Wondering how much you should invest in cryptocurrency? This risky but high-upside asset class has generated significant gains in recent years, so allocating a segment of an investment portfolio is worth considering.

The purpose of this guide is to explore how much to invest in cryptocurrency in 2023.

Before delving into our comprehensive analysis, consider the key points below when asking the question – how much to invest in cryptocurrency?How Much to Invest in Crypto for Beginners – Key Tips

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members

How to Decide How Much Money to Invest in Cryptocurrency

So that begs the question – How much should I invest in cryptocurrency?

As per the key takeaways above, there are seven core strategies that can be undertaken to assess suitable cryptocurrency investment stakes.

Read to determine how much to invest in crypto.

1. Budget and Disposable Income

Before electing to buy cryptocurrency, investors should spend ample time assessing their personal financial circumstances. The overarching objective here is to write down the figures in terms of monthly outgoing and disposal income. The focus should be on core expenses such as:

- Rent or mortgage payments

- Food and other household essentials

- Utilities

- Travel

- Etc.

After assessing fixed and variable expenses, investors should then be able to identify how much disposable income is available. This essentially refers to the amount of cash available to an individual or couple after all core expenses and outgoings are comfortably covered.

For example, if somebody earns $3,500 after tax and $1,500 in monthly expenses, this leaves $2,000 worth of disposable income. As we briefly noted earlier, cryptocurrency investment stakes should only come from what’s available at the end of each month.

2. Avoid Debt

The next consideration to make when assessing how much to invest in cryptocurrency is to ensure that debt is avoided. This is super-important, as it can be tempting to buy Bitcoin with a credit card or through a loan to maximize investment stakes. However, it is also important to remember that cryptocurrency prices can go up as well as down – for extended periods of time.

- For example, let’s say that somebody decides to invest in cryptocurrency with a credit card that comes with an APR of 25%.

- The investor decides to max out the card at a value of $10,000

- At the time of the investment, Bitcoin is trading at $63,000

- When the credit card statement arrives, Bitcoin is trading at $47,000 – representing a decline of 25%

- This means that the $10,000 investment is now worth just $7,500

- However, the investor still owes the credit card company $10,000 – in addition to interest if the full amount isn’t paid off.

As per the above example, the investor is in somewhat of a complex situation. If they are forced to sell their Bitcoin to cover the credit card statement, they will do so at a 25% loss. The investor could sell just a small segment of the Bitcoin to at least cover the minimum credit card balance requirement.

However, in doing so, this would then attract interest and perhaps a stain on the investor’s credit score. In the above example, Bitcoin dropped by 25% – which is, of course, a sizable decline. However, Bitcoin has since declined by 70% from its former all-time high of $69,000. As a result, this should further demotivate people from investing in cryptocurrencies with debt.

3. Diversification

Ever wondered how much Bitcoin should I buy right now? So far, in attempting to answer the question – how much should I invest in crypto? – we have discussed budgeting, disposable income, and avoiding debt. Next, we can talk about one of the best crypto tips of them all – diversification. This investment strategy isn’t exclusive to cryptocurrencies but virtually all asset classes.

The main concept is that diversification ensures that investors do not put all of their eggs into one basket. In this regard, there are two factors to consider. First and foremost, investors should diversify within the cryptocurrency space itself. After all, there are thousands of cryptocurrencies to choose from across many different project types.

This means that creating a diversified portfolio is a relatively straightforward task.

Let’s start by looking at a quick example of why diversification is important:

- Let’s suppose that the investor has $5,000 to invest in cryptocurrency.

- An inexperienced investor may elect to allocate the entire $5,000 by investing in Bitcoin.

- This would represent that they are overexposed to just one market (not to mention one cost price).

- Nonetheless, the $5,000 investment is made at a time when Bitcoin is priced at $60,000

- A few months later, Bitcoin is worth just $30,000 – so that’s a decline of 50% from the original cost price

- As a result, the investment portfolio is now worth half – at $2,500

In other words, the example above highlights the risk of having a portfolio that is over-exposed to just one cryptocurrency.

Now let’s explore how things could have been different had the investor diversified their portfolio:

- As per the above, the investor has $5,000 in capital

- This time, the investor allocates just 20% of the portfolio to Bitcoin

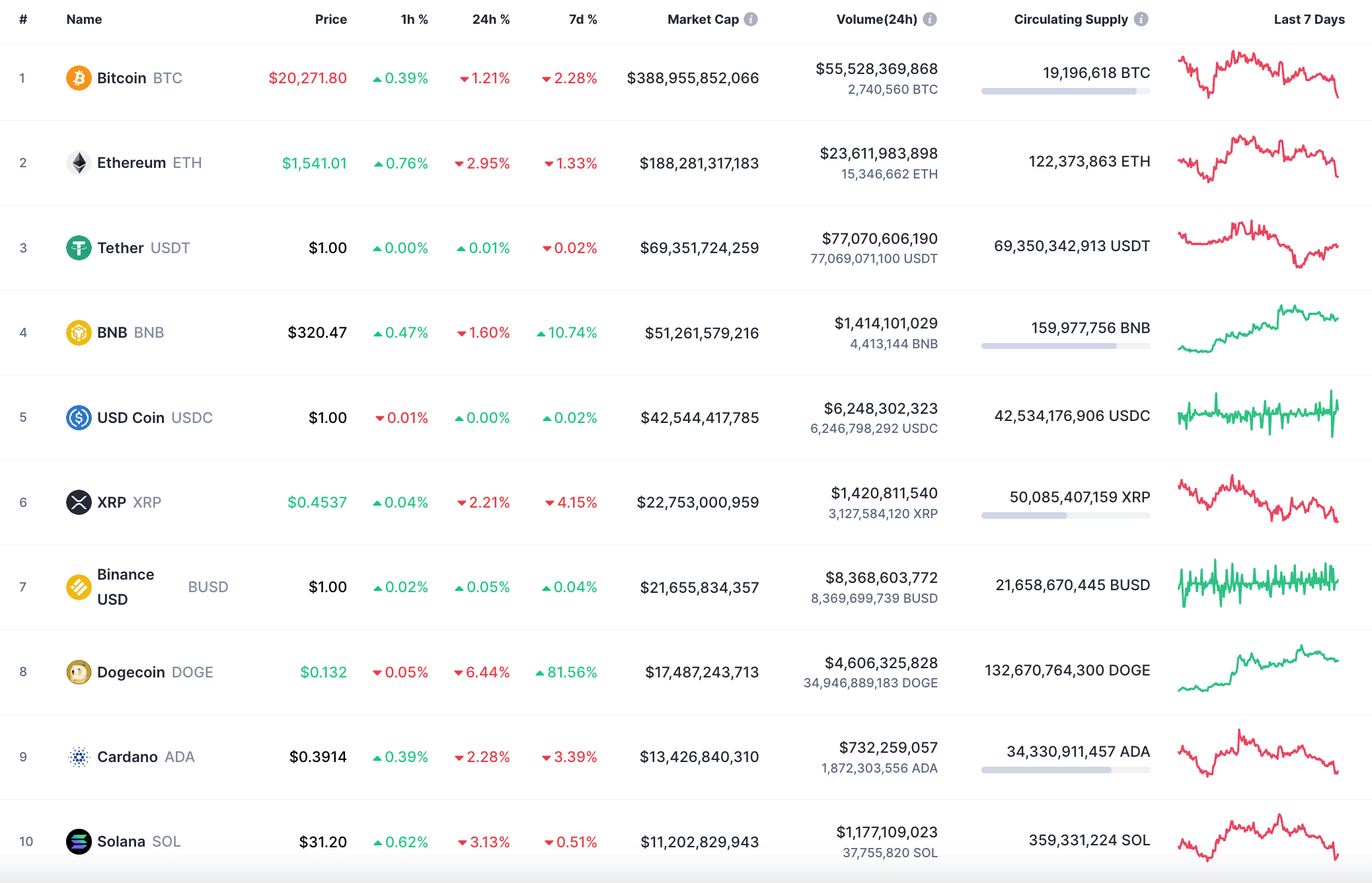

- In addition to this, the investor allocates 40% to top-10 projects, such as Ethereum, BNB, Cardano, and Solana.

- The remaining 40% is investing in crypto presales like Dash 2 Trade and IMPT

As per the above, the investor has allocated funds to a wide number of cryptocurrencies across many different market capitalizations.

This means that while Bitcoin might underperform, other cryptocurrencies within the portfolio – such as Dash 2 Trade, have every chance of generating notable gains. As a result, the overall value of the portfolio could cover the Bitcoin losses and actually provide the investor with an upside.

4. Dollar-Cost-Average

Dollar-cost averaging is another proven strategy that will help answer the question – how much should you invest in cryptocurrency? This strategy is utilized by many seasoned investors that wish to adopt a long-term ‘buy and hold’ strategy. Dollar-cost-averaging will therefore not be suitable for short-term traders.

Nonetheless, the main concept with dollar-cost-averaging is to enter the cryptocurrency markets gradually, by investing slow and steady amounts at fixed periods. This can be something as simple as allocating $100 at the end of each month. In taking this approach, investors no longer need to worry about timing the market, not to mention shorter-term volatility.

This is because dollar-cost-averaging supports the long-term game, not least because each investment will attract a different cost price. Since the creation of cryptocurrency in 2009, there are many examples that support the effectiveness of dollar-cost-averaging.

- For example, in 2017, Ethereum went from just $8 to $1,300.

- After hitting a then-all-time high, Ethereum declined to lows of $85.

- This represents a decline of 93%.

- However, fast forward to 2021 and Ethereum hit new highs of almost $5,000.

- This means that from the lows of $85 in 2018, Ethereum went on to witness gains of over 5,700%.

The key point here is that by dollar-cost-averaging Ethereum over the course of several years, the investor would have generated significant gains. Irrespective of whether the cryptocurrency was on an upward or downward trend, the dollar-cost-averaging strategy will continue to inject capital each and every month. But does this mean that Ethereum is a good investment in 2023?

When the cryptocurrency was on a downward trend, the investor would have purchased Ethereum at a discounted price. And when Ethereum was on a bull run, the investor would have seen the value of their portfolio rise for an extended period. The best thing about dollar-cost averaging is that it fully aligns with the other strategies that we have discussed so far.

For example, dollar-cost-averaging stakes can align with the investor’s budget and disposable income. It can also align with diversification, as each month the investor can allocate their funds to a basket of different cryptocurrencies. Therefore, when assessing how much to invest in cryptocurrency, dollar-cost-averaging is crucial.

5. Time in the Market

Another assessment to make when evaluating how much to invest in cryptocurrency is the amount of time to spend in the market. As we discussed in the section above, long-term investors generally do much better than those that try to time the market based on current trends.

- For example, in Q1 2020 – when covid-19 was declared a pandemic, the value of Bitcoin went from approximately $10,000 to just $5,000 in a matter of days.

- This resulted in many investors panic selling at a 50% loss.

- Those that avoided selling would have then enjoyed an extended bull run that result in Bitcoin hitting highs of $69,000.

The key point here is that while long-term strategies are typically the best way to go, this won’t be suitable for everyone. The reason for this is that it can take several years for cryptocurrencies to generate a return – if at all.

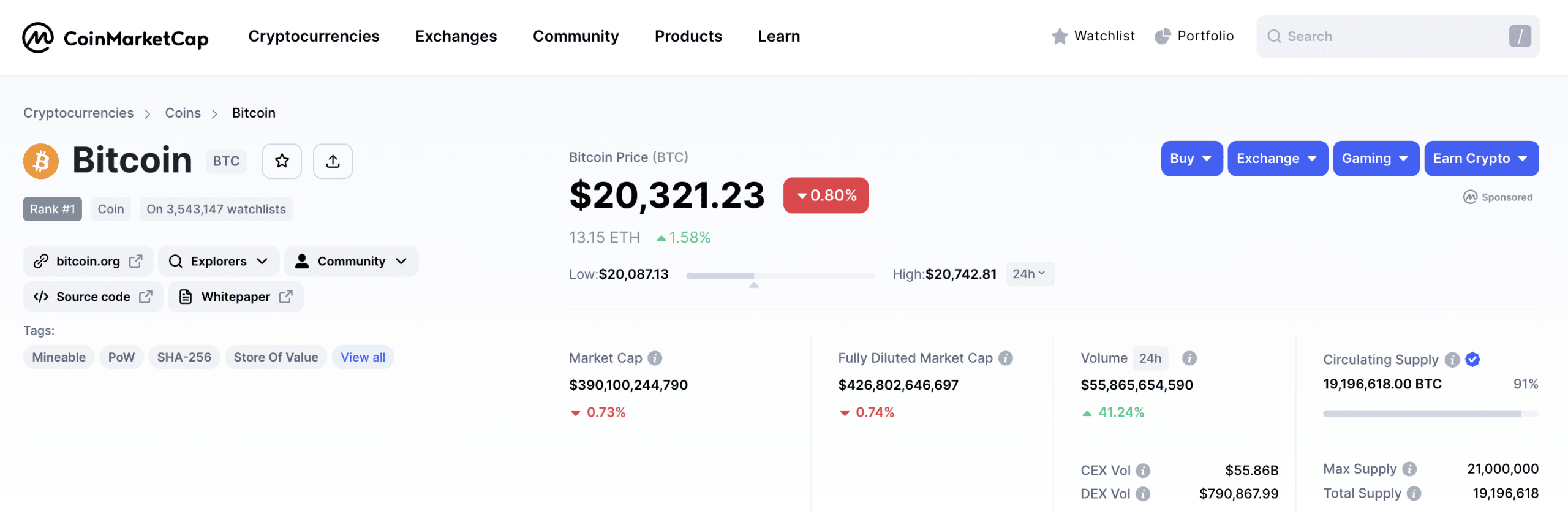

For instance, it took Bitcoin nearly three years to regain the $20,000 all-time high that it initially generated in December 2017. During this timeframe, many investors opted to sell – often because of a requirement for capital. And if this is the case, investors needing access to fast money might be forced to sell their cryptocurrencies at a loss.

This is why it is important to be realistic about the amount of time that investors remain in the cryptocurrency market. Those that are looking to make short-term gains might be more suited for crypto day trading or presale campaigns. The latter enables investors to buy a newly launched token at a discount before it is listed on an exchange – more on this later.

6. Liquidity

Liquidity is an important factor to consider irrespective of the asset class – whether that’s crypto, stocks, ETFs, or commodities. This refers to the amount of capital that a specific market attracts and how readily the investment can be sold.

For example, Bitcoin and Ethereum are both highly liquid digital assets. Over the past 24 hours alone, Bitcoin and Ethereum have attracted $55 billion and $23 billion in trading volume. This results in two crucial outcomes. First, investors can cash their Bitcoin or Ethereum tokens out at any given time – meaning that there will never be an issue finding a buyer.

Second, due to the sheer amount of trading volume in the market, investors can sell their Bitcoin or Ethereum at a fair price, without needing to worry about slippage or wide spreads.

- Now let’s compare this to a small-cap project like World Mobile Token – which as of writing carries a market capitalization of $40 million.

- Over the prior 24 hours of trading, World Mobile Token attracted just over $567,000 worth of daily trading volume.

- This means finding a suitable buyer when attempting to cash out can be challenging.

- Furthermore, with such a small amount of liquidity, selling a sizable number of tokens is likely to result in a major drop in value.

Now, this isn’t to say that investors should avoid smaller projects with low trading volumes. On the contrary – as we cover shortly, smaller projects often represent the best crypto winter tokens to buy.

The key point is that the investment portfolio should also contain larger-cap projects like Bitcoin and Ethereum. This will ensure that at any given time if the investor needs access to fast cash, there will always be enough liquidity in the market to achieve this goal.

7. Consider Investing in Low-Cost Presales

Leading on from the above section, we can now discuss presales in the context of how much to invest in cryptocurrency.

Crypto presales – otherwise refers to as ICOs (initial coin offerings), enable newly launched projects to raise capital from outside investors. The investor will invest a popular cryptocurrency into the presale – such as Bitcoin or Ethereum. And in return, the investor will obtain the project’s new, native cryptocurrency.

In this regard, presales are somewhat similar to the best upcoming IPOs (initial public offerings). This is because early investors in the IPO will typically get the best stock price possible. This is also the case with crypto presales. Meaning, that early investors can buy the respective cryptocurrency at the lowest price, subsequently resulting in an upside once it is listed on an exchange.

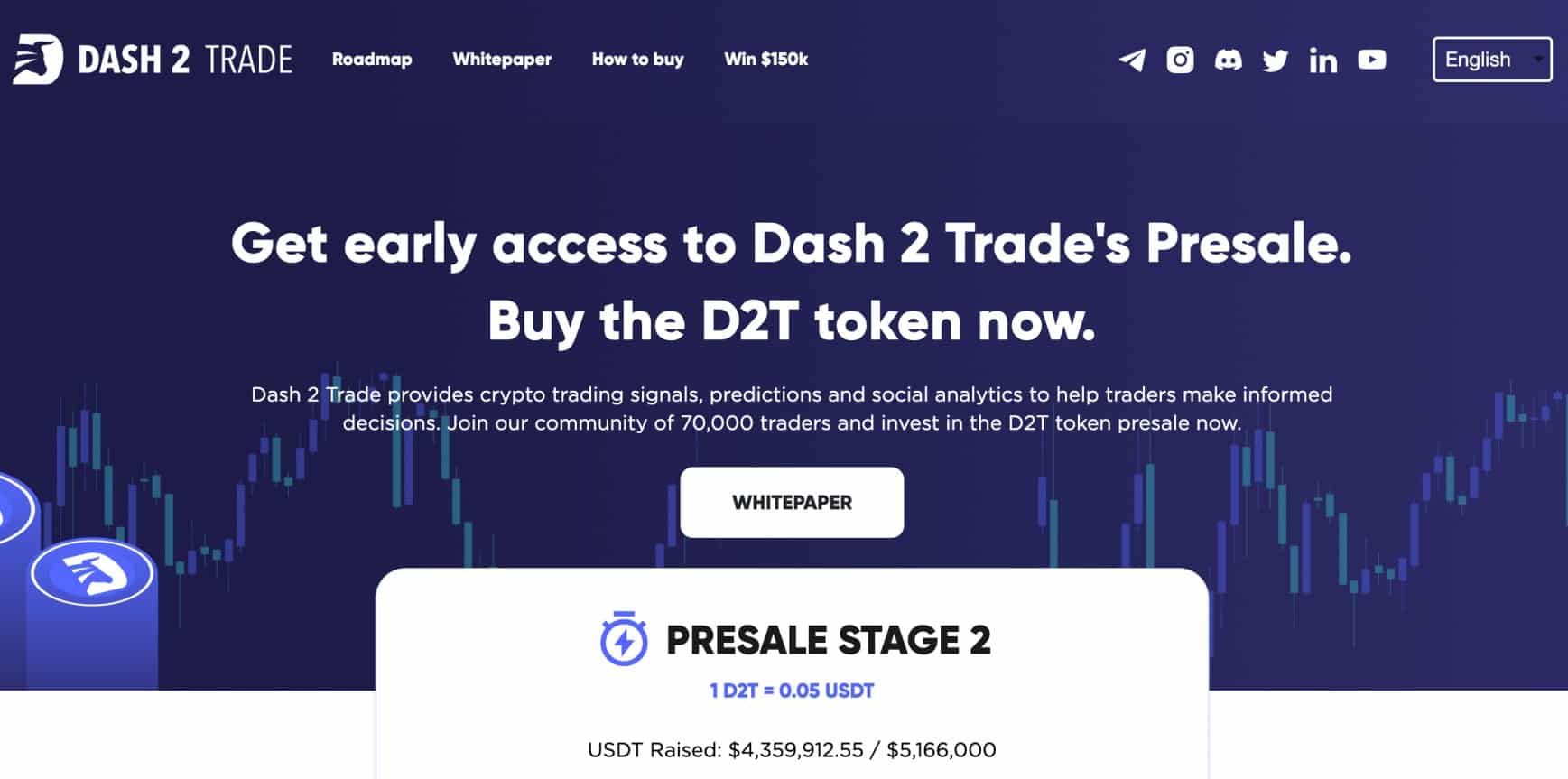

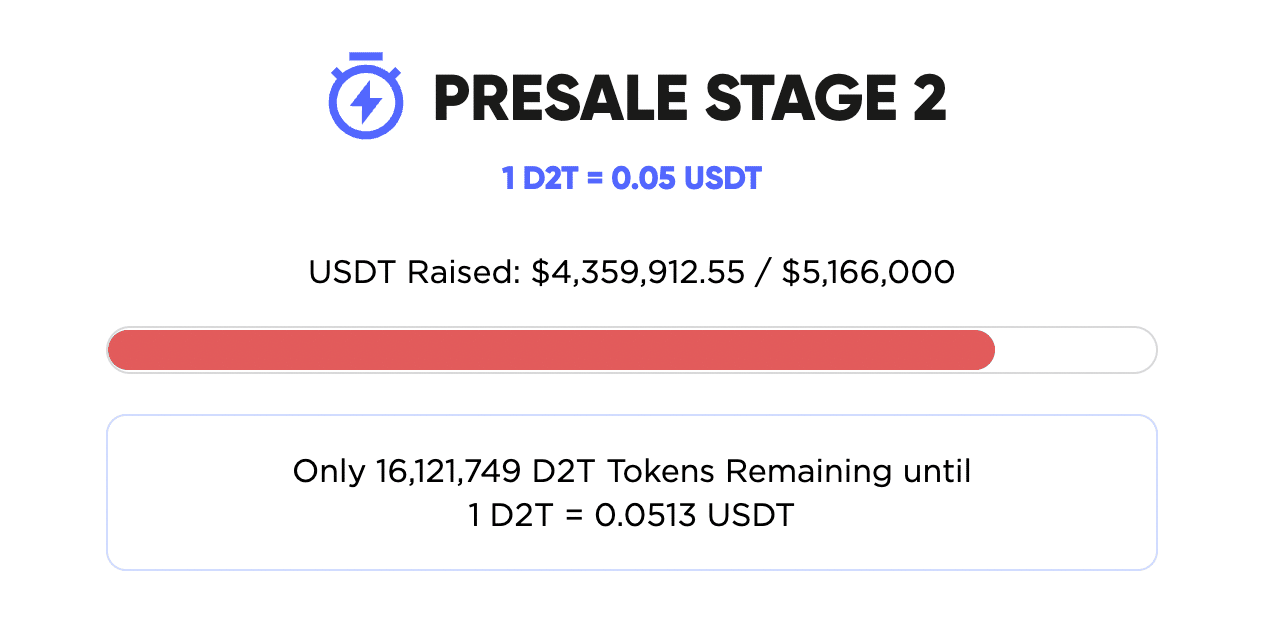

- Let’s take Dash 2 Trade as a prime example – which we found to be the best crypto ICOs to gain exposure to right now.

- In a nutshell, the Dash 2 Trade presale is offering early investors the chance to buy its native D2T tokens at a discount – across nine stages.

- Each stage represents a tranche of D2T tokens that are sold at a specific price.

- Moreover, after each tranche sells out, the following stage will increase the cost price of D2T tokens.

- Those investing in phase one will obtain an upside of 40% once the presale concludes.

- Furthermore, and perhaps most importantly, this upside is achieved before D2T tokens are listed on an exchange for public trading.

In terms of the business model, Dash 2 Trade is building a revolutionary cryptocurrency analytics terminal. Think along the lines of the industry-leading Bloomberg terminal, but exclusively for cryptocurrencies. The Dash 2 Trade terminal will be jam-packed with crypto tools and features, including a fully-fledged signals dashboard.

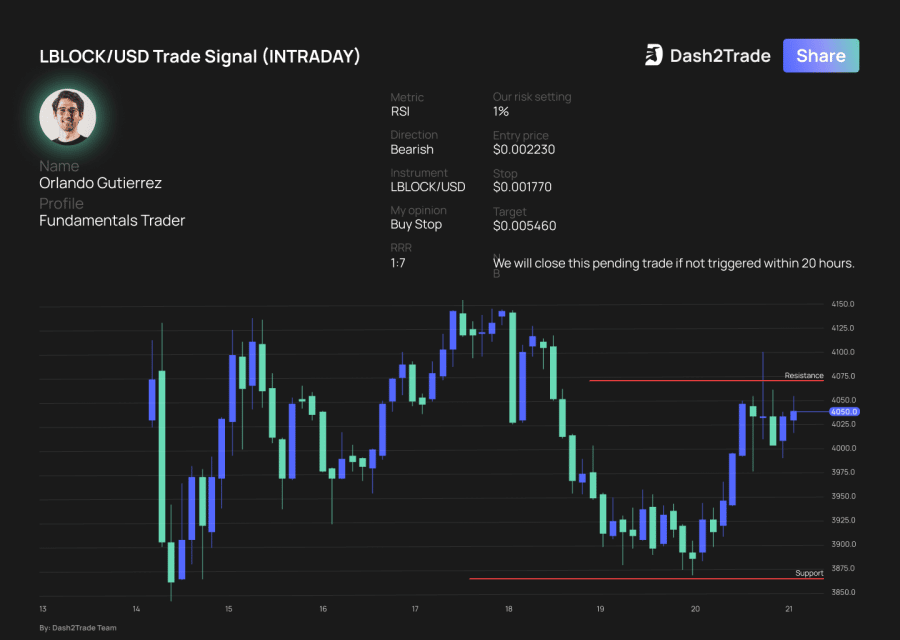

Put simply, crypto signals distributed by the Dash 2 Trade terminal will inform D2T token holders of upcoming trading opportunities that should not be missed. As per the image above, the signal offers each and every piece of information that the D2T token holder requires to act on the trade.

This includes the pair (LBLOCK/USD), direction (buy order), entry price ($0.002230), stop-loss ($0.001770), and take-profit ($0.005460). This means that the Dash 2 Trade user can then place the suggested orders at their chosen exchange. The Dash 2 Trade signal also provides information on the in-house trader that created the trade, in addition to the main market indicator.

Not only that, but the Dash 2 Trade terminal will also provide a full suite of useful metrics – inclusive of social media sentiment to find trending cryptocurrencies, notifications on new exchange listing announcements, and on-chain data regarding large token movements to and from wallets (and exchanges).

This is in addition to trading competitions, grade-one pricing data and charts, technical indicators, strategy-building tools, and a live backtesting facility. Most importantly – the D2T token is required to pay for monthly subscription fees – which grants unfettered access to the Dash 2 Trade terminal and all of its innovative features.

Scroll down to learn how to invest in the Dash 2 Trade presale in under 10 minutes from start to finish.

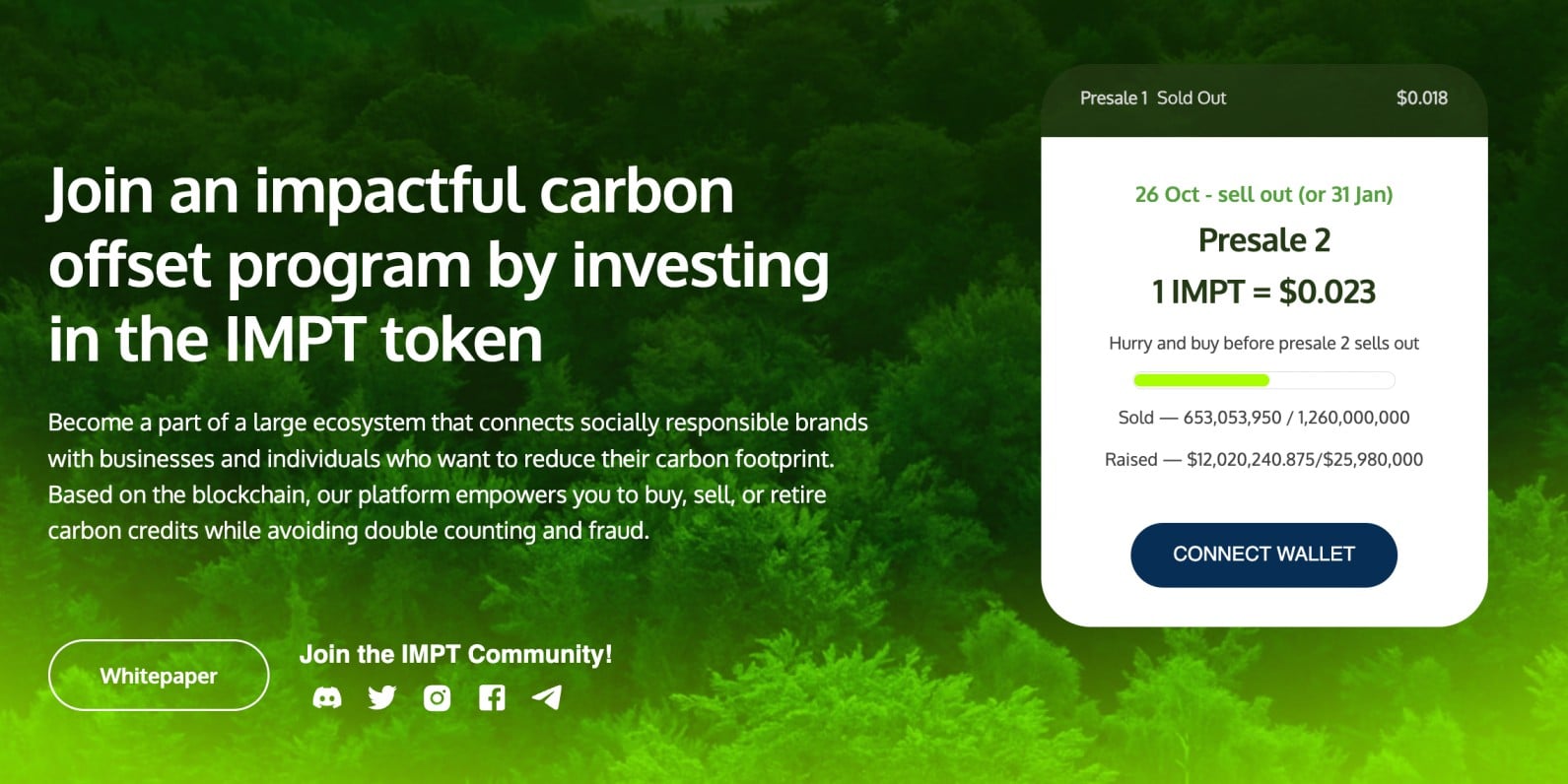

In addition to Dash 2 Trade, we came across another crypto presale that should not be missed – IMPT. IMPT is building a dashboard and ecosystem that will facilitate the buying, selling, and retiring of carbon credits. For those new to this industry, carbon credits enable companies to emit additional emissions into the atmosphere each year.

This is because many countries have put limits on carbon emissions each year, so companies need to purchase credits should they require more. The key barrier to entry for small businesses that require carbon credits is that this industry is largely accessed via over-the-counter (OTC) exchanges. Carbon credit trading on an OTC basis can be cumbersome and expensive.

IMPT, on the other hand, is building a carbon credit trading ecosystem that will be inclusive for all. Not in terms of only small and large companies, but even individual investors. The main concept is that initially, IMPT tokens can be purchased and then converted into carbon credits.

What happens next is entirely depending on the goals of the individual or company. For example, the investor can hold on to their carbon credits for the long run, in anticipation that global prices will increase. If this is the case, the investor can sell their carbon credits to other stakeholders on the IMPT dashboard.

Companies, on the other hand, can utilize their IMPT carbon credits to meet their annual emission requirements. It is even possible to retire carbon credits on the IMPT dashboard. This will appeal to those that wish to reduce their carbon footprint. Just like Dash 2 Trade, IMPT is running a presale campaign that rewards early investors. IMPT tokens have become popular with investors concerned about the climate crisis, with some analysts calling IMPT the greenest crypto on the market.

As of writing, the presale is in phase two – having already raised over $12 million. This phase is priced at $0.023 for every IMPT token purchased. After the completion of its presale, IMPT will list its native token on public exchanges for trading.

How Much Should I Invest in Crypto? What Top Crypto Investors Say

In addition to the seven tips outlined above, we also explored the viewpoints of leading investors and analysts in terms of how much to invest in cryptocurrency.

We found that the vast majority of market commentators suggest a conservative approach to cryptocurrency, in relation to more established assets that carry a lower-risk profile. For example, most commentators suggest limiting the portfolio to just 5% in cryptocurrencies, with the balance made up of growth and dividend stocks, index funds, bonds, and commodities.

- Some commentators argue for an even lower allocation of just 2-3% of the portfolio.

- Mark Cuban, on the other hand, goes one step further by suggesting that retail clients should only invest amounts into cryptocurrency that they are prepared to lose.

- This represents solid advice, considering that many cryptocurrencies are trading at lows of 90% or more when compared to prior all-time highs.

More bullish cryptocurrency analysts suggest a more aggressive approach, especially for those under the age of 35. This is because younger investors can take more risk when building a portfolio, considering that they have many years to recover losses in the event the respective cryptocurrency investments do not go to plan.

Ultimately, however, investors should make their own minds up when it comes to assessing how much to invest in cryptocurrency. Investors should explore all of the core points we have discussed on this page – such as budgeting, disposable income, diversification, dollar-cost averaging, and time in the market.

What Percentage of Your Portfolio Should be Crypto?

As per the above section, there is no hard and fast answer when it comes to the best crypto portfolio allocation. It all boils down to personal goals, tolerance for risk, and crucially – how much money investors are prepared to lose.

With that being said, a report by the Chartered Financial Analyst (CFA) yielded some very interesting results that show portfolios don’t need to be over-exposed to crypto to see notable results.

The CFA study showed that between January 2014 and September 2020, allocating just 2.5% to Bitcoin outperformed traditional portfolios by 24%. This is impressive considering the small percentage allocated.

But once again, the specific percentage allocation should be determined on a case-by-case basis. The most important thing is that investors avoid investing more than they can afford to lose.

How to Make a Crypto Investment

Already decided how much to invest in crypto? If so – alongside a well-diversified portfolio, the Dash 2 Trade presale offers access to the project’s D2T token at a discounted entry price.

Follow the steps below to buy D2T tokens in under 10 minutes.

Step 1: Get Crypto Wallet

The first step is to get a wallet that supports the Ethereum blockchain. MetaMask is a top option for both newbies and experienced traders.

Download the MetaMask app for iOS or Android, or install the browser extension for added convenience. The latter offers a more seamless experience as the Dash 2 Trade presale investment can be made on a laptop device.

It takes just one minute to set up the newly installed MetaMask wallet. Simply open the wallet, choose a strong password, and write down the 12-word passphrase.

Step 2: Get Ethereum

To buy D2T tokens via the presale, the payment must be made in Ethereum or Tether. For the purpose of this guide, we will explain the process using Ethereum, albeit, it’s the same when opting for Tether nonetheless.

Those without Ethereum can buy tokens from any online crypto exchange. Just make sure the exchange is regulated and that it accepts the preferred payment method – such as a debit card.

Step 3: Transfer Ethereum to MetaMask

After buying Ethereum from an exchange, transfer the tokens to MetaMask. The exchange will ask for a destination wallet address.

This is the address unique to the newly installed MetaMask wallet and it can be found below the ‘Account 1’ tab. Paste the address in when prompted by the exchange and confirm the transfer.

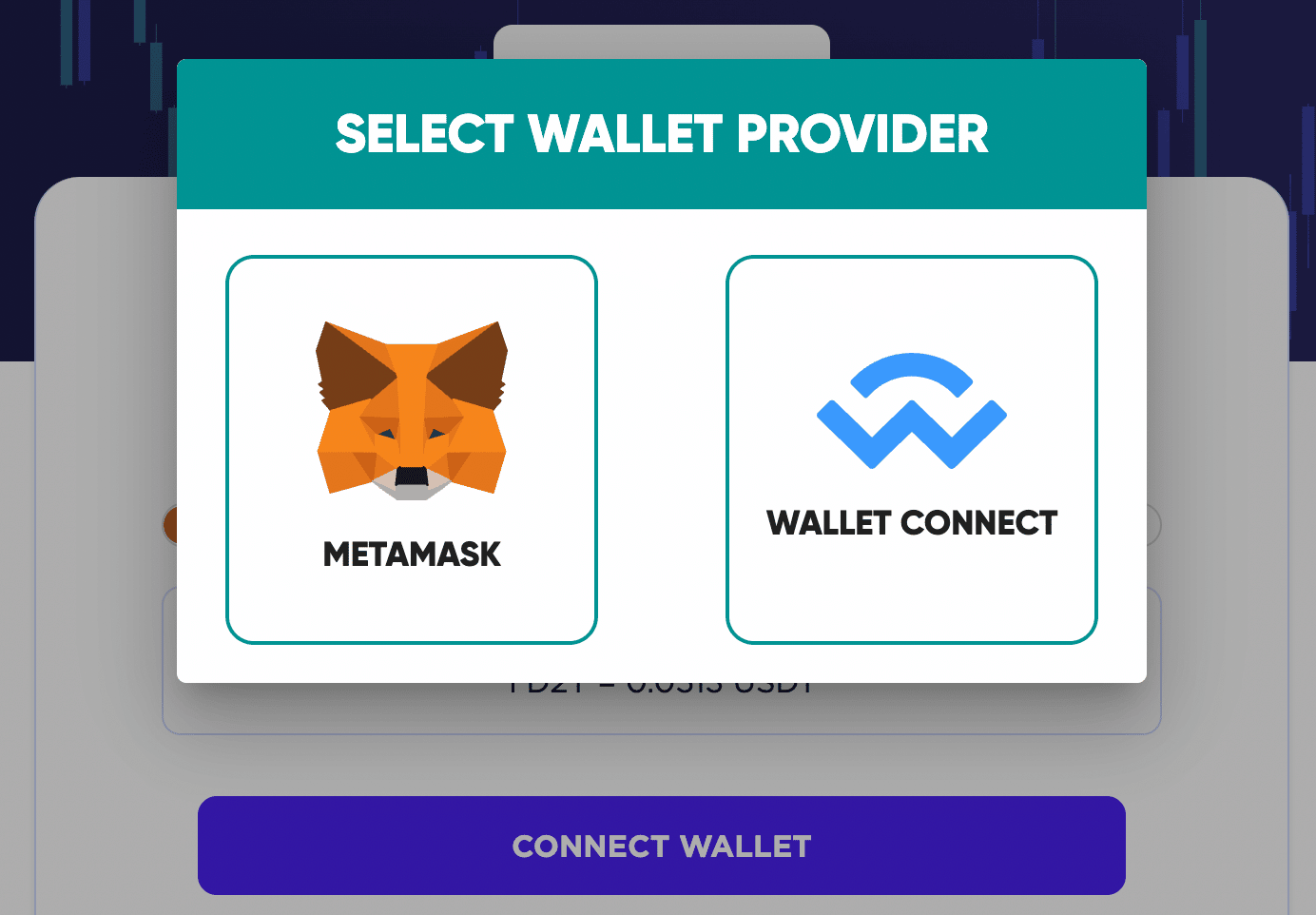

Step 4: Connect MetaMask to Dash 2 Trade Presale

After the Ethereum tokens land in the MetaMask wallet, visit Dash 2 Trade and click on ‘Connect’. Select MetaMask and wait for a notification to appear via the wallet app or browser extension – depending on which option was selected in Step 1.

Either way, the investor simply needs to confirm via MetaMask that they wish to connect the wallet to Dash 2 Trade.

Step 5: Buy D2T Tokens

Finally, enter the number of D2T tokens to buy. The minimum investment is 1,000 D2T tokens (approximately $50 as of writing).

Confirm the Dash 2 Trade presale investment via MetaMask when promoted. The tokens will be deducted from MetaMask instantly and transferred to Dash 2 Trade. The D2T tokens can be claimed after the presale sells out.

Conclusion

In summary, there are many strategies that can be taken when assessing how much to invest in crypto. This includes diversification, budget analysis, dollar-cost-averaging, and portfolio management.

It is also worth exploring low-cost, high-upside crypto presales like IMPT and Dash 2 Trade. Both presales offer discounted prices on their respective digital assets as a reward for investing in the project early.

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members