GO Markets is an Australia-based CFD broker that offers trading on forex, stock indices, commodities, share CFDs and treasuries. The broker offers very competitive forex trading fees and access to a wide range of trading tools, including the MetaTrader 4 and MetaTrader 5 platforms.

In our GO Markets UK review, we’ll help UK traders decide if this broker is the best place to trade today.

GO Markets UK Pros & Cons

Pros

- Trade forex, shares, commodities, and more through CFDs

- Commission accounts available with spreads from 0.0 pips

- Trade with leverage up to 500:1

- Offers MetaTrader 4 and 5

- 24/5 customer support

Cons

- No cryptocurrency CFD trading due to regulation

- Not regulated by the Financial Conduct Authority

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Tradable Assets

GO Markets launched in 2006 in Australia and has since expanded around the globe. The company specializes in contracts for difference (CFDs) for high-liquidity assets like forex, commodities, stocks, indices, share CFDs and treasuries. Here are the assets traders will find at GO Markets UK:

Forex

GO Markets offers forex trading on 50+ forex pairs, including major and minor pairs. The maximum leverage is 500:1 for UK traders on major forex pairs.

Commodities

GO Markets offers trading on the most highly traded commodities, including gold, silver, WTI crude oil, and Brent crude oil. The broker also offers trading on US and UK oil futures and soybean and wheat futures contracts via CFDs.

Gold trades can use leverage up to 500:1. Leverage for all other commodity CFDs varies.

Stock Indices

GO Markets offers trading on CFDs for 12 global stock indices, including the FTSE 100 in the UK, the S&P 500 in the US, and the STOXX 50 in Europe. Leverage is available up to 100:1 for specific indices.

The China 50 index, US Dollar index and Volatility Index are also available to trade through futures CFD contracts.

Stocks

GO Markets offers a wide range of share CFDs for individual stocks from the US, UK, Australia, Germany, and Hong Kong. Traders will find most popular stocks from the S&P 500 and NASDAQ 100 indices in the US, as well as from the FTSE 100 in the UK. Stocks can be traded using leverage up to 20:1.

Treasuries

GO Markets offers trading on treasuries through CFDs, enabling traders to place bets on future interest rates in various countries. Treasuries available to trade include 5-year and 10-year US treasury note futures, Eurozone BUND futures, UK Gilt futures, and Japanese government bond futures. Treasury futures can be traded with leverage up to 100:1.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

GO Markets UK Fees

GO Markets offers competitive fees across all of its tradable assets. Traders can choose between a spread-only account and a commission account with reduced spreads. We’ll take a closer look at all of GO Markets’ fees.

Trading Fees

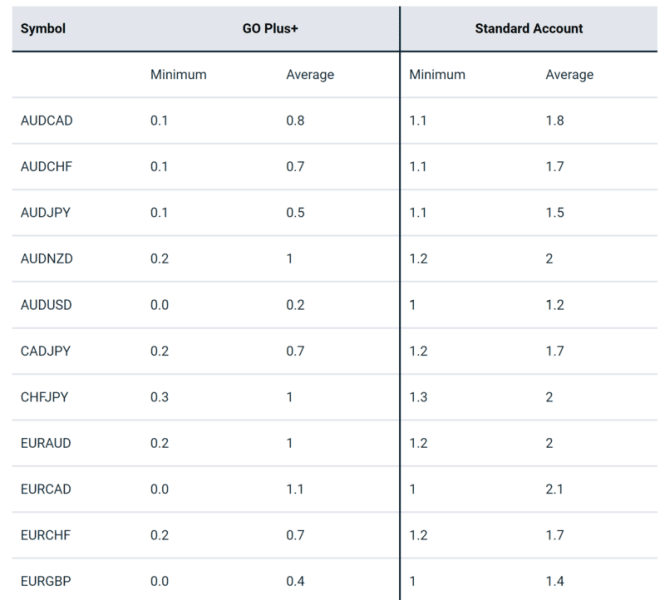

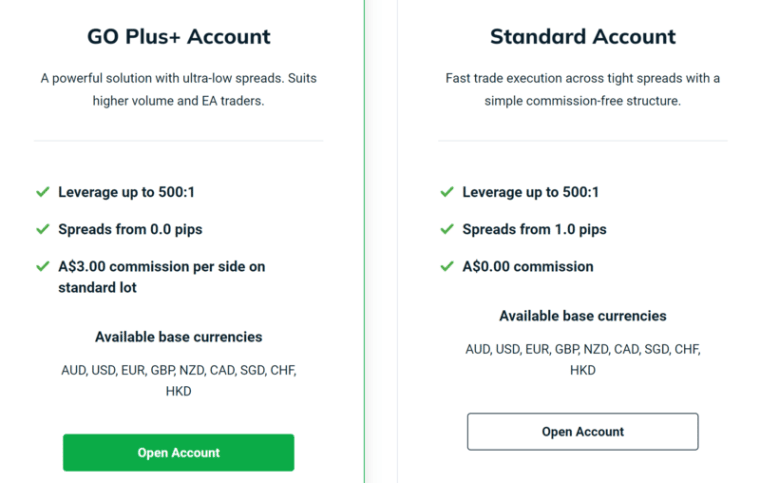

GO Markets offers 2 account options with different trading fees.

The Standard account offers no commissions and spreads starting from 1.0 pips.

The GO Plus+ account charges a flat commission of £2 per lot per side and reduced commissions starting from 0.0 pips. The average spread for popular forex pairs like EUR/USD is 0.1 pips with a GO Plus+ account.

Individual share CFD trades also carry commissions regardless of which account traders choose. There is no minimum commission on UK, AU, US and Euro shares, while Hong Kong shares are around HK$50, depending on account currency.

Like most CFD brokers, GO Markets charges interest fees for leveraged positions that are held overnight. These rates vary daily and by asset, and are only visible when opening a leveraged position.

| Standard | GO Plus+ |

| Spread: From 1.0 pips

Commission: None |

Spread: From 0.0 pips

Commission: £3 per lot per side |

Non-trading Fees

GO Markets does not charge deposit or withdrawal fees. There are no fees to open an account and there are no inactivity fees at this broker.

Data for most markets is included with a GO Markets account. However, there is an extra cost for market data for trading individual shares in specific countries.

Data for US, UK, and Euro shares is free. Data for Australian shares costs $22 per month and data for Hong Kong shares costs HK$120 per month. These fees are refunded for traders who place at least 4 trades in that country’s market per month.

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

GO Markets Platforms

GO Markets offers 2 trading platform options: MetaTrader 4 and MetaTrader 5.

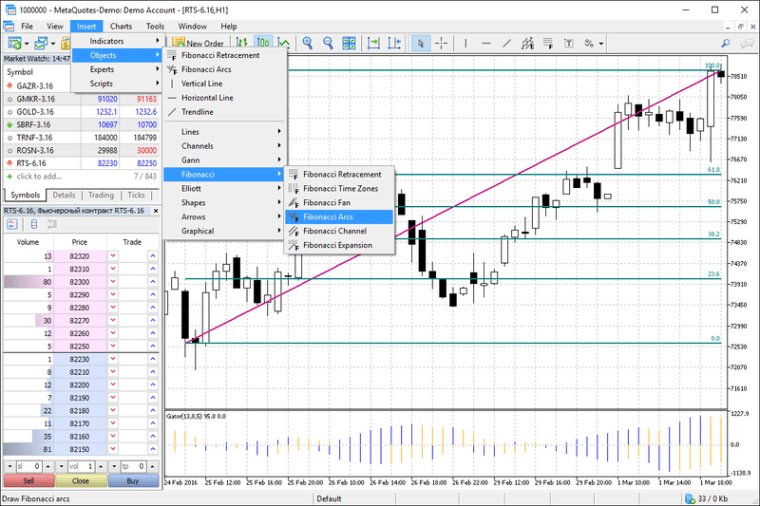

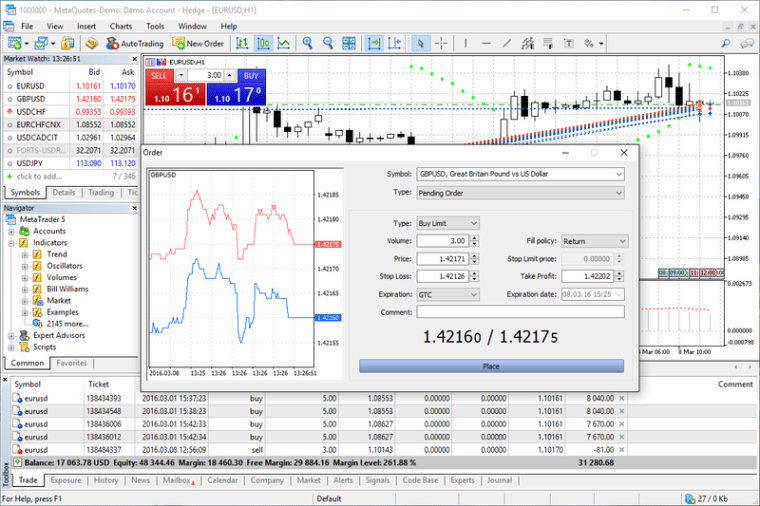

MetaTrader 4 is a widely used forex and CFD trading platform with a lot of capabilities. It supports advanced technical charting, custom indicators, scripts, algorithmic trading, and more. Many experienced forex traders use MetaTrader 4 and it is offered by most CFD brokers.

MetaTrader 5 is similar to MetaTrader 4, but supports individual share trading in addition to forex, commodity, and index trading. Traders who want to trade individual shares through GO Markets must use MetaTrader 5.

MetaTrader 4 and MetaTrader 5 are also available through mobile apps and as desktop software. These apps offer all of the same charting features as the web platforms and are straightforward to use.

One of the especially handy features of the MetaTrader platforms is that they offer one-click trading. This enables traders to open positions just by clicking on their charts. One-click trading can be very useful for fast-paced day trading since it speeds up the trading process.

Is GO Markets User-friendly?

GO Markets keeps CFD trading fairly simple compared to other brokerage firms, and that can be a significant advantage for traders. Whereas other brokers offer many different account types and half a dozen trading platforms, GO Markets offers a pretty clear choice between 2 trading accounts and 2 trading platforms.

MetaTrader 4 and MetaTrader 5 have steep learning curves. However, we found that once traders learn their way around these programs, they’re straightforward to use. Web versions of MT4 and MT5 can be accessed right from GO Markets’ website and traders can launch technical charts in seconds. The platforms also enable traders to keep track of open positions on a panel below their charts, making it easier to keep an eye on trades as they progress.

GO Markets Charting and Analysis

Most of the analytical firepower that GO Markets offers comes from MetaTrader 4 and MetaTrader 5. These are advanced trading platforms with highly customizable technical charts and support for custom technical indicators.

Traders will find dozens of popular technical indicators built into the platform, as well as support for advanced analysis such as Fibonnaci forex analysis or Gann pattern analysis. In general, traders will find few charting limitations in MetaTrader 4 and 5, whether they’re using the web, desktop, or mobile apps.

GO Markets also gives traders access to its Trading Central tool. This is an integration for MetaTrader 4 and 5 that offers automated technical analysis. The software can automatically identify support and resistance prices and help traders identify potential opportunities using a series of backtested trading strategies.

In addition, GO Markets offers a-Quant, a forex signals service. a-Quant delivers 9-12 forex signals each day for the 10 most highly traded forex pairs. Notably, these signals are delivered to traders’ emails rather than integrated into MetaTrader 4 or 5 for automated trading.

GO Markets Account Types

GO Markets offers 2 account options: Standard and GO Plus+.

The Standard account is a spread-only account with no commissions. Spreads start at 1.0 pips.

The GO Plus+ account is a commission account that charges £2 per lot per side traded. Spreads are discounted and start at 0.0 pips. The average spread for the EUR/USD pair is 0.1 pips.

Both accounts require a minimum deposit of £200. There are no account fees for either account type.

Demo Accounts

GO Markets offers a free paper trading account. Traders must sign up for an account with GO Markets to test out the demo, which gives them access to MetaTrader 4 and MetaTrader 5. Traders can choose their starting account balance and base currency, and reset the demo account at any time.

GO Markets App Review

GO Markets does not offer a mobile app of its own, but MetaTrader 4 and 5 have mobile apps. The MetaTrader 4 and MetaTrader 5 apps are widely considered to be among the best forex trading apps.

With the MetaTrader 4 and 5 apps, traders have access to all of the advanced charting and analysis tools that this trading platform offers. Traders can create custom strategies and indicators, set up custom chart views, and execute automated forex trading strategies.

Notably, the MetaTrader 4 and 5 apps also offer price alerts and technical indicator-based alerts. So, it can be used by traders on the go to stay on top of fast-moving markets.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

GO Markets UK Payment Methods

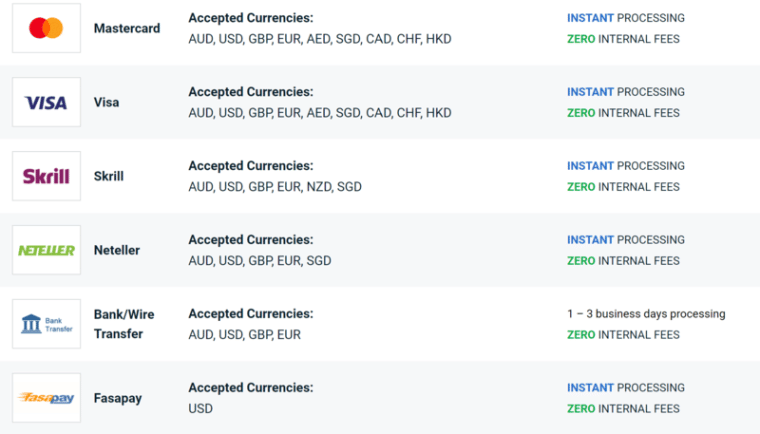

GO Markets offers fast and free deposits and withdrawals. The platform accepts debit and credit cards, bank transfers, wire transfers, Neteller, Skrill, and FasaPay.

E-wallet and card deposits are available instantly, while bank/wire transfer deposits take 1-3 days to reach a trader’s account.

GO Markets Minimum Deposit

GO Markets requires a minimum deposit of £200.

GO Markets Withdrawal Times

All withdrawals from GO Markets are free and are processed in 1 business day. Depending on the withdrawal method, funds may take an additional 1-5 days to reach a trader’s account after the withdrawal is processed.

GO Markets Bonus & Promos

GO Markets is currently offering a £40 bonus for every £200 traders deposit into their account. To claim the bonus, traders must trade a number of lots that is equal to their deposit amount divided by 200. Once this requirement has been met, traders are able to withdraw the bonus funds.

The bonus is limited to a maximum of £2,000 per account.

GO Markets Demo Account

GO Markets offers a free demo account that enables traders to try out the brokerage risk-free. Anyone can open a GO Markets demo account with no deposit, although traders must register with their name and email address.

The demo account is customizable such that traders can choose their starting account size, base currency, and trading platform. There is no time limit on the demo account and traders can reset their account balance at any time.

GO Markets Customer Support

GO Markets offers 24/5 customer support by phone and email. The support team can answer questions about GO Market’s trading products or MetaTrader 4 and 5.

GO Markets UK Licensing & Security

GO Markets was founded in Australia in 2006 and today operates in more than 150 countries around the world. In the UK, GO Markets Pty Ltd operates under a license from the Financial Services Commission of Mauritius (FSC) and is authorized by the UK’s Financial Conduct Authority.

UK traders do not receive protection from the UK’s Financial Services Compensation Scheme (FSCS) or negative balance protection. All funds deposited with GO Markets are at risk.

All activity on GO Markets is protected with SSL encryption.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How to Start Trading with GO Markets UK

Here’s how UK traders can start trading with GO Markets today.

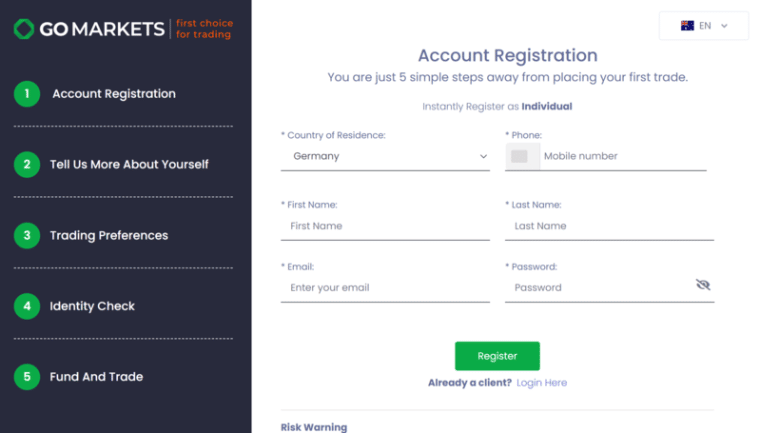

Step 1: Create an GO Markets Account

Head to GO Market’s website and click Open Account to open a new trading account. Traders must select the UK as their country, then enter their name, email address, phone number, and a password.

Step 2: Verify Account

GO Markets follows Know Your Customer (KYC) laws and requires new traders to verify their identity by uploading a copy of their passport or driver’s license. In addition, traders must upload a copy of a recent bank statement or utility bill to verify their country of residence.

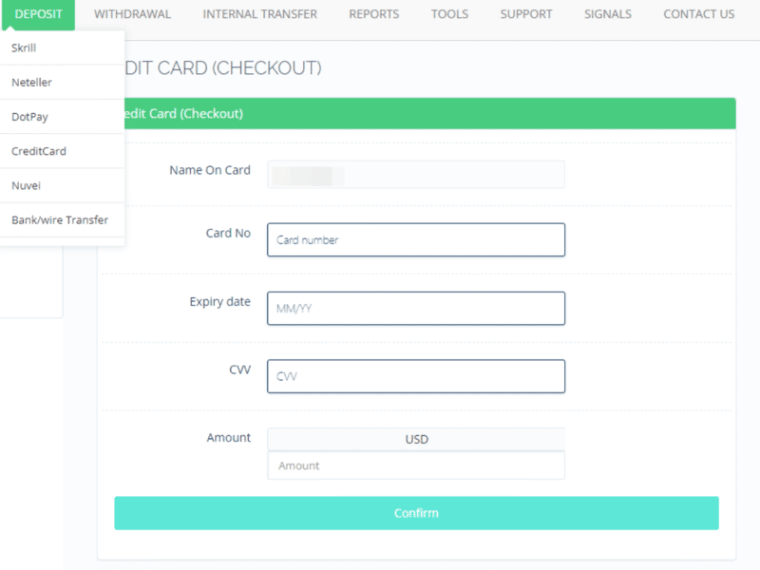

Step 3: Deposit

From the GO Markets account dashboard, click Deposit. Select a payment method and then choose the amount to deposit and enter payment details. Keep in mind that GO Markets requires a minimum deposit of £200.

Step 4: Trade

Open MetaTrader 4 or 5 and log in using a GO Markets account. Select one of the available forex, commodity, treasuries, share CFDs, or index CFDs to trade and open the trade panel. Enter the trade details, including the amount to trade, and then click Place to open a new trade.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Conclusion

GO Markets is a global CFD broker that offers trading on forex, commodities, share CFDs, treasuries and stock indices. The broker offers competitive trading fees and no account fees. Traders can use the popular MetaTrader 4 and MetaTrader 5 platforms to trade, plus get access to automated analysis and forex signals from GO Markets.

Sign up for a GO Markets account to start trading forex and more in the UK today!

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.