The enormous amount of electricity used to mine Bitcoin has become a significant problem in recent years, prompting many projects to veer away from the network’s Proof-of-Work (PoW) consensus mechanism. This has allowed numerous ‘green’ cryptos to emerge that offer the same (if not better) services with a much lower energy requirement.

This guide discusses the most green cryptocurrency on the market in 2023, presenting several projects with eco-friendly technology underpinning them before highlighting why green cryptos are so important in today’s world.

The Top 12 Greenest Cryptocurrencies to Buy in 2023

The greenest crypto projects tend to limit their energy requirements to reduce their impact on global warming. As a result, these also end up being the most sustainable cryptocurrency projects, thanks to their eco-friendly tech.

Listed below are 10 of these projects, each of which will be analyzed comprehensively in the following section.

- C+Charge (CCHG) – Most Green Cryptocurrency of 2023 by Rewarding EV Drivers

- IMPT (IMPT)– Innovative Carbon Offset Protocol set for Breakout 2023

- Ethereum (ETH) – Popular Green Cryptocurrency of 2023

- Chia (XCH) – Best Green Cryptocurrency for Low Energy Consumption

- Polygon (MATIC) – One of the Greenest Cryptocurrency Projects in the Blockchain Sector

- TRON (TRX) – Green Blockchain Network with Low Carbon Footprint

- Hedera (HBAR) – The Greenest Cryptocurrency as an Alternative to Blockchain

- Algorand (ALGO) – Peer-Reviewed Blockchain with Regular Carbon Credit Purchases

- Stellar (XLM) – Decentralized Payments Network with Modest Electricity Requirement

- Celo (CELO) – Open-Source Blockchain Hosting Exciting Eco-Friendly dApps

- Tezos (XTZ) – Low-Energy Blockchain with High-Profile Partnerships

- Solana (SOL) – Popular Green Cryptocurrency with High Scalability

A Closer Look at the Most Green Cryptos to Invest In

The most energy-efficient cryptocurrency projects are also appealing from an investment perspective. This is because the greenest cryptos often utilize cutting-edge technology to reduce energy consumption – which tends to result in an increased lifespan for the project.

With many investors concerned the crypto could be bad for the environment many have started searching for the most green crypto projects of 2023:

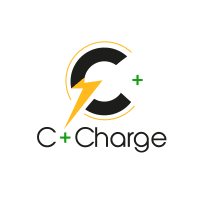

1. C+Charge – Most Green Cryptocurrency of 2023 by Rewarding EV Drivers

We rate C+Charge as the greenest crypto project in the space as it is helping push drivers to make the switch from fossil fuel to electric vehicles (EVs).

While EV sales have boomed in the past decade, the vast majority of vehicles on the road are still powered by fossil fuels and responsible for large amounts of pollution.

C+Charge wants to incentivize EV ownership – by rewarding drivers with carbon credits while they recharge – and make it more convenient and efficient.

Carbon credits are permits that allow a user to offset and reduce their carbon footprint by funding eco-friendly projects.

C+Charge has partnered with Flowcarbon to offer EV drivers Goodness Nature Tokens (GNT) while they recharge, which are 1:1 backed with carbon credits from verified carbon regeneration programs.

Flowcarbon made headlines in mid-2022 after attracting more than $70 million in venture capital investment from the likes of a16z, Invesco and Samsung Next.

C+Charge will also develop a mobile app that will help tackle the inefficiency and inconvenience of recharging an EV.

The app will provide information on the nearest charging station, how much it will cost to recharge, how long the waiting time is and if the charging point is functional.

It will also enable users to purchase and store C+Charge’s native token, CCHG, which are used to pay for recharging – the project wants to make recharging costs uniform and end the wildly varying prices EV drivers currently face.

C+Charge, which has a doxxed and KYC-verified team, has also already partnered with Perfect Solutions, which owns around 20% of charging stations in Turkey.

CCHG tokens are currently on sale for $0.013 in stage 1 of its presale, although the price will have increased by 80% to $0.0235 in the fourth and final stage. Of the 1 billion max supply, 40% are available in the presale with no vesting period and a hard cap of $6.6 million. C+Charge price predictions are mostly bullish despite the current crypto winter.

For more information, read through the C+Charge whitepaper or join the Telegram group for the latest news

| Presale Started | 16 December |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Binance |

| Min Purchase | None |

| Max Purchase | None |

2. IMPT (IMPT) – Innovative Carbon Offset Protocol set for Breakout 2023

Experts are predicting IMPT to see huge growth in 2023 when market conditions improve, after the project completed one of the best presales of 2022 and raised more than $20 million, with CoinCodex.com and CryptoPresales.com rating IMPT as one of the best crypto projects of the year.

IMPT’s primary service is streamlining the process of obtaining and trading carbon credits, which – as mentioned above – play a fundamental role in the fight against climate change by allowing holders to offset their carbon footprint by funding eco-friendly projects.

As noted in IMPT’s whitepaper, the volume of carbon credits required globally is expected to increase at least 20-fold by 2035. This increase in demand necessitates a safe and transparent marketplace that allows individuals and companies to work together for the common good.

This is where IMPT comes in, as its blockchain-based platform helps eradicate the ‘double-selling’ within the carbon credit market. Moreover, IMPT makes it easy for individuals to help the environment by allowing them to acquire carbon credits through their everyday shopping activities.

IMPT achieves this by partnering with over 10,000 household brands, including Nike, Dyson, Amazon and Microsoft, each opting to contribute a percentage of their sales margin to eco-friendly projects. Thus, whenever an IMPT user buys goods or services from these brands, they will be rewarded with $IMPT – IMPT’s native ERC-20 token.

$IMPT looks likely to become one of the best ERC-20 tokens since users can exchange them for carbon credits. Users can trade these carbon credits on IMPT’s marketplace since they are structured as NFTs. Interestingly, users can even ‘retire’ these credits, effectively removing CO2 from the atmosphere.

Users who take this approach will be rewarded with a unique digital artwork NFT, which can also be traded on the marketplace. In addition to this, the whole process is sustainable since the IMPT ecosystem is hosted on Ethereum – which is among the most energy-efficient blockchains after the Merge cut its usage by 99.9%.

IMPT also has a built-in ‘social network’ that gives everyone an ‘IMPT Score’ based on their environmental impact. This allows all network users to easily see who is doing the most for the environment and incentivizes individuals/companies to improve their efforts.

Those looking to keep up to date on IMPT’s progress can do so by joining the official Telegram group.

3. Ethereum (ETH) – Popular Green Cryptocurrency of 2023

. As most crypto investors will know, Ethereum is an open-source blockchain network that offers smart contract functionality. Due to this, Ethereum has become the go-to for decentralized application (dApp) developers in various fields.

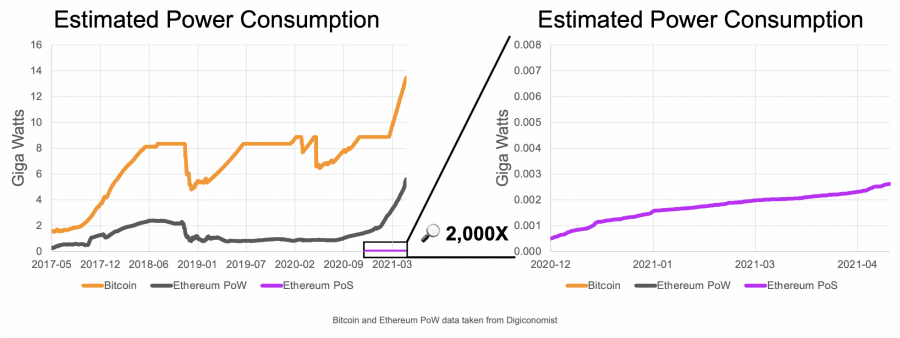

Most investors opt to buy Ethereum for its value potential – yet this green crypto cryptocurrency is also doing its bit for the environment. Ethereum’s transition to a Proof-of-Stake (PoS) consensus mechanism – – dubbed the Merge – dramatically decreased the network’s energy consumption by removing the need to ‘mine’ tokens.

According to the Ethereum website, moving to a PoS mechanism reduced the network’s energy requirements by 99.95%. In turn, this minimizes the amount of CO2 being pumped into the atmosphere that can be attributed to Ethereum’s operations.

Moreover, there will be no ‘arms race’ regarding expensive computer hardware since network users can now become validators using simple laptops or other devices. Thanks to these changes, Ethereum is our pick for the most green crypto of 2023.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

4. Chia (XCH) – Best Green Cryptocurrency for Low Energy Consumption

Instead of energy-intensive mining, the Chia blockchain is secured by utilizing unused storage space on network participants’ HDDs and SDDs. The owners of these storage devices write 100GB ‘plots’ on them, which are filled with hashes. When a new block is created, its hash is compared with the hashes in these plots.

The plot with the closest similarity to the block’s hashes ‘wins’ the block and the associated XCH reward. According to the Chia website, this approach means the Chia blockchain uses just 0.16% of Bitcoin’s annual energy expenditure.

Moreover, Chia’s creator, Bram Cohen, has even authored a peer-reviewed ‘Green Paper’ that details how the network’s unique consensus mechanism can help the environment. This adds enormous credibility to the project – making Chia one of the greenest cryptos to keep an eye on.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

5. Polygon (MATIC) – One of the Greenest Cryptocurrency Projects in the Blockchain Sector

Like many green crypto mining blockchains, Polygon uses a PoS consensus mechanism, meaning the network’s validators only consume around 0.00079 TWh of electricity yearly. Compare this to Bitcoin’s annual energy draw of 35 to 140 TWh, and it’s clear how much better Polygon is for the environment.

Polygon has also emerged as one of the best altcoins for sustainability reasons, thanks to the unveiling of its ‘Green Manifesto’. This document highlights Polygon’s pledge to go carbon-neutral in 2022, with the developers also deploying $20 million to offset the network’s carbon footprint.

Polygon will achieve this by purchasing carbon credits and then retiring them – effectively removing CO2 from the atmosphere. Finally, this environmentally green cryptocurrency project has even offered to help partner companies offset their carbon footprint by providing the resources needed.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

6. TRON (TRX) – Green Blockchain Network with Low Carbon Footprint

At the time of writing, many believe TRON is the best crypto under $1 due to the network’s aim of removing the middleman from the content-creation process. In turn, this allows creators to retain a greater degree of ownership over their content, ultimately leading to larger financial rewards.

However, TRON is also a green crypto cryptocurrency since a recent Crypto Carbon Ratings Institute (CCRI) report noted that the network only consumes about as much energy as 15 US households. Furthermore, the CCRI found the carbon intensity of the network to be just below the world average.

The report also found that TRON consumes less energy than other leading ‘green’ blockchains, such as Avalanche, Algorand, and Cardano. This means that TRON emits just 69.42 tons of CO2 each year – making it one of the greenest cryptocurrencies with a low carbon footprint.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

7. Hedera (HBAR) – The Greenest Cryptocurrency as an Alternative to Blockchain

The technology underpinning this algorithm is relatively complex, but the bottom line is that this approach is designed to be more scalable than the current blockchain networks in operation. In turn, this means that Hedera can handle 10,000 transactions per second (TPS) with finality in 3-5 seconds.

However, Hedera is also one of the most eco-friendly crypto projects and has committed to being carbon-negative. Hedera’s team achieves this by purchasing carbon offsets every quarter in conjunction with Terrapass to ensure that the purchased amounts are correct.

Although Hedera’s energy consumption will grow as the network expands, the team has pledged to purchase more carbon offsets to account for this growth. Either way, since Hedera only consumes 0.00017 kWh of energy per transaction (compared to Bitcoin’s 1,736.85), this network can undoubtedly be considered a green energy crypto.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

8. Algorand (ALGO) – Peer-Reviewed Blockchain with Regular Carbon Credit Purchases

One of Algorand’s most appealing features is that the network supports various programming languages. This includes Java, Go and Python, JavaScript, and more. Ultimately, this makes it much easier for developers to construct apps on Algorand since they don’t have to learn another language.

However, ALGO is also one of the best utility tokens from a sustainability perspective since it uses smart contracts to offset its carbon footprint. This is achieved by using a portion of every transaction fee to purchase carbon credits, reducing the network’s CO2 footprint.

The purchasing process is streamlined through Algorand’s partnership with ClimateTrade, which helps verify the carbon credits traded on the blockchain. As such, this green crypto mining alternative is both fully-transparent and scalable, ensuring the positive impact doesn’t diminish over time.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

9. Stellar (XLM) – Decentralized Payments Network with Modest Electricity Requirement

Stellar was co-founded by one of Ripple’s earliest team members and has received backing from payments giant Stripe, highlighting the project’s credibility. Thanks to Stellar’s infrastructure, payments can be processed in just five seconds, with fees that equate to a fraction of a cent.

As noted by the Stellar Foundation, the network uses a Proof-of-Agreement (PoA) protocol to achieve consensus. This unique approach means that programs using this protocol consume just 261,435 kWh of electricity per year – the equivalent of 22.4 US households.

What’s more, the Stellar Foundation has established an ongoing carbon dioxide removal process and aims to remove the historical carbon footprint of the network, stretching back to 2015. Network users can even opt-in and aid in this process through the Stellar website.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

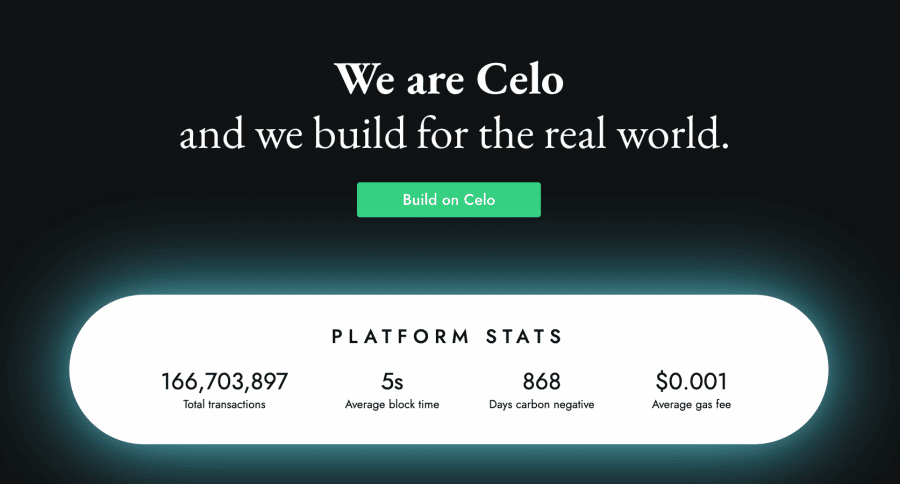

10. Celo (CELO) – Open-Source Blockchain Hosting Exciting Eco-Friendly dApps

The vital thing to note about Celo is that it is designed to be used on smartphones – a concept that hasn’t been given much attention within the space. Additionally, Celo is compatible with the Ethereum Virtual Machine (EVM), making it easy for developers to port their dApps over if they wish.

Celo may also be one of the most undervalued cryptos since it is a carbon-negative blockchain. The network contributes daily offsets in conjunction with Project Wren, meaning Celo has offset over 3,362 tons of CO2 since its inception.

To put this in perspective, this figure is the equivalent of avoiding 3,491 flights from LA to Paris or walking for over 8.3 million miles instead of driving. In addition, Celo has also played host to exciting blockchain-based projects like Loam and MOSS, which aim to slow down global warming by reducing CO2 emissions.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

11. Tezos (XTZ) – Low-Energy Blockchain with High-Profile Partnerships

Those wondering how to invest in Web3 may wish to consider Tezos, as the network now has an array of exciting apps in the realms of decentralized finance (DeFi), NFTs, and blockchain gaming. In addition, Tezos has partnered with high-profile names like Manchester United, Ubisoft, and Red Bull, enhancing its publicity.

However, Tezos also aims to be the most green crypto in the blockchain arena due to its PoS consensus mechanism, meaning it has an average energy footprint of just 17 global citizens. This means the network’s annual electricity consumption is just 0.001 TWh – far less than Bitcoin.

Interestingly, Tezos’ energy consumption decreases as on-chain activity increases. This means that Tezos becomes more eco-friendly as the network’s popularity grows. Due to this, Tezos is undoubtedly one green crypto cryptocurrency to keep an eye on in the months and years ahead.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

12. Solana (SOL) – Popular Green Cryptocurrency with High Scalability

People often buy Solana due to its high throughput, yet the network has also made a name for itself in the NFT niche. At the time of writing, Solana has just reached an all-time high in terms of NFT mints, breaching 300,000 digital assets in a single day.

From a sustainability perspective, Solana was able to become carbon neutral in 2021 and aims to repeat this feat in 2022. Solana achieves this by funding ‘refrigerant destruction’, which is considered the top solution for reversing climate change, according to Green America.

Solana is also one of the green cryptos on this list that has partnered with leading eco-friendly institutions, such as Watershed, to offset its CO2 footprint. Finally, Solana’s team has pledged to continue making the blockchain more performant – leading to greater energy efficiency.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

What is Green Cryptocurrency?

So what is ‘green cryptocurrency’? This is a catch-all term used to describe cryptocurrency projects with sustainability goals. By far the most widely-used goal is reducing (or removing) CO2 emissions, which are a major contributor to global warming.

As those who invest in Bitcoin will know, ‘crypto mining’ has given the market a bad reputation in the eyes of the media. Bitcoin’s mining process is incredibly energy-intensive since high-power hardware is required to validate transactions. This has led many reports to note that the Bitcoin network consumes as much electricity as a small country.

Ultimately, this has shone a spotlight on the crypto market and prompted developers to find better ways to run their networks. This is where ‘green cryptocurrency’ comes in, as these projects veer away from Bitcoin’s approach in favor of more eco-friendly technologies.

The most common distinction is that green cryptos use low-energy consensus mechanisms. Proof-of-Stake (PoS) has emerged as a viable alternative to Bitcoin’s Proof-of-Work (PoW) mechanism – so much so that Ethereum’s developers opted to transition to the former through ‘the Merge’ upgrade and cut energy usage by 99.9%.

However, many of the most promising cryptocurrencies take things one step further by partnering with outside institutions to reduce their carbon footprint. This is primarily done by purchasing carbon offsets, which can then be ‘retired’ to effectively remove CO2 from the atmosphere. Some green crypto projects even partner with institutions related to reforestation, allowing them to take a more active approach.

The bottom line is that the most green cryptocurrency projects are aware of the negative impacts of carbon dioxide emissions and put plans in place to reduce their energy consumption. What’s more, many of these projects (e.g. Tezos) are designed to consume less energy as they grow – providing an incentive for developers to use them.

Why Green Crypto is Important

The rate of global warming is increasing, meaning that sectors worldwide must do their bit to offset CO2 emissions. This is no different for the crypto market, which has developed a poor reputation thanks to Bitcoin’s colossal energy expenditure.

With that in mind, detailed below are several reasons why the most green crypto projects are so important in today’s world:

Provides an ESG-friendly Investment Opportunity

Environmentally-conscious investors looking to buy cryptocurrency have had their hands tied in the past since leading cryptos like Bitcoin and Ethereum aren’t exactly the most eco-friendly. However, the emergence of green cryptos has provided viable opportunities for this demographic of investors.

Interestingly, green cryptos may also represent appealing opportunities over the long term. This is because these cryptos often use technology that is essentially future-proof, meaning they will remain in demand for years to come.

Helps Slow Down Global Warming

It goes without saying that green cryptocurrencies are essential since they actively help slow down the rate of global warming. According to NASA, global warming has resulted in the ocean getting warmer, ice sheets melting, glaciers retreating, and sea levels rising.

Since carbon dioxide emissions directly contribute to global warming, the green crypto projects that actively reduce CO2 expenditure are crucial to slowing climate change. Although they still emit energy, these projects ensure their electricity requirements are as low as possible.

New projects such as C+Charge and IMPT are helping to fight global warming by offering their users carbon credits – which are permits that allow the holders to offset their carbon footprint as they fund eco-friendly projects.

Improves Crypto’s Reputation

Green crypto projects are also important because they help improve the sector’s reputation in the eyes of the media. We briefly touched on the negative connotations of the Bitcoin network earlier, which has tainted many people’s views on crypto.

However, as sustainable projects become more popular, views will begin to change. This has already started happening, thanks to Ethereum’s transition to a PoS chain and the developers’ focus on sustainability.

Creates New and Valuable Use Cases

Finally, many of the best long-term crypto investments are those with cutting-edge eco-friendly technology, which cannot be found elsewhere in the market. The Chia network is a prime example of this, as its ‘Proof-of-Space-and-Time’ mechanism has offered a new alternative for PoW and PoS chains to consider.

These new technologies are also appealing from an investment perspective since they’ll likely be one of the major factors leading to adoption. In turn, this will help increase demand for the related network’s token – helping promote upwards price momentum.

How to Find the Greenest Cryptocurrencies

Those wondering how to invest in carbon credits may be interested in green cryptos, as they allow individuals to impact the environment positively. To streamline the analysis process, detailed below are some of the best strategies that help uncover green cryptocurrencies:

Use Social Media

The best TikTok crypto projects often have solid sustainability agendas, allowing them to generate significant publicity on social media. Thanks to their eco-friendly nature, these projects attract attention from those interested in crypto – creating a snowball effect that increases their visibility.

The same can be noted on the best crypto YouTube channels, which often analyze projects with environmentally-friendly tech. Thus, investors can easily uncover green cryptos using platforms like these.

Look for Major Upgrades

Since global warming is increasing at an alarming rate, many established crypto projects are being altered to become more eco-friendly. Ethereum is a prime example of this, with developers opting to change to a PoS consensus algorithm, which uses much less energy.

Thus, by keeping track of any significant changes to leading crypto projects, investors can identify which are making a conscious effort to be greener and which aren’t.

Research Roadmaps and Whitepapers

Those looking to make money with crypto can usually inform their investment decisions by reviewing a project’s whitepaper and roadmap. These resources provide insight into the project’s future plans, allowing investors to determine whether it has longevity or not.

However, these resources often highlight whether a project is green or not – especially the whitepaper. By assessing the whitepaper, investors can get an idea of the project’s impact on the environment and whether any measures are being implemented to mitigate that impact.

Keep Tabs on the Latest Technology

Finally, investors can identify green crypto projects by keeping track of the latest innovations within the sector. Although PoS chains were all the rage a few years back, new consensus mechanisms have emerged that look to improve energy efficiency even more.

The mechanisms used by Solana and Chia are just two to be aware of, whilst Hedera moves away from blockchain entirely through its ‘hashgraph’ technology. Thus, investors can often uncover ‘hidden gems’ by looking for projects using new tech since they tend to be the most environmentally friendly.

Greenest Cryptocurrencies to Invest In – Conclusion

In conclusion, this guide has taken an in-depth look at the greenest cryptocurrency projects on the market, highlighting what they are doing for the environment and how they plan to remain sustainable over the long term.

Investors looking to buy green cryptocurrency can do so by partnering with the heavily-regulated broker, eToro. eToro serves over 28 million clients worldwide and allows investors to buy crypto from just $10 per position – with full support for credit/debit card, PayPal, and Neteller deposits.

C+Charge is our top pick for the greenest crypto project as it is trying to incentivize drivers to switch from fossil fuels to electric vehicles by incentivizing ownership with carbon credit rewards and making it more convenient and efficient through its mobile app.

The CCHG presale has just launched with tokens currently on sale for $0.013 in the first of four stages.

IMPT is another green project looks set for a breakout 2023 after completing one of the best crypto presales of 2022, where it raised more than $20 million.

C+Charge - Next 10x Crypto with Real Life Utility

- Democratizing Carbon Credits

- Incentivizing Wider Adoption of EVs

- Real Life Use Case for Web3 Technology

- First Platform Allowing EV Owners to Earn Carbon Credits On or Off Chain