If you are looking to add some cannabis stocks to your portfolio – it is wise to open an account with a low-cost broker that gives you access to both the US and international markets.

This is because, in addition to the NASDAQ, many cannabis stocks are listed in Canada and the UK.

In this guide, not only do we show you how to buy cannabis stocks in under five minutes – but without paying a cent in commission.

How to Buy Cannabis Stocks in 2023

For users looking to invest in Cannabis stocks, the table below provides a simple guide on how to do so with the broker of your choice:

- ✅Step 1 – Open a Trading Account: Users can head over to the website of their preferred broker and begin the registration process. Enter your personal details and create a username and password.

- 🛂Step 2 – Upload ID: Get your newly created account verified instantly by uploading a copy of your ID. Choose from a passport, state ID, or driver’s license.

- 💳Step 3 – Deposit Funds: Users can deposit funds by choosing a payment method which may include e-wallets, credit/debit cards, and ACH.

- 🔎Step 4 – Buy Oil Stocks: Users can search for their preferred Cannabis stocks on the search bar of their platform and begin the open order process. Enter the amount you wish to invest and confirm the transaction.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Once you have completed the above steps, the cannabis stocks will be added to your investment portfolio.

Popular Brokers that Offer Cannabis Stocks

Although a small number of medium-cap cannabis stocks are listed on major US exchanges, many are listed overseas.

Users may choose a stock trading platform that offers low-cost access to both the US and international stock markets.

For an overview of where to buy stocks from the cannabis industry, review the brokers discussed below.

1. eToro

Supported markets outside of the US include Canada, the UK, Germany, the Netherlands, France, Hong Kong, and more. With eToro, not only can you buy cannabis stocks in the US without paying any commission, but this is also the case with foreign equities.

Furthermore, regardless of which cannabis stock or exchange you are interested in, you only need to risk $10 per trade. Before you can buy cannabis stocks here, you will need to open an account and upload some ID – which takes just five minutes from start to finish. You can then make a minimum deposit of $10 if you’re based in the US or the UK.

Traders located in other regions are required to deposit a slightly higher amount of $50. If you are depositing funds in US dollars, then eToro will not charge you any transaction fees. Otherwise, you will pay a competitive FX charge of just 0.5%. Many traders will opt to fund their account and buy stocks with credit card, Paypal, Neteller, or Skrill.

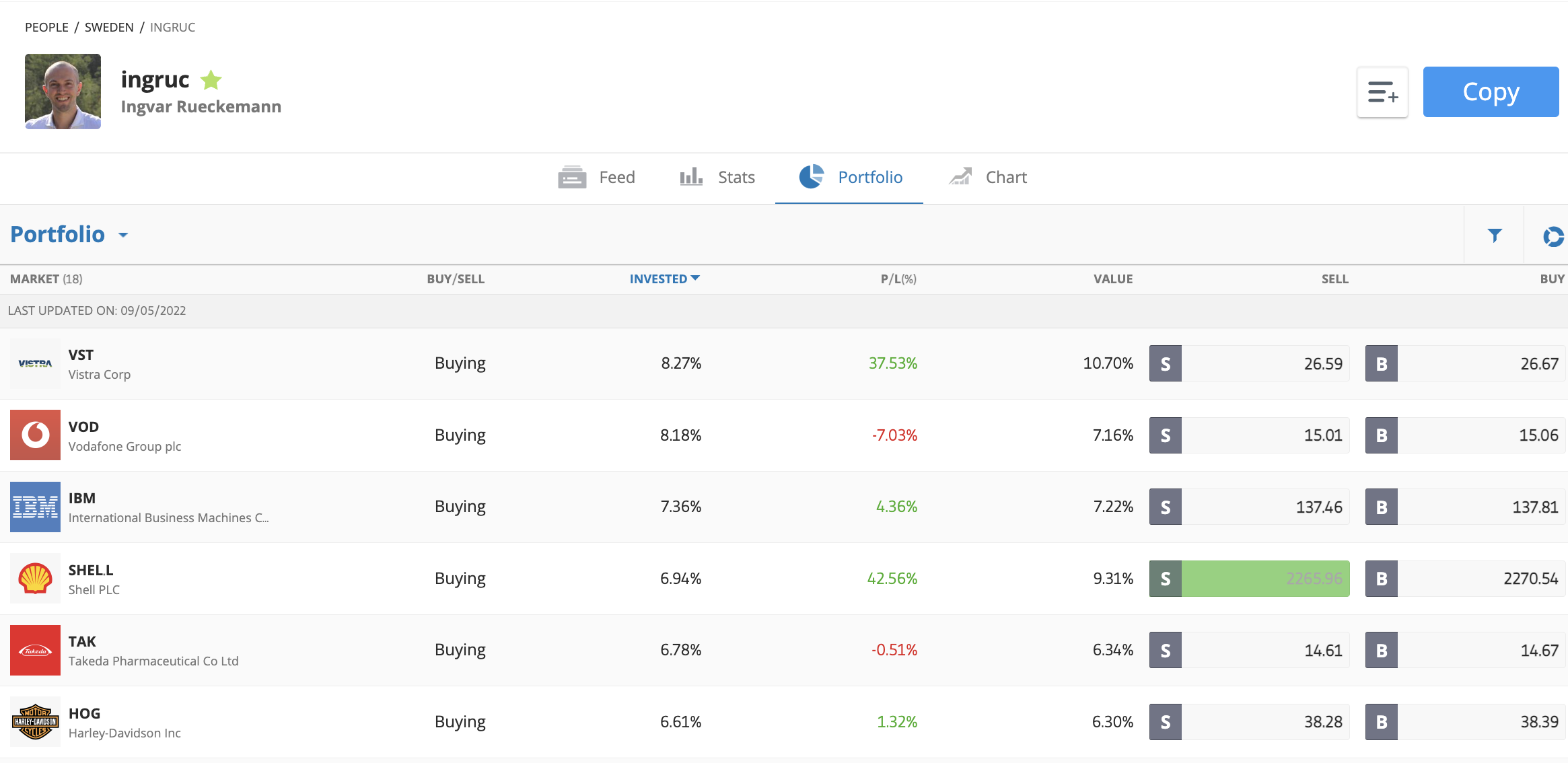

These payment methods are processed instantly. Alternatively, if you’re not in a rush, you can also transfer funds via ACH or online banking. Once you have added your favorite cannabis stocks to your portfolio, users may also access the copy trading tool. This allows you to copy another eToro investor like-for-like, meaning that you can trade passively.

If you’re looking to build a diversified basket of stocks but don’t quite know where to start, eToro offers dozens of pre-made smart portfolios. These are managed by the eToro team so again, this supports a passive investment strategy. In addition to stocks, eToro lists commission-free ETFs and you can also buy cryptocurrency assets like Bitcoin and Ethereum.

Available on both iOS and Android, the eToro stock app gives you access to the same features as the primary web trading platform. Finally, eToro is regulated by the SEC and FINRA to offer stock trading services in the US.

| Minimum Deposit | $10 |

| Fractional Stocks? | Yes – $10 minimum |

| Pricing System | 0% commission on all cannabis stocks and ETFs |

| Cost of Buying Cannabis Stocks | Spread only |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull

Webull is an online broker that has a reputation in the US stock trading scene with both beginners and experienced investors alike. You can open a free stock trading account here without needing to meet a minimum deposit.

And, if depositing funds via ACH, you won’t be charged any fees. If, on the other hand, you transfer funds via a domestic bank wire, you will be charged $8. Nonetheless, Webull is home to thousands of US-listed stocks. As such, if your chosen cannabis stock has its primary or secondary listing in the US, you will likely find it here.

The main drawback with Webull is that the very few international stocks hosted on its platform are represented via ADRs. This results in indirect ownership alongside higher fees.

Nevertheless, Webull provides multiple stock options. This allows you to speculate on US-listed cannabis stocks without needing to outlay the full investment stake. This also allows you to speculate on the value of the stock going down. You can also use your Webull account to invest in cryptocurrency assets and ETFs.

Other core features that you will find on Webull include fully-fledged retirement accounts, across a variety of IRAs. You can also trade stocks on margin, albeit, this will require a minimum balance of $2,000 at all times. Webull also offers a user-friendly trading app for iOS and Android. Finally, Webull is regulated in the US to offer stock trading services.

Read More: Read our eToro vs Webull guide to find out more about these two trading platforms.

| Minimum Deposit | $0 |

| Fractional Stocks? | Yes – $5 minimum |

| Pricing System | 0% commission on all cannabis stocks, ETFs, and options |

| Cost of Buying Cannabis Stocks | Spread only |

Your capital is at risk.

How Much Does it Cost to Buy Marijuana Stocks?

The amount that you will need to pay in fees to buy cannabis stocks will depend on the broker that you opt for and the exchange that the stocks are listed.

Therefore, the sections below analyze some of the potential fees and charges that users may have to pay when buying Cannabis stocks.

Deposit Charges

Before you get to the stage of buying your chosen cannabis stocks, you will need to make a deposit. The vast majority of US-based brokers allow you to deposit funds for free via ACH.

However, if you wish to transfer funds via a bank wire, then you might be charged a flat fee. At Webull, for example, this costs $8 for each domestic bank wire transfer that you execute.

Trading Commissions

The next fee that you need to look out for when learning how to buy cannabis stocks is the commission. This fee, if applicable, is charged when you buy cannabis stocks and then again when you eventually decide to cash out.

Now, if your chosen cannabis stocks are listed in the US, then you will likely not need to pay a commission. However, if you are interested in cannabis stocks listed in Canada, the UK, or further afield, then commissions will all but certainly apply.

FX Risk

FX is an indirect fee, as to whether or not you lose out will depend on the FX rate between the US dollar and that of the currency that backs the exchange in question.

For example, if you buy cannabis stocks located in Canada, users may want to look at the FX rate on CAD/USD both at the time of the purchase and the sale.

Conclusion

The cannabis industry is a potential way for users to diversify their assets. Users who are interested in this sector can look to begin investing with a reputable stock broker of their choice. Users may analyze the brokerages by comparing them on the basis of their fees, pricing structure, available Cannabis stocks and more.