GO Markets is an Aussie CFD and stock brokerage that offers trading on a wide range of assets. With GO Markets, Australians can trade forex, commodities, cryptocurrencies, stock indices, treasuries, and shares from around the world. The broker offers access to outstanding trading tools, including the popular MetaTrader 4 and MetaTrader 5 platforms.

In our GO Markets Australia review, we’ll take a closer look at GO Markets and help Aussie traders decide if this is the right brokerage for them.

GO Markets Australia Pros & Cons

Pros

- Trade forex, commodities, crypto, stocks & more with CFDs

- Pricing from A$3 commission + 0.0 pips

- Buy ASX-listed shares and ETFs outright

- Leverage up to 30:1 for major forex pairs

- Includes MetaTrader 4 and 5

- 24/5 Australia-based phone support

Cons

- Cannot buy US or European stocks outright

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Tradable Assets

GO Markets is an Australian forex broker that launched in 2006. The broker now operates in more than 150 countries around the globe, but Aussie traders have access to a dedicated entity, GO Markets Pty Limited, that’s regulated by the Australian Securities and Investment Commission (ASIC).

Here are the assets available to Aussie traders:

Forex

GO Markets offers forex trading on 50+ forex pairs, including all major and most minor pairs. The maximum leverage is 30:1 for major forex pairs like EUR/USD.

Commodities

As one of the best CFD brokers in Australia, GO Markets offers trading on a variety of global commodities, including precious metals like gold and silver. Traders can also trade spot CFDs for WTI and Brent crude oil and futures contracts (via CFDs) for US and UK oil futures and soybean and wheat futures. The maximum leverage for commodities trading is 20:1.

Stock Indices

GO Markets offers trading on CFDs for 12 global stock indices, including the Australian ASX 200, the UK’s FTSE 100, and the US’s S&P 500. The broker also offers trading on futures for the China 50 index and US Dollar index. Maximum leverage is either 20:1 or 10:1 depending on the index.

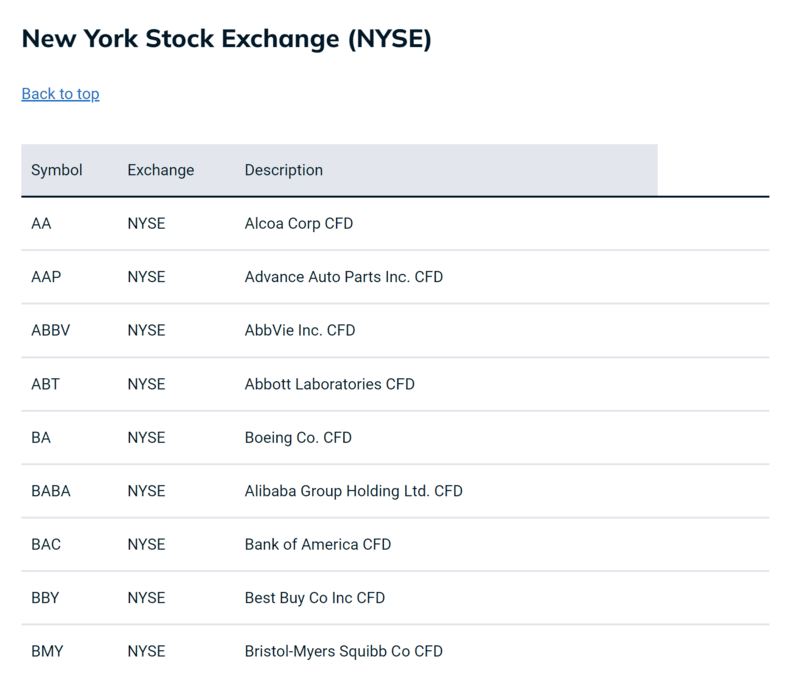

Stocks

Ever wondered how to buy shares in Australia? GO Markets offers 2 ways to trade stocks. The first is through share CFDs, which are available for hundreds of stocks from Australia, the US, the UK, Europe, and Hong Kong. Traders will find the most popular stocks from the S&P 500 and NASDAQ 100 indices in the US. Share CFDs can be traded using leverage up to 5:1.

The second way is to buy ASX-listed shares and ETFs outright. GO Markets offers a separate trading platform for ASX share trading with separate trading fees from CFD pricing.

Treasuries

GO Markets offers trading on 5 of the world’s biggest treasury bills through CFDs. These include 5-year and 10-year US treasury note futures, Eurozone BUND futures, UK Gilt futures, and Japanese government bond futures. Treasury futures can be traded with leverage up to 5:1.

Cryptocurrencies

GO Markets offers CFD trading for 10 of the largest cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Ripple, and more. Cryptocurrencies can be traded with leverage up to 2:1. GO Markets does not enable traders to buy cryptocurrency outright like a crypto exchange.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

GO Markets Australia Fees

GO Markets pricing is relatively simple for most assets, although a few – like ASX-listed shares – have special pricing structures.

The brokerage’s share trading fees are higher than some but competitive at 0.05%, while it offers zero account fees.

Trading Fees

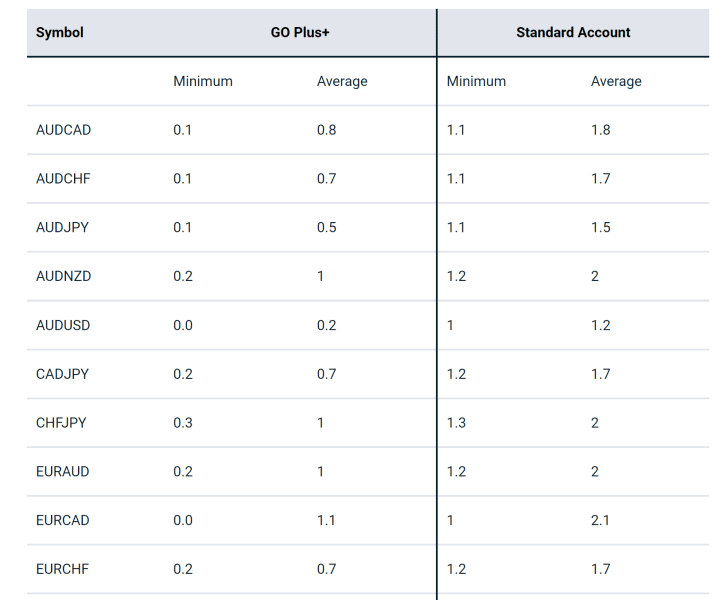

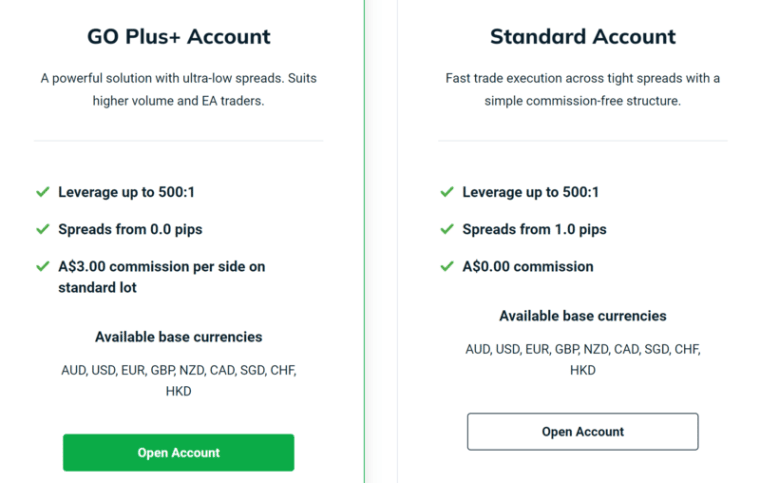

The Standard account offers no commissions and spreads starting from 1.0 pips. The average spread for the EUR/USD and AUD/USD forex pairs is 1.2 pips, while the EUR/AUD pair has an average spread of 2.0 pips.

The GO Plus+ account charges a flat commission of A$3 per lot per side. Spreads start from 0.0 pips, but the average spread may be higher. The average GO Plus+ spread for the EUR/USD and AUD/USD pairs is 0.2 pips, while the EUR/AUD pair has an average spread of 1.0 pips.

There are additional charges for share CFD and ASX-listed share trading.

CFD rates come with no minimum commission on ASX, US and European shares – Hong Kong shares have a minimum commission of around HK$50, varying based on account.

There are also data fees for Australian and Hong Kong share CFD markets. Data for Australian shares costs A$22 per month and data for Hong Kong shares costs HK$120 per month. Traders can earn a rebate for their data fees if they place at least 4 trades per month in that country’s market.

ASX-listed share trading incurs a commission of A$7.70 per trade, or 0.05% for trades involving more than A$100,000 in value – which is much cheaper than competitors for large trades.

The minimum value of shares that can be traded is A$500, which equates to a percentage commission of 1.54%.

| Standard | GO Plus+ |

| Spread: From 1.0 pips

Commission: None ASX shares: 0.08% with no minimum charge |

Spread: From 0.0 pips

Commission: A$3 per lot per side ASX shares: 0.08% with no minimum charge |

Non-trading Fees

GO Markets charges no account fees. There are no charges to open an account, no inactivity fees, and no deposit or withdrawal fees. Traders must make a minimum deposit of A$200 to open an account.

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | None |

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

GO Markets Platforms

GO Markets offers 2 platforms for CFD trading and an additional trading platform for ASX-listed share trading.

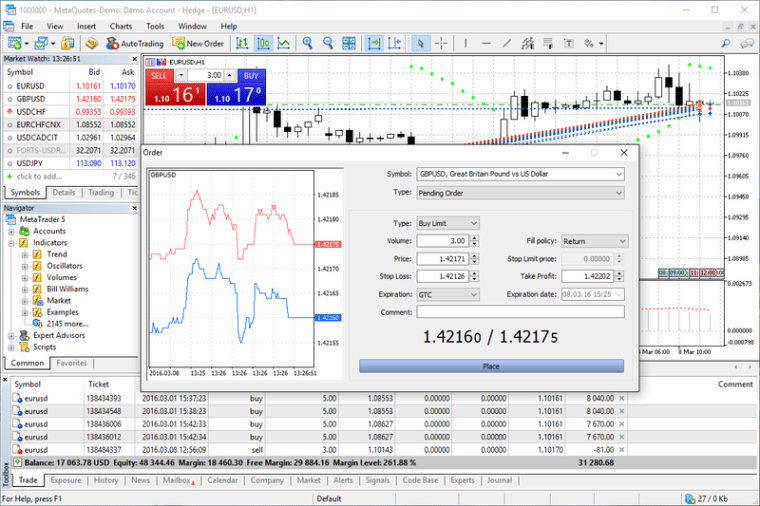

For CFD trading, traders can choose between MetaTrader 4 and MetaTrader 5. These are both widely considered to be among the best forex trading platforms and are packed with advanced analysis tools.

There are a lot of similarities between MT4 and MT5, but one notable difference is that MT4 does not support share CFDs. Traders who want to trade share CFDs through GO Markets must use MetaTrader 5. Both platforms support trading on all other CFDs available from GO Markets.

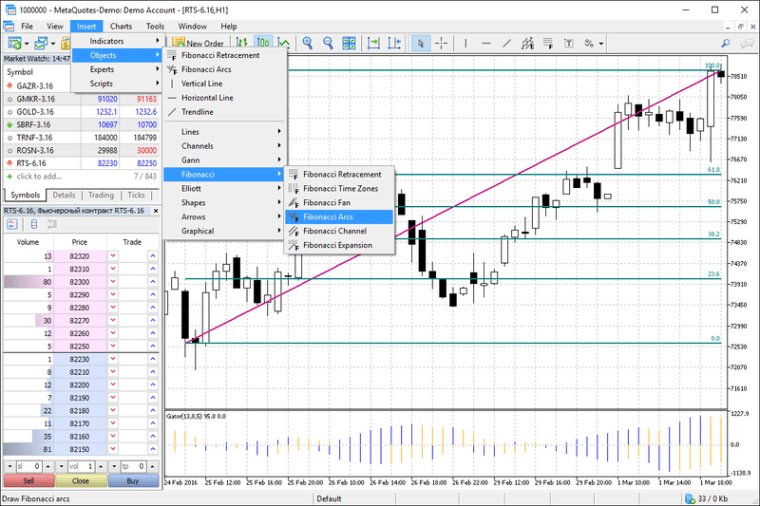

Both MetaTrader 4 and MetaTrader 5 include dozens of built-in technical indicators and premade chart layouts to help traders get started. More advanced traders can take advantage of the ability to build custom indicators or set up algorithmic trading routines. Both platforms have advanced risk management tools such as fill-or-kill orders, stop losses, take profits, and more.

MetaTrader 4 and 5 are available as desktop software, through mobile apps and through a web trading platform.

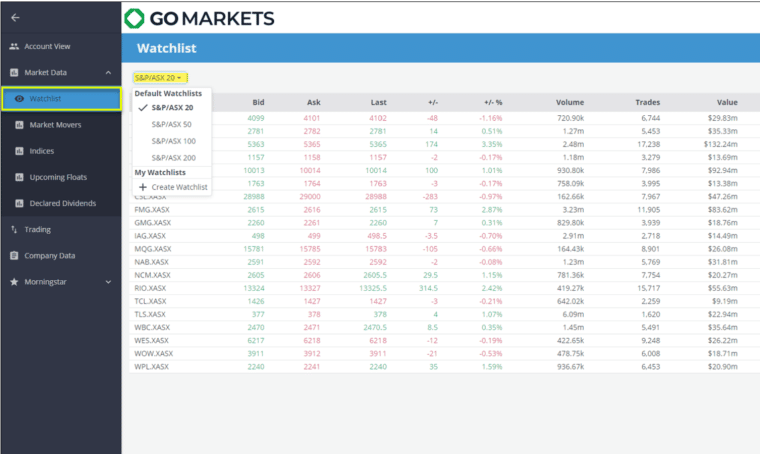

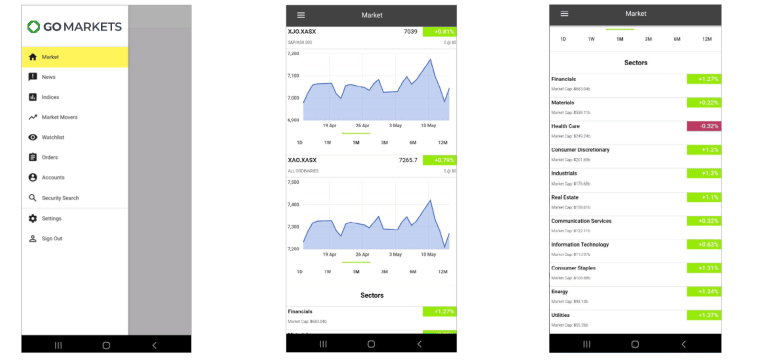

GO Markets has a separate trading platform for share trading, called GO Markets Securities Share Trading. This platform is available on the web and through mobile apps.

The share trading platform is significantly simpler in design than MetaTrader 4 or 5. It offers only basic technical charting capabilities and is focused more on watchlists and price alerts. Traders can easily monitor the performance of their portfolio, but this isn’t an ideal platform for day trading stocks.

It’s also worth noting some of the additional trading tools that GO Markets offers for customers. All traders have access to Autochartist, an integration for MetaTrader 4 and 5 that can automatically plot trend lines and support and resistance lines on technical charts. The software can also identify popular candlestick patterns and price breakouts.

Traders also have access to a-Quant, a forex signals service that delivers 9-12 forex signals each day to traders’ email. GO Markets customers also receive access to Myfxbook, a service for tracking the performance of forex trades.

ASX share traders have access to ShareSmart, an automated stock scanner tool. This tool scans the ASX daily for top stock picks based on a variety of technical indicators, helping Aussie traders find the best shares to trade.

Is GO Markets User-friendly?

GO Markets is very user-friendly. It only takes a few minutes to open a new account and get started trading. The platform also offers a wide range of deposit methods, many of which make traders’ funds available for trading immediately.

Since traders will use MetaTrader 4 or 5 for most trading activity, there is little direct interaction with GO Markets beyond setting up an account or transferring funds.

Traders who are new to MetaTrader 4 or 5 will find that these platforms have a steep learning curve. It takes time to fully understand how advanced charting features in these trading platforms work and to begin the process of building or importing custom technical indicators. These platforms are not the most user-friendly, but they are widely used.

The GO Markets Securities Share Trading platform is significantly easier for beginners to use. It features a simple layout and watchlist-building tools that are relatively self-explanatory. The downside to this ease of use is that the share trading platform lacks many of the advanced charting capabilities of MetaTrader.

GO Markets Charting and Analysis

MetaTrader 4 and 5 bring a ton of analytical capabilities to GO Market. These are among the most powerful trading platforms on the market today and there are few charting capabilities that they don’t offer.

Traders can use dozens of built-in indicators in drawing tools, import indicators from other traders, or build their own indicators. In addition, MetaTrader 4 and 5 both support advanced Fibonnaci forex analysis and Gann pattern analysis.

To make MetaTrader 4 and 5 even more powerful, GO Markets offers traders access to AutoChartist and its own MetaTrader Genesis package. The Genesis package includes tools for advanced order management, indicator-based alerts, market sentiment tracking, and more.

GO Markets Australia Account Types

GO Markets offers 2 account types: Standard and GO Plus+.

The Standard account offers no commissions and spreads starting from 1.0 pips. The GO Plus+ account charges a flat commission of A$3 per lot per side and spreads starting from 0.0 pips. Which is right for a specific trader depends on how much volume they expect to trade and how frequently they expect to place trades.

Either account requires a minimum deposit of A$200. There are no fees to open either a Standard or GO Plus+ account.

In addition, GO Markets offers trust, SMSF, and corporate accounts. These accounts are suitable for business entities that want to trade CFDs as opposed to individual traders.

Demo Accounts

GO Markets offers a free demo account for Aussie traders to test out the brokerage and its platforms. To access the paper trading platform, users need to create an account with GO Markets. They can choose their own starting demo account balance and reset the account at any time.

GO Markets App Review

MetaTrader 4 and 5 are each available through mobile apps. MT4 and MT5 are among the best forex trading apps according to many traders.

The mobile apps offer many of the same charting features as the desktop platforms, although creating custom charts on the app takes a little bit longer. The apps are perhaps most useful for monitoring automated forex trading strategies or receiving price or indicator-based alerts. Of course, the apps enable traders to execute traders through GO Markets.

The GO Markets Securities Share Trading platform also offers mobile apps for iOS and Android devices. These apps offer limited charting capabilities, but make it easy to monitor watchlists or the performance of open trades. The apps also offer price alerts and can be used to execute share trades.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

GO Markets Australia Payment Methods

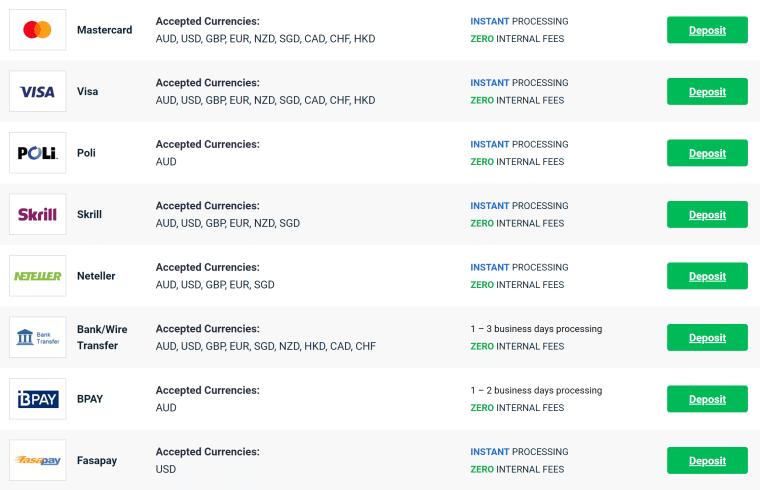

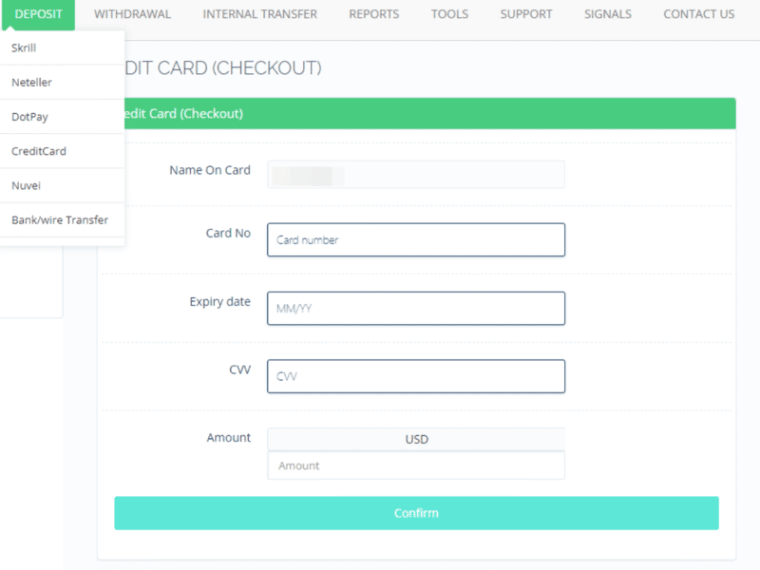

GO Markets offers a variety of deposit and withdrawal methods, all of which are free. Traders can make a deposit by Visa or Mastercard, bank transfer, wire transfer, Poli, Skill, Neteller, and BPay. Card and e-wallet deposits are instant, while bank and wire transfers take 1-3 days.

GO Markets Minimum Deposit

GO Markets requires a minimum deposit of A$200 to open either a Standard or GO Plus+ account.

GO Markets Withdrawal Times

Withdrawals are free and processed in 1-2 business days. Withdrawals may take longer to settle in a trader’s account after processing.

GO Markets Bonus & Promos

GO Markets does not offer a welcome bonus for CFD traders, but it does have an ongoing promotion for ASX share traders.

Traders who transfer an existing ASX brokerage account (HIN) to GO Markets get 50 commission-free trades. To qualify, the market value of the transferred brokerage account must be at least A$10,000.

GO Markets Demo Account

GO Markets offers a free demo account that traders can open simply by registering with the brokerage. There is no minimum deposit required and traders can test out all of the features of GO Markets, including the MetaTrader 4 and 5 platforms.

When opening a demo account, traders get to choose their starting account value. They can also reset their demo account balance at any time.

GO Markets Customer Support

GO Markets offers Australia-based phone and email support 24/5. The broker’s support team can answer questions about account opening, trade pricing, or any of its trading platforms and tools.

GO Markets Australia Licensing & Security

GO Markets has several entities operating around the globe. In Australia, traders sign up with GO Markets Pty Limited. The brokerage is regulated by the Australian Securities and Investment Commission (ASIC) and offers negative balance protection for all Aussie traders.

All activity on GO Markets is protected by SSL encryption.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

How to Start Trading with GO Markets Australia

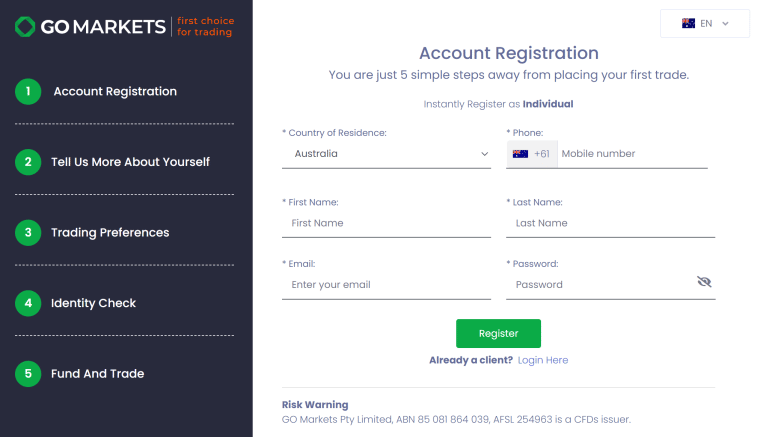

We’ll walk Aussie traders through the steps to sign up with GO Markets and start trading today.

Step 1: Create a GO Markets Account

Head to GO Market’s website and click Open Account, then choose to open an Individual Account. Traders must select Australia as their country of residence, then enter their name, email address, phone number, and a password. GO Markets also asks a series of questions about traders’ preferences and trading experience.

Step 2: Verify Account

GO Markets follows ASIC’s Know Your Customer (KYC) requirements. All new traders must upload a copy of their passport or driver’s license along with a copy of a recent bank statement or utility bill to verify their Australian residence.

Step 3: Deposit Funds

In the GO Markets account dashboard, click Deposit. Select a payment method and choose the amount to deposit. GO Markets requires a minimum deposit of A$200 for new accounts.

Step 4: Start Trading

Download MetaTrader 4 or 5 or open the web trading platform and log in with GO Markets account details. Choose an instrument to trade and open a new order execution form. Enter the trade details, including the amount to trade, whether to go long or short, and any stop loss or take profit desired. When ready, click Place to execute the trade through GO Markets.

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Conclusion

GO Markets is an Australian CFD and share broker that offers trading on a wide range of assets. Aussies can trade everything from forex and commodities to cryptocurrencies and stocks. The brokerage offers advanced trading platforms like MetaTrader 4 and 5 along with advanced tools for automated charting and forex signals.

Sign up for a GO Markets trading account to start trading in Australia today!

64% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.