyday investing.

There are clear icons to switch between charts, such as candlestick and line charts. Users can also easily change timeframes or draw shapes and patterns on the charts. There are clear, user-friendly buttons on the right of the screen to buy or sell assets.

The mobile and web apps are perfect for those who do not require advanced charting strategies or want to make a quick trade.

On the other hand, the MetaTrader 5 is equipped with high-tech software to deliver almost institutional-grade trading to everyone. Although it requires more know-how, once you have the hang of it, you can employ the most advanced trading strategies.

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.

Mobile App

Have you ever been away from your PC and heard of a huge dip in a stock or crypto you have been watching? In times like these, you need a trading platform that is available anywhere, anytime. The Evest app gives you just that and more.

It is easy to use and rated 4.3 on the app store (with over 1k reviews). Among other things, it offers 0% latency and push notifications for price movement and trading signals. So it is no wonder Evest was awarded “Fastest Growing Broker 2021” at the Forex Expo in Dubai.

The application is secured with 256 rapid SSL encryption. In other words, it is almost impossible to hack, even with the most advanced computers.

Evest Minimum Deposit & Payment Methods

The minimum deposit for Evest is $50. Once you have deposited your funds, you can place trades of just $0.10 or less.

Evest accepts credit and debit card payments. To deposit funds to your account, you will need your card number, expiry date and CVV number.

Withdrawing funds on the platform is easy. But remember, you cannot withdraw funds currently in open positions. You should close your positions, and then you can withdraw from your available balance.

The minimum withdrawal amount for Evest is $25 and may take up to seven days to process.

Evest Licensing & Regulation

Evest is a brand owned by ATRIAFINANCIAL HOLDINGS LTD, registered in the United Kingdom. The broker holds a Dealing in Security Principal’s License from Vanuatu Financial Services Commission.

What Countries Does Evest Accept?

Currently, Evest serves the Middle East and North Africa region (MENA) and some countries in Europe and South America.

But at the moment, the platform does not accommodate users from the UK, EU, United States or Canada.

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.

How to Trade with Evest

If you want to trade on Evest, the first step is to sign up. There are two ways to do this: via the web or mobile app. We will use the web app for this guide, but the process stays the same on the mobile app.

Step 1: Sign Up

Visit the Evest website and click the sign-up button. Then fill out the sign-up form.

Step 2: Verify Your Identity

Where it says “Hi, ‘your name’ in the top right drop-down box, click, and a button for the verification centre will drop down. Click that and proceed to fill out your details.

Once complete and you have provided your ID details, continue to the next step.

Step 3: Deposit Funds and Trade

Now, you can either deposit funds directly or visit the trading hub and do it when you are ready to make a trade. If you want to deposit funds immediately, click deposit from the drop-down box in the top right, and follow the prompts.

Or, hit the trade button in the top left, where you will be taken to the trade hub. From here, you can search through the investment opportunities Evest has to offer.

Once you have decided what to buy, hit the buy button, and you will receive a prompt to make a deposit.

After you have made your deposit, it’s time to complete that first trade!

Step 4: How to Close A Position

When you are ready to sell or close a position, you can click the opposing option to the one you selected before. So if you clicked buy, you would sell. But if you speculated price would go down (and shorted with the sell button), you would click buy to close the position.

You can find your open positions at the bottom of the screen in the open trades section.

Conclusion

Overall, Evest offers an accessible solution to many issues traders and investors face. The platform is easy to use, provides access to a massive range of investment instruments and comes equipped with many advanced trading features.

Moreover, since Evest is focused on the MENA region, incorporating the Islamic trading account means everyone can use the platform. Therefore, we believe it is one of the best forex brokers in Saudi Arabia.

Evest also solves some complex financial issues, such as the best ways for beginner investors to diversify their portfolios and the easiest way for crypto investors to manage their coins.

Trading CFDs is highly speculative, carries a high level of risk and is not appropriate for every investor. You should not speculate with capital that you cannot afford to lose.