Thinking about investing in Bitcoin for the first time, but not sure how much money to risk? This beginner’s guide explores some key considerations that newbies need to make when asking the question – how much Bitcoin should I buy?

We discuss diversification, risk tolerance, time in the market, disposable income, and other important factors.

How Much to Invest in Bitcoin to Make Money – Key Takeaways

Beginners should consider the following key takeaways when assessing the question – how much Bitcoin should I buy?

- Budget and Disposable Income – The most important assessment to make when exploring how much to invest in Bitcoin is how much disposable income is available. In order to make this evaluation, investors should create a budget that highlights non-negotiable outgoings – such as groceries, utilities, and mortgage payments. Anything left after the identified expenses can be considered for investing in Bitcoin and other assets.

- Tolerance for Risk – Make no mistake about – Bitcoin is as risky as it gets when investing in the markets. Although to date Bitcoin remains the best-performing asset since it was launched in 2009, there is no guarantee that this will always be the case. In reality, any investments made in Bitcoin should represent money that the investor is prepared to lose.

- Time in the Market – Like many assets – especially the stock market, Bitcoin generally moves in prolonged cycles. Since late 2021, Bitcoin has remained in a bearish cycle, resulting in the price of the cryptocurrency dropping 70% from its former high of $69,000. While many commentators argue that the next bull run will eventually arrive at some point in the future, if and when this happens could be several years from now. As such, investing in Bitcoin should be viewed as a long-term play.

- Dollar-Cost Averaging – Assuming that a long-term outlook is suitable, it is worth considering a dollar-cost averaging strategy on each investment when assessing how much Bitcoin to buy. For example, let’s suppose that the investor has $5,000 in savings that they wish to allocate to Bitcoin. Rather than investing the entire lump sum in one go, it might make more sense to opt for 10 monthly investments at $500 each. This will average out each investment in terms of the underlying cost price.

- Diversification – Bitcoin represents just one of many thousands of cryptocurrencies that trade in this space. As such, investors should consider exploring other cryptocurrency projects to ensure that the investment portfolio is well diversified. This is somewhat similar to investing in an index like the Dow Jones, which cover 30 stocks from multiple sectors. One of the hottest trends to diversify into right now is crypto presales – which offer early access to newly launched tokens at the best price possible. Some of the most popular presales ongoing right now are Dash 2 Trade, IMPT, and Calvaria.

The key takeaways highlighted above offer some insight into the thought process that should be taken when assessing how much should you invest in Bitcoin. We explain each point in great detail in the following sections.

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members

Methods to Ascertain How Much to Invest in Bitcoin

Is it too late to buy Bitcoin? As noted above, some of the best methods to utilize when assessing how much to invest in Bitcoin include diversification, dollar-cost averaging, and creating a well-rounded budget.

This is in addition to evaluating tolerance for risk and how long to spend in the market.

Step 1: Budget and Disposable Income

It goes without saying that beginners should never invest more in Bitcoin than they can realistically afford to lose. This is the same concept that should be followed irrespective of the asset class. But this sentiment is even more important in the case of Bitcoin – considering that this asset is still in its infancy.

Sure, Bitcoin was first launched in 2009 but this still represents an unproven model in the grand scheme of things. With this in mind, the first step to take when assessing how much to invest in Bitcoin is to create a budget and assess how much disposable income is comfortably left over.

This means assessing the total household income for the month and what non-negotiable outgoings are expected. As we briefly highlighted above, this should include factors like groceries, utilities, and mortgage payments. There should also be an allocation for savings, in the event of an emergency that requires immediate funding.

After all, should there be a requirement for fast cash, selling Bitcoin to fund the payment isn’t a risk-averse strategy to take. On the contrary, the Bitcoin investment might have already dropped by significant amounts at this point, meaning that the investor will be cashing out at a loss.

Once the budget assessment has been compiled, anything left over should be viewed as disposable income. This is income after all expenses and savings that can be spent on discretionary items. This includes everything from entertainment and eating out to vacations and of course – making investments.

As we cover in more detail shortly, the amount allocated for making investments should not exclusively be put into Bitcoin. Instead, it is wise to diversify the investment capital into other asset classes to reduce the long-term risk.

Step 2: Tolerance for Risk

When asking the question – How much should I invest in Bitcoin? – it is important to be aware of the risks. At the forefront of this is the volatile nature of Bitcoin and cryptocurrencies in general. Since its creation in 2009, Bitcoin has gone through multiple bull and bear markets – all of which can be considered extreme – at least when compared to the traditional stock market.

- For example, during the previous bull run, Bitcoin went from $5,000 (April 2020) and peaked at $69,000 (November 2021). This means that in just 19 months of trading, the price of Bitcoin increased by over 1,200%.

- In comparison, based on an average annualized return of 10%, it would take the S&P 500 approximately 120 years to reach similar levels of growth.

- With that being said, when Bitcoin enters a bear market, its value – along with the rest of the cryptocurrency space, tends to drop significantly at a rapid pace.

- For example, after hitting $69,000 (November 2021), Bitcoin has since dropped to lows of under $20,000 (June 2022). This means that in just seven months, Bitcoin lost over 70% of its value.

Experienced cryptocurrency traders have seen extreme volatility like this many times previously. However, for complete beginners, volatility of this nature can be challenging to deal with. After all, based on a decline of 70%, this means that for every $100 invested, the Bitcoin portfolio is worth just $30.

Taking all of this into account, when assessing how much to invest in Bitcoin, it is important to be prepared for the underlying risks. In essence – and as we discuss in the next section, investing in Bitcoin is best approached as a long-term play.

Step 3: Time in the Market

There is no surefire way to know if or even when Bitcoin will once again enter a bullish trend. While previously Bitcoin has always recovered and subsequently gone on to generate new heights, there is no guarantee that this will happen again. Nonetheless, if history is an indicator of future results (which it isn’t), then Bitcoin is more suitable as a long-term investment.

This means being prepared to stay in the market for several years at a time. The good news for first-time investors is that Bitcoin remains at lows of $20,000. This means that current pricing levels represent a discount of 70% from Bitcoin’s former all-time high.

There must, however, be a firm belief that Bitcoin is here to stay. If there is, then staying in the market for extended periods of time can eventually pay off. Previously, for example, Bitcoin went from highs of $20,000 (December 2017) to under $4,000 (December 2018). It was at this period that many commentators argued that Bitcoin was dead.

However, as hindsight now informs us, Bitcoin has since increased in value by over 1,600% from its December 2021 lows. The key consideration for beginners to make is whether or not they will need access to the money being invested in Bitcoin. As noted earlier, selling Bitcoin at a loss to cover short-term expenses will never end well.

Instead, to reiterate, any money being invested in Bitcoin should be forgotten about – especially in the short term.

Step 4: Dollar-Cost Averaging

Dollar-cost averaging is a long-term strategy that will enable investors to limit the amount of Bitcoin they buy at any given time. As we very briefly explained earlier, this strategy aims to invest in Bitcoin in slow and steady increments – rather than allocating a large, lump sum payment.

The reason that dollar-cost averaging is viewed as risk-averse is that the investor will not be over-exposed to one cost price. Instead, on each weekly or monthly investment, the investor will pay a different price for Bitcoin. And as such, the benefit is that the cost price will mirror Bitcoin’s long-term trend.

- This means that when Bitcoin prices are falling, the investor buys the cryptocurrency on the cheap.

- When the price of Bitcoin is rising, the value of the portfolio will also increase.

To illustrate the above point, let’s look at two real-world examples.

The first example – which can be found below, will explore a poorly managed investment strategy that does not incorporate dollar-cost averaging.

- We’ll start by saying that an investor has $10,000 worth of free cash flow in the bank that they are prepared to invest in Bitcoin

- The investor decides to buy Bitcoin in November 2021 while prices are still rising

- The investor pays $64,000 and invests the entire $10,000 lump sump

- 12 months later, Bitcoin is trading at $20,000

- As such, the portfolio is down 68% and thus – the $10,000 investment is now worth just $3,200

Now let’s compare the above scenario with a well-prepared dollar-cost averaging strategy:

- As noted above, the investor has $10,000 to invest in cryptocurrency

- Only this time, the investor splits the $10,000 across 10 monthly investments of $1,000

- In month 1, the investor pays $64,000

- In month 2, the investor pays $50,000

- In month 3, the investor pays $41,000

- In month 4, the investor pays $43,000

- And so on

As per the above, in the first four months of dollar-cost averaging, the investor paid a cost price of $64,000, $50,000, $41,000, and $43,000. As such, the average cost price of the Bitcoin portfolio is now just $49,500.

In comparison, in the previous example, the investor that did not dollar-cost average is stuck with a cost price of $64,000.

Step 5: Diversification

The final consideration to make when asking the question – how much Bitcoin should I buy? – is to ensure the overall investment portfolio is well diversified. This means two core things.

First, the portfolio should not only hold Bitcoin – but a range of other cryptocurrencies. Second, the portfolio should also own assets outside of the cryptocurrency space. Examples here may include index funds, commodities, individual stocks, real estate, and even US treasuries.

In terms of diversification into other cryptocurrencies, investors might consider metaverse crypto, as well as those that focus on DeFi coins (decentralized finance). It could also be worth investing in crypto ETFs and index funds. This option enables investors to gain exposure to a broad range of cryptocurrencies through a single investment.

With that being said, perhaps the fastest-growing cryptocurrency growth market right now is presales. In a nutshell, when a new blockchain project enters the market, it requires funding. This is much the same as a traditional start-up that raises cash from angel investors. But in the case of presales, investors get crypto tokens as opposed to equity.

The crypto token will be unique to the project and thus – this offers an opportunity for early investors to gain exposure at preferential pricing. Once again, this is like angel investors getting a much lower entry price when compared to the eventual IPO listing.

Investing in High-Quality Crypto Presales in Addition to Bitcoin

Leading on from the above section, we will now expand on the benefits of opting for a crypto presale in addition to Bitcoin. While Bitcoin is the largest cryptocurrency in terms of market capitalization, this doesn’t have its drawbacks. The reason for this is that Bitcoin has already consumed significant levels of growth.

More specifically, although Bitcoin still has room to grow in the long run, the days of generating gains of 50x, 100x, or more are likely over. After all, even at current pricing levels, Bitcoin has a market capitalization of $390 billion. For Bitcoin to grow by 100x from here, this would require a valuation of $39 trillion.

- Now compare this to crypto presales – which often launch with a market capitalization of just a few million.

- For example, as we discuss in much more detail below, Dash 2 Trade will launch on exchanges after its crypto presale with a market capitalization of just $66.2 million.

- This means that the upside potential is substantially higher than that of established projects like Bitcoin.

- On the flip side, holding Bitcoin still represents a solid move – not least because it offers cryptocurrency-centric portfolio stability.

- Plus, Bitcoin carries sizable levels of liquidity, so cashing out will never be an issue. Bitcoin is also readily accepted as collateral, meaning that investors can use their tokens to obtain further funding.

Nonetheless, those in the market for a higher upside potential might consider one of the three crypto presales discussed below:

Dash 2 Trade (D2T) – Innovative Crypto Signals and Social Trading Platform with Bespoke Scoring System for Crypto Presales

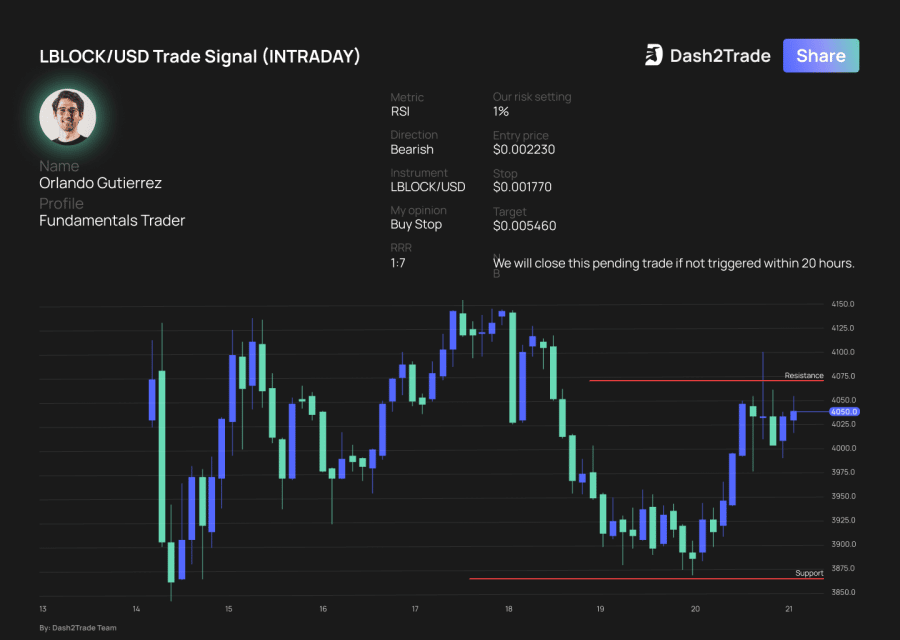

From a data perspective, Dash 2 Trade will provide users with social media metrics. In simple terms, the underlying algorithm will scan leading social networks like Reddit, Twitter, and Telegram to assess which cryptos are trending at any given time. If there is a lot of buzz surrounding the coin, this will be highlighted in real-time on the Dash 2 Trade terminal.

Moreover, the Dash 2 Trade algorithm will also scan leading blockchain networks such as Bitcoin, Ethereum, and BNB. The idea here is to spot whether a major whale movement is about to take place. If it is, Dash 2 Trade users are notified. There will also be an alert if a coin has just been confirmed as being listed on a major exchange – like Binance or Coinbase.

This will then enable Dash 2 Trade users to act on the announcement before it likely witnesses a rapid bull run. Dash 2 Trade will also offer users crypto trading signals. In addition to the name of the coin and relevant buy/sell position, signals will inform users of the suggested stop-loss, take-profit, and entry order price.

Experienced users will likely enjoy the trading competitions that will operate on the Dash 2 Trade terminal. This comes with real-world prizes – paid in D2T tokens. Social trading will sit at the heart of Dash 2 Trade, with users having the capacity to share market insights and ‘like’ comments, just like on Facebook but in a professional, trading environment.

There will be three tiers offered by Dash 2 Trade, albeit, in order to gain unfettered access to all of the above features, a premium membership is required. This requires payment in D2T tokens – as does the start plan. There is also a free plan, but this offers limited features.

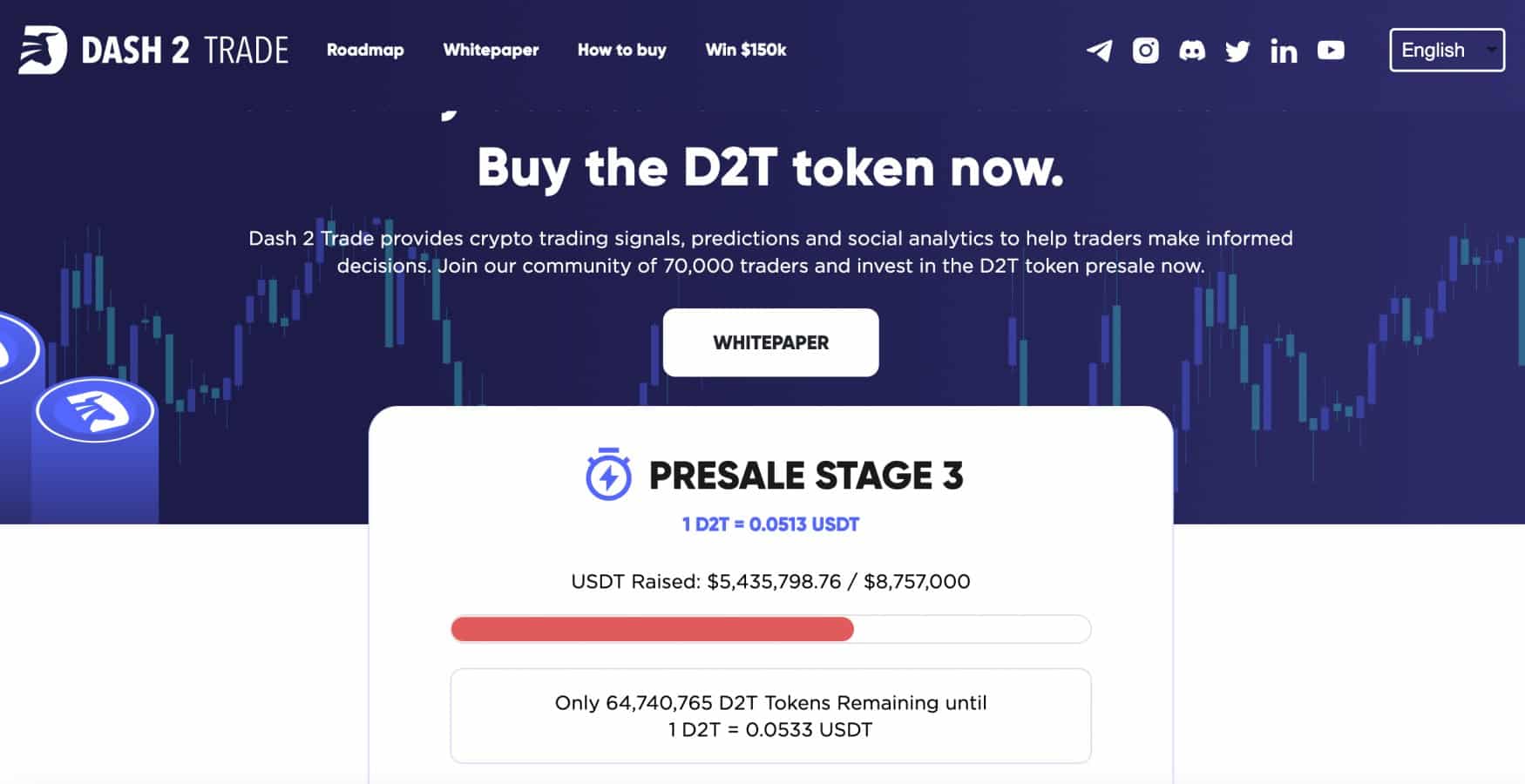

Now to the crypto presale – early investors can now buy D2T tokens at a discounted price. The presale is already in phase three – having raised over $5 million in under three weeks. Phase three pricing stands at $0.0513. The next phase will increase to $0.0533. In total, there are nine phases and once this is completed – D2T tokens will be listed on a prominent crypto exchange.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

| $0.0556 | $4,865,000 | 87,500,000 |

| $0.0580 | $5,075,000 | 87,500,000 |

| $0.0606 | $5,302,500 | 87,500,000 |

| $0.0635 | $5,556,250 | 87,500,000 |

| $0.0662 | $5,792,500 | 87,500,000 |

For further details about this best future cryptocurrency, read the whitepaper and join the Telegram group now.

IMPT (IMPT) – Revolutionary Carbon Offset Program with Greenest Cryptocurrency Utility Token

The key hindrance is that the carbon credit markets are highly fragmented and oftentimes, businesses need to go through over-the-counter exchanges. IMPT has since created a blockchain-based platform that facilitates carbon credit trading for companies of all shapes and sizes.

Moreover, IMPT is also accessible to individual investors that wish to speculate on the future value of carbon credits. This is because carbon credits prices rise and fall based on demand and supply much like any other asset class. The process of using IMPT is as follows – stakeholders – whether that is a business or individual, will first need to register an account.

After that, stakeholders can buy IMPT tokens which are subsequently converted to carbon credits. At this stage, businesses have the required carbon credits that they need to meet their annual emission needs. On the other hand, investors can hold onto their IMPT carbon credits (issued via an NFT) in the hope that global prices rise.

Investors can then sell their IMPT carbon credits on the platform’s secondary marketplace. IMPT even enables stakeholders to ‘burn’ their IMPT carbon credits. This subsequently reduces the stakeholder’s carbon footprint- as the credits no longer remain in circulation.

To invest in the growth of IMPT, the presale campaign is ongoing. Over $12.4 million has been raised thus far and IMPT is pricing its tokens at $0.023 each. Once the current batch of IMPT tokens sells out, the presale will move on to stage three. This means that the presale price of IMPT will once again increase. Therefore, investors making a move early are rewarded.

Calvaria (RAI) – Exciting New Play-to-Earn Crypto Game with High Upside Potential

Each battle card that is minted will have its own randomly-generated traits. Some traits will be more valuable and stronger than others. Players will then need to use their battle cards to defeat other users. The Calvaria game takes a strategic approach, alongside a metaverse-style universe that players can explore.

Furthermore, and perhaps most importantly, players can earn crypto tokens when playing Calvaria. Rewards in the ecosystem are paid in RAI tokens, which is the proprietary crypto asset for the Calvaria platform. Not only that, but players will own all in-game battle cards and items that are earned or purchased, represented via Ethereum-based NFTs.

This is in stark contrast to traditional games – which enable players to make in-game purchases but the developer always retains ownership and control of the items. To gain exposure to Calvaria and its innovative P2E concept, the project’s presale is still ongoing.

The presale is in stage four as of writing – and for every 1 USDT invested, 1 RAI will be obtained. In stage five of the presale, the same 1 USDT will get just 33.33 RAI. As a result, stage four investors will have already secured an immediate upside of over 16%.

How Much to Invest in Bitcoin? Market Insight on What Experienced Investors Say

When exploring the question – how much Bitcoin should I buy? – investors will likely find that the general consensus suggests a maximum portfolio allocation of 5%.

- This 5% refers to cryptocurrency in general, meaning Bitcoin and perhaps some of the presale that we discussed in the sections above.

- This means that risk-averse investors will utilize the remaining 95% of the portfolio for other, more established assets and markets.

- This will likely cover a blend of stocks and bonds – albeit, the specific allocation for each will vary depending on the financial goals and risk tolerance of the investor.

- According to some market analysis, even 5% of the portfolio being allocated to Bitcoin and other cryptocurrencies is too high.

- On the other hand, there is also a growing community of seasoned investors and analysts that believe a higher portion of the portfolio should be allocated to cryptocurrencies and other emerging markets – such as growth stocks.

Ultimately, rather than being fixated on the specific portfolio allocation when assessing how much Bitcoin to buy, it is best to consider the points we discussed earlier. This includes dollar-cost averaging and most importantly – compiling a budget to assess the level of disposable income available at the end of each month.

After all, no two investor profiles are the same. That is to say, what works for a seasoned analyst might not be suitable for a casual investor that is looking to buy Bitcoin and other cryptocurrencies for the first time. And most importantly – as noted by Mark Cuban, beginners should only invest in Bitcoin amounts that they can realistically afford to lose.

Conclusion

This beginner’s guide has helped clear the mist when assessing the question – how much Bitcoin should I buy? We have covered important metrics surrounding disposable income, budget, dollar-cost-averaging, diversification, and risk tolerance.

One of the most common strategies being utilized by investors right now is to buy Bitcoin in addition to newly launched cryptocurrencies that are offering presale campaigns. We discussed IMPT – which is building an ecosystem for carbon credit trading.

Dash 2 Trade – which is developing a cryptocurrency analytics terminal, is also engaged in an ongoing presale launch – where more than $5 million worth of D2T tokens has been sold already. Follow the link below to learn more about this crypto signals project and get in on the ground floor while the market price is still low.

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members

Read more: