Green investment funds are investment funds that hold environmentally-friendly companies. Some funds focus on specific themes like renewable energy or water conservation, while others offer green versions of traditional index funds.

In this guide, we’ll highlight 10 of the most popular green investment funds for 2023 that investors can explore. We’ll also explain more about how green investment funds work and how individuals can invest in one.

10 Popular Green Investing Funds to Watch in 2023

Let’s take a look at the 10 most popular green investing funds for 2023:

- iShares Global Clean Energy ETF (ICLN) – Established Clean Energy ETF with Low Management Fees

- Invesco Solar ETF (TAN) – Solar-focused Green Fund

- Global X Lithium & Battery Tech ETF (LIT) – Green Fund for Investing in Battery Technology

- First Trust Global Wind Energy ETF (FAN) – Green ETF Focused on Wind Energy Stocks

- VanEck Future of Food ETF (YUMY) – Green ETF Focused on Sustainable Food Supplies

- First Trust NASDAQ Clean Edge Energy Index Fund (QCLN) – Green Investment Fund for Clean Energy Tech

- iClima Global Decarbonization Transition Leaders ETF (CLMA) – Green Fund for Climate Innovation

- Invesco Water Resources ETF (PHO) – Green Fund for Water Sustainability

- iShares MSCI ACWI Low Carbon Target ETF (CRBN) – Green ETF for Investing in Carbon Removal Tech

- iShares ESG Screened S&P 500 ETF (XVV) – S&P 500 Index Fund for ESG Investors

You can invest in these and other green investment funds using regulated brokers like eToro.

78% of retail investor accounts lose money when trading CFDs with this provider.

A Closer Look at Green Investment Funds

Each of these green ETF funds focuses on a different subset of environmentally-focused companies. Let’s take a closer look at each of the funds on our green energy investing list.

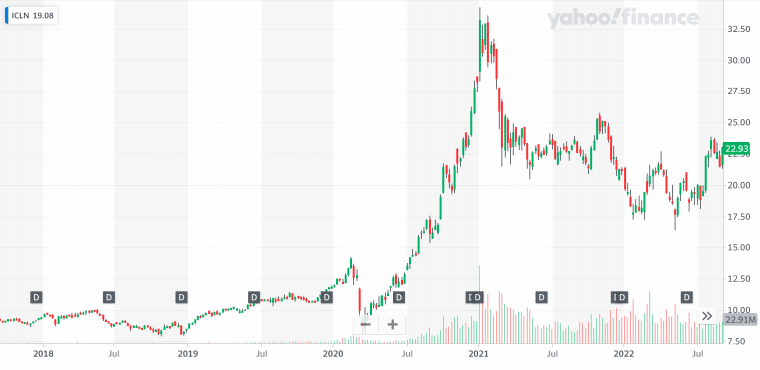

1. iShares Global Clean Energy ETF (ICLN) – Established Clean Energy ETF with Low Management Fees

The IShares Global Clean Energy ETF is one of the largest green funds and one of the longest-running clean energy ETFs on the market today. The fund first launched in 2008, right in the midst of the financial crisis, and it has $5.6 billion in assets under management today.

This green fund focuses broadly on clean energy technology. It invests in companies developing solar and wind power, geothermal power, hydroelectric power, biofuels, and more. It also invests in electric utilities that are preparing their grids for renewable energy sources as well as battery and semiconductor companies.

Top holdings include Enphase Energy, First Solar, Plug Power, and Vestas Wind Systems. The fund includes 98 total holdings with an average price-to-earnings (P/E) ratio of 37.6.

The ICLN fund has a 5-year return of 19.16% and a relatively low expense ratio of 0.40%.

78% of retail investor accounts lose money when trading CFDs with this provider.

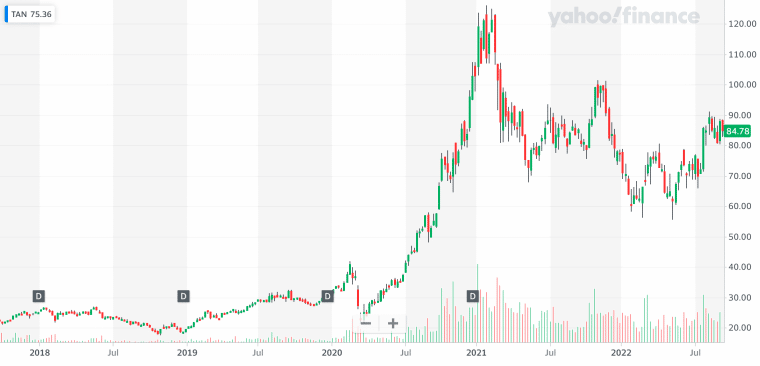

2. Invesco Solar ETF (TAN) – Solar-focused Green Fund

The Invesco Solar ETF is one of the most popular green investment funds for investing in solar power. The fund’s top holdings include companies like Enphase Energy, First Solar, SolarEdge Technologies, and Sunrun. A little over half of the fund’s investments are based in the US, with an additional 18% in Chinese solar panel manufacturing companies.

The TAN ETF has an average P/E ratio of 69, which makes sense given that many solar companies are viewed by investors as growth stocks. The fund has 54 total holdings.

This fund has a 5-year return of 32.0% and an expense ratio of 0.66%. The fund also pays an annual dividend of around $0.10 per share.

78% of retail investor accounts lose money when trading CFDs with this provider.

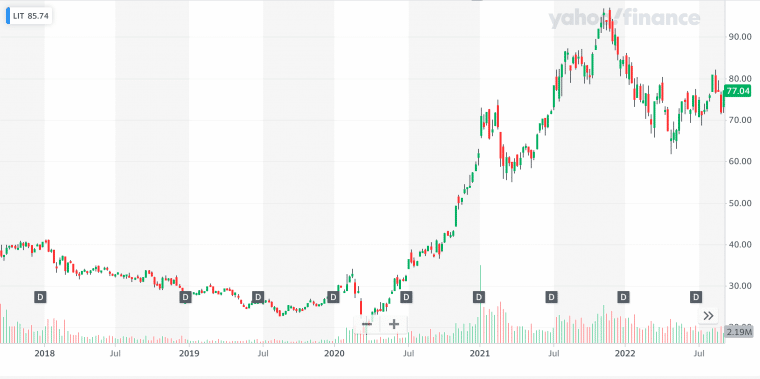

3. Global X Lithium & Battery Tech ETF (LIT) – Green Fund for Investing in Battery Technology

The Lithium & Battery Tech ETF from Global X invests in potentially high-growth companies that are building the technologies needed for electric vehicles, off-grid energy storage, and more.

Investors will want to take note that the fund also invests in mining companies that are involved in bringing lithium and other essential metals for battery production to market. So, while the companies this ETF invests in may be considered green in some senses, some investors may not consider all of the fund’s holdings to be ESG stocks.

Top holdings in this ETF include Albemarle Corporation, Quimica Y-SP, and LG Chemical. Tesla stock also makes up 4.4% of the fund’s holdings. 39% of stock holdings are based in China, while only 21% are based in the US.

This green climate fund has an average annualized performance of 22.3% over the past 5 years, making it one of the best-performing green ETFs on this list. The fund has an expense ratio of 0.75%.

78% of retail investor accounts lose money when trading CFDs with this provider.

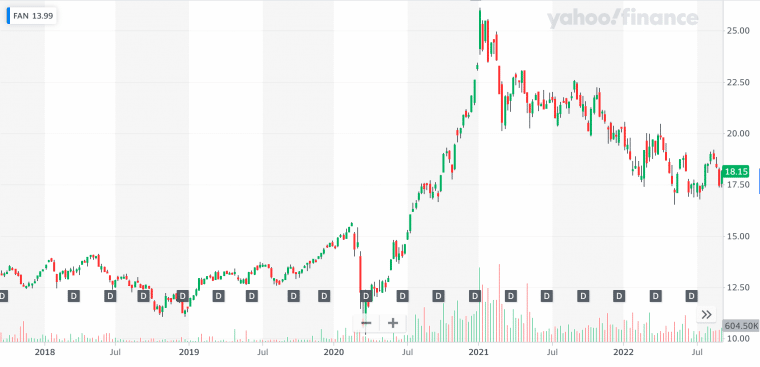

4. First Trust Global Wind Energy ETF (FAN) – Green ETF Focused on Wind Energy Stocks

First Trust’s Global Wind Energy ETF invests in companies that are building wind turbines, components for wind turbines, wind energy storage systems, and utility operators that are using wind energy. Top holdings include Northland Power, EDP Renovaveis SA, Orsted A/S, and Vestas Wind Systems A/S.

There are 52 total holdings with an average P/E ratio of 21.5. Many of the utility companies and foreign companies in this green fund have relatively low P/E ratios, but most investors would not consider them undervalued stocks for this reason alone.

Stocks in the US and China combine to make up less than 25% of this fund’s holdings. Nearly half of the fund’s holdings are based in Spain, Denmark, and Canada.

The fund has a 5-year performance of 8.0% and an expense ratio of 0.60%.

78% of retail investor accounts lose money when trading CFDs with this provider.

5. VanEck Future of Food ETF (YUMY) – Green ETF Focused on Sustainable Food Supplies

The VanEck Future of Food ETF is an interesting fund that invests broadly in companies that are working to make the world’s food supply more sustainable, particularly in the face of climate change and more widespread drought.

The fund includes shares of alternative meat companies like Beyond Meat, but many of the holdings are in agricultural companies. For example, some of the biggest holdings are Corteva Inc., Deere & Co., and Ball Corp. Major food manufacturers like Nestle and Kellogg are also included in the fund.

More than half of the fund’s assets are based in the US, and this green ETF has relatively little exposure to China or other emerging economies. The fund’s holdings have an average P/E ratio of 16.2.

YUMY just launched late in 2021, coinciding with a broad decline in the stock market. So, this green fund’s performance has been underwhelming. Since its inception, the fund has lost 22.5% of its value. This green investment fund has an expense ratio of 0.69%.

78% of retail investor accounts lose money when trading CFDs with this provider.

6. First Trust NASDAQ Clean Edge Energy Index Fund (QCLN) – Green Investment Fund for Clean Energy Tech

This green climate fund from First Trust is an index fund that aims to track the NASDAQ Clean Edge Energy Index. The fund is very broad-based, investing in everything from renewable energy technology to semiconductor manufacturing to battery technology and more. All of the stocks that it holds are listed on the NASDAQ stock exchange.

Top holdings in this fund include Enphase Energy, Tesla, NIO, ON Semiconductor, Albemarle, and Plug Power. Many of these are growth companies and many smaller holdings in the fund are not yet profitable, so First Trust doesn’t report the fund’s average P/E ratio.

The QCLN ETF has a 5-year return of 24.4% and an expense ratio of 0.58%. It pays an annual dividend yield of 0.45%.

78% of retail investor accounts lose money when trading CFDs with this provider.

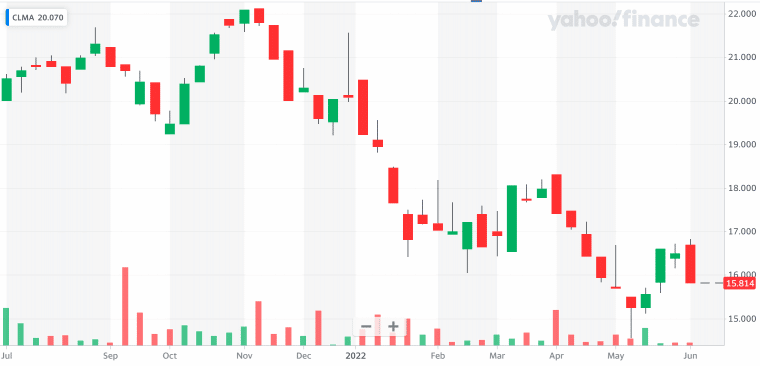

7. iClima Global Decarbonization Transition Leaders ETF (CLMA) – Green Fund for Climate Innovation

The iClima Global Decarbonization Transition Leaders ETF is a unique green fund that focuses on companies developing carbon removal technology. In that sense, it’s somewhat distinct from the other green investment funds on this list. Instead of investing in clean energy tech, the CLMA fund is investing in ways to remove the CO2 that’s already been released into the atmosphere.

This is a relatively small fund, with just over $580 million in assets under management. Top holdings include LG Energy Solutions, Waste Connections, Albemarle, and Trane. The majority of the fund’s holdings are based in the US and Europe.

The fund launched in 2020 and has a return since inception of -4.2%. It pays a dividend yield of 1.5% and has an expense ratio of 0.65%.

78% of retail investor accounts lose money when trading CFDs with this provider.

8. Invesco Water Resources ETF (PHO) – Green Fund for Water Sustainability

The Invesco Water Resources ETF is a global green fund focused on sustainable water solutions in a world with a growing population and more frequent droughts. Rather than focusing on a single approach to water conservation, the PHO fund invests in everything from desalination to water filtration to improved drainage systems.

Top holdings in this ETF include Xylem, Danaher, Ecolab, and American Water Works. The companies have an average P/E ratio of 23.0.

The fund has a 5-year return of 13.3% and an expense ratio of 0.59% with 1.6 billion in assets under management.

78% of retail investor accounts lose money when trading CFDs with this provider.

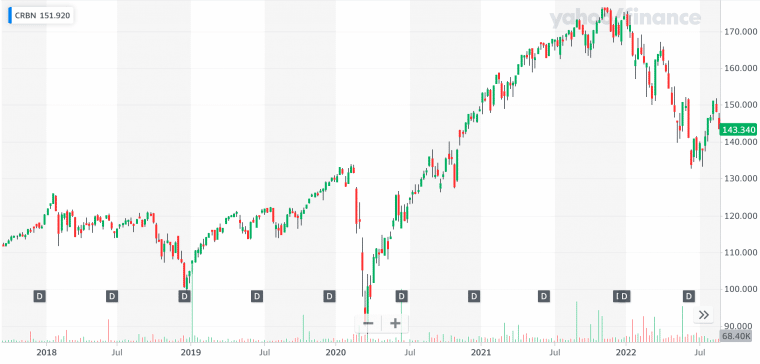

9. iShares MSCI ACWI Low Carbon Target ETF (CRBN) – Green ETF for Investing in Carbon Removal Tech

The iShares Low Carbon Target ETF is a broad fund that invests in a wide range of environmentally sustainable large-cap companies. Instead of aiming specifically to invest in clean energy technology or another green theme, the fund more or less mirrors the composition of the S&P 500.

Some of the biggest holdings in this fund include household names like Apple, Microsoft, Amazon, Tesla, Johnson & Johnson, and Meta (Facebook). All of the companies that the fund invests in have launched sustainability initiatives or pledged to reduce their carbon emissions.

The fund has more than 1,200 holdings, so it goes beyond just the S&P 500. The average P/E ratio of all holdings is 16.0 and more than 60% of included companies are based in the US.

The CRBN fund has a 5-year average annualized performance of 7.1% and an expense ratio of 0.20%.

78% of retail investor accounts lose money when trading CFDs with this provider.

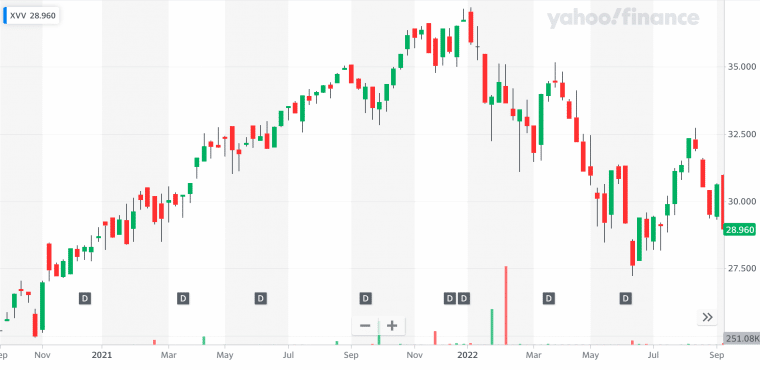

10. iShares ESG Screened S&P 500 ETF (XVV) – S&P 500 Index Fund for ESG Investors

iShares launched the ESG Screened S&P 500 ETF in late 2020, amid a broader push for ethical stocks among investors. The fund simply takes the list of stocks in the S&P 500 index and filters out companies that don’t meet ESG standards. Not all companies in the fund have environmental initiatives or carbon reduction pledges – some focus on workforce diversity or corporate governance – but the vast majority do.

The fund’s top holdings shouldn’t come as a surprise: Apple, Microsoft, Amazon, Tesla, and Alphabet, which are also the biggest stocks in the S&P 500. In total, the fund has 452 stocks instead of roughly 500.

Since launching, the fund has delivered a total return of 14.3%. It has an expense ratio of 0.08%, which is comparable to the fee for traditional S&P 500 index funds.

78% of retail investor accounts lose money when trading CFDs with this provider.

What are Green Funds?

Ever wondered what sustainable investing is? Green investment funds, also known as sustainable investing funds, are ETFs, mutual funds, or other types of funds that invest in environmentally-friendly companies and assets. Most green funds invest in stocks, but there are also green bond funds and green funds that invest in non-traditional assets.

Many green funds revolve around renewable energy stocks, but there are also green funds for water sustainability, carbon removal, sustainable land use, and more. As the environmental movement grows in size and more companies develop environment-focused technologies, the breadth of green investing funds is likely to grow.

How Greenness is Ranked in Investment Funds

What constitutes a “green” investment fund is in the eyes of the investor. There are no rules around what a fund must or must not include in order to be considered green. Rather, it’s up to fund managers to assemble holdings that match a fund’s environmental theme – and it’s up to investors to decide whether they like a fund’s holdings.

Green funds can be environmentally-focused in different ways. Some funds call themselves green because they invest in companies that have made pledges to reduce their carbon emissions or reduce their waste, even if they’re not involved in creating climate-friendly technologies. Other funds only invest in companies that are directly working to solve climate change or help the world switch to renewable energy.

When evaluating the greenest investment funds, investors should look carefully at what holdings are inside the fund. Many companies put out ESG or environmental impact reports that offer more details on their green initiatives.

Why Do People Invest in Green Funds?

Ever wondered what socially responsible investing is? Green investing funds are popular among many investors because they offer a way to support the environment with their capital. For investors who care about limiting climate change or preserving the environment more broadly, green funds enable them to invest while knowing that their money is supporting companies that share their values.

Some investors also invest in green energy funds because they are bullish on green technologies and products. For example, many investors think that renewable energy companies will be worth a lot more in the future. A green fund enables investors to build a broad portfolio of renewable energy technology companies without having to invest in individual stocks.

Types of Green Funds

There are several different types of green funds available.

All of the funds we covered above are green ETFs, or exchange-traded funds. ETFs trade on stock exchanges and can be bought and sold just like individual stocks. They often have lower expense ratios than other types of funds.

Green energy mutual funds are like ETFs, but they’re offered by individual brokerages or financial firms instead of trading on an exchange. Typically, green mutual funds have a minimum investment requirement and they can charge higher fees than comparable ETFs.

Many green funds invest in stocks, but there are also green bond funds. A green bond fund might invest in bonds from environmentally-friendly companies or even from nonprofits and other organizations that are involved in eco-friendly initiatives.

Most of the green investment funds we covered focus on specific themes, such as clean energy, water conservation, or land sustainability. However, there are also green index funds. A green index fund usually mirrors a specific market index like the S&P 500, but with modifications to only include environmentally-friendly stocks.

Regulated Stock Brokers Offering Green Funds

Investors can choose from a wide range of stock brokers to invest in green investment funds. Since green ETFs trade on major stock exchanges like the NASDAQ, they’re available from most major brokerages.

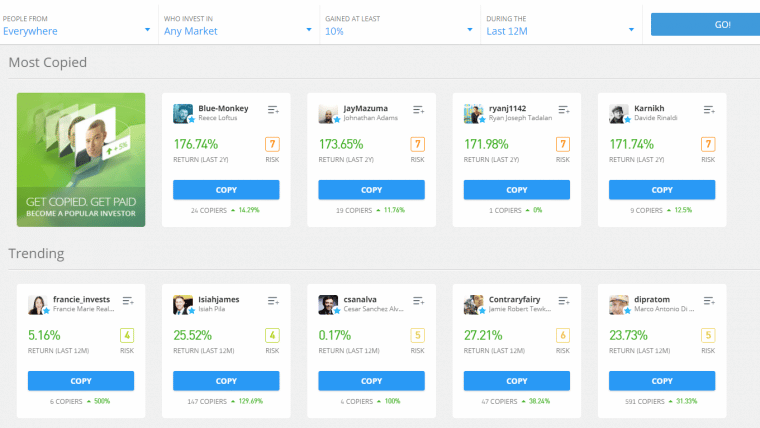

One broker that investors can use is eToro, which offers 0% commission when buying and selling green ETFs. eToro is a global stock brokerage with more than 20 million users worldwide and it offers trading on many of the green funds we covered above.

eToro offers a wide range of analysis tools for sustainable investors to use. Investors can access detailed technical charts along with dozens of built-in indicators and drawing tools. The broker also has professional research and analysis about the funds on offer.

One of the most popular features of eToro is its social investing platform. This enables investors to start discussions with each other, such as asking about a fund’s holdings and green characteristics. Users can also see what funds other green investors are buying and selling and whether investor sentiment around a fund is bullish or bearish.

eToro also offers copy trading, which enables investors to mimic the trades of more experienced investors. There are green-focused copy traders on the platform, so investors can use this feature to build a portfolio of green stocks in combination with green fund investing.

Investors can open a new eToro account with as little as $10 using a debit card, credit card, bank transfer, PayPal, and more. The brokerage offers 24/5 customer support.

78% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

Green investment funds offer a way for investors to invest in environmentally responsible companies and companies that are developing technologies to solve the world’s biggest environmental challenges. Many popular green ETFs are available to invest in through eToro with 0% commission.